Opening Comments

Great response to the last piece “It’s a Small World.” I had 40% opens in under two hours. Interestingly, the two most opened links were the Joe Rogan story and the UFO story. For whatever reason, my readers like anything about UFOs or sightings and consistently open those links. I am a believer that we are not alone.

If you enjoy the Rosen Report, please send it to friends and colleagues. I am trying to grow my readership and it is 100% word of mouth.

Sunday’s piece will be entitled “Gone Fishing” as I am off on an epic trip-weather permitting- so no report next Wednesday. Details in Sunday’s report. Plan is for Grand Cay and Walker’s Cay in the Bahamas 110 miles Northeast of Boca. The seas might be questionable which will require a postponed venture, but hoping we can do it.

For my son’s birthday we went to Houston’s for the 1st time since we lived in Florida as many places were closed on Monday. When we lived in NYC, Jack’s birthday resulted in a Michelin Star restaurants. We ain’t in NYC any more. For his 11th, we went to Le Bernardin which got him is 34th Michelin Star. In Boca, the culinary wasteland of the USA, we ended up at the chain, Houston’s. Shoot me on going out to eat down here. The Eric Ripert Le Barnardin is a 3 Michelin Star restaurant, but to me, it is over rated despite good food and service. The portions are for Lilliputians and the bill is for a billionaire, but it is top rated in NYC, so we went. Comparing Le Bernardin to Houston’s is akin to comparing me to Michael Jordan in basketball. It is unfair to him and to me, just as it is unfair to Le Barnardin and Houston’s. Despite my love of South Florida, I am not convinced I will ever be truly satisfied on the restaurant front. NYC made my bar just too high. The only silver lining is I spend so little on dining out relative to NYC, as I cook almost every night.

I spoke with Tesla. In the past 6 months, they are averaging 99.5%-100% in Florida of sales completion, meaning almost no one walks on an order. A year ago, it was 90-91%. Still waiting for my wife’s new car, as her Tesla was totaled a few months ago by another woman who ran stop sign. Tesla said the car will be ready by August, but we’re hoping we get it sooner. The rented Camry she is driving is just not cutting it.

Pictures of the Day-Me and My Boy

Baseball Card Blues

Quick Bites

Markets, Bitcoin, Crypto Regulation

Gundlach on the World, Dimon on Economy-My Thoughts on Future

Supply Chain on Housing, Biden Press Conferences

Vaping Alliance, NYC Soft on Crime-Bragg

Perseverance Story at UGA, Insane Military Technology Video

Other Headlines

Virus/Vaccine

Data-Cases Growth Slowing, Hospitalizations and Deaths Rising

CNN on Hospitalization Data

Supreme Court COVID Data Blunders

CDC Walensky Commentary on Co-Morbidities/Bad Outcomes

The WHO on Booster Shots

New Emails on Lab Leak-Clear Cover Up

Real Estate

Miami Story

Bloomberg article on High-End

LA Estate

Eric Schmidt Spent $65mm on Beverly Hills Lot

$100-Foot NYC Office Rents are More Prevalent

Mateverse R/E Sales Continue to Blow My Mind

Pictures of the Day-Me and My Boy

Jack turned 16 on Monday and I thought I would share some pics of him growing up. Everyone always told me time flies and I questioned it. I cannot believe I am 52 years old with a 16-year-old. Seems like yesterday we brought him home from the hospital. He is now a young man standing 5’11.5” with a size 12 shoe and a golf swing like a champ. I lost my father when I was so young that I don’t remember him. I feel I have over compensated to spend an inordinate amount of time with my children as a result of my loss. I am with Jack 5 or more hours a day on a golf course, working out or fishing. I was absolutely destroying Jack on a golf course until about a year ago and now, I can barely play the same tees. It is humiliating and exciting all at the same time. I cherish the time with my kids as they will both soon be out of the house. Jack, good luck, you are not a little boy any more. Chase your dreams and reach for the stars. Hard work and perseverance will allow you to achieve great things (see bullet on perseverance below). But remember, you may never be able to do more push-ups or pull-ups than your dad.

2007-Twins on the terrace in Greenwich Village. Yes, he had the flow going early.

2011-With Papa

2013-Fishing with my late friend, Mark. Nice striped bass. Jack had a broken arm.

2015-Nassau, Bahamas at Atlantis. One of my favorite pictures. I sure can’t hold my kids like this any more.

2016-Swimming with dolphins in Cabo. Water was freezing.

2018-Every year, our dear friends, Craig and Val, host us at Sleepy Hollow. The 2019 picture is not in because it started to pour just as we were taking the picture on #16 and had to run.

2019-Big mutton snapper in Bimini.

2020-Kittansett. What a difference two years makes. He grew 9.5” in 14 months. Jack had some serious flow going. I did not want him to cut it.

2021-Now he towers over me and beats me in golf. Getting old sucks. Again, #16 at Sleepy Hollow. Thanks Craig and Val. Cant wait to do it again this summer.

Baseball Card Blues

I was never a lover of baseball, but as a kid, I collected cards. I have Hank Aaron, Roberto Clemente, Lou Brock, Pete Rose, Carl Yastrzemski, Reggie Jackson, Rod Carew and a host of famous player cards from the 1960s, 1970s and 1980s. Many of them autographed. I also have some football and basketball mixed in as well including Mean Joe Greene, OJ Simpson and Kareem Abdul-Jabbar. I was unsure how to value these “gems,” and it turns out Jack’s golf coach is an expert in collectibles. He let me know the market is on fire for quality rookie cards in excellent condition. There is a grading company which you pay to rate the condition of our card. It is called PSA and if you have a “10,” of an important card, it could be worth millions, while a “7” might only be worth $100k. He gave me an example of Michael Jordan’s rookie card in mint condition being worth $750k in late 2020. In December 2020, it sold for $40k. Of course, I don’t have any of these. Since the massive run up, it appears the prices has taken a hit back to around $200k. A LeBron James rookie card sold for $1.85mm in 2020, while a Giannis Anteokounmpo went for $1.81mm and a 1979 Wane Gretzky sold for $1.29mm.

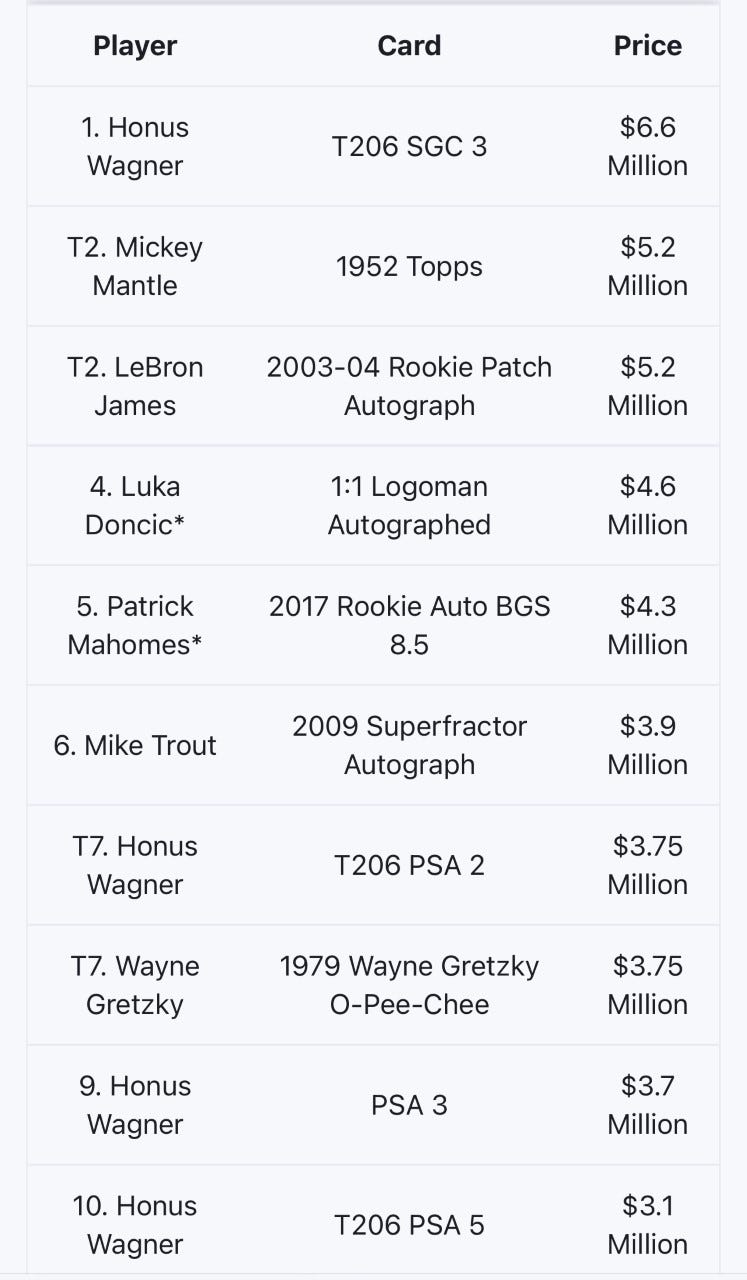

This is a list of the 10 most valuable baseball cards. Do you think I have any in my collection?

Jeff came over for dinner, and I had my cards ready for him to look through to show me which ones were “gold mines.” I had maybe 1,000 cards, so surely something in there had value. I did not sleep a ton the night before as I kept thinking about how many valuable cards I had forgotten about. Surely, I had something worth $100k, right?

Well, Jeff started to go through the cards and let me know that I had not kept them in perfect condition. I said, “I was between 5-10 years old when I bought these, have moved a dozen times and kind of forgot about them.” I recall at one point, they were kept in my mother’s garage for a decade. He continued to search for rookie cards and when he found one it was from some unknown player. When he found a great player card it was not a rookie. I had a pack of 50 unopened cards and they were all duds. I had sets of Kellog 3D cards which I was sure would pay for my kids’ college tuition. NOPE. Jeff crushed my dreams about a dozen times that night and is no longer allowed over for dinner. Jeff is the bearer of bad news when it comes to your baseball card collection.

After going through all the cards, Jeff declared my collection to be “The worst old collection of cards he has ever seen.” Jeff is a mathematician and suggested the probability of having not one important card from a collection this big is almost zero and believes someone must have gone through and taken the good ones. In hindsight, I recall my step-father’s grandson going through my cards when I was away at college. I wonder if he pilfered my good ones?

I never liked baseball and now like it even less as I was planning on buying a new boat with my long-lost rookie cards. Now, I am singing the baseball card blues. I hear stories of amazing collections being found in attics. This was not the case with mine. Jeff suggested using them to start a fire. Son of a …. If anyone sees a card in these pictures they believe to be valuable, let me know, but it does not appear to be the case. I have one thousand more behind the ones pictured. All these great athletes with cards from the 1960s and 70s and all are worthless? How is this humanly possible? Maybe all the Rosen Report readers should get together and have a big bonfire of worthless baseball cards. With all the focus on NFTs, I am thinking about making an NFT about my worthless cards and selling it for $1mm. Some of the crap NFTs I have seen have sold for more.

Quick Bites

U.S. stocks moved slightly higher Wednesday after a key inflation report showed a historic gain but largely matched expectations. The S&P 500 added roughly 0.3%, and the Nasdaq Composite rose 0.2% for its third straight positive day. The Dow, which shuffled between modest gains and losses through the session, finished with a gain of 39 points. The moves come after the December reading for the consumer price index, a gauge of prices across a broad spectrum of goods, showed a gain of 7% year over year. That is the biggest jump since 1982, but was in-line with expectations from economists surveyed by Dow Jones. Bank stocks have been outperforming due to the rates move (see chart below). The 10-Year Treasury is yielding 1.74%. Natural Gas and Oil are rallying at 4.9 ad $83 respectively.

This chart is concerning about the price of Bitcoin and crypto in general. These are volatile assets, but I continue to believe they are here to stay. However, legendary investor Bill Miller says half of his personal net worth is invested in bitcoin and other cryptos. I am not overly concerned about Bitcoin over the long haul and we have seen multiple bouts of substantial sell-offs during the past 5 years. Bitcoin is at $44k (+2.65) and Etherum was $3.4k (+4.4%).

Securities and Exchange Commission Chairman Gary Gensler said he wants more transparency from the country’s largest private companies and the private firms that fund them. Gensler, who spoke on CNBC’s “Squawk Box,” said he wants to ensure large private companies and private equity firms are disclosing enough information. With private funds managing trillions, many companies are delaying their entry to public markets and sometimes use an IPO to allow wealthy investors to cash out. As long as regulation is reasonable, I do not have a problem with it. My fear is over-reaching regulators do something stupid.

I am a big fan of Gundlach and the story highlights his 14 best quotes from the interview. Topics include Fed balance sheet, market valuations, recession, Bitcoin, NFTs, China… Some interesting perspective and worth opening the link for a quick read. The billionaire investor Jeff Gundlach rang the recession alarm, touted emerging-market stocks, and said bitcoin was massively overvalued during a Yahoo Finance interview that aired on Saturday. The DoubleLine Capital boss — whose nickname is the "Bond King" — also cautioned against investing in China, argued that US house prices are less heady than they seem, and explained why he was staying away from nonfungible tokens, or NFTs.

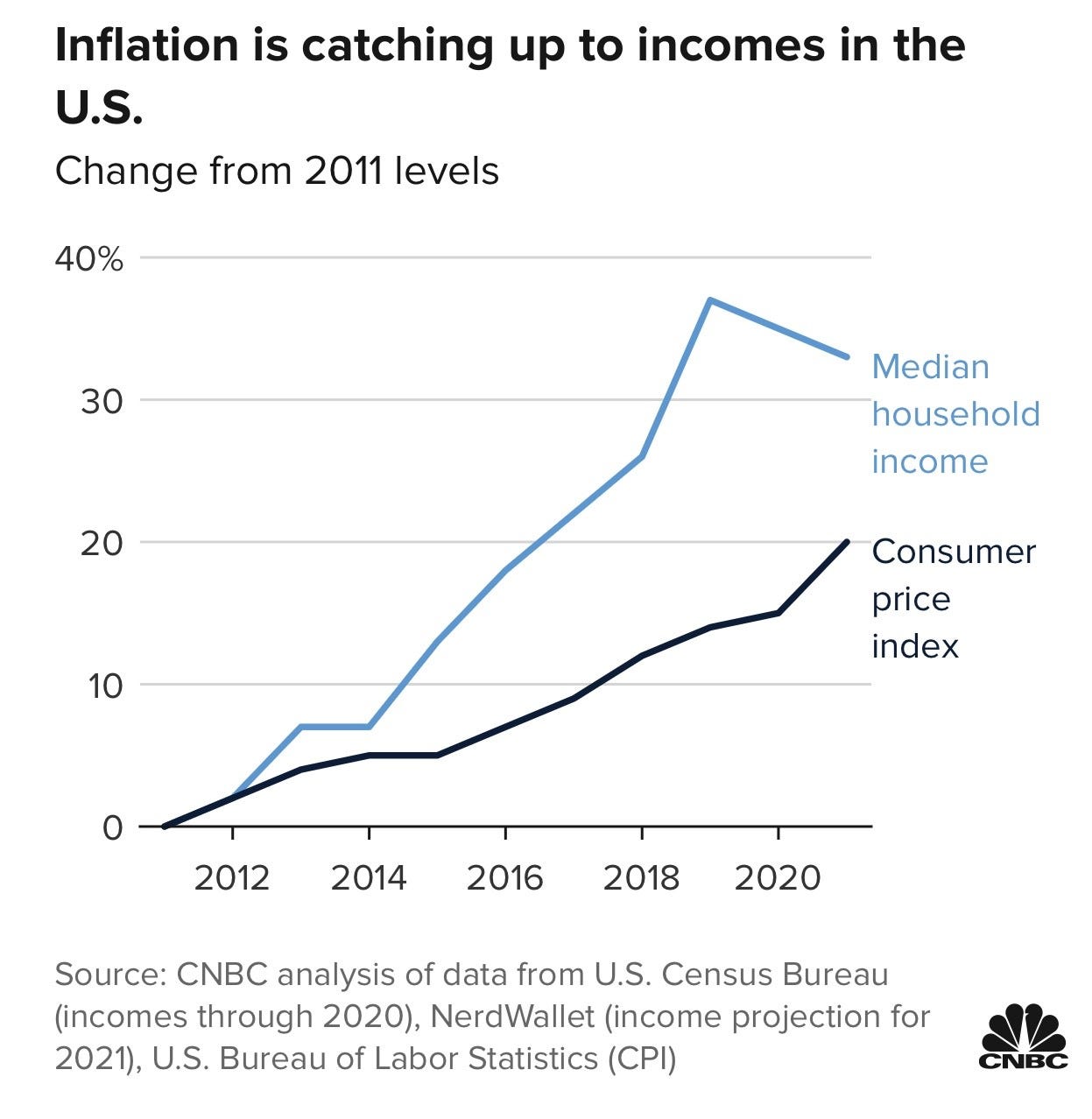

U.S. households are spending more on housing, food, gas, transportation and medical care and falling deeper into the red. From credit cards to car loans, the average family now owes $155,622. Higher prices are already taking a toll.

As consumers pay more for everything from groceries to gasoline, household income is failing to keep pace with a higher overall cost of living, according to recent reports. Over the past two years, median income fell 3% while the cost of living rose nearly 7%, due, in part, to rising housing and medical costs. There are many reasons President Biden’s approval ratings are low, and this is one of the main causes. The latest Quinnipiac Poll (today) has Biden’s approval rating at 33%, with the last 7 polls-(49%, 46%, 42%, 38%, 37%, 3%, 33%). The link to the poll has a lot of details and other interesting polling terms on Trump (59% don’t want him to run again). The December Consumer Price Index came out Wednesday and increased 7%, the fastest level since 1982. I have written that I felt inflation was not transitory for nine months or more. The Fed got it wrong again in my opinion. Bank of America research put out these stats of changes in the past year:

Global food prices up 27% YoY;

US heating costs up: 30% for natural gas, 43% for oil, 54% for propane;

US rents up 12%,

House prices 18%

Lumber prices up 40% past 4 months

Jamie Dimon said the U.S. is headed for the best economic growth in decades.

“We’re going to have the best growth we’ve ever had this year, I think since maybe sometime after the Great Depression,” Dimon told CNBC’s Bertha Coombs during the 40th Annual J.P. Morgan Healthcare Conference. “Next year will be pretty good too.” Dimon, the longtime CEO and chairman of JPMorgan Chase, said his confidence stems from the robust balance sheet of the American consumer. JPMorgan is the biggest U.S. bank by assets and has relationships with half of the country’s households. “The consumer balance sheet has never been in better shape; they’re spending 25% more today than pre-Covid,” Dimon said. “Their debt-service ratio is better than it’s been since we’ve been keeping records for 50 years.” I have said it countless times about Jamie; He is the most important person in finance, and I love this guy. He was the best CEO I ever worked for by about 100 miles. His ability to understand so many businesses in intricate detail and present himself in such a remarkable manner is legendary. He was involved in my business at points which was shocking for a person of his stature and the size of the firm. I want him to run for President, but fear his head would explode over all the dysfunction in DC. Jamie, if you run, I am happy to come work for you again, but this time it is for free. The country needs you, given the never-ending clown-show in DC. I made you your first promotional picture for your run with my low-tech team. A reader sent me this WSJ article about Hillary coming back in 2024 given the issues with Biden and Kamala. The article suggests Hillary will use the mid-term beat down on the Dems as an excuse to throw her hat in the ring. Come on, we can crush her. Let’s Go Jamie! Your country needs you more than ever.

This WSJ article is about supply chain issues and the impact on new homes. Supply-chain backlogs are roiling the new home market, upending efforts to accelerate construction, limiting home-buyer choices, and causing some new owners to move into unfinished homes. Home builders have increased activity in the past year in response to robust home-buying demand and a shortage of homes in the existing-home market. In many cases, the surge in demand in late 2020 and early 2021 overwhelmed builders, forcing many to halt sales in some markets while they caught up. Now the industry is struggling with global supply-chain woes. Pandemic-related factory closures, transportation delays and port-capacity limits have stymied the flow of many goods and materials critical for home building, including windows, garage doors, appliances and paint. While supply-chain delays for some products showed signs of easing at the end of last year, builders say it is still taking weeks longer than normal to finish homes. About 90% of home builders surveyed by housing-market research firm Zonda in November said they were experiencing supply disruptions, up from 75% in January 2021. One builder I spoke with waited two years for stone to finish the house. Think of the carrying costs due to the supply chain issue. He had to wait as the stone needed to match and only a portion of it was delivered on time.

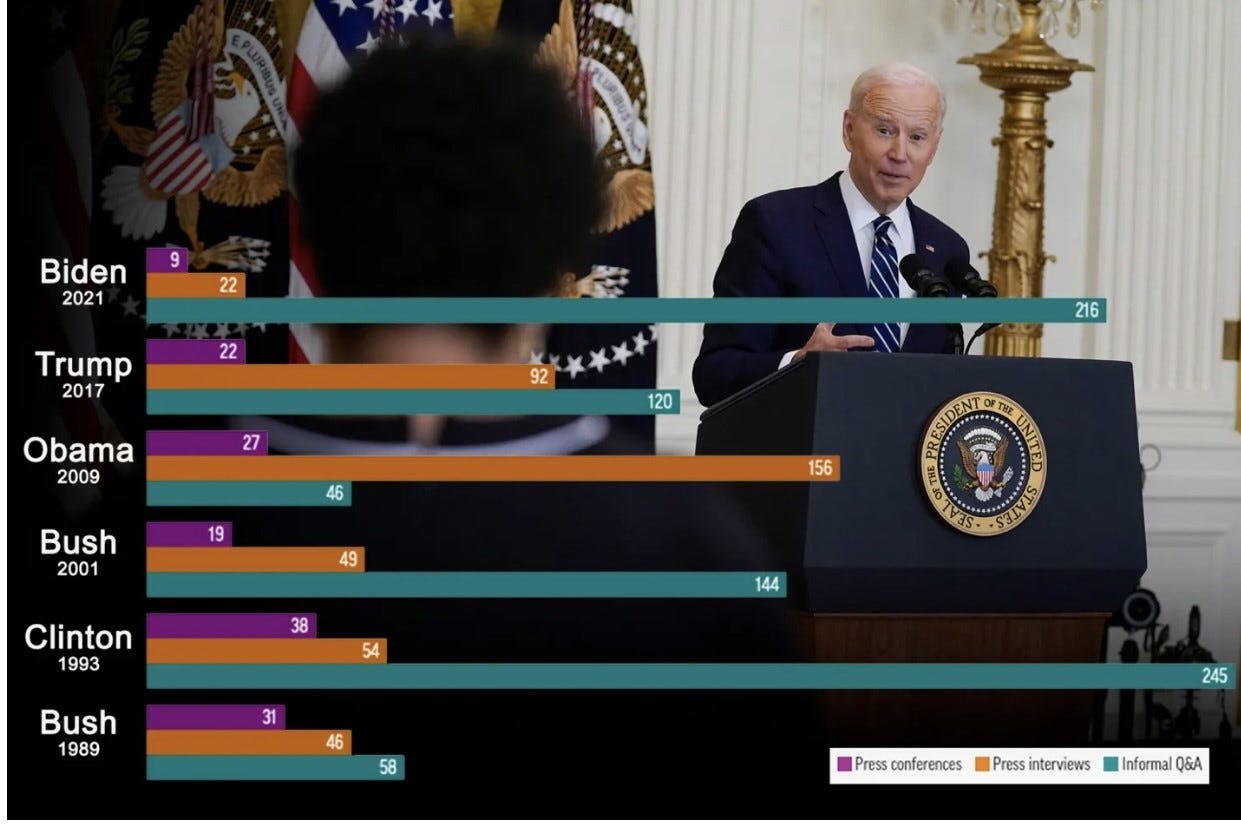

Nearing his first full year in office, President Biden has conducted fewer news conferences than any of his five immediate predecessors at the same point in their time in the White House and has given fewer media interviews than six of them did, according to a story on Sunday. The president has done 22 interviews with the media and held nine formal news conferences – six solo and three with visiting foreign leaders – an analysis by Martha Joynt Kumar, a professor at Town University and director of the White House Transition Project, found, the Associated Press reported.

“The World Vapers’ Alliance amplifies the voice of passionate vapers around the world and empowers them to make a difference for their communities,” reads the homepage for the WVA, whose logo is revolutionary pastiche—a left fist clenching a vape pen. “Back vaping. Beat smoking,” the page urges. As for the people who want you to make the switch, the site says that its alliance “includes groups representing vapers—our partners—as well as individual vapers from around the world.” And while the WVA provides a list of those partners, one key name is missing: the world’s largest tobacco company.

According to sources and internal documents, British American Tobacco (BAT) has played a central and hands-on role in orchestrating, directing, and funding the World Vapers’ Alliance—a seemingly grassroots lobbying group designed to recruit pro-vaping advocates around the world under an anti-smoking guise. I am an adamant non-smoker. I have never smoked a cigarette in my life and always had a firm rule against dating a smoker. My kids know that if they vape or smoke that the consequences are dire. Everywhere I look, I see young kids vaping and they all tell me the same thing; They cannot stop. Kids think it is cool. I think it is disgusting. Yes, BAT is a world-leading vaping company. No conflict here. Read the article, as it does not read well for BAT.

I know Mayor Adams has talked tough on crime, but his DA has other ideas. What is happening in NYC is in stark contrast to when Rudy came to clean up the mess. I remain perplexed how and why violent criminals should not face the consequences of their actions. Why is this good for law-abiding, tax-paying citizens of NYC? A wanted ex-con allegedly stole more than $2,000 worth of merchandise by threatening a drug store worker with a knife — yet had his armed robbery charges downgraded under the controversial, progressive policies of Manhattan’s new district attorney. The move followed a similar case in which prosecutors reduced a felony robbery charge to misdemeanor petit larceny as per the marching orders DA Alvin Bragg gave them last week. “Bragg’s policies are an affront to every law-abiding citizen in New York City,” fumed former Manhattan assistant district attorney Daniel Ollen, who’s now a defense lawyer.

This is an important story about perseverance. Stetson Bennett IV, the starting QB for the National Title University of Georgia team did not have a straight path to stardom. He passed on smaller school scholarships to be a walk on at UGA only to leave for junior college. He returned with a scholarship offer, lost his starting job and regained it due to the injury of a starter. The coaches clearly did not believe in him and continued to recruit his replacement. Bennett is 5’11” and 190 lbs, which is undersized for an SEC QB. Yet he led his team to a 33-18 victory over the powerhouse Alabama team with two second half touchdowns. The kid has heart. He is unlikely to play in the NFL, but given this kids grit, work ethic and perseverance, I am sure the job offers will roll in. After all, he was the offensive MVP and brought UGA its first title in 41 years. Finally, Kirby Smart beat his teacher, Nick Saban. Kids, let this be a lesson to chase your dreams and don’t take no for an answer. Bennett’s dream as a kid was to play for UGA and win a title. He actually achieved his childhood dream. He got rid of his distracting smart phone and uses a “flip phone,” because he felt he was on his phone too much and wanted to focus on football. Good on you.

I was never a kid who liked super hero or sci-fi movies. I never saw any of the major movies which are viewed as classics, as I had zero interest. On a flight from Dubai, I watched Iron Man with Robert Downey Jr and thought it was fun. This video of Marines performing boarding exercises with Jet packs reminded me of Iron Man. Technology today is insane. You need to watch the short video of people flying from boat to boat. I want to do this.

Other Headlines

Fed Chair Powell says rate hikes, tighter policy will be needed to control inflation

Natural gas surges 14% as cold snap ahead is expected to boost demand

The contract for February delivery advanced 14.3% to settle at $4.857 per million British thermal units, hitting the highest level since November.

Tiger Global Lost 7% Last Year, First Annual Drop Since 2016

The fund struggled in the final two months, dropping 8% and 10.7% and erased a 13% gain that it had built through the first 10 months.

Ken Griffin is worth many tens of billions.

Facebook drops 36 spots on Glassdoor’s annual Best Places to Work list after a year of PR crises

The article also discusses the top ranked employers including: Chipmaker Nvidia, followed by HubSpot and Bain & Co., all with a score of 4.6 out of 5.

There’s a growing push in Congress to limit lawmakers’ ability to trade stocks

I am in shock this is allowed. Many politicians have taken advantage and I believe have traded on inside information.

FBI warns hackers are sending USBs infected with ransomware to businesses

Alan Dershowitz lobbied Trump to pardon Ghislaine Maxwell

This does not read particularly well for Dershowitz who has claimed his innocence. Ghislaine belongs in prison for her horrific crimes. Suggesting a pardon seems insane to me.

Billionaire supermarket CEO warns of meat, egg shortages as Omicron disrupts supply chain. This article from CNN talk about empty shelves as well.

Exercise may protect your brain even if you have signs of dementia, study finds

Regular exercise could be the key to children getting good grades in school

Proof of life on Mars could appear within 20 years – though aliens might find us first

Facebook delays return to office until March, Covid-19 boosters required

United cuts flights as about 3,000 workers call out sick from Covid

Pfizer CEO says two Covid vaccine doses aren’t ‘enough for omicron’

JPMorgan’s Jamie Dimon Issues Warning to Unvaccinated New York Staff

I love Dimon, but I am not supportive of his stance here. Will he require boosters in perpetuity?

Virus/Vaccine

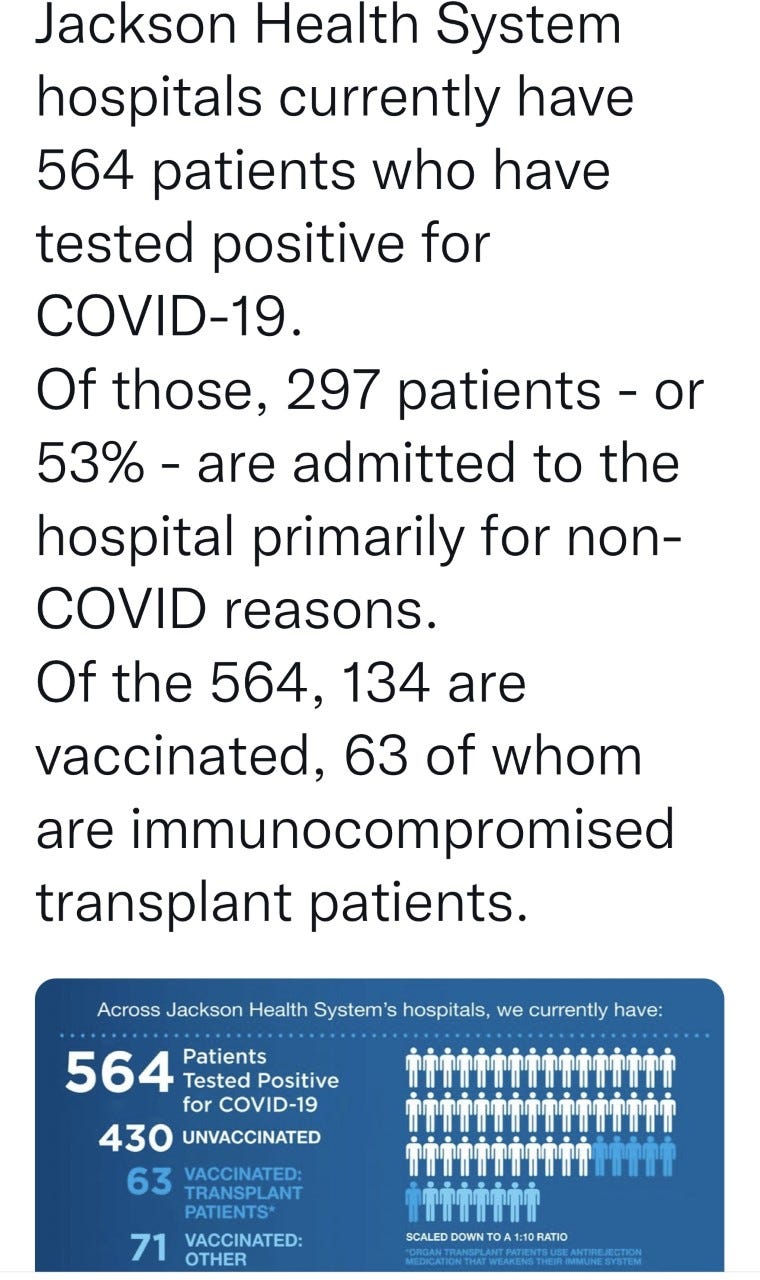

Case growth continues to slow, but also is growing at a rapid rate. The positivity rate appears to be plateauing in the past couple days and is at 26% and appears to be stabalizing after a torrid run higher during the past few weeks. The good news is the rate of case growth has slowed, but remains quite elevated. Case growth was +185% (was +260% last week) and cases now are averaging 761k. The previous peak was 251k a year ago. When I look on a state by state level, many states appear to be peaking, while others are seeing fast growth. For example, NY, NJ, DE, CT, PR, DC, MD, VT, TX, OH seem to see significantly slower growth or reductions from peak in terms of cases. However, RI, MA, UT, HI, CA, CO, AR, WI, NH, NC, AL, WA, SD, AZ, OK, AK, OR are seeing case growth continue or accelerate. The RI chart has gone through the roof, for example. Hospitalizations grew at 84% and averaged 141k beating the prior peak of 138k approximately one year ago. However, approximately 50% of the hospitalizations today are not for COVID, but tested positive while hospitalized. With respect to deaths, they have climbed sharply at +40% and average 1.7k/day. The peak death rate was 3.3k/day a year ago for perspective. I would like to know if someone dies in the hospital in surgery for a gall bladder, but tested positive, is it considered a COVID death? Given how pervasive the cases are today, this counting would have a big impact on the numbers. I am not trying to undermine the severity of this Omicron surge, but again, would like to see clean data. The bad news is the data is not good, but it appears that the slowing case growth has the US closer to a peak in cases and within weeks we should see hospitalizations and deaths peak as well. Given the prevalence of Omicron, I am convinced the case count is substantially higher than we are seeing. Hopefully, this means more Americans have natural immunity, something which should help for future waves.

I have written about my data frustrations two years into the pandemic and Jake Tapper agrees. I recently wrote about the high number of hospitalizations which are asymptomatic and are not there for COVID, but there with COVID. Following CDC Director Dr. Rochelle Walensky's admission that up to 40% of reported COVID hospitalizations are due to other medical emergencies, Tapper sounded the alarm about the inflated statistics. So, the hospitals are still stretched thin because of this... but if 40% in some hospitals- 40% of the people who have COVID don't necessarily have problematic COVID- they're there because they got in a car accident, they're there because, you know, they bump their head, and they're being included as ‘in the hospital with COVID,’ that number seems kind of misleading," Tapper told CNN's chief medical correspondent Dr. Sanjay Gupta. "We're two years into this, and we need the clearest picture possible. If somebody's in the hospital with a broken leg and they also have asymptomatic COVID, that should not be counted as hospitalized with COVID, clearly," Tapper later added. I agree and have been talking about how poor the data is for months. How is this possible in the USA two years into the pandemic that the data is so poor? How hard can it be to get clean hospitalization data out into the media?

The Supreme Court heard arguments for the vaccine mandates and there were some whopper mistakes by justices. Sotomayor- “We have over 100,000 children, which we’ve never had before, in serious condition, many on ventilators.” At the time she made this comment, federal data showed that fewer than 5,000 (closer to 3,500) coronavirus-positive children were in the hospital. In fact, fewer than 83,000 children have been hospitalized for COVID-19 — cumulatively — since August 2020. When Justice Breyer waded into the fray, he suggested the OSHA rule was needed because “hospitals are full almost to the point of maximum” and that “750 million new cases” had been reported in the US yesterday — despite the fact that the population of America is around 330 million. The day he was referring had 759k new cases, NOT 750mm new cases. I am a bit disappointed that such well-educated, respected SUPREME COURT justices could say things so dramatically off the facts. Even liberal media outlets such as the WaPo wrote about it.

Very interesting article and CDC study on vaccinated adults at 465 hospitals. Be sure to read the end of this section as it is a direct quote from the CDC study. Yes, I read it. All the people studied with severe outcomes had at least one comorbidity and 77.8% had four or more. The number of infected in this study is small at 2,246, of which 327 were hospitalized, 189 had a severe outcome and 36 died. This data is specifically for this study and is not meant to suggest this is the case for all severe outcomes. An ABC News appearance by CDC Director Dr. Rochelle Walensky prompted confusion this weekend after she referred to vaccinated people killed by COVID-19 with multiple "comorbidities." "The overwhelming number of death, over 75 percent, occurred in people who had at least four comorbidities," Walensky said in the posted video after Vega's question. "So really, these are people who were unwell to begin with. And yes, really encouraging news in the context of omicron. This means not only just to get your primary series but to get your booster series, and yes, we're really encouraged by these results." Critics jumped on Walensky's remarks across the spectrum when they were posted online, with some thinking she was callously encouraged that only those with several underlying factors were dying of the virus, while others thought she was tacitly admitting that the coronavirus death count – officially over 800,000 and counting in the United States – was inflated since those dying had other problems. "Good Morning America screwed over Walensky by the way it edited her comments. Some users like writer James Surowiecki said Walensky appeared to make more remarks on "Good Morning America" before her line about the "over 75 percent." If you watch the full section of the clip, she said something before the 75% line, presumably to explain the numbers. But GMA cut it," he wrote. I found the prior statement on line in which Walensky explained, “A study of 1.2 million people who were vaccinated between December and October demonstrated that severe disease occurred in about 0.015 percent of the people who received their primary series and death in 0.003 percent of those people." Here is the full CDC report that Dr. Walensky was citing. It makes it clear that vaccines improve outcomes for hospitalization and death in the study of 465 hospitals of patients 18 and over. The study makes it clear (middle of 1st paragraph) about how many of the most adverse outcomes in the study had had four or more risk factors. “Risk for severe outcomes was higher among persons who were aged ≥65 years, were immunosuppressed, or had at least one of six other underlying conditions. All persons with severe outcomes had at least one of these risk factors, and 77.8% of those who died had four or more risk factors.”

The WHO has not shown me impressive moves since the start of the pandemic and made an interesting statement. “A vaccination strategy based on repeated booster doses of the original vaccine composition is unlikely to be appropriate or sustainable,” the WHO Technical Advisory Group on Covid-19 Vaccine Composition (TAG-Co-VAC) said in a statement published on Tuesday. “Covid-19 vaccines that have high impact on prevention of infection and transmission, in addition to the prevention of severe disease and death, are needed and should be developed,” the advisory group said. I agree with both statements, but, I do not believe the answer is boosters every few months for new variants for the rest of my life.

The lies about the origin of the pandemic have been too many to count. Now, released emails suggest a cover up. Leading Western experts believed a lab leak was the 'likely' origin of Covid but were silenced because it could cause harm to Chinese scientists, bombshell emails show. Sir Jeremy Farrar, who publicly denounced the theory as a 'conspiracy,' admitted in a private email in February 2020 that a 'likely explanation' was that the virus was man-made. In the email, sent to American health chiefs Dr Anthony Fauci and Dr Francis Collins, Sir Jeremy said it was possible Covid had been evolved from a Sars-like virus in the lab. He went on that this seemingly benign process may have 'accidentally created a virus primed for rapid transmission between humans.' But the British scientist was shut down by his counterparts in the US who warned further debate about the origins of the virus could damage 'international harmony.' He was told by other scientists with links to virus manipulation research that it could cause 'unnecessary harm to science in general and science in China in particular.' Despite his concerns, Sir Jeremy went on to sign letters in The Lancet a fortnight later denouncing anyone who believed in the lab leak theory as bigoted. Critics slammed the 'lack of openness and transparency' and accused Western scientists of shutting down debate about Covid's origin for political reasons. I have suggested since the beginning it was a leak and anyone who suggested as much was a conspiracy theorist. I wrote a piece entitled, “Fauci Ouchie,” in June suggesting it was time for him to move on after decades of service and I stand by that piece.

Real Estate

From my broker friend, Devin Kay regarding a Miami house. I showed an off-market house that I have on N. Bay Rd to a buyer the other day and we submitted an offer for $38mm only to get it slapped back. The existing house is more than likely a tear down otherwise it needs more than $5 million in renovations to bring it up to speed. It is an amazing 30,000-square-foot lot with 175’ of water frontage with an irreplaceable view. The owner told me he has already rejected $42mm and wouldn’t sell for less than to $50mm. $42mm for a lot which is less than an acre? What planet do we live on right now? North Bay Road is the hottest address in Miami, especially in the 40s and 50s on the water with amazing views. Houses which sold for $13-14mm just prior to the pandemic are worth $50mm or more today in many cases. The picture below is an aerial of some North Bay Road homes. In a related story, it is confirmed Ken Griffin bought the $75mm teardown on Star Island recently. On the back of that, another home is listed for $90mm. The house is on almost 1 acre and has two dwellings totaling 25,000 feet. The property sold for $10.8mm in 2011 and it was restored in 2014.

Bloomberg article on the high end housing market. “It’s impossible to underprice a property in this environment,” says Bradley Nelson, chief marketing officer of Sotheby’s International Realty, which released its 2022 luxury outlook report on Monday. A potent combination of sky-high bonuses, accelerating inter-generational transfers of wealth, low interest rates, and the specter of inflation “makes investing in a concrete, fixed asset like real estate attractive to many as they balance their portfolios,” Nelson says. Tax considerations continue to drive luxury purchasing decisions. “That’s really the headline in both the United States and internationally,” says Nelson. “You’re going to see the greatest investments continue to be in tax havens.”

Less than four months ago, Nicolas Berggruen doled out $63.1 million at auction for L.A.’s storied Hearst Estate — previously known as the Beverly House thanks to its prime locale on North Beverly Drive. Now the Parisian-born billionaire investor has added another property to his real estate portfolio, acquiring the smaller and less flamboyant house next door. Combined, the two separate parcels offer a nearly 4.5-acre compound. Records show the founder and chairman of the Berggruen Institute — a think-tank geared toward developing ideas and shaping political, economic and social institutions for the 21st century — ponied up an additional $12.3 million for his newly acquired home, which was initially listed with a $15.5 million ask. Like the Hearst Estate, this ancillary property was also owned by one Leonard Ross, and was sold as part Ross’ ongoing bankruptcy proceedings.

Eric Schmidt, the former chief executive of Google, has paid $65 million for Enchanted Hill, a prized piece of undeveloped land in Beverly Hills that was owned by late Microsoft co-founder Paul Allen, according to people familiar with the situation. The deal, which closed in December, marks the end of a more than three-year push to sell the roughly 120-acre property, which came on the market asking $150 million in 2018. Real-estate agents say the property is one of the largest undeveloped parcels left in Beverly Hills, with views of the ocean and the Los Angeles Basin. It could be developed into a large compound totaling as much as 80,000 square feet. Mr. Allen paid about $20 million for the site in the late 1990s, The Wall Street Journal reported. Amazing short video in the link which shows the property.

Here is a promising article on $100/ft office rents in NYC. Read it close as there are concessions which bring the rents down. To office landlords’ joy, C-Note leases – those with starting rents of $100 and up – are making a robust rebound, helping to quell fears about the office market’s long-term health. CBRE reported that some 105 C-note leases comprising 2.7 million square feet of prime space in Manhattan were signed in 2021. Not only did the total number more than double the meager 49 completed in 2020, it also topped the five-year historical average by 18 percent. The $100-plus lease has long been the bragging-rights gold standard in a market where most rents average $60 to $80 per square foot. A very few, attention-grabbing deals of up to $300 a foot were usually for very small penthouse floors. Perhaps the largest new lease in the $100-plus club was Chubb Group, which took 240,000 square feet at Olayan Group’s redesigned 550 Madison Ave. Sources said that the price for a few high floors would rise to $192 a foot toward the end of a 20-year term. Others starting at $100 and up in 2021 included for private-equity firm Hellman & Friedman at L&L Holding’s new 425 Park Ave. and law firm Venable LLP at the Durst Organization’s One Five One, the former Four Times Square. There’s a qualifier: CBRE analysts Nicole LaRusso, Michael Slattery and Jared Koeck note that average so-called net-effective rents (NERs) were lower than their $100-plus face values due to generous free-rent periods and tenant-improvement allowances. The average NER in 2021 in the $100-and-up club was $85 a foot, up 25% from 2020 but 6% below the pre-Covid five-year average, CBRE reported. Sources told The Post that Chubb, for example, is getting 12 months’ free rent. I have spoken with multiple landlords and they headline number is vastly different from effective rent with free rents and build-out allowance.

For whatever reason, my metaverse R/E stories tend to get a lot of commentary from readers. I have not made any investments here and quite frankly do not believe I will be making any. There is a short and informative video in the link. Real estate in virtual worlds — sometimes called the metaverse — is going for millions of dollars in some cases. The most expensive spots are near where lots of users congregate — for instance, someone recently paid $450,000 to be Snoop Dogg’s neighbor in a virtual world called the Sandbox. But even proponents are warning would-be investors that this is risky business. It’s no secret the real estate market is skyrocketing, but the Covid pandemic is creating another little-known land rush. Indeed, some investors are paying millions for plots of land — not in New York or Beverly Hills. In fact, the plots do not physically exist here on Earth. Kiguel’s company recently dropped nearly $2.5 million on a patch of land in Decentraland — one of several popular metaverse worlds. “Prices have gone up 400% to 500% in the last few months,” Kiguel said. Someone paid $450,000 to be Snoop Dog’s virtual neighbor. The insanity blows my mind. One quote in the article said, “You should only invest capital that you’re prepared to lose.’ You think?