Opening Comments

Good feedback on the last piece, “Concern Growing & the R/E Double Whammy is Not Helping.” I received calls and emails from over a half dozen real estate investors who are growing concerned and agreed with my sentiments in the piece. This is a great article in Bisnow entitled, “Opportunistic Investors Awaiting A Wave Of Office Value Destruction.” In Canada, a once red-hot real estate market, things have cooled sharply. Rompson, one of Canada’s largest private debt managers is restricting redemptions from its flagship R/E fund citing delays in loan repayments and the need to protect against loan losses. The fund’s ability to pay back its investors largely relies on its borrowers’ ability to refinance their debt.

I felt Marko Kolanovic’s (JPM Markets Strategy) comments about the Nord Pipeline explosion were interesting: The destruction of the Nord Stream pipelines this week, is an event that significantly increases tail risks and makes it very difficult to de-escalate near term. The ramifications of this event are hard to fully assess (military, economic, and political both in US and Europe), but many believe that the current situation is similar to the Cuban missile crisis. Personally, I have been concerned, but not overly nervous recently. I am beginning to feel more pessimistic about the world, markets and my lack of faith in the Fed. Banks are in a much better position today, so there are positives relative to the Global Financial Crisis, but I am feel more uneasy recently.

I checked gas prices in each state and I found it interesting that the national average is $3.79, while CA is $6.38 approximately double that of TX ($3.01), LA ($3.10), AR ($3.21), TN ($3.19), MS ($3.07), AL ($3.20), FL ($3.25), SC ($3.26), and NC ($3.31). In CA, there are counties at basically $7/gallon.

Credit Suisse

Picture of the Day-Fed Balance Sheet

As The Weather Turns

Quick Bites

Markets

Economic Data

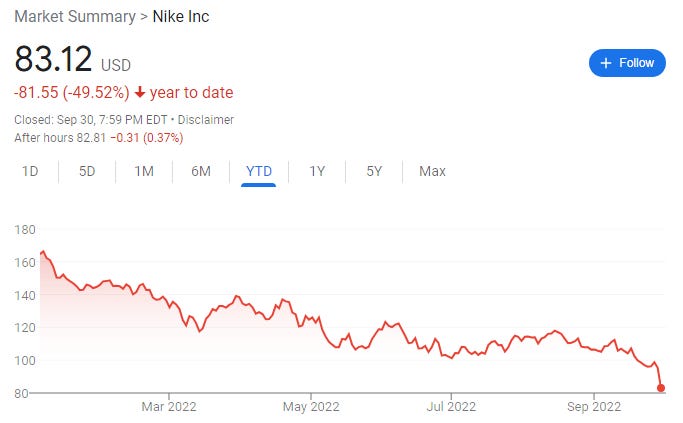

Nike & CarMax Earnings

UK Intervention

Larry Summers

MrBeast $1bn Offer. What?

Other Headlines

Crime

Virus/Vaccine

Real Estate

Boynton Beach Retirement Community Pricing

Brickell PH Sold for $20mm or $2k/ft

Mortgage Rates

Recent NYC Office Leases-Details

Other Headlines-Lot on 2023 Home Prices

Credit Suisse

There are rumors around CSFB, the inept Swiss bank which has found virtually every banana peel imaginable. The stock is -60% YTD and -23%+ in the month of September. The CEO is assuring his staff and clients all is well, but the markets are sending another message. The market cap is down to $10bn and they are not nearly the bank they were prior to the GFC.

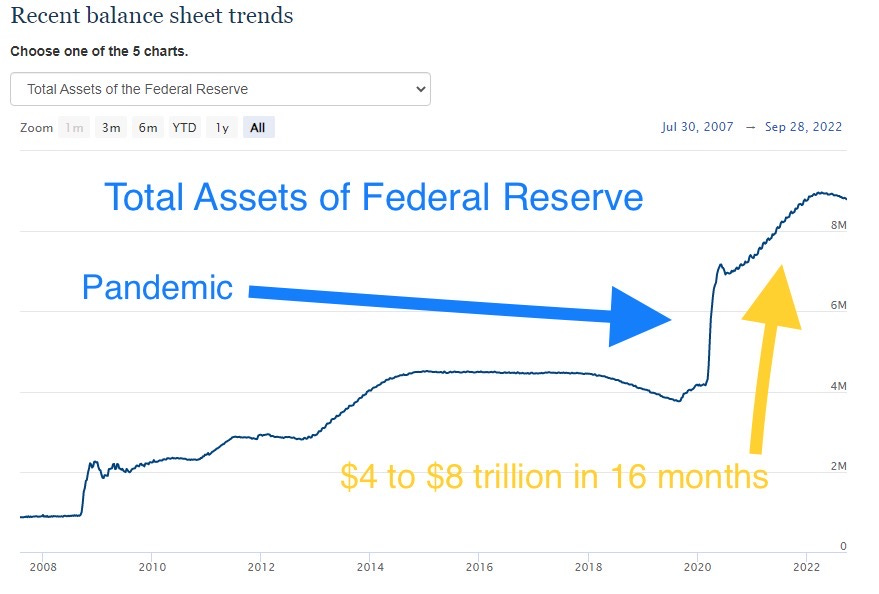

Picture of the Day-Fed Balance Sheet

The Fed waited too long to end Quantitative Easing and have barely reduced the balance sheet as seen in the chart below. We have seen unprecedented moves in Treasuries and currencies as the Fed has raised Fed Funds by 300bps in 2022 and gone from $47.5bn to $95bn in monthly security sales in September. The Fed was buying up to $120bn in bonds (Treasuries and Mortgages) late into 2021 despite high inflation and a massive housing shortage. After peaking at $8.965 trillion in April, the Fed balance sheet is down to $8.795 trillion this week. Long way to go to bring down the balance sheet. Have we ever seen a more inept Fed? How does Powell/Mr. Transitory have a job?

As the Weather Turns

As a kid, I am not proud of it, but I got hooked on this stupid soap opera called, “General Hospital.” It was Luke and Laura who graced the covers of all the magazines. They were the stars of the show and had a famous wedding in November 1981 which brought in over 30mm viewers. It was the highest rated soap opera episode in history. Another soap at the same time was called “As the World Turns,” and although I did not watch it, I decided to use a play on it for today’s piece.

South Florida was just hit with Hurricane Ian leaving horrible devastation in its wake. So far, 77 confirmed deaths in Florida and North Carolina, property damage in the tens of billions and over 1.5 million have no power in Florida. Having lived through quite a few storms, I can tell you they can be devastating. The southeast coast of Florida was largely unscathed. My thoughts are with those who lost so much and hope for a quick recovery. This will test Governor DeSantis. His response is important to save lives, insure a quick recovery and to make a statement given his ambitions for President. I like to think that a true leader rises up against adversity and hope that is the case, as the cost of being wrong is too high for those in desperate need. I don’t want to see a Katrina situation. I am adamantly opposed to Kamala Harris’ suggestion that hurricane aid should be based on “equity” and “communities of color” would be first in line for relief. I believe relief should be color blind. Let’s hope the politicians can get this right and bring the people the relief they need. On a concerning side note, there are concerns about the Florida home insurance market as so many insurers have left. Could Ian be the straw that broke the camel’s back? If you are moving to Florida, getting health and home insurance is no joke and not cheap.

Now that the storm has passed, South Florida has seen a break in the horrible heat. I have written frequently that July-September are terrible and the weather “turns” sometime in mid-October generally. We see cooler temperatures and falling humidity which stays with us through May. Being outside in the summer heat is brutal and just taking out the garbage by 20 yards can lead to substantial perspiration in the heat of the day.

I hope the passing of the Ian and the beautiful weather this week means the worst of the heat, humidity and rain is behind us. Despite my bronchitis, I played tennis for almost two hours early Saturday am, and it was perfect. Yes, I was warm, but not like two weeks ago with a 115 heat index when I lasted 54 minutes and was near death. Check out the forecast (1st picture), relative to the 2nd picture from September 11th. I just hope this is not a head-fake, and I am miserable again next week. Do we have an early “turn” this year? Let’s hope so.

Quick Bites

Stocks fell in choppy trading Friday as Wall Street closed out a terrible week, month and quarter that brought the S&P 500 to a new 2022 low. The Dow closed below 29,000 for the first time since November 2020. The index fell 500 points, or 1.71%, to 28,726. The Nasdaq was 1.51% lower, ending the day at 10,576. Meanwhile, the S&P 500 was down 1.51% on Friday, falling to 3,585.62. The index closed out its worst month since March 2020. Continued fears about how aggressive the Fed will need to be in coming months weighed on markets with mixed data this week (see below). I inserted a chart of select stocks -50% or more YTD along with sector data. I picked a wide array of stocks and was shocked by the diversity (note how little is green in any column). Treasuries were volatile on the week, with the 10-year hitting 4.0% before rallying back to 3.83% later in the week partially on the heels of the UK government bond buying program, which caught many off guard. After weeks of declines, gas prices rose 11 cents on the week to $3.79/gallon, just as the Strategic Petroleum Reserve (SPR) is depleting. The Biden Administration has sold 165mm out of the planned 180mm barrels originally planned out of the SPR. The SPR has 422mm barrels today, down from 635mm when Biden took office. Let’s not forget Trump tried to buy oil $23/barrel, and the Democrats blocked his plan.

Thursday had a stronger than expected jobless claims report which suggested the Fed will continue with aggressive rate hikes, and the short-lived rally was over with the equity markets falling 2-3% by 10am (Nasdaq hit the hardest). Also of note, the Personal Consumption Expenditure Price Index excluding food and energy rose .6% after being flat in July. Despite these concerning headlines suggesting inflation remains hot, many other data points suggest otherwise (see next bullet on CarMax and Nike earnings). The Chicago manufacturing September PMI posted 45.7 well below August and estimates. The manufacturing index from the Dallas Fed fell to -17.2 from -12.9. The estimate was -9. It’s negative for a 5th straight month. I remain convinced that the economy is slowing, inflation is turning and consumers are pulling back.

This section is on earnings from Nike (-12% on stock) and Carmax (-25% on stock) which both disappointed. Nike suggested that retailers pulled back on ordering while supply chain issues eased causing a sharp increase in inventory. North American inventory grew at 65% versus the prior year and in-transit inventory grew at 85%. I constantly write about the US $ strength and it clipped revenue growth by 600bps! CarMax cited "Macro factors, including vehicle affordability that stem from persistent and broad inflation, climbing interest rates and low consumer confidence, all led to a market wide decline in used auto sales. In addition, wholesale values were affected by steep depreciation in the quarter...We believe industry sales were also impacted by a shift in consumer spending prioritization from large purchases to smaller discretionary items. With both moving down in price sharply, now Nike is -50% and Carmax -48% YTD. We have seen many once hot items fall in recent weeks (commodities, cars, clothing, some food, clothes, electronics, appliances, airfare, rental cars….) and the earnings report from Nike and CarMax suggest challenges ahead. Another sign of a slowdown is shipping rates which are down 75% over the past year according to the WSJ article. Amazing numbers in the piece showing demand plummet causing prices to drop sharply.

When it comes to world news and financial matters, I believe I am extremely well versed, but I did learn something new this week by reading Peter Boockvar’s blog Friday am about the UK’s policy change to buy back Gilt (Government Bonds). Liability Driven Investment (LDI) is what UK pension funds took part in. Simplistically speaking, they essentially bought leveraged positions in gilts in order to reach future return requirements. As gilts sold off, they got margin calls in need of more collateral. So, as seen 15 yrs ago, when the cost of capital rises sharply, over leveraged entities get exposed. They won’t be the last ones. Leverage kills. We do not discuss it enough, but zero interest rate policies FORCED investors globally to take more risk through leverage or buying riskier assets in order to make money. This is a perfect example where Pensions added leverage to increase returns only to get slammed requiring government intervention. I am sure there are more shoes to drop in coming months.

I am not the biggest Larry Summers fan of all-time, but thought I would share his latest thoughts which are quite dreary. The current level of risk in global markets is reminiscent of conditions seen in 2007 ahead of the Great Recession, ex-Treasury Secretary Larry Summers warned on Thursday. Summers detailed his concerns one day after the Bank of England was forced to intervene to stabilize the United Kingdom’s cratering economy — an event that some saw as a potential “contagion” event that could infect global markets. Summers identified several factors that are contributing to the elevated risk, including uncertainty about the path of central bank policy, “uneasiness” over decades-high inflation and volatility in commodity prices as well as geopolitical crises related to the Russia-Ukraine war and China. Also Michael Burry (The Big Short) is chiming in with quite a negative take: “Today I wondered aloud if this could be worse than 2008,” Burry said in a now-deleted tweet. “What interest rates are doing, exchange rates globally, central banks seem reactionary and in [cover your a–] mode.”

I clearly live in a bubble. I had never heard of MrBeast, Jimmy Donaldson, who has over 105mm YouTube subscribers. He is a 24-years-old college drop-out and was offered $1bn for his content empire. He claims he would not sell below $10bn. I watched a couple of his videos and he spends up to $4mm to make his content. He does massive give-away promotions which attracts millions. My point is that today, there is more than one way to make a substantial living. Not everyone is cut out to go to a fancy school and become a banker, lawyer, doctor, programmer…. Influencers who are not exactly curing cancer can make huge money: Kardashians/Jenners, Madison Beer, Charlie D’Amelio, Huda Kattan, James Charles, Windersson Nunes, and many others including MrBeast. Do you know how many followers footballer, Cristiano Ronaldo has? Try 517mm!

Other Headlines

Bed Bath & Beyond reports 28% drop in sales as it presses ahead with turnaround plan

Lordstown Motors begins production of its Endurance electric pickup truck

I don’t mind another EV in the house and would like a truck, but you must have an internal combustion engine car in Florida to escape hurricanes.

New York expedites efforts to ban the sale of new gas cars by 2035

CA, NY and others are making bold legislation which cannot be met. We lack the natural resources to make the cars, charging stations and power grids to handle the demands.

Carnival shares shed 20% on ballooning costs, dragging cruise stocks lower

Meta Freezes Hiring, Cuts Headcount, Slashes Budgets Across Teams

Stock -60% Zuckerberg said Thursday that the company would be “somewhat smaller” by the end of 2023. Grew for 18 years and then stopped.

SoftBank plans at least 30% staff cuts to Vision Fund, source confirms

So let me get this right. Horrible returns, bad investments and crazy leadership leads to layoffs? Who would have thunk it. I guess $21.6bn quarterly losses do have a cost after all. Who would invest in this company?

NFT Trading Volume Plunges 97% Since January, Raising Questions About Their Future

I never bought an NFT and questioned the insanity. However, I got burned nicely on any crypto investments I made. $17bn of NFT volume in Jan and $466mm in September.

Supply Chain Effects From Hurricane Ian Could Linger For Weeks

This is not what we need right now as we are seeing a nice dent in inflation.

Europe braces for mobile network blackouts

Given horrific energy policy, they may need to eliminate the ability to use phones to save the grid. Tlaib, you are right, we should absolutely follow the idiotic policies of Europe. Europe is the gold standard for what NOT to do. Given how we are all so addicted to these devices, maybe it is not a bad idea after all to go cold-turkey for a while.

Where Democrats’ Grip on Minority Voters Could Slip in Midterm Elections

Latino, Black and Asian voters are pillars of the Democratic coalition. That support showed signs of weakening in 2020 in ways that could affect political races this November. Great charts in the WSJ article.

House Democrats Signal No Vote Now on Bill Banning Stock Trading for Congress

I just don’t get it. Why the hell should these people be allowed to trade stocks at all? What am I missing?

Bill Clinton says ‘there is a limit’ to how many migrants US can take without causing ‘disruption’

Berkeley Develops Jewish-Free Zones

Nine different law student groups at the University of California at Berkeley’s School of Law, have begun this new academic year by amending bylaws to ensure that they will never invite any speakers that support Israel or Zionism.

I ran businesses in London and have been there countless times. For some reason, I am not great with jet lag, and this fast plane seems perfect for me.

Fentanyl crisis continues to ravage US communities as border drug trafficking hits new records

Porous borders have many costs. These scumbags are disguising the dangerous drug as candy.

Harris hails US ‘alliance with North Korea’ in latest Biden admin botch

In the history of bad VPs, Harris really takes the cake.

Apple VP leaves company after making jokes in viral TikTok video

One of the 30 most senior people at Apple.

'Irregular presence': Putin sends bombers to nuclear weapons base as fears of WW3 rise

Putin ally recommends Russia use low-yield nuclear weapons in Ukraine

Crime Headlines

How many of these horror stories do I need to write about before the dimwit, Bragg and his idiot friends realize they are causing far more damage then they realize.

Shoots a cop and pays no price and then caught with a gun yet again. We should absolutely let him out to hurt or injure others. Yeah right!

Greenwich Village block held hostage by lunchtime rowdies

I lived a couple blocks from here from 2002-2011 and I loved the neighborhood. I never had one issue. Now, Washington Square Park is a drug den, and there is rampant crime all over the neighborhood. These kids are pulling out toy guns are residents. Only a matter of time before someone is carrying a real gun and shoots them not knowing it is a stupid game.

NYC's Financial District is now blighted with crime, vagrants

Virus/Vaccine

Real Estate

My sister from Chicago is in town looking for real estate. After 63 years in the Windy City, she feels too unsafe to stay. Countless robberies, murders and shootings in her “fancy” neighborhood have her living like a hermit. Couple high crime with high taxes and bad weather, and it is a “no-brainer” to leave. We looked at some homes in West Boynton Beach in 55+ aged communities. Prices from $500k-1mm. I was surprised at how well these homes are hanging in given the move in rates. Shockingly low inventories of available units. GL homes built about a dozen “Valencia” communities with 500-1,000 each homes over the past 20 or so years. No golf, but central club house, pool, tennis, gym and restaurant. There are approximately 10,000 homes in the communities, and I am told there are not 30 homes for sale today which almost seems impossible. We looked at 20-year old homes in the $500-600k range, and I was shocked at the lack of choices. Is it a combination of too early in cycle and the great migration? I think so. I do feel R/E will be repricing, but places like South Florida will hold up better than many others. I just thought there would be more cracks in a price-point so impacted by the doubling of mortgage rates. I have recommended to most who are looking for R/E to wait as I believe prices are going lower.

Devin Kay told me of a PH in the Zaha Hadid building, 1000 Museum which sold for $20mm or $2k/ft, a high price for Brickell. The high-end in Miami remains with limited inventory and in high-demand. I don’t know if this is the same PH, but it is approximately 10,000 ft in that building to give you an idea of what it may look like for that price. The sale discussed has not closed, so details are limited.

US long-term mortgage rates up for 6th week; 30-year at 6.7%

Despite the challenging times, there is some good news on the NYC office market in recent weeks with some substantial deals. As I understand it, these are newer buildings. The Franklin Templeton transaction that was just announced on Thursday: 347,000 square feet at One Madison Avenue for 20 years. That is a total of approximately 1.5 million square feet of new lease commitments done in Manhattan in the past 30 days. Here are some other recent office leases sent to me by Bruce Goodman, an advisor to tenants. Of note, the 456,000 square feet for KPMG is 42% less than the space they have today.

Other R/E Headlines

The home price correction intensifies—what to expect from the U.S. housing market in 2023

Fortune article discusses markets likely to be hardest hit and lists: Boise, Vegas, Denver, Nashville and parts of Florida, Phoenix, Austin.

American homebuyers are finding UK bargains, discounted by a weaker pound

Decoding the Data Reveals Surprising Office Market Trends

Less bearish article on the office market. Don’t need to pay for it, but do need to put in your email to get access.

Thanks. Missed the note.

I’m confused. What is conoppont? Thanks. Good luck.