Opening Comments

Elections are coming and it is important that you vote. Voting rates are far too low, and elections have consequences which are far too great to ignore. For perspective, voter turnout in 2018 in NYC was 17% relative to 39% the year prior. In the last Presidential Election, 66% of registered voters submitted a ballot. Don’t complain about the outcome if you don’t take the time to cast your vote.

In my day, Halloween was something I looked forward to and went all out on costumes. I found this picture of me going as Borat and my wife going as AliG years ago. Given my wife is more likely to walk the red carpet since she is in the fashion world, people were shocked I got her to do it. No, that is not a wig I’m wearing, and I bought the polyester suit at the Goodwill thrift shop on 8th Street in the Village for $10. I am candy corn lover, but this article has me questioning my desire to ever eat one again.

Last night, there was a 70s/80s themed party and Jill went as a disco chick, and I went as Fletch in his Lakers uniform. I had to borrow a Lakers uniform from a friend’s son. Let’s just say it was a wee bit tight and my chances of ever having kids again are low. It was a Kobe Jersey, and I put Fletch on the back. Ton of fun. A couple pics from the party. Yes, that is my hair. NO wig. I had to hit the take picture button and jumped in front of my loyal Rosen Report readers. Yes, they are all readers.

I tried a different Podcast format today. I go into less topics and into more detail, especially the Pelosi attack relative to what I wrote in the report. Given the funny nature of today’s piece, I think it is a fun podcast to hear today. It is under 23 minutes long.

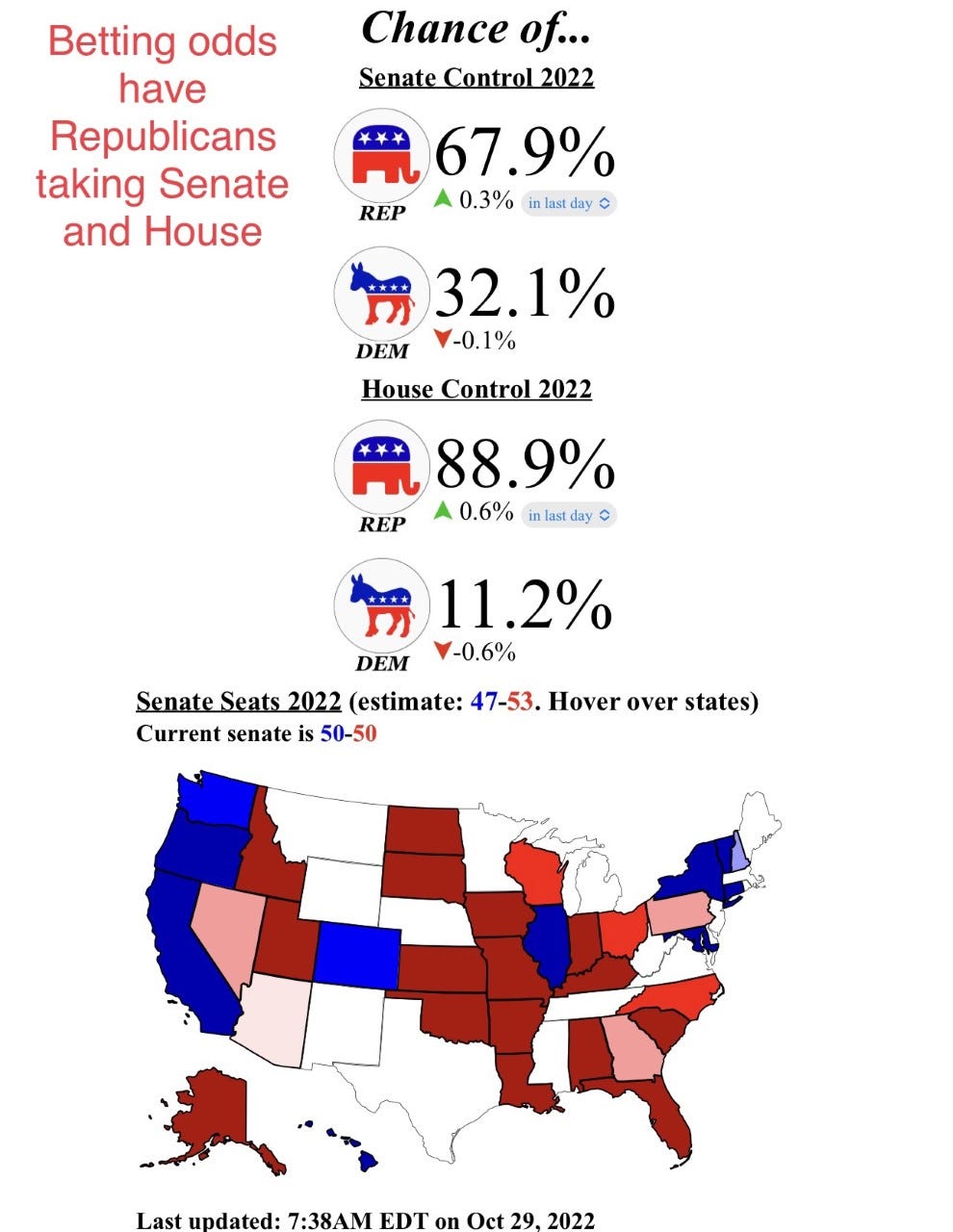

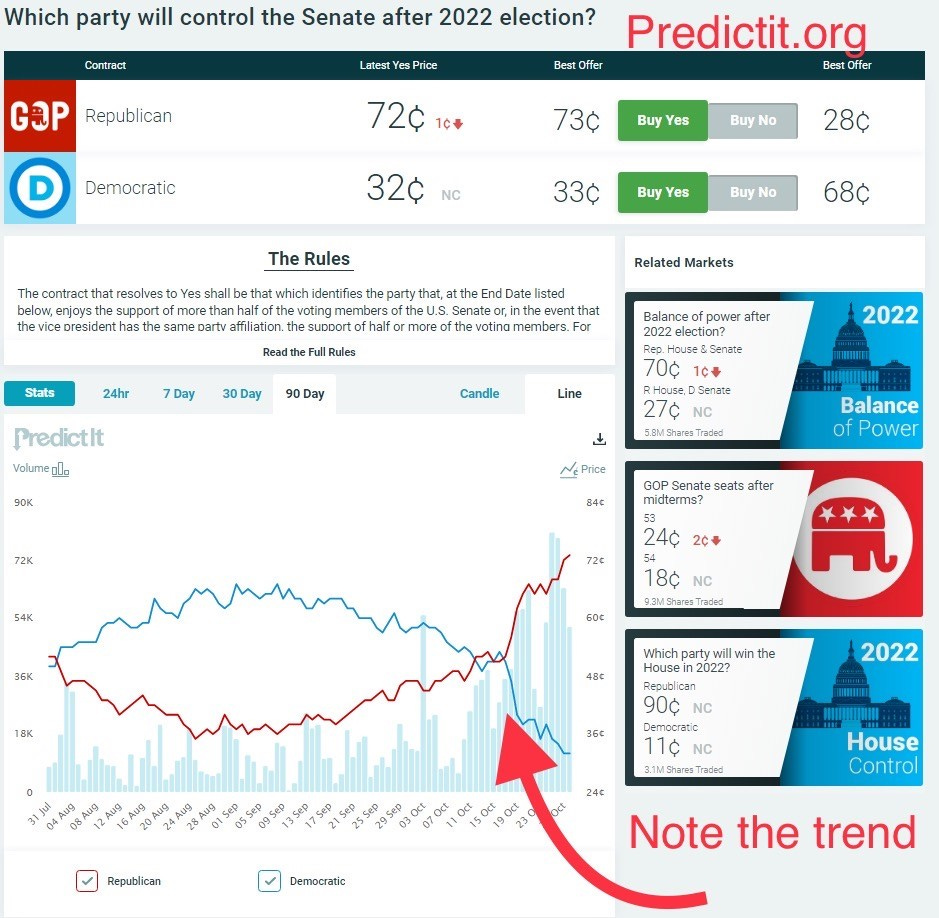

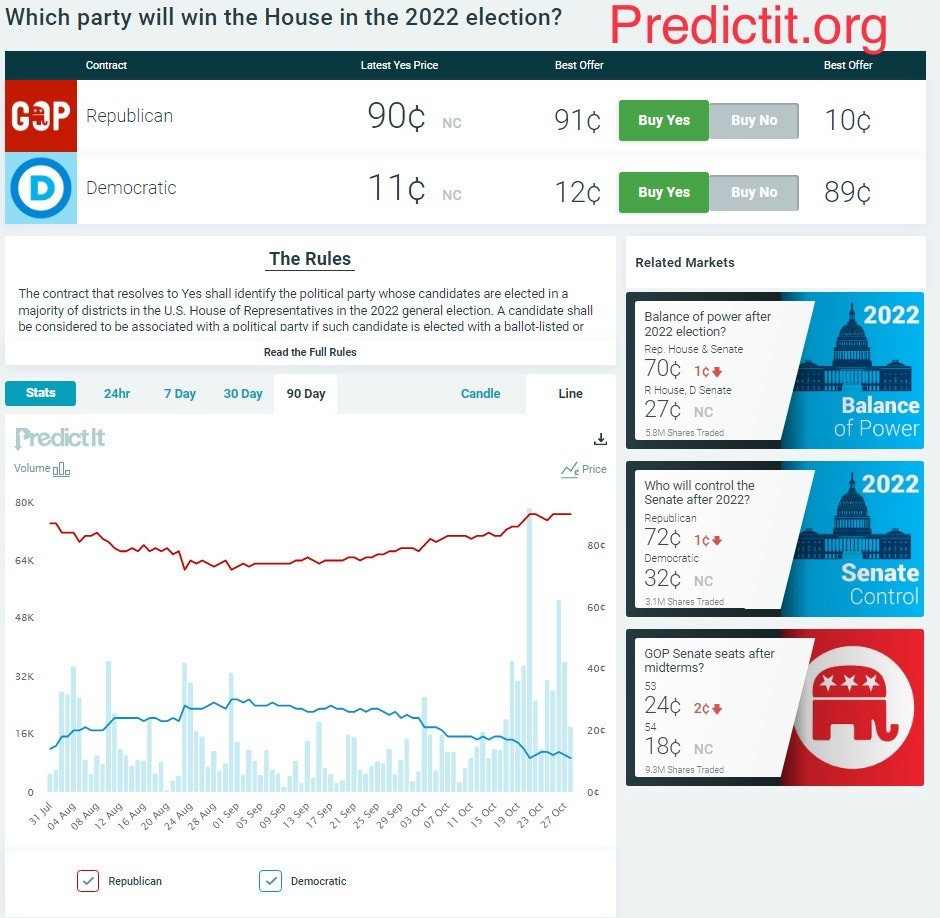

Pictures of the Day-Election Betting Odds-Big Moves

Austin, TX-Brooklyn Vibes with a Young, Southern Flair

Quick Bites

Markets

Tech Bloodbath

GDP-Improving Inflation Data

American Middle Class Wealth Declining

Twitter/Musk

Other Headlines

Crime Headlines

Real Estate

Hamptons Inventory is Lower than I Expected

Home Price Charts of Cities with Winners/Losers

Mortgage Rates/Pending Home Sales Crash

NYC Commercial R/E Article-Firms Looking Past the Pandemic

Virus/Vaccine

Pictures of the Day-Election Betting Odds-Big Moves

I find betting odds more predictive than polls for a host of reasons. I think the pictures I am attaching are telling. I don’t only look at numbers today, but trends, and the trends are all similar with the Republicans surging. Take note of the sharp change in trend in recent weeks. The Democrats had a commanding lead in September to retain the Senate, and betting odds have flipped in a big way, far more than polls suggest. I have attached pictures from Electionbettingodds.com and Predictit.org, the two I follow. I do believe early mail-in voting will play a big part. For example, in PA where Fetterman faltered mightily in the debate, but may have been after many votes cast. Regardless, now OZ is now heavily favored. Hochul had a 24 pt lead in NY Governor’s race two months ago, and it is now a dead-heat.

Austin, TX-Brooklyn Vibes with a Young, Southern Flair

I had not been to Austin since 1998, and it sure has changed. I walked over 12 miles to see as much of the city as possible and was impressed. My favorite area was South Congress which is a collection of smaller, hip retailers and cool restaurants. There is a solid music scene, great parks and nightlife. They do not have a major sports team other than soccer. However, the University of Texas Football team is effectively a professional program and is treated as such.

The Austin crowd is so young, and it is refreshing coming from South Florida where there are a lot of blue-haired people. I felt like I was elderly walking around Austin, and in Florida, I feel like a child at most restaurants given I don’t have a cane...yet. I went for a drink at 6pm on Tuesday night in downtown Austin, and the bar was packed with 25-35-year-olds. There is a 100% chance I was the oldest person in the place. The average age of an Austin resident is 33.7 years old as compared to 48.2 years old in Boca.

In a hysterical coincidence, I went to dinner with 4 friends at Trattoria Romana in Boca on Thursday night. One of the guys and I were 1st to arrive and went to the bar where I was accosted by a 69-year-old woman. She grabbed me aggressively and repeatedly told me, “You are so young, and I am a widow.” My friend, and reader, Jeff, was laughing hysterically. The woman was an octopus and would not stop touching me and grabbing me, while telling me I was a baby. This would not happen in Austin, as I am considered elderly there. Welcome to Boca where I am the youngest guy at the bar and apparently have fans who are quite my senior despite being 53 in November. My friend is not convinced she is 69, but older. How rude, she did not look a day over 67!

Austin is a city of approximately 1mm people. Pictures of South Congress below. I was heading to a meeting, so I did not feel like walking in with a bunch of bags, but there was an amazing shop called Goorin Bros hat shop, which had a collection of cool hats.

The food scene is impressive in Austin. I ate at Vespaio, a very solid Italian on Congress. I thought the menu, vibe, and food were all very good and prices reasonable. Great wine list too.

I also went to Clark’s Oyster Bar and had a very good lobster roll. I was told the oysters were amazing. The shoestring fries with the roll were fantastic.

I had lunch at Terry Black’s BBQ, which was highly recommended. I had already eaten so much that I only ordered green beans, ribs and brisket. The seasoning was great and I find it much better than Memphis BBQ. Clearly not my order below from Terry Black’s BBQ. It is a cafeteria style eatery where you grab a tray, pick your sides and then go to the meat section and get your desired weight of select meats. I ate outside an a beautiful afternoon.

I also at ate Uchiko which was pretty good, not amazing. Remember, I was there for 36 hours, yet found a way to have a ton of meals. My COVID weight loss will be gone in no time given all the meals eaten in a short time. As a matter of fact, I was -9lbs last week and now only -5lbs, and believe the trip to Austin can account for 90% of the gain.

On Tuesday, I walked 6 miles around the University of Texas campus. It was nice, but for the life of me, I cannot figure out why it was dead. I saw maybe a dozen students in my two-hour walk. I thought there would be more action given 40,000 undergrad students. There were a lot of newer buildings and the school has a great reputation and is now ranked 38th for national universities by US News. The stadium is right in the middle of campus. One negative about Austin is the homeless situation. I saw far more homeless people than students. The statistics suggest 3,200 homeless in Austin, but it sure seemed higher to me. I am told it was much worse two years ago when the city allowed camping for a short time.

I think Austin is the scooter capital of the USA. There are scooters laying around every corner. I did not ride one, as I am convinced I would have gotten injured.

Overall, I found Austin to be very livable. The airport is 15 minutes from downtown and although the cost of real estate is up sharply, it is still cheap relative to the bigger cities, and prices are cracking (1st chart). This WSJ article is entitled, “Austin Builders Couldn’t Finish Homes Fast Enough. Now Their Product Is Piling Up.” More major companies have offices in Austin now as well. Apple, Meta, Google, Oracle, Charles Schwab, GM, Intel and many other companies have offices in Austin. This link is of recent large office leases in Austin. I stayed at the Tommie Austin which is a Thompson hotel. Great location and a fantastic gym. Looking forward to my next trip back to Austin and plan on hearing some music and would love to go to a University of Texas football game. However, it won’t be in the summer, as I understand the weather is unbearable.

Quick Bites

I feel a bit Dazed and Confused about the market performance, which is on fire despite horrific tech earnings. Stocks rose on Friday despite a tumble in Amazon shares after economic data pointed to slowing inflation and a steady consumer. The Dow closed up 829 points, or about 2.6%, higher at 32,862. The S&P 500 added nearly 2.5%, to close at 3,901. The Nasdaq ended up about 2.9%. On a weekly basis, the major indexes made notable gains. It was the fourth positive week in a row for the Dow, a first since a five-week streak ending in November 2021. The 30-stock index is up 5.7% this week in its best performance since May. The S&P 500 and the Nasdaq are up 3.9% and 2.2%, respectively, for the week. On the week, the 2-Year Treasury yield fell 8bps to 4.41% on slowing inflation data, after being 4.61% last Thursday and clearly contributed to the market euphoria. The Fed is expected to go 75bps in November and 50bps in December, but a 30% chance of 75bps in December. I don’t think the Fed goes 75bps in December or should (more in 3rd bullet). Oil was +2.5% on the week to close north of $88/barrel despite China shutdowns, as Saudi Arabia seemed to make additional threats after Biden’s aggressive moves post the OPEC 2mm/day production cut. Of note, Diesel prices are soaring. NY Harbor diesel is at a 20 year high @ $4.46. Diesel prices are higher today than when oil was at $150/barrel, as we don’t have enough heavy crude to make diesel. Story on oil company substantial profits. Big #s.

Amid the earnings-related bloodbath so far this week, there have been huge losses. Alphabet, Microsoft and Meta have already posted their results, and tumbled in the wake of the reports. A staggering $3 trillion in combined market cap has been lost in one year. The chart below was before AMZN posted weak fourth Q guidance and the stock fell another 20% or $220bn, but recovered to be down 7% on Friday with the broader market rally. They guided to $140-148bn in 4th Q revenue and analysts were expecting $155bn. Like the rest of Big Tech, Amazon has had a rocky year so far as it confronts macroeconomic headwinds, soaring inflation and rising interest rates. Those challenges have coincided with a slowdown in Amazon’s core retail business, as consumers returned to shopping in stores. We have had major weak tech earnings with substantial drawdowns on related stocks. Apple beat, but came up light on iPhone sales and services on Thursday after the close. Zuckerberg and Musk each lost over $100bn recently. SNAP is -81% in the past year or -$65bn in market cap, but is not included below given it is a smaller company. Also challenging for many tech companies was Apple’s new policies demanding that apps pay 30% of sales to Apple for promoted social posts, and it seems that Meta will be hit by it.

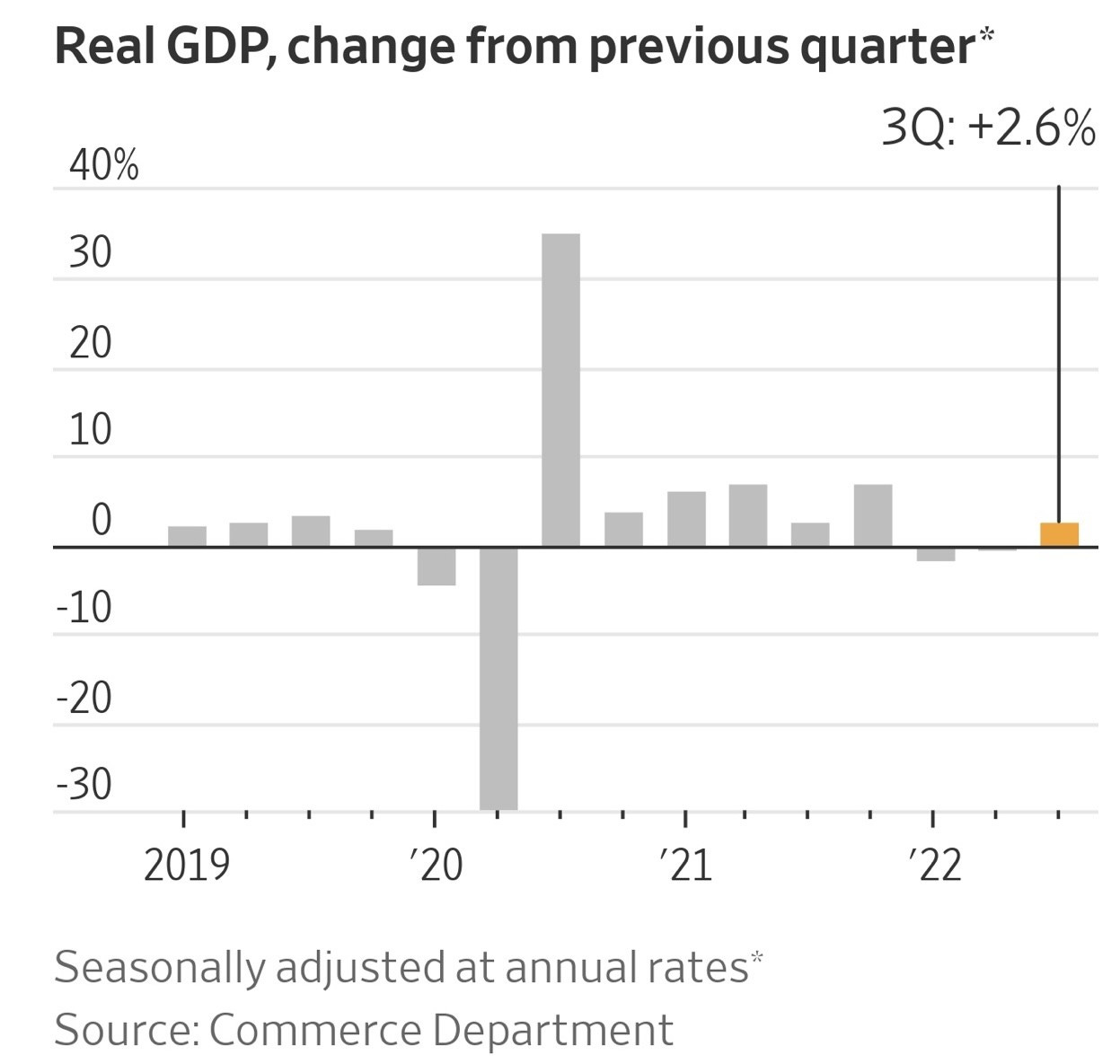

GDP for the 3rd Q came out and was +2.6% relative to expectations of +2.3%. In addition to showing stronger than expected growth, the GDP report provided at least some good news on inflation. The chain-weighted price index, a cost-of-living measure that is adjusted to reflect changing consumer behavior, rose 4.1% for the quarter, well below the 5.3% estimate. Also, headline inflation rose 4.2%, down sharply from 7.3%, according to a gauge the Federal Reserve uses. The result was lower Treasury yields (bonds rallied) and higher stocks on Thursday despite weak tech earnings. I suggested three months ago that inflation peaked, and I stand by that call. We have seen housing, new/used cars, shipping rates, oil, gasoline, natural gas, lumber, wheat, copper, clothing, technology and many other things fall sharply, not to mention stocks and bonds have lost trillions. Below is a chart of shipping rates which went parabolic during the pandemic and are now BELOW the long-term average. The last chart shows the growth in housing for sale and rent inventory rising sharply. Wages and some food items remain sticky. All this means to me that the Fed will be pausing early in 2023 and will need to reverse course later in the year.

That’s the conclusion of a Bloomberg News examination that paired new wealth data with an exclusive Harris Poll of attitudes of the 100 million adults who sit at the core of the US economy and its politics ahead of the election. What do you think this means for the election in a couple weeks, home prices and consumer confidence? There are fantastic charts in the piece that I did not include. Also of note, Bloomberg suggests that 41% of US households are struggling to cover usual expenses according to the US Census Bureau.

I have written extensively about Twitter/Musk and feel it is good for the world to have a less biased social media platform. I would say the same thing if all the social media/media leaned right. I have suggested in numerous reports that Musk is substantially over paying for Twitter based on the broader market moves in the space and his poor structure for the deal. Dan Ives from Wedbush Securities wrote: “The $44 billion price tag for Twitter will go down as one of the most overpaid tech acquisitions in the history of M&A deals on the Street in our opinion,” “Musk buying Twitter remains a major head-scratcher.” Ives argued that Twitter’s fair value is just $25 billion, meaning Musk overpaid by some $19 billion. I believe fair value is lower and closer to $18/share based on comps and the moves in stocks such as Meta and Snap. My share price would suggest he is over-paying by $29bn. Either way, Musk is substantially over paying for Twitter, and we have not discussed the “bot issue,” or the heavy debt load. Also, many left-leaning celebrities are quitting Twitter due to Musk involvement and many advertisers have threatened to boycott if Trump is re-instated. I spoke with one person who has a large Twitter following who quit the platform given since Musk’s ownership. He received too many threats and aggressive negative commentary, as the Twitter world is trying to push boundaries. I was offered to participate in the Musk deal and took a hard pass due to the premium he was paying to what I felt was fair value and things have only deteriorated. All these tech companies have reported substantial declines in ad revenues, and last I checked, that was 90% of Twitter revenues. This does not mean that Musk and his clan will lose money, it just means they have a big challenge ahead and remember, Musk has TSLA, Neuralink, SpaceX, Boring, and now TWTR (no CEO or CFO as he fired them). He is a great engineer, but spread far too thin and not the best CEO. Also, of note, Musk net worth is down approximately $120bn in the past year.

Other Headlines

Meta shares plunge 24% on downgrades, missed earnings and big spending on metaverse

As of Thursday, Meta was -71% YTD and -74% from all-time highs.

Credit Suisse shares plunge 12% as bank announces huge third-quarter loss and strategic overhaul

It is official. CS is the worst run bank of the last 50 years. Letting go 9,000 employees. I have never seen a bank step on more banana peels.

Ye escorted out of Skechers office in Los Angeles after he showed up unannounced

In the never ending, sad tale of Kanye, he went to Skechers unannounced, and was forced to exit and the company made a clear statement they want nothing to do with him. I read his net worth is down over $1bn. GOOD.

Bitcoin miner Core Scientific issues bankruptcy warning and the stock is down 97% for the year

Is inflation burning a hole in your budget? These 5 apps can help you earn cash back and save money

GOP Has a Chance at Oregon Governorship for First Time in Four Decades

The article suggests homelessness and crime as key drivers for the potential change.

As Covid Hit, Washington Officials Traded Stocks With Exquisite Timing

I don’t understand why more is not done to stop this behavior. We go to jail for this stuff, but it is ok for Federal officials?

People who make good first impressions never do these 4 things, says public speaking expert

I feel these were good tips and suggest those interested check them out.

Jon Stewart slams Hunter Biden’s Burisma job as ‘corruption straight up’

At least 153 dead, 150 injured in Halloween stampede in Seoul, South Korea

There May Be 4 Quintillion Alien Spacecraft Buzzing in Our Solar System

My readers love alien and UFO stories. The title is not exactly as it seems, but worth a look.

Indonesian woman's body found inside python, say reports

There are lots of ways I don’t want die, but being eaten by a snake is near the top of the list.

German heir 'annoyed' by multibillion-dollar inheritance, wants it taxed away

I have a good idea Marlene, you can “donate” your billions to the Rosen Report and I will be sure it will go to a good use. I have no confidence the German government will use it wisely.

Clearly, I am doing something wrong.

Putin says risk of world conflict is ‘high’; Moscow official calls for ‘de-Satanization’ in Ukraine

Crime Headlines

Progressives have it wrong on crime, and the polls are telling them as much. A young man who lives in NYC said, “It has gotten scary at times, and I feel uncomfortable more than I should.”

NYC commuter shoved onto tracks in another random subway attack

Not Again: Subway crime in 2022 looks a lot like the 1980s

How Hochul could make such a dumb comment when asked about consequences for criminals while debating is beyond me-“I don’t know why it’s “so important to you.”

Elderly man punched in head on NYC subway in latest transit attack

NYC fire inspector stabbed on subway: Nobody stopped to help me

Shooter fires into NYC restaurant, killing 1, wounding another

Ex-NYC Transit chief Sarah Feinberg assaulted near subway stop

Wild video: Dirt bikers surround woman’s car, fire shots at her in Old Town

This was in my old neighborhood in Chicago. High rent district. Nothing could get me to live in Chicago. Elections matter: Mayor, DA, Governor are horrific.

Paul Pelosi attacked after assailant breaks into home

The article suggests the attacker was yelling, “Where is Nancy?” I do not condone violence of any kind other than self-defense. The suggestion is the attacker is a right-wing nut case, but I am not convinced. I did not condone Rand Paul’s attack, or Steve Scalise being shot by left-wing nut jobs. I condemn all of it. However, I am a bit suspicious of the Pelosi attack story and the more research I do, the more questions I have. Still doing homework, but want people to know I am not 100% convinced the story is as it seems. Musk is not convinced either and Tweeted about it below. Things are not adding up for me. If I am wrong, I will be sure to let my readers know.

Real Estate

I was a bit surprised to read this article in Bloomberg entitled, “Hamptons Homes Sell Faster Than Ever Amid Inventory Squeeze.” Due to higher rates, market losses in equities and fixed income, lower bonuses, bad hedge fund returns and layoffs, I expect Hamptons to reprice lower. Properties in the posh Long Island beach towns were listed for an average of 70 days before finding buyers, down from 96 days a year earlier, according to appraiser Miller Samuel Inc. and brokerage Douglas Elliman Real Estate. The median price of purchases that closed in the quarter was $1.6 million, tying the record high set in the previous three-month period. While the number of sales fell year-over-year for a fifth consecutive quarter — a 16% decline this time, to 333 — there are plenty of house hunters circling the market. From Jared Halpern from Douglas Elliman: “If you price correctly there are plenty of buyers, the days of people wildly overpaying are gone but if you have a realistic / motivated seller there see buyers.”

I thought this Slate article was interesting: “The Reason Home Prices Are Finally Dropping. But Not Everywhere.” Check out the 2nd chart comparing some cities with declines vs increases. Keep hating on Florida, 3 of the top 8 increases, while California is 5 out of the top 8 decliners.

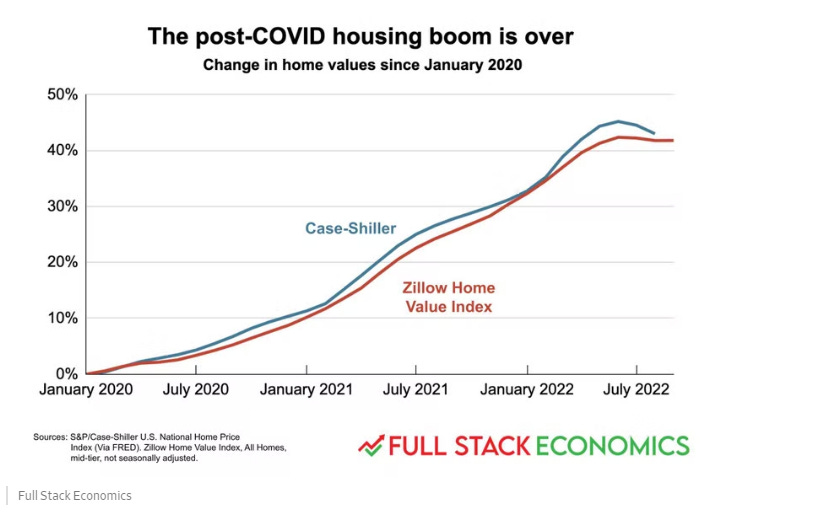

Mortgage rates topped 7% for the first time in 20 years, the latest milestone in a rapid climb that has all but paralyzed the housing market. The rate on a 30-year fixed mortgage averaged 7.08% this week, according to a survey of lenders by mortgage giant Freddie Mac. Just seven weeks ago, the rate was below 6%. A year ago it was just over 3%. I had seen quotes as high as 7.25% for 30 year mortgages. No wonder why housing is diving in most cities. Pending home sales fell 10% in September relative to 4% expected. Sales were -31% year over year. The 2nd chart is another reason I believe the Fed is close to stopping the rate hikes. We are approaching the post Global Financial crisis levels and things are just getting started.

This is a positive story on NYC commercial real estate and lists new leases signed and new buildings in development. Some high priced leases are discussed. The suggestion is companies are looking past the pandemic now and looking at more space.

Virus/Vaccine

Improvements have slowed sharply and I expect things to turn in the other direction soon. So many test positive at home and do not report to the CDC.

I’m merely suggesting that the facts don’t add up. I am not certain of anything here, but question the current narrative. Worth hundreds of millions and 3rd in line to President. No alarms? Security. Guy was in his underwear. Just does not add up. I’m not saying the right wing media is right. I’m suggesting the current popular narrative has some holes. I would love to see security footage. We have been told so many lies by the media on both sides it is hard to know the truth. To me, there seems to be a few too many holes in the story. I condemn all the violence. Against Pelosi, Paul, Scalise…. I just have a suspicion that there is more to the story, but it will take a while for us to find out about it. I am not suggesting the right wing media is right. I am suggesting I am not convinced the current narrative is correct. I call out both sides. The media has a 7% of the population’s trust. I don’t care what side of the isle you sit on. You must admit that the bias is remarkable. I would say the same if Google, Meta and Twitter went the other direction. I call out trump, Taylor, Gaetz and many others on the right just as I call out the left. If you don’t like my point of you, I understand if you don’t want to read it. If you only listen to CNN and MSNBC, you don’t get the facts. I listen to all of it and form my own opinions. I spend 40 hours a week doing research to write these pieces. I don’t get paid. I have Progrssive readers and right wing readers. I think they appreciate what I do, but understand you need to be comfortable with what you read. Good luck. Thanks for reading.

You are going to lose me as a subsciber if you go down the Pelosi attacked by gay prostitute rabbithole. Musk just repeating "news" from disreputable sources. Please stick to markets, economy, business and give us one newsletter that doesn't put politics in our face. Thanks