Opening Comments

My last note was entitled, “Bostwana Beats the Hamptons in This Regard,” and resulted in many emails of agreement about awful cell service and the need for a fix.

The most opened link was the CNBC emotional intelligence quiz. One reader sent me this: “Thanks for the link on the emotional intelligence quiz. My family chat is having a field day discussing the results! Like you I got a 9 and disagree with their preferred answer on the 10th.”

I hosted a great panel Wednesday afternoon with 3i Members which covered a lot of ground on the luxury residential real estate market in NYC, Hamptons and South Florida. Thank you to John Burger (Brown Harris-Manhattan), Tim Davis (Corcoran-Hamptons) and Devin Kay (Douglas Elliman-South Florida) for participating. I will have excerpts or the entire video once the recording is edited. The feedback was amazing.

I had a crazy glitch in Substack today and had to recreate this in short order. I apologize if there are some errors. It was a freak breakdown in the system.

Cembalest’s Eye on the Market-The Rasputin Effect: Global Resilience to Higher Rates

Markets

US Federal Annual Interest Just Under $1 Trillion Annualized

US Consumer Data Continues to Concern

Trump Indicted….AGAIN

Two High End Miami Transactions

Low Luxury Inventory for Residential

Higher Rate Mortgage Holders are More Likely To Sell

Migration Patterns

More NYC Office Defaults

Cembalest’s Eye on the Market-The Rasputin Effect: Global Resilience to Higher Rates

Another great piece by Michael which goes over rising rates and resilient economies. The article discusses rising rates take time to impact profit margins and balance sheet. You always learn something reading these pieces.

Video of the Day-Crazy Marlin Jumps Into Boat

Fishing can be dangerous. Some of these fish are huge and aggressive. Each year, I see videos of large marlin literally jumping in the boat. Remember, they are hundreds of pounds and have a long and sharp bill which can kill you. When I caught my 350 lb marlin in Cabo (20 lb test), I refused to bring it into the 24ft panga given the dangers with my son on board. Watch this short video of the huge marlin jumping into the boat while being reeled in by the angler. Not sure how it ends, but it appears no one was hurt. It would be hard to get a large marlin out of the boat without injury.

38 Hours in NYC Rosen Report Style

I think I have NYC dialed in for the most part after decades of living in the city and countless visits since my departure. I decided to pop into NYC Friday night, July 28th for a short visit to see what I could accomplish in a day and a half. I got to the city around 5pm and did a quick work out, showered and headed down to the Lower East Side. I had wanted to try the hot bar, “Double Chicken Please,” which was voted #1 in the country by Conde Nast Traveler.

It was 98 degrees, and I was wearing Bonobos pants and a long sleeve shirt. BAD IDEA. I was dying in the heat. Also of note, relative to the young, tattooed hipsters, I may as well have had on a tux with top hat and tails. I was the only person in long pants and a long sleeve shirt. I got there at 6:30pm assuming it would be quiet at that time. There was a line out the door despite the heat, the fact that it was a weekend in July, and it was early. I befriended the bouncer, Dre, and got in quickly for a seat at the bar. There is a front and back section, and the back is only for reservations. The place is hip and cool with fun drinks. Drink names are food names, and I tried the Key Lime Pie. They recommended the chicken sandwich called the “Salted Egg Yolk,” and I ordered it despite generally not eating fried food. Let me be clear, it was the best chicken sandwich I have EVER eaten. The menu is limited, but it was enjoyable despite being the oldest person in the room by 20 years.

I decided I needed to walk off the calories and started to walk over to the West Village, about 1.5 miles northwest of the bar. I stopped for at the Little Cupcake Bakeshop which was pretty darn good, but I like Magnolia better.

My favorite lasagna in the city was I Sodi in the West Village and they just moved locations about 100 yards, and I had not been to the new one. From an ambiance perspective, the old one wins, as it had exposed brick walls and was charming. The new one is a bit cold. I was in shock when I was unable to get a seat at the bar as a single in July on a Friday night at 7:30pm. UNHEARD of for me. I had been to the old one at least a dozen times and NEVER once had a reservation to sit at the bar.

I was quite disappointed and walked over to Little Owl. It WAS a good restaurant when I lived there. Quaint and a great date place. Let’s just say the quality of food slipped a bit and my meatball sliders were a “C” at best. The farfalle pasta with pesto and sun-dried tomatoes was tasty, but the cook on the pasta was awful. I was so mad at myself, but in shock at being turned away from I Sodi.

I walked over to L’Artusi (great Italian) and sat at the bar for a drink before going to listen to Jazz at my friend’s club, Cellar Dog. He is among the most loyal Rosen Report readers and a big contributor. It is a cool place with pool tables, ping pong, foosball and shuffleboard and chess with live jazz. Young crowd.

Five hours and counting…

I woke up at 6am Saturday, worked out, walked Central Park (6 miles) and went to the Met Museum prior to the 10am opening. I went to the masters (Renoir, Van Gogh, Monet…), Modern art which had a great Guston exhibit, and went to see the Egyptian section with the Temple of Dendar. My wife and I were co-chairs of the Apollo Family Circle fundraiser for the Met for years and held the annual dinner at the Temple of Dendur (completed 10 B.C.). Special place. I recorded this 1 minute video showing the Temple for those who have never seen it, and explained the room done by one of my favorite architects, I.M Pei. The Met Museum is overwhelming, and is 2.2 million square feet of art and history. You can spend days there.

19 hours and counting…

From the Met, I walked down to the MOMA (Museum of Modern Art) and saw more amazing pieces. I collect Modern art and would love a bigger collection. If I had $1bn, 80% of it would be spent on art between 1940-1970. IF I could afford it, my collection would have Pollack (50s), Lichtenstein Girl from the early 60s, Rothko (50s), Warhol (60s), De Kooning (50s), Shiraga (50s) and one Van Gogh (late 1800s) as well as less important works.

After the MOMA, I walked to meet friends for lunch at Avena on 66th and Madison. You guessed it, another family (avid readers) who are looking to move to Florida and wanted to speak with the ambassador (me) about the best communities. They live on the Upper East Side and cited crime/safety concerns, quality of life, cost of living and taxes as the main reasons for the move. We had a great lunch.

I went home and showered only to put on pants and a SHORT SLEEVE shirt due to the heat and lessons from Friday. I jumped on the bus downtown (did not feel unsafe) and went back to the Village as I was determined to get into I Sodi and got there at 5pm. Guess what. NO JOY. The line started at 3:45pm and I was 30th on the wait list as a single for the bar. What the hell is going on here? I went to 4 Charles. No Joy. I went to Nakazawa, NOPE. I went to L’Artusi and yet another Heisman. Restaurants are packed on a Friday and Saturday night in July at 5pm with near 100 degree temps? Frustrated and dejected, I walked to Eataly and had wine and some food. Yes, it is good, not elite. The fennel with breadcrumbs stole the show but they definitely have a bit of a kick.

I bought a ticket to the show, Funny Girl, with Leah Michele and walked over to Times Square. The show was amazing, and she has one hell of a voice. Leah is leaving the show in early September and suggest you see it prior to her departure. I walked home and got back at 11:30pm and worked on a Rosen Report.

30 hours and counting….

I woke up at 6am to lift weights and then catch the first Jitney back to the Hamptons.

Folks, few consume more culture than the author of the Rosen Report, especially when I lived in NYC and prided myself on consuming all that the city had to offer (museums, sports, art, food, music, philanthropy, architecture…). Now that I live in Florida, when I come back, I try to pack it in to get as much done as possible in short order.

I did witness a homeless man urinating on a car at 8pm in the West Village on Bleeker Street. I saw hundreds of people smoking weed including 3 teens sitting on a stoop in the Village using MASSIVE bongs in front of cops. I saw a lot of filth including this syringe on the sidewalk in the West Village.

Although I am not a fan of what NYC has turned into, I was happy for the restaurant industry that the places were packed and of note, the average age was less than 35. How the hell do they afford these places? I was disappointed that despite consuming a great deal of culture in short order, my food intake was subpar relative to my normal trips… there is always next time. As a side note, some people still wear masks…outside and I have never seen more for rent signs in the retail space, and it was all over the city.

Quick Bites

After a nice run for stocks, there was a sell-off Wednesday largely induced by the Fitch downgrade of the US Long Term Credit Rating to AA+. The Nasdaq index shed 2.2% to end at 13,973, while the S&P 500 pulled back 1.4% to close at 4,513. The Dow tumbled 348 points, or 1%, to finish at 35,283. Interestingly, again, the front end of the Treasury market rallied on the downgrade, but 7 years and longer sold off on the news. The 30-Year Treasury sold off 8bps to 4.18%. In a concerning move, the US pulled back the offer to buy 6mm barrels of oil to refill the strategic petroleum reserve which is at historic low levels.

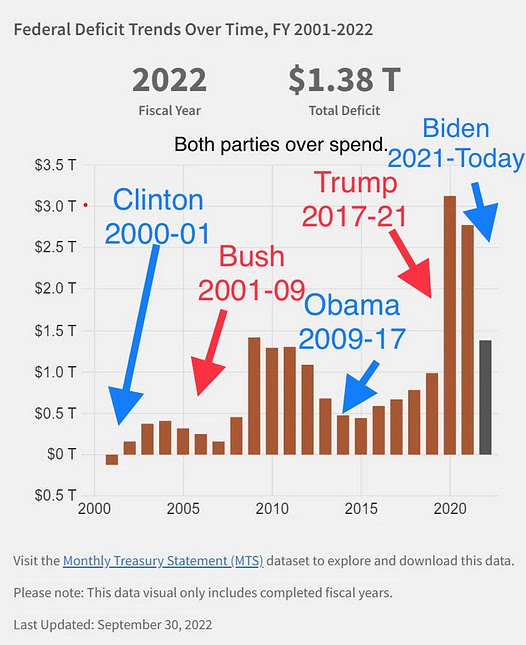

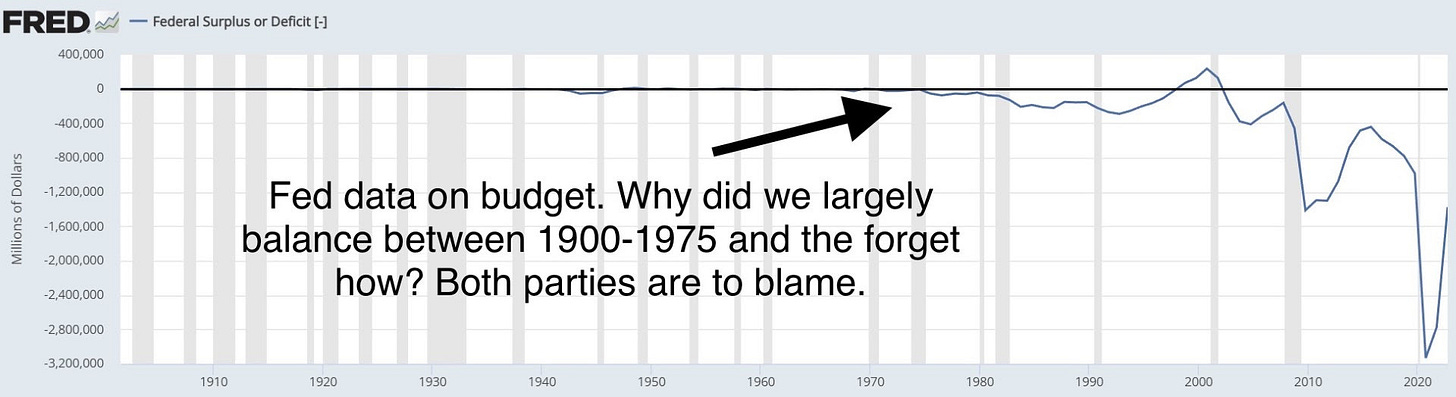

I have been sounding the alarm on deficits, government spending, entitlements, aging population, health care costs and the exploding Federal debt levels. Bloomberg put out the latest chart on annualized interest payments which are approaching's $1 trillion. My investing hero, Stan Druckenmiller, has sounded the alarm on these issues recently and I am in total agreement. He has made a half dozen speeches on the matter in the past 9 months and I included short excerpts above. The math does not add up and entitlement spending and interest expense is crowding out non-discretionary spending. We need to start acting on these issues today before it is too late. Yes, I am pointing fingers at both parties. The 2nd row of charts are from Cembalest at JPM. Of note, this week, Fitch downgraded the US long-term rating to AA+ from AAA citing debt limit political standoffs. Clearly, the massive growth in debt and interest burden is not helping matters.

I have been concerned about the US Consumer for some time and have written extensively about debt levels credit cards, interest rates, impact of inflation, auto loan payments, delinquencies… The US consumer is resilient, but they are closer to cracking. Check out this message below from the Kobeissi Letter. Debt is for buying a house, not for food. In the first quarter, used-car borrowers had on average of almost $9,000 in negative equity at origination, according to a J.D. Power and TransUnion study released in June. Consumers buying more expensive used cars with less or no money for a down payment contributed to this, he said. 61% of Americans say they are living paycheck to paycheck even as inflation cools. The article suggests more consumers are turning to high-priced credit cards to fund the deficits. As of the end of the 1st Q, credit card debt was $1 trillion and up sharply in recent years. Awaiting 2nd Q 2023 data in Aug.

Trump was indicted for the third time this week due to his alleged effort to overturn the 2020 election. Prosecutors say the alleged scheme, which they say involved six unnamed co-conspirators, included enlisting a slate of so-called "fake electors" targeting several states; using the Justice Department to conduct "sham election crime investigations;" enlisting the vice president to "alter the election results;" and doubling down on false claims as the Jan. 6 riot ensued -- all in an effort to subvert democracy and stay in power. Despite his mounting indictments, legal fees, and large donors going elsewhere, he remains the frontrunner for the Republicans. I do wonder what the discovery process will reveal here. It is clear to me that both parties lack leadership and remain hopeful 2024 sees new candidates not named Trump or Biden. I do not see how Trump can possibly win with what has transpired. The Republican party needs to find new leadership. The judge overseeing the case is Tanya Chutkan, and was appointed by Obama.

Other Headlines

Banks say conditions for loans to businesses and consumers will keep getting tougher

Meta’s stock just wrapped up its ninth straight monthly gain as Wall Street cheers cost cuts

Walmart Buys Tiger Global’s Flipkart Stake for $1.4 Billion

Article suggests with prior sales, Tiger Global made $3.5bn on the investment.

Trucking Giant Yellow Shuts Down Operations

The 99-year-old company with 22,000 Teamsters employees advises customers and workers of shutdown. Article suggests mergers and over leverage caused the demise.

Ford Will Lose $4.5 Billion On EVs This Year, Up From $2.1 Billion Last Year

Despite this, Ford raised its guidance but is "throttling back" on plans to ramp up EV production.

Home Insurers Are Charging More and Insuring Less

Industry tries to rebound from years of losses owing to storms, fires and inflation

The average age of Congress is rising. That’s unlikely to change soon.

I keep writing about this topic. We can do better.

Joe claims to never have had ANY conversation with his son about business, yet many people claim Joe was involved. What gives? Devon Archer makes some damaging claims. However, let us not forget Archer is going to jail for fraud.

High school boys are trending conservative

Interesting article on high school boys and girls and how they identify politically over time.

In June of 2021, I wrote, “Fauci Ouchie,” suggesting it was time for Fauci to step down. I personally believe his poor decisions and conflicts made the impact of the pandemic far worse. The suggestions here are he was lying under oath. Remember, I called it the Lab Leak early and was absolutely eviscerated for doing so.

Peltz, Druckenmiller, Navarro give big to Tim Scott PACs as DeSantis falters

Shirtless man pumping gas in Brooklyn stabbed to death by offended Muslim stranger

The Muslim was offended by the shirtless man and the dancing.

Illinois Gov. Pritzker allows non-US citizens to become police officers with new law

Mugger posing as UPS delivery man beats woman with weighted sock, robs her of $25 in NYC building

The incident happened on E 27th in Kips Bay (neighborhood for many new college grads starting careers in NYC). The perpetrator has not been caught. When he is, what are the consequences?

Los Angeles security guard Daniel Sandifer killed by mob outside Dragonfly Hollywood nightclub

Pittsburgh mass shooter sentenced to death for slaughtering 11 in synagogue

‘We can’t coexist anymore’: Miami Beach weighs outdoor sleeping crackdown for homeless

The article suggests there are 235 homeless in Miami Beach and 608 in all of Miami. How does this compare to other cities? Even on a population adjusted basis, LA and NYC have 5-6x more homeless than Miami.

I applaud James and his team for trying to make an impact. Unfortunately, the results are disappointing. There were some areas of improvement, but clearly not as hoped.

Why do some people get cancer, while others don’t? Scientists have one ‘revolutionary’ explanation

The abundance of circular RNA molecules within certain individuals’ cells is a major determining factor in why some individuals develop cancer-causing genes or oncogenes, while others do not.

Interesting article, but not clear that the results are meaningful yet.

‘Barbenheimer’ is a billion-dollar win for the global box office

Look inside the world’s largest 3D-printed neighborhood in Texas

Properties currently on offer are being sold at $475,000 to $599,000.

The 3D-printed homes range in size from 1,500 to 2,100 square feet and have three to four bedrooms.

Vegan raw food diet influencer Zhanna D’Art dies of starvation

The pictures in the article are concerning.

This was declared the ‘world’s healthiest’ food — here’s how to eat it

Miami’s Overflowing Septic Tanks and Trash Piles Test Appeal to Rich

As the city tries to attract more out-of-state workers and wealthy residents, it must deal with a multi-billion dollar environmental problem. It is clear to me that South Florida has infrastructure issues around roads, schools, hospitals, doctors, golf and clearly trash dumps.

Phoenix on cusp of all-time hottest month on record

I was in Vegas last two weeks ago and can tell you that it was BOILING.

25 craziest TikTok challenges and the ordeals they've caused

Kids have died due to these dumb challenges.

Real Estate

I wrote that high-end Miami and Palm Beach homes continue to amaze and won’t back down. A couple examples: 37 Indian Creek Island Road just sold and was listed at $69mm. New home, but awful lot. Speculation is the sale happened in the mid 60s. Most lots on Indian Creek are 2 acres with 200ft of water frontage and this only is on 1.2 acres and 115ft on the water. The location is not good, but it is a new build, a rarity on the island. The views from this lot are weak relative to most others on the island. David Guetta (famous DJ) bought the house. I cannot imagine his neighbors will like any loud parties. This transaction makes Tom Brady’s new build worth $90mm+ down the street. In a separate transaction, 3511 Lake Ave, Maimi Beach sold for an undisclosed amount after asking $39.5mm. I am told, Barry Diller may have been the buyer and it is a knock down built in 1987. The money continues to pour into Miami and Palm Beach. I am now working with multiple readers to move to South Florida at prices between $5-35mm. All from NYC. Hearing another world-famous billionaire just bought two lots in Miami on the water as well. I will disclose when I can confirm. Maybe, just maybe CA and NY don’t have it right.

Sales of luxury homes nationwide, defined as the top 5% of homes based on estimated market value, declined by 24.13% in the three months ended June 30, compared with the same period last year, according to a new report by brokerage Redfin. Inventory of luxury homes was down 2.39% during that same period, while the median sales price for a luxury home was up by 4.55%. In many metros, homeowners appear to have pulled back on listing homes in light of the market shift. New luxury listings were down by 17.08% year-over-year in the three months ended June 30, Redfin’s data shows. Sales of nonluxury homes also fell during the same period, but that drop—19.42%—was smaller than the decline in the luxury market, according to Redfin. Inventory for high end homes is lower. People have nowhere to move when they sell. Also, the large increase in rates is playing a part. If you locked in a 2.25% mortgage and sell, your new home mortgage will be closer to 7%. Lastly, in Florida, taxes play a huge part. If I sell my home today at market prices for $14mm or so, and buy a new one for $12mm, my annual taxes will triple to $250k. That is a big driver of me not selling. Beautiful pictures in the WSJ link.

US homeowners are nearly twice as willing to sell if their mortgage rate is 5% or higher, but just one in five mortgaged homes meet that criteria. For those who have a mortgage rate of at least 5%, 38% said they’re planning on selling their homes, according to a quarterly survey by Zillow. Just 21% of holders with rates below that dividing line said the same. Existing-home sales have fallen almost every month since the start of last year as higher mortgage rates disincentivize owners from moving. Prospective buyers have sought out new construction instead since inventory on the resale market is so low. I know from many readers, they won’t sell their homes with a 2% mortgage despite wanting to do so because the new mortgage will be closer to 7%.

With mortgage rates at 20-year highs, more people are looking to relocate from high-cost coastal cities to places in the South and Southwest, with Las Vegas as the top destination. Nearly 26% of property search queries on online real estate brokerage Redfin.com are for cities where potential homebuyers don’t live, based on data for the three months ending June 2023. That’s the highest percentage since 2017, when Redfin first started tracking migration data. Homeownership costs seem to be driving the trend, as the majority of homebuyers are from cities with some of the highest home prices in the country, such as New York or Los Angeles. Based on an analysis of 100 metro areas, the following 10 cities had the highest net inflow of property searches on Redfin’s website. Net inflow is the number of people looking to move into a city minus the number of people looking to leave. Note, 4 of the top 10 are Florida.

The unfortunate case of 111 Wall Street might be even more unfortunate than it sounds. Two months since we wrote that the vacant, 1.2 million square-foot tower at the corner of South Street “epitomized the crisis” of the downtown commercial market, the building owned by Nightingale Properties and Intervest Capital Partners now faces a foreclosure action by mezzanine lender Oaktree Capital Management, as first reported by Real Estate Alert. An auction is scheduled for Sept. 19 to be run by JLL, which is the tower’s leasing agent. JLL declined to comment. As we wrote on June 8, the owners plunked nearly a half-billion dollars into buying the 1960s property and handsomely redesigning it top-to-bottom with new, modern infrastructure, only to encounter the worst office-leasing market in decades. I wonder how much debt is on the building and if the sale prices cover Oaktree’s loan. All eyes meanwhile are on 60 Wall Street, the nearly vacant tower a few blocks east that’s nearly twice as large as 111 Wall. Owner Paramount Group, a global operator, is much stronger than Nightingale and its partners and 60 Wall’s location is nearer to the Fulton Center subway complex.

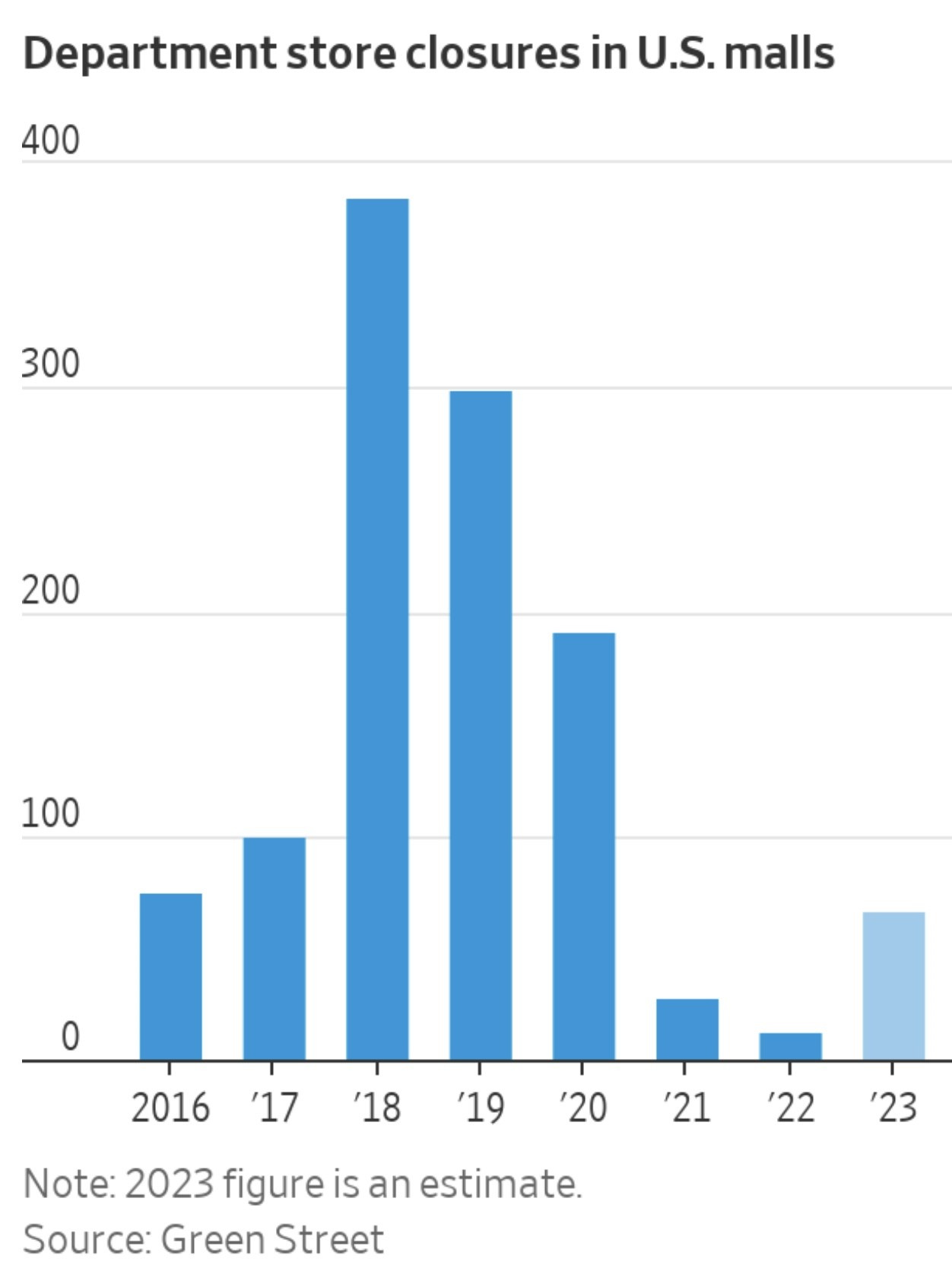

Older, low-end malls are worth at least 50% and, in some cases, more than 70% less than they were when mall valuations peaked in late 2016, said Vince Tibone, head of U.S. retail and industrial research for real-estate research firm Green Street. Now, as more than $14 billion of loans backed by these properties comes due in the next 12 months, according to Moody’s Analytics, struggling malls are defaulting on their debt. With mortgage rates up sharply, refinancing that debt will be more challenging and expensive. About a fifth of all malls financed through commercial mortgage-backed securities are underwater, meaning the properties are worth less than the loans they back, said Kevin Fagan, head of commercial real-estate economic analysis for Moody’s. In one example, Crystal Mall in CT was valued at $153mm in 2012 and sold for $9.5mm recently at auction.