Opening Comments

Adrift

Natural Gas Markets

Quick Bites

Markets, Jobs Report, Inflation

BOE Warning/Cotton Prices, Deepfake Technology

5 Foods to Help Memory & Focus

TX High School Shooting Suspect Released

NYC Gifted & Talented Program Ending?

NYC Thief on a Pink Girls Bike

Virus/Vaccine

Data-Continued Improvement

Delta Variant

Nordic Countries on Vaccine for Kids

Military Vaccination Rates

Seattle PD

Real Estate

My General Comments

FL Car Registration Rules For New Residents

Canadian R-E Concerns

NYC R/E Tax Loophole

CA Median Home Prices to $800k

TSLA Headquarters to TX

Miami Condos Accepting Bitcoin

Opening Comments

I was solo with the kids for 5 days while my wife, Jill, went to NYC to visit her family. She had an amazing time and her mom threw her a small surprise party. The pandemic took so much away from everyone. Missed interactions, family gatherings, holidays, graduations, proms, homecomings…. It is nice to see some return to normal. I continue to blame China for the virus, the cover up, lies, buying all the PPE and they have not paid any price for it. I have suggested this was lab made (not wet market) since early in the pandemic and nothing I have seen alters my view.

I am trying to keep the Rosen Report a bit shorter, but it is hard to edit it down with so much going on in the world I find interesting. Please keep good story ideas coming. A reader introduced me to an energy expert who helped me prepare a section on natural gas prices for today’s piece. Evan, thank you for the intro and I hope my readers find the section as informative as I did. It makes today’s report a bit longer, but feel the natural gas story is important. Expect winter heating costs to be up substantially this season, especially in the northeast.

Airlines cancelled flights with Southwest at the top of the list cancelling 28% of flights on Sunday for a total of approximately 1,018 flights, while 808 were cancelled Saturday. American and Spirit cancelled low single digit percentage of flights Sunday. The airline blamed air traffic control issues and weather. On a related note, I continue to hear about rental car prices being elevated despite the end of the busy travel rush. One person was scheduled to go to Idaho last week and was going to be charged $1,200 for 3 days for a Camry prior to taxes and fees. Another reader called about a mid-sized car in Indiana which was quoted at 4x his normal rate. A savvy reader told me to get the Avis app and I have been booking rental cars at discounted prices since. Give it a try and I think you will find that it saves you real money.

Picture of the Day

I was sent this photo of the mullet run which happens in South Florida this time of the year. Mullet are small bait fish which show up by the millions. They are so thick you can almost walk on the water. They bring with them hungry snook and tarpon who feed on the small fish. A lucky fisherman caught this remarkable photo last week. The large fish are 100 lb tarpon and the little ones are mullet. I see 6 tarpon in this picture and I am sure there are far more under the water. Nature is remarkable. Note the pelicans getting in on the action too. By the way, this is on the beach just feet from the shore and YES, you can catch massive fish from the beach this time of year. When you catch a tarpon, they jump and flip and twist. Lots of fun.

Adrift

A friend of mine asked me to go to Bimini with him to show them how to high speed troll which is a form of fishing for wahoo; it is quite technical. My friend has a $2.5mm HCB fishing boat with 1,700 horsepower. I brought one of my other friends who high speeds with me all the time, so we could do it right. You need to drive the boat between 16-18mph and zig-zag over massive depth changes (100 to 1,000 foot shelves). I fish with trolling weights ranging from 16 to up to 64 ounces to keep the baits at varying depths to find fish and prevent tangles. Each rig (lure, leader, weight) is $150-200, so you don’t like the lose them. The distance the line is away from the boat needs to be staggered and also depends on the amount of weight. It is complicated and took me time to learn it, but I find it incredibly effective to catch wahoo.

Wahoo swim 60mph and when they hit the large lure, the line rips off the reel. We fish four rods at once. When you get into a school of fish, you can get three or four on at once and pandemonium ensures. We rode 80 miles in this fast boat to the “Gingerbread Grounds” to fish. Everything looked good until shortly after we started fishing and the boat lost its ability to steer. A warning came onto the system to shut it down. We could not see land and were miles from shore. We shut down the system and it worked…for a short time and shut down again. We could still drive the boat as there are two throttles-one for the left 2 engines and one for the right two engines. You can steer without a wheel, but it is not incredibly easy to do. We could not high speed troll and we quickly caught some yellow eye snapper, strawberry grouper and some lobster. But it was not an epic fishing day due to the mechanical issues with the boat. We ended up getting back safely despite the issues, but it clearly could have been a heck of problem. On a full day like this, I would generally catch 3-8 wahoo and much bigger snapper. The owner of the boat threw a great party after where we ate all the fresh fish and it was a fun time.

As I think about the direction of the US, I too feel it is adrift and not on the proper course. I was critical of many of Trump’s actions and behavior despite agreeing with some of his policies (pro-growth, lower regulation, lower taxes, business friendly, pro-Israel, tough on borders, tough on trade/China…). I find the political divide has become so great between the right and the left, there is no longer a middle ground. I receive emails from readers telling me “Biden is a B+ and Trump is an F.” Personally, I am not impressed with either, which is far too often the case. The latest poll from Quinnipiac University found 38% of those surveyed approve of Biden’s job performance and 53% disapprove. These numbers are not far off of Trump’s with positive views from his own party and negative from the other side. Biden received less than 40% approval on handling of the economy (39%), his role as commander in chief (37%), foreign policy (34%), immigration (25%), the situation at the Mexican border (23%) and taxes (37%).

I do not blame Biden for all that is wrong with the direction of this country. It is unfair to suggest any one individual has that much power. However, as a country, we are adrift and the currents are taking us down a dangerous path between too much crime, too much stimulus/growing deficit issues, border issues, foreign policy blunders, lingering pandemic issues, over-wokeness, economic inequality, lack of affordable education housing and healthcare, labor/wage problems, inflation/rising food prices and oil/gas, growing anti-semitism, growing power of Progressives, a lack of middle ground between the left and right, the growth of the welfare state, concerns over the integrity of elections, poor leadership from politicians on both sides of the isle, varying views on vaccines and mandates and so many other issues. Additionally, there have been more COVID deaths in 2021 (361k) than in 2020 (352k). To be clear, I do not blame Trump or Biden for this pandemic. I do feel we need real leadership from both sides of the isle based on the issues we face as a country.

Thankfully, the boat I was on made it safely back home without a major incident and I have a fun story to tell despite catching less fish than usual. I sure hope the story of the direction of this country has the same happy ending, but am growing worried that America’s ship is heading towards trouble.

Natural Gas Markets Explained

I spoke with Chris Brook, Director of Natural Gas & Energy Services at Competitive Energy Services to help me get data and information around what is going on with natural gas prices. I have touched on the topic, but wanted to take a deeper dive given the large price moves in the space, especially at some locations.

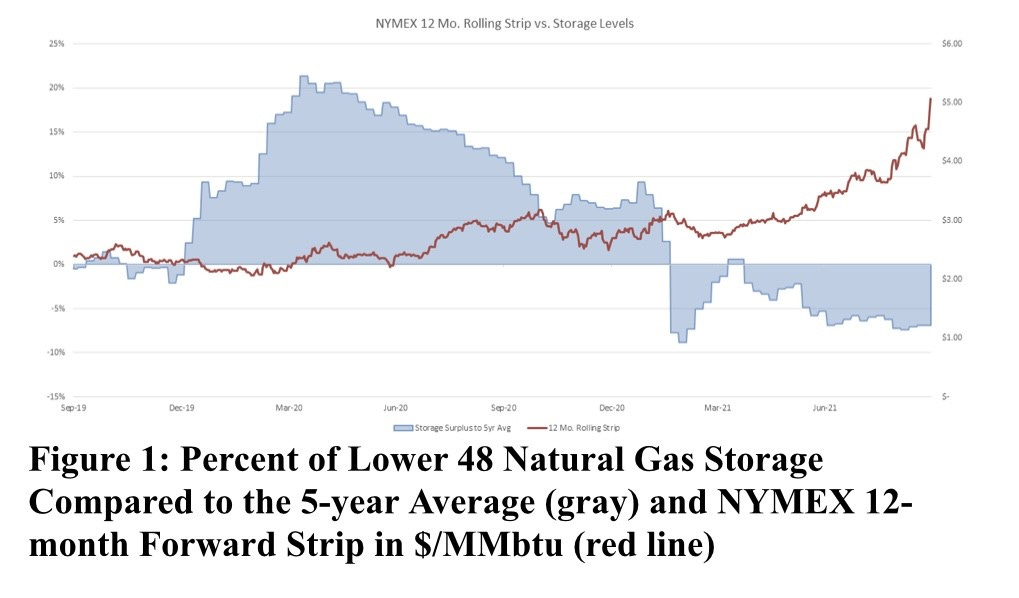

Production of natural gas has not rebounded to the same levels as before the pandemic. Suppliers are more disciplined, and less money is flowing into production. That fact, combined with the effects of Hurricane Ida, have had a major influence on markets and prices. In terms of the market’s current inventory, the U.S. is 7 percent below the 5-year-average

In addition, natural gas is in short supply in Europe. Europe acquires its gas through domestic production, LNG imports, and pipeline imports – including imports from Russia. The shortage is the result of a record hot summer, closing of production wells in Norway, declining imports from Russia and limited LNG cargo since early 2020. Domestic U.S. demand for power generation hit an all-time record this summer, due to hot weather, lower coal utilization, and because renewables underperformed. Specifically, the extreme drought that is plaguing the West resulted in lower hydro generation, less natural wind generation across the Midwest this past summer, and lower solar production as compared to historically higher levels. In addition, the industrial sector is booming, and economic activity is recovering. Growing markets such as petrochemical production and the oil refining process are very energy- and gas-intensive. That scenario has also driven increased demand.

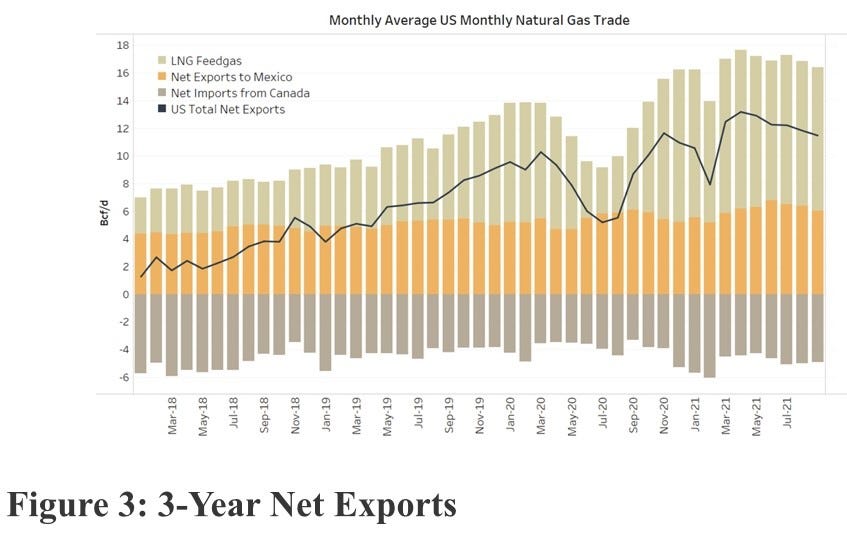

Domestically speaking, exports represent the other piece of the puzzle. We net export 25 percent of what we use every day through LNG, through pipeline gas to Mexico, and a net trade deficit heading into Canada. Those exports are helping drive down – or helping to keep inventories below – that 5-year-average.

Spot pricing always carries risk and many times, a reward. LNG prices and outdoor temperatures are the key drivers of spot prices. New England is going to continue to compete with Europe and Asia for shipments of LNG. If New England experiences a long stretch of sub-zero temperatures, spot prices are likely to rise above $35/MMBtu. Asia has already seen spot prices of $28 - $50/MMBtu. For perspective, last winter, natural gas averaged $5-6/MMBtu in New England. People are going to have shell shock when they see heating bills this summer.

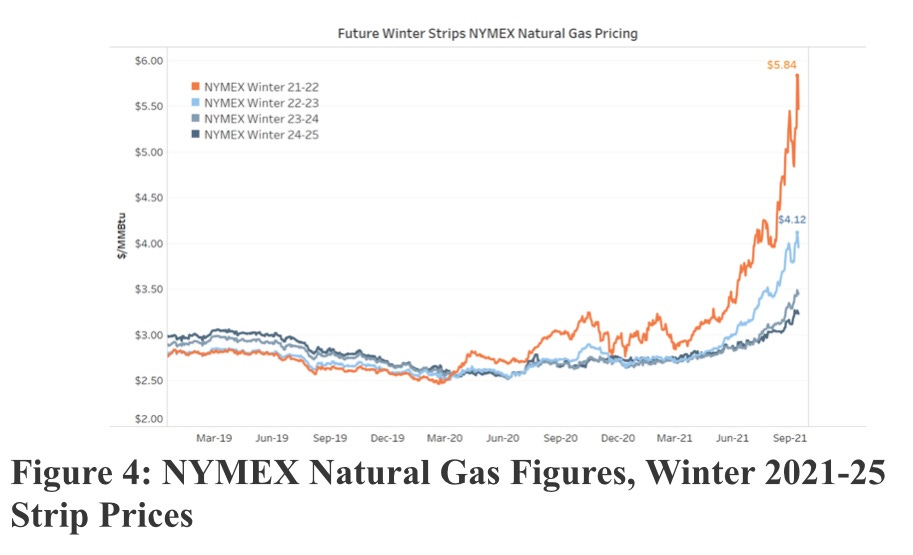

We have seen some production return to the market and increases in rig counts. Permits in Marcellus Shale are also on the rise. All of that is going to help push down price. It is important to remember that there are more private producers coming online due to higher future prices and lower barriers to entry. Even the markets are telling us that prices are not going to stay at these high levels. The forward prices are trading at a discount to winter 2021-22. An example of that would be a future price for calendar 2024 that is trading around $3.10 compared to a calendar 2022 trading at $4.50. In effect, the market is offering a 25 percent discount.

Right now, the market is concerned with the upcoming winter. Headwinds are expected that will challenge near-term price reductions.

Fundamentally, there is a world inventory shortage of coal and natural gas. Renewables have been intermittent, causing a reliance on natural gas. Demand is hitting all-time levels for electricity generation. Everybody is trying to fill storage at the same time. A significant amount of production increases will be needed to move that storage level needle. In addition, public energy production companies have become much more fiscally disciplined with their production expenditures and they are just not opening the spigot at any cost like they have done for the past 13 years.

I found this Wapo article on the global energy crisis interesting as well.

Quick Bites

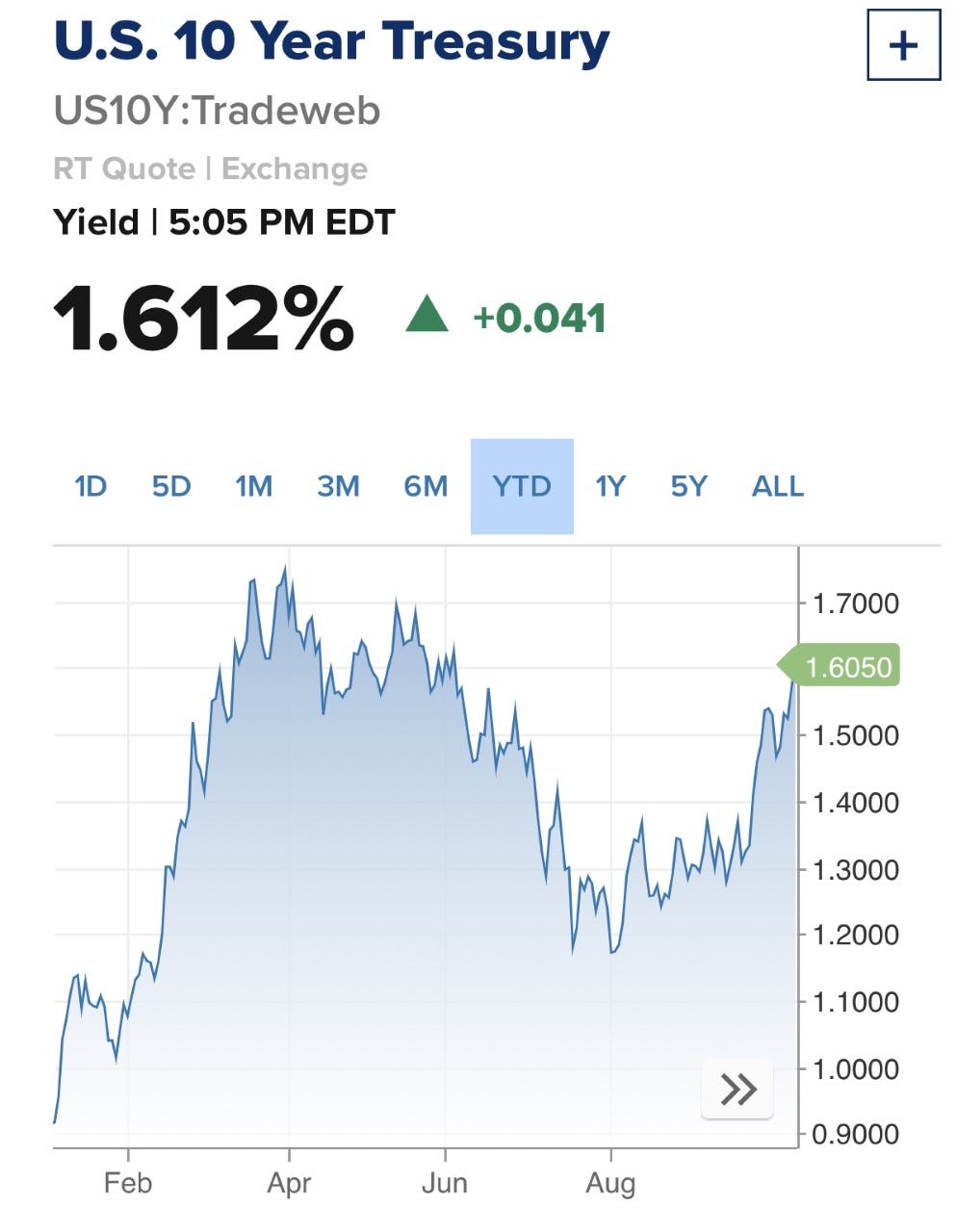

The Dow was little changed on Friday, notching a winning week as optimism about a short-term debt ceiling deal trumped a disappointing jobs report. The Dow Jones Industrial Average dropped 8.69 points to 34,746. The S&P 500 fell about 0.2% to 4,391. The technology-focused Nasdaq Composite fell 0.5% to 14,579. The major averages all ended in the green for the week. The Dow rose 1.2% for its best week since June. The S&P 500 rose about 0.8% for its best week since August. The Nasdaq rose just shy of 0.1% since Monday. Energy stocks plowed higher on Friday as West Texas Intermediate crude futures, the U.S. oil benchmark, crossed $80 per barrel on Friday for the first time since November 2014. WTI crude settled at $79.35. Exxon Mobil rose 2.5%, Chevron advanced 2.2% and ConocoPhillips added nearly 4.8%. Bitcoin is back up to $55.2k after dropping below $30k in July. The 10-year Treasury is back up to 1.61%. For perspective, it was 91bps at the start of the year. The market is clearly getting more concerned about inflation and I write about it in various bullets below.

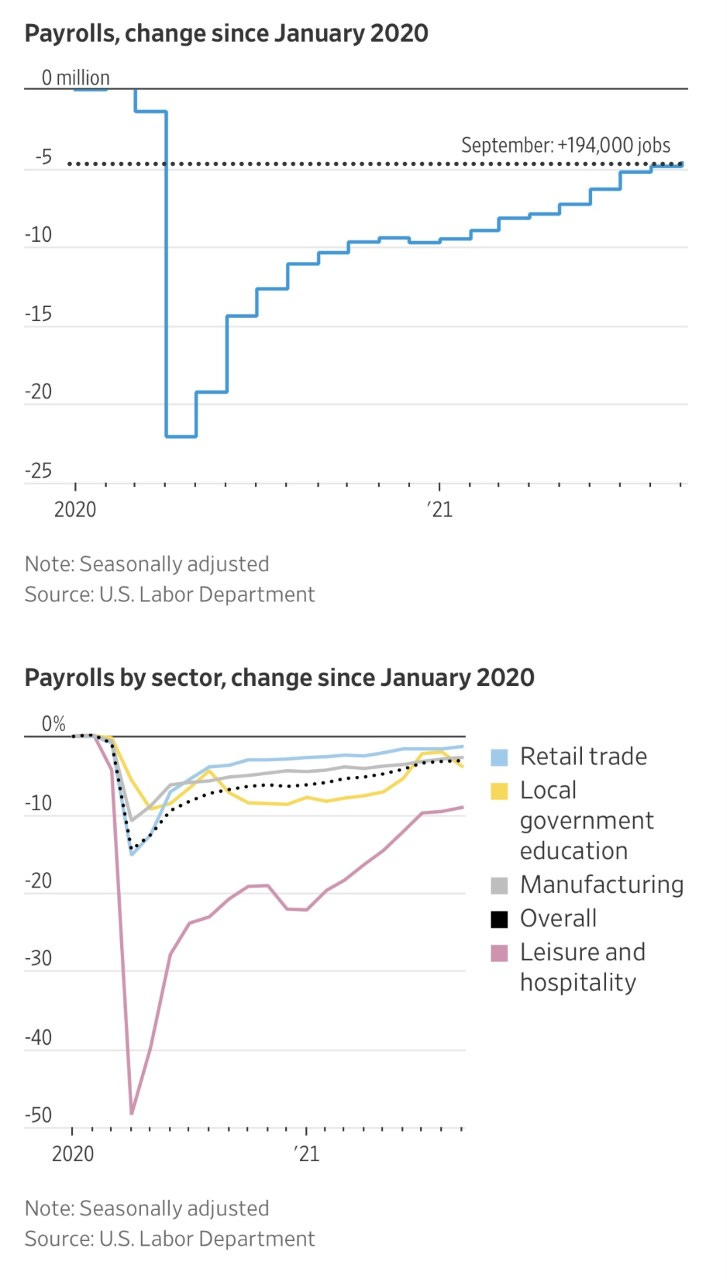

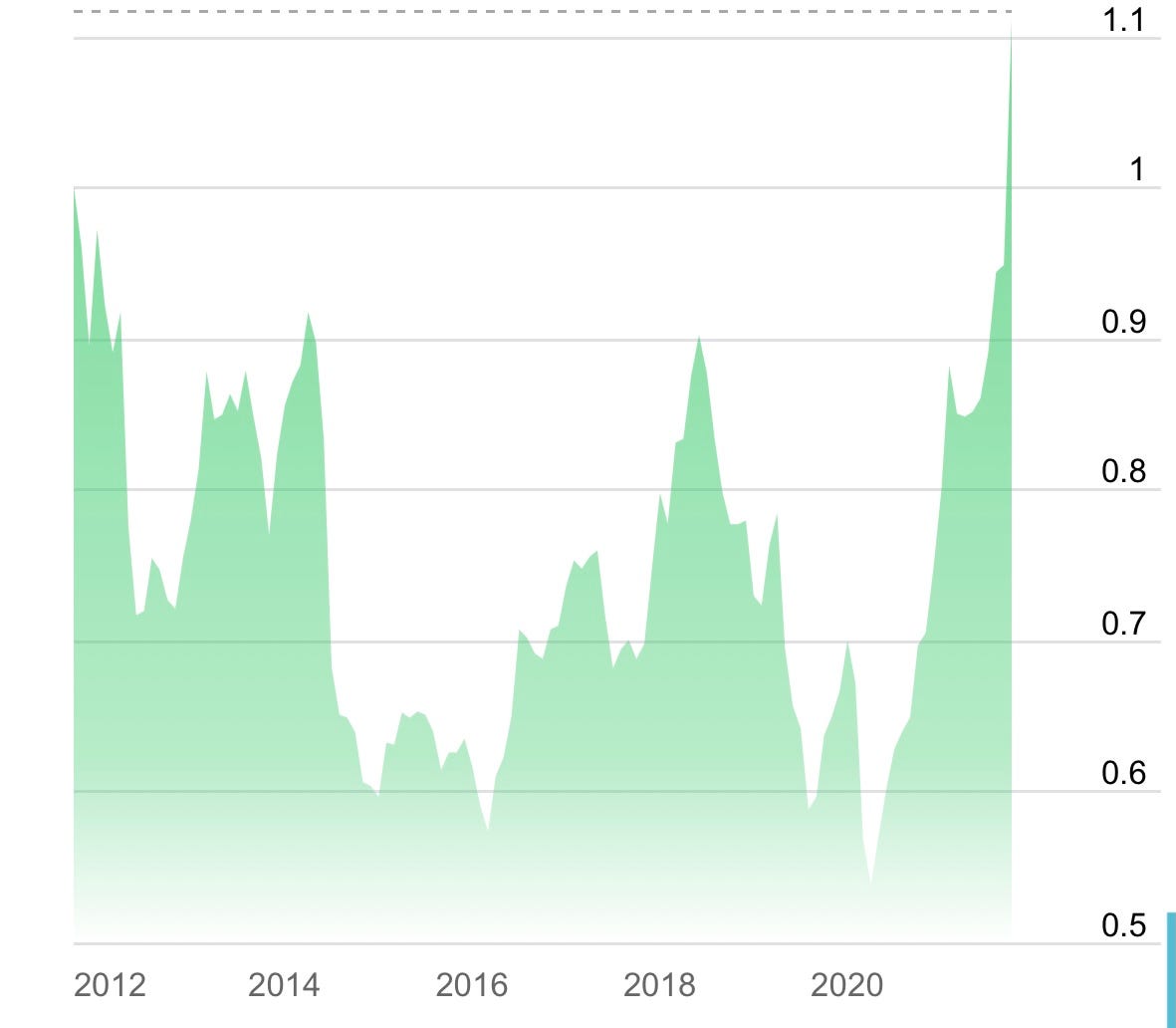

With respect to the jobs report, the headline number was a disappointment as the economy added just 194,000 jobs in September, the Labor Department reported. That was well below the Dow Jones estimate of 500,000. On the positive side, the unemployment rate itself fell to a much lower point than economists forecast. At 4.8%, that’s the same level seen in late 2016. Many workers gave up the job search and exited the labor force, the data showed. A bleaker labor picture could stall the Federal Reserve, as it prepares to slow its $120 billion-per-month bond-buying program.

Cotton prices hit a 10 year high on Friday reaching $1.16/pound and is up 47% in 2021. Expect higher prices on clothes.

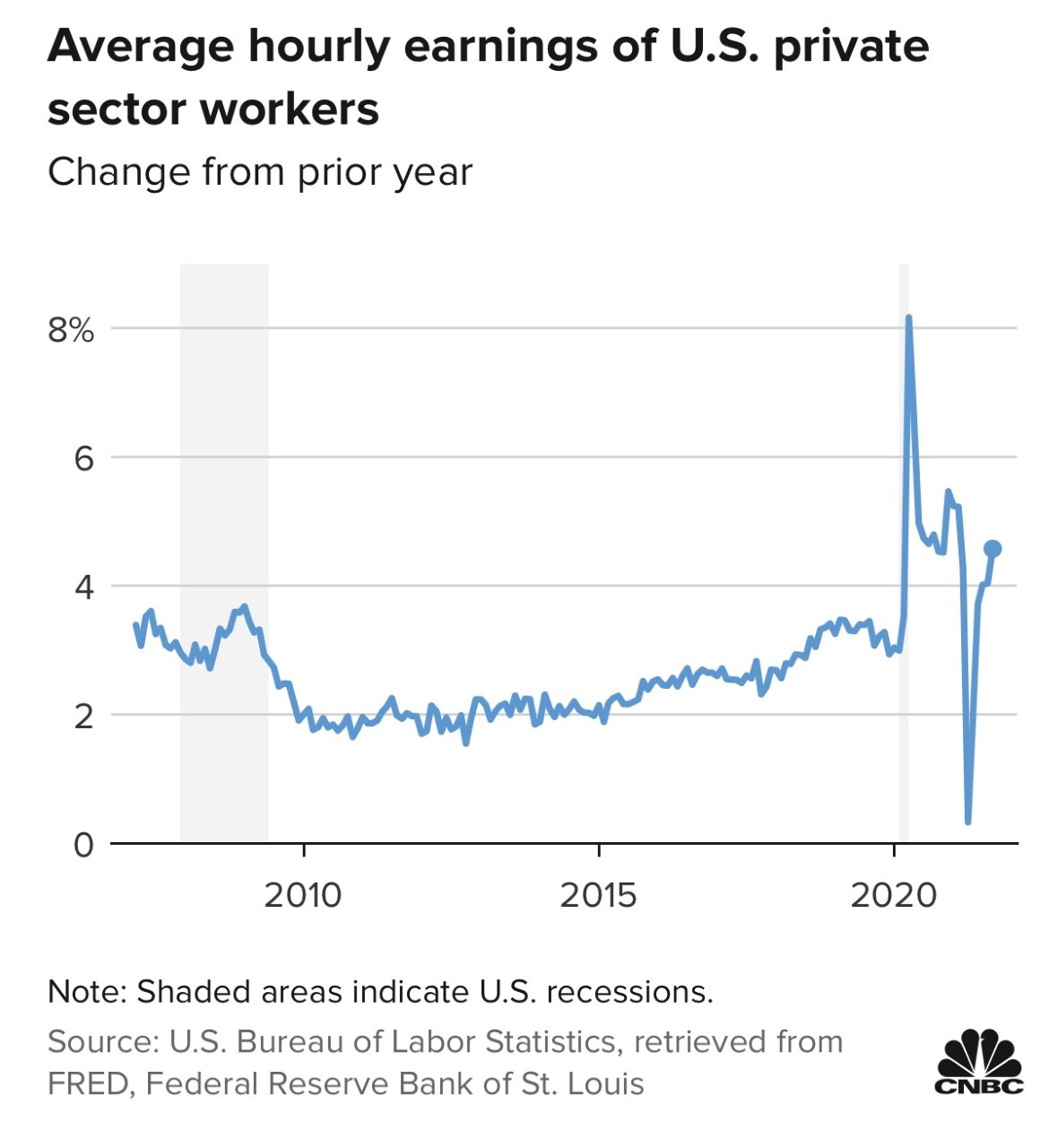

I am not sure I could have written about inflation more than I have in the past nine months, as I have been relentless. The wage gains continue as outlined in the September jobs report. September’s wage gains provided more fuel to the argument that the current pace of inflation could run longer than many economists anticipate. Average hourly earnings rose 0.6% for the month, making the year-over-year increase 4.6%. Over the past six months, wages are running at an average 6% annual gain. Excluding a brief spike in 2020, that’s the fastest annual pace since the Bureau of Labor Statistics started tracking the measure in March 2007. It’s also the third month in a row that the annual rise has been more than 4% and comes amid a tightening labor market and inflation that has been more persistent than many experts have expected.

On the continued inflation theme, I found this Reuters article interesting. The historically high value of financial assets could correct sharply if investors reassess the prospects for recovery from COVID-19, with signs of increased risk-taking at investment banks, the Bank of England said on Friday. The BoE’s Financial Policy Committee (FPC) said in a statement there was evidence that risk-taking remained elevated in a number of financial markets relative to historic levels. “Asset valuations could correct sharply if, for example, market participants re‐evaluate the prospects for growth, inflation or interest rates,” the statement said. “There are signs of continued loosening in underwriting standards and increased risk-taking in some investment banking businesses.”

Deepfake technology could soon give anybody with a computer or phone the power of a Hollywood special effects department. In the next several years, technologists predict we will all be able to create photo-realistic videos and sound recordings using software enabled by artificial intelligence. That means instead of using cameras and microphones, next-generation "synthetic media'' will be completely generated by computers. The story will be broadcast on the next edition of 60 Minutes, Sunday, October 10 at 7 p.m. ET/PT on CBS. Watch the one minute video in the link above. Holy $hit. This is scary and the implications are concerning. This link shows deepfake pictures which look incredibly authentic, but you know they are not.

A Harvard nutritionist and brain expert shared the 5 foods she eats every day to sharpen her focus and memory. Given I am 52 years old next month, I better start eating these daily. I forgot someone’s name the other day. It was humiliating. “Hey bud, how are you?”

Extra Dark Chocolate

Berries

Tumeric

Leafy Greens

Fermented Foods

Yet another tragic school shooting in Texas last week. The Texas student who allegedly opened fire at his high school, injuring four people, including a teacher, was sprung from jail on Thursday afternoon — as an attorney who joined him insisted that the case wasn’t a “standard-issue school shooting.” Timothy George Simpkins, 18, who attends Timberview High School in Arlington, will report to home confinement after he posted $75,000 bond at Tarrant County Jail, news station WFAA reported. One of the students struck by 4 bullets remains in a coma. The Simpkin family insists Timothy was bullied and robbed according to the articles I read. Not only was the 18-year-old released from Jail, his family threw him a party. I guess NY and CA are not the only states with dumb bail laws which allow suspected murders out of jail.

New York City parents ripped Mayor Bill de Blasio’s “extremely disappointing” and “abominable“ plan to ax the public school system’s Gifted and Talented program in his final months in office. The lame-duck mayor, announced Friday, to phase out the coveted exclusive education model by next fall — after he leaves Gracie Mansion at the end of 2021 as critics of the program asserted the coveted model is racist. I assume at the end of the day, it will be the call of Eric Adams to make the determination on the future of the program. DeBlasio is one of the worst mayors in the history of the US. He ran for President and received almost zero percent of the vote after running the largest city in America. He is now talking about running for governor of NY. Any person who is dumb enough to vote for the moron deserves him. Elections have consequences. New Yorkers’ new motto should be, “Anyone But Blaz.” Remember, this idiot contributed to the homeless crisis, massive rise in crime, bail reform, billions in tax revenues leaving the city, blown budgets, billions in waste and the latest is his misuse of security detail for personal reasons which means NYC taxpayers spend another $320k on Blaz as he has refused to pay it back. Another story outlines the pervasive shoplifting in NYC which is leaving many store shelves empty. Yes, leadership matters. One man was arrested 46 times for shoplifting in 2021. Why is he out on the streets? How many arrests until you actually stay in jail? Do you need 100? In another horror story, a Times Square homeless mugger shoved a nurse who hit her head and died. Jermaine Foster, had been arrested previously and has a history of mental issues.

A thief riding a pink bicycle with butterflies on it in New York City robbed a 10-year-old girl of her cell phone before peddling away Wednesday, police said. The girl was walking to school in Queens around 8 a.m. when a male on a girl's bicycle approached her, the New York Police Department said. The state of NYC under DeBlasio sure is not pretty. Little girls getting robbed from a man on another little girl’s bike? I wish this was an SNL skit, but it is not.

Virus/Vaccine

Improvements continue across the board and all charts are heading in the right direction as seen below. Cases are now down 44% from recent highs. Hospitalizations are down 35% from recent highs and deaths are down 15% from recent highs. However, it should be noted that there have been more COVID deaths in 2021 (361k) than in all of 2020 (352k).

A Canadian study has found a link between the new variants of SARS-CoV-2, particularly the Delta variant, and an increased risk of severe disease and death. The retrospective study, by the University of Toronto and appearing in the Canadian Medical Association Journal (CMAJ), looked at 212,326 cases in Ontario from February 7 to June 27, 2021. The study authors compared the risks of hospitalization, ICU admission, and death from the VOCs with those risks from non-VOC SARS-CoV-2 strains. In the Delta cases, there was a 108% increase in the risk of hospitalization, a 235% increased risk of ICU admission, and a 133% higher risk of death, compared with the original variant.

Finland, Denmark and Sweden are limiting the use of Moderna’s Covid-19 vaccine in young people over concerns around rare cardiovascular side effects. Finland’s national health authority, THL, announced Thursday that it would pause the use of Moderna’s Covid vaccine in young men. All males aged 30 or younger would be offered the Pfizer-BioNTech vaccine instead, THL said. The decision by THL followed announcements from its Swedish and Danish counterparts on Wednesday that both would be restricting the use of the Moderna vaccine in similar demographics. In Sweden, the use of the vaccine will be stopped in people born in 1991 or later, while Denmark is pausing the Moderna shot in everyone under the age of 18.

This article suggests that hundreds of thousands of US service members remain unvaccinated or partially vaccinated as the Pentagon’s first compliance deadlines near. For instance, 90 percent of the active-duty Navy is fully vaccinated, whereas just 72 percent of the Marine Corps is, the data show, even though both services share a Nov. 28 deadline. In the Air Force, more than 60,000 personnel have just three weeks to meet the Defense Department's most ambitious deadline.

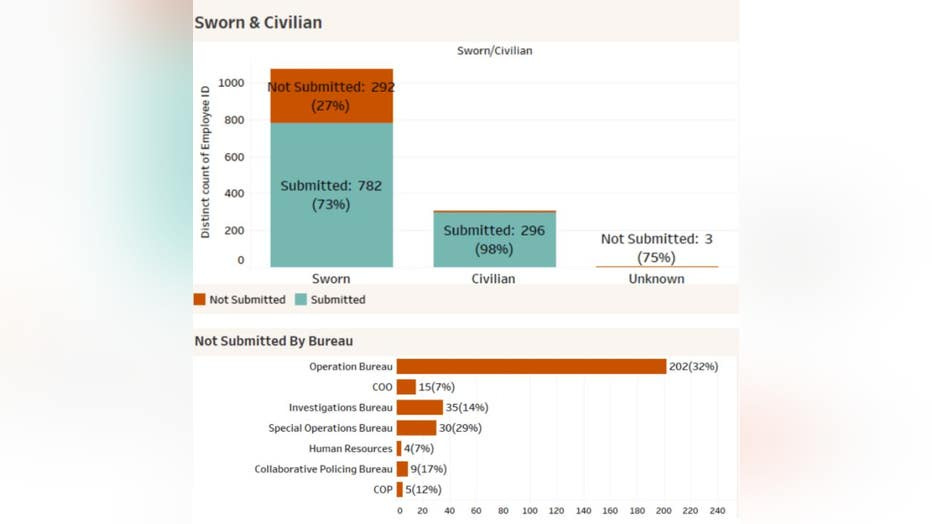

Already facing a staffing crisis, the Seattle Police Department is bracing for the possibility that hundreds of officers will fail to meet an Oct. 18 vaccination deadline. As of Oct. 6, 292 sworn personnel had yet to provide proof of a COVID-19 vaccination. That number is down from 354 on Tuesday.

Real Estate

A friend bought a house on a wide canal in Lighthouse Point, Florida a year ago. He paid $3.5mm. It is an older house with low ceilings and really a knock down. It is not listed for sale and he plans on demolishing it and building something new. He has been offered $5mm for it despite the fact that it is not listed. This is a 42% rise in a year and assume it would go for more if a formal process was followed. A young man I know (25 years old) rents a small 3 bedroom apartment with a friend in Boynton Beach, FL. He has lived there one year and was paying $2,000/month. He was just notified it is being raised to $2,500 (+25%) and he has a short time to decide as the landlord feels they will get even more from a new resident.

There is an article about relocating to Florida and changing your car plates. Those moving here need to know: Florida law makes it clear: you must register your vehicle in Florida within ten days of moving here, registering your child in a school, or starting a job.

A loyal reader, Bill, from Canada, sent me an article about the R/E market there and labor issues. I cannot attach it as there is no link, but here is an excerpt which is driving costs higher: There’s an absolute war on labor right now, specifically on the at-site, management construction staff. It’s nowhere close to 10%, 15% or 20%. We’re seeing salaries essentially increased by 50% to 100%.” Then there are rumblings of disruptions. While lumber shortages were well documented earlier this year, other disruptions are just beginning. “What we are starting to see on the ground is, you know, candidly, it’s a very concerning track,” he said. “Each one of our sub-trades is giving us a heads up that there are upcoming supply chain disruptions that are starting to happen. This is problematic because, as you could imagine, all the activities are sequenced if you’re doing a 40-story tower. You can manage around it, and you can focus your staff on the different elements. But you’re not able to close up any of the walls until the electrical and plumbing are in there.” “If these supply chain disruptions actually occur, they’re going to blow up, not just the budget side of the equation, but also the schedule side, which could have a pretty massive impact on the industry overall.” Personally, I am not convinved that these massive wage gains are transitory. I believe they will be stickier than many people believe.

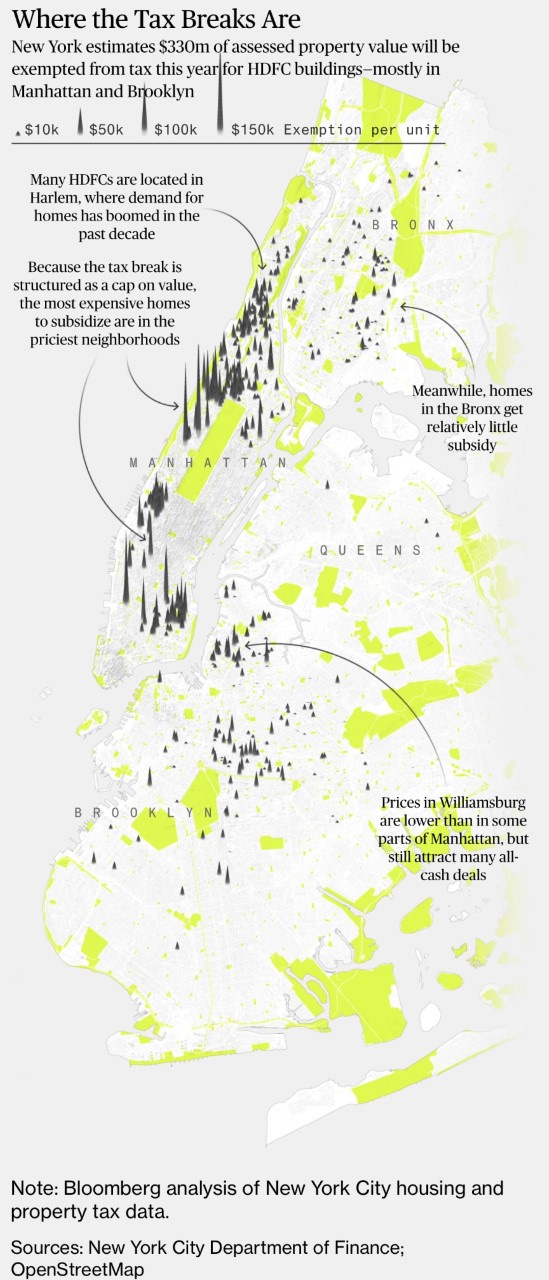

This is a Bloomberg Businessweek story about a NYC tax loophole on R/E which I never knew about until I read it. Kids of wealthy parents buy apartments in Housing Development Fund Corporation (HFDC) buildings which have a cap on the maximum taxable value of a unit which is set at $11,079. Remember, the median price of a home in the market is $770,000. A lot of banks will not lend into these buildings capping prices, but kids of wealthy parents are able to take advantage due to loans from parents. Here is the 1,000th example of another government program gone wrong.

The median price for a home in California is set to jump north of $800,000 next year, adding to a long-simmering affordability crisis in the state. The state, which has grappled for years with a shortage of affordable housing, will see prices rise 5.2% to a median of $834,000 in 2022, according to a forecast by the California Association of Realtors. The Rosens almost moved to San Diego from NYC 4.5 years ago. A combination of cost of living, taxes, and distance to NYC ended the search. These prices are just insane to me given what is going on in the state of CA. I would think with WFH and more companies considering relocating (see below), it would place downward pressure on prices. CA is still considering increasing income taxes to higher levels and wealth taxes. The state has a huge homeless crisis, crime, fires, mudslides, earthquakes and imposes very strict rules on its residents. The bar for me to be a CA resident would be quite high despite my love of the weather and surf.

Tesla officially moved its headquarters from Palo Alto, California to Austin, Texas CEO Elon Musk announced at the company’s 2021 annual shareholder meeting. In April 2020, on a Tesla earnings call, Musk lashed out at California government officials calling their temporary Covid-related health orders “fascist” in an expletive-laced rant. In 2020, Musk personally relocated to the Austin area from Los Angeles where he had lived for two decades. This article suggests the Tweet from CA Assemblywoman Lorena Gonzalez which said, “F—k Elon Musk,” was a big reason for the move. I love that Musk is leaving CA and how much in taxes will that cost the state? Constant hate of wealthy people has consequences. Does Gonzalez feel she won? Which other companies follow TSLA? Is it in the best interest of many companies to stay in CA versus NV, TX, WY, FL, TN…?

Two luxury condos are up for sale in one of Florida’s most exclusive oceanfront properties for a combined price of $31 million – and the developers are accepting payment in bitcoin. The 16-residence, 12-story building in the town of Surfside near Miami is called Arte, and prices start at more than $10 million apiece. Developers Alex Sapir and Giovanni Fasciano say interested buyers are welcome to make offers in either bitcoin or ethereum. Earlier this year, they sold a penthouse in the building for a record-breaking $22.5 million in crypto.