Fiscal Responsibility Lessons From Warren Buffett & Eric Rosen

10-22-23

Opening Comments

My last note was about auto thefts including my car in college. The most opened links were a video of a car getting stolen in my community and Mike Cembalest’s eye on the Market about the quality of cities from an economic, business and fiscal perspective.

I work hard on the Rosen Report and get a lot of emails from my readers. Some are not kind and others are very supportive. This is an excerpt from an email I received the other day, and when I started reading it, I thought it was another negative note, but turned out to be very positive. Keep these coming!

Eric, I have a complaint. You're contributing to me becoming time-poor. Your newsletter has become so good that I need to allocate twice as much time to read it versus the last few years. You are doing a great job and it has evolved into a very professional, informative report.

Early send as I am out of the house almost all day.

Fiscal Responsibility Lessons from Warren Buffett & Eric Rosen

Markets

Powell on Rates

Rising Delinquent Auto Loans

Tesla Earning Comments

Biden Disapproval Rating

Ken Griffin Palm Beach Estate $1bn+/Palm Beach Market

NYC Homeowner Costs Rising Fast

Home Sale Slowing

Video of the Day-Commercial Real Estate Panel

I am fortunate enough to partner with 3i Members and I find amazing professionals whom I interview for content. I called my good friends and put together an amazing panel of Adam Spies, Brian Goldman and Eli Elephant. I am going to release clips over the next week or so and here are a handful. Each one is a few minutes. Adam is the co-head of Capital Markets at Newmark, Brian is a top tenant representative for commercial R/E at Newmark, and Eli is PBC’s CEO, which owns commercial R/E. They are very knowledgeable and do a ton of deals.

Attributes and sentiments of NYC leasing markets pre and post-pandemic

Exciting aspects and opportunities in commercial real estate

Fiscal Responsibility from Warren Buffett & Eric Rosen

If you read the Rosen Report, you know I talk about fiscal responsibility a great deal. I am disgusted by the runaway government spending at the federal, state, and municipal levels. Anyone who runs a business knows it would end in bankruptcy if you run indefinite deficits. I feel the same about my personal balance sheet and spending. I grew up with limited means in a single-parent household. I went to public school and worked starting at 11 years old. Growing up, I did not understand what was in the art of possible because I was not surrounded by any successful people. I have been frugal because I paid for almost everything since I was a young kid. No one bought me a car, paid my insurance, paid for my college or anything else. Early in life, I understood the value of a dollar and hard work to afford any lifestyle. As a teen, I worked countless jobs (valet parking, pizza delivery, busboy, car washer…) and my heroes were Crocket and Tubbs from Miami Vice (TV show from 1984-90) as seen in the picture below in my white linen suit at 16-years-old. I did not get braces until I was 25-years-old, as they were too expensive as can be seen in my bad teeth in high school.

As I became a professional and started making money, I only thought about how much I could save. I did not have credit card debt and did not spend lavishly. I am the greatest saver of all time relative to my income. I love clearance sales and brag about how much I save, not how much I spend.

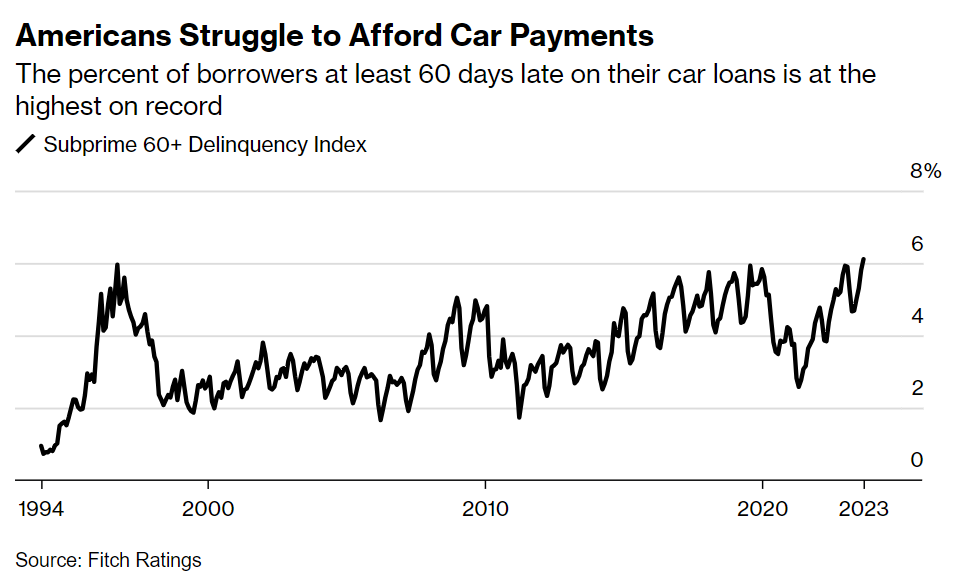

Unfortunately, I find we live in an instant gratification society where people see it and need it immediately. We have social media filing our minds with drivel and the only thing people post is their best self in the new car, on a fancy vacation, with the new outfit… We have these awful Buy Now Pay Later companies that charge massive interest for people to buy something they cannot afford. The US Credit Card debt has grown dramatically recently, hitting $1 trillion with an average interest rate of 24% according to Lending Tree. As seen in “Quick Bites,” auto delinquencies are rising.

I try to teach my kids about fiscal responsibility as best as I can today. My daughter asked for an expensive pair of sneakers that were a “must-have.” I said, “I think $100 is fair. You have money saved and can use your money to pay the difference.” All of a sudden, the “must-have” sneakers no longer were appealing.

She said, “Wait, I have to pay with my babysitting money?” No, she did not buy the shoes when it was with her own money. Funny how that changes perspective.

I am growing increasingly negative on the world for all the reasons I have discussed in recent pieces (rates, lack of leadership in DC, fiscal irresponsibility, border, crime, consumer slowdown, bank exposure to R/E and corporate debt maturing, the Middle East, oil, US consumer… The result is I am 75% in short-dated Treasuries preparing for opportunities that I believe are coming. I am getting more calls on opportunities for me to invest at interesting attachment points given the backdrop and expect far more over the next 18 months. Too many people spread themselves thin by either overspending or not keeping enough cash on hand. Cash is king and will be more true in 2024. Being fiscally responsible is imperative.

I appreciate Buffett for so many reasons and his frugality is right up there with his investing. I loved reading this story about a McDonalds lunch between Buffett and Gates. His frugality isn't for personal gain. He has given billions to various charities and signed the Giving Pledge, affirming that over 99% of his fortune will be dedicated to philanthropic causes during his life or upon his passing. Microsoft Corp. Co-Founder Bill Gates, one of Buffett's close friends, recalls an incident in the 2017 annual letter posted on Gates Notes. During a trip to Hong Kong, the billionaire duo decided to grab lunch at McDonald's. To Gates' amusement, when Buffett offered to pay, he pulled out a handful of coupons.

Buffett is worth over $100bn and has the ability to buy literally anything. Instead, he clips coupons, lives in the same house since sine 1958 which he paid $32k for at the time, and reminds us what smart business people do. His company, Berkshire Hathaway has TENS OF BILLIONS of cash on hand and is clearly going to be prepared to take advantage of what I believe is coming. My favorite Buffett saying is “Be Fearful When Others Are Greedy and Greedy When Others Are Fearful.” Warren is a role model for so many reasons including investment prowess, philanthropic activities, fiscal responsibility, and the simplicity of his genius. We can all learn from him. Please follow in his spending footsteps. You don’t need everything you buy and debt will hurt, especially in the new rate environment. Now if I could just get the idiots in DC to reign in spending, complete entitlement reform, not give money away to every country that asks and actually balance a budget, we have a chance. I just don’t like the odds of it happening.

Here are 34 tips from Warren Buffett. I picked my favorite ones and they are things I believe in and live by.

Quick Bites

Stocks had a rough week with a broad-based selloff as rates climbed and the geo-political risks have escalated dramatically. Concerns over higher rates weighed on the market during the week. The S&P 500 is down 2.2% on the week, while the Dow has lost 1.5%. The Nasdaq is off 3%, putting it on pace for its second straight week of losses. I inserted a chart of index, sector ETFs, and select stock performance on week and YTD. Regional banks were under pressure with the KRE ETF falling 4% and Regions Financial falling 12% on the day due to weak earnings. Solar stocks were hit hard as Solaredge fell almost 30% on Friday citing weak European demand. The 10-year Treasury yield hit 5% before rallying given the broader market sell-off Friday and finished at 4.91%. This WSJ article shows how Treasury Bonds and stocks are becoming highly correlated (see chart). Also of note, the government bond sell-off was global with the US, Germany, Australia, UK, Italy… all seeing higher yields. I wrote recently that I felt VIX (volatility of S&P) was too low and it is +18% on the week and now approaching 22. I suggested last week that 30 was in the cards before year-end. The last chart from Bank America is generally a buy signal, but I am not buying it. This link shows each stock performance in the S&P 500 YTD through Thursday and ranked from best (Nvidia) to worst performing (Solaredge).

Federal Reserve Chairman Jerome Powell acknowledged recent signs of cooling inflation but said Thursday that the central bank would be “resolute” in its commitment to its 2% mandate. As Powell spoke, futures market traders erased any possibility of a rate hike in November and decreased the chances of a move even in December. He acknowledged the progress made toward bringing inflation back down to a manageable level but stressed vigilance in pursuing the central bank’s goals. “Inflation is still too high, and a few months of good data are only the beginning of what it will take to build confidence that inflation is moving down sustainably toward our goal,” The US wrapped up the fiscal year with a deficit of $1.7 trillion as the runway spending continues. Chairman Powell, maybe if you had not left rates at zero for so long and continued buying $120bn/month of Treasuries and mortgages (Quantitative Easing) while the housing market was on fire we would be in a different position. Powell’s “Transitory” call could be the worst Fed policy mistake in history and Bernanke’s (Subprime is contained is the 2nd worst call).

No one has written about consumer concerns more frequently and earlier than I have in the Rosen Report. This Bloomberg article (sent to me by Brad) is entitled, “Car Owners Fall Behind on Payments at Highest Rate on Record.” Months ago, I started writing about the trends and the article highlights how bad things have become and student loan payments are just restarting now, after the data discussed in this article. The percent of subprime auto borrowers at least 60 days past due on their loans rose to 6.11% in September, the highest in data going back to 1994, according to Fitch Ratings. As higher rates move through the system, I expect things to deteriorate further.

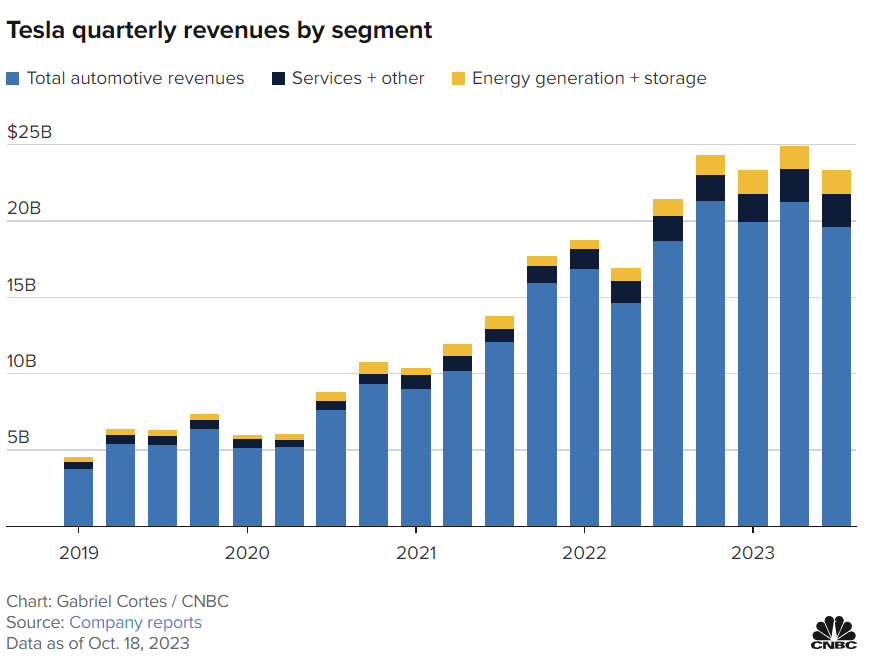

Tesla earnings came out minutes prior to my last note, so I only included a couple of sentences. The earnings call has some interesting points on cost. Musk said: “I’m worried about the high-interest rate environment we’re in,” and said people buying cars are focused on how much their monthly payments will be. “If interest rates remain high or if they go even higher, it’s that much harder for people to buy the car.” Musk later noted: “I just can’t emphasize enough how important cost is. …. We have to make our products more affordable so people can buy it.” TSLA stock was -9% on Thursday post earnings and -15%+ on the week. After peaking at $410/share in 2021, the stock is now at $212/share or -49% from the highs.

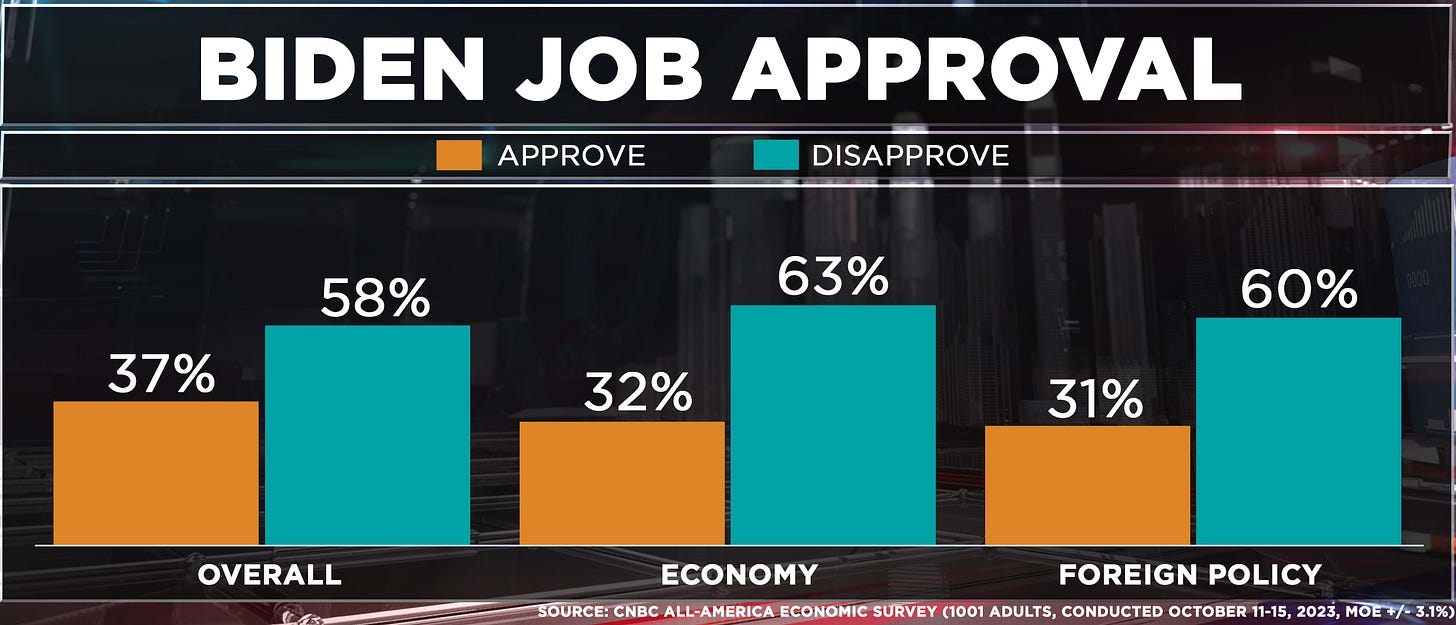

A record 58% of Americans do not approve of Biden’s performance in the White House, a CNBC survey released Wednesday found. The president received particularly low marks for his handling of the economy – 32% approve – and foreign policy – 31% approve. Biden’s numbers among young voters, blacks and Latinos “are very troubling,” Democratic pollster Jay Campbell told the outlet. In a potential head-to-head matchup against former President Donald Trump, Biden would lose by 4 points, the poll found. The results showed 46% supporting the 77-year-old former president compared to 42% who would back the incumbent. I keep saying we need new candidates from BOTH parties. America deserves better than Biden or Trump. New story that Joe’s brother gave him a $200k check in 2018.

Israel Headlines

I have spoken with multiple Jewish students/readers who are so scared on college campuses that they are hiding their Jewish identity. Yes, I would say we have a problem. I have never had bad dreams in my life. Now, I literally have nightmares every night about the escalation of hate around Jews. Every temple I see is covered in police out of fear of attacks.

Biden’s speech on Thursday starts at 42 minutes

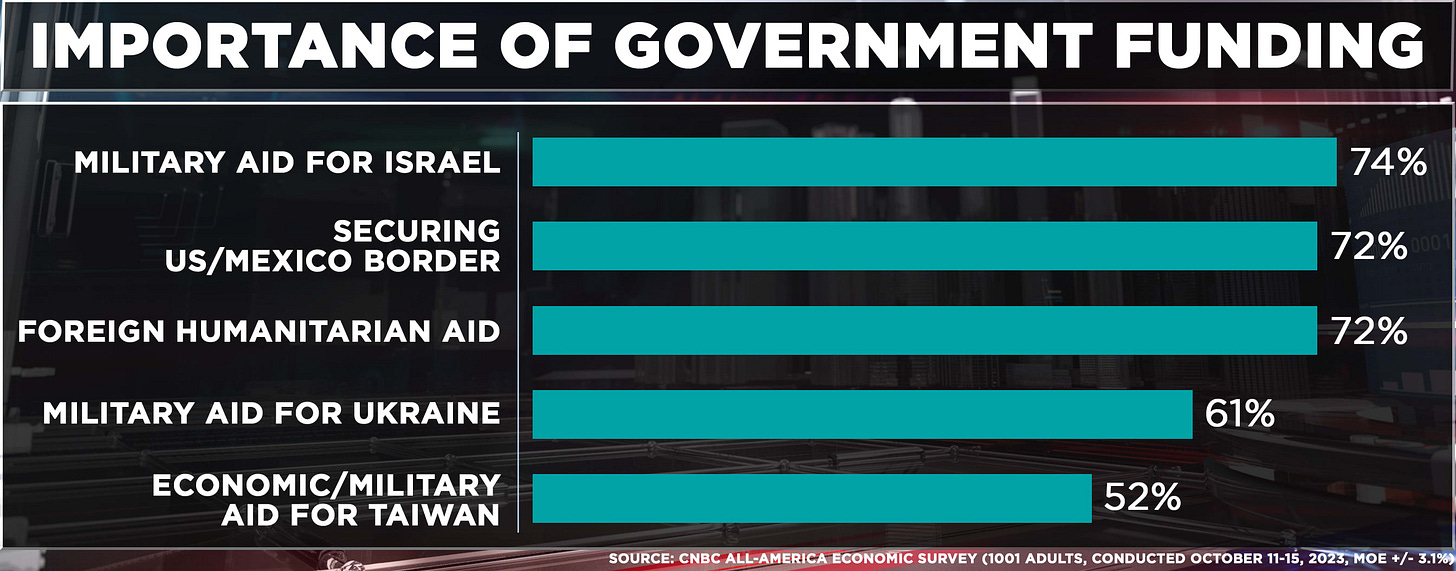

On a positive note, Biden seems committed to Israel and Ukraine. Sadly, the policies of this administration towards Iran and Palestinians have only emboldened bad actors with vast sums of money. The lack of a border has not made Americans any safer either. Again, I am not for Trump or Biden. Biden wants $60bn for Ukraine and $14bn for Israel as part of a $105bn request.

American mother and daughter taken hostage by Hamas have been released

The suggestion is there was a health issue and it was done for “humanitarian causes.” Let’s be crystal clear on this subject. Hamas does not know what humanitarian means. They decapitated babies, raped girls, and killed entire families of civilians.

US Navy destroyer shoots down missiles potentially headed toward Israel

China deploys six warships to Middle East over fears Israel crisis could spark WW3

Xi Jinping believes a two-state solution for an independent Palestine is the “fundamental way out.”

Israel says it found Hamas files with instructions for making cyanide-based weapon

Israel, US Intelligence, Biden, and major news organizations all point to Hamas. Rep. Rashida Tlaib (D-MI) is doubling down on her unfounded claim that Israel is responsible for an explosion near a hospital in Gaza Tuesday, declaring at a Wednesday rally in Washington, D.C. that Israel and President Joe Biden are responsible for a “genocide.”

Ilhan Omar breaks down in fit of rage aimed at Biden, Democrat leadership over support for Israel

NYT rehires Hitler-praising Soliman Hijjy to cover Israel-Hamas war

There is a picture in the link where Soliman has Hitler and above it, “How great you are Hitler.” I want you to think about which companies you support. If the NY Times hires people who admire Hitler and praise him, should you be supporting the NYT? I will not.

Hamas terrorists likely used North Korean weapons during brutal attack on Israel, evidence shows

Man slugs woman in the face on NYC subway tells her it’s because ‘you are Jewish’

Will he be charged with a Hate Crime and serve time or get out with no bail to do it again?

Dr. Mika Tosca, Chicago professor, apologizes for calling Israelis ‘pigs’ and ‘very bad people’

If you apologize after calling Israelis “pigs” does it make it ok?

Greta Thunberg posts then deletes 'free Palestine' post after pushback: 'I was completely unaware'

Drones attack a US military base in southern Syria and there are minor injuries, US officials say

U.S. State Department issues ‘worldwide caution’ alert as tensions in the Middle East soar

There are more stories of incidents in the USA. Multiple reports of Uber drivers asking passengers if they are Jewish and making threats. I have not confirmed them firsthand, but given the environment, nothing would surprise me today.

Detroit synagogue president found stabbed to death outside home

No details given. It is unclear if this is indeed a hate crime.

Other Headlines

Netflix stock surges 13% as profit beats expectations, ad-tier subscriptions rise

OpenAI Is in Talks to Sell Shares at $86 Billion Valuation

The CEO owns ZERO shares in the company and now he says he cannot rule out OpenAI making its own chips.

Net worth surged 37% in pandemic era for the typical family, Fed finds — the most on record

Harvard’s $51 Billion Fund Beats Yale in Hard Year for Endowments

Jim Jordan no longer GOP speaker nominee after third defeat on House floor

We are 19 days without a Speaker of the House during a trying time in America and the world. We have a debt ceiling issue, wars in Israel and Ukraine, a border crisis, runaway spending, upheaval in academia over the Middle East, no real energy policy…. The lack of leadership in DC is truly appalling.

Pro-Trump lawyer Sidney Powell pleads guilty in Georgia criminal election case

Judge fines Trump $5,000 for gag order violation after threatening him with jail time in fraud case

New York AG demands evidence review after top Trump exec is accused of lying in fraud trial

Woman in critical condition after randomly being pushed into moving NYC subway

Last week, I took the subway 5 times. My head was on a swivel. I stood with my back against a column so I could not be pushed from behind. The suspect in the attack was arrested and is tied to a second subway attack. The DA’s in NYC sure do an awful job at putting violent criminals behind bars.

When I think about the decline in America and the direction of the country, I look to stories like this one to prove my point. The video is 1.5 minutes. Please watch it and look at what is happening in the country. How is this possible? Sex offender giving “Free Fentanyl” across the street from a school. What could possibly go wrong?

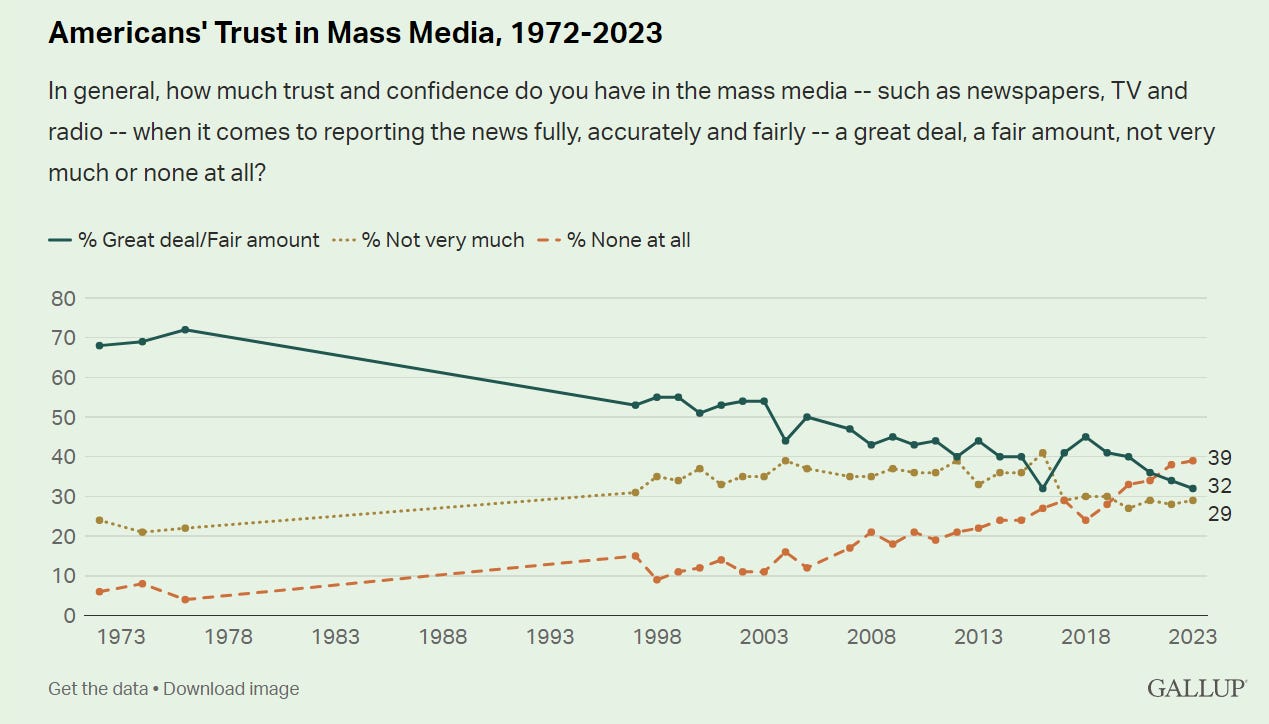

Media Confidence in U.S. Matches 2016 Record Low

The 32% of Americans who say they trust the mass media “a great deal” or “a fair amount” to report the news in a full, fair and accurate way ties Gallup’s lowest historical reading, previously recorded in 2016.

US government says it received over 200 reports of UFOs/UAPs in last 8 months

Come on, man. A few of these must be true UFO’s not from this world.

Florida street racer driving 80 mph goes airborne after losing control, lands in canal: wild video

Of course, it is Florida.

Real Estate

Ken Griffin is building a home in Palm Beach which would be worth up to $1bn according to this article. Great picture in the article showing his 14 parcels on the property. He spent almost $500mm accumulating 27 acres on the Intracoastal and ocean and plans to spend $150-400mm on construction. The link has renderings and pictures. The 50,000 ft home will include a service basement, contemporary house, and guest house. I don’t understand how you can spend $250mm to build a 50,000 ft house. Seems impossible. You can build something out of this world for $1,500/ft. I do not see how you can spend $5,000/ft, but when you are worth $40bn, you can do whatever the hell you wanna do. I’m throwing up in my mouth on the annual taxes, upkeep, cleaning, electric bills, and landscaping. How many staff are required to manage the property and how many people in the world can afford it when it gets sold? If it were to be assessed at $700mm, he would be paying $1mm/month in taxes. I spoke with a large Palm Beach high-end R/E developer and he told me the LAND VALUE is $1.2bn today. This CNBC article is entitled, “Billionaires are driving South Florida home prices to new records,” and only further proves the point about high-end R/E in South Florida. The average sale price in Palm Beach was over $20mm, making it the most expensive market in the country.

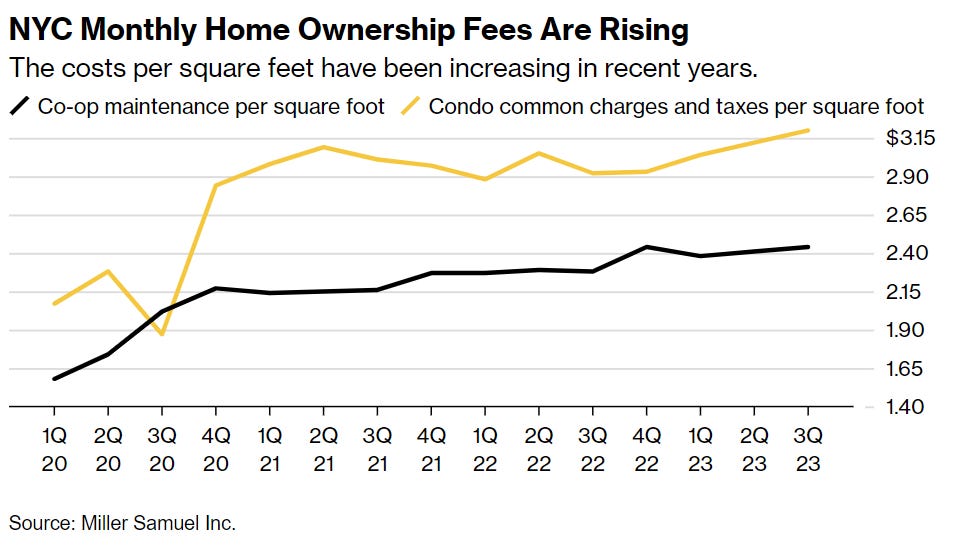

Great Bloomberg article entitled, “NYC Homeowner Costs Are Rising at Three Times the Inflation Rate.” No one ever said living in New York City is cheap. But surging expenses in recent years are threatening to squeeze homeowners even more. Fees paid to co-op and condo boards have soared almost three times faster than the rate of inflation. Ever-tougher rules on inspections, escalating insurance premiums and preparations for a strict new climate law are adding hundreds or even thousands of dollars to monthly bills for residents already paying some of the world’s highest housing costs. The cycle of near-constant repairs and construction across the city is pushing up insurance expenses, which have jumped more than 300% for some properties. After years of steep inflation in the US, New Yorkers aren’t alone in paying higher prices for everything from taxes to water, gas and electricity. As routine expenses have surged, so have the fees the city’s condo and co-op boards charge unit owners. Those bills — meant to cover utilities, labor and basic building maintenance — jumped roughly 54% from the first quarter of 2020 to the third quarter of this year, according to appraiser Miller Samuel Inc. Across the economy, US consumer prices were up 19% in the same period. The article also discusses the massive costs of buildings becoming “climate compliant,” which will sharply increase the costs to live in the buildings.

Sales of previously owned homes dropped 2% in September from August to a seasonally adjusted, annualized rate of 3.96 million units, according to the National Association of Realtors. This is the slowest sales pace since October 2010, during the Great Recession, when the market was in the midst of a foreclosure crisis. As a comparison, just two years ago, when mortgage rates hovered around 3%, home sales were running at a 6.6 million pace. The average rate on the 30-year fixed today is right around 8%, according to Mortgage News Daily. The NAHB homebuilder survey in October weakened further to 40 from 44, 4 pts below expectations and the weakest since January.

Rosen Report™ #624 ©Copyright 2023 Written By Eric Rosen