Opening Comments

My last note was about three embarrassing stories from the Rosen family. The most opened links were the article on how many pushups you should do by age for both men and women, and the new college dream school that is not Harvard.

One of the things I am very proud of is my mentoring program. Each year, I mentor over 100 students, young professionals, and even some in some professionals in their 60s. I never charge anything for my time, and the goal is to help improve outcomes and make a difference. In the past 10 days, I have received calls from four of my mentees with amazing news of jobs offers, internships, promotions and other wins. One called up and said, “Eric, I would never have gotten this internship without your help, advice, and guidance. Also, reading the Rosen Report better prepared me for my interviews. Thank you.” This job is at a top investment bank. These conversations where my mentees are winning is the highlight of my week.

There’s so much happening in markets, tariffs, and politics – both domestic and global – that I won’t even try to cover it all.

"There are decades where nothing happens; and there are weeks where decades happen"--Vladimir Ilyich Lenin.

At a R/E conference in Palm Beach today. Early send.

Markets

Wealthiest Fund Managers in Credit Space-IMPRESSIVE

Mar-a-Lago Accord

Hedge Fund Returns for Endowments

Medicaid/Entitlements

Manhattan Office Leasing Market is HOT

80 Clarkson-West Village, NYC New Condos

Pictures of the Day-Amazing Lunch & Upcoming Podcasts 3/13

I am doing two podcasts on Thursday, 3/13. I have the pleasure of cooking live with the amazing Chef Edvina. I went to her home for lunch last week with my wife, and we were blown away by her cooking and beautiful presentation. It was as though we were in a top restaurant as we sat out on the terrace overlooking the Atlantic Ocean on a stunning afternoon. I will be live at noon on Thursday and the link is here. If you want to cook alongside me, I am doing my ginger-crusted salmon and you can see the ingredients with this link. It is a relatively easy dish, and I make it often when entertaining. I like to think of myself as a chef, but Edvina is on another level. I’m hoping to pick up some skills from her and step up my cooking game. I will drive back from Miami to do my 3i Markets Update with Peter Boockvar, Alicia Levine, and Alon Rosin at 4:30 pm and again the video will be available afterward in my report Sunday along with the cooking video.

Finding the Level

My career was made trading and managing credit products that tended to be illiquid relative to equities, treasuries, and FX assets. Some products traded quite infrequently.

When I was a trader or managing traders, I always wanted to find the level for liquidity. Some of the products we traded were illiquid and when negative news came out, it could be challenging to determine the correct price. Should the bond or loan be down 30 points or 45 points? It was a combination of art and science. I wanted to know where the real market was ASAP to determine if we should buy or sell. Some traders would “quote” unrealistic levels in hopes of finding an institutional investor to provide liquidity. I pushed traders to make small markets and find out where buyers and sellers wanted to transact.

I feel the same in real estate. Too many sellers ask aspirational prices for their homes and it actually does them a disservice. The house sits on the market too long and everyone can track the “days on market.” It looks “stale” to potential buyers. They will ask, “What is wrong with the house? Why has it been on the market for over a year?”

This WSJ article, “The Wealthy Are Overpricing Their Homes. Auctions Show Just How Much,” gives concrete examples of the mispricing of homes and the ultimate result. IF you do over price your asset, lower it to find the right level. You will exclude potential buyers due to a crazy unrealistic asking price. If the asset is not getting attention or offers, lower the price to “find the level.”

The first example in the article is a Manhattan PH that was listed for $12.2mm that was a triplex with a 2,000 square foot terrace and a private elevator. The 3,300 square foot place sold for $5mm. Think of how many potential buyers never considered the PH given the asking price was more than twice the sales price.

In the Hamptons, “La Dune” was listed for $150mm in 2022 and sold two years later for $89mm.

“The One,” a Bel-Air mansion that was listed for $500mm sold for $126mm.

A Beverly Hills estate sold for $51mm after being listed for $165mm.

An Upper East Side townhouse owned by Real Housewife Sonja Morgan was listed for $10.75mm and sold for $4.59mm 10 years later.

A Martha’s Vineyard estate was listed for $16.9mm by the owner because there was a $17mm listing nearby. He worked with 3 different agents and cut the price to $7.9mm with no luck. It is being auctioned with a $6mm reserve.

There is a house in Boca on the Intracoastal that has 50 ft of water frontage (tiny). The house is odd (long and narrow) and the layout is a 2 out of 10. The builder went through a half dozen real estate agents and none could sell the house given the ridiculous asking price. It was on the market for over 5 years. He refused to find the level.

I strongly suggest intellectual honesty when listing. Asking an unrealistic price, especially for your house, does you no good. If you get it wrong, correct it. Listen to market feedback. Be realistic and drive traffic. I hear from owners, something along the lines of “My neighbor’s house sold for $20mm, so I should get $20mm.” Well, the neighbor’s house is new, bigger and on a better lot…so it is not the perfect comp.

Quick Bites

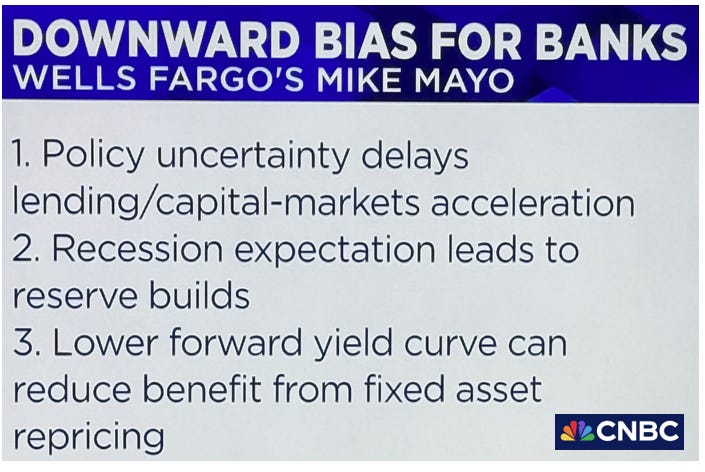

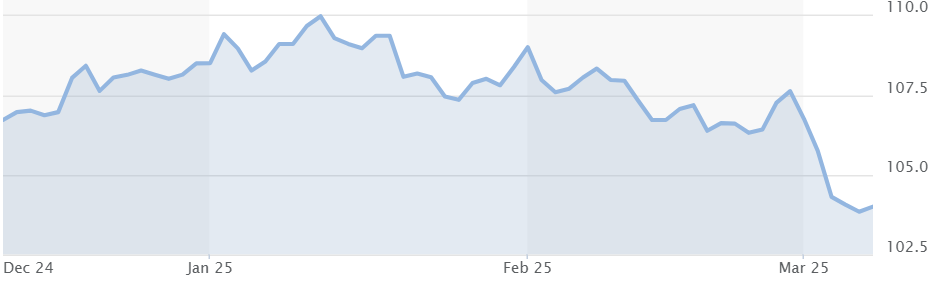

Stocks started off the week by selling off after Trump talked about the possibility of a recession as the economy was going through a through period of transition. Major indices were -2 to -4% on the day. The Dow fell as much as 1,189 points and the Nasdaq fell almost 5% at the afternoon lows. The Nasdaq lost $1.1 trillion on Monday alone, and tech megacaps lost $750bn+ on Monday. This link shows the performance of the Nasdaq components YTD and this link is for the S&P 500. The S&P has lost $5 trillion from its peak valuation as of Tuesday’s close. The combination of choppy data, weak stock performance, tariff impacts, a weakening consumer, and recession fears have market prognosticators on CNBC talking about the “Fed Put,” suggesting rate cuts are in play. I am waiting to start seeing more downward revisions, and Wells Fargo put out a downward bias for banks (see below). On Monday, the 10-year Treasury fell as much as 11bps and closed at 4.22% (-9bps). It is not performing as well as I would have thought with the stock carnage. Yet another retailer warned with a rough outlook (Kohl’s) and the stock was -24% on Tuesday. The trade war escalated as Ontario put a 25% tariff on energy and Trump responded with a 50% tariff on Canadian steel and aluminum, sending markets lower again Tuesday. Markets rallied Tuesday as it looks like Ukraine accepted a 30-day ceasefire and Ontario reversed the energy tariff pushing Trump to halt his 50% tariff. However, there was another sell off late closing lower for S&P. The CPI data came in better than expected at .2% and created a nice morning rally, but was on shaky ground. Trump’s new 25% tariff announced Wednesday on steel and aluminum made yet another trade war headline, and Canada and the EU responded with more tariffs. Nasdaq outperformed Wednesday with tech names rebounding. Investors bought more puts than ever (3rd) chart which suggests funds are overedged and may be due for a pop. The VIX hit 30 on Monday but has settled back down at 24 despite the crazy headlines. One good output of the market carnage is lower rates for borrowers – including the Treasury, which has countless trillions to refinance. Mortgage demand +11% due to lower rates. Crypto came under pressure again with BTC falling below $78k (day lows) on Monday after being $98k less than one month prior. It has since settled at $83k.

Interesting article from Market Watch on endowments investments into many hedge fund strategies and the conclusion is not positive for returns in many strategies. An astonishing two-thirds of big university endowments are invested in hedge funds and other alternative investments that actually have delivered zero outperformance since the 2008 global financial crisis. That’s the conclusion of Richard Ennis, a quantitative-investing pioneer who helped create the field of institutional investment consulting. An astonishing two-thirds of big university endowments are invested in hedge funds and other alternative investments that actually have delivered zero outperformance since the 2008 global financial crisis. Private-equity funds, meanwhile, generated cumulative returns about 20% greater than the stock market, according to two studies, but at a greater risk. And now the industry faces higher interest rates as well as higher valuations for private companies. In my opinion, traditional long/short equity hedge funds should outperform in periods of market stress and underperform in big bull markets due to hedges. They are a diversification tool.

I know most of these guys as I have been in the credit markets for decades. The wealth creation has been incredibly impressive in the space. Twenty years ago, swaggering hedge fund managers, leveraged buyout kings and corporate raiders would have dominated any list of masters of the Wall Street universe. Today another corner of finance has become a billionaire factory: the decidedly less glamorous business of making loans directly to companies—often small and medium-size ones, the kind that are squeezed out of the traditional bond market and are often deemed too risky for banks. This line of work has become broadly known as private credit. And it’s booming. In only a decade, its assets have more than tripled, to $1.6 trillion, as institutional investors and wealthy individuals seek alternatives to regular stocks and bonds. The Bloomberg Billionaires Index calculated the fortunes of 18 beneficiaries of the private credit boom. Together, these individuals, who work at seven different companies, are worth $61 billion.

Great article from Torstel Slok from Apollo on the Mar-a-Lago Accord. The US dollar is the global reserve currency because America is the most dynamic economy in the world, and the US provides stability and security. As a result, there is upward pressure on the US dollar because everyone wants to own the world’s safest asset. With safe asset flows putting constant upward pressure on the dollar, there is a need for a deal—a Mar-a-Lago Accord—to put downward pressure on the US dollar to increase US exports and bring manufacturing jobs back to the US. The Mar-a-Largo Accord is the idea that the US will give the G7, the Middle East, and Latin America security and access to US markets, and in return, these countries agree to intervene to depreciate the US dollar, grow the size of the US manufacturing sector, and solve the US fiscal debt problems by swapping existing US government debt with new US Treasury century bonds. Conceptually, I am not opposed. I do like Trump getting something in return for all the US does for other countries. I just don’t know the likelihood of this coming to fruition. Of note, the US $ has been under pressure (chart).

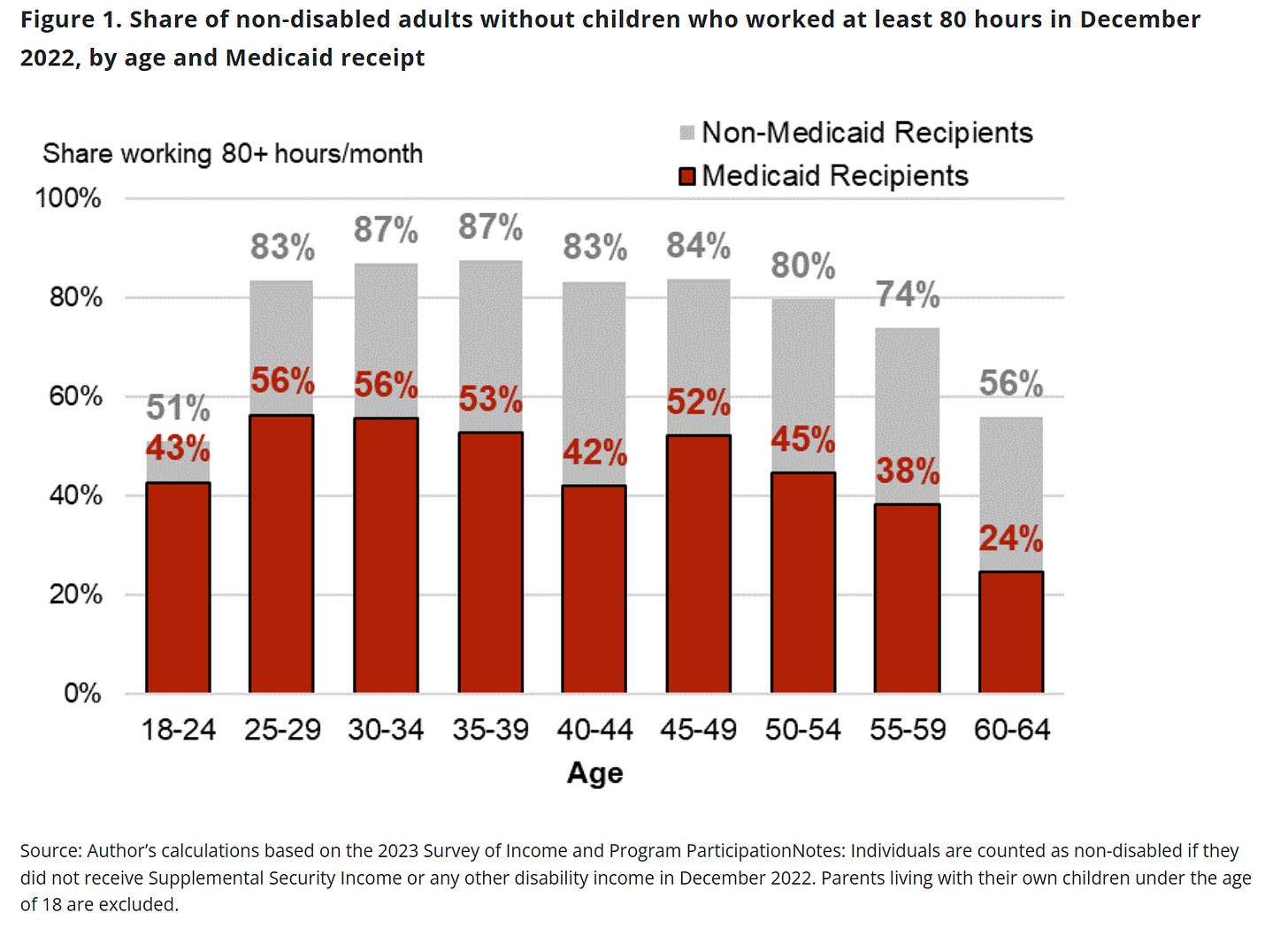

I have been consistent in my view of the dire need for entitlement reform. I want to raise the retirement age, means test, and increase the contribution caps. Sadly, both parties refuse to tackle the important issue. This article “Less Than Half of Medicaid Recipients Work Enough to Comply With a Work Requirement,” is interesting and suggests ideas for changes to make a dent in the hole we have today. Underlying the policy debate is the extent to which Medicaid recipients already work. On the one hand, if the vast majority of non-disabled working age Medicaid recipients already work, then imposing a work requirement may achieve little cost savings and serve mostly to impose administrative burdens on an already compliant pool of recipients. On the other hand, if many do not work, then work requirements may meaningfully reduce federal spending as recipients gain employment and obtain private health insurance, or potentially lose health insurance coverage if they fail to comply with the work requirement. I would like to see the impact of requiring a minimum amount of work for non-disabled Medicaid recipients of working age. I also beg both parties to consider a major entitlement reform. Remember, when Social Security started in 1935 post the Great Depression, the average expected lifespan was 60.7 years. Today, life expectancy at birth is 78.4 years – nearly 18 years longer – and the US has not raised the age for benefits. A Stanford study suggests that 5-year-olds in 2023 are likely to live to 100 for those from wealthier nations. Couple this with the fact that US fertility rates have plummeted, and healthcare costs are out of control and you have a disaster on your hands. If France can raise the retirement age, surely it can be done in the USA. The Congressional Budget Office Outlook (last chart) is pretty clear. In 2025, there is $4.2 trillion in mandatory outlays. Social Security is $1.6 trillion, Medicare is $942 billion, and Medicaid is $812 billion for a total of $3.3 trillion or 79% of mandatory spending. It is unsustainable. By 2035, entitlements will be almost 85% of total mandatory spending according to the CBO, and they are low on estimates. Ray Dalio is very concerned about US debt. The US deficit is already over $1.1 trillion this fiscal year (5 months).

Politics

Trump says a transition period for the economy is likely: ‘You can’t really watch the stock market’

What a shift from his first time around, when he was entirely focused on the markets before COVID hit.

Trump rejects pleas from business for more clarity on tariffs

Trump says tariffs on Mexico and Canada ‘could go up,’ declines to rule out possible recession

Volkswagen and Stellantis evade Trump’s 25% tariffs, while BMW braces for impact

Rubio announces end of 83% of USAID programs

He further confirmed that the remaining 1,000 programs would be administered directly by the State Department.

House passes bill to fund federal agencies through September, though prospects unclear in Senate

Secret Service shoots armed man after 'confrontation' near White House

Term limits please. Also, voters need to spend more time voting for the best candidates. Some real clowns out there.

DOGE says $312M in loans were given to children during COVID pandemic

There have been multiple instances of backtracking after making a statement out of DOGE. However, it is clear to me there are hundreds of billions of waste in the Federal government.

Department of Education staff told offices will be closed Wednesday

Canada’s Liberal Party chooses Mark Carney to succeed Justin Trudeau

Moderate independence movement wins elections in Greenland

Looks like this is a path towards secession from Denmark.

Middle East

Israel says it is cutting off its electricity supply to Gaza

Department of Education investigating 60 colleges and universities over antisemitism claims

Other Headlines

US economic worries mount as Trump implements tariffs, cuts workforce and freezes spending

Airlines are cutting forecasts and United claims it has seen a 50% drop in government travel. Although cutting waste is great, there will be unintended consequences of these cuts that will clearly impact the economy.

Faced with economic anxiety, retailers pare expectations for the year

Oil’s Bearish Lurch Has Speculators Betting Worse Is Yet to Come

JPMorgan Chase & Co. became the first to call for oil in the $50s at an energy conference in London last week while Citigroup Inc. reiterated calls for $60.

Fintech stocks plummet as Wall Street worries about consumer spending, credit

More signs of a slowing consumer. I was too early on this topic.

Delta Air Lines slashes earnings outlook citing weaker U.S. demand, sending shares down (Stock-14% post earnings)

Rocket Companies to buy real estate firm Redfin in $1.75 billion deal

Musk Says "Massive Cyberattack" On X Originated "In The Ukraine Area"

Musk was flying high post-election and now his businesses have had a lot of negative headlines, while TSLA stock has been smoked (-55% in 3 months).

1 arrested, more suspects sought after Southern University fraternity hazing death

It is shocking to me that in 2025, kids still die from hazing.

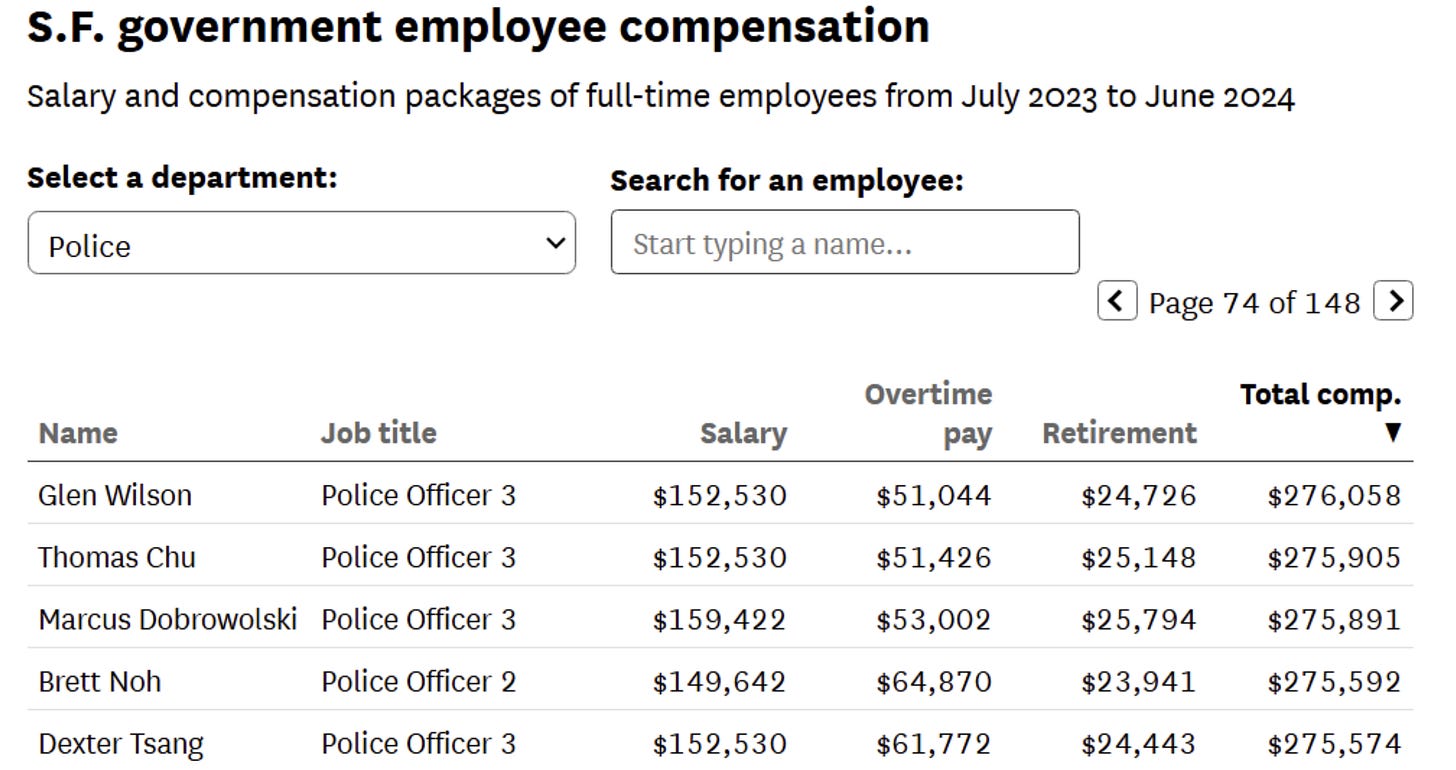

The MEDIAN police officer in SF made 276,000 dollars last year

The FAA’s Troubles Are More Serious Than You Know

Concerning article.

U.S. is headed toward a hospital bed shortage, researchers warn

Aging population, dwindling number of beds, labor shortages, and hospital closures are mentioned in the article.

Seems like most good experiences are getting out of control on price.

These are the 10 best countries for working women—the U.S. isn’t in the top 10

Starting the day with a healthy breakfast is becoming a pricey luxury

Record high prices for eggs and coffee coupled with inflation from the prior few years are making breakfast incredibly eGGspensive. Last chart outlines that in the past couple of days, egg prices have dropped.

Celebrity AI deepfakes are flooding the internet. Hollywood is pushing Congress to fight back

These deepfakes can be so real, I have no idea they are fake.

Anora had a $6mm budget and won six Oscars, while The Electric State had a $320mm budget and has been panned.

One of the last US survivors of Pearl Harbor dies at 102

2,403 US personnel died in the attack on Pearl Harbor. During WWII, 2.1mm Japanese military personnel died and over 2mm civilians.

Just disclose it to the public already. I want to know the truth. I find it hard to believe Earth is the only inhabitable planet. Give the aliens my address to come abduct me and let me video it for the Rosen Report.

Health

What to Do When an Adult is Choking-3 minute video

A reader sent me a great video of how to properly administer the Heimlich Maneuver. Everyone should watch this for a few minutes. You might save someone’s life.

6 Most Expensive Medical Procedures, Ranked

The article goes into healthcare spending data and outlines the outrageous costs of transplants.

Men with this reproductive issue are 500% more likely to be genetically predisposed to cancer

Forget apples — doctors find eating this fruit daily can lower depression risk by 20%

Women who consume a lot of citrus are less depressed, according to a physician from Harvard Medical School.

Scientists discover genetic key to why women’s brains age better than men’s

100-year-old sisters died within days of each other: Here are 5 lessons they taught me I’ll never forget

People with this blood type are 16% more likely to have a stroke before the age 60

Real Estate

Manhattan’s office leasing is off to its strongest start to a year in more than a decade, a positive sign for the beleaguered market. In January and February, the amount of space leased totaled 5.13 million square feet (476,600 square meters), the most for that two-month period since 2014, according to a CBRE Group Inc. report that measures new deals, expansions and pre-leasing. In February alone, leasing was about 1.5 times more than the five-year monthly average. The uptick helped cut the office availability rate to 18.4% in February, down 10 basis points from a month before. It’s a boon to the city’s office market, which has been grappling with higher vacancies ever since the pandemic spurred more companies to allow employees to work from home.

The developers of 80 Clarkson, at the southern edge of the West Village, filed their offering plan for the project with the state attorney general’s office. The 112 units range from two to seven bedrooms, and 80% of the apartments will have outdoor space, thanks to the design’s stepped setbacks. Many also will offer Hudson River views. The towers — set to reach 400 and and 450 feet (122 and 137 meters) when completed — will be the tallest buildings in the low-slung neighborhood, overshadowing the townhouses and stouter modern condos around them. The offering plan filed by Zeckendorf Development, Atlas Capital Group and the Baupost Group discloses prices for 26 of the units so far. The least expensive of those is a $6.755 million two-bedroom apartment with just over 1,900 square feet (177 square meters) of space. The largest price tag is $63 million for a five-bedroom spread spanning the whole 31st floor of the west tower, with nearly 7,000 square feet indoors plus almost 600 square feet of outdoor space. I love the West Village. There are amazing restaurants and bars plus great shopping. The issue is if you work in Midtown, it is a pain to commute.

© 2025 The Rosen Report LLC. All rights reserved. Does not constitute investment, financial, legal, or tax advice. Consult with your lawyers and professional financial advisers. Rosen Report™ #769 ©Copyright 2025 Written By Eric Rosen.