Opening Comments

Wednesday marked my 25th trip to Miami this year. This is more than my first four years combined and is a testament to the amount of action going on down there today. So many of my friends have moved to Miami or are visiting on vacation or business trip. So many new restaurants as well. The caliber of the new Miami crowd is incredibly impressive. Young, well-educated, successful, interesting people are moving down in droves. Historically, NYC would be more of a draw, but for all the obvious reasons, Miami is attracting people who historically would never consider it. For, me, I can’t live there as it is far too congested and the golf is limited, but the place is on fire and the rents are showing that to be the case. I ate at the Faena in Miami Beach, and it is a pretty cool scene and the food at Los Fuegos was solid. The drive down only took 1:15 (express lane) despite being rush hour. The drive back at 10:30pm took 1:55 due to I-95 lane closures for construction.

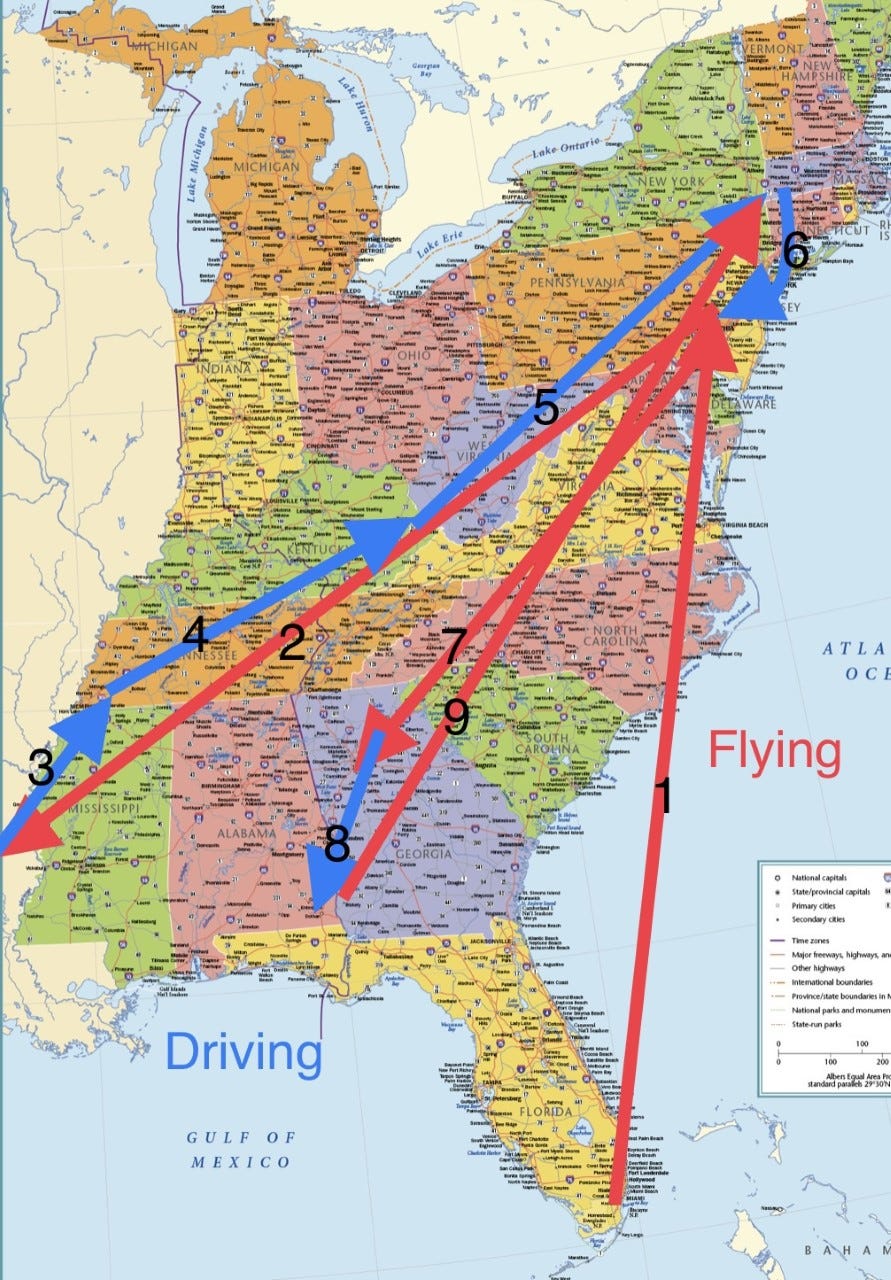

Jack and I start our golf tournament journey early Monday am. Philly, Hershey, Saucon Valley, NYC, Louisiana, Memphis, Kentucky, NYC, Alabama, Philly, NY in the 1st three weeks. The glamorous travel will be outlined in upcoming reports. Eric Rosen hanging out in laundry mats in Kentucky and Alabama sounds like a blast, but for some reason, I am not so fired up. Driving much of the trip as our destinations are not near airports. The map below outlines the travel from May 30th until June 26th, assuming I don’t have a nervous breakdown before then. Red is flying and Blue is driving. In a shocker, I received an email from someone who knows Ashland, Kentucky. What are the chances of that one?

Picture of the Day-Russian Propaganda

Don't Talk Politics or Date Your Dental Hygienist...TRUST ME

Quick Bites

Markets

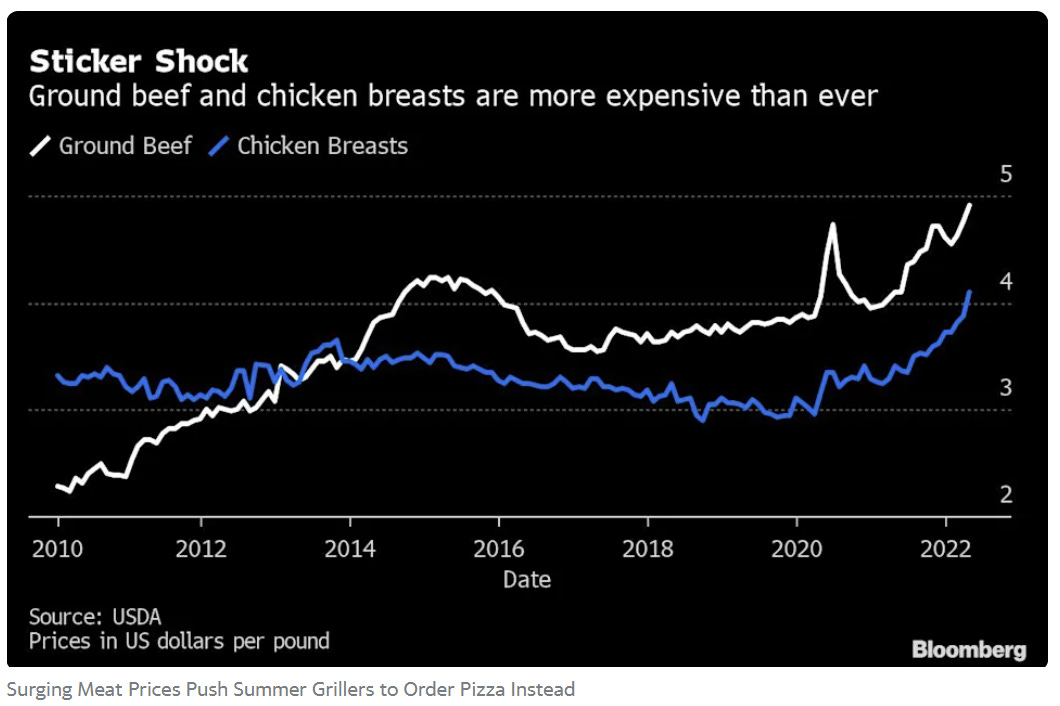

Demand Destruction

SPAC Bust

Consumer Confidence

Start-Up Blues

Massacre Headlines

Other Headlines

Virus/Vaccine

Data

Death Tolls By President-I Don’t Blame Either

Real Estate

Boca Mansions

Sun Belt City Population Growth

Housing Supply

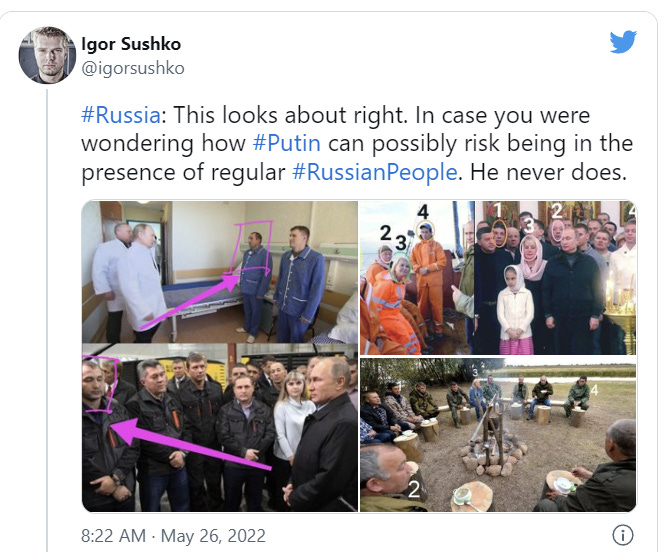

Picture of the Day-Russian Propaganda

Russian President Vladimir Putin may have staged a recent visit to a military hospital in Moscow to meet with wounded soldiers, according to eagle-eyed online users who claimed to have recognized one of the “patients” from a previous event. But a day later, Adam Rang, a self-described “counter-propaganda” activist living in Estonia, tweeted that one of the soldiers in the hospital looked eerily familiar. “Putin met with a wounded soldier, who by a strange coincidence, was also a factory worker he previously met,” Rang stated. There is so much propaganda. Hard to know what is real anymore. I suggested in February that Putin was ill and I continue to believe that to be true.

Don't Talk Politics or Date Your Dental Hygienist...TRUST ME

As my readers largely know by now, I can talk with anyone. I feel it is a core competency. Well, I went for my teeth cleaning the other day and sat down in the chair and realized the hygienist was either Russian or Ukrainian. I had just read that there had been a recent assassination attempt on Putin and mentioned that and she said, “I don’t watch the news or know anything about it.” I did not say anything else and she came back with aggression asking how I could possibly have the view about Putin. When I tried to explain the article I read, she said, “I don’t want to talk about politics it is inappropriate.” I was not upset and moved on, after all, she has sharp objects pointing in my mouth. She went bonkers in there with those pointed objects, and I was bleeding pretty good. Clearly, our brief and what I felt was a minor conversation set her off. Note to self, don’t speak any politics when someone has sharp objects in your mouth. I am still sore days later.

The incident last week reminded me of a story from 1993. I was working at Continental Bank in Chicago and went to the dentist for my check-up. The hygienist, Kelly, was adorable and in making conversation, asked what she was doing that weekend. It was not meant to ask her on a date. She said, “I am dying to learn how to Rollerblade; Do you know how?”

My young idiot self responded, “I know how to rollerblade pretty well.”

She said, “Would you show me?”

I responded, “Sure. It sounds like fun.” At that age, stupidity reigns. Her eyes lit up and apparently, I asked her out on a date for the weekend. I met Kelly at the rental store and set her up with Rollerblades and we went to the park for a couple hours of blading on the rare nice summer day in Chicago.

Afterword, we had a late lunch and went our separate ways. We got together another time for dinner a couple weeks later, and that was it. I was dating quite a bit at the time, and don’t recall why things did not materialize. But I was 23 years old, so I think that explains it.

I had forgotten about our couple dates and it was 6 months later and time to go for my dental check-up. Clearly, Kelly was not happy that our two dates did not lead to something more. I was accosted in there. I mean, I needed a blood transfusion after the vicious attack with objects which should be considered deadly weapons. Kelly was all smiles as she “inadvertently” dug death utensils into my gums while I squirmed like a stuck pig. It seemed like a 3 hour ordeal, but it was closer to 20 minutes. I think Kelly’s favorite was the “Jacquette Scaler” which she used to carve me like a pumpkin.

Just before the dentist came in, she said, “Maybe you will call me?” I was thinking to myself, “Are you kidding me right now?” She seemed more like Glenn Close in Fatal Attraction than a dental hygienist. I could see her boiling my bunny in the kitchen (crazy scene from the movie). How about this Kelly. You are the last person I would call after you destroyed my gums in a vengeful rage. The dentist came in and saw a fair amount of blood on the bib and in the sink and made a comment. Kelly left the room while I sat there trying to think of what to say about his lunatic employee. I did not want to get her fired, but also never wanted to see her again.

I decided it was in my gums best interest to find another dentist after my traumatic ordeal. So you heard it from the Rosen Report, don’t talk politics or date your hygienist. Trust me, it is dangerous and painful and your gums will thank you for it.

Quick Bites

Investors got a reprieve from a painful sell-off as the Dow and the S&P 500 rallied to close their best weeks since November 2020. The Dow jumped 576 points, or nearly 1.8%, to 33,213. The S&P 500 rose about 2.5% to 4,158. The Nasdaq was the outperformer, helped by strong earnings from software companies and a fall in the 10-year Treasury yield. It ended the day up 3.3% to reach 12,131. Friday, the core personal consumption expenditures price index, the Fed’s preferred inflation gauge, rose 4.9% from a year ago in April, in line with estimates and a deceleration from March data of 5.2%. To me, this is good news. I had suggested that inflation was peaking and although this is a data point, it suggests we are heading in the right direction on inflation, but data can be spotty, so it would be good to see the trend continue. The slowing inflation (still elevated) suggests the Fed may not need to be as aggressive on rates if inflation continues to moderate. This article gives a view on inflation and is entitled, “Goldman says signs that inflation is peaking could be a positive for stocks.” The Dow finished up 6.2% for the week and snapped its longest losing streak, eight weeks, since 1923. The S&P 500 is 6.5% higher and the Nasdaq is up 6.8% on the week. The 10-year-Treasury rallied 8bps on the week to close at 2.74%. Oil was $2 higher on the week and closed at $115, while natural gas was incredibly volatile and traded as high as $9.39 on the week before closing at an elevated $8.71. Despite the sharp equity rally this week and Friday, crypto was under pressure. BTC closed at $28.8k and ETH at $1.7k. The crypto market fell $500mm or 29% in May.

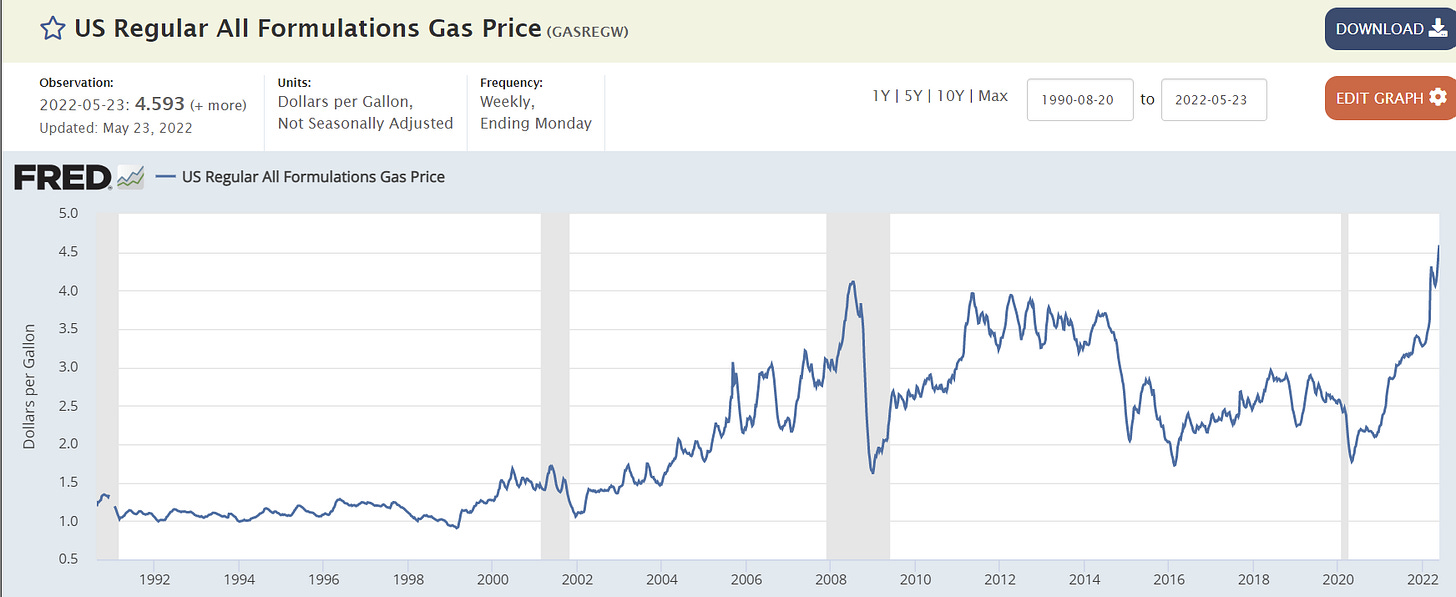

This article is about demand destruction on gas due to high prices and I agree with it. I wanted to take my boat to the Bahamas, but I actually considered $6.5/gallon gas at the Marina (more in Bahamas) and felt a one-day trip was not worth the money. I had never once considered that in the past when I was paying $3 or $3.5/gallon for gas. Demand on a four-week rolling basis has hit its lowest level during this time of year since 2013, excluding the pandemic-outbreak period in 2020, according to data from the Energy Information Administration compiled by Bloomberg. Compared with year-ago levels, demand is down roughly 5%. Prices at gas stations across the US have hit record after record over the past two weeks, dashing some hopes for a driving season that approaches pre-COVID-19 levels, AAA previously predicted.

The SPAC boom brought a wave of companies to the public markets promising years of rapid growth and profits to investors. Two years since the boom began, many of these companies are already warning they may go bust. At least 25 companies that merged with special-purpose acquisition companies between 2020 and 2021 have issued so-called going-concern warnings in recent months, according to research firm Audit Analytics. Among those to issue the warnings—which come when a company’s auditor determines there is “substantial doubt” about its ability to stay afloat for the next 12 months—are a company planning to build an air-taxi network, numerous upstart electric-vehicle companies and a scooter-rental business. This piece by the law firm, Skadden Arps, discusses the proposed significant changes to rules affecting SPAC’s.

University of Michigan Consumer Confidence Index is at 11 year lows. The recent drop was largely driven by continued negative views on current buying conditions for houses and durables, as well as consumers’ future outlook for the economy, primarily due to concerns over inflation. At the same time, consumers expressed less pessimism over future prospects for their personal finances than over future business conditions. This CNBC article discuses inflation and consumer confidence as well. Of note, confidence is materially lower than the spring of 2020 where the pandemic panic was in full swing, and today levels are in-line with the Global Financial Crisis. This is a good WSJ article entitled, “Shoppers Are Fretting. Stores Are Listening,” and discusses changing consumer spending habits due to inflation. This Bloomberg article discusses $45bn of extra inventory at major retailers as spending habits are shifting. The last picture was sent by a reader, Jeff, and I thought it was funny.

This is an interesting CNBC article about venture and the challenges of raising money today given the carnage in the space. I have been discussing the impact of funding drying up leading to layoffs, hiring freezes, lower valuations… For those interested in the topic, I think you will enjoy it. I would not invest in a business plan that is not fully funded. Slow your hiring! Cut back on marketing! Extend your runway! The venture capital missives are back, and they’re coming in hot. Y Combinator, the start-up incubator that helped spawn Airbnb, Dropbox and Stripe, told founders in an email last week that they need to “understand that the poor public market performance of tech companies significantly impacts VC investing.” “Companies that recently raised at very high prices at the height of valuation inflation may be grappling with high burn rates and near-term challenges growing into those valuations,” Shakir (Lux Capital) told CNBC in an email. “Others that were more dilution-sensitive and chose to raise less may now need to consider avenues for extending runway that would have seemed unpalatable to them just months ago.”

I wrote about the horrific school shooting in Texas in my last report, but there is a lot of troubling news out since. I am going to insert headlines and links. Clearly, MANY mistakes were made. Lots of warning signs missed and the police did not respond properly to this tragedy in my opinion. The shooter had been known by police, was violent towards women and had some troubling postings on social media. There is too much gun violence between the mass shootings and daily shootings in inner cities. I am supportive of gun ownership, but believe more stringent background checks are required for assault rifles and longer wait times. This does not solve the countless crimes of guns purchased illegally. In the Texas incident, it appears the police response times are questionable, and what happened once on the scene is even more troubling. They waited by the door of the class for up to 45 minutes before going in according to reports.

Texas school shooter Salvador Ramos was 'violent towards women'

Uvalde Shooter Fired Outside School for 12 Minutes Before Entering

Uvalde Police Made ‘Wrong Decision’ in Waiting to Storm Shooter, Says Texas Official

Texas Gov. Abbott 'misled,' 'livid' about cops' delayed response to school shooting

Student who survived Texas school shooting recalls gunman saying: 'You're all gonna die'

11-year-old school shooting survivor called 911, smeared blood on herself, played dead

Texas schoolgirl shot when gunman heard her yelling for help 'after police told her to'

Other Headlines

As Biden administration leans toward $10,000 in student loan forgiveness, advocates push back

AOC swings at the White House for weighing only $10,000 in student debt relief: 'We can do better'

I paid for college myself. I am not sure why the US government (taxpayers) should pay for people who went to college and cannot pay the loans back.

Drivers in this city pay $3,700 more for car insurance than the national average, data shows

Biden Admin: K-12 Schools Must Put Boys In Girls’ Bathrooms To Get Federal Lunch Money

Call me crazy. I do not want my 14-year-old daughter in a bathroom with a biological boy.

Top SF high school sees record spike in failing grades after dropping merit-based admission system

Who could have possible seen this one coming? Take away merit based acceptance to a top high school in the nation and allow a lottery system to for entry for hundreds of students and grades plummeted? “D” and “F” grades tripled.

LaGuardia High School in NYC in uproar over ‘equitable’ academics

North Carolina preschool uses LGBT flashcards depicting a pregnant man to teach kids colors

Do we really need to show a pregnant man to preschool kids? In the next year, out of 162mm males in the US, how many will get pregnant?

I loved movies. I have not been to a movie theater in over four years. Not sure when I go back, but want to see this one. Hearing good things.

A trucker crashed his truck at a Florida Publix. He had ‘an honest response’ for cops

“I was smoking my meth pipe.”

The China shock: Germany turns away from its biggest trading partner

Virus/Vaccine

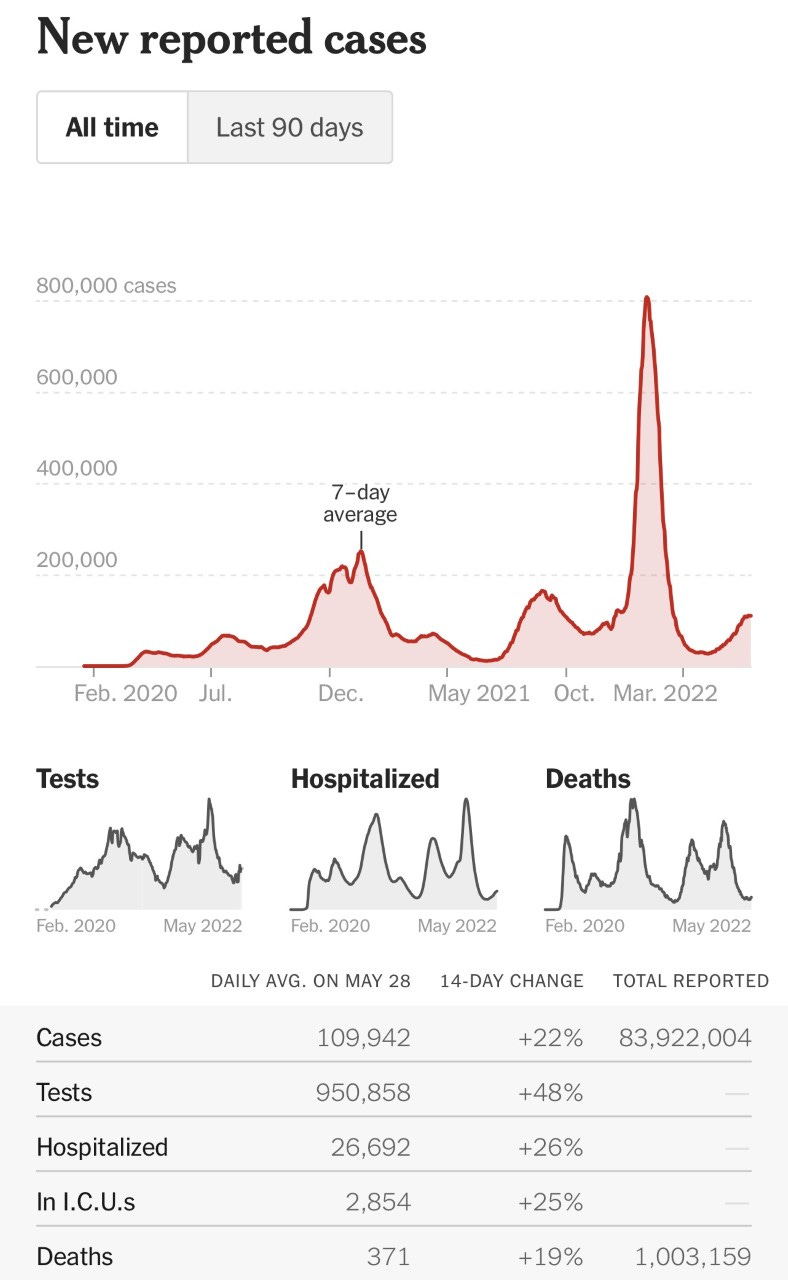

My daughter went to a small Bat-Mitzvah this weekend and there were 50 cancellations due to COVID. The good news below is case growth is slowing as are hospitalizations and ICUs. However, daily deaths are growing again given the lag between case growth and deaths.

In round numbers, there were under 400k deaths from COVID under Trump and over 600k under Biden. Biden had the benefit of the vaccines which the Trump Administration should get some responsibility for to help reduce the impact of the pandemic. On the news during the Trump Administration, every night was “body bags” and talk of “Trump” deaths. I did not blame Trump for the pandemic, nor do I blame Biden, but you do not hear a peep about “body bags” and “Biden” deaths. It is the hypocrisy which is frustrating. What would the Biden death toll look like without the vaccine? I blame China, reliance on the world for manufacturing PPE rather than doing it domestically and mistakes by the WHO and CDC.

Real Estate

A reader, Alex, sent me a CNBC article entitled, “Mansions in Boca Raton are commanding Miami Beach prices. Here’s a look inside.” A ton of good pictures in the link and shows how crazy things have become. When I moved down 5 years ago, $10mm was a HUGE price for waterfront in Boca. I looked at brand new water homes for $9mm in 2017. Now, many listings for $25-40mm are in Boca. I took this picture from my boat the other day as I thought the pool on the 2nd floor looked great. Scares me from a leak perspective, but pretty cool. Things in general are slowing down in my mind. Staying on market longer, new product coming on-line, less bidding wars. However, I still hear about some frothy stories, but far less of them. The 2nd and 3rd pictures are from the article attached above.

The supply of homes for sale jumped 9% last week compared with the same week one year ago, according to Realtor.com. Real estate brokerage Redfin also reported that new listings rose nearly twice as fast in the four weeks ended May 15 as they did during the same period a year ago. Pending home sales, a measure of signed contracts on existing homes, dropped nearly 4% in April, month to month and were down just over 9% from April 2021, according to the National Association of Realtors. “Rising mortgage rates have caused the housing market to shift, and now home sellers are in a hurry to find a buyer before demand weakens further,” said Redfin Chief Economist Daryl Fairweather. This story is called, “US Home Sellers Cutting Prices Hits Highest Level Since 2019 and suggests almost one in five sellers dropped prices last week. I had inserted this chart a few weeks ago and it outlines PIMCO’s (large asset manager), Mark Kiesel, and his view on housing. He has successfully called the last three housing tops/bottoms almost to the day.