Opening Comments

My last piece entitled “The Economics of Absurdity-Everyone Has a Price” generated a lot of feedback. The most opened link was the 2-minute video to the movie Wall Street where Gordon Gekko negotiates with Sir Larry Wildman over Anaocott Steel. The LIV plot thickens with this NY Post story suggesting a LIV ececutive called Rory a derogatory name. Not a lot of details on the deal, but it is clear to me that this is the Saudi show, and they are overtaking the PGA Tour. PGA Tour Commissioner, Monahan, admitted that they could not compete with the unlimited funds from the Saudis.

Flights to NY on Thursday were an unmitigated disaster and we did not get to NYC until 2am. However, I did not find the smoke bad at all in NYC or Pennsylvania on Friday. However, it is forecast to get bad again.

I had included a short note about a college student in need of a summer internship after his fell apart last minute and there were a handful of responses which were greatly appreciated. He is speaking with the potential opportunities directly. THANK YOU. The power of the Rosen Report!

Hedge Fund Job Opening

Another close friend is doing very well at a multi-manager platform and is looking for an analyst with tech and consumer experience for long/short equity. My friend is very bright and has been allocated significant capital. It would be a great opportunity for someone and the manager is a world-class guy.

Markets

Jeffries CEO’s Guide to Summer Internships-Share with the Kids

Trump Indictment

Wealth Migration to Florida

High-End Boca Home Sells for $22.6mm-Insurance Update

Jeff Greene on R/E Market

San Fran Hotel Pain

Alternative Lenders in Apartment Market

Office Turmoil in Virginia

The Most Convincing UFO Footage You'll Ever See...Experts are Stunned!

Readers know I am fascinated with UFOs and believe we are not alone. I have been begging to be abducted so I can write about it in the Rosen Report. Watch these two links which discuss a recent siting from a plane. The videos are short and pretty impressive. They are the clearest videos I have ever seen on this subject. It appears the UFO banks to avoid the plane. It happened on April 4, 2023. This was an interesting citing too: Las Vegas police spot suspected UFO — and residents claim to see 8-10 foot aliens. In yet another crazy story, of a UFO recovered by the US Military, the experience left one investigator who entered the ship “nauseous and disoriented” and there was all kinds of “distortion” of space and time. There is an account of the amazing things he saw when he went into the spaceship. I am not sure what is driving this flood of new sightings I am indeed intrigued. Aliens, I am in the tri-state area right now if you want to abduct me. I come in peace.

Candy Kisses

When I grew up in Florida, my mother worked in a real estate office as a bookkeeper. There was an elderly woman who sold real estate in the office. She claimed to be a “famous” Ziegfeld dancer and actress from the 1920s.

The woman, we will call “Susan” wore crazy outfits from days gone by. She had eyeglasses covered in rhinestones and wore boas around her neck with her “showgirl” dresses. She was very showy and spoke in a strange manner, often overly annunciating words for effect.

My mother also helped Susan with her personal finances and balanced her personal books. The woman lived on the beach in a townhouse, and I would go surfing behind her place once in a while. Also, she would inevitably want something moved around in her house and I was the guy who was responsible to do it.

Susan had this little yappy dog called, “Candy Kisses.” I believe it was a Yorkshire Terrier. It was one of those super annoying, spoiled, excessive barkers no one but their owner can stand. Watching Susan and Candy Kisses together could have been an SNL comedy skit. Susan would get her drink on, mind you she was pushing 90 years old. She had these huge glasses which magnified her incredibly deep wrinkles. She would sip gin and kiss the dog as it yapped away. It was very hard for me not to laugh at the spectacle. I recall the dog licking Susan’s face for an uncomfortably long period of time while Susan professed her love to Candy Kisses. The dog looked like the picture below.

One day, Susan called my mom screaming that she had lost her emerald ring which was quite large. My mom and I went over, finding Susan quite intoxicated and tore apart the house only to find it in the cushion of her couch. I think she gave me $5 for moving the furniture in search of it. The pictures in the house showed her at lavish parties with important people and she indeed looked like an elegant actress decades prior to this time period.

As Susan aged, she was very concerned about Candy Kisses and who would take care of her when she was gone. She told my mother that after she passed, whoever took care of Candy Kisses would get $50k. Let me be crystal clear. In 1987, $50k to me was the equivalent of $5mm today. When my brother-in-law and I found out about such a reward, we were arguing about who would take care of Candy Kisses. When we would go over to help Susan, we would act like we loved the mutt in hopes of getting $50k. It was so funny at the time.

We were on our hands and knees calling Candy Kisses. “Come here, Candy Kisses. You are beautiful. I would love to have a dog like you….Who is the prettiest dog in the world? Candy Kisses….” We wanted to be sure Susan heard that our love for the dog was real. The dog would yap at a high pitch and it was beyond irritating, but we acted as though she was a show dog. I let this thing lick my face in hopes Susan would see the shared love between me and Candy Kisses.

We got a kick out of the whole thing. I have no idea what happened to Candy Kisses, but clearly, neither of us was given the dog in the will much to our chagrin.

Susan died in her late 90s. She had lots of extravagant stories about times gone by. I have no idea what was fact relative to a creative recollection, but she claimed to be a pretty big deal in the 1920s-1950s. I just wished I would have been given that “beautiful” dog, Candy Kisses…along with the $50k that came with her. Just think if I had received the money and put it all into Apple stock in 1987 at $.3/share at the time.

Quick Bites

The S&P 500 rose slightly Friday, touching the 4,300 level for the first time since August 2022 as investors looked ahead to upcoming inflation data and the Federal Reserve’s latest policy announcement. For the week, the S&P 500 was up 0.39%. This was the broad-market index’s fourth straight winning week — a feat it last accomplished in August. The Nasdaq was up about 0.14%, posting its seventh straight winning week — its first streak of that length since November 2019. The Dow advanced 0.34%. YTD, the Dow is +5.0%, S&P+7.0%, Nasdaq+12.8% and the Russel 2000 is +.8%. The market is also looking toward next week’s consumer price index numbers and the Federal Open Market Committee meeting. Markets are currently anticipating a more than 71% probability the central bank will pause on rate hikes at the June meeting. Treasury yields continue to climb with the 2-Year at 4.6% (+10bps on the week). Oil fell Friday to $70.4 as demand concerns outweighed the Saudi cut, but MTD, oil is +2.3% but -12% YTD.

This is a fantastic Fortune article that is advice for summer interns from Richard Handler, CEO of Jeffries. “This is not college. You are an adult and we will treat you like one.” I have so many incredible intern stories (good and bad). I would 100% want my college-aged kids to read this article and learn from it. Internships are critical for development and will help college kids better understand a potential career path. You can learn a lot and have a great experience and time despite working hard. Handler gives really good advice. Be professional, respectful, responsive and act as though you want to get a job. I recall one intern came in incredibly cocky. The Stanford graduate challenged me to a pull-up contest and told me he would crush me. I was 34 and he was 21. It ended in tears for him in front of everyone. If you play that strong, you better dominate, and he fell miles short. Be confident and let your work product show your skills. Be friendly too. If you don’t have Fortune, Handler’s Twitter outlines his guide and can be found here. posted on June 4th.

Donald Trump was hit with a sweeping 37-count indictment from the special counsel's office Thursday, alleging that he willfully retained documents containing the nation's most sensitive secret (violation of the Espionage Act). The indictment also alleges that Trump caused false statements to be made, concealed documents from investigators, obstructed justice and allegedly conspired to do these things. Trump posted this in Truth Social in response: “I AM AN INNOCENT MAN! This is indeed a DARK DAY for the United States of America,” he wrote. “I have been summoned to appear at the Federal Courthouse in Miami on Tuesday, at 3 PM,” Trump wrote. “We are a Country in serious and rapid Decline, but together we will Make America Great Again!” The Bloomberg story is troubling as well suggesting he showed confidential information and admitted he did not classify documents. Even Fox News legal commentator, Jonathan Turley, called the indictment “Extremely Damning,” and “Overwhelming.” On the surface, the indictment seems far more legitimate than the one in NY over hush money paid to Stormy Daniels. However, we have to consider the fact that Hillary deleted 33k emails and nothing happened. Biden had confidential documents for decades hidden in plain sight in a garage of a house occupied by his crack addict son. Do Trump’s confidential transgressions seem worse to me, they do. However, I believe Clinton and Biden were careless and then some and should face consequences as well. They don’t have a key Trump protection. The difference in favor of Trump is he had the Presidential Records Act (PRA) that allows a President access to documents, both classified and unclassified, once he leaves office. This will not save Trump on all counts, but could help him in most of them. This WSJ Opinion piece makes it clear they are not fans of Trump, but question the ramifications and legitimacy of the indictment due to the PRA. Alan Dershowitz came out and suggested the indictment does not meet the “Richard Nixon Standard.” Also, Musk came out and suggested Trump is being targeted, “Far higher interest in pursuing Trump than others.” Two more of Trump’s lawyers resigned Friday. Special Counsel, Jack Smith, says he will seek “speedy” trial for Trump. Up to 100 years in prison for Trump if found guilty of all charges. I am begging for other candidates in 2024 not named Biden or Trump. To be clear, I have zero problem if Trump is found guilty on some of these counts but want to see a more even-handed treatment for Clinton and Biden. Yes, Trump is his own worst enemy. Of course, he vowed to stay in the race even if he is convicted. The judge randomly assigned to the case is a Trump appointee unless she recuses herself.

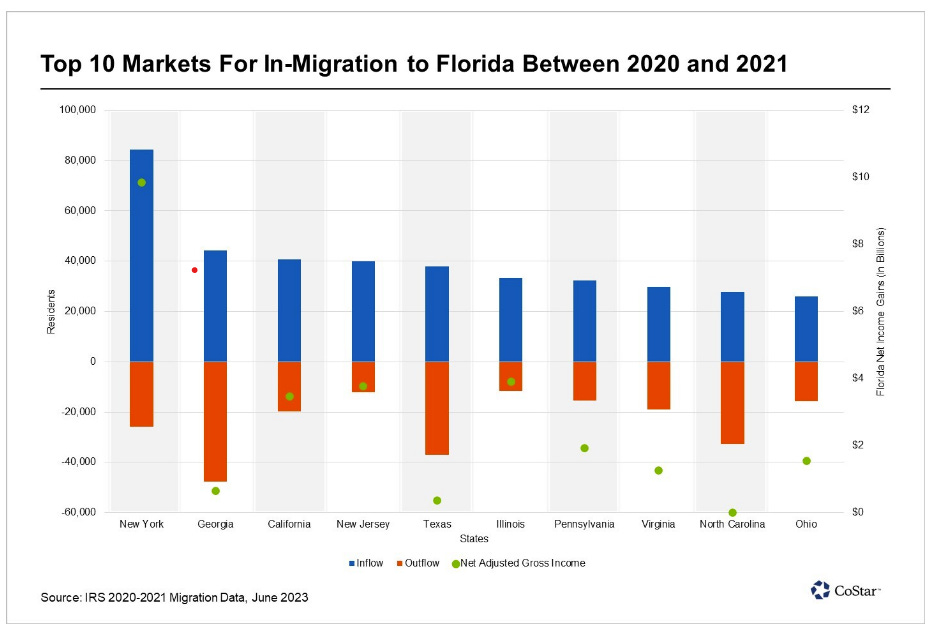

I have been critical of policies in NY, Chicago, LA, SF, Portland, Seattle…I loved living in Chicago and NYC during my time and was very fortunate to have a fantastic career. However, at the end of my NYC stay, I felt the city was no longer the city I loved, and in the past 6 years, things have only deteriorated further. I have written extensively about the budget implications and ramifications of wealth and corporations running from these cities. CoStar has an article, “Sunshine State Gained Nearly $40 Billion in Adjusted Gross Income from Pandemic-Related Moves,” which explains the moves. Nearly 85,000 New Yorkers Moved to Florida Between 2020 to 2021, Bringing $11 Billion in Income. I can tell you that the wealth migration is real and the uber wealthy are flocking to South Florida. The number of high-end cars, high-end homes, high-end restaurants down here today relative to 6 years ago when I moved down is incredible. What you need to consider if you are staying in the cities which are seeing an exodus is how will they balance budgets given the wealthy pay such a disproportionate about of taxes and generate the lion’s share of sales tax and spending. With the numerous crises in major cities (illegal immigrants, homeless, crime, filth, pollution, budget deficits…) and a shrinking tax base on both income and commercial R/E, real budget holes will be left. The latest projections have NY State budget deficits at $36bn for the next three fiscal years by the State Division of Budget. The projected deficit seems to climb with each new run of the numbers. This Bloomberg article is entitled, “Leaving New York for Miami Can Save Nearly $200k a Year,” and outlines that people who make $650k can save $200k due to lower taxes and cost of living. Moving to Miami from San Fran saves $150k.

Other Headlines

Euro zone enters recession after Germany, Ireland growth revision

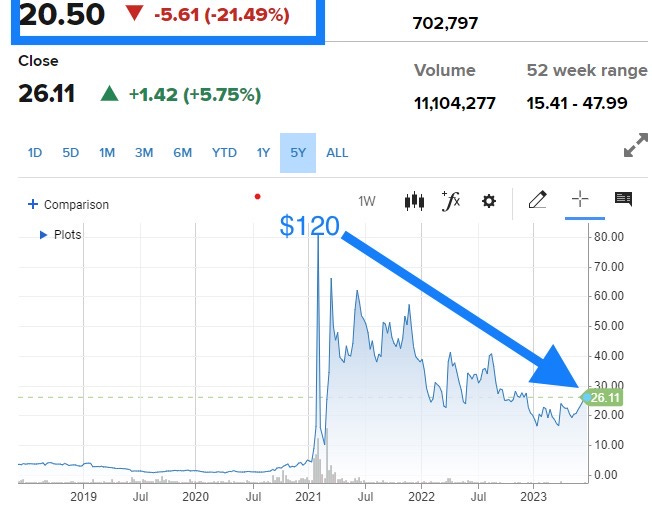

GameStop shares fall more than 20% after big executive shakeup

I was very critical of the Reddit craze and actually taught some college classes on the topic. Yes, markets can remain irrational for some time, but the once high-flying $120 stock is now down to $20/share as of Thursday. Of note, GME rallied 5.8% Friday.

What Tesla charging partnerships with Ford and GM mean for the EV industry

Tesla 'Autopilot' crashes nearly triple, despite Elon Musk's claims - The Washington Post

JPMorgan bond chief Bob Michele sees worrying echoes of 2008 in market calm

In previous rate-hiking cycles going back to 1980, recessions start an average of 13 months after the Fed’s final rate increase, he said. Pain is likely to be greatest in three areas of the economy: Regional banks, commercial real estate and junk-rated corporate borrowers.

Tiger Global Among Hedge Funds Riding AI Mania to May Gains

The Bloomberg article suggests some funds are riding AI mania to drive returns in 2023. The issue is funds with big drawdowns need to get back to their high-water mark. For example, Tiger Global was -56% in 2022. They need to be up 127% after the 2022 performance to get back to flat from the end of 2021. If you invested $1 on 1-1-22, you would have $.44 at 12-31-22. Now that Tiger is +15.5% in 2023, your original $1 is now $.51.

Google to crack down on office attendance, asks remote workers to reconsider

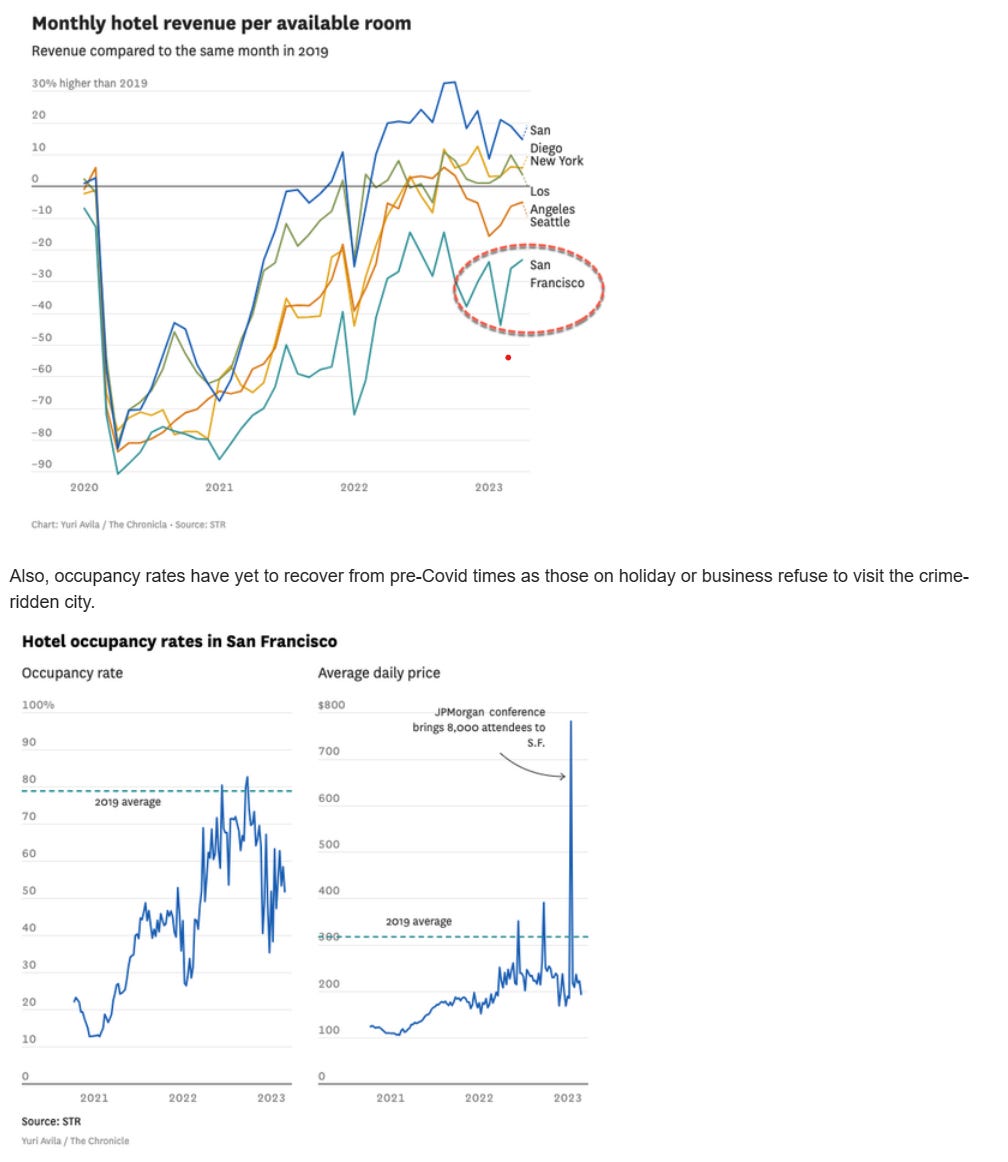

If a lot more tech companies do this, it will be good for San Fran R/E.

I have been adamant on Trading Restrictions for members of Congress and this Tweet set me off. Options on Nvidia, Meta, MongoDB, Shopify & AMD which are up between 49%-89% since his purchases. He should go work at a hedge fund. The rules pertain to us but not them (politicians). Clearly insider trading. $43mm of stock and options in a year? Here I thought he was working hard for his constituents. Looks like he is working hard to line his own pockets.

S.F. sheriff to deploy emergency unit as Mayor Breed cracks down on drug dealers and users

Brilliant idea.

MS-13: From El Salvador to Your Neighborhood

About 30% of MS-13 gang members arrested in recent years by ICE entered the U.S. as unaccompanied minors. Federal authorities have removed just 409 of 345,000 unaccompanied minors in the last three years, a minuscule one-twelfth of 1%.

California Advances Bill To Help Shoplifters Steal

The bill which passed 29-8 would make it illegal for store employees to confront thieves. Why own a store in California?

California Bill Would Charge Any Parent Who Doesn’t Affirm Transgenderism With ‘Child Abuse’

Not clear this passes, but read the proposal.

Roughly Three-Fourths of Princeton Students Believe Shouting Down Speakers is Acceptable

I’m a neuroscientist — avoid these 3 habits to ‘keep your brain young’

Not looking at my phone for 30 minutes in the morning and before you go to bed? Impossible.

‘Humiliated’ NY lawyer who used ChatGPT for ‘bogus’ court doc profusely apologizes

The idiot should be disbarred.

Colombia plane crash: Missing children found after more than a month in Amazon

Kids were 13, 9, 4 and an infant. What are the chances they could survive alone in the Amazon for 40 days after being involved in a plane crash? The story is almost unbelievable.

When the government fast-tracks vaccines and cuts corners mistakes are made.

Real Estate

The house at 298 Key Palm finally sold for $22.6mm after initially being listed at $35m. They were offered $29mm a year ago and passed. The house is stunning with 11.4k under air. Boca high end is definitely well off the December 2021 highs. It was likely sold furnished as well. When I moved in 2017, 71 homes for sale in Royal Palm. Got down to 4 in December 2021 and up to 33 today. 21 of the 32 homes listed are asking $15mm+. In 2017, one house sold for over $10mm. I still believe there are too many unrealistic asking prices. However, I am told the houses between $5-10mm are moving easier than the most expensive listings. One friend sold his house in 5 days in the $8mm range for a 20-year-old home. Remember, if moving to Florida, be sure to get your kids into school before buying a home. Also, home insurance is very challenging and expensive, especially on the water. Good WSJ article on insurers pulling back in risky areas nationally (FL and CA) listed. With more insurance companies pulling out of markets, prices are rising and getting coverage is increasingly challenging. I have a good insurance broker for those readers who need one.

I had lunch with Jeff Greene a few years ago and came away incredibly impressed. He shorted the R/E market in the GFC and made a killing and then bought up a bunch of R/E for pennies on the dollar, especially in Palm Beach. He is a legend. A real-estate billionaire who made a fortune shorting the mid-2000s housing bubble is bracing for another painful downturn. "We are heading into a very frightening time in the entire real-estate industry," Jeff Greene warned. He said many businesses and consumers would fall behind on their rent and mortgage payments because of higher interest rates and struggle to secure financing as banks pull back from lending. Greene said that the pain in commercial real estate was only just beginning. The real-estate tycoon added that historic amounts of fiscal and monetary stimulus during the pandemic were still shoring up demand and employment in the US economy, staving off a surge in late payments and foreclosures. However, he said that companies would pare their workforces and office spaces as the economic picture darkened and higher borrowing costs squeezed them.

Good article on private lenders picking up steam in the apartment market as traditional lending sources dry up. I am currently working on a few projects and working with lenders. The non-traditional lenders are creative, responsive and interested, albeit at a higher price and worse terms than a year ago. I wrote about alternative lenders in my last report in Quick Bites. This year, $27.9 billion in apartment debt is set to mature, according to debt rating firm Morningstar, including loans through government agencies Freddie Mac and Fannie Mae, private lenders and multifamily commercial mortgage-backed securities. With less to lend, borrowers are having to rely on, or put up much more of, their own capital to complete a refinancing. The combination means investors have less capital for acquisitions, renovations and possibly a smaller return to their investors.

An article about more pain in San Fran as hotels face a debt maturity wall. It suggests at least 30 hotels are facing loans due in the next two years and based on the chart, San Fran is decently under performing in the hotel market. Clearly, work from home, crime, filth, homelessness, pandemic mandates, quality of life deterioration, and a reduction in business travel have all played a role.

Monday Properties is at risk of losing seven high-rise office buildings in Rosslyn, Virginia, just across the river from D.C., after it missed a payment on a piece of an $841M loan, which matures in less than two weeks. The owner went into monetary default on a $150M mezzanine loan backing the 2.1M SF portfolio after it failed to make its May payment, according to information shared with Bisnow by Morningstar Credit. Monday Properties' $691M senior loan is expected to go to special servicing as it hasn't been able to refinance it ahead of the June 9 maturity date. Lenders will be faced with tough choices on many office portfolios, as taking them back from owners and managing them is costly.

Big difference between Trump and Biden. Trump kept dodging the FBI and the Dept of Justice for over 1 year and a half. They gave him multiple opportunities to return the documents. He pushed his lawyers to lie for him. He showed secret documents to friends. When Biden and Pence realized they were keeping secret documents they reported it immediately to the authorities. No charges were filed against Pence which means none will be filed against Biden.