Opening Comments

My last note was about the importance of punctuality. I received a lot of supportive emails agreeing with my stance around being on time. Clearly, readers from my vintage are more sticklers for punctuality than the latest generation. A few people sent me something along these lines and I agree:

The most opened links were tkhe video of sworn testimony over $2bn in US taxpayer funding being sent by USAID to Hamas and the Bolivian community with just 1% dementia and the healthiest hearts in the world.

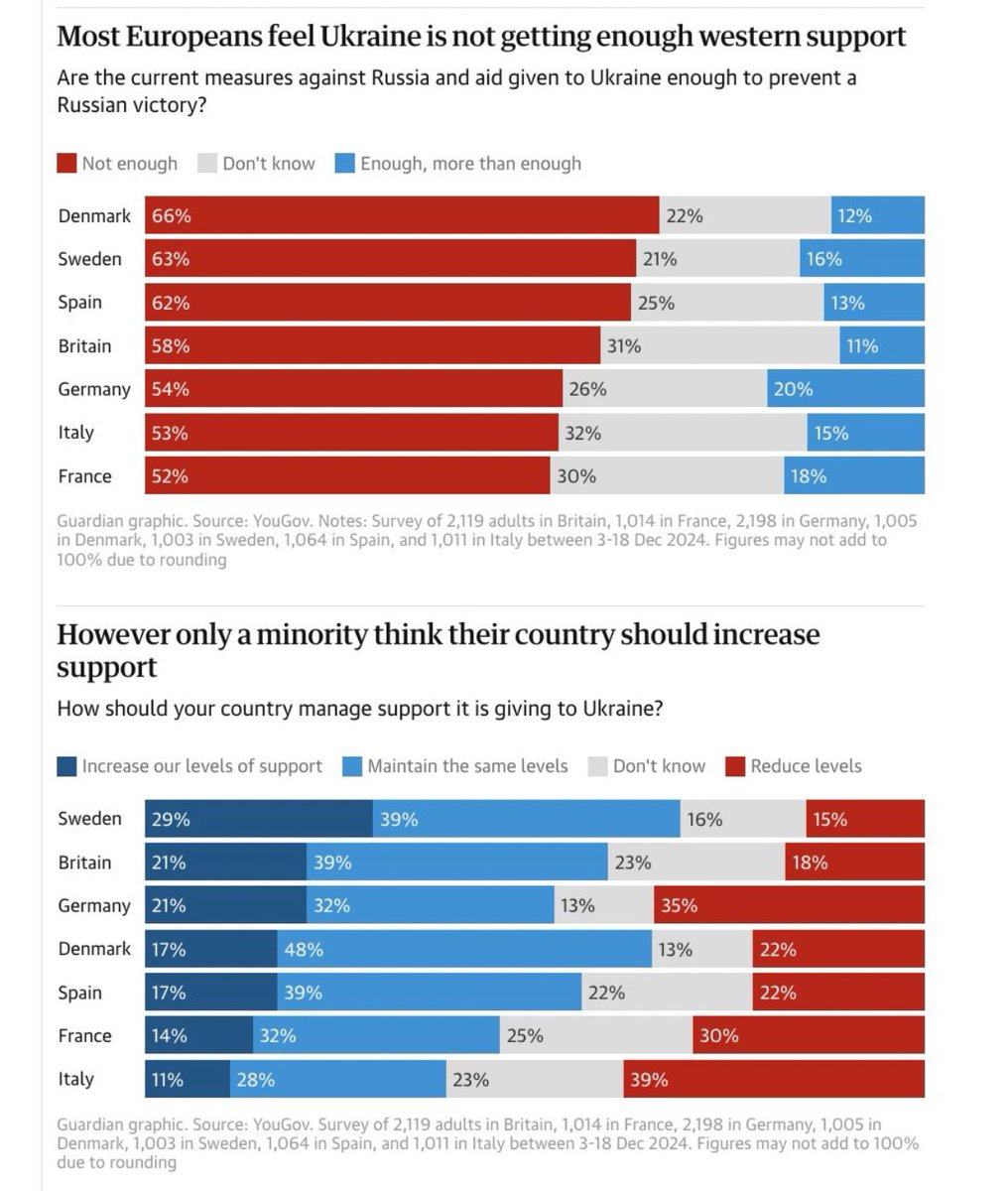

I get a lot of emails from readers each week. Most are supportive and appreciated, but some offer constructive criticism – and a few are just plain critical. I received emails from a few readers who were upset about my comments on Zelenskyy and my disapproval of his attire. I am of the view that if you are meeting world leaders, you should be dressed appropriately. The readers commented that I never mentioned the fact that Musk is not dressed in a suit and tie. To be fair, the readers are correct. Musk should be dressed appropriately and his kid should not be running around the Oval Office. Musk was in a suit and tie at the President’s speech to Congress Tuesday, so we know he owns one. I also wrote that I felt the argument last Friday should not have played out publicly. On a positive front, Reuters is reporting the mineral deal between the US and Ukraine is back on. Also of note, Tuesday afternoon Euronews reported that Zelensky was willing to work under Trump’s leadership to get a peace that lasts. To be clear, I am of the opinion the US must give support to Ukraine due to the Budapest Memorandum (1994) which I have written about extensively in the past. During the fall of communism in Russia, Ukraine had 1/3rd of the Russian nuclear warheads and agreed to remove them in return for security assurances from Russia, the US, and UK. No country should ever give up their nuclear warheads based on how this played out for Ukraine. I also am of the belief that most of the cost of Ukraine should fall to Europe not the USA. Europeans feel Ukraine is not getting enough support, but they don’t want to pay for it.

I have written about Lang Insurance 1 (866) 964-4434, my property and casualty broker. Kevin Lang continues to help Rosen Report readers with their insurance needs and just last week saved someone $30k on ONE policy alone. He also was able to get another reader access to a top insurer who previously refused to insure in a certain older building in NYC. My readers are raving about Kevin and his team. I switched to Lang after a dozen years with another broker and am happy I made the switch.

A lot of readers are under the weather. I lost my voice and have been incredibly congested. I have no fever and definitely have not lost my appetite. I have an upper respiratory infection and am on a Z-Pak and cough medicine. Not getting much sleep.

Markets

Tariffs

Asset Backed Market

South Florida Condo Crisis

Home Prices/Inventory

New Development in West Boca

Mortgage Demand Surged

Pictures of the Day-Stubborn Seed

My love of food is legendary. Last week when I attending the JPM Leveraged Finance Conference, I grabbed a quick bite at the bar at the Michelin Star restaurant Stubborn Seed in South Beach. Chef Jeremy Ford never disappoints at this farm to table restaurant that infuses both Latin and Asian influences into his dishes. If you eat at a table, you are required to get the 8-course tasting menu for $175. I sat at the bar (limited a la carte options) and was again blown away by the combination of service, food, presentation and experience. I started with the ricotta gnudi that is hard to explain other than to say delicious. Gnudi is similar to gnocchi, but gnudi is made from ricotta cheese and flour, while gnocchi is made from potatoes and flour. The last time I was there, I had ordered the crunchy truffle bravas and it was one of my favorite potato dishes in recent memory. The textures are amazing, and the portion is massive. For my entree, I had the striped sea bass that was presented beautifully and also, lived up to the hype. The Swiss chard chimichurri stole the show, and the complexity of flavors blew me away. For dessert, I ordered the mille-feuille over allspice ice cream and it was tastefully presented. Even though I am not an espresso fan, I left nothing on the plate. As I walked back to my hotel some 10 blocks away, I found myself in front of Prime 112 (over rated and had not been in years) and recalled an amazing dessert there (chocolate & peanut butter smores). I felt morally obligated to partake, but it was a mistake. The decadent sugar bomb was fine, but too much after my Stubborn Seed meal. I regretted it and left with a stomach ache.

Food-9.2 (Stubborn Seed is a top 10 Miami Restaurant)

Service-9

Ambiance-8 (Room is beautiful)

Cost-Full but Fair-$150 including one glass of wine

Sports Day in South Florida

Florida has so many amazing opportunities to attend sporting events across the state and on Sunday, I was able to partake in two of those events. My son, Jack, and I started early Sunday by playing padel at Replay with dear friends Jaron and Josh.

A reader called me the other day and asked if I wanted two VIP tickets to the Cognizant Classic (PGA Tour event). My friend, Max Greyserman was playing in it, and I had wanted to support him. As a result, I accepted the kind offer to attend the golf event during the day on Sunday and went after the padel match.

We were able to watch the event and cheer on Max (#35 in the world). We also saw some other amazing pro golfers including Rickie Fowler, Jordan Spieth, Shane Lowry.

We had a great time with our friends and the VIP tent was amazing with lots of food and drink. Max shot -5 on the day and had yet another solid finish (T-11). The weather was absolutely stunning on Sunday making for an amazing afternoon. Here is a 10 second video of Max chipping on #18 to leave himself a tap-in birdie putt. My raspy voice is the one in the background (recorded on my iPhone). When I interviewed Max last year, I strongly suggested companies should be sponsoring Max. Let’s just say the price went up after an amazing 2024.

From the tournament, we went home to shower and change and drove 50 miles to watch the Miami Heat play against the NY Knicks with the entire family. The tip off was 6pm, so it made a pre-game dinner challenging. I bought seats online for a couple hundred each (far less than if MSG). However, those annoying fees always irritate me and feel they should disclose the FULL price in advance.

We watched a great match up of Eastern Conference rivals that started with the Heat blowing out the Knicks but ended in overtime with a Knicks win.

It was a long day that required almost 200 miles of driving, but it was well worth it. I got some great time with my son who is off to Wake Forest in no time and had a great family event at the Heat game. South Florida has a lot more to offer in recent years as the wealth has relocated. There are more sporting events, improved restaurants, plays, shows, concerts and you cannot beat the weather eight months a year.

Quick Bites

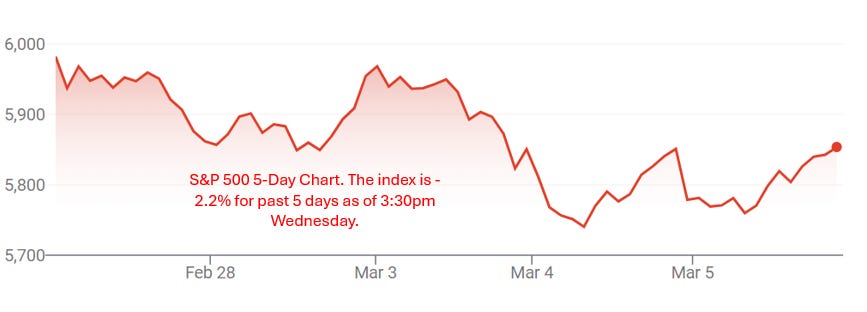

Markets sold off sharply Monday (-1.5-2.9%) on the news that Trump would continue with tariffs. Stocks took a notable leg down in afternoon trading following President Trump’s reiteration that 25% levies on imports from Mexico and Canada would go into effect on Tuesday, dashing investors’ hopes of a last-minute deal to avert the full tariffs on the two U.S. allies. All three indexes traded in positive territory earlier in the day, with the Dow rising nearly 200 points at session highs. I have been critical of the on again/off again tariff discussion which add too much uncertainty to the markets. I feel these could have been handled better. I have written in recent pieces that the markets do not feel so good to me, and I questioned the Friday afternoon rally in Sunday’s note. I am worried that the combination of high stock valuations, tariffs, and uncertainty can lead to a decent amount more volatility. Again, on Tuesday we saw markets sell off sharply due to trade war concerns. The Nasdaq was in correction territory Tuesday after falling more than 10% from its recent high as the Mag 7 trade unwind continued. The S&P closed below where it finished on election day in November. Financials underperformed as fears of slower economic growth/lower earnings due to tariffs weighed on markets with the KBW Bank Index -8% mid-day Tuesday before closing down 4.5%. Wednesday saw more volatility with a rally after Trump paused tariffs on autos. At 3:45pm, stocks were +1-1.4% for the major indices. The Treasury market rally continued with the 10-year yield down to 4.16% Monday after a recent high of 4.8%. However, as of Wednesday afternoon, the 10-Year Treasury was back up to 4.28%. Crypto rallied sharply after the announcement of a strategic reserve but sold off again in conjunction with equities. However, Wednesday, Crytpo rallied again and BTC is back to $90k. Oil prices fell to $66/barrel on OPECT output increases, tariffs and the pause on Ukraine aid.

An economist warned Monday that the U.S. is “gagging” on uncertainty around the Trump administration’s economic policymaking, and that the situation could get worse. Mark Zandi, Moody’s Analytics chief economist, gave the dire assessment during an interview with CNN in which he was asked about comments made by Treasury Secretary Scott Bessent over the weekend about the potential impact of the tariffs Trump is threatening to impose on China, Canada, and Mexico. On Face the Nation, Bessent dismissed as “alarmist” an analysis from the Peterson Institute which found that the tariffs would cost the typical U.S. household over $1,200 a year. CNN host Kate Bolduan asked Zandi if he agrees with Bessent’s conclusions that the tariffs. “I think they’re going to raise prices,” Zandi answered. “They’re a tax on American consumers. If you add up all of the tariffs that are now in play, those that have already been imposed—like the 10 percent on China—and those that are being discussed, like the 25 percent on Canadian and Mexican imports… That’ll add about $1,250 to the typical American’s bill over a period of a year.” I am concerned about the impact of tariffs on pricing. I also believe the way these played out led to a lot of market uncertainty. If tariffs are in place for negotiation purposes and will be repealed quickly, I am less concerned. Lutnick is suggesting tariffs on Mexico and Canada could be scaled back quickly. If we are talking about this months from now, I do have fears of unintended consequences as markets are already on edge and vulnerable. If the tariffs are prolonged, we could see a slowing economy which to me is the outcome that could lead to lower prices, but for the wrong reason. As a result of economic impact fears, the futures market is anticipating three rate cuts in 2025, which is up from one cut a few months ago. The likelihood of a 2nd half of 2025 recession has gone up and the longer the tariffs are in place, the higher the likelihood will be of a sharp decline in economic activity. Here is Warren Buffett’s take on tariffs. Produce prices expected to rise in days. I don’t have the space to go through all the tariffs, but I will focus on China with the chart below. In 2024, the US exported $143.5bn to China and imported $438.9bn from China. China just announced additional tariffs of up to 15% on some US goods. Trump better hope our trading partners blink, or I fear things can deteriorate further. Best Buy CEO warned price increases are “highly likely” post tariffs, and consumers are already struggling with inflation. Stock market darling Nvidia is hit $110 on Tuesday - well below the DeepSeek lows due to tariff fears. If these onerous tariffs lead to a quick resolution and improved trade terms for the USA, Trump looks like a hero. If these last and help push the USA into a recession, he looks like a clown.

Great WSJ article about the asset backed market. The convention halls at the Aria Resort & Casino on the Las Vegas Strip were packed for four days this past week with bankers and their clients, in uniforms of Italian sportscoats and office sneakers. At 10,000 people, it was the biggest ever SFVegas—the annual gathering for the structured-finance industry. The last time it boomed like this was 2006 and 2007. Mortgage bonds were selling like crazy, and this crowd was flying high. Then these financiers crashed the U.S. economy and sent the global financial system to the brink. Now, structured finance is back. Wall Street is once again creating and selling securities backed by everything—the more creative the better—including corporate loans and consumer credit-card debt, lease payments on cars, airplanes and golf carts, and payments to data centers. Once dominated by bonds backed by home mortgages, deals now reach into nearly every cranny of the economy. New U.S. issuance of some of the most popular flavors of publicly traded structured credit hit record levels in 2024 and are expected to surpass those tallies this year, according to S&P Global. New asset-backed securities totaled $335 billion last year. Collateralized loan obligations, or baskets of corporate debt, rose to $201 billion, also an all-time high. These asset backed securities are not a bad thing, but there are levered plays here that tend to eventually lead to pain.

Politics

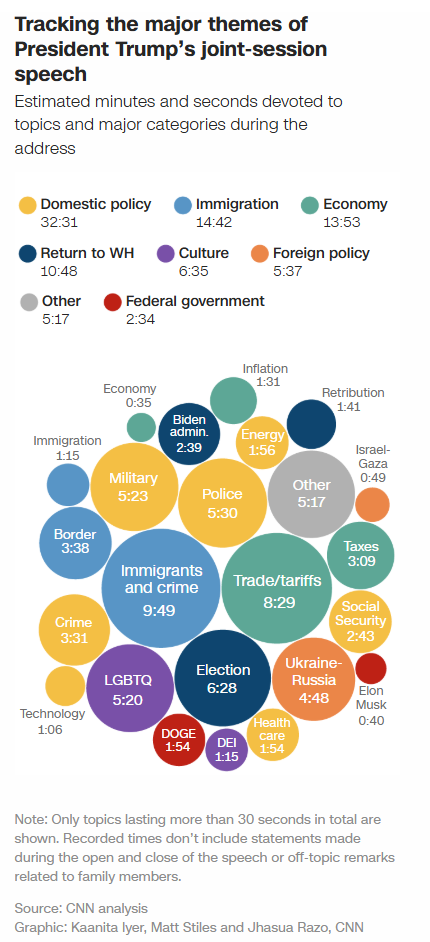

My piece is too long to go over the entire speech Trump gave to Congress. The President hit on “Common Sense” policies and brought up mistakes by the prior administration. The address was far too long at 100 minutes, but felt Trump was effective, albeit divisive. The feedback from polls was positive and here are some of the views from various media outlets: NPR, Fox, NY Post, CNN, AP. He spoke at length about transgender rights, migrant crime, DEI and ending the woke era. He honored women killed by illegal immigrants as well. The Democrats in the room were not enthused and one, Al Green (D-X), was removed from the building due to heckling. As usual, Trump over exaggerated his accomplishments. I felt he over estimated DOGE’s savings. I also felt his long list of people over 100 in the Social Security system suggested they were receiving benefits but I am not convinced that is broadly true. He did not talk much about inflation and suggested that “tariffs are about making America rich again.” He did brag about shutting down the border and those results are hard to argue. He revealed that the top terrorist behind the Abbey Gate attack in Afghanistan was caught. He made a point discussing a letter from Zelenskyy where the Ukrainians are looking to get to a deal in both minerals and peace. I thought he was actually funny at times in the speech, but the Democrats did not budge and held signs “Musk Steals” and “False” while he was speaking. Full speech here. Everyone should listen. Overall, I thought Trump did a good job. I just wish he did not overstate facts, as it makes it so easy to poke holes.

Trump tariffs live updates: Canadian PM Trudeau announces 25% retaliatory levy on U.S. products

Although I am not a Trudeau fan, I felt his press conference was well done.

I would be surprised if this happens.

Zelensky describes Oval Office meeting as ‘regrettable,’ says he is ready to negotiate peace

Elon Musk appears to back US withdrawing from NATO and the UN

Although I appreciate Musk, his contributions to society, and help on DOGE, I feel he needs to stay a bit more in his lane. Focus please.

Trump pauses all US military aid to Ukraine after heated Oval Office meeting with Zelensky

Hong Kong firm to sell stake in Panama canal ports to BlackRock group

AG Pam Bondi says FBI delivered 'truckload' of Epstein files after she put out hard deadline

Will we finally get details or more disappointing information releases?

Trump ‘bump’ disappears as the S&P 500 is now negative since the election

US government mulls sale of 443 federal properties

The portfolio comprises non-core assets across 47 states, the District of Columbia, and Puerto Rico. The assets, almost 80 million square feet of commercial space, are currently owned and maintained by the General Services Administration’s Public Buildings Service.

Here we go again. When we elect the elderly, this is what happens.

Middle East

DOJ Antisemitism Task Force Planning Visits to Ten College Campuses

“The President, Attorney General Pamela Bondi, and the entire Administration are committed to ensuring that no one should feel unsafe or unwelcome on campus because of their religion.” Hard not to love this if you are a Jew.

Another example of the Trump Administration supporting Jews. I love this.

Other Headlines

Wall Street Banks Say Markets Are Flashing Rising Recession Risk

Private employers added just 77,000 jobs in February, far below expectations

Wednesday am released data disappointed (does not include government jobs) and stocks sold off on the news.

Leon Cooperman says he’s selling into market strength and holding lots of cash

Markets don’t feel great, but they have been incredibly resilient.

Goldman Sachs rolls out downside protection ETFs as market volatility picks up

Target warns February sales were soft, adding to concerns around the consumer

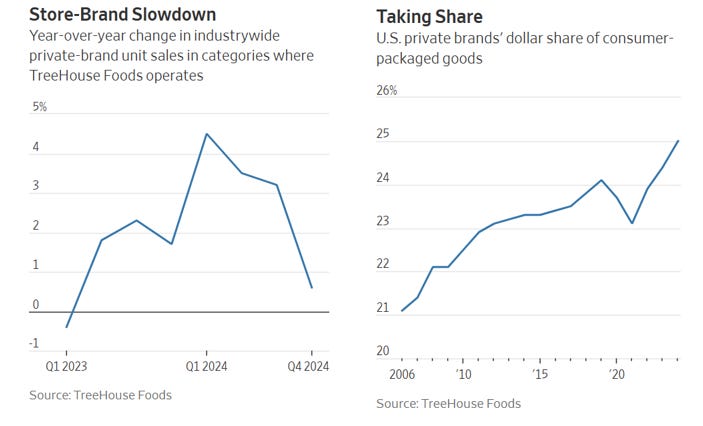

Store-Brand Supplier Feels Pain as Shoppers Pull Back on Lower-Cost Groceries

Best Buy shares plunge as CEO warns price increases ‘highly likely’ due to tariffs

Xiaomi to sell EVs globally ‘within the next few years’ after launching $73,000 car

NYC shootings fall to 30-year record low as crime drops citywide

Great step in the right direction. Clean up the streets and make subways safe again please.

I just cannot comprehend why this is even a discussion. How are we allowing biological men to compete with women and allow them in girl’s bathrooms and locker rooms? Lia Thomas was #554 in the Men’s division and a national champion as a woman. Mic drop.

Graduates From Top MBA Programs Are Struggling to Land Jobs

I am not a big fan of hiring MBA students, despite having an MBA from the University of Chicago. I have had very limited success on MBAs and prefer to hire undergrads and pay them so well they don’t want to leave.

Strip club Cinderella story ‘Anora’ wins best picture at 97th Academy Awards

Article outlines the winners of Sunday’s big night. Anora, the Palme d’Or winner at Cannes, won five awards despite a $6mm budget. The director, Sean Baker won best director, best picture, best original screenplay and best editing tying Walt Disney (1954).

Michelin-star chef says this is the No. 1 thing home cooks waste money on

Hard to argue his point.

Daylight saving time is this week — 3 tips to ease in so you don’t ruin your sleep

Swearing is linked with increased pain tolerance and strength

If that were the case, I would be the Incredible Hulk.

White Lotus fans upgrading to US$10,000 suites to mimic show

Its popularity drove up room rates at the Four Seasons resorts in Maui, Hawaii, and Taormina, Sicily, where the first two seasons were filmed

Health Related

Most adults expected to be overweight or obese by 2050

So much for GLP-1s making a dent. This is surprising given how many people are taking drugs to lose weight.

You can reduce your chances of dying by 31% with just this much brisk walking

Real Estate

I have written extensively about the South Florida condo crisis brewing in older condo buildings and this NY Post article goes into greater detail. Amid a property market that’s still vibrant for nearly every other segment, Florida’s aging condominiums are losing value. And nearly 1,400 buildings are now blacklisted from receiving mortgage financing, making those apartments an even-tougher sell. At the heart of this turmoil is a basic reality: Florida’s aging condo buildings desperately need repairs, and state officials are forcing them to assess (and pay for) those long-overdue upgrades. Under a law enacted after the tragic 2021 collapse of Champlain Towers South in Surfside, condo boards may no longer defer major structural improvements. The “Building Safety Act” required every condo tower in Florida aged 30 years or older to complete a structural integrity study by the end of 2024, to get a full grasp of what problems need fixing. I would not be purchasing an older condo unit unless the price was dirt cheap.

Interesting WSJ article, “Are Home Values About to Fall? It Depends on the Location.” Stark regional differences are opening up in the housing market. Buyers have the power to demand big price cuts in some parts of the country, but still face bidding wars in others. Beneath the headline numbers, different states are recovering at sharply different paces. Inventory has shot above 2019 levels in a handful of areas. In Texas, the number of properties for sale is 20% higher than it was before the pandemic, data from Realtor.com shows. Florida and Colorado are also above 2019 levels. At the other end of the spectrum, supply is crunched in parts of the Northeast and Midwest. In 15 states including New Jersey and Pennsylvania, the number of homes currently on the market is still less than half what was normal before the pandemic.

I am helping friends find a house in Boca and went to a new development to see the models to report back. It is in Lotus Edge (Glades and Lyons). It is a GL Homes community under development and the models just opened. I could not find a place to park as there were so many potential buyers and brokers looking at the units. Lots of amenities and the price point is $1.5-3.0mm range. Small lots, new construction and clearly plenty of demand. Pools, tennis, padel, pickle, gyms, restaurants, indoor basketball, kids’ playrooms for the 600+ homes. I was amazed at the number of people looking. It is a bit west, but there are numerous communities out there and many people love it. I was just shocked at the amount of traffic to see the models and felt that the homes were nice for the price point. When you go east and live in a golf community, the prices are far higher for less house.

Weekly mortgage demand surges 20% higher, after interest rates drop.

© 2025 The Rosen Report LLC. All rights reserved. Does not constitute investment, financial, legal, or tax advice. Consult with your lawyers and professional financial advisers. Rosen Report™ #767 ©Copyright 2025 Written By Eric Rosen.