Opening Comments

Today is the 21st anniversary of 9/11. I was in NYC during the attacks and remember everything like yesterday. Innocent lives lost and lived in fear with for years after. It changed the world. How we travel, borders, foreign relations, led to wars…. Almost 3,000 were killed on 9/11 for no good reason. Many more have become sick or died from cancers due to cleaning up the debris from the fallen buildings. Evil prevailed that day. I lost friends and countless nights of sleep. I will never forget walking from 270 Park up to my Upper West Side apartment through Central Park with thousands of people in shock. There are many who hate the freedom we have in the US. Despite my many issues with the moronic policies and politicians in the US, we are still a country of freedom and the best in the world. Let’s not forget. 9/11 Memorial below.

I thought the last piece Mostly Miserable with a Little Oppressive was a good one. Unfortunately, my request for assistance in spreading the word about the Rosen Report, fell on deaf ears as new sign ups were anemic. If any of my fancy-pants readers have any ideas on how to grow this newsletter, I am all ears. I get positive feedback from loyal readers across the spectrum (college students, moms, school teachers, Hedge Fund/PE/RE managers to CEOs of Fortune 500 companies as well as billionaires). However, the growth is hardly parabolic. Given my jealousy of all things Kardashian, if the readers think I need to show a bit more skin to grow subscribers, then so be it. I have been working out harder lately now that my back is better. No, there is no photo shop or editing here. All natural, just like the Kardashian clan. No, my daughter did not Photshop my face on a young model’s body. No one question this photo or you will be unsubscribed from the world famous, important and life altering newsletter, the Rosen Report. Sizzle sells, so maybe this gets me some new subscribers?

Picture of the Day-Queen Elizabeth

Brace Yourself

Quick Bites

Markets

Lael Brainard/Powell on Rates

Oberlin College Owes $36mm

SAFE T Act Illinois Disaster

Southern CA, Rainfall Perspective

Kim K-My Hero

Other Headlines

Crime Headlines

Virus/Vaccine-Impressive Declines

Real Estate

General Comments-NYC vs FL Examples from 2015 to Today

US Mortgage Rates

China R/E Issues

Other R/E Headlines

Picture of the Day-Queen Elizabeth

I have never been much of a Royal watcher. My mother, on the other hand, was fascinated by the Royal Family. This link has some amazing pictures of the Queen over the years. She passed at 96 years old and had been Queen for over 70 years. She lived one hell of a life, one 99.9999% of the world would love to have experienced. During her reign, she had 15 Prime Ministers from Winston Churchill to Liz Truss. Queen Elizabeth met with 13 out of the past 14 US Presidents (Lyndon Johnson excluded). She was supposed to have had a great sense of humor and a loyal reader, RM, sent me this fun story, but there are many others. Her passing results in the transfer of power to Charles, now officially King Charles III. It also results in shift of her personal wealth and the ownership in trust of all her assets (castles to crown jewels). It is rumored her net worth is $500mm, but the value of the brand of the British Monarchy is valued at $78bn including Buckingham Palace. I question the future of the monarchy in its current state. Given the turmoil in the British family, I am officially making myself available for adoption by the Royals. Prince Eric has a fantastic ring to it. If I am made price, I will continue to write the newsletter, but it will be renamed Prince Rosen Report.

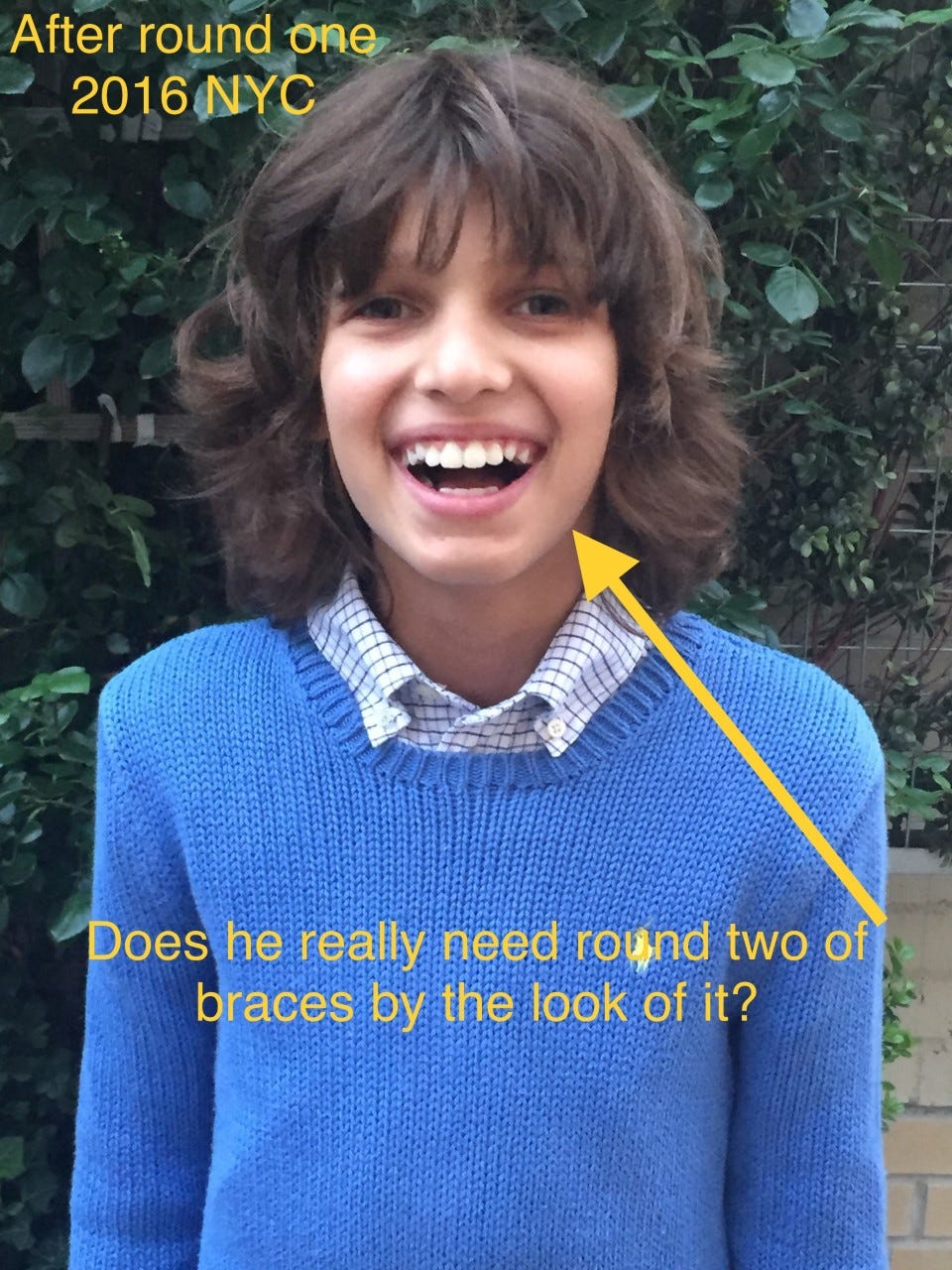

Brace Yourself

I wrote a piece called Human TheSaurus last year about my horrific adult lingual (behind the teeth) brace experience at 26 years old, which resulted in my speaking like Daffy Duck. Both of my kids had braces, NOT ONCE, but TWICE in the new scam orchestrated by orthodontists. Each kid cost between $10-12k in total. Both of my children had braces at approximately 8 years old. They were taken off after a year or so and then had them again at 13/14 for 18 months. My daughter, age 15, just got her braces off Friday, and now the Rosens are brace-free, but out over $20k in the process.

When I was a kid, braces were approximately $2,500, ugly metal and you wore them once for a couple years as a teenager during your awkward period in 7-10th grades. I did not have the resources for braces and decided to get them in my mid 20s. Now, the orthodontists have colluded to suggest that kids wear them twice for the perfect smile. Why I went along with this insanity is beyond me. I am guessing that at a conference some years back, an orthodontist stood up and said, “I have a great idea on how to significantly grow our revenue base off the same clients. If we all tell the parents the kids need braces twice, we double revenue without the need for incremental marketing.” And so the new scam began. I cannot confirm this hypothesis, but it is a solid hunch of mine and sure seems plausible.

To add insult to injury, the orthodontists down here are so jam packed that getting an appointment off schedule is akin to winning Powerball. Inevitably, one of the kids broke a brace and they could never squeeze you into the office. They had to miss school to get an appointment as the coveted early am (before school) or afternoon appointments (after school) require your money and BOTH kidneys. Sasquatch sightings are far more frequent than getting those good appointment time slots.

The office had you make your next appointment during your visit for 6 weeks later. If you needed to change, it was pandemonium. Makes sense after all the money spent. I am now offering my children out as smile/tooth models in an effort to recoup the stupid amount of money I spent. All proceeds go to the Rosen Brace Fund. Given they started their orthodontic journey in NYC and finished in Boca, we got no discounts for being lifetime clients. Times are tough with rampant inflation and Jack and Julia are now available for hire with what damn well better be the perfect smile. Who is hiring my kids for their smile or anything else for that matter? Julia is also available for babysitting, and Jack can give golf or guitar lessons. Both now officially have perfect smiles.

Yes, the Rosen boys have no shortage of hair. It is our calling card.

Quick Bites

U.S. stocks rallied Friday as Wall Street caps off a strong weekly performance, recovering from a Federal Reserve-induced slump. The Dow gained 377 points, or about 1.19% to 32,152. The S&P 500 jumped 1.53% to 4,067, and the Nasdaq Composite climbed 2.11% to 12,112. Shares of DocuSign surged more than 10% after the electronic agreements company reported an earnings beat. All three major averages snapped a three-week losing streak. On the week, the 2-Year-Treasury sold off 17bps to end the week at 3.56% on hawkish Fed comments. Oil fell approximately 4.5% on the week to $86.1/barrel despite the OPEC 100k barrel/day production cut. Yet another sign of inflation cracking (made the call over two-months ago) is the Manheim used vehicle price index dropped 4% month over month) with the index at the lowest for a year. Gas is down to $3.72/gallon from $5.01 in mid-June. Also of note in Germany, factory orders fell for the 6th straight month and were down by almost 14% year over year. I remain very concerned about Europe and the ramifications of the energy debacle there.

Lael Brainard, the No. 2 official at the central bank, acknowledged risks that the Fed could overdo it on interest rate increases, a sentiment notably missing from Chair Jerome Powell's hawkish speech in Jackson Hole, Wyoming, in late August. "At some point in the tightening cycle, the risks will become more two-sided," Brainard said, according to the prepared text of a speech before a banking group in New York. The rapidity of rate increases and uncertainty about the pace of their economic effects "create risks associated with overtightening," she continued. I happen to agree with Brainard. I do not know of anyone who published more on the topic of the Fed being behind the curve than I did. Rate hikes take time to get through the system, and I do fear that we will may see too aggressive of hikes only to be followed by rate decreases in 2023. Federal Reserve Chair Jerome Powell said officials won’t flinch in the battle to curb inflation, hardening expectations that they’ll deliver a third straight jumbo rate hike later this month. “We need to act now, forthrightly, strongly as we have been doing,” Powell said Thursday in remarks. In a related note, investor, Cathie Wood, is calling for a significant Fed policy pivot in three to six month as she believes deflation looms. However, she got smoked on tech investments.

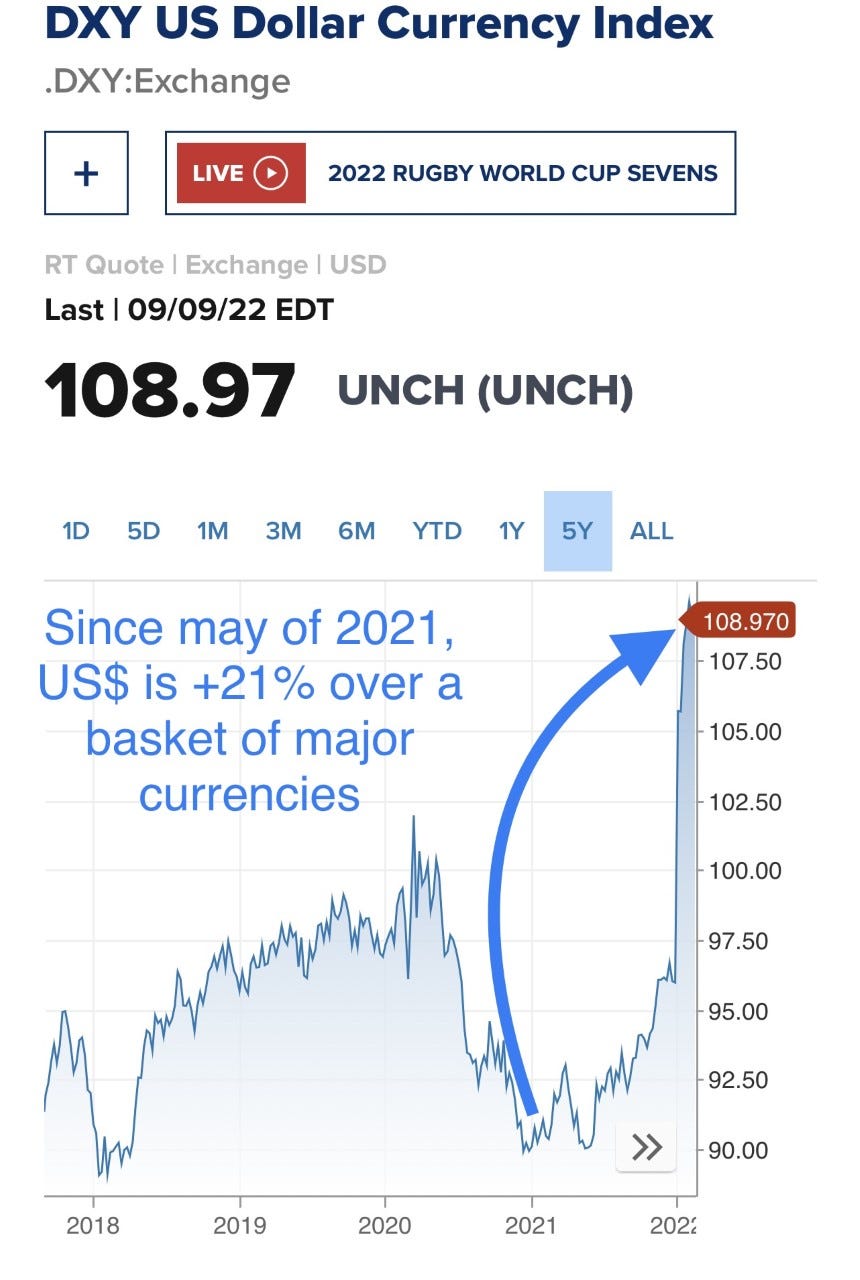

This bullet is a relative of the prior one. I wrote often about the US Dollar strength against other major currencies and included countless charts while outlining concerns, and there is a new paper echoing my prior notes, written by prominent economists. The Federal Reserve’s aggressive efforts to wring out inflation have sent the U.S. dollar soaring to historic highs — further aiding the effort to get price pressures under control. Beware, however, the potential for unwanted side effects, a pair of economists warned in a new paper.

“The Federal Reserve has been among the most aggressive (if not early) tighteners, and the dollar has appreciated sharply since mid-2021. Determined disinflation by the Fed and continued appreciation of the dollar could lead to more intense debt troubles for a range of EMDEs (emerging market and developing economies),” wrote Maurice Obstfeld, economics professor at the University of California, Berkeley and Zhou, a PhD from Princeton. Worries stem in part from rising dollar-denominated debt in those economies over the course of the pandemic. A surging dollar makes it more difficult for borrowers in those countries to repay dollar loans. If a foreign company or country borrows in US dollars and their home currency devalues by 20%, they have to come up with more money to service the debt and pay back the principal as their own currency is now worth less in US Dollar terms. Some currencies are down 40% or more against the dollar.

When the Rosen family was leaving NYC, we considered San Diego and South Florida. I was drawn to San Diego for the weather, waves, and lifestyle. In the end, it was too far of a commute, the taxes were too high and the natural disasters too great. There is a hurricane threatening San Diego, and I wanted to put the rainfall into perspective. It is something I studied when I was making the move decision. With the storm, as much as 8-10” of rain is expected in localized areas. Check out the next two charts with the 1st being San Diego which averages less than 12” of rain a year relative to Palm Beach which is almost 63” of annual rainfall. It rains 38 days a year in San Diego and 140 days in Palm Beach. Although I dislike the homelessness issue, crime policy, taxes, natural disaster, power grid… the weather in Southern California is spectacular most of the year absent a rare hurricane.

This is an EXTREMELY concerning story about the WOKE nature of the college universe today. Oberlin College has agreed to pay over $36 million to the family-owned bakery the Ohio school falsely accused of being racist in a shoplifting incident. Gibson’s Bakery filed suit against the progressive college in 2017 for siding with three black students who claimed the store racially profiled them when they were caught stealing from the shop the year before. The hefty payout comes after the Ohio Supreme Court last month denied Oberlin’s bid to hear its appeal of the 2019 jury verdict, which found that the college defamed the bakery when a staffer made flyers claiming that Gibson’s had a history of racial profiling. Allyn (Bakery owner’s son), who is white, chased that student out of the store — and a scuffle ensued between him and the three students. The arrests caused an uproar with hundreds of students and teachers picketing outside the bakery the next day with signs claiming they were white supremacists. One college staffer created a flyer claiming “LONG ACCOUNT of RACIAL PROFILING and DISCRIMINATION,” urging people to boycott the shop. The Oberlin College actions are UNACCEPTABLE. I am very happy Oberlin was forced to pay for crushing the lives of innocent people who were wrongly accused of discrimination, but this took 5 years!

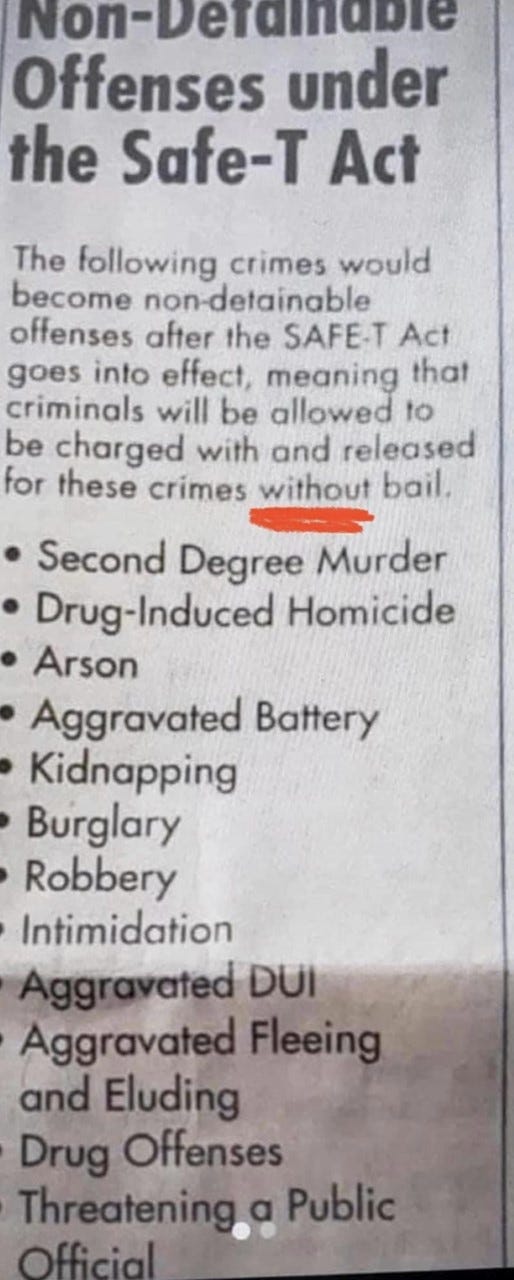

I touched on the SAFE T Act in Illinois on my last note in Crime Headlines. It is a concerning piece of legislation which is effective on 1/1/23 and again puts criminals ahead of law abiding citizens. Here is a sheriff’s take on it in a very short video and it is CONCERNING. People, elections matter and have consequences. Now, the citizens are paying with sky-high crime rates (55 shot and 11 killed last weekend). Theoretically, the bill allows the judges the discretion to keep suspects they deem dangerous without bail, but I question how often that will happen given recent history. Citadel left the city and Ken Griffin is a Florida resident and took his $30bn with him. The wealth has left the city, and the once great Magnificent Mile has been renamed the Murder Mile. There is nothing, and I repeat nothing to ever get me to live in Chicago again. Remember, I was born there, worked there and attended the University of Chicago. The list below has been going around. The SAFE T Act is 764 pages, so excuses me if I did not read it in its entirety, but the sheriff eludes to most of the list. The Illinois State’s Attorney has serious concerns about the SAFE T Act for good reason. The new law also states who can be arrested: For example, someone trespassing on private property can be fined by police but not removed. Even though the SAFE-T Act aims to overhaul the state's criminal justice system and is designed to end 'mass incarceration' ... critics of the new legislation are overwhelmingly alarmed that a plague of violent crime will spread across the state.

Reality TV star Kim Kardashian launched a private equity fund, Skky Partners, which she co-founded with Jay Sammons, a former partner at the investment firm Carlyle Group. “Together we hope to leverage our complementary expertise to build the next generation Consumer & Media private equity firm,” Kardashian wrote on Twitter. Alongside investing in consumer and media companies, the firm will also target the hospitality, luxury and digital and e-commerce sectors, Skky Partners tweeted. The brilliance of the Kardashian clan is getting under my nerves. For people with almost no talent, they sure know how to capitalize on fame. Let me be clear. I am jealous, envious, and upset at the entire family for printing money and having hundreds of millions of followers. These people are such influencers, the entry into private equity is brilliant as she can have a massive impact on brands by wearing the clothes, sending a Tweet or Instagram…. If only my readership could grow by 100,000 times, I could do this too. Hello. I need your help.

Other Headlines

Scott Minerd calls for the S&P 500 to drop 20% by mid-October, saying the bear market is intact

He sites monetary policy, macro backdrop, PE ratio and seasonality.

Gavin Newsom slammed for AC 'double standard' amid heatwave

During mask mandates, he partied in Napa mask free. During the heat wave he requests residents to use less energy while he was in a fleece in cold AC. Newsom is the perfect politician, “Do as I say, not as I do.” I believe he is the 2024 Democratic candidate. At least he is not dementia ridden and meets my age requirements for President.

Growing alarm as more election workers leave their posts ahead of Election Day

Princeton Will Cover All College Costs for Families Making Up to $100,000

CNN ratings continue to tank as boss Chris Licht revamps network

Shocking how bad the #s are in the link.

California high school teacher boasts 'queer library' with material on orgies and BDSM/kink

So, we are not teaching kids the basics and they can’t read Shakespeare or To Kill a Mockingbird, but gay orgies and BDSM are all good? This is not a Left or Right thing. To me, this is just common sense, and we should be appalled.

Carlos Alcaraz, Jannik Sinner make US Open history in match that lasts over five hours

I know these are elite athletes and far younger than I am, but for the life of me, I don’t know how you can play tennis for 5 hours. Below is the future of men’s tennis. He is #1 if he wins today.

Woman, 19, gives birth to twins by TWO fathers after having sex with both of them on same day

I am not sure how much more awkward a situation can be with respect to family. I had no idea this was possible. Try explaining that to the boys when they get older.

Eli Lilly’s obesity medication looks poised to become a $100 billion a year drug

Given my writings on obesity, I sure hope this works and is a safe, game-changing option.

American Neo-Nazi arrested after displaying hate messages at gates of Auschwitz

Signs are vulgar, but can be see on the link. I honestly hope these people die painfully in jail.

Bad Bill Hunting: Like NYC, Harvard kids also not impressed with de Blasio

So deBlasio was a horrible mayor, laughable Presidential candidate and is a bad professor? I honestly wonder what his highest and best use will be? Sparring partner for MMA boxers who rip his head off?

NYC Subways Record Highest Daily Ridership Since Start of Pandemic

Thursday 3.6mm turnstile clicks relative to 5.7mm in 2019. The MTA believes it will take until 2035 to get back to pre-pandemic levels.

Analysis-Kim Jong Un's 'decapitation' fears shine through in new N.Korea nuclear law

Crime Headlines

Woman randomly slashes man, 82, with machete, pepper-sprays him in NYC

Numerous prior arrests, but of course she is out on the streets. Bloody pictures in the link. Stop the madness.

Woman slashed in NYC subway station attack: ‘Criminals are getting bolder

This was in Chelsea on 23rd and 8th. Not the kind of place you would think this would happen. Thank you, DA Bragg.

Caught on video: Man with walker robbed at knifepoint in the Bronx

$13 was stolen. If they catch the suspect he will be set free anyway.

NYC block hires armed security guards to patrol against drug-ridden street

I lived at 5th Ave and 9th Street in Greenwich Village for 10 years and that is .3 miles from where this story takes place.

15-year-old student killed in shooting after leaving school in Downtown Brooklyn park

Mugger tackles man into NYC fruit stand in broad daylight-Crazy Pictures

Memphis shooting: Teen accused of killing 4, injuring 3 others in rampage streamed on Facebook

He has a previous criminal history and was charged with first degree murder but pled to aggravated assault in 2021. Why in the hell do these violent criminals keep being let out to hurt or kill others?

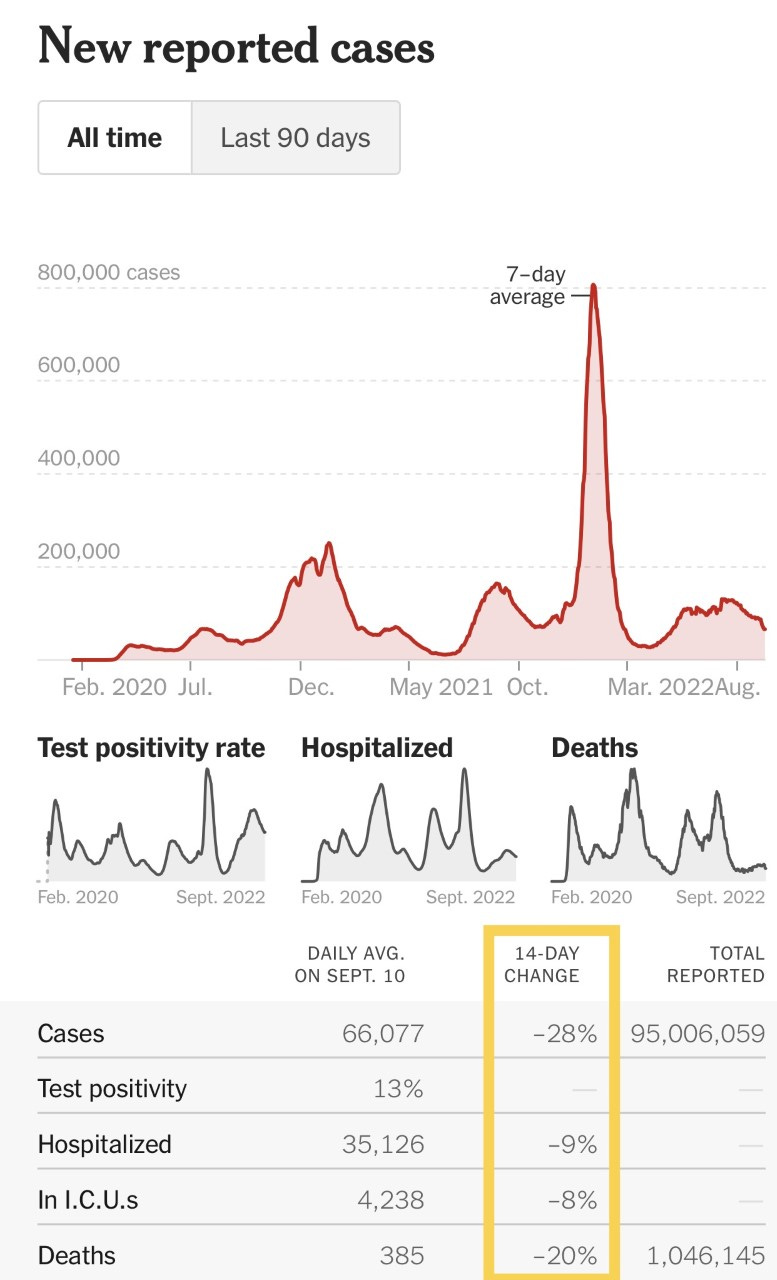

Virus/Vaccine

Solid declines with cases falling 28% and deaths down 20%.

Real Estate

I have been to the building, 737 Park Avenue, developed by Harry Macklowe. A friend wanted to buy in 2015/6, and I talked him out of it based on the price per foot and my views on the market at the time. I lived at 791 Park (74th), 3 blocks north of 737 (71st). It is a great neighborhood. Two blocks from Central Park and one block from the convinces on Lex. Bob Knakal paid $13mm in 2015 for a 4,700 ft apartment with high ceilings in 737 Park and clearly put money into it. The seller is basically asking what he paid for it. This is a condo in a great NYC location, directly across the street from one of the most important buildings in the city, 740 Park Avenue. I asked developers and R/E brokers in Palm Beach and Miami this question: If you spent $13mm in 2015 on the water, what would it be worth today. In Miami on North Bay Road, I heard it would be a minimum of $35mm and probably well over $45mm. On Palm Beach Island, minimum of $40mm and as much as $60mm. In my community in Boca, you could have bought 2 homes on the water for $14mm. Today, they would be worth $25-40mm in total, depending on condition. My point is simple, WFH, bad policies, high taxes, crime, homelessness, filth and high cost of living have a price. I sold my apartment in November of 2016 at the all-time highs. I told my broker that the market was turning, and I wanted to get out in a hurry. No one believed me. I would guess my Park Avenue PH is down 20% and my Florida home is +140% in the 5+ years since the transactions. I could never recommend to anyone to ever buy a co-op. The process is far too intrusive, and the asset becomes far too illiquid. I have been discussing the issue of the lack of school seats in South Florida, and this article is yet another one on the topic. Wall Streeters fleeing NYC pack elite Palm Beach private schools to capacity. I spoke with Devin Kay from Douglas Elliman who told me this summer he only completed 3 transactions on the residential side. However, given people are back from school, he has completed $52mm over 7 homes/condos under contract in the past two weeks. He said all of the 7 transactions are double what they would have been in late 2019 (pre-pandemic). We should see activity tick up now that more people are back and expect November through March to have a fair amount of action.

Mortgage rates hit their highest point since November 2008 this week, crushing home buyer demand. The rate on the 30-year fixed mortgage jumped to 5.89% from 5.66% the week prior, according to Freddie Mac. Rates have surged nearly three-quarters of a point in just three weeks and are now over 2.5 percentage points higher than the start of this year. Elevated borrowing costs and inventory shortages have pushed inflation-struck homebuyers to the sidelines, while those who remain in the market are no longer rushing to make a bid, forcing sellers to reassess their pricing expectations. The move in rates since late 2020 results in an increase over $1,300/month for a $500k mortgage. Another article suggested the rate was now 5.94%, even higher than this article suggests.

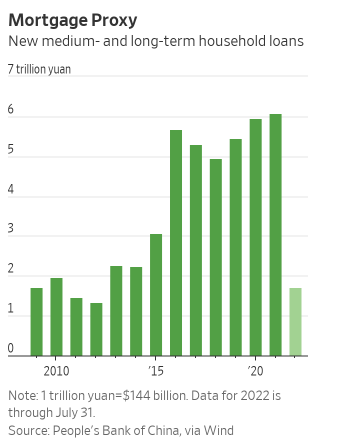

China is increasingly counting on its banks to step up mortgage lending and help boost a sinking housing market. But there is a problem: Lenders are stuck with many mortgages from boom times that are at higher risk of not being repaid. Chinese property developers wrote at least $300 billion of mortgage guarantees over the past few years for partially built apartments that they presold, according to regulatory filings. The real-estate firms promised that they would cover home buyers’ interest and principal payments to banks if the borrowers defaulted before their apartments were completed and delivered.

Other R/E Headlines