Opening Comments

Jack had a great experience getting fit by Taylor Made and received an entire set of clubs from his sponsor. His fitter was 6’10” and made me feel very small again as was the case in my last report, The Night I Talked BBall With Coach K. Many readers felt it was one of the funniest notes, but the open rates were down a touch given the late send resulting from my travel nightmare. If you did not read it, just read the subject section as it is topical and humiliating. We all know how the Rosen Report readers love it when Eric is embarrassed.

On the subject of Eric making a mistake, I received an email from a reader who prides himself on catching any grammatical errors. It was in response to my last note (link above). Son of a …. despite reading my note 20 times to find errors, I missed this blatant one which is kind of funny:

"35 births in the NCAA tournament"

Man, he has been BUSY! How many wives does he have? 🤣👍🎉

(you meant "berths")

If you open only two links today, look at a portion of the video of the day AND the 39 second Trump video from 2018 about German energy dependence on Russia while the German delegation laughs in his face. Trump is in Quick Bites in the oil discussion.

Cooking a big dinner tonight: steaks, roasted cauliflower, broccoli, mashed potatoes, caramelized onions….Hitting send early. Gotta get in the kitchen.

Eye On The Market-Michael Cembalest-China and the Russian invasion of Ukraine

Video of the Day-Russian Commander’s Side of the Story

Customer Service-Divine Intervention

Quick Bites

US Markets, Gas Prices ($8.45 in Mendocino)

Crypto Order, Demand Destruction

Russian Import Ban, US Oil Production

Commodities, Nickle Prices

Gundlach on Markets, Tech Stock Beat Down

Private Plane Pricing Insanity

Other Headlines-Many Ukraine/Russia Headlines

Virus/Vaccine

Data-Improvements Continue

Pfizer Released Documents

FL Vaccine Policy for Kids

Real Estate

General Comments

Miami Craziness-Affordability is Gone on Choice Property

Malibu $99.5mm Oceanfront

$20mm Chicago Condo

Eye On The Market-Michael Cembalest-China and the Russian invasion of Ukraine

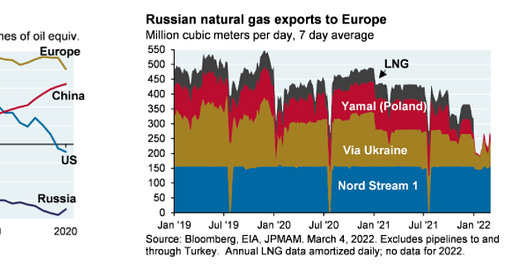

I love pieces from Cembalest and the readers do to. Countries that reduced their supply of thermal energy at a much faster pace than they reduced their demand are paying a very stiff price for that right now. We expect some about-face movements on this in the days ahead. After issuing an Executive Order banning new oil and gas leases on Federal lands, Biden is now reportedly considering a trip to Saudi Arabia to ask for more crude supply (Source: Axios), his team already visited Venezuela to do the same, and the administration is engaging in “outreach” to the oil and gas industry. Wow. I keep talking about failed energy policies in the US and Europe putting both in a worse situation than they should be. Lots of good charts and information on China.

Video of the Day-Russian Commander Interview-Worth a Listen

An avid reader, Mike (Happy B-Day), sent me this video. It is 9 minutes long of a Russian Commander embarrassed that his superiors told him he was fighting due to the fact that Nazis were controlling Kyiv people needed liberating. National Guard Lt. Col. Astakhov Dmitry Mikhailovich, who was captured along with two other soldiers, said he had been told they were being sent to help Ukraine because it was “dominated by a fascist regime” and that “nationalists and Nazis had seized power.” “I feel shame that we came to this country,” the colonel said. “I don’t know why we were doing it. We knew very little. We brought sorrow to this land.” You do know that Zelensky is Jewish, right? Although it is obviously translated, the Russian’s demeanor is so pure, I believe he is telling the truth. I ask that you watch a few minutes of the video to judge for yourselves. The lies and propaganda out of Russia have become concerning. I believe Putin has some form of health issue, and the consequences are high for the rest of the world. The more I read, the scarier it becomes. America, this is a wake-up call. Iran cannot get nukes and we need to be energy independent AND bring manufacturing home, and being less reliant on China and others.

Customer Service-Divine Intervention

I remember the days when you called a company on the phone and someone actually picked up the other line. I sound like I am dating myself. All my readers know about my legendary lack of patience and ADHD. Far too often, I am on hold far too long and then when someone gets on the phone, they are from some far off land and barely speak English.

I have saved miles due to credit card use over the years. Given the Rosen family travel has been limited for a couple years, I have not used miles. I tried to use some American miles and I could not get into my account. I was on hold for 45 minutes and then someone who barely spoke English got on the phone. I had to go through countless security questions (address, email, phone number, three security questions, middle name….). Finally, he said “I have confirmed it is you Mr. Rosen,” and tries to reset my password. What happened then? The American Airlines system crashed, and I could not get into it using my new password to book my flights. To add insult to injury, they transferred me 3 more times to book the flight on the phone given their system issues. I was on hold another 45 minutes and then hear a dial tone. The call was disconnected by them. Don’t worry, I swore like a drunken sailor for 5 full minutes and made up new swear words. Then I called back and waited another 40 minutes and the man on the other line actually helped me in three minutes. Do you believe in miracles? (Al Michaels from the 1980 USA Hockey Game).

In a recent note, Hidden Fees, I talked about the Frontier Flight and the deception from advertised to actual price. We took the crap airline to Atlanta Sunday and Jack’s golf bag weighed 41lbs. The limit was 40lbs and the guy behind the counter said, “It is a safety issue and you need to reduce the weight to 40lbs.”

“I am taking a towel out of the golf bag which I paid $37 to check in and putting stuff in my carry bag. The plane will be carrying the same weight,” I said. He looked at me and said, “You can pay an extra $50 if you don’t want to reduce the weight.” Solid customer service over-1 pound.

When we landed back in Fort Lauderdale, the airport was swarming with travelers, given Spring Break. I ordered a Lyft, and it took 25 minutes to find a driver. The driver’s car stood still for 5 minutes after already taking 13 minutes, so I called him to see what was going on. I politely asked for an ETA as the car had not moved. He said, “Heavy traffic and hung up AND cancelled my trip.” He was a 5 Star rated driver. Given how horrible the customer service is on Lyft, there was no way for me to complain about a cancelled ride. The Lyft app gets an “F” for ability to complain about issues like this one. I went on line on my computer and finally found a way to have Lyft call you. My phone rang 1 second later. I was on hold for 20 minutes and they hung up. I cannot even call to complain about the incident. Lyft customer service is HORRIBLE. I finally got them on the phone and they transferred me and disconnected the call.

We are planning a trip to Casa de Campo in the Dominican Republic. I booked the villa on line on 2/7/22 through the hotel website and was throwing up at the price. I was unsure how to book dinner reservations, golf for Jack, excursions for the family... I called the main phone number on 5 occasions and never got to someone on the other end despite frustrating hold times. I used the customer support email multiple times and no response. This is one of the most expensive hotels I have ever considered and you can’t get someone on the phone or to reply to an email for almost one month? My sister, Shelley, is in the hospitality business and I was telling her the story and suggested I was going to cancel the reservation. Shelley knows someone who rates hotels and was having a conversation with her later that day.

Clearly the woman my sister knows has some serious clout and called someone at Casa de Campo. I actually received a lovely email asking how they could help within minutes of her conversation. Then I received a ton of other emails from various people as well as calls and now am treated like a celebrity. It seems as though the Rosen Family will be taken care of during our stay and we are looking forward to the trip and fun activities. I have had conversations with the manager of the property, and it is clear we will now have a special time at Casa de Campo and will receive great service after the hiccup. The kids are incredibly excited. Truth be told, I am excited to have a real vacation too. We are riding a dune buggy, zip lining, snorkeling, Jack is golfing, pool, beach, working out and a little rest with some good meals along the way. Despite the rough start, Casa de Campo’s response has been OVERWHELMINGLY POSITIVE and let’s hope the stay is as good.

I believe in a personal touch. I still write hand written thank you notes when I can, given my mom taught me the importance of them. If I was given a gift as a kid, I would have serious consequences if a hand written thank you note was not sent within 48 hours of receiving the present. I am happy to pay a premium for service and to get someone on the phone in a reasonable time.

If any readers are heading to Casa de Campo, come find the Rosen family and you can buy me a drink! I might need it if I have any more customer service issues, but now feel I will be taken care with 5 star service after the divine intervention.

Quick Bites

Despite continued bad headlines out of the Ukraine, stocks posted sharp gains on Wednesday as recently surging commodity prices, especially oil, cooled off while the war in Ukraine continues. The Dow rose 654.points to 33,286, helped by gains in Salesforce, Nike and JPMorgan. The S&P 500 climbed 2.6% to 4,278, for its best day since June 2020. The Nasdaq Composite gained 3.6% to 13,256, for its best day since November 2020, boosted by strong gains in mega-cap technology darlings. Wednesday’s gains dragged the Dow out of correction territory and the Nasdaq out of bear market territory. For perspective, despite today’s rally, for the past 5 days, the Dow is -2.0%, S&P -2.8% and Nasdaq-4.2%. YTD, Dow is -8.5%, S&P -10.4% and Nasdaq-15.4%. Oil was hit hard and ended the day -12%+ to $109 which helped give life to the stock market after yesterday’s weakness as the US tries to encourage oil production from other sources. Airlines rallied hard with the drop in oil. Silver, copper and platinum were all lower on Wednesday. Wheat futures were sharply lower, though palladium continued its march higher. After hours, Amazon announced a 20 for 1 stock split and $10bn buyback and the stock was +7%. The 10-Year Treasury sold of 9bps to yield 1.96% and it was recently as low as 1.69% and as high as 2.05%.

Crypto rallied sharply in part due to the broader market (absent energy) and Biden’s new executive order on cryptocurrencies. The measures announced will focus on six key areas and the link goes into detail on each. The executive order, which attempts to fix the lack of a framework for the U.S. development of cryptocurrencies, has been broadly welcomed by the industry and its investors. Biden also discussed looking into a digital version of the US dollar. BTC was up 8%+ to $42k and TTH was +5% to $2.7k.

Consumer and investor protection

Financial stability

Illicit activity

U.S. competitiveness on a global stage

Financial inclusion

Responsible innovation

I paid $1.47 at the pandemic lows for gas in Florida and today it is $4.25 at the same station. I am hearing from readers that people are spending well over $100 to fill up tanks in SUVs today. One reader told me he spoke with multiple garages in NYC who claim people are driving less due to the high gas costs. Last summer, I drove 8,000 miles for Jack’s golf tournaments. The northeast has expensive gas which could be $5-6/gallon. Jack better bring home some trophies or he is riding his bike to the tournaments. Airlines are cutting routes and raising prices. The US Average is now $4.25/gallon (new record two days in a row), and is up 52% in a year according to AAA. Remember, expensive states such as CA and NY are far higher. CA averages $5.57 for perspective with the highest price station at $8.45/gallon (regular unleaded) in Mendocino, CA (2nd picture). The irony is they are the biggest adopters of EVs. CA drivers average approximately 13,000 miles/year. Let’s assume the average car gets 22 miles to the gallon. This would result in an annual cost of fuel of approximately $5k at that expensive pump. I just wanted to put that price into perspective and the median family income in Mendocino is $64k. Extrapolating one data point is an aggressive assumption, but just wanted to make a point. The gas prices just cannot be good for Biden’s approval ratings.

Stratospheric oil prices are flowing through into the plastics industry with producers reducing activity as profit margins collapse, a first sign of the demand destruction that may spread to other sectors. Several Asian operators of plants that make the petrochemicals used as the building blocks for everything from children’s toys to car interiors have cut processing rates to as low as 80%, said five traders at these companies. The facilities, known as crackers, typically run at or near full capacity. Others will be coming soon.

President Joe Biden announced the U.S. will ban imports of Russian oil, a major escalation in the international response to Moscow’s invasion of Ukraine. The move came as Western-allied nations work to sever Russia from the global economy and punish Russian President Vladimir Putin. The United Kingdom also announced its own plans to phase out its reliance on Russian oil imports by the end of the year. The European Union earlier Tuesday morning unveiled a plan to wean itself off of Russian fossil fuels. The article suggested the US imported 672,000 barrels/day from Russia in 2021. However, Germany has refused to ban Russian oil and gas. They are so beholden to them due to idiotic German energy polices which painted them into a corner. From German Chancellor Olaf Scholz: "At the moment, Europe's supply of energy for heat generation, mobility, power supply and industry cannot be secured in any other way. It is therefore of essential importance for the provision of public services and the daily lives of our citizens." Germany was too aggressive in trying to phase out traditional sources of energy in favor of renewables (Energiewende) and now requires Russia for sourcing. This is an informative piece from the Clean Energy Wire discussing the Energiewende process.

If you open one link today, I hope it is this one. It is a 39 second video from 2018 where Trump says, “Germany will become totally dependent on Russian energy if it does not immediately change course. Then he talks of the US being committed to being energy independence.” I know many hate Trump, but give the dude some kudos for making this call. Oh yeah, the German delegation laughs in his face at the energy comments. Who is laughing now?

I found this CNBC article from the CEO of Occidental Petroleum, Vicki Hollub, to be interesting. “We’re in a really dire situation,” she said Tuesday at CERAWeek by S&P Global. “We’ve never faced a scenario where we need to grow production, when actually supply chains not only in our industry but every industry in the world [are] being impacted by the pandemic.”

U.S producers were largely expecting to keep production flat this year, and in the face of surging crude prices, output can’t just be ramped up right away, Hollub said. “Now, with supply chain challenges, it makes any kind of attempt to grow now — and at a rapid pace — very, very difficult,” she said.

Production in the oil-rich Permian Basin is back around its pre-pandemic peak, according to Hollub, who noted the region faces significant challenges in boosting output. It’s the only shale basin in the U.S. that can increase production, she said. The point is, we cannot massively ramp up US production quickly. It will take time and the vilification of producers must end. We are not ready to be reliant on alternatives near term.

This article is a week old, but outlines the commodities from Russia and Ukraine: Energy, Food, Transport, Metals and Microchips. To me, this means supply disruptions could get worse and prices higher. Time to worry about stagflation. Some examples: Russia and Ukraine produce over 25% of the world’s wheat exports. Ukraine makes almost have of exports of sunflower oil. Ukraine is the top supplier of corn to China. About 90% of neon, which is used for chip lithography, originates from Russia, and 60% of this is purified by one company in Odessa. With the backdrop we are seeing, the Fed is going to get painted into a corner. The years of idiotic Fed policy, bad energy policy, decades of moving manufacturing offshore are coming back to haunt.

The London Metal Exchange suspended trading in its nickel market after an unprecedented price spike left brokers struggling to pay margin calls against unprofitable short positions. Nickel, used in stainless steel and electric-vehicle batteries, surged as much as 250% in two days to trade briefly above $100,000 a ton early Tuesday. Chinese nickel titan Tsingshan Holding Group faces up to $8bn in losses, people familiar with the company said according to this WSJ article. The reliance on Russia and Ukraine for key commodities is adding fuel to the fire. This CNBC article suggests that the Nickel price surge could threaten ambitious EV plans.

Billionaire 'Bond King' Jeff Gundlach warned oil prices could surge past $200 a barrel. The DoubleLine Capital boss rang the stagflation alarm, and slammed the Fed's stimulus efforts. Gundlach touted emerging-market stocks over US equities, and trumpeted cash and bonds. His interview had 8 big points. I am struggling on #8 near term. I am not convinced that oil goes to $200 at this point.

Gas is going a lot higher

Oil going to $200/barrel

Blames transition away from fossil fuels too soon

Oil shocks lead to demand destruction

Fed in a pickle

Blames over accommodative/dovish Fed

Sell US stocks for Emerging Market Stocks

He likes cash and bonds due to deflation fears

This CNBC article is entitled, “Some tech stocks are down 75% from their highs last year — these are among the biggest losers.” High-growth tech stocks were already getting pummeled before Russian’s invasion of the Ukraine. The skid has only gotten worse. “The mood of the market right is real foul right now for good reasons,” Snowflake CEO Frank Slootman told CNBC’s “Mad Money” last week. The selloff has hit cloud software, e-commerce, fintech and consumer devices. Companies listed were Wish, Robinhood, Stitch Fix, Peloton, Affirm, Opendoor, Roku, Wix, Redfin, and Toast. For perspective, the Ark Innovation EFT is down 50% in the past 12 months and 37% YTD. Stich Fix missed after hours Tuesday and the stock was -17%.

I spoke with someone who is in the business of leasing out private planes. Prices are up 40% or more with the pandemic and new fuel surcharges have started at $800/hr for Challengers and Gulfstream aircraft. He told me larger fractional operators such as Netjets and Flexjet are charging up to $1,900 +/hr for fuel (based on the fractional pricing model, they always broke out fuel per hour pricing so the point here is it was up from around 900/hr-1900/hr). Prices to lease a Challenger or comparable from NY to Florida have gone from $18,000 to $30,000+ with the surcharge (the heightened demand really drove the prices up. Then fuel kicked it into overdrive. Even at 1000/hr, that’s 2,500 for the NY – FL route ~ 2.5 hrs. Of note, Netjets, Flexjet, Sentient and Wheels Up had to stop taking new business due to excess demand. This article is entitled, “The Future of Jet Cards You can’t always get what you want.” On pricing of planes, G450s that were trading for $8-9m are now trading 11-15mm+, if you can find one. Challenger 300s that were $7-8m are now $10-11M, again if you can find one. Throw out your comps, they don’t matter anymore – every aircraft is turning in to a auction style sale with many sellers getting over ask. A reader sent this to me this morning, “I put another LOI on a Lear60 last night, sight unseen. I had 30 minutes to make a decision, if I didn’t sign it, there were 3 other buyers in line.”

Other Headlines

Morgan Stanley and Citi Strategists See Equities Storm Forming

“Downside risk remains most acute over the next 6-8 weeks,” Morgan Stanley’s Michael Wilson wrote in a note to clients. “We are firmly in the grasp of a bear market that is incomplete in both time and price.”

Analysts warn of recession if oil prices continue to surge further into ‘uncharted territory’

As inflation heats up, 64% of Americans are now living paycheck to paycheck

WallStreetBets founder debuts new fund that mimics Nancy Pelosi stock trades

I love this. I am adamantly opposed to politicians being able to trade stocks. It is called insider trading. If you do it, you will serve time, if they do it, all good.

US sends home Guantanamo prisoner suspected of trying to join 9/11 hijackers

The only place this guy should be sent to is hell.

Brittney Griner Flew to Russia an American Basketball Star—and Landed in Custody

Let me get this right, she went to a foreign country and was caught with an illegal substance (hashish oil) and people are shocked she is in custody? She is now the subject of a drug smuggling investigation.

Jury finds first US Capitol riot defendant to go on trial guilty on all counts

NYC career criminal slashes man after he was freed for a prior attack

Do the people responsible for these idiotic laws which free violent criminals feel any remorse? Six arrests since October!

Passenger caught urinating on NYC subway as commuters seem unfazed

NYC McDonald's employee brutally stabbed while defending coworkers

Aaron Rodgers reportedly agrees to 4-year, $200 million extension with Packers

I would have taken $4 years and $150mm. I am still available.

Russia/Ukraine

Fighting in Ukraine Forces Two Million to Flee as Russia Presses Offensive

I feel this could be a positive development. Putin needs a win and this could be it to diffuse this situation.

Mariupol authorities accuse Russians of bombing maternity hospital

Inspirational Zelensky echoes Churchill in historic commons speech

Scary view from the editor-in-chief of Russia Today who resigned over what is happening.

U.S. Spies See Grim Global Outlook With Russia, China Top Foes

UN tells comms staff not to call Ukraine conflict ‘war’ or ‘invasion’: report

China considers buying stakes in Russian energy, commodity firms

Russia-Ukraine war: NYC on 'ultra-high alert' amid increased risk of Russian retaliatory cyberattack

Ukraine-Russia war: Western officials 'seriously concerned' Putin could use chemical weapons

A frustrated Putin is likely to 'double down' in the coming weeks, CIA says

I agree with this article and China may put the US to the test.

Coca-Cola follows McDonald’s, Starbucks in suspending business in Russia

Russia warns that a WWIII 'would involve nuclear weapons'

Russian Foreign Minister Sergey Lavrov argued against NATO involvement in Ukraine by claiming that a broader war would involve nuclear weapons.

If Putin is 'losing the war, the nuclear risks grow': Nuclear weapons expert

Virus/Vaccine

For a couple years, the pandemic has dominated the headlines in a negative manner. Recently, COVID data is actually becoming a bright spot in a dark world. All data pointing in the right direction for weeks. Cases down to 40k/day and hospitalized is at 35k with ICU under 7k. Deaths fell to under 1.5k/day from a recent peak of 2.7k.

While reports of vaccine side effects continue to roll in across the globe, the FDA’s initial request of 75 years to release the data, which is linked to its decision in December 2020 to grant Pfizer-BioNTech “Emergency Use Authorization” for its mRNA vaccine, was finally turned down and subsequently, a judge ordered the release of data to begin in March, citing the request as “paramount to public importance.” The Children’s Health Defense notes that a 38-page report was also included within the documents that features an Appendix called: “LIST OF ADVERSE EVENTS OF SPECIAL INTEREST.” To me, the number of potential side effects is not overly concerning (1,291), as if you look at a bottle of Tylenol, it is a long list. I just want more transparency and am concerned the government is hiding something. This is a bombshell,” said Children’s Health Defense (CHD) president and general counsel Mary Holland. “At least now we know why the FDA and Pfizer wanted to keep this data under wraps for 75 years.” Why was there a block for data disclosure for 75 years? How serious are the side effects?Why was more information not disclosed initially? I lack the infrastructure to do a deep dive on this topic. However, I am troubled that the media is not covering this subject more in depth to educate the public. There is enough here to warrant further investigation in my opinion, but I do not have enough information to know how serious the implications are of these initial reports.

Health experts have widely denounced Florida’s decision to recommend against Covid-19 vaccinations for children, describing it as “irresponsible,” “reckless,” and “dangerous.” The move followed two recent Covid-19 surges in which pediatric hospitalization was believed to be higher because of low vaccination rates among children. The state has not yet released a formal policy to describe exactly who would be included in the designation “healthy children.” The move goes against accepted advice from federal health authorities and a large majority of independent experts, who recommend vaccines as a powerful tool to protect children from the worst outcomes of Covid-19. Given the lack of meaningful deaths in kids, I struggle to force healthy children to be vaccinated. If you have co-morbidities, it is another thing. I would not get healthy 5 year olds vaccinated today. The FL Surgeon General said, “I cannot recommend that healthy children receive the vaccine. When the overall risk is low & there is a higher anticipated rate of serious adverse events in clinical trials, it is unclear if the benefits outweigh the risks…

Real Estate

I spoke with a NYC realtor who told me his client’s daughter was unable to find a one-bedroom for $4,500/month, so she has moved into their apartment. I know of a kid attending NYU spending over $6k/month to live in a one-bedroom apartment in the village. With tuition, food and expenses, you are talking about $150k/year for school. I just don’t believe an education is worth that much money.

In Miami, on North Bay Road, a non-waterfront house sold for $9mm. These dry lot homes have doubled in two years, which is far less than the triple or quadruple for waterfront on North Bay Road. If the house was across the street on the water, it would have sold for $25mm-30mm, given it was on .42 acres and the 50s on N. Bay have amazing views. The dirt trades for close to $25mm in the 50s on the water without a home. Pre-pandemic the water lots on N. Bay were $6-10 for the most part. One lot sold for $8mm in 2020 and the exact lot next door sold for $22mm last week. Nice homes on nice lots on N. Bay on the water are $35-50mm+. A broker is showing a house of approximately 10,000 ft on a 30,000 ft lot for $45mm on N. Bay Road this week. It is off market. The house is not new, but gives you an idea of what we are talking about. I also found out that on Sunset Island in Miami a house was bought in 2020 for $14mm (new construction). The lot is 20,000 ft for an 8,500 ft house. Just sold for $32mm. Also on Sunset Island, a 28,000 ft lot facing downtown (great lot) went from $18mm to $33mm in 18 months. For perspective, I spoke with someone who bought a townhouse in NYC in 2014 for $9mm. They believe today it is worth approximately $10mm. If you spent $9mm in Miami, Boca, or Palm Beach on the water in 2014, I cannot imagine it would be less than $25mm and if you bought right, $75mm.

A Malibu estate once owned by Cindy Crawford is being offered at $99.5mm and was purchased for $45mm in 2018. The roughly 7,500-square-foot property, which is Mediterranean in style with a contemporary twist, is located on more than 3 acres with a pool and tennis court, said Mr. Weiss. The home sits on the bluffs above El Sol County Beach, with steps leading directly to the sand.

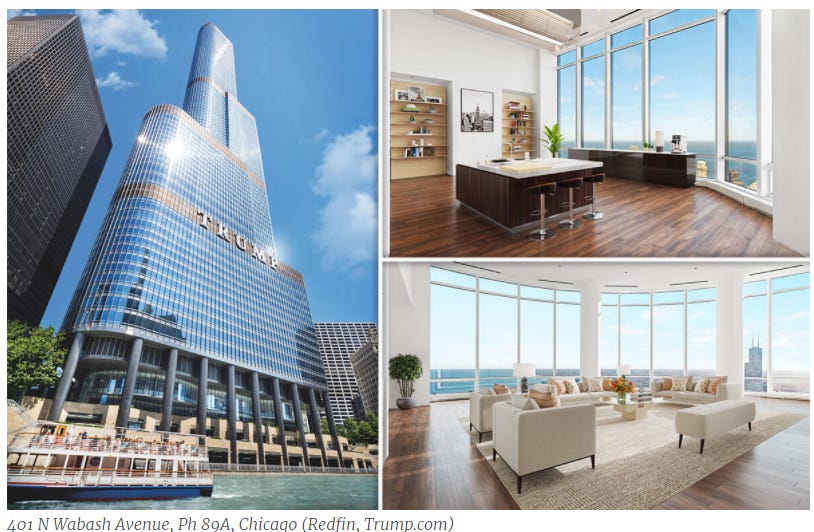

An 89th-floor penthouse at Chicago’s Trump International & Tower sold for $20 million in the city’s second priciest condo deal. The condo owned by Sanjay Shay, CEO of Hoffman Estates-based software maker Vistex, sold on March 7 after going under contract in mid-February, the Chicago Tribune reported. Shay bought the 14,260-square-foot full-floor penthouse for $17 million in 2014 and listed the unit for $30 million in September. I can think of a lot of ways to spend $20mm on real estate and NOT one of them includes the city of Chicago.