Opening Comments

There is a new app on iPhone for Substack, and I think it may make reading the report easier. It just came out. The sign up for the app is above. It will also make it easier to find old reports.

We took possession of the new 2022 Tesla Model Y for Jill, as hers was totaled a four months ago. I must tell you, these cars are great, albeit far more expensive than the Model 3. The Y cost a total of $64k with all the bells and whistles including 20” wheels and white interior. It looks and drives great and the 20” black wheels are amazing. Unfortunately, the incentives are gone. When I bought the Model 3.5 years ago, we received approximately $10k in government incentives, which brought the cost of the car down to $42k. This new one is surely nicer and a better model, but costs 50% more. Given a 330 mile range before needing a charge, I continue to contend it is not realistic for long road trips, but perfect for going around town. There are not enough super charging stations with easy access at this point. I hope in coming years this will change.

I recently received a great compliment from a reader.

“Eric, I am quite busy and when I open up your report, my attention is to scan it and not read the entire piece. What happens is I find 90%+ of your content so interesting and informative, I end up reading the whole thing.”

I really enjoyed this comment and it means my hours of curating and editing the piece are worth it. Today, be sure you look at the 2s/10s Treasury bullet in Quick Bites. Things are getting interesting. Today’s piece has more financial and economic information than usual. With spring break and some travel, there might be a couple missed reports depending on the news flow and my internet connection.

Video of the Day-Russian Tanks Eviscerated

Flavor to the Maxx-Pricey, but Solid Food in So. FLA

Quick Bites

US Markets, 2s/10s Curve Flattening

Inflation, QE Ended, Chinese Stocks

Consumer Stress Levels

Future Renewable Energy Sources

Jussie Smollett Sentenced

Other Headlines-Big Russia/Ukraine Section with my Commentary

Virus/Vaccine

Data-Improvements Continue

Global Death Toll 18mm+?

China Lockdown

Real Estate

My General Comments

The challenges in South FL (Housing, Schools, Doctors)

R/E Wealth Gap

$1mm Homes Growth By City

Video of the Day-Russian Tanks destroyed by Ukrainian Artillery

DRAMATIC footage shows the moment a column of Russian tanks is destroyed by a Ukrainian ambush near Kyiv. The attack reportedly claimed the life of yet another senior Russian commander as Vladimir Putin’s forces press in on the capital city. The video is a little over 1 minute and is amazing footage of a bunch of Russian tanks getting obliterated. I continue to question Putin, his strategy and the ultimate goal. He could bring the full force of Russia on Ukraine and eviscerate it if he wanted. I remain convinced he is not well. In my note “Hidden Fees” from 2/27/22, I questioned Putin’s heath and compared pictures in the past couple years. In the past 24 hours, I have read at least a half dozen articles suggesting Putin is ill and under steroid treatments and has absurd social distancing rules and has become erratic. Multiple articles are suggesting he has cancer, but obviously none of these are confirmed. I am convinced he has something. Here is yet another article questioning his health.

Flavor to the Maxx-Pricey, but Solid Food in So. FLA

I have been incredibly critical of the food in South Florida and it is for good reason. Most of the restaurants are marginal at best and are over priced. There are very few good eateries in my opinion, but I am a bit jaded having lived in NYC and Chicago. I will admit some good new places have gone up in Miami, but that city has a long way to go before it is considered a food destination. Yes, I have called South Florida a culinary wasteland in more than one Rosen Report, but it is justified.

When we first moved down in 2017, we would celebrate birthdays, anniversaries or other special occasions at Cafe Maxx in Pompano Beach. It has been opened for almost 40 years and we have never had a disappointing meal there. Given the pandemic and limited outside dining, we had not been in over two years. Recently we went as we had my wife’s family in town. To me, Cafe Maxx is an excellent combination of quality food, diverse menu options, great presentation, fantastic wine list, solid desserts and high quality service. The scene is not hip or cool, but beggars can’t be choosers.

I always start with the Tuna Sashimi Pizza with wasabi cream cheese, sweet soy, caviar, scallion and spicy mayo. It is one of my favorite dishes on the menu and it is something I have never seen in other restaurants. It is small and had two for the table. I also enjoy the Roasted Buffalo Cauliflower with blue cheese and celery. You must get the Brussels Sprouts as they cannot be beat and come with sweet chili sauce and Asian vegetables. Jack talks about these Brussels Sprouts more than anything on the menu.

The menu which constantly changes has soup and salads and a handful of different pasta choices. They offer lighter fare of veggie platters, and small entree portions. However, if you come to Cafe Maxx, go big or go home. Pants with an elastic waste might be required, as we doubled up on a bunch of the appetizers as they were so good.

The seafood is fresh and fantastic. I suggest locally caught fish such as Yellowfin Tuna, Sweet Onion Crusted Snapper, or Herb Crusted Grouper. I had the Grouper and it was delicious and a healthy portion. The texture of the grouper was interesting with the herb crust and I enjoyed the vegetable medley as well. My son had the Cashew & Macadamia Crusted Triple Tail (local fish), and he devoured it.

The menu offers plenty of meat and poultry dishes including Filet, Lamb Chops, Ribeye, Chicken and Pork Chops. If you cannot find something on this menu, then you have some serious issues. They even make accommodations for picky eaters like Sally from “When Harry Met Sally.” (Please watch the short scene). How do I know this? My wife is not dissimilar from Sally on the ordering front. My nieces both devoured the food and they are finicky eaters too.

For dessert, they have amazing Key Lime Pie, Warm Apple Tart, Peanut Butter Brownie and the famous Fallen Chocolate cake. As a table, we went through three Fallen Chocolate Cake orders in short order and the Key Lime Pie is quite tasty as well. I love the crust of the Key Lime Pie and never want to leave any behind.

The wines by the glass and list are quite good albeit not inexpensive. Overall, I really enjoy the experience. I generally get upset when I go out to dinner down here. It is expensive and the food is never overwhelming. At Cafe Maxx, it is quite expensive (prices must be up 25% since the pandemic). The food is so outstanding that I don’t even mind paying between $35-80 for an entree (most are around $50). The crowd could dress a little better (too many Tony Soprano Bowling shirts), but I am so delighted with the food, presentation, wine and service, I really don’t care and am willing to pay for it once in a while. Wait, who just said that? Not the notoriously frugal man named Eric Rosen who is the author of the world famous Rosen Report. Yes, he just said that.

Food-A

Presentation-A

Service-A

Wine List-A-

Ambiance-B

Cost-EXPENSIVE for South Florida

Quick Bites

The Dow fell on Friday and notched its fifth straight week of losses as investors remain cautious about the war between Russia and Ukraine. The Dow dropped 230 points to 32,944, dragged down by losses in Nike and Apple. The S&P 500 fell 1.3% to 4,204. The Nasdaq fell 2.2% to 12,844. For the week, the Dow lost 2.0%. Meanwhile, the S&P fell 2.9%, and the Nasdaq slid 3.5%. “The S&P 500′s -12% decline from its peak suggests much of the froth has been taken out,” said Savita Subramanian, equity and quant strategist at Bank of America Securities. “Stocks are largely pricing in the geopolitical shock, where the S&P 500 fell 9% from peak-to-trough since Russia-Ukraine headlines in early Feb, similar to a typical 7-8% fall in prior macro/geopolitical events.” The once high-flying ARK Innovation ETF is off 64% from the all-time high last February for perspective. The ETF was up over 140% in 2020. The 10-Year Treasury is at 2%, oil is at $109 after hitting $135/barrel and Natural Gas is $4.8. Crypto remains volatile with BTC at $39k and ETH at $2.6k. The volatility index (VIX) is at 31. For perspective, it was 76 peak pandemic and was 9 in 2018. I spoke with a large hedge fund manager and he told me the market felt awful Friday and there was a lot of inventory for sale. The data I have through Thursday shows the JPM HY Index yielding 6.4%, but should be a bit higher after Friday’s sell off.

Every time the 2s/10s Treasury curve has gone negative, we have seen a recession shortly there after since 1980. The 2s/10s curve is getting obliterated as the front end is widening sharply. It now stands at 25 bps. It was 158 bps one year ago meaning the 2-year Treasury was 158 bps less in yield than the 10-year Treasury. This is something I would be watching carefully and have been inserting it in recent Rosen Reports. The gray vertical lines are recessions and the wider the line, the longer the recession. The more negative the 2s/10s becomes the closer we are to a recession based on the chart. At the very least, we are looking at a material slowdown in GDP, while prices are escalating. At worst we are looking at stagflation with a decent recession. Risk of a US recession as high as 35%, Goldman Sachs says. This is the link to the chart if you want to follow it (from St Louis Fed). Historically, recessions see inverted yield curves like below and some kind of commodity price shock or Fed tightening. Looks like we might have all three. It should be noted, that Ed Hayman from Evercore believes recession risk remains “low” for the following 7 reasons: 1) Positive yield curve, 2) Unprecedented monetary stimulus, 3) Changes in monetary policy take time, 4) $2 Trillion consume excess saving, 5) Reopening, 6) Housing booming, 7) Inventory rebuilding. Ed is pretty impressive.

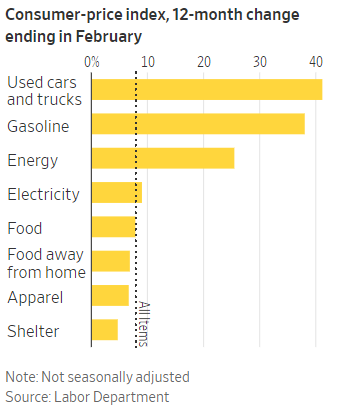

Prices kept rising last month in America, pushing a key inflation measure to a level not seen since January 1982. The Consumer Price Index, which measures a basket of goods and services, stood at 7.9% over the 12-month period that ended in February, without seasonal adjustments, the Bureau of Labor Statistics reported Thursday. Everything I buy is going up sharply in price: Food, consumer products, gas, restaurants, services, shipping, airlines, rental cars, airplane tickets, hotels….Treasury Secretary Yellen said, “Americans will see another year of very uncomfortably high inflation.” Remember, they were all saying “Transitory” not long ago. This will make the mid-terms very challenging for Democrats unless inflation cools sharply in coming months. It would be nice if a politician ever took any responsibility for a mistake. Biden said, “I’m sick of this stuff… the American people think the reason for inflation is government spending more money. Simply not true!” I believe it is a combination the $1.9 trillion American Rescue Plan, a Fed which was too accommodative (next bullet), bad energy policy, supply chain issues, people unwilling to go back to work, and the Ukraine situation which is in part due to bad foreign policy. Is this 100% on Biden, NOPE, but it ain’t zero. This WSJ Opinion piece is entitled, “It’s Joe Biden’s Inflation.” Remember George H.W. Bush had an 89% (highest in modern history) approval rating in 1991 and lost to Bill Clinton the next year. Lots of time left and we know wars tend to improve approval ratings at least temporarily (Biden’s ratings up in past 10 days). Be a leader, take responsibility and get to the right decision. Energy independence is key. I do not believe Putin would have gone into Ukraine under Trump. Note, Putin took Crimea in 2014 under Obama and went into Ukraine under Biden. We all know I am not a huge Trump fan, but look at the actions of Putin under the three Presidents. Bill Maher made similar comments on his show about Putin invading under Biden. I know, Trump had lots of other shortcomings. Disappointingly, we are constantly required to pick between the lesser of two evils and keep losing either way.

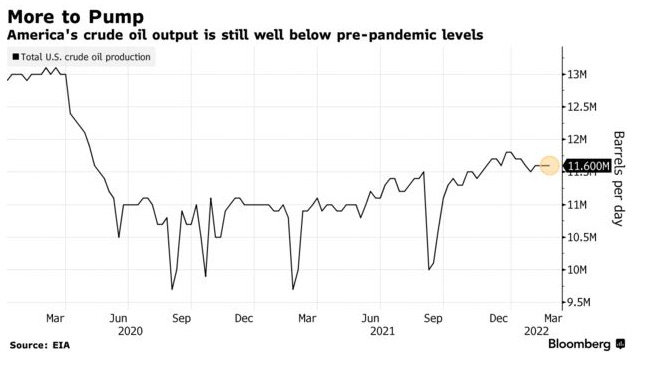

Gas prices finally leveled off after climbing to new highs each day as seen in the AAA chart below. The all-time high from 2008 has been beat by 23 cents last week. Uber has added a customer surcharge to trips and Uber Eats as a result of the gas price increases. This Telegraph story is entitled, “Record gas prices are pushing up everyday costs, dampening economic recovery.” It discuses higher gas prices are increases plane tickets, lawn care company charges, mobile dog groomers, trucking and delivery….This is not 100% on Biden, but he too should take blame. We will be reliant on fossil fuels for a long time. Vilifying producing oil and gas, cutting the Keystone Pipeline and acting as though we can rely on alternatives is a false narrative. Less than 1% of cars on the road in the US are EVs. The 2nd chart from Bloomberg shows production is down approximately 1.4mm barrels/day.

I enjoy research from DB’s Jim Reid, and include it in the report from time to time. I have been CRITICAL of the FED for keeping rates too low for too long and for Quantitative Easing (QE) lasting far longer than required. The Fed got it wrong yet again and Jim’s recent note reminded me of my frustrations. In QE, the Fed conducts open market purchases of largely Treasury and Mortgage bonds to increase money supply and encourage lending and investment. The Fed also bought some corporate bonds as well. Friday marked the end of an era. The Fed conducted its final QE purchases for this cycle (that’s right, QE is still ongoing with inflation near 8%), bringing the taper to an end. After the final QE purchases settle, the Fed will have added more than $5 trillion of securities since Covid, more than doubling the size of the balance sheet. This compares to $3.7tn securities added through three rounds of QE between 2009 and 2014 to combat the GFC so a much more aggressive response and one that occurred alongside huge fiscal stimulus. The Fed’s balance sheet will top out north of 35% of GDP. DBs Chief US economists expect the Fed to unveil QT caps at next week’s FOMC meeting, with QT beginning in June. They expect the Fed to shed $1.9tn of assets through 2023 – the equivalent of 3 or 4 rate hikes - and just shy of $3tn

securities in total through this whole QT program. I am sorry, the purchases ending in mid-March of 2022 are idiotic and should have ended closer to a year ago based on the crazy real estate markets, general inflation and all the other programs of free money the Fed and Biden threw at the system. Too much fuel added to the fire. The 2nd picture was sent to me by a reader, Robert.

Chinese stocks listed in the U.S. endured their worst day of trading since the global financial crisis as traders were whiplashed by renewed regulatory concerns following another day of intense swings in Asia. The Nasdaq Golden Dragon China Index plunged 10% on Thursday and another 10% on Friday. American depositary receipts including Nio Inc. and XPeng Inc. were each down over 20% for the past two trading days. Aside from the geopolitical concerns that have caught many global investors off guard, Chinese stocks have been under intense pressure after months of regulatory crackdowns. I have written no fewer than a half dozen times that I will not invest in China. There are too many risks and the potential of the ADRs getting de-listed only reinforces my prior view. One stock all my readers know is Alibaba. Baba was down 8% on Thursday and down another 7% Friday. YTD it is -28% and from the 2020 high it is -72% with a PE ratio of 50% of Amazon. When you factor in the cash positions relative to market value of AMZN and Baba, it is clear Baba trades at even less than 50% on many metrics (Thanks Mitch). The Baba market cap peaked at $858 bn in 2020 and today it is $236bn. Baidu ADR has gone from $340/share to $119/share or -65% from the highs. JD.com ADR is down over 54% from the highs. Didi fell 44% on Friday alone and is -87% from the IPO price. Softbank ADR is -61% in the last year. If you have been waiting to get into China, this sell-off could be your opportunity. Many of these stocks are cheap on many metrics, but it is China and should trade at some discount to Europe or the USA.

Financial woes, coupled with a barrage of horrifying scenes from Ukraine as Russia continues its invasion, have pushed a majority of Americans to unprecedented levels of stress, according to a new report from the American Psychological Association. The association's annual "Stress in America" poll, published Thursday, found that U.S. adults — already weary from two years of the Covid-19 pandemic — are now overwhelmingly troubled by inflation and the war in Ukraine. According to the results, 87% of those surveyed cited rising costs of everyday items, such as groceries and gas, as a "significant source of stress." More than 70% of parents said they were fearful that the pandemic has impacted kids' social, academic and emotional development. And 68% said they were concerned about children's cognitive and physical development. At the end of the day, we have endured 2 + years of the pandemic, lockdowns, mask mandates, social distancing, kids home schooled, vaccines, hand sanitizer until we are raw, and now we have inflation, war and the threat of nuclear war. I too am stressed. The poll showed approximately 25% of respondents tried to cope with the pandemic by drinking more alcohol.

I found this WSJ article on new ideas for renewable energy. I know these won’t be available tomorrow, but some are interesting. Many readers have contacted me about the energy crisis we are facing. Again, I feel we will be reliant on fossil fuels for decades, but over time, the proliferation of new alternatives and the growth of EVs will help alleviate the reliance on fossil fuels. This article talks about Stacked Turbines, Kite Power, Turbines in Water, Wave Energy, Geothermal Energy, and Space Based Solar. Below is a drawing of Stacked Turbines which is interesting. One concerning point in this CNBC article is the rising cost of Solar which jumped 18% in 2021 after years of decline.

After an emotional day of testimony on both sides, actor Jussie Smollett has been sentenced to 150 days in jail in connection to a staged hate crime that occurred in Chicago in January 2019. He was also ordered to pay more than $120,000 in restitution to the city of Chicago and was fined $25,000. He was also sentenced to 30 months of felony probation. Smollett claimed he was punched in the face, an unknown chemical poured on him, a rope wrapped around his neck and the two attackers made reference to MAGA (Trump’s slogan). The whole thing was a hoax and thousands of police hours were wasted. Cops suspected something on day one, but spent thousands of hours on the case. I personally felt the sentence should have been harsher. Timeline of incident. Of note, a reader, Rich, immediately questions Smollett’s accusations and proved to be right. Remember all the politicians who came running to his side and called this a “modern day lynching?” No comments from them now. Why not speak out against Smollett’s actions after his conviction and sentencing?

Other Headlines

Rivian stock sinks after EV maker says it expects to deliver a modest 25,000 vehicles this year

This once high-flyer stock hit $172 in 11/21 and is now at $38 or -78% over 4 months. It went public at $78/share on 1/10/21. I wrote about the absurdity of the valuation when the stock flew. Peak market cap was almost $130bn. Today Ford is $64bn for perspective.

Rihanna’s Lingerie Company Weighs IPO at $3 Billion Valuation

I read Rihanna owns approximately 50% of the company.

Ether’s use cases could drive price to $40,000, says Abra CEO: CNBC Crypto World

Doritos Cuts Number of Chips in Each Bag

Doritos took out 5 chips, Bounty has cut three sheets of paper towels and Wheat Thins has 28 fewer crackers. You just cannot look at price alone.

Disney pauses political donations in Florida over 'Don't Say Gay' bill backlash

Trump Asks Supporters to Give Him Money For New Plane After Emergency Landing Over the Weekend

'Trump Will Be Charged,' Kirschner Concludes After AG Garland's Remarks

This would sure be an interesting development. I am hopeful that the 2024 candidates do not include Trump, Biden or Harris.

North Korea testing new intercontinental missile system, U.S. intel agencies believe

Seems to me Russia is testing the US. China is in support of Russia and likely Taiwan situation and N. Korea is getting into the mix. I just am not convinced our leadership is able to handle this. I sure hope I am wrong.

India accidentally fires missile into Pakistan

Both have nukes. Could you imagine if the missile hit a school? This could have been a huge disaster.

China warns of 'worst consequences' for any country that supports Taiwan militarily

Iran fires missiles at Irbil US consulate; Tehran: ‘Secret Israeli bases’ targeted

Career criminal indicted on murder charge freed without bail by NYC judge

There is no one who can convince me that a CAREER CRIMINAL who allegedly murdered someone should be out with no bail. He admitted to the crime according to the article. The law abiding citizens are paying for these idiotic policies. Don’t elect soft on crime politicians. It is your own fault. Free without bail?

I cannot believe we are having a conversation about a person with 47 arrests who hit someone in the head with a hammer. Why is this person not serving life in jail? Read the story and tell me why this person should ever be released. If when released, he goes on a killing spree as promised, the judge, DA and all others involved should serve life in prison. The attacker identifies as a woman.

As a retired NYPD officer of 29 years, I watched the city turn on us

The ramifications of police hate are concerning according to a long-time officer.

More than 1 ton of fentanyl seized in NYC in 2021 — soaring 206 percent in one year

Woman sues for $30M after NYPD puts her pic on ‘wanted’ poster

This story is bonkers. She should get MILLIONS due to the reputation damage here.

Woman whose rape DNA led to her arrest to sue San Francisco

I was in shock at this one. A woman was raped, and her DNA matched a burglary and she was arrested. I had never considered this possibility.

I have called for Fauci to move on for over one year. He is the highest paid person in the government and when a researcher looked into Fauci’s financials, that researcher was fired. I am not upset Fauci is well compensated. I am disappointed in the lack of transparency and secrecy and how Fauci is being protected. There are some serious conflicts here which warrant an investigation.

Houston Texans QB Deshaun Watson won't face criminal charges in connection with sexual misconduct

When I heard 22 women accused Watson of harassment and sexual assault, I assumed he was guilty, and I was wrong. The grand jury has spoken.

Saudi Arabia Executes 81 People In 1 Day For Terror Offenses

Russia/Ukraine-As I read the headlines, it is hard not to be concerned for Ukraine and the direction of the world between Russia, North Korea, Iran, China… Disappointingly, I am not convinced we have the strongest leadership in D.C. at a time we need it most in recent history. Here are some recent headlines: Russia bombs hospital, Putin bombs disable care home and 48 schools, even state TV Pleading with Putin to stop, Russia has killed 596 civilians UN believes toll is “considerably” higher, Russian soldiers raping women, Russia warns US military shipments to Ukraine are 'legitimate targets,’ Intelligence points to heightened risk of Russian chemical attack, Journalist Shot Dead… I am not expert here, but these sure sound like war crimes to me. Despite this, Biden claims his decision not to send jets to Ukraine was to prevent WWIII. I am not sure that is the right decision. It seems to me Putin is in a weakened position yet is dictating terms. I fear what comes out of China, Iran and North Korea next.

Russia confirms use of thermobaric 'vacuum bombs' in Ukraine, UK says

There is a short video explaining how these bombs work and it is quite stunning, but not in a good way.

China's state media buys Meta ads pushing Russia's line on war

Why would Facebook allow this after banning Russia from doing it?

Russia owes Western banks $120 billion. They won't get it back

Kremlin says Russian economy in 'shock' after sanctions

"Our economy is experiencing a shock impact now and there are negative consequences; they will be minimized.” (Kremlin).

Russia Bans Export of 200 Products After Suffering Sanctions Hit

Goldman Sachs predicts what will happen to Europe’s economy if Putin shuts off the gas taps

The article outlines the impact to GDP on Europe and specifically Germany based on scenarios. There is a wide range, but maybe countries should work on energy independence and not be beholden to bad actors such as Iran, Russia and Venezuela. Just a thought.

Poland's two largest cities warn they can no longer absorb Ukrainian refugee

Russian troops insist to Ukrainian that real target of war is ‘USA inside Ukraine’

Mayor of Ukrainian city abducted by Russian troops, officials say

After Ukraine, Europe wonders who’s next Russian target

Russia has its hands full with Ukraine right now, but it does bring up a good question.

Virus/Vaccine

Jack had his 16th check up at the pediatrician on Friday. I asked about COVID cases. They have over 1,500 patients at the office. Since the beginning of the pandemic over two years ago, they had 3 patients go to the hospital. One was a newborn. One was obese and one had multiple co-morbidities. The data continues to improve as seen below. From recent peaks, cases are -96%, hospitalizations are -81% and deaths are -51%.

The pandemic’s death toll may be three times higher than official Covid-19 records suggest, according to a study that found stark differences across countries and regions. As many as 18.2 million people probably died from Covid in the first two years of the pandemic, researchers found in the first peer-reviewed global estimate of excess deaths. For perspective, this would be more than all of the people the Nazis killed between the Holocaust and the persecution of Soviets, Polish and others. Yet, China pays ZERO price. If I told you a country would be responsible for killing almost 20mm people, trillions of damages and two lost years in various lock downs, I would think the country responsible would have some consequences. Not here.

China locks down city of 9 million amid biggest COVID-19 outbreak in 2 years

Real Estate

I must get 5 emails per week from readers primarily from the Northeast asking me when the South Florida market will crack. I have been through enough booms and busts to know that there will be another crash at some point, but I just don’t see it near term. There is almost zero inventory, at the high end, purchases are largely cash and there are no big plots of develop-able land between desirable areas from Miami to Palm Beach. I do not see the high price growth continuing as affordability is coming under pressure. I also do not see a massive correction in short order. On fringe areas and places where big development is going in (Hobe Sound, for example), maybe. In desirable spots in Miami and Palm Beach, I do not see a big correction near term absent a major shock. I just heard a story about a house in Miami on North Bay Road (most sought after street in Miami). The house sold for $25mm in 2017. The $14mm buyer in early 2020 is a Rosen Report reader. Yes, it was down big between 2017 and 2019. Pre-pandemic, there was a lot of inventory on the market in South Florida. Based on recent transactions on the street, a broker friend believes the house is worth $55-60mm today. Think about that for a second. In two years the value has basically quadrupled. How much higher can prices go? A broker told me that someone had a deposit on a condo in Miami for $3.8mm less than two years ago. The same condo is worth over $7mm today.

If you are relocating to South Florida aside from the challenges of finding a home, the two most pressing issues are getting into a private school, health insurance/physicians. When the Rosen family moved almost 5 years ago, schools were quite easy to enter as virtually all were looking for students. Today, any reasonable school in South Florida is quite challenging. Before buying a home, be sure you have the school situation settled. With respect to health insurance, I could write a book. If you work for a large employer, you are safe. If you do not, the process is very hard and RIDICULOUSLY expensive with limited options. I was paying $3,900/month for a crap insurance called Florida Blue. I spent over 250 hours on the insurance issues and am happy to educate those who care. Next is finding a primary care physician. I was lucky and have a great orthopedic surgeon who tends to my constant injuries. I don’t have a primary care physician after 5 years. Even the Concierge Medicine folks are full.

This WSJ article outlines the growing wealth gap on the real estate front. From 2010 to 2020, about 71% of the increase in housing wealth was gained by high-income households, according to a report released Wednesday by the National Association of Realtors. Overall, the total value of owner-occupied homes in the U.S. rose $8.2 trillion over the decade to $24.1 trillion, NAR said. Those wealth gains have continued in the past two years, as housing prices have surged because of robust demand and limited supply. The housing-value gap between households earning more than 200% of their area’s median income and other homeowners widened significantly over the decade. In 2010, high-income homeowners held 28% of all U.S. housing wealth. By 2020, that figure rose to 42.6%. The share of housing wealth held by middle-income households declined to 37.5% in 2020, from 43.8% in 2010. Low-income housing wealth fell to 19.8% in 2020, from 28.2% in 2010.

If you need any more proof of the crazy level of home price appreciation in 2021, here it is: A record number of cities (146) joined the list of locations where the typical home value is more than $1 million, according to research from Zillow. That number of entrants into the “million dollar club” was nearly triple the number of locations to achieve that threshold in 2020 and more than there were in the past six years combined. The total number of cities where the typical home is priced above $1 million is now 481. The metro areas with the most locations with home values of $1 million and up are San Francisco and New York, each with 76; Los Angeles (57), San Jose (22), Boston (18), Seattle (16), Miami (14), Washington (11), Santa Rosa, Calif. (9) and Santa Barbara, Calif. (9). I can speak for the South Florida market and there is just no inventory. I don’t even know what a single family house in Miami Beach could look like under $1mm given the massive price increases. I looked on Zillow and in Miami Beach, there are a total of 7 homes for sale under $1mm. Here is the link to see what you get and it ain’t pretty. One is a 2/2 for $875k built in 1927 which totals 1,780 ft.

Excellent job ER! Love reading through your reports. Informative and entertaining. A great mix of content. Keep up the great work!