Opening Comments

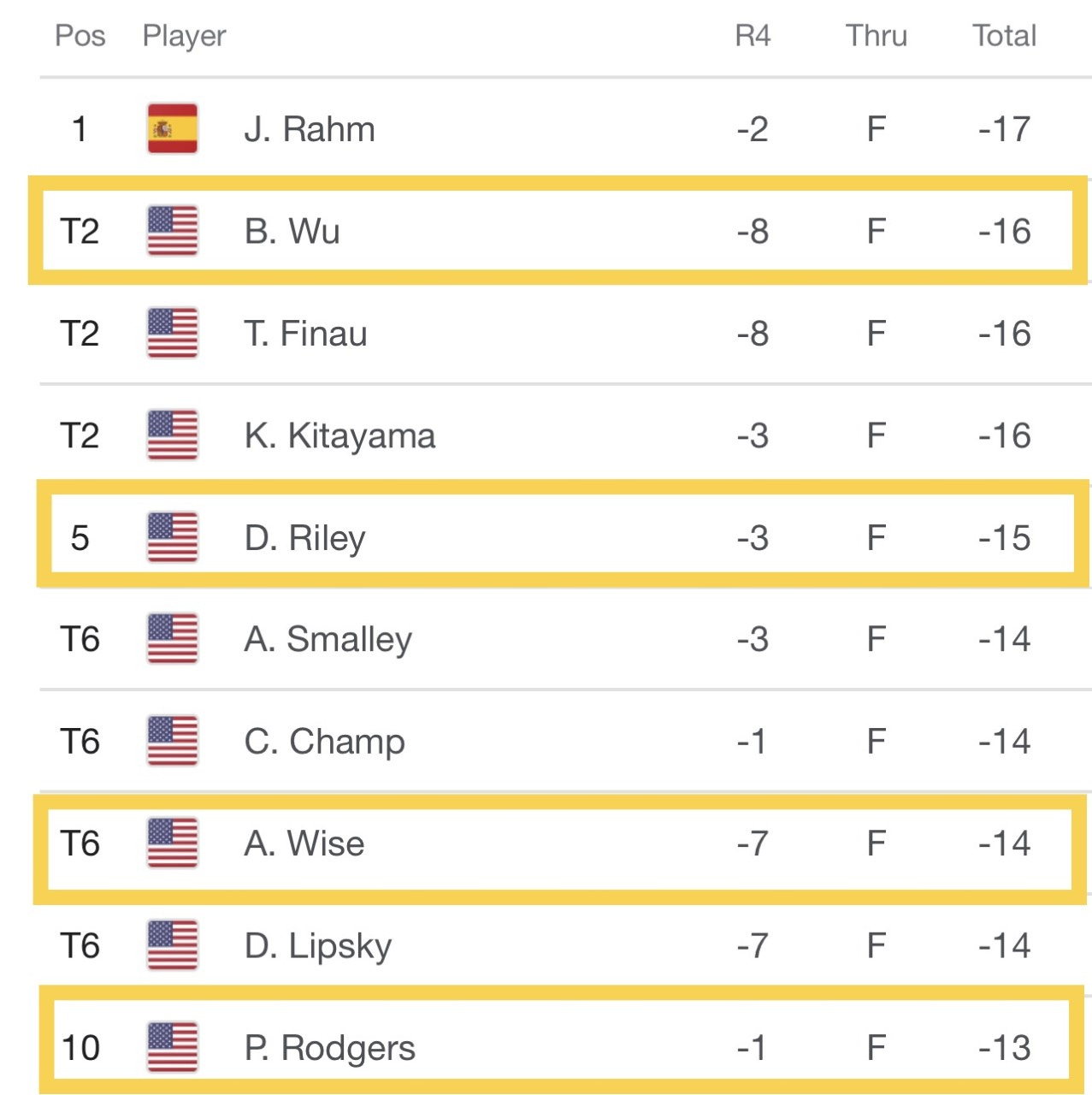

Jack golfed with Brandon Wu a couple months ago. He is a great young man who is incredibly polished and polite. His putting and short game is offensively good. Every putt from 20 feet goes in or has a good chance. Brandon played his collegiate golf at Stanford and is now on the PGA Tour. He had a great round on Sunday, shooting a 63 to put himself in contention with the clubhouse lead. I have never had a scorecard which looks like his from Sunday’s final round. Why? 6 birdies and an eagle with no bogeys.

I sent him a text to congratulate him. This was his response:

“Thanks Eric! No joke, I read the Rosen Report to kill some time waiting to see if I would be in a playoff.”

Thankfully, Sunday, I hit send early to give something for Brandon to do while waiting. If Stanford educated PGA Tour players are reading my report to get valuable insights on the world and some laughs, surely your high golf handicap self could glean something from it too. Brandon finished T-2. The only better story would have been had he won in a playoff, and in the interview after cited the Rosen Report as key to his victory. There is always next week. He is now 77th in the Fedex Cup. Brandon, when you win your first PGA title in coming weeks, be sure to give full credit to the Rosen Report for the victory. I smell a sponsorship coming. “Brandon Wu brought to you by the Rosen Report.

On the subject of golf, Jack’s coach, Jeff Smith, had quite a day Sunday with 4 of his players finishing in the top 10. Another congratulations is in order. I do not think it is a mere coincidence that both Jeff and Brandon are avid readers of the Rosen Report and are achieving a great deal of success. No one on the planet can take credit more easily for other’s accomplishments than I can. Remember, Al Gore and I invented the internet.

Quick send given I am jammed with Julia’s golf tournament. Apologies for missing anything.

Picture of the Day-A Scary Glass Walking Bridge

The Elephants in the Room-Mike Cembalest JPM

“Father” of the Year

Quick Bites

Markets

Natural Gas

Fed Statement

Paul Tudor Jones on Market

Uncle Warren on Bitcoin

Portland Police

Roe Vs. Wade

CA Water Crisis

Other Headlines

Virus/Vaccine

Data

Real Estate

General Comments

Royal Palm Listings

Palm Beach Lot Flip

Other Story Links on Affordability

Picture of the Day

My dislike of open heights is not knew to my readers. This is yet another bridge I will not cross. It is 2,000 feet long in Vietnam and is suspended 500 feet above a valley. I’m a “Hell no.”

The Elephants in the Room-Mike Cembalest JPM

I always include my friend, Mike Cembalest’s research in my reports. I have not had a chance to spend too much time on it yet, but the topic is global energy markets and is always informative. The link is here. Every time I include his pieces, it is the #1 opened link. Lots of good charts, but I like this one and it is the reason I push energy independence. We will be using fossil fuels for decades.

“Father” of the Year

For a period of time, I went to London from NYC with some regularity as I had a team of people there. I always flew Business Class on the red-eye over to Heathrow, leaving from JFK. I would check into the hotel, shower, change and head to the office. I vividly recall one flight around the year 2000 where I was trying to sleep unsuccessfully. There was a woman with a couple of kids, and one was crying non-stop. The mom could not seem to comfort one kid and the flight attendants were trying to help. The father seemed to be doing nothing, and I was starting to get stressed as were other passengers. The kid was screaming. Finally, the man got up, opened up the overhead bin, grabbed the bag with a pacifier and took the baby out of the mom’s arms. I was very excited that the dad was getting involved. He sat the baby on his lap, and the mom was looking kind of strange about it. I was a couple rows over, but was very glad the screaming stopped. I got my shut-eye and awoke just before landing and the family was all sleeping.

I was getting off the plane and the “father” was walking out without waiting for his family as the mom was struggling with the children. I said, “excuse me, I think your family needs your help.”

He said, “What are you talking about? I don’t have a family.”

I said, “I could have sworn you grabbed the kid and got him to sleep.”

He said, “I did, but I don’t know them. I just could not take the screaming and had to take matters in my own hands.”

I put out my hand to shake his and said, “Thank you for allowing to get some sleep. I can’t believe you did that. You are my hero.”

I am not sure I have ever had more respect for an individual in my life. I am sure in today’s society, he would have found himself arrested, on the cover of the NY Post, fired, divorced, lost custody of his children and cancelled for the rest if his life. I don’t know your name, but if you were are a reader of the Rosen Report, please reach out, I am buying you dinner.

Quick Bites

Stocks jumped sharply on Wednesday in a relief rally from their 2022 doldrums after the Federal Reserve raised rates by a widely anticipated half percentage point and Chairman Jerome Powell ruled out getting even more aggressive in the central bank’s inflation-fighting campaign. The Dow rose 933 points, or 2.8%. The S&P 500 gained nearly 3%. The tech heavy Nasdaq Composite jumped 3.2%. For both the Dow and S&P 500 , it was the biggest gain since 2020. The 10 year hit 3%, but closed at 2.91% with the broader market rally. Oil rallied 5.4% to $108/barrel. Crypto rallied approximately 6% with BTC at $40k and ETH at $3k.

Natural gas surged 9% to highest level since 2008 on Tuesday. The surge follows a nearly 30% gain in April. The swift upward price action, which is also being fueled by surging demand for U.S. liquified natural gas, is adding to inflationary pressures across the economy. Consumers’ electricity bills are rising as utility companies pass along their higher input costs. Of note, if we have a big hurricane season which disrupts production, we could see some real issues next winter. The chart is as of 7am Wednesday am, but you get the picture. This is YTD natural gas which is up 126% YTD and up 22% since the close on 4/287/22 as of Wednesday am and was up from the $8.06 level below. Natural Gas closed at $8.43 today or +6%.

The Federal Reserve increased its benchmark interest rate by half a percentage point, in line with market expectations. In addition, the central bank outlined a program in which it eventually will reduce its bond holdings by $95 billion a month. The rate move is the largest since 2000 and is in response to burgeoning inflation pressures. Fed Chairman Jerome Powell underlined the commitment to bringing inflation down but indicated that raising rates by 75 basis points at a time "is not something the committee is actively considering." Stocks moved sharply higher when Fed Chair Jerome Powell said the central bank was not considering a 75-basis-point hike in future meetings. “So a 75 basis point increase is not something that committee is actively considering,” Powell said. “I think expectations are that we’ll start to see inflation, you know, flattening out.” “Inflation is much too high and we understand the hardship it is causing. We’re moving expeditiously to bring it back down,” Fed Chairman Jerome Powell said during a news conference, which he opened with an unusual direct address to “the American people.” He noted the burden of inflation on lower-income people, saying, “we’re strongly committed to restoring price stability.” I was surprised by the move in stocks post the announcement. The Fed added too much fuel to the fire for the past year and rarely seems to get it right. The market is suggesting far more confidence in the Fed than I have today. Sounds like more 50bps moves are in the cards.

Billionaire hedge fund manager Paul Tudor Jones said the environment for investors is worse than ever as the Federal Reserve is raising interest rates when financial conditions have already become increasingly tight.

“You can’t think of a worse environment than where we are right now for financial assets,” Jones said Tuesday on CNBC’s “Squawk Box.” “Clearly you don’t want to own bonds and stocks.” The founder and chief investment officer of Tudor Investment believes investors are now in “uncharted territory” as the central bank had only eased monetary policy during past economic slowdowns and financial crises. He said investors should prioritize capital preservation in such a challenging environment for “virtually anything.” Jones is an impressive investor, but is not always right. Many of these guys got the pandemic bottom wrong (including me). Jones did call the 1987 crash and tripled his capital in a hurry. Another CNBC headline and story is interesting: ‘Bubble’ hitting 50% of market, top investor warns as Fed gets ready to meet and gives Dan Suzuki’s view.

I love Uncle Warren, and his long-term track record is amazing. Let’s keep in mind despite his huge successes and net worth, he did miss Amazon, Tesla and Google, so he does not get every disruptive investment right. Bitcoin has steadily been gaining acceptance from the traditional finance and investment world in recent years but Warren Buffett is sticking to his skeptical stance on the cryptocurrency. He said at the Berkshire Hathaway annual shareholders meeting Saturday that it’s not a productive asset and it doesn’t produce anything tangible. Despite a shift in public perception about bitcoin, Buffett still wouldn’t buy it. “Whether it goes up or down in the next year, or five or 10 years, I don’t know. But the one thing I’m pretty sure of is that it doesn’t produce anything,” Buffett said. “It’s got a magic to it and people have attached magic to lots of things.”

The resource-strapped Portland Police Bureau (PPB) reportedly took more than 20 minutes to respond when alleged antifa members assaulted a Saturday campaign event near police headquarters in downtown Portland. By the time officers had "sufficient resources" to establish a crime scene near Southwest 3rd and Main Street, the black-clad demonstrators had already dispersed after hurling smoke grenades, paint-filled balloons and fireworks, according to police. The protesters' violence cut short the event in support of Republican gubernatorial candidate Stan Pulliam, whose platform includes refunding the police. "We called the police, we called 911," he said. "In fact, at the Justice of Peace Center, we were just outside of their headquarters, sat on hold for over 20 minutes. Pulliam contrasted when Portland had 30 officers per 100,000 people in the 1970s to the present-day ratio of eight per 100,000. Another place I would never live or visit. The list is growing. Real companies are leaving these poorly run cities for a reason.

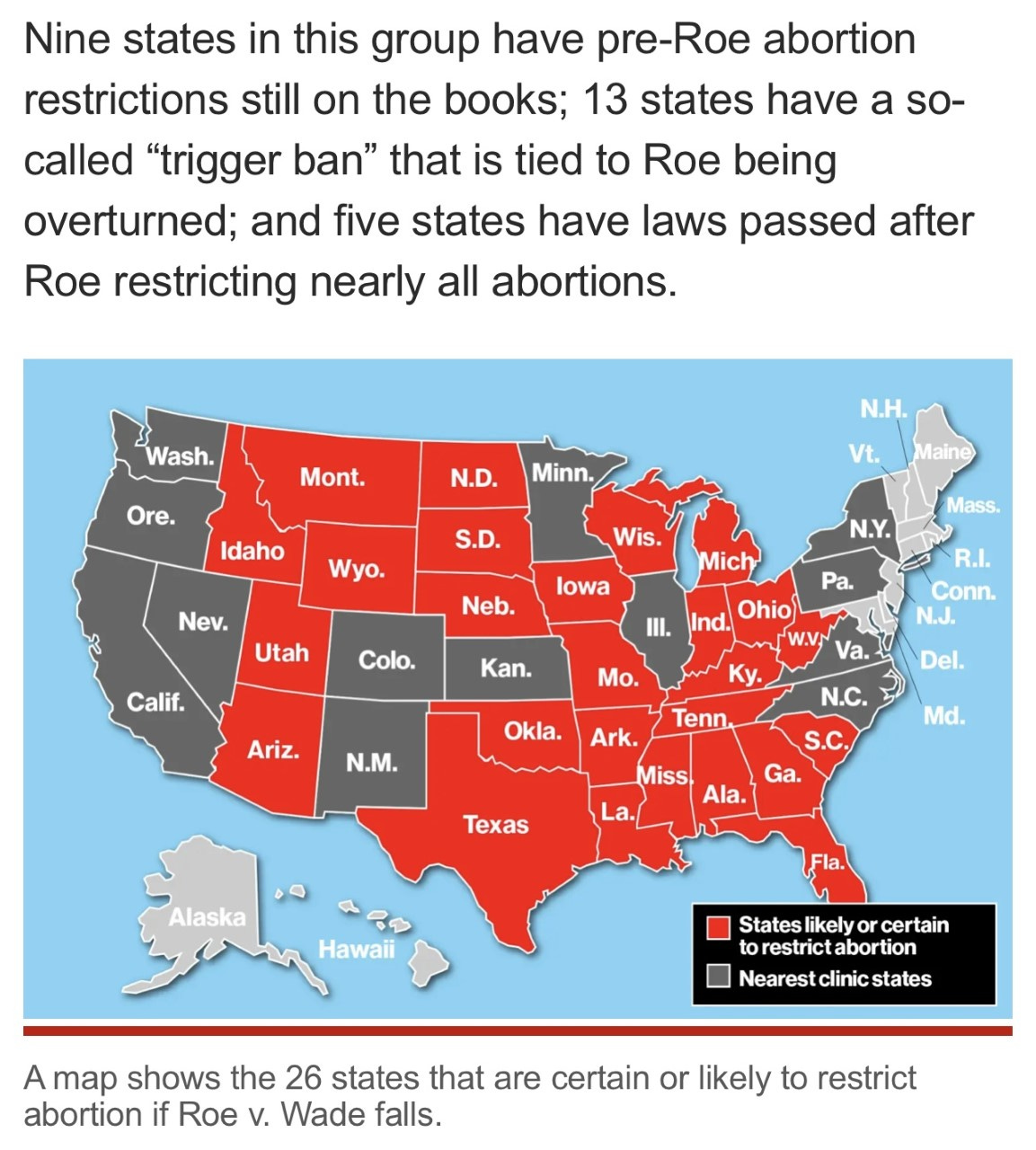

The Supreme Court is poised to overturn the constitutionally protected right to abortion ensured by the nearly 50-year-old Roe v. Wade ruling, according to a leaked initial draft. The draft was written by Justice Samuel Alito, with the concurrence of at least four other conservative members of the Supreme Court. “We hold that Roe and Casey must be overruled,” Alito wrote in the 98-page draft decision on Mississippi’s strict new abortion law, according to Politico’s report published Monday night. “The inescapable conclusion is that a right to abortion is not deeply rooted in the Nation’s history and traditions.” “It is time to heed the Constitution and return the issue of abortion to the people’s elected representatives,” the justice wrote in the draft published by the site, and whose authenticity CNBC has been unable to confirm independently. The Supreme Court news site SCOTUSblog tweeted: “It’s impossible to overstate the earthquake this will cause inside the Court, in terms of the destruction of trust among the Justices and staff. This leak is the gravest, most unforgivable sin.” However, Chief Justice John Roberts said the draft isn’t the court’s final opinion regarding Roe v. Wade. The ruling is a serious one which will push the abortion decision to the states. Also, the leak is damaging to the reputation of the highest court in the land. Chief Justice Roberts ordered a probe into the “egregious” leak. We are a nation fractured on many topics, and this news and leak will lead to more issues. Of note, in the 1980s, then Senator Biden signed a proposed amendment that sought to overturn Roe v. Wade, but today he believes "a woman’s right to choose is fundamental." Article on the 26 states which are going to ban abortions.

Also of note is a report that suggests the Roe v. Wade potential ruling is likely to have an impact on the mid-term elections. Here is an example of the betting odds shift after the news. It looks similar for both the House and Senate.

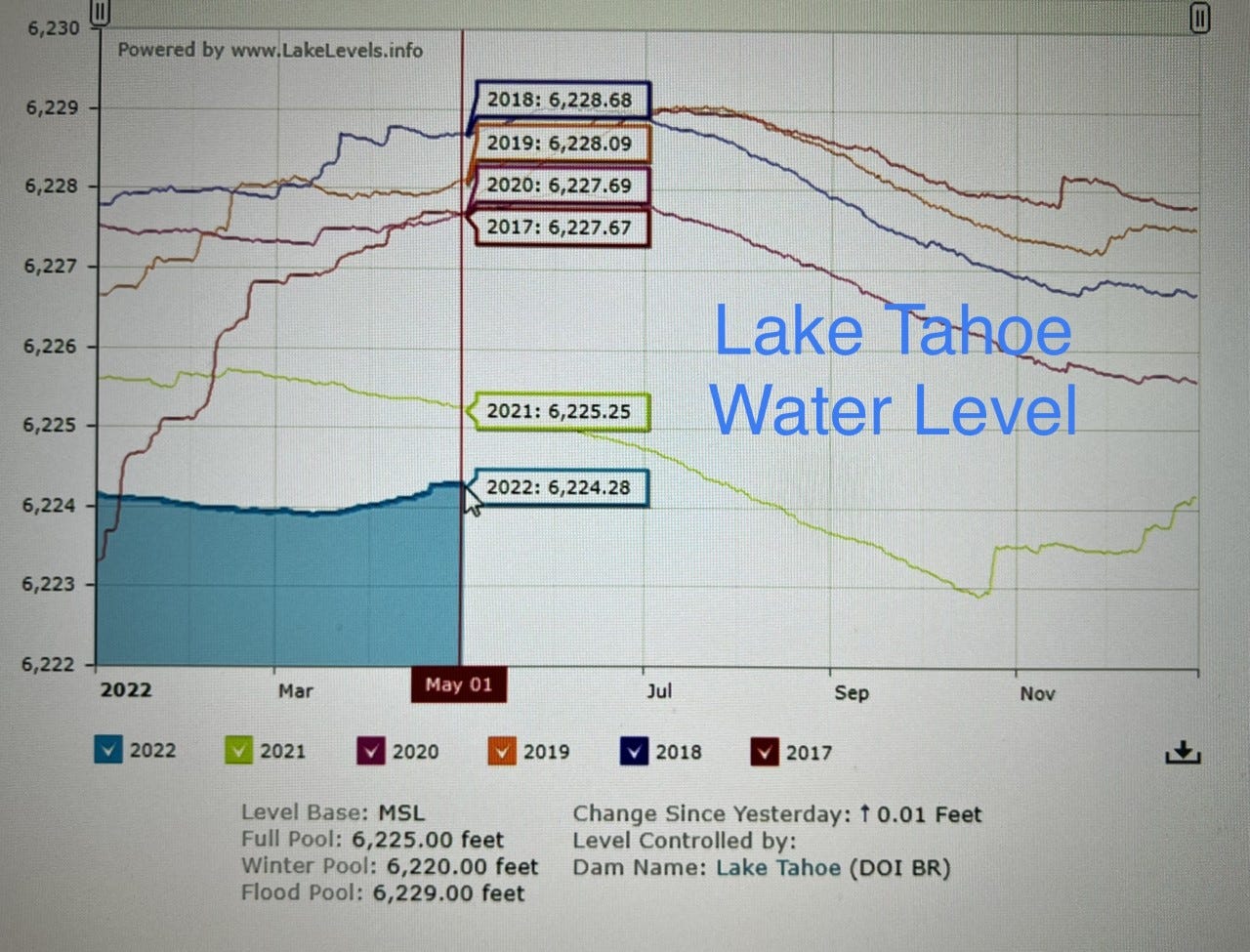

In my last report, the most opened links were about the lakes/reservoirs in Arizona running dry, and then I saw this story about California. When the Metropolitan Water District of Southern California this week unveiled its strictest-ever water restrictions for about 6 million residents, it did so with an urgent goal in mind: a 35% reduction in water consumption, equating to an allocation of about 80 gallons per person per day. "We need to stretch the water because we can't get any more water at this point" for these parts of Southern California, Hagekhalil said. “We're saying the water we have available to us is the water that's going to last us until the end of the year. And we want everyone to help.” So let me get this right. In CA, you have to deal with earthquakes, fires, mudslides, droughts, floods, crime, gangs, homelessness, high taxes, high R/E taxes, horrible traffic, lack of public transportation, high cost of living, highest gas prices in the country and overly woke politicians. No wonder why the population is running for the exits. I found the Lake Tahoe water levels to help put it into perspective and the chart is gong in the wrong direction. The R/E section has stories about bidding wars in CA. Makes no sense. Get out while you can. Remember, the crash in tech will likely lead to a huge budget issue which means even higher taxes.

Other Headlines

Recession is ‘almost inevitable’: former Fed’s Ferguson says

The probability of a recession in 2023 is certainly very, very high, because of the challenges of getting this roaring inflation under control and having so few tools to control the supply side of the economy ‘

Nearly risk-free I bonds to deliver a record 9.62% interest for the next six months

Biggest Treasury Buyer Outside U.S. Quietly Selling Billions

Japanese investors can find good debt opportunities in Europe

Rising currency hedging costs and Fed hikes deter inflows

Citi says a trader error caused Europe’s ‘flash crash’. Here’s how it unfolded

Starbucks to hike wages, double training for workers amid union push

AMD sales jump 71%, shrugging off concerns about PC slowdown

Airbnb beats estimates with 70% revenue growth as travel rebounds

I feel this summer will see high prices for air travel, hotels, rental cars.. Pent up demand is real and airlines are cutting back flights.

Amazon to Reimburse U.S. Employees Who Travel for Abortions.

Major U.S. Beefpacker Says Steak Prices Will Continue to Soar

Consumers may adapt to inflation and buy less expensive cuts

Trump loses bid to stay New York contempt of court order and avoid $10K daily fine

Biden’s Team Eyes $125,000 Income Cutoff for Student Loan Relief

Officials say plan would relieve at least $10,000 of debt

Warren, progressives want Biden to forgive at least $50,000

Antisemitic incidents spiked during Squad's anti-Israel rhetoric, blue states at top of list

9 out of the top 10 states listed voted Biden in 2020.

'Dead' woman bangs on coffin to say she's alive during funeral in Peru

Dave Chappelle tackled on stage at Hollywood Bowl by audience member

There is a video in the link (2nd video). I wrote when the “slap” happened that this could embolden others and it seems as though we may have seen the first incident post the Oscars. Way to be a role model, Will. Chappell was not injured.

I hope the boy who did this spends at least 10 years in juvenile detention and gets his ass kicked everyday. What is wrong with people? What kind of a demented child throws a fireball at a little boy?

Virus/Vaccine

Case growth is decelerating slightly, but remains +50% from the prior two weeks. At 62k/day, we remain 91% peak levels from January. All four regions in the US are showing case growth. This NY Times link has some granular data by state if you are interested. Hospitalizations are climbing at +18% and ICU +4%, but we are sharply below the prior highs. Deaths are declining, but the rate of decline is slowing at -17% from the prior two-week period. We are at 340 deaths/day and 993k in total. I continue to pressure the CDC, NIH, WHO and others to have more transparency on data. What percent of hospitalizations nationally are for COVID rather than with COVID? Those in ICU or deaths, what is the co-morbidity status of each patient

Real Estate

I won’t name the projects, but I am hearing that some of the new planned golf courses and communities from Jupiter to Hobe Sound are running into permitting issues. I have heard this in a few spots. It will be interesting to see what progress is made in coming months, but as I understand it, there will be at the best some delays and at worst, projects scaled back. Separately, I spoke with an owner of a home in the community, Delaire, in South/Central Delray. Historically, it has been a retirement community with an average age well into the 60s. Pre-pandemic, a nice house was $1mm and now it is $2mm+. There are 6 homes for sale out of a total of 324 homes. Prior to COVID, it was nearly impossible to sell a house in the community and dozens were for sale. Today, some young families live there and the average age in the community is down sharply. They have 27 holes of golf (well manicured), tennis and some pretty darn good food.

I have written about the Royal Palm Community in Boca Raton. It is the highest end community in the area. When I bought in 2017, there were 71 homes for sale, with an average price of $4.9mm. Today, there are 12 for sale (a few are under construction and a couple need to be torn down). Of the 12 homes, the average ask is $16.5mm and there are tear downs on the list which would bring the average price up. Here is a link to all the homes. I feel the prices are getting out of control. I am dying to sell my house. I just have no idea where I would go, but at these prices, I would love to monetize. Some of the houses listed really look beautiful. I am just shocked at the price points, especially given where they were pre-pandemic. I would think the market will start pushing back at these levels. One home is asking $3k/foot. Unheard of for these parts and not on the intracoastal, but a canal. Each house has the link to it below for those interested. Of note, the $35mm home sold for $9.4mm 12/20, was split into two lots and ONE is asking $35mm. The other is yet to be listed, but was told the ask will be high $20s. Insanity.

Royal Palm Homes for Sale

$35,000,000 On a small canal-Nice house. New

$24,500,000 Small canal. 2020 House.

$17,995,000 Golf Course Lot. New

$17,500,000 Small golf lot. New

$11,950,000 Built in 1996. Small Canal.

$11,577,000 Built in 2020. Busy street.

$9,570,000 New build. HORRIBLE location.

$8,995,000 Built in 1970! Teardown. Double Lot

$8,775,000 Built in 2017. Decent house.

$8,250,000 Built in 2006. On course.

$16,464,720 Average Asking Price

A mansion along the Intracoastal Waterway in Palm Beach sold for $36.5 million, a 46% gain from its last trade about six months ago. An $11.5mm profit in 6 months ain’t bad, but it the norm for high-end R/E from Palm Beach to Miami. The lot is 0.61-acres at 625 Crest Road. The buyer is a Delaware-registered company, so it’s not clear who manages it. This was an off-market deal. A house in Miami is asking $170mm. The insanity is all around us on the high end. I think the house is ugly.

Home affordability is nearly the worst on record as mortgage rates spike

Homes Fetch Million-Dollar Bids Over Asking in Crazed California

Soaring wealth and a persistent housing shortage are deepening an affordability crisis, yet prices keep soaring. Some crazy examples in the article. Why you would live in CA is beyond me.