Opening Comments

My last note was about my awful dinner at the new “hotspot” in Delray called Gabriella’s. The most opened links were the communication mistake at work that can damage your reputation and overlooked signs of skin cancer.

Tomorrow, my son Jack and I leave for NYC. He has some amazing internships to learn more about real estate investing and sales and trading. I have some meetings and will be eating plenty of food for reviews. There are so many new restaurants that I cannot wait to try. Great sushi, here I come! We will also be in the Hamptons, near Cape Cod, and in Pennsylvania for golf.

On Wednesday morning, I will be on Bloomberg Surveillance with Tom Keene.

Markets

Millionaires & Billionaires by Country

The New Cost of Golf Clubs is Inanity

Additional NYC Rent Regulations?

South Florida Slowing

Hamptons Rental Market Slowing

Happiest Cities in the World are not in USA

Video of the Day-Elite Padel Points

I have been pushing the greatness of the fastest growing sport in the world for a reason. Padel is catching fire globally, and videos such as these two I am attaching are why. Check out these points from the pros. I am playing four times a week and LOVE this game. Sadly, these players are at a “slightly” different level than I am today. I will be playing all over the Northeast this summer. Check out this short video. These guys are good. Padel requires far more athleticism than pickleball, as can be seen in this quick video.

Caitlin Clark Effect

Caitlin Clark has taken the once-struggling WNBA by storm and had an outsized impact on the league relative to any other player in WNBA history. There are plenty of Clark haters, and I am not sure that is fair. Clark has set numerous records and plays at a high level. Her rookie records:

Let’s go back in time to when Tiger Woods joined the PGA Tour in 1996. The year before his arrival on tour, the total payout for the 1995 season was $61mm. This included the two highest purses of $3mm (The Players Championship and the Tour Championship). By 2010, the total annual purses jumped to $273mm, and the Players Championship purse was $9.5mm. Fast forward to 2025, and the total purses will be in excess of $640mm including the FedEx Cup payout of $100mm+. Eight tournaments have purses of $20mm or more in 2025. Last year alone, Scottie Scheffler won $62.5mm. In 1995, Greg Norman was the highest PGA tour earner with $1.7mm in earnings. For perspective, Jack Nicklaus, who won 18 majors, has career earnings of $5.7mm, or $31mm when adjusted for inflation.

Any PGA Tour player who does not thank Tiger for being the biggest part of the growth of golf is a moron. I feel the same way about Clark. She sells out stadiums, ticket prices have skyrocketed, ratings for her games are off the charts, her jersey sales are in the stratosphere, and her team valuation has grown 4-fold in a year.

Everywhere Clark plays the stadiums are full. Some teams have started playing in larger stadiums to accommodate fans. The Fever has moved games to larger areas as well due to Clark’s popularity. WNBA attendance jumped 48% in 2024. The game with the largest attendance was Indiana Fever vs Washington Mystics with 20,711 in attendance. For perspective, Madison Square Garden’s max capacity for a basketball game is 19,812.

The Fever average ticket prices in 2023 was $60 and by 2024 they jumped to $174 thanks to Clark’s participation. They jumped to $197 in 2025 for home games and are now at a whopping $282 for away games for her team. The Fever’s preseason game against Brazil in Iowa City set a WNBA record, with average resale tickets reaching $440.

Unfortunately, Clark is injured and is taking two weeks off. Before her injury, average ticket prices for the upcoming Fever game vs the Chicago Sky (Angel Reece) averaged $86. Within 48 hours of the announcement of Clark’s injury, prices fell 71%. Reese is a nice player, but to suggest that she is moving the needle anywhere close to Clark is insulting. Reese has been lashing out, suggesting she receive more credit for impacting the WNBA, but her empty arenas suggest her impact is not as big as she believes.

When you look at the top-rated WNBA games, Clark’s team was part of ALL of the top 16 games and in 17 out of the top 20. There is no coincidence there. Also, given she is injured, ratings are falling without her playing.

Clark’s jersey sales are the best in the WNBA and trail only Steph Curry for all of basketball. In 2024, Clark’s jersey outsold LeBron, Luka, Ant Edwards, and Jason Tatum. When she was drafted, her jersey sold out in less than one hour, making Clark the top seller of any draft night in Fanatics history. In 2025, Clark leads the WNBA again with Paige Bueckers in 2nd, Kate Martin in 3rd, and Angel Reese in 4th.

Clark’s team was valued at $90mm last year and $340mm this year. I think it is safe to say that growth is due almost solely to Clark. She is responsible for 26.5% of all WNBA economic activity last season. Remember, there are 144 players in the WNBA. The WNBA is a money-losing business ($40mm loss), but prospects improved largely due to Clark. She only makes $78k/year in salary, but many millions more in endorsements. Thanks to the Clark effect, the WNBA started using charter flights rather than commercial. I feel Clark is massively underpaid despite the financial challenges of the WNBA. She should consider going abroad to monetize her fame on the court over and above her lucrative endorsements (Nike, Gatorade, State Farm, Wilson, Hy-Vee, Xfinity, Gainbridge, Lilly and Panini).

No, I am not suggesting Clark will be as dominant as Tiger Woods, although time will tell. I am suggesting both athletes had massively outsized impacts on their leagues and should be appreciated for their contributions. I want Clark to be treated with the respect she deserves, and do not want to see players taking cheap shots at her. She is the future of the WNBA. This does not mean other players are not special. The stats speak for themselves on Clark’s outsized contribution.

Quick Bites

Markets rallied sharply on Thursday on the heels of better-than-anticipated Nvidia earnings and the court decision blocking reciprocal tariffs. On the week, the S&P was +1.9% and the Nasdaq was +2.0%. For the month, the S&P was +6.2% and the Nasdaq was +9.6%. Inflation came out lower than expected with the PCE at 2.1% on an annual basis. The 10-year Treasury rallied 10bps on the week and is down to 4.40%, partially due to lower-than-expected inflation data.

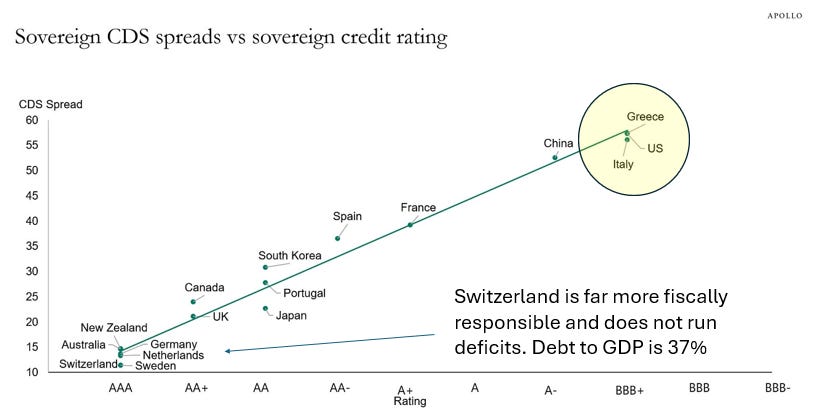

I keep hitting on the topic of fiscal responsibility and deficits. The latest Daily Spark from Apollo shows US sovereign CDS spreads at BBB levels. The higher the CDS spread, the more likely the probability of default. Right now, the US is trading near Italian and Greek levels as seen in the chart below, yet the morons in D.C. refuse to make tough choices and reduce the deficits. We have a spending problem and cannot control it. Dimon is at again and discussing the spiraling national debt. I have discussed this for five years. He is concerned a crack in the Treasury market will happen. A potential debt-market crisis isn’t the only scenario that has Dimon worried. He also believes that if America’s economic and military might erodes, the dollar’s pre-eminent status is at risk. I have been writing about this for years for good reason.

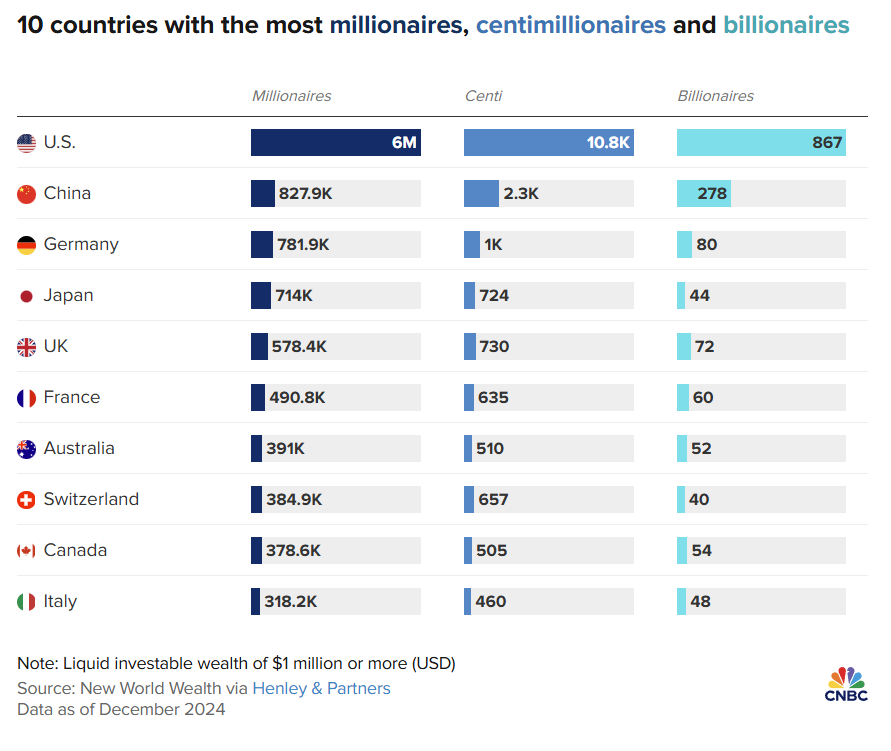

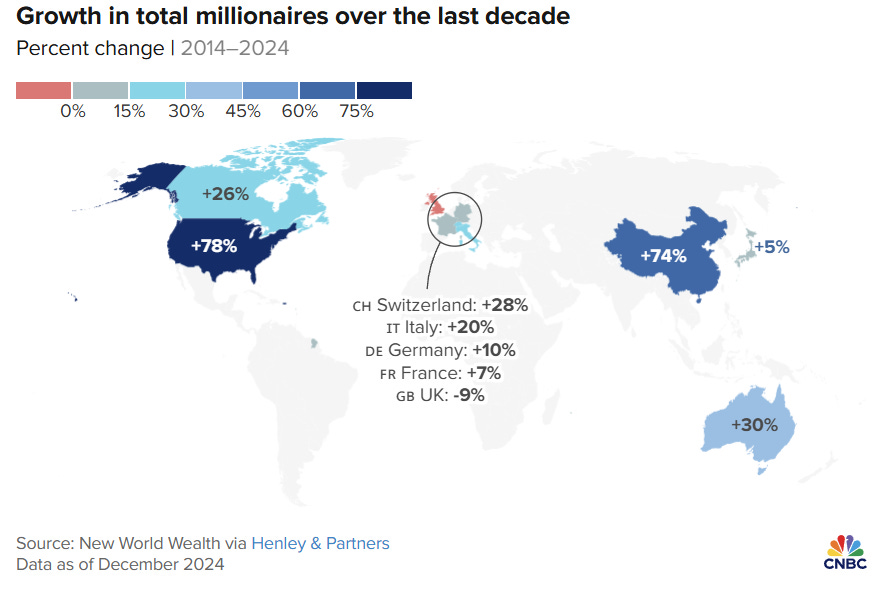

Interesting CNBC article outlining millionaires by country. The U.S. has more than 6 million liquid millionaires, or those with investable assets of more than $1 million, up 78% over the past decade, according to a report from Henley & Partners and New World Wealth. US millionaires account for 37% of the global millionaire total despite the US population accounting for 4% of the global population. The number of U.S. centimillionaires, or those with $100 million or more in investable assets, reached 10,835 in 2024 — more than four times the number for second-ranked China. There are now 867 American billionaires, representing a third of all global billionaires. America is still the land of opportunity and the place to be to create wealth, despite all the idiocy.

I have written about the absurdity of golf and how prices and access to fancy private clubs have gotten out of control. This article, “The New Pay to Play,” outlines a bunch of examples. The model has changed in some instances. Golf courses were non-for-profit, but today, many are owned by individuals for profit. Private golf clubs have always been symbols of wealth and exclusivity, but today there are more new ones than ever before, and they’re only getting more difficult to join. In Florida, when I moved down nearly eight years ago, virtually every club was looking for members. The most expensive club in Florida (La Gorce) was $175k, and today the same club is $1mm with a long waitlist. The most expensive club in Florida today is Shell Bay in Hallandale, which is now $1.4mm to join and is full. Clubs that were struggling pre-pandemic and charging less than $25k to join are charging as much as $350k+ today for initiation. North of Palm Beach, a bunch of new courses are under construction. Now, Apogee is a whopping $850k to join and am told it is going to $1mm once the third course is open. In the Hamptons, prices of some of the best courses are out of control. Sebonack is at least $1.4mm to join and the Bridge is approaching $2mm if it is not there already. All clubs are different in terms of structure, but given demand now you get less of your initial investment back than pre-COVID. Demand is sky high, and there are waitlists for virtually every club in a desirable location and facility. The prices are outlined are for initiation fees. Annual dues tend to range from $25k to $50k or more, depending on the services offered. The caliber of people at these high-end clubs is very different than the old school country clubs. Countless CEOs and leaders of industry are members at these places. There are a growing number of clubs in hard-to-reach places as well that are also fully priced.

Tariffs

Federal trade court strikes down Trump's reciprocal tariffs

A three-judge panel on the Court of International Trade said President exceeded "any authority granted" by the International Emergency Economic Powers Act.

Trade whiplash: Appeals Court allows Trump to keep tariffs while appeal plays out

Trump accuses China of violating preliminary trade deal

China is not to be trusted. EVER.

EU ‘prepared to impose countermeasures’ after Trump doubles steel tariffs to 50%

Politics

Elon Musk thanks Trump, says he’s leaving government work with DOGE

Musk promised of $2 trillion of savings, and if you recall, I took the other side of that and hoped for $500bn/year as a big win. I just don’t see this happening. DOGE itself claims to have saved a measly $175bn, and that is not an annual number, as many of the contract cancellations were multiyear. Any savings is appreciated given $2 trillion deficits, but I am disappointed with DOGE after all the promises.

VA-based DOGE associate gets ‘the boot’ after publicly discussing his work

Trump Admin Moves To Revoke U.S. Student Visas For Chinese Nationals

Hiltzik: Explaining the newest Wall Street craze — the 'TACO' trade

TACO- “Trump Always Chickens Out.” I have been extremely critical of Trump’s ill-advised tariff policy and constant flip-flopping. TACO is appropriate.

Secret Service whistleblower said Biden would ‘get lost in his closet’ at the White House

Are you kidding me? This is a Secret Service agent. The number of people in the Biden Administration and media that covered up the decline of the most powerful person in the world is scary. We were lied to and despite my never- ending examples, we were told it is fake news. Most of Biden’s executive orders were signed by autopen, which raises the question of who was making the decision due to the President’s reduced cognitive ability.

Trump Shuts Down Paramount’s $15 Million Offer to Settle ‘60 Minutes’ Lawsuit

White House acknowledges problems in RFK Jr.'s ‘Make America Healthy Again’ report

Crazy claims of referencing studies which do not exist.

Trump doesn’t rule out pardon for Diddy if convicted of sex trafficking

I have listened to enough of the court testimony to know that Diddy is a disgusting human being. I cannot tell you if he goes to jail for it, but if he does, he should not be pardoned.

Lefty NYC Councilwoman Gale Brewer demanding free dental care for illegal migrants

Why should Americans continue to pay for illegal immigrants? The US is $37 trillion in debt and running $2 trillion deficits, which are 5-7% of GDP during good economic times. Our infrastructure is crumbling. We have massive air traffic issues, healthcare, education, roads, tunnels, bridges, Veterans care, and natural disasters to deal with.

Middle East

Iran Builds Up Near Weapons-Grade Uranium Stockpile Despite Nuclear Talks

This story suggests Iran has uranium for 10 nukes. Our policy with Iran has been a joke. Iranian leadership hates Jews, Israel, and the West. What could possibly go wrong with lunatics having nukes?

Israel accepts new US proposal for ceasefire with Hamas, says Israeli official

‘It haunts me daily:’ Freed Israeli hostages fear for those still held captive by Hamas

Israeli laser defense system already operational, IDF reveals

Four tools at the Trump administration’s disposal after a U.S. court blocks tariffs

Israel approves biggest expansion of West Bank settlements in decades

Israel Fears Being Boxed In by Trump’s Iran Talks

Israel is caught in a bind with its most important ally on its most pressing national security question

MIT Students Mass-Exit As Graduation Speaker Goes On Gaza ‘Genocide’ Rant

Imagine Dragons frontman kisses Palestinian flag at Milan concert

Other Headlines

3 key takeaways from Nvidia’s earnings: China blow, cloud strength and AI future

AI could spark bloodbath for white collar jobs — and send unemployment to 20%: Anthropic CEO

Crazy thoughts from someone far more knowledgeable on AI than I am.

SEC drops Binance lawsuit, ending one of last remaining crypto enforcement actions

Best Buy cuts full-year sales and profit guidance as tariffs raise cost of electronics

Dell shares climb after company raises full-year profit outlook on AI demand

Gap shares plummet as retailer says tariffs could cost between $100 and $150mm

E.l.f. Beauty to acquire Hailey Bieber skincare brand Rhode in deal valued up to $1 billion

$800mm upfront and $200mm earnout. Could not confirm Bieber’s share.

JPMorgan Chase is heading upmarket to woo America’s millionaires

I don’t understand the lack of consequences in many cities today.

NYC subway assaults up 19% — with many of the attacks coming against police officers, stats show

Get ready for several years of killer heat, top weather forecasters warn

I work with rich CEOs — multi-millionaires all share these same 6 habits

How this ‘gifted’ boy became youngest-ever Mensa member — at age 2: ‘It’s a very unusual accolade’

Love this story.

Non-alcoholic beer projected to overtake ale as the second-largest beer category worldwide this year

Scientists 'strike gold' in shocking discovery from Hawaiian volcanic rocks

France to ban smoking outdoors in most places

I love this. I am an adamant non-smoker and LOVE Mayor Bloomberg for ending smoking in NYC restaurants.

Health

First new antibiotic in 50 years to tackle superbug

Zosurabalpin works differently to all existing drugs and may lay foundation for development of new treatments.

Sexual activity before bed improves objective sleep quality, study finds

Trending ‘Zone 2’ workout burns fat without intense exercise

61.7% of insomniacs have this personality trait — and what that means for treatment

Vaping's sickening side effects as study shows it's 'even worse than smoking'

I cannot stand seeing kids vape. My kids know better. I have never smoked a cigarette in my life.

Real Estate

I have been critical of the NY rent laws from 2019, as they have done far more damage than good. Significantly, limiting rent increases despite significant improvements to buildings and units takes away any incentive for owners to fix or improve real estate holdings. Now, there is talk of multi-year rent freezes for nearly one million rent-regulated units in NYC. I get the affordability issues, but what about the landlords dealing with higher interest rates, skyrocketing insurance costs, higher labor costs, and the costs of additional regulation? More owners are unable to make mortgage payments and are walking away from properties due to the absurdity. Rent increases that do not keep up with inflation are a recipe for disaster. The last mayoral election in NYC saw a 23.3% turnout. If you don’t go out and vote for the right NYC leaders, don’t complain when De Blasio types rule for a dozen years.

I have been showing more high-end homes in South Florida recently, and things are slowing down. Part of this is the seasonal aspect, as more people are gone for the summer. However, I am seeing more homes sit on the market longer. An increasing number of homes are also having price declines, even for the once highly sought-after homes over $20mm. No, I am not seeing fire sales, but yes, I am seeing more aggressive sellers. The chart below outlines growing inventory in Florida. Obviously, the vast majority is not high-end.

Hamptons rentals are down 30% from the same period in previous years, according to Judi Desiderio of William Raveis Real Estate. Brokers who focus on ultra-high-end rentals say their rental business is down between 50% and 75%.

“People are holding on to their money,” said Enzo Morabito, head of the Hamptons-based Enzo Morabito Team at Douglas Elliman. “They don’t like uncertainty.” Of course, Hamptons renters often wait until the last minute to book July and August rentals. Brokers say this year may be starting even later due to cold, rainy weather in May. Some renters may also be holding out for better deals in a Hamptons market that has become far more expensive after Covid. On the plus side, the rise in unrented inventory means potential bargains and choice for renters. Brokers say some listings have started lowering their prices by 10% to 20% in hopes of saving the summer. Some homeowners are adding more flexibility, allowing for shorter one- or two weeks stays in hopes of getting renters.

This is the happiest city in the world, new data shows—it’s not in the U.S.

© 2025 The Rosen Report LLC. All rights reserved. Does not constitute investment, financial, legal, or tax advice. Consult with your lawyers and professional financial advisers. Rosen Report™ #789 ©Copyright 2025 Written By Eric Rosen.

100%. Shoot. Should have mentioned Olympic snub.

Agree with your all your points on Caitlin Clark’s impact on the league, and basketball, economics. It was a huge mistake not to put her on the last Olympic team. A missed opportunity by the WNBA globally.

She plays a very entertaining game with a mix of long range shooting and great court vision and passing. Obviously a big part of her appeal is she is white in a sport dominated by athletes of color.

The comparison to Tiger works economically but not in athletically. Caitlin is an all-star level player but not above her peers. Tiger Woods dominated professional golf from the start and for the better part of two decades.