Opening Comments

I never thought I would say this, but on a relative basis, South Florida temperatures are cool compared with Louisiana, Kentucky, Tennessee, Mississippi and Alabama. It is good to be home and sleep in your own bed and even better to drink wine that is not sold by the gallon at Wal-Mart. I made a Waygu burger, sauteed onions and grilled fennel for myself when I got home. Sure beats Cracker Barrel and Chili’s.

I was shocked at the number of readers I have from Nashville or who love it there. Coincidentally, I saw this Bloomberg article entitled, “Booming Nashville Is Being Transformed by Luxury Tourism,” and based on the feedback, I thought I would include it.

I have been in Florida for a few days and have caught up with friends which has been fun. I golfed at Adios and played 9 holes in 36 minutes despite hitting a couple balls on two tees. I did not feel like I was running, but probably could have done it in 30 minutes. The nice thing about South Florida is it quiets down in the summer.

Picture of the Day

New Michael Cembalest Research Piece

Common Decency

Quick Bites

Markets

SPACS

Financial Job Cuts

Pension Investing Mistakes

Retail Return Policy

NYC Budget Impact by Exodous

Other Headlines

Virus/Vaccine

Data

Real Estate

Picture of the Day

Two different friends went to the Bahamas this week. The first picture is the head of a Yellowfin Tuna which was chomped by a big shark. The Tuna is 80lbs and destroyed. This happens a shocking amount when fishing. They lost a dozen Tuna to sharks in a day. The 2nd picture is of a large Nassau Grouper which was caught while free diving with a Hawaiian Sling.

New Michael Cembalest Research Piece

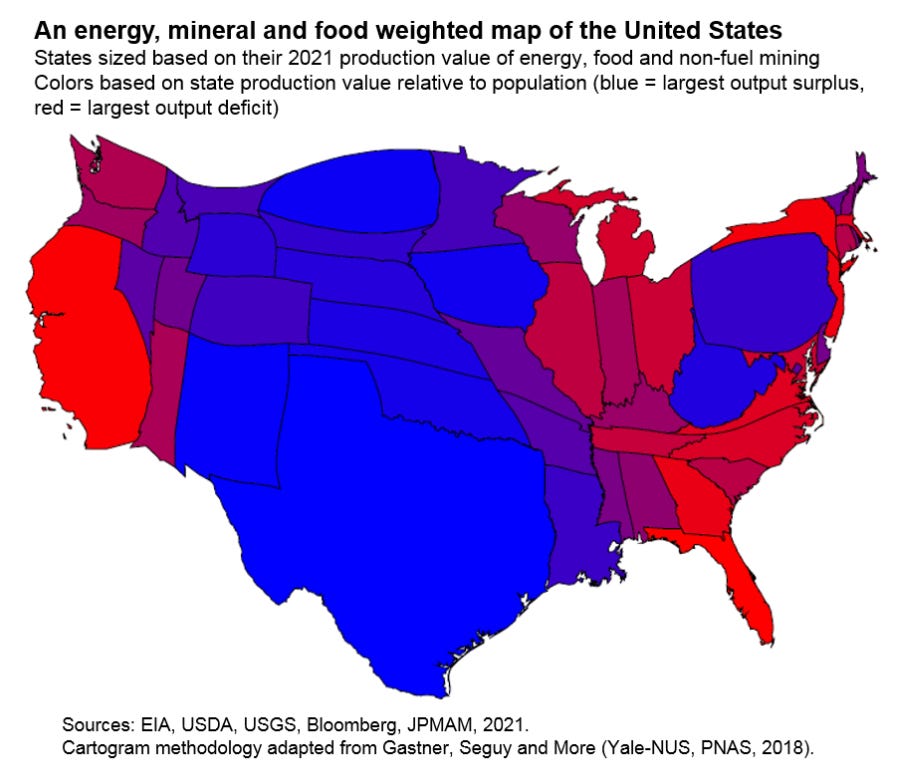

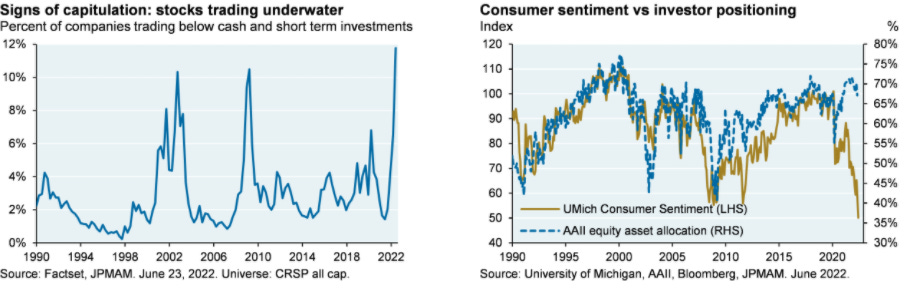

Topics: A revised map of the United States; investing in equities before a recession; Russia’s natural gas squeeze on Europe leads to another rescue program for Italy; the high cost of pariah status for the oil refining industry This is a succinct report with VERY topical discussion points. Based on the email questions I get from readers, you will want to check it out. I put a few interesting charts from the piece below, but open the link to see the full report.

Common Decency-Where Have You Gone?

I have written about the challenging airline travel experience in the airports and the crazy costs of flying today. There have been a growing number of aggressive passengers fighting with each other and airline staff. There have been stories of fistfights over masks on planes and multiple flight attendants have been injured due to unruly passengers.

I had a strange experience in my flight from Atlanta to Miami on Saturday. I will start with a brain fart. The plane was at Gate A29 and when I boarded the plane, I sat in 29C and put my bags up above me. A woman came and suggested I was in her seat and realized I was supposed to be in 20C, not 29C and the gate issue confused me as I am an idiot. It must have been three weeks of traveling with bad food, horrible hotels, and 110 degree heat which melted my brain. Now, mind you, I cannot move 9 rows forward as there are 200 people trying to board the plane, so I went to the back and waited in humiliating fashion. Shockingly, there was room for one of my bags above my seat and grabbed by back-pack and put it by my feet.

Despite being a 99% full flight, there was a space between me (isle) and the woman next to me in the window seat. The Hispanic male flight attendant came over and said, “Ma’am, is this your backpack in the overhead bin?”

The woman next to me said, “Yes,”

He replied, “Can you please put it under your seat? We have larger bags which need the space in the overhead compartments.”

The lady said, “I paid for a Comfort seat and I am guaranteed over head space. NO, I will not put the bag under my seat,” in a rude and defiant tone.

Mind you that NO ONE confuses me with Shaquille O’Neal, but this woman was a midget next to me and I had my large back pack under my seat as I felt it was common decency to do so. Her bag was half the size of mine, under my seat, for perspective.

The lady was yelling at the flight attendant who was nothing but polite and courteous to her despite her obnoxious behavior. “I am sorry, Comfort does not guarantee you overhead space, so can you please put the bag under the seat in front of you,” the flight attendant asked.

The flight attendant remained cordial and polite and asked, “Would you like the bag under the seat in front of you or would you like it checked?” He asked this question no fewer than 5 times and the woman was suggesting he was racist and was not cooperating. This flight attendant had the patience of a saint and was never flustered. I was getting ready to lose it, and if I were the flight attendant, I would have been fired.

The pilot got on and said, “I am sorry, but there appears to be a commotion with a passenger and we cannot depart until it is settled.” Passengers were irate and people around me were asking what is happening. My seat mate is demanding that she has a space in the overhead. She then said, “I want a manager now as I feel that I am being unfairly singled out.”

The flight attendant says, “If we cannot get the bag under your seat or checked, we will delay the flight, but if you wish, I can call a manager. It will delay the flight by at least 30 minutes.”

She said, “I don’t care if the flight takes off hours late, this is wrong and I am being taken advantage of. It is unfair. I was here first and have a right to the overhead bin.”

Then, a Black woman flight attendant came over to try to smooth things out and the woman next to me ranted and raved about how race is a part of the equation, and she is being victimized. The new flight attendant would not have it either and suggested she put it under the seat. As this is playing out, a sturdy man came to sit between us (last guy on the plane). The woman next to me had called Delta demanding a manager come to the plane and coincidentally, a Delta employee in a red vest was on the plane for another matter a few minutes later. The loud woman got the manager’s attention in rude fashion and told him what happened. He asked her to calm down and she would not. She asked to see his manager and I was livid. I said, not so kindly, “Put the bag under your seat. You are holding up the plane for everyone and some have connections to make.” She gave me Manson Lamps (evil stare) and was a nightmare of a person. This woman was offensive, rude and defiant over a small bag which clearly could fit under the seat.

Another flight attendant said, “I am not flying on this plane unless this woman is removed.” Then another one chimed in with a similar concern.

Quite frankly, I thought it was the right call by the flight attendants and of course, the problem woman was in my row and made me feel quite uncomfortable. The red vested employee asked her to get off the plane and the woman could not believe it, but took her time getting her belongings while she cursed and caused even more commotion. Long story short, she left the plane 30 minutes after the initial incident and did not need to be restrained. People of all races were clapping as she was leaving the plane.

This was NOT a race issue. This was an issue of common decency, and the woman tried to pull the race card and it did not work with 4 of the 4 Delta people being Black or Hispanic. The right outcome took place and she left the plane. The issue was our flight was quite delayed as a result. How about some common decency? Why are people so selfish?

Quick Bites

China started to ease lockdowns to 10 days which should help to alleviate some of the supply chain bottle necks and the market responded positively to the news on Tuesday early in the day. However, stocks sold off sharply on the day with the S&P finishing -2% and Nasdaq-3% on Tuesday as consumer confidence continued to fall. Stocks fluctuated on Wednesday, after the major averages made a failed attempt at a bounce in the previous session, and as the market prepares to close out the worst first half of the year since 1970. The Dow finished the day up 80 points, or 0.3%, to 31,028. The S&P 500 slipped 0.07% to 3,819, and the Nasdaq inched lower by 0.03% to 11,178. Investors continued their search for the bottom of a vicious market sell-off as the second quarter comes to an end Thursday. Concern over a slowing economy and aggressive rate hikes consumed much of the first half of 2022, and fears of a recession fears are rising. The 10-year Treasury yield fell 11bps to 3.1% as economic fears continue to be pervasive. Russia defaulted on its external sovereign bonds for the first time in a century. The chart below outlines returns for some of the major indices and key traded assets. Today, famous short-seller, Jim Chanos, explained his new shorts against brick and mortar data centers sending shares lower.

SPACs, once Wall Street’s hottest tickets, have become one of the most hated trades this year. The proprietary CNBC SPAC Post Deal Index, which is comprised of SPACs that have completed their mergers and taken their target companies public, has fallen nearly 50% this year. The losses more than doubled the S&P 500′s 2022 decline as the equity benchmark fell into a bear market.

Meanwhile, a regulatory crackdown is drying up the pipeline as bankers started to scale back deal-making activities in the space. The biggest laggards this year in the space include British online used car startup Cazoo, mining company Core Scientific and autonomous driving firm Aurora Innovation, which have all plunged more than 80% in 2022.

Broad-based job cuts loom at major banks for the first time since 2019, thanks to a confluence of factors that have cast a pall over markets and caused most deal categories to plunge this year, industry sources said. The math is ominous: Headcount at JPMorgan’s investment bank, Goldman Sachs and Morgan Stanley jumped by 13%, 17% and 26%, respectively, in the past two years amid a hiring binge. Meanwhile, capital markets revenue has fallen off a cliff. “When banks have a revenue problem, they’re left with one way to respond,” said one Wall Street recruiter. “That’s by ripping out costs.” Last month, JPMorgan Chase President Daniel Pinto said bankers face a “very, very challenging environment” and that their fees were headed for a 45% second-quarter decline. The link goes into detail on headcount increases since the pandemic and they are concerning given the backdrop on bank/investment bank revenues and rising costs. Decent layoffs will be coming soon based on the data in this report. What will that do to NYC/Hamptons R/E prices and city/state tax receipts. The chart below is quite telling on IPO proceeds and convertible bond performance and issuance has fallen sharply as well.

There is an interesting WSJ article entitled, “Pension Funds Plunge Into Riskier Bets—Just as Markets Are Struggling.” U.S. public pension funds don’t have nearly enough money to pay for all their obligations to future retirees. In 2021, public pension plans had an average of just $0.75 for every dollar they expected to owe retirees in future benefits, according to data from the nonprofit Center for Retirement Research at Boston College. A growing number are adopting a risky solution: investing borrowed money. More than 100 state, city, county and other governments borrowed for their pension funds last year, twice the highest number that did so in any prior year, according to a Municipal Market Analytics analysis of Bloomberg data. There are ramifications for idiotic Fed Policies of zero rates in perpetuity. These policies forced both people and institutions to take more risk than they normally would to find yield/return. Pensions have been under pressure for a host of reasons and expected returns have not been met creating large funding deficits. I think we can agree that artificially low rates for too long pushed investors to take extra risks and this is another example. Adding leverage and riskier assets to pension plans; what could possibly go wrong? Of note, pension funds do not tend to be the best investors, and in many cases chase returns.

The chaotic mix of record fuel prices and an unending supply chain crisis have retailers considering the unthinkable: Instead of returning your unwanted items, just keep them. In recent weeks, some of the biggest store chains, including Target, Walmart, Gap, American Eagle Outfitters and others have reported in their latest earnings calls that they have too much inventory of stuff ranging from workout clothes, spring-time jackets and hoodies to garden furniture and bulky kids' toys. It's costing them tons of money to store it. Now add on to that glut another category of product that stores have to deal with: returns. So instead of piling returned merchandise onto this growing inventory heap, stores are considering just handing customers their money back and letting them hang onto the stuff they don't want. "For every dollar in sales, a retailer's net profit is between a cent to five cents. With returns, for every dollar in returned merchandise, it costs a retailer between 15 cents to 30 cents to handle it,” according to one retail expert. This is a sign about how bad things have become at retailers, and to me, is another sign inflation is peaking. Having traveled extensively through small towns this summer, I have seen an unimaginable number of vacant retail space across the country from NYC to Zachary, Louisiana and everywhere in between. One small town in Alabama looked like a ghost town with 80%+ of the retail on the main drag vacant. Michael Burry (The Big Short) investor feels this is a sign the Fed will reverse interest rate increases and Quantitative Tightening.

A reader sent me a bunch of clips from news stories on the subject of the wealth leaving NYC. I have written about this quite a bit and remain very concerned for the city in term of the impact on the budget with the wealth leaving and an unwillingness by the DA to prosecute. The hundreds of thousands of New Yorkers who left the city during the early days of the coronavirus pandemic drained it of $21 billion in taxable income, according to IRS filings received in 2020 and 2021. New York City relies heavily on its wealthiest residents to support schools, law enforcement and other public services. The top 1 percent of the city’s earners, who make more than $804,000 a year, contributed 41 percent of New York City’s personal income taxes in 2019. The outflow of about 300,000 residents was the biggest in the city’s records, The Times’s Nicole Hong and Matthew Haag report, and it will have long-term effects. The city’s outlook could be grim. It collected more tax revenue in both 2020 and 2021 than it did in 2019, thanks in part to at least $16 billion in federal pandemic aid. But many forms of stimulus have now ended. And the loss of in-person workers has caused the market value of office buildings to plunge during the pandemic, prompting a sharp decline in property tax revenue.

Other Headlines

More than 1 million voters switch to GOP in warning for Dems

Great AP article which highlights the big move in the suburbs to switch to Republican. Two-thirds of those who switched parties went to the Republicans.

Vice President Harris creates new uncertainty about Biden's plans for reelection

Slight walk back in language. I sure hope Biden, Harris or Trump are not the candidates for the good of the country.

Trump attacked Secret Service agent after Jan. 6 Capitol trip rejected

Click the link to read the comments about the incident. However, this story suggests it may not have happened as described.

The whispers of Hillary Clinton 2024 have started

I don’t see her running. I sure hope it is not a Trump/Biden election and in my view, if it happened today, Trump would probably win if it was between the two. Many betting odds have DeSantis heavily in the mix.

President Biden annoyed by 2024 questions, reports New York Times

I honestly do not see how Biden’s team could allow him to run again. If the US re-elects this man as President, we deserve what is coming.

Inflation Hits July 4 Cookouts With Food Prices Up as Much as 36%

Bank of Japan's government bond holdings exceed 50% of total

Record level of buying are inverting the yield curve and hurting the Japanese Yen.

ARK Invest’s Cathie Wood says the U.S. is already in a recession

I want to put a chart up of Cathie’s recent investment performance. It looks like her fund is in a recession. It is down 67% in a year and 55% YTD.

How to find a hidden spy camera in hotel rooms and rental homes

Flight cancellations stressing weary travelers as July 4 approaches

Delta pilots to protest nationwide for improved pay, protections, and scheduling

Millions in California to Get up to $1,050 in ‘Inflation Relief’

Total CA package is $17bn. With IPO proceeds in the tank and tech layoffs coming, what will the CA budget look like. Let’s not forget all those billionaires leaving for Nevada, Texas and Florida.

The 150 mile death journey in 103 degree heat that killed 51 migrants:

NYC prosecutors flee in droves amid soft-on-crime policies, burdensome state reforms

‘Professional booster’ notches 100th shoplifting bust — and is released without bail again

I just will never understand the mindset of the DA’s who condone zero consequences for crime. The damage to the community, businesses, and residents is ridiculous.

Atlanta Subway customer shoots dead female worker for putting too much MAYO on their sandwich

You don’t think with NYC new carry rules we will see more of this?

Ghislaine Maxwell sentenced to 20 years in Jeffrey Epstein sex trafficking case

I want the list. Why won’t she give it up? The names of Epstein’s clients has to come out at some point. How has this not leaked yet? Must be some powerful people involved in this one. Check out a Musk Tweet from a few weeks ago on the subject (Pictured Below). Classic.

I just don’t believe the invasion of Ukraine has gone according to plan for Putin by any measure. I thought it would have been over in days as well.

Russian strike hits Kremenchuk shopping center with more than 1,000 civilians inside

Virus/Vaccine

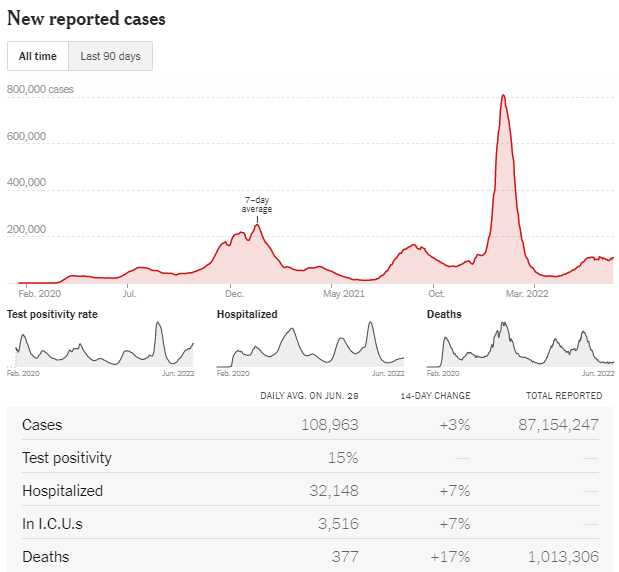

Cases are flattish, but the positivity rate keeps climbing and is at 15%. It was at 2% not long ago. Deaths are up 17% to 377/day. A NY Doctor is warning of a stronger Omicron variant starting to show up. He calls it the “worst version of Omicron.” The suggestion is a possible sixth wave.

Real Estate

I am hearing more reports of slowdowns in the South Florida market with investors getting spooked as easy “flips” are gone and others are unable to afford homes given the sharp market sell-off. However, I spoke with a real estate broker who focuses on retirement communities in South Florida. She spoke with me about GL Homes Valencia properties which in total have almost 10,000 homes. Right now, 25 homes are for sale in these communities which is shocking to me. Very tight inventory levels and prices have held in better than I imagined in these areas. I feel the price point of many in the $400k-1mm range should come under pressure as they are more rate sensitive, but thus far are holding up well.

New York-based Nightingale Properties has agreed to purchase the 915K SF glass-encased office complex straddling Georgia 400 for $182M in an off-market transaction, Commercial Real Estate Direct reports. Sumitomo bought the property from Hines in 2016 for $222.5M, and has since invested $15M to upgrade AFC during its ownership, CRE Direct reported. I believe the Japanese banks and investment companies are the worst investors ever. We would always comment on the trading desks when the Japanese banks were getting into a trade theme. With near 100% certainty, you wanted to take the other side of it. They consistently bought high and sold low. Let’s not forget the Rock Center debacle with the Japanese. Legendarily bad.

The penthouse in Brazilian billionaire José Isaac Peres’ 57 Ocean in Miami Beach sold for a record $37 million. Property records show 57 Ocean 1701 Land Trust purchased PH-1 at 5775 Collins Avenue from PH1 Ocean LLC, an entity managed by José Isaac Peres. Peres is the founder and CEO of Multiplan Real Estate Asset Management, the developer of the 19-story, 69-unit oceanfront 57 Ocean. James Marx, a Miami-based attorney with Marx Rosenthal, signed as the trustee. The true buyer is unknown.

THANKS!!

Thank you Eric. Absolutely fantastic summary of the week's events.