Opening Comments

My last post was about the best movie songs of all time and I received quite a bit of feedback about missed songs. The most opened links were the short video of Cristiano Ronaldo’s lucky break and Tom Brady’s health advice. Some of the songs I “missed” according to readers include: Ill Soce Sueno from the Fifth Element, I’m Alright-Caddyshack (Kenny Loggins again), songs from the movie, the Big Chill, Eye of the Tiger from Rocky III, I Melt With You from Valley Girl, In the Air Tonight from Risky Business, and many others. One reader came up with his own 20 song list.

It was my wife’s birthday on Friday and we went to Miami for dinner at Catch in the Continuum Building in SOFI. I will write up a full report; for now, I’ll say it is hip and pretty solid but ain’t no bargains served there.

When I left New Orleans last week, I had to fly the worst airline of all time, Spirit. I booked a “first class” aisle seat for $429/one-way. First class on Spirit is a regular seat on Jet Blue. As I was boarding the crappy airline, they called me to the podium to tell me my seat changed and gave me a window seat without giving a reason and not asking me if I would switch. Only fly Spirit in an emergency. There are no bargains and the service is awful. The stock is down sharply and they are talking about bankruptcy. Maybe bad service, high prices, crap planes and bad customer experiences have something to do with it. Last September, I wrote a piece entitled, “Spirit Airlines Has No Spirit.” I stand by my comments.

Another storm forecast to hit Florida’s west coast this week, which could mean the Tampa area gets hit again.

Markets

Port Strike Settled

China Stocks on a Tear

Ackman Crushes Harvard

Refinancing Markets Picking Up Steam

$95mm Palm Beach House

Rock Center Refinancing?

Housing Turnover at 30 Year Lows

Picture of the Day-World’s Top Tax Havens

Great chart by the Visual Capitalist shows the world’s top tax havens. Hong Kong and Switzerland dominate the chart.

Reliance on Being Connected

I think about how much our lives have changed since the invention of the internet and smartphones. I had a nice childhood playing outside every day-soccer, football, basketball, golf, surfing, tennis, stickball… the list was endless. I had no video games, smartphones or computers. My first cell phone or computer was in 1997 at the age of 27. I went to college without a computer and turned in my papers using handwriting. Wow, I sound ancient.

Since then I have been disconnected a few times in my life. I went to a small island near Fiji called Namotu that barely had any connection. It was during Hurricane Sandy in 2012 and I was so worried about my family in NYC with the little TV service we had on the island and barely one bar on my phone. It was a long week with almost zero speaking ability with my family.

I have been on fishing trips where I am in the ocean for a couple of days with no connection and it feels exhilarating and concerning at the same time. My instinct is to check my phone for that important email or text, only to realize, with no connection, there are no new messages. I must have instinctively checked my phone 15 times an hour, only to find zero new messages given no connectivity.

South Florida has a lot of storms creating power outages and surges. Well, on Tuesday, we had a big power surge that fried my surge protection equipment in my AV closet rendering it useless. I was without TV, WiFi or a hard connection for internet Tuesday and Wednesday. I did have my network connection for my phone but was unable to write the report and respond to messages appropriately on a computer.

No, it was not a freeing feeling that I felt. It was one of frustration and despair. I was so livid about something so small in the scheme of things. That’s when I realized we all have become too reliant on “being connected,” especially young kids. The 24 hours of challenge was a nice reminder about how lucky we are to have so much technology at our fingertips. We are so much more efficient for having such powerful technology, but too reliant on it.

Quick Bites

The payrolls data showed 254k jobs created relative to 150k expected and the unemployment rate fell to 4.1%. Government payrolls hit another record as well. Was 50bp cut the right move? I had suggested 25bps was the right call. Stocks rallied post payrolls and finished at or near the highs but Treasuries were hit pushing up yields sharply. The 2-Year is now 3.92% (+21bps on day) and the 10-year yield is 3.97% (+12bps on day). Since the Fed Cut rates a couple of weeks ago, the 2-year is +33bps and the 10-year is +33bps. Larry Summers suggested that the 50bps Fed cut was a mistake. My investing hero, Stan Druckenmiller, was also critical of the Fed. The futures market is pricing in 46bps of cuts by year end and prior to payroll data, it was 59bps of cuts priced in by year end. Global food prices were +3% from August and +2.1% from last September. U.S. crude oil jumped as Biden comments on possible Israel retaliation on Iran pushing oil +5% on Thursday and finishing the week +9.1% to $74.6/barrel.

CNBC reported that the port strike ended and the longshoremen agreed to a tentative deal on wages by extending the existing contract until January 15th. It looks as though the contract will give the workers a 61.5% increase over 6 years, although they sought 77% over 7 years. However, I believe the most important segment of the contract was the automation angle and I cannot find anything on that side of the agreement. This CNBC article suggests that the deal is far from done and automation is the big hurdle in negotiations. Workers wanted no automation to preserve jobs despite U.S. ports being antiquated. Ports in Europe and Asia are far more efficient than the US. I would never sign a deal halting automation. As an aside, Harold Daggett, the union boss who has threatened to “cripple” the economy over longshoremen’s salaries and banning automation actually is quite wealthy. He lives in a 7,000 sq ft mansion in NJ on 10-acres and drives a convertible Bentley.

China stocks have been on a tear. Beijing’s announcements of economic support last week have fueled China’s CSI 300 blue-chip index to rally over 25% in a nine-day winning streak. It popped over 8% on Monday to their best day in 16 years, before the markets were closed for a week-long holiday. Then, Hong Kong stocks dropped on Thursday, ending a 6-day winning streak and sparking fears that China’s stimulus rally could have started to fizzle out. I will never invest in China. I do not trust the government or the market there. I have missed opportunities but sleep better at night. I believe the China stock market has been closed since Sep. 30th for “Golden Week.”

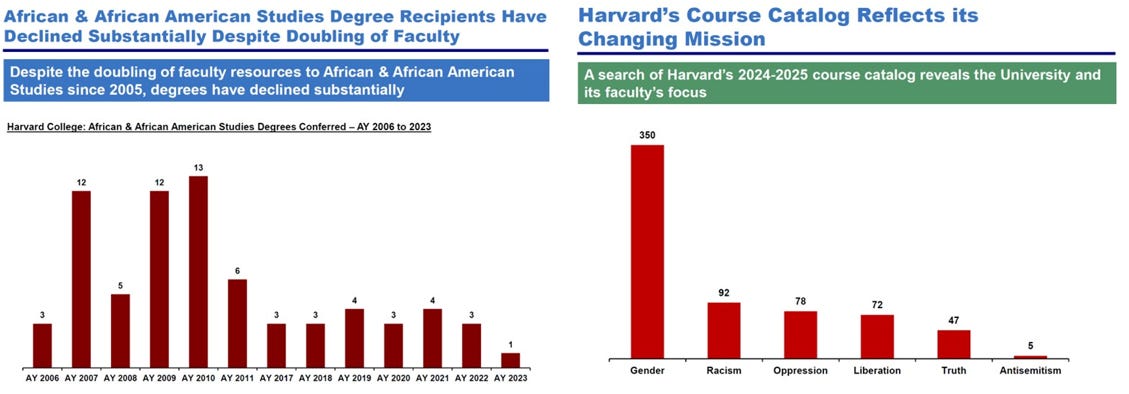

To be clear, I was NOT a fan of Bill Ackman for a long time. I thought he was a bit too conceited, and despite not knowing him personally, I did not like him. Well, that has changed based on his leadership about antisemitism and calling out institutions for bad behavior. In his latest rant, he crushes Harvard for good reason. Here is a nearly 50-page presentation from Ackman on the problems Harvard currently faces. I grabbed the summary from Whitney Tilson’s newsletter below. Nothing could get me to send my kid to Harvard. Whitney is a prolific publisher on countless topics.

While the number of students and faculty has barely grown over the past two decades, administrative staff is up 40% and the all-in cost to attend four years has doubled to $307,000.

“Harvard does not generate positive cash flow. Its operating margin would be negative 40% without the distributions from its endowment and the General Operating Account (“GOA”).

“In an anonymous survey, 77.1% of Harvard’s faculty identify as liberal or very liberal and only 2.9% of Harvard’s faculty identify as conservative or very conservative.”

“Harvard ranks 251st out of 257 colleges in the 2025 college free speech rankings published by the Foundation for Individual Rights and Expression.”

“Harvard’s average GPA has increased from ~2.6 in 1960 to ~3.8 today” – that’s right: the AVERAGE grade is a 93 or A-.

2024 Election

Although I am not convinced Helene is Biden’s Katrina, I do not believe this administration is handling the storm recovery particularly well. Many have slammed the administration for the response and Musk is no different.

Key takeaways from special counsel Jack Smith's major filing in Trump's 2020 election case

11 damning details in Jack Smith’s new brief in the Trump election case

These stories do not read well for Trump. However, CNN’s Elie Honig (legal analyst) called the Jack Smith filing a “cheap shot,” for interfering with the election. Some of the evidence is not admissible. Honig believes Smith has a strong case but feels rules were broken on Jack Smith’s tactics.

Biden-Harris Admin Used FEMA Disaster Funding For Illegal Immigrants

Northern Border Patrol Sector Records More Apprehensions This Year Than Last 17 Years Combined

Agents in the Swanton Border Patrol sector, which covers Vermont, New Hampshire, and part of New York, recorded 19,222 illegal immigrant apprehensions in fiscal year 2024, marking a drastic uptick from previous years. The illegal migrants came from 97 different countries around the world.

Thousands of noncitizens removed from voter rolls, dozens of lawmakers want answers from Garland

Why are we even discussing this topic? On what planet should illegal immigrants be allowed to vote in US elections?

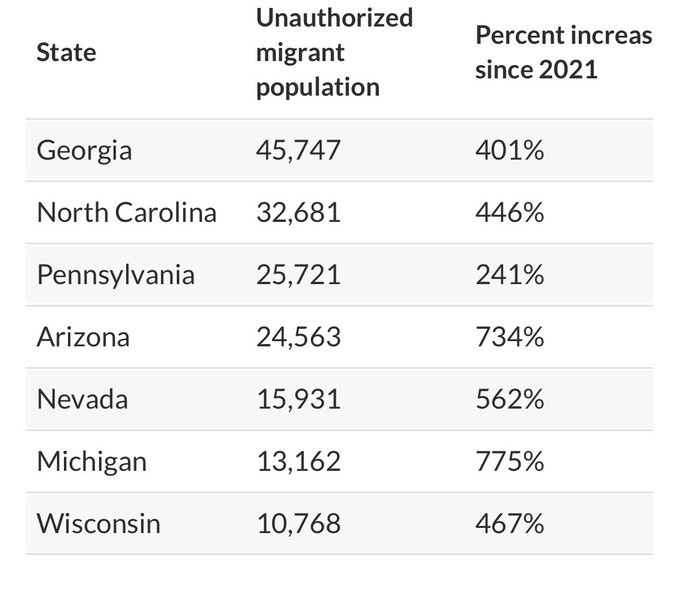

Increases in Illegal Immigration populations in Swing States under the Harris/Biden Administration

Harris holds a 66-electoral-vote lead over Trump, calculates prominent data scientist

Elon Musk Gave Tens of Millions to Republican Causes Far Earlier Than Previously Known

The donations were to groups with ties to former Trump aide Stephen Miller and to Florida Gov. Ron DeSantis’s presidential bid

Jamie Dimon denies Trump’s claim that JPMorgan CEO has endorsed him

Trump, why would you make such an idiotic statement that were not true knowing Dimon would come out and challenge you?

Trump Promised to Release His Medical Records. He Still Won’t Do It.

If you run for President, you should disclose full medical records and tax returns in my opinion.

As fraud scandals erupt in Minnesota on Gov. Tim Walz’s watch, accountability is in short supply

Surprising that CNN is reporting this one.

Pennsylvania Closes Down Voter Registration on Night of Trump’s Return to Butler

How is this not election interference, closing voter registration during a Republican rally? Would PA do it during a Harris rally?

Israel/Middle East

Iran warns of ‘unconventional response’ in case of new Israeli attack

I feel Israel needs to attack Iranian nuclear facilities before it is too late. I have major concerns that if these terrorists get a nuke they will use it on Israel.

That did not take long. YEAH!

Netanyahu Says 'Shame' On Macron For Urging Halt To Arms Supply To Israel

Tel Aviv shooting: Mom turns human shield, dies protecting 9-month-old son

How Biden/Harris Blew-Up The Middle East In Five Easy Steps

Kamala and Biden said, “Don’t” to Iran about attacking Israel. Clearly, it was not a very effective warning. Iran does not respond to weakness and I just do not feel this administration shows strength. Iran hit Israel with almost 200 missiles after the strong words from this administration.

Biden discourages Israel from striking Iran’s oil industry, crude posts best week in more than year

Iran’s supreme leader declares Israel ‘won’t last long’ and that Oct. 7 attacks were ‘legitimate’

Masked attacker holds U. Michigan rabbi, students at gunpoint after Rosh Hashanah meal

FBI and DHS warn that Oct 7 anniversary could incite violence in US

Ted Cruz Faces GOP Rebellion in Texas as Republicans Back Opponent

Other Headlines

He feels the Fed rate cuts and China stimulus are temporary and we are headed for a major correction.

Traders Bet On $100-a-Barrel Oil as Middle East Risks Escalate

Almost 27 million barrels of Brent $100 calls traded

Nvidia CEO Jensen Huang says demand for next-generation Blackwell AI chip is ‘insane’

Elon Musk’s X is worth nearly 80% less than when he bought it, Fidelity estimates

Rivian shares fall after EV maker slashes production forecast

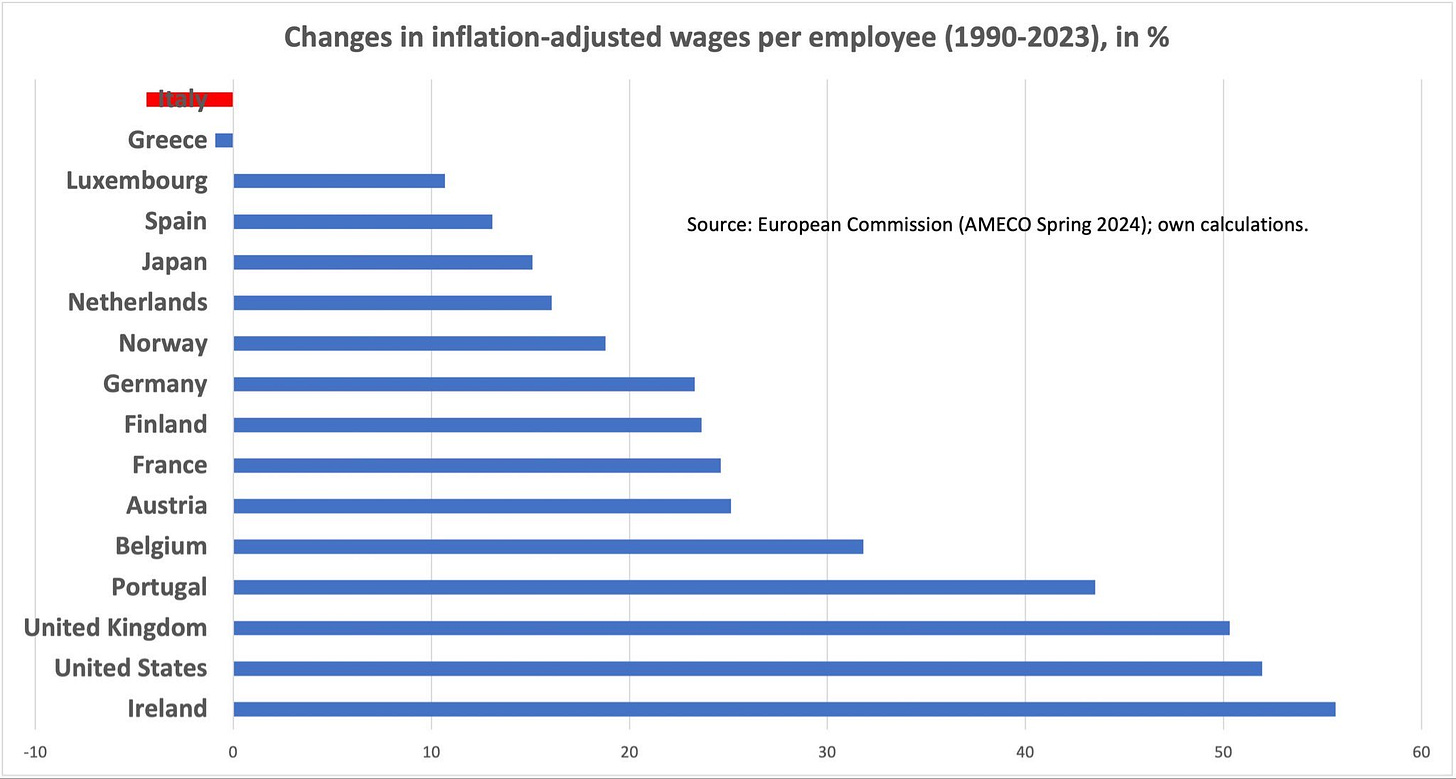

French president tells fellow European leaders the bloc is falling behind the US and China because of over-regulation and under-investment. OVER regulation and under-investment. Sound familiar?

AI Can Only Do 5% of Jobs, Says MIT Economist Who Fears Crash

I think he is a bit low. Incredible plan for world’s first AI passenger plane with NO PILOT where travelers can sit in the cockpit & enjoy the view. I have no interest in flying on this plane.

CNBC’s No. 1 financial advisor has a golden rule: ‘We do not time the market’

Seattle judge releases accused killer 27 hours after 65-year-old military veteran stabbed to death

Sean 'Diddy' Combs Accused of Sexually Abusing 9-Year-Old Boy as 120 People Allege Abuse

A lawyer representing victims suggests half are men and 25 are minors. A “Diddy” hotline receive 12k calls in 24 hours.

Ex-NY Gov. David Paterson, stepson attacked by gang of young suspects while walking dog on UES

The former Governor of NY was attacked while walking with his son on 96th Street before 9pm. NYC needs consequences for crime and a new D.A.

Dad hires bodyguard for NYU freshman daughter as crime surges on campus: ‘It can get scary’

I lived at 20 5th Avenue in the Village within blocks from NYU. It has become a disgusting place to live. Washington Square Park is a drug den.

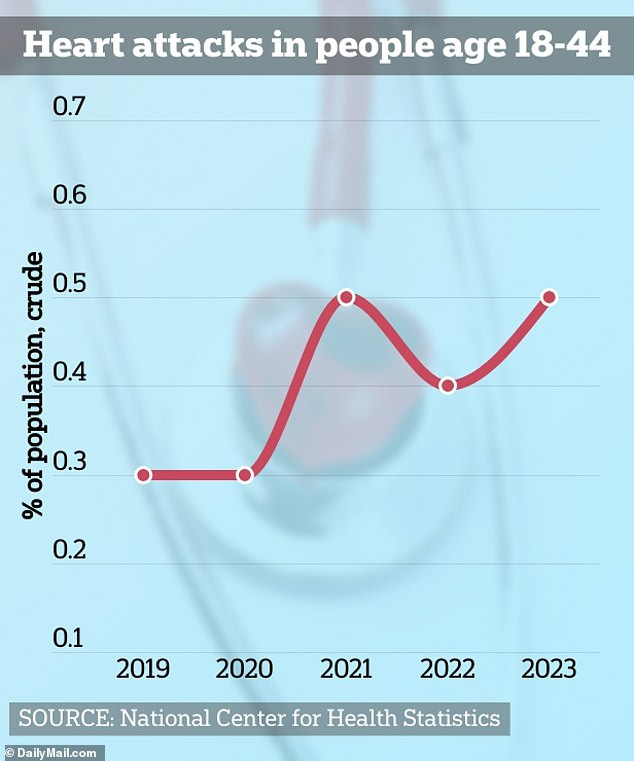

There are many factors, but I believe the COVID-19 vaccine plays a big part. This short video by a cancer researcher is scary as well.

Migrants Enrich UK With Massive 51% Surge In HIV Cases To 15-Year High

Two Walmart Heirs Top $100 Billion Wealth for the First Time

Rob, Jim and Alice Walton have gained $89 billion this year

Alice Walton is nearing 12-figure mark as Walmart shares climb

Post by Musk about Starlink.

What could possibly go wrong here?

A junk dealer found a painting in a basement. Experts say it’s an original Picasso

Real Estate

This Bloomberg article suggests that with mortgage rates near 6%, we may see a refinancing wave. Mortgage refinancing volume is picking up sharply (3x higher than last year). I spoke with a mortgage broker who told me things are far busier in the past week. Civic Science conducted a survey at the end of September and it showed one in six planned on refinancing a mortgage or personal loan.

This WSJ article outlines a $95mm listing on Palm Beach Island. The 16k ft house is on the Intracoastal and was last purchased for $21.3mm in 2018. The article suggests $25mm was invested into the house. The inside looks nice but the outside is not my taste. I keep repeating that the high end in Palm Beach and Miami remains hot. There is limited inventory, especially for new homes or those that are nicely redone. People want move-in condition. Lots and older homes that need a lot of work are harder to sell. People will pay a premium to move in. Approvals on Palm Beach are brutal and it can take 2 years to get your plans approved and permits to build. Here is the listing for the $95mm home.

Interesting WSJ article entitled, “Can Rockefeller Center Rise From the Ashes of New York’s Office Market? The New York office and retail complex’s owner, Tishman Speyer, is looking for $3.5 billion of debt, according to media reports. Some of the cash is needed to pay off a roughly $1.7 billion commercial-mortgage-backed-securities loan that matures in May next year. Details about the structure and timing of a deal are scant, but if Rockefeller Center taps the CMBS market for the full amount, it would be a monster refinancing. The last time an office owner asked for this much money was in mid-2021, before interest rates began to rise, when Manhattan’s biggest office landlord SL Green got a $3 billion loan for its One Vanderbilt tower. The property had a 95% occupancy rate at the end of June, which is high for Midtown Manhattan. It has a comfortable debt-service coverage ratio of around 2 times and earns cash from multiple sources including its retail and office tenants, the NBC Studios, Radio City Music Hall and its famous ice rink, analysts at Moody’s CMBS say.

Only 25 out of every 1,000 US homes changed hands between January and August this year, the lowest turnover in at least 30 years. Over the last 3 years, the rate of home sales has declined by 37.5% and remains ~30% below pre-pandemic levels. Los Angeles had the lowest turnover among metros where just 15 out of every 1,000 homes changed hands in the first 8 months of the year. Meanwhile, the rate of homes being listed for sale hit 32 out of every 1,000, the lowest in at least 12 years.

© 2024 The Rosen Report LLC. All rights reserved. Does not constitute investment, financial, legal, or tax advice. Consult with your lawyers and professional financial advisers. Rosen Report™ #723 ©Copyright 2024 Written By Eric Rosen.