Dimon to the Rescue

6-5-22

Opening Comments

I spent a couple days in NYC last week. The traffic is not something I miss. It took 35 minutes to go a couple miles. I went to a JPMorgan Alumni event with Jamie in attendance. It was a great time for me to catch up with a bunch of former colleagues. I took an Uber home 18 blocks which took 5 minutes. I checked Lyft, and it was $39 for the fare at 9pm on a Wednesday evening. Uber was a little cheaper, but wow, prices are up sharply from when I lived in NYC. I remember taking an Uber from my office in Midtown to LaGuardia Airport for $20.

I sent Jack to Rezdora with his grandmother, and he LOVED it. He is approaching 50 Michelin Stars. Had we stayed in NYC, he would be over 100 by now. He ordered everything I suggested in my review, Rezdora-I Want Mora from 11-10-21. The second evening in NYC, we went to Junoon. It had a Michelin Star for years. I am not the biggest fan of Indian food, but this is another level. To me, the food and presentation are worthy of one Michelin Star, but the service and table settings fall short. I had written a review of Junoon on 8-22-21. The last night I went to Carne Mare at South Street Seaport. Trust me when I tell you the restaurant is a hard pass from a food and cost perspective. I could not imagine ever returning there. However, the revitalized seaport is worth a look. Many cool shops and bars to hang outside on a nice summer night.

Florida had a tropical storm come through and dumped serious rain. I warned you to leave from June-October if you can.

Jack and I landed in New Orleans Sunday am and checked into the 5-star (really 0-star) Comfort Inn, in Zachary, Louisiana. Jack opened the door to the room and said, “Dad, this smells horrible.” I walked in and started gagging. I went to change rooms and luck would have it that they are sold out. Good news, they sprayed some cheap perfume like substance in the room trying to cover up the smell. Allergy attack here we come. Now the room smells like gym socks and potpourri. It gets better. The internet is not working. I have had the same ATT plan for 20 years and had to change it in order to get a Hotspot to get out my piece today. Two hours with the lovely people from Comfort Inn trying to get internet access. We are all going to have a good laugh when Jack plays on the PGA Tour someday. Zachary is not exactly utopia. More on that in an upcoming report. By the way, the local grocery store, Rouses Market takes the cake for the worst grocery store I have ever seen.

I have been receiving positive feedback on the shorter format, which I will try to continue. Remember to send story ideas, forward the Rosen Report to friends and hit the “like” button if you enjoy what you read.

Picture of the Day-Eurozone PPI

Dimon to the Rescue

Quick Bites

Markets

Dimon Economy Comments

Musk/TSLA Job Cuts

Fed Vice Chair on Fed Put

OPEC Production Growth

Tiger Global Rough Year

Other Headlines

Virus/Vaccine

Data

Mask Study

Real Estate

Retail Example

Home Listings Increasing

Gulfstream, FL Estate Flip

Picture of the Day-Inflation

The first picture is a Tweet from Gundlach about Eurozone inflation. The second chart is the Producer Price Index (PPI) of the Eurozone. Energy policy has serious consequences for both the US and Europe. The main driver behind the surge continued to be the energy (99.2%) but rises were also widespread in other categories. Excluding energy, prices rose 15.6% including intermediate goods (25.1%), non-durable consumer goods (11.2%), durable consumer goods (8.5%), and capital goods (7.2%). Compared to the previous month, producer prices increased 1.2%. The third picture is from Jim Reid at DB and shows implied Fed and ECB hikes.

Dimon to the Rescue

I went to the JPM Alumni Event at the JPMorgan Library last week. I walked in and my former boss, Daniel Pinto (top lieutenant of Dimon), and Jamie were standing there. I shook their hands and Jamie said, “I was just telling a funny story about Eric Rosen this morning.” Son of a…. I was thinking to myself. There are plenty of Rosen stories out there, but which one did he tell today, and how embarrassing was it, but I was excited Jamie still talks about me. Jamie then said, “Eric, do you remember the bathroom incident at JPM?”

I responded, “How can I forget? I wrote a Rosen Report about it two years ago.” (It was actually from 9/20).

He said, “I must have missed that one.” Jamie then talked about how the bathrooms in the new multi-billion dollar headquarters of 270 Park Avenue (under construction) will have sensors in them to alert for leaks, given the new building is ultra-high tech and Jamie told people the story about our bathroom incident from 15 years prior. I will re-tell it below.

Jamie would ask me to go to lunch with some regularity. He would invite a few other people from different areas of the bank in an effort to expand networks and be sure there was good communication. The lunches were held in the “Partners Dining Room.” Maybe someone from the Private Bank, Asset Management, Credit Cards, Back office, Legal… could be there. Yes, Jamie is an amazing leader. At one such lunch around 2007, Jamie asked, “Eric, what can I do for you and your business?” I let him know all was going very well, but I had one odd request.

“Jamie, the Credit Trading business has grown substantially and our trading floor has so many people the men’s bathroom just cannot accommodate the population, and it is disgusting. I let him know people leave the office to go to the bathroom and we don’t allow clients into the men’s room under any circumstances, as it is embarrassing. I told him there are regular leaks and the floor gets covered in toilet water. He did not believe me and said, “After lunch, we are going down there so I can see it for myself.” Now, I know damn well that the bathroom clogs up EVERY afternoon, so I was quite confident Jamie would be appalled when he walked into the hell we called the 8th floor men’s room.

As promised, we came down to my trading floor and people were buzzing that the big man was walking around. He pushed open the bathroom door and stepped right into toilet water as “Old Faithful” blew yet again flooding the entire floor. I wish I had a picture of Jamie’s face and a recording of his reaction, but I don’t. Jamie went ballistic and could not believe this was an issue at JPM. He said, “Eric, I will take care of this, and it will never happen again.” Jamie hired a full-time bathroom attendant (started the next day) to make sure things were in the proper order with any leaks dealt with immediately.

My team thought I was a complete hero for improving the horrific bathroom issues and bringing it up to the CEO of JPM which took some guts. The fact that Jamie stepped in toilet water made my request even more fantastic.

One smart ass salesperson decided to make a plaque on the men's room door. It said, "Eric Rosen Memorial Washroom." I was quite irritated. I announced that I appreciated the thought and effort, but “Memorial” suggests I am dead. It should be honorary or something. Everyone got a laugh out of it, and my name was on the door of the men's room for years. The team appreciated Jamie’s efforts to improve the work environment and morale improved due to his handling of a sticky situation. He always asked what he could do to help and actually did something about it every time. This request was strange, but Jamie intervened and made it better immediately.

I had the pleasure of working for Jamie for some time. I feel confident in saying he is among the best CEOs in the world, and his attention to detail is remarkable. He inherited a mess of companies when he took over JPM and in no time, Jamie combined entities, systems, infrastructure, cut costs, developed new risk systems, improved returns and became a world-wide leader in virtually every product JPM offers. I have seen Jamie in action first hand and it is impressive.

I believe we are all frustrated with the political environment and have been for some time. We have had a bad run of Presidents and feel it is time for Jamie to take his brilliance to DC and help fix the issues with his no-nonsense style of making things happen and having an immediate impact. He leads by example and would be a President the world would be proud of regardless of your political beliefs. The Rosen Report has some pretty good reach with influential people and I would be shocked if we could not kick start a campaign with some gusto. I will come out of retirement in a nano second to help him, because I feel we are in a dire situation and he can fix a lot of what is broken. There has been a real leadership void for too long, and we need a smart leader who gets to the right answer in a hurry. After all, within hours, he fixed a “crappy” situation for me and there is plenty of crap in DC which needs fixing.

Quick Bites

U.S. stocks slid Friday to close the week lower as investors digested a stronger-than-expected jobs report and its implication for monetary policy going forward. The Dow fell 349 points, or 1.1%, to 32,900. The S&P 500 slipped 1.6% to 4,109. The Nasdaq fell nearly 2.5% to 12,013. All three indexes finished negative on the holiday-shortened week. The S&P 500 fell 1.2% this week, while the Dow and the Nasdaq each lost nearly 1%. Investors parsed through the latest jobs report showing U.S. hiring remained elevated in May. Nonfarm payrolls added 390,000 jobs last month, the Bureau of Labor Statistics reported Friday. Economists expected 328,000 jobs added, according to Dow Jones. The 10-year Treasury yield was +2.5bps to 2.94% and oil continued to rally despite the OPEC production announcements. Oil was + 2.9% and closed over $120/barrel and nat gas ended up and closed at $8.53. A reader sent me the picture below from Orange County, CA. Gas prices are now up over 100% since Biden took office ($2.4/gallon to $4.85).

At the Wednesday JPM dinner, Jamie was asked about his concerns around the economy after the articles cited him calling for an “economic hurricane.” He reiterated his concern about rising rates, Quantitative Tightening and the impact on the economy, but he went one step further by saying something to the effect of: “I will be generous and suggest there will be a 20% chance the Fed can pull off a soft landing, but I don’t think it is that high. There is a 30% chance of a recession. There is a 30% chance of a bad recession and there is a 20% chance of something worse than that.” Historically, I have been the pessimist and was sounding alarm bells in JPM in the summer of 2007 before it was en vogue. Now, Jamie’s recent comments, inflation, rising inventories, consumer sentiment, lack of leadership in DC, supply chain issues, geo-political risks, a Fed behind the curve…. has me a bit more concerned. Jamie has access to more information on the consumer and corporate America than anyone. A reader sent me this picture which I thought was interesting. Porsche drivers for Dominos suggest times are tough.

Tesla shares dipped more than 9% on Friday after news that CEO Elon Musk plans a hiring freeze and 10% job cuts at his electric vehicle and renewable energy company. Reuters reported late Thursday on an e-mail Musk sent to Tesla executives saying he had a “super bad feeling” about the economy and called for the job cuts. This weekend, Musk softened his layoff targets.

Federal Reserve Vice Chair Lael Brainard told CNBC on Thursday that she doesn’t see the central bank taking a break anytime soon from its rate-hiking cycle. “We’ve still got a lot of work to do to get inflation down to our 2% target,” she said. Despite worries over inflation, Brainard expressed confidence otherwise in the economy. I have written about my inflation concerns for over one year and they can be found in my prior Substack articles, which are numerous. I do not see a “Fed Put” (Fed stepping in to prop up markets) without a massive deterioration in risky asset levels, and we are not close in my opinion. Although I believe we are seeing inflation peak, I am not convinced it comes down incredibly quickly just yet. I do see some demand destruction and harder comps relative to the low levels of 2020, but the higher rates and Quantitative Tightening will take to work through the system. This article is a summary of a Bank of America report which suggests inflation may not come down so quickly despite an aggressive Fed. Larry Fink, Blackrock CEO, also sees elevated inflation for years.

OPEC and its oil-producing allies agreed to hike output in July and August by a larger-than-expected amount as Russia’s invasion of Ukraine wreaks havoc on global energy markets. OPEC+ will increase production by 648,000 barrels per day in both July and August. The group has been slowly returning the nearly 10 million barrels per day it agreed to pull from the market in April 2020. I was a little surprised to see oil RALLY on the news. No, the OPEC increased production will not solve all issues, but felt it was at least a positive which should have resulted in some oil price sell off. Oil climbed 4.5% on the week despite this production news.

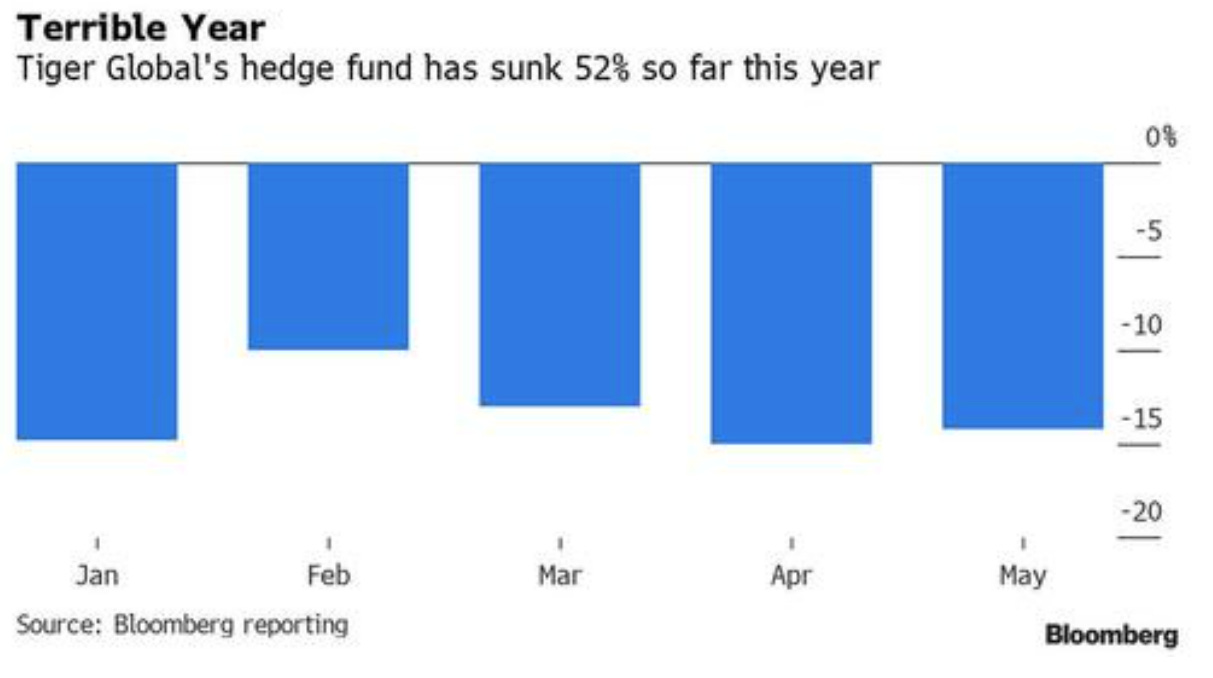

Chase Coleman’s Tiger Global Management suffered huge losses in May amid a tech-driven sell-off, making the hedge fund’s tough 2022 even worse. The growth-focused flagship fund at Tiger Global tumbled 14.3% in May, bringing its 2022 losses to over 50%, a source familiar with the return told CNBC’s David Faber. The firm’s long-only fund lost 20.6% in May, bringing its losses for the year to 61.7%. Coleman is one of the so-called Tiger Cubs, protegees of legendary hedge fund pioneer Julian Robertson. He had managed to produce double-digit annualized returns through 2020 by taking advantage of the explosive growth in technology. Despite the steep losses, Tiger Global is seeing five times more inflows than the amount of redemptions requests, according to a source. I know Coleman is impressive, but I do not know how he gets himself out of this one. He needs to make over 100% in the hedge fund to get back to his “high-water mark,” to generate full incentive fees. Coleman’s partner bought a high-profile Palm Beach mansion last year for over $122mm and the correlation between such insane expenditures and funds blowing up is quite high. I wish them luck making up the losses and know they have locked up money. I would like to see the private book and understand those marks, especially after the WSJ commentary: Tiger, which manages about $75 billion across its public and private-equity funds, said the value of its private investments had become a far larger proportion of its funds as its portfolio of public stocks continued to lose money. I am sure there are other large funds with major performance issues in 2022. In coming weeks there will be more headlines here.

Other Headlines

Pope Francis fuels new speculation on future of pontificate

Suggestion is possible retirement.

A paradigm shift has begun in markets, says Morgan Stanley’s Ted Pick. Here’s what to expect

I found this CNBC article interesting a worth the read.

Is a Recession Coming? Corporate America Grows Pessimistic on the US Economy

Lifting Tariffs on Goods May Make Sense, US Commerce Chief Says

Raimondo says president open to ideas that will tame inflation

Some steel, aluminum duties to stay to protect US workers

More than half of Americans say they are ‘pro-choice,’ the most since 1995, Gallup finds

How much will this impact the elections? According to polls I have read, less than I would have thought. This WSJ article had good charts.

I only take meds when necessary. I am crazy on this topic.

Seattle police stopped investigating new adult sexual assaults this year, memo shows

“The community expects our agency to respond to reports of sexual violence,” Sgt. Pamela St. John wrote, “and at current staffing levels that objective is unattainable.” Who in the hell would move to this city?

Cops ID NYC suspect with 43 prior arrests in unprovoked stabbing outside pub near MSG

As long as criminals do not face consequences, the city will be a mess.

Abbott Nutrition restarts baby formula production in reopened Michigan plant

Interviews suggest it will take time for deliveries to take place (weeks).

California is rationing water amid its worst drought in 1,200 years

Why do people live here again? Earthquakes, fires, floods, droughts, taxes, high cost of living, highest gas prices in the country, overly woke, COVID mandates…. This article talks about nearly $10 gas. Average Californian drives 14k miles and the average car gets 25 MPG. That means they are consuming 560 gallons of gas/year per car. At $9, that is over $5k. Houston, we have a problem. More than one car per household.

Biden administration will cancel student debt for half a million students from Corinthian Colleges

Saudi Arabia's $500 Billion Plan For World's Largest Buildings Ever

That bites! 8 in 10 delivery workers admit to eating a customer's food - Study Finds

Tulsa gunman targeted surgeon he blamed for pain

Something has to give. The mass shootings are out of control.

Teachers, parents want discipline as NYC student suspensions fall

Disturbing article about lack of consequences for bad behavior. One kid was assaulted 5 times in middle school. Suspensions are -42% since 2017 given new rules and kids are running wild. I am adamantly opposed to rules which cause havoc in schools. Talks of teachers being spit on with little or no consequences. What about the kids who actually want to learn? Who benefits by problem kids running wild? Surely not the teachers or students who want to attend college. I sent Jack to PS-6 10 years ago in NYC. Nothing could get me to send a my kid to public schools in NYC today.

Missouri mom beaten by teen girls who had tried to fight her 16-year-old daughter

What the hell is wrong with kids today? What are the consequences here? I want jail time. They need to be tried as adults.

Amber Heard is ‘broke’ due to mounting legal fees, lavish spending: sources

Putin Treated for Cancer in April, U.S. Intelligence Report Says

I wrote of Putin’s health on 2-27-22 and suggested he was quite ill and compared pictures. This Newsweek article goes further and also suggests there was a failed assassination attempt on March.

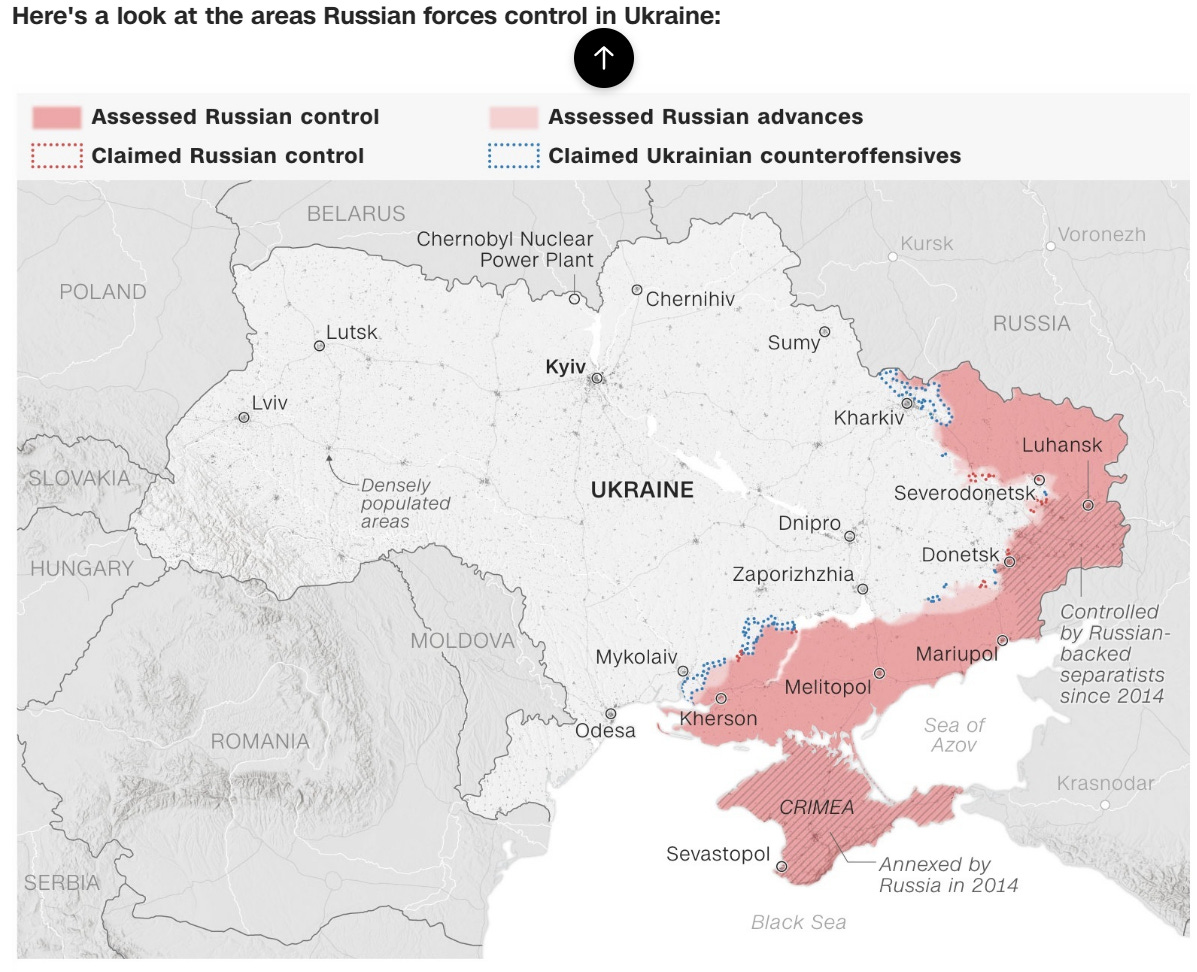

20% of Ukraine is under Russian control, President Zelensky says

Virus/Vaccine

The data is improving, but includes the Memorial Holiday which will skew data to appear it is better than actual. I need to see cleaner data before I get too excited as many doctors/labs were closed for the long weekend.

I am all for vaccines and being smart. I do not feel isolation and mask mandates were the answer and Cornell data suggests as much.

Real Estate

Jack and I went to Promenade Shoppes in Saucon Valley, PA. There are 77 storefronts in the mall which includes a movie theater, Fresh Market, Barnes & Noble and a bunch of restaurants and clothing stores. One third of the stores are for rent, including some of the best locations in the front of the mall. I feel places like NYC will be very interesting over the next 24 months as leases come due, especially for office space in Midtown. I imagine the re-set prices will be materially lower.

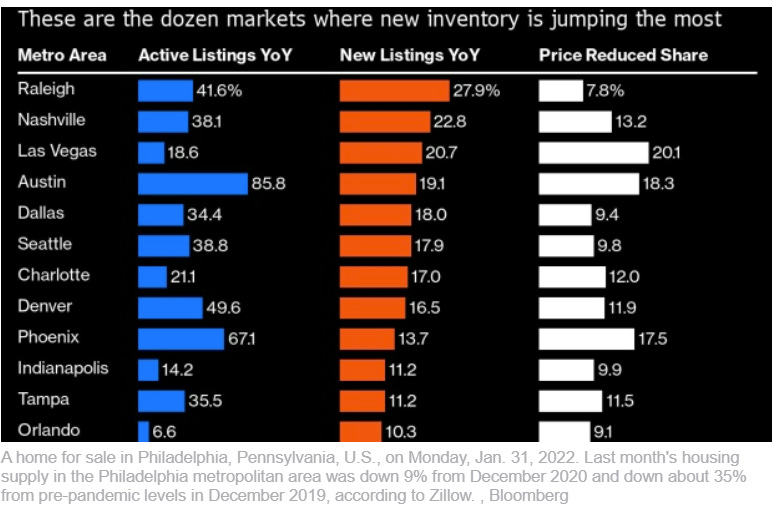

Home listings increased for the first time since June 2019, according to Realtor.com data, suggesting the US housing supply hit a turning point last month. The number of active listings rose 8% year-over-year in May. The largest increases in new listings were in the West and the South, in cities including Austin, Texas, and Phoenix, Arizona. Listings remain 48.5% below their May 2020 level, and price increases have accelerated in recent months. Listings remain 48.5% below their May 2020 level, and price increases have accelerated in recent months. I believe the housing high is in and we will see continued inventory increases in coming months.

An oceanfront Gulf Stream estate traded for $27.5 million, nearly twice its sale price one year ago. James and Kimberly Caccavo sold the six-bedroom, seven-and-a-half-bathroom home to James and Estee Sausville. The Caccavos paid $14.9 million for the property in May 2021, marking an 85 percent increase compared with the latest sale. The 6,117-square-foot Gulf Stream house sits on a 0.8-acre lot. It was on the market with William Raveis Real Estate’s Paula Wittmann and Michelle Noga for nearly $30 million. Mitch Frank with Echo Fine Properties represented the buyers.