Opening Comments

Travel expenses are through the roof. Plane tickets, rental cars and crappy hotels have gone up sharply. Book early.

My last piece, Rain Man, was well received and yet again, I proved I am indeed THE Rain Man. I washed my car Friday morning and this happened in the afternoon. It was torrential causing flooding. This news article suggested 6-9 inches of rain in Boca on Friday.

I continue to hear that many of my readers do not always receive the emails on Wednesday and Sunday. One suggested to respond to one of my prior Rosen Reports and that helps it to get by the filters and your email will no longer believe it is spam. You can always go to Substack.com and search the Rosen Report or go to this link which is my Substack page. Reports dating back a year are on the link.

I want to give a shout-out to my friend, Ned Zachar, for qualifying for the Senior US Open at Saucon Valley in June. Ned is an accomplished amateur and a great person. Let’s go play Saucon before your big day. Coincidentally, I am a member of the course which is hosting the US Senior Open next month.

JPM-Mike Cembalest-Bear Market Barometers

Picture of the Day-Medical Bill

Agent Austin Powers Rosen "009"

Quick Bites

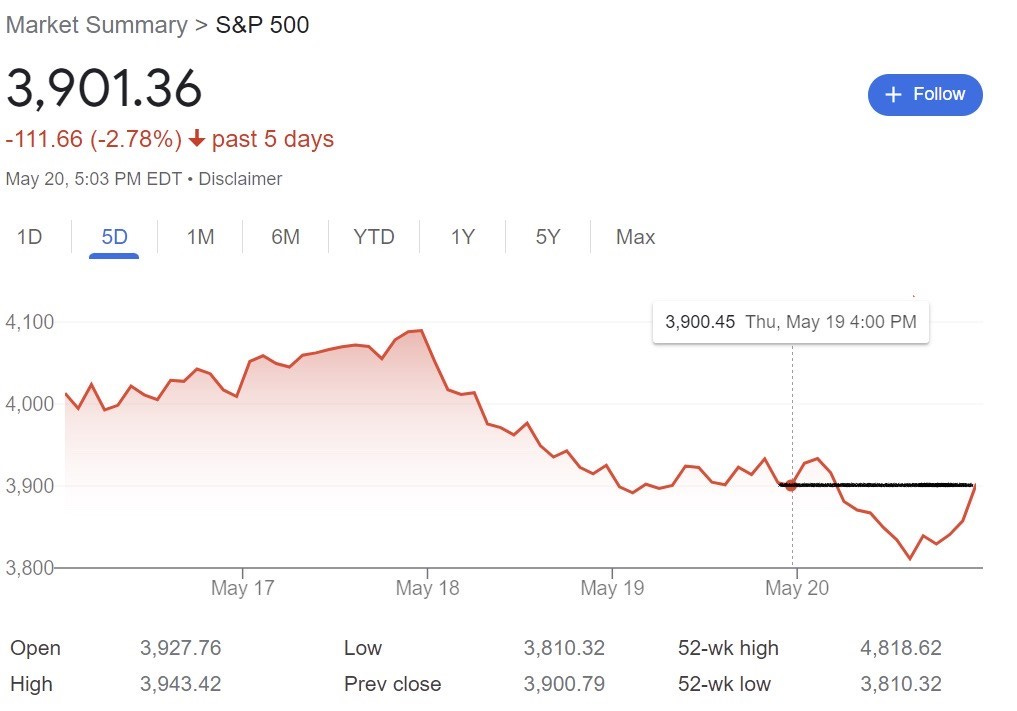

Markets/Retail Earnings

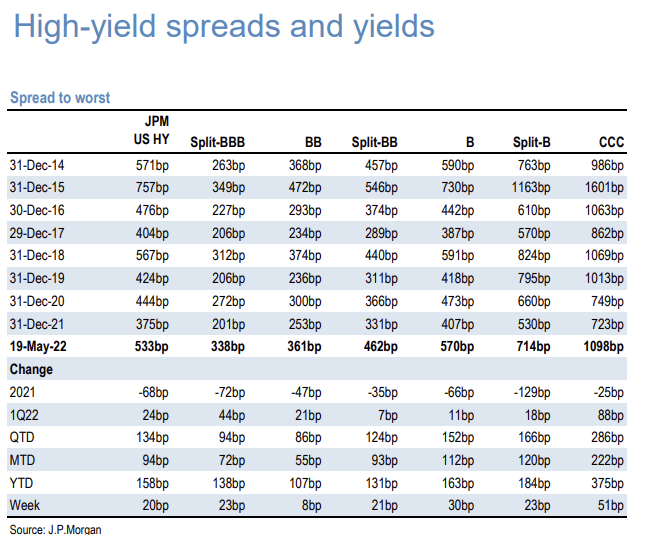

Credit Market Update

Fed Mess/Bernanke Comments

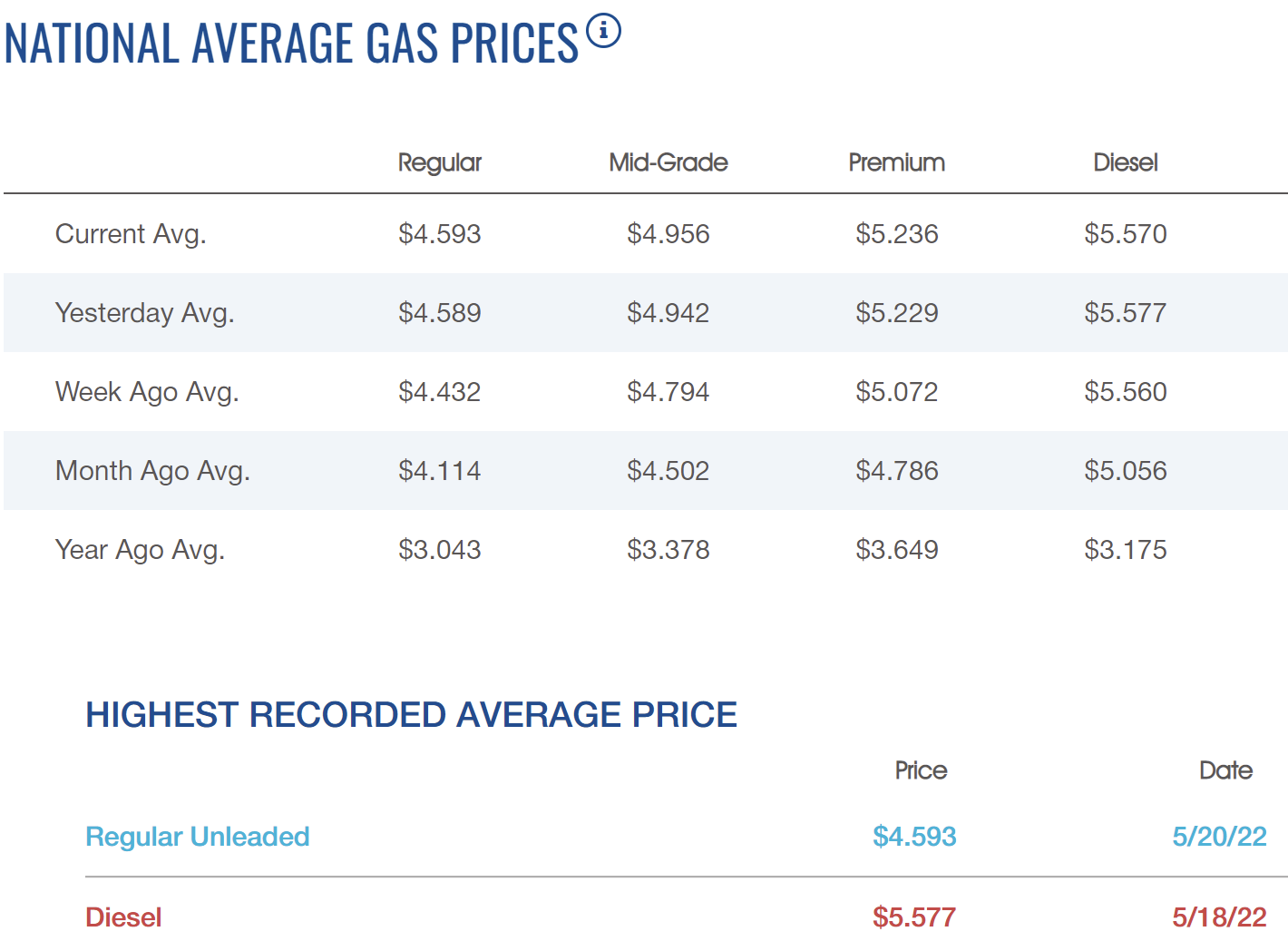

Gas Prices

Finland/Sweden/Turkey/NATO

Biden Approval Rating Woes

Tesla/ESG/Crazy

Other Headlines

Virus/Vaccine

Data-Cases and Hospitalizations Growing

Monkeypox

Real Estate

General Comments-Passed on Panther National

$100mm+ Palm Beach Flip

Inventory Increasing

Huntsville, Alabama is “Best” Place to Live?

JPM-Mike Cembalest-Bear Market Barometers

Mike does another great job on his latest piece which touches on the current market environment and crypto debacle. He remains concerned about the market and valuations in here.

Picture of the Day-Medical Bill

A woman posted a picture and story about her sister’s doctor’s appointment. The young woman is suffering from an illness and cried briefly at the appointment. She was charged $40 for her tears, more than the cost of her eye test, blood draw and hemoglobin testing. This doctor should lose his/her license.

Agent Austin Powers Rosen "009"

How cool would it to be James Bond? I think that would be incredible. As mentioned in my note last Sunday, I was off to take two days of training with former CIA agents. The first day (Sunday) was cyber security and the second day (Wednesday) was for situational awareness, surveillance detection, threat identification, safety and preventing bad outcomes in what has become a far more dangerous world. Unfortunately, I do not think I am ready to be a covert agent despite my day and a half of training. The only thing I may qualify to be is Agent Austin Powers Rosen “009.” The class was One.61 Personal Protective Techniques. Below is a bald Agent Austin Powers Rosen “009” going undercover for super-secret covert operations.

Like it or not, everyone faces substantial risk of being hacked. I never told this story, but someone stole my social security number and bought a house and took a mortgage without my knowledge about 20 years ago. You have no idea of the time, money and hassle it took to "clear" my name on a foreclosed house I never owned. I had a more recent situation where a hacker got into my email account and sent an email to my JPM banker requesting a large wire to a contractor. The email actually came from MY personal email account. Thankfully, the banker thought it was an odd request even though I was doing construction at the time. This website will show you the strength of your passwords. This email site, haveibeenpwned.com, shows if your email has been hacked. Great news, my main email has been hacked 11 times!

The class was taught by an "Ethical Hacker," Cyber Mike, who opened my eyes to the stupid things I do with respect to passwords, WiFi use, phone settings.... Out of respect for the class, I will only share a couple specific ideas, but there are a dozen things to do to protect yourself. The teacher was ADAMANT about the use of a password manager. Some he suggested include Nordpass, Keepass and Lastpass. As I understand it, the system randomly generates passwords which are long and far harder to hack. You need to remember one password to get in and then all your passwords are kept and you copy and paste it as needed. The other specific example was a travel router NOT MADE IN CHINA. Logging onto airport and hotel lobby/room public WiFi is incredibly dangerous. They showed a video of a woman getting hacked in minutes in a hotel lobby and the hackers gained access to her room in very short order. They put up cameras to find out ALL HER PASSWORDS. The hack was simple as they sent her a fake WiFi access, which she thought was from the hotel. Watch this video and start it at 8 minutes. The travel router will protect you. There are so many other things you need to do to protect yourself in today’s world of hackers.

Quite frankly, I would have preferred to have 6 hours on cyber, not 3 hours and felt the class only scratched the surface of what we need to do to protect ourselves. I have made suggestions to the founders of the class to modify it and will send links after they have updated the curriculum.

The second day of the class was fun, as we walked Brickell and had to determine if we were being followed. In a car, we had to try to determine who was following us as well. There are far more situations where patrons are followed home from a restaurant or jewelry story and robbed. These repeated scenarios opened my eyes to be more aware and what to do if being followed on foot or by car. However, it also has me seeing some "ghosts" as well where I was convinced I was being followed and was not. From there we discussed what to do in an active shooter situation and how to improve your odds to survive it.

There was a discussion on international travel and how to reduce the chances of bad outcomes. We also did some work with black belts in Jiu Jitsu to help you with self-defense. It was not enough time and who knows what you would do if ever attacked by a knife or gun wielding individual, but hopefully, what was learned could improve my chances of survival. They teach you to give up what is asked (money, wallet, phone, watch...).

Agent Austin Powers Rosen "009" getting ready to get out of a choke-hold. No problem for an experienced expert with a few hours of training.

The most interesting man in the world, Johnny P, getting ready to flip his attacker. Of course, Johnny P was a wrestler and knew the moves in advance.

One of the most informative sessions of the day was first aid. I was certified in CPR years ago, but it was great to have a refresher on adults and children. We learned how to use a tourniquet and were given one as well.

It was an interesting time and I learned a bit, especially on how exposed we are to cyber attacks. Given this was among the first sessions, I feel there are some kinks and programming which need to be improved prior to suggesting my readers take the class. However, I am quite confident that the founders will make improvements and have products which I will be suggesting for my readers. Unfortunately, I will not be asked by special forces to be an agent after my dismal showing. You are stuck reading the Rosen Report for a while, but Agent Austin Powers Rosen "009"and Special Agent Johnny P “001” are available on short notice for covert operations. Do I hear a Russian op to take out Putin? All we need is a paper clip and some bubble gum and we can do it after training.

Quick Bites

Again, I was surprised by Tuesday’s sharp rally despite Powell’s hawkish comments about the level the Fed needs to take interest rates. “If that involves moving past broadly understood levels of neutral we won’t hesitate to do that,” the central bank leader told The Wall Street Journal “We will go until we feel we’re at a place where we can say financial conditions are in an appropriate place, we see inflation coming down. The market needs to be prepared for much higher rates. Wednesday, market darling, Target, disappointed and I listened to the CEO being interviewed on CNBC. The stock fell 25% on Wednesday and down 42% from its recent high after the company said its quarterly profits got hit by supply chain troubles, higher fuel costs and lower than expected sales of discretionary merchandise. The link has an excellent 5 minute video of the TGT CEO. His comments are telling. One which stood out was his commentary on freight and transportation costs and cited it will cost an additional $1bn this year and discussed record Diesel prices. This is on the heels of Walmart falling 18% in two days. Lowes missed estimates as well and the stock fell approximately 10% before erasing some of the loss.

The stock action this week was concerning and the market needs to come to grips with much higher rates based on Fed guidance. I have a chart which shows retail stocks, sectors, indices and crypto performance. I included sector performance and this link allows you to get even more details. Note the disparity between Energy and Utilities and everything else this year. The 10-year Treasury finished at 2.78% and it was 3.14% on 5/9. The flight to quality trade has pushed yields down sharply in short order. Oil is back up to $113 and natural gas at $8.1. I did feel a bit better about the rally into the close on Friday. At one point, it looked like we could be down 3% on the day, but finished largely unchanged. For perspective, tech stocks are on the longest losing streak (7 weeks) since the .Com bubble burst and the Dow is on the longest losing streak since 1923.

Look at the S&P on Friday. It was down 2.3% at the low Friday and finished unchanged.

A quick note on the credit markets. Through Thursday, the High Yield (HY) market was -10.3% year to date, the 2nd worse performance in 40 years with only 2008 being worse. The average HY bond price is now down to $88.7. The Investment Grade Bond market is -13% YTD, a new record. The loan market is under pressure as well and there are growing opportunities in the space through ETFs and loan mutual funds. Floating rate loan yields are now in the 8.5% range with average loan prices sub $95, which has historically been a good entry point. I closed my credit hedge fund a number of years ago, as I felt the environment was not giving us the opportunity to make a good risk adjusted return. Things are finally starting to get more interesting in the credit space. When dollar price falls and yields rise, I get excited and nervous at the same time. YTD, HY spreads are 158bps wider as seen below. Even short dated muni bonds are offering attractive yields. I am buying highly rated bonds with an average duration of 2.5 years and getting a 4%+ tax equivalent yield.

Rosen Report readers know I had been writing about over stimulating the economy for a year. The Fed was buying mortgages until late 2021 for some idiotic reason. The Fed has plenty of blame for this mess. In an ironic twist, Bernanke (Harvard undergrad and PhD from MIT), commented negatively on the recent Fed performance. Remember, Brenanke told Congress subprime was contained in 2007 when I was short anything that moved. Then in January 2008, the rocket scientist, Bernanke, said, "The Federal Reserve is not currently forecasting a recession." Here is another doozy from Benny B from July 2008, "The GSEs are adequately capitalized. They are in no danger of failing.” Former Federal Reserve Chair Ben Bernanke said the central bank erred in waiting to address an inflation problem that has turned into the worst episode in U.S. financial history since the early 1980s. “The question is why did they delay that. ... Why did they delay their response? I think in retrospect, yes, it was a mistake,” he told CNBC’s Andrew Ross Sorkin. “And I think they agree it was a mistake.” This link has 30 quotes from Ben Bernanke where he was quite wrong. If you managed money with these beliefs at the time, your fund would have imploded. Benny B, you have been wrong so many times, it is inappropriate for you to throw stones. I would like to see more Fed Presidents who have had a real job. I inserted this chart recently which raised eyebrows. I know there are a couple new Presidents, but I don’t have an updated chart.

The updated Fed Funds outlook showing the Fed has a ways to go. Took the picture of my TV of a CNBC story. Maybe Quantitative Easing should have stopped a year ago as I suggested.

U.S. households are now spending the equivalent of $5,000 a year on gasoline, up from $2,800 a year ago, according to Yardeni Research. In March, the annual rate of gasoline spending was at $3,800, Yardeni noted. During the week of May 20, the national retail price for gasoline reached a record $4.59 per gallon, the firm said. “No wonder that the Consumer Sentiment Index is so depressed. The wonder is that retail sales have been so surprisingly strong during April and May,” Yardeni said in a note. A reader sent me this picture of the pump filling up his truck in Florida. We seem to hit new gas price highs daily (interactive gas price chart). CA is now averaging $6.1/gallon with some counties averaging over $6.9/gallon and they have more EVs than any state and account for over 40% of zero emissions vehicles sold in the US. Also concerning is the increasing likelihood of blackouts this summer due to the pressure on power grids.

The ramifications of Russia’s invasion of Ukraine are too many to count, but developments around Sweden and Finland joining NATO took a surprising turn. I had not realized that NATO ascension for a new member state requires consensus approval from all existing members. Turkish President Erdogan has doubled down on his opposition to Sweden and Finland joining the NATO alliance, a move that would be historic for the two Nordic countries in the wake of Russia’s invasion of Ukraine. “We will not say ‘yes’ to those [countries] who apply sanctions to Turkey to join security organization NATO,” Erdogan said at a news conference late Monday. He was referring to Sweden’s suspension of weapons sales to Turkey in 2019 over its military activities in Syria. Now, Putin says Russia has ‘no problems’ with Finland, Sweden in NATO. Comments ease off earlier Russian rhetoric about ‘far-reaching consequences.’

I always pull for the pilot, but Biden has made it difficult and the latest approval ratings show that his support is waning. Only 39% of U.S. adults approve of Biden’s performance as president, according to the poll from The Associated Press-NORC Center for Public Research, dipping from already negative ratings a month earlier. Overall, only about 2 in 10 adults say the U.S. is heading in the right direction or the economy is good, both down from about 3 in 10 a month earlier. Those drops were concentrated among Democrats, with just 33% within the president’s party saying the country is headed in the right direction, down from 49% in April. Of particular concern for Biden ahead of the midterm elections, his approval among Democrats stands at 73%, a substantial drop since earlier in his presidency. In 16 months, Biden’s overall approval rating fell from 61% to 39%. The link above has an interactive chart. In my opinion, an already weakened President will see carnage in the mid-terms over inflation, foreign policy, border, energy policy and consumer sentiment. The growing likelihood of a recession will not help. Gas is +51% in a year and +87% since Biden took office. Of note, the stock market gains from early in the Presidency have been given back. On 1/20/21, the S&P closed at 3,851 and Friday, it closed at 3,901. The NASDAQ is 15% below the 1/20/21 levels. I cannot imagine the “investigations” the Republicans will demand of Biden if they sweep the mid-terms.

I tried not to laugh at this headline: Why Tesla was kicked out of the S&P 500′s ESG index. The S&P 500 booted electric vehicle maker Tesla from its ESG Index as part of an annual update to the list. Meanwhile, Apple, Microsoft, Amazon and even oil and gas multinational Exxon Mobil were still included on the list. The S&P 500 ESG Index uses environmental, social and governance data to rank and effectively recommend companies to investors. Tesla’s “lack of a low-carbon strategy” and “codes of business conduct,” along with racism and poor working conditions reported at Tesla’s factory in Fremont, California, affected the score. There is an oil company on the ESG index, but the most important EV company on the planet is not on it. This link is to the most recent All In podcast which was a 1.5 hour interview with Elon Musk. It was eye opening. Like him or hate him, he is impressive and I enjoyed the interview. Topics across the board from Twitter, politics, Tesla, population patterns….He is so brilliant, yet he can simplify the conversation for everyone to understand. I believe he is the most influential person in the world right now.

Other Headlines

Stephen Roach calls stagflation his base case, warns market is unprepared for the consequences

Druckenmiller is betting against the wider market, while seeing value in energy stocks

Netflix lays off 150 employees as the streaming service contends with big subscriber losses

I believe we will see a great number of layoffs in tech and other sectors given the wealth destruction, WFH pushback and challenging capital raising environment.

Why remote workers are at risk of getting axed first in tech downturn

Crypto is a solution in search of a problem — or problems. This is a less flattering article on crypto.

$18 for a beer is downright offensive.

California’s $6 gas could spread nationwide, JPMorgan warns

I saw $6 gas for the 1st time in Miami last week. My boat was $6.39/gallon. These prices will impact the way people live as it is a regressive tax which disproportionately impacts those with limited means. The US energy policy has consequences.

Biden invokes Defense Production Act to boost baby formula manufacturing to ease shortage.

Teen Babysitters Are Charging $30 an Hour Now, Because They Can

Sitter shortage has parents treating teenagers like VIPs; ‘order anything you want for dinner’. When I was a kid, I got $3 an hour. I am not that old that it should be $30 now. That would be 6.5% growth a year for 37 years and they never ordered me a fancy dinner!

U.S. Census Bureau Keeps Hiring “Unsuitable Individuals” with Criminal Records

This is a shocking article. Hiring criminals to come to your home for census info seem horrific to me.

Every home in America now has a wildfire threat score, and some areas see a 200% jump in risk

Melvin Capital says it’s winding down funds and returning money to investors during market turmoil

Not a shocker and expect more to follow. This market has crushed many amazing fund managers.

Ken Griffin's Citadel Nears Tipping Point on Chicago Exit With Crime Rising

Why anyone would live in Chicago is beyond me, and I was born there and worked there for a number of years while attending University of Chicago. The 10 people shot at McD next to my sister’s apartment won’t do anything to quell Griffin’s fears.

Charges dropped against C Blu, teen rapper accused of shooting NYPD officer

The 16 year old gangbanger “cannot be prosecuted” the city Law Department said on Friday. You shoot a cop and no charges are filed. Makes complete sense to me. Why is this good for the community? The Bronx judge, Naita Semaj, has a history of cutting loose violent teens.

Man shot and killed on NYC subway in ‘random’ broad daylight attack, cops say

Shooter not caught. Even if they are caught, I am sure they will not be prosecuted.

Eighth graders using the wrong pronouns is now considered sexual harassment

Read this story and the “crime” committed around pronouns by eight graders. As a society, we have gone too far now and need a dose of common sense.

This book for NYC school kids has AOC instead of ABCs

A book intended for 10- and 11-year-olds — which glorifies socialist Alexandria Ocasio Cortez and her far-left “Squad,” knocks religion, and mocks Senate Minority Leader Mitch McConnell – is being distributed to public school libraries. HOW IS THIS POSSIBLE?

Musk denies ‘wild accusations’ against him in an apparent reference to harassment report

Tax filings reveal how BLM co-founder spent charity funds

Nothing to see here folks. Expensive homes and almost $4mm paid to the founder’s brother and father of her child. This one suggests $840k was paid to BLM founder’s brother for security services.

Black box on doomed China Eastern flight indicates crash was intentional: report

Onlyfans creator claims having sex with Meta employees led to unbanning of her Instagram account

Facebook forbids mainstream political argument as ‘hate speech.”

“Biological me have no place in women’s sports” was the quote. Musk, please buy Twitter and allow rational conversations.

A 1955 Mercedes just nabbed $143 million at auction, making it the most expensive car ever sold

Don’t get me wrong, the car is stunning. I am not sure any car is worth $143mm or anywhere close!

Amazing video of an 18-year-old high school student jamming with rock legends at a concert.

‘F*** the war!’ Putin backlash begins as thousands stage revolt at St Petersburg concert

Virus/Vaccine

The cases are growing and it seems as though many of my readers and friends have been infected in the past two weeks. Positivity rates are approaching 10% again. On 4/7, positivity rates in the US were 3% and today, it is 9.8%. My daughter’s school had a big outbreak and she tested positive missing the entire week of classes. 53 people at the school tested positive this week. There was a two month stretch where maybe a few tested positive. COVID cases back right now. In NYC, on 3/29, there were 817 hospitalized with 130 in ICU and on 5/19, 2,638 were hospitalized with 249 in ICU.

NYC patient tests positive for virus related to monkeypox

There is one confirmed case in Massachusetts from someone who travelled to Canada. This is not what we need right now. Dr. Gottlieb says rising monkeypox cases suggest it’s spread “pretty wide.” Now, 92 confirmed cases and 28 suspected cases of Monkeypox from 12 member states in the UN. This article suggests human to human transmission through sex of a form of Monkeypox.

Real Estate

I had a reservation on a home at Panther National which I have written about extensively in my pieces (West Palm Beach Gardens). Despite putting the reservation down days after it was opened, I was 59th on the list. I moved up to 49th as people cancelled. However, I was unable to secure a “choice” lot in the 1st delivery of homes, as friend and family had the first look. In a shaky market with rising rates, slowing economy, trillions in losses, economy slowing…taking a property which is almost 12 miles west of the beach in the $6.5mm range had too much risk. I do feel a correction in housing in general is coming. I believe Florida will be less impacted than other markets, but it will not be immune. The Palm Beach market is undeserved and Panther will be an amazing facility for golf, fitness with remarkable smart homes. For all those Wall Street folks moving down and priced out of Palm Beach Island and near West Palm, this is a 25 minute commute to downtown Palm Beach and better amenities than most communities with far less density. I believe the golf and practice facility/amenities will be WORLD CLASS and offers a price point not available closer to downtown. Tesla solar panel roofs and “Tesla Walls” also provide power to the house without the need for back-up generators. Truly smart home technology. The demand is incredibly strong for the project from everything I have been told.

Barely nine months ago, a shell company tied to financier Scot French forked over $64 million for a lavish oceanfront mansion on Palm Beach’s ultra-exclusive South Ocean Boulevard. Soon after, East Coast-based French flipped the “Billionaires’ Row” property back onto the market — asking a whopping $115 million, after a few aesthetic updates — and now records show an as-yet-unidentified buyer has stepped up to the plate, with the estate now under contract to be sold. Nestled alongside 175 feet of ocean frontage, right next door to a $73 million mansion belonging to billionaire hedge funder and Carolina Panthers owner David Tepper.

I will be heading to Alabama in June for an inconvenient golf tournament for Jack. According to this article, the Huntsville, Alabama is the best place to live in the USA. The article cites growing job opportunities, low cost of living and clean air help it take the top spot for the first time. Maybe I will like it so much that the Rosen family will relocate. I can see a reality show of the Rosens in Alabama. It could unseat the Kardashians.