Opening Comments

Coming up with new theme pieces gets challenging at times. After writing, Skiing is for Billionaires,” I got so many responses and reposts, it got me to thinking of other skiing stories. Today’s piece is about a ski adventure from some 20 years ago in Telluride, Colorado.

Temps in South Florida have heated up recently after a warmer-than-usual winter. We are also getting very heavy rain after an extended dry streak. It is getting more challenging to play tennis mid-day with high temps and humidity. Two to three inches of rain forecast for Wednesday.

On the private plane front, I have received 2 calls and 3 emails this week from brokers looking for business. Tell-tale sign of a slowdown in the space.

Markets

Bond Market Overplaying Recession

Paul Singer Market View

Corporate Equality Index-CEI-MUST READ

MS on Commercial R/E

Blackstone Sold Office Bldgs at Loss

$30bn New Blackstone R/E Fund

Americans are “Rent Burdened”

Houston Apartment Foreclosure (3,200 units)

Top 10 Places for a Beach House

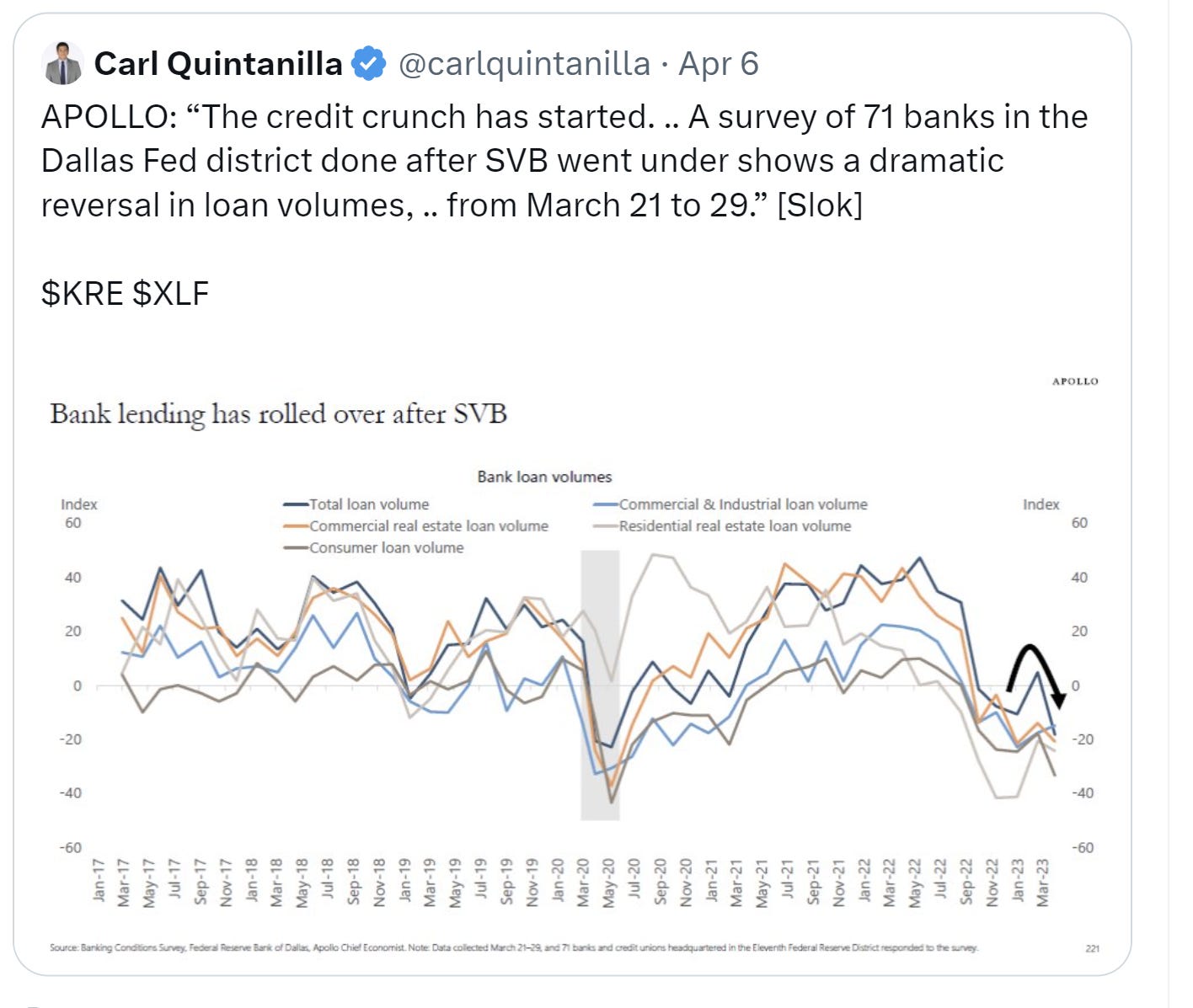

Picture of the Day-Credit Tightening

An avid reader and real estate owner/developer called me this week. He has owned a piece of property for decades and has a $900k loan on it with his long-time regional bank as the lender. The loan-to-value (LTV) on the property is 15%, and he has been a customer of the bank for ages. He also had given a personal guarantee (PG) on the loan. The loan matures soon, and he went to refinance it. The bank told him they are not able to do so today. This is one small example of my concern about the impacts of the sharp pullback in lending by regional banks. If this wealthy investor with a long-standing relationship with a bank cannot get a low LTV loan approved with a PG, what does that say about everyone else’s ability to borrow? The bank in question has a stock that is down, but outperforming many of the regionals. This NY Fed survey suggests that access to credit was the toughest since the inception of the survey in 2014. The bank’s report also said, “Respondents were more pessimistic about future credit availability as well, with the share of households expecting it will be harder to obtain credit a year from now also rising.” In a related note, even prior to SVB, auto loan rejection rates increased to 9.1% in February (March data not available) from 5.8% in October. I am anxiously awaiting the March report.

Eye on the Market-Mike Cembalest-Frankenstein’s Monster

Cembalest tackles many topics of interest (banks, Credit Suisse, commercial R/E SFO and others) in his latest piece and always does it with a fun twist and great charts. I agree 100% that the dovish Fed policies for so many years had unintended consequences. My personal belief is the mistake from 2021 on Fed Policy will go down in history as one of the worst policy mistakes. Cembalest explains the Contingent Capital market given the write-down related to CS. Of course, he did all the homework and it does not bode well for CoCo investors. On the US office market, too much to go over, but check it out.

Flying Into Telluride with White Knuckles

I am not a scared flier. I generally fall asleep prior to take-off (Narcoleptic When Needed) and have only been concerned a handful of times in my life on a plane. However, one of the most memorable flights for the wrong reason was flying into Telluride, Colorado. It was around the year, 2000, and I was speaking at a conference for Chase. I flew into Denver, and we were on a small plane that sat maybe 12 people. At the time, you could see into the cockpit open without a door (pre-9/11). Most of the passengers were heading to the conference, including the guy sitting next to me from TCW.

The wind was whipping and the plane was bouncing from side to side. The dozen or so passengers were all “white-knuckled,” but me. The pilot announced, “It is too windy to land and we will circle until the wind backs down.” We circled once and I looked down at what appeared to be a large dining table but was instead the tiny landing strip on top of a mountain. NOW, I was nervous. I thought to myself, “What the hell?”

The runway is 9,070 feet above sea level at the top of Deep Creek Mesa in Colorado. The runway then was 6,870 feet long but looked more like 1,000 feet to me when we were circling in the wind, due to the fact that the airport is on top of a mountain. The airport has a huge cliff at either end of the runway. I saw this from above and all of the sudden, this once-calm flyer was now not so happy. The guy next to me was green and holding the armrests so tight, I thought he might break them. I actually thought the look on his face was funny, but I was now scared given the size of the runway, and found less humor in his pain. Also, the winds at 9,000 ft are no joke.

After circling for 20 minutes, the pilot announced the winds calmed, and that he was going to attempt a landing. Whatever his words were did not suggest he had a great deal of confidence. The plane was banking from side to side fairly aggressively as the pilot was trying steady the small plane being battered by a strong cross wind. I was in the aisle of the 2nd row looking out through the windshield of the plane, and it did nothing to calm my nerves. The guy next to me grabbed my arm convinced we were going to crash. I was doing my best to be calm in the storm but was a bit uneasy myself.

Despite banking hard, we touched down and came to a stop. I had never been so happy to get off a plane in my life. I grabbed my bag and ran off the plane happy to be alive and swore I would NEVER land at Telluride again. This is an article entitled, “POV video shows landing at 'America's most dangerous airport', found in Colorado,” and has some crazy pictures in it too.

I had a great conference and some fun skiing in solid conditions with lots of powder. The people on the plane were all happy to be alive and drank far too much at altitude the first night, which made for a rough next day. Telluride is a cute town, but a few of the conference attendees could not handle the altitude and had to leave. The town is at 8,750 feet, and the village is just under 10,000.

The trip was before people wore helmets skiing, and I wore my famous “Hamburger Hat” which was the theme of an old newsletter. My look was always a crowd-pleaser with a Big Mac hat on my head.

When the conference was over, I refused to fly out of Telluride given the trauma caused by the landing a few days prior. Instead took a car service to Montrose Airport, 70 miles away. I recall the driver showing me a property with a fence and he said, “Check out this property.” It turns out it was Ralph Lauren’s estate which can be seen in this Architectural Digest story. The property is a measly 17,000 acres which is 26.5 square miles. I guess the clothing business has been kind to Ralph Lipschutz (Lauren’s real name).

I have not been back to Telluride in over 20 years, and given my last flight into that airport of death, I don’t plan on going back despite the fact that I enjoyed my time there. This article outlines the recent improvements to the airport and now the runway is a whopping 7,111 feet. This compares with Chicago’s O’Hare which is 11,245 feet long. I swear, I thought the runway at Telluride was about 1/10th the length they claim based on my awful, “White Knuckle,” experience. Although I am not opposed to going back to Telluride, I refuse to land on the dining table they call a runway.

Quick Bites

The consumer price index, a widely followed measure of the costs for goods and services in the U.S. economy, rose 0.1% for the month against a Dow Jones estimate for 0.2%, and 5% from a year ago versus the estimate of 5.1%. This link gives some breakdown on pricing changes and egg prices fell 0.0% after soaring 70% on a year-over-year basis in January. Inflation is coming down, yet the futures market believes there is a 73% chance of a 25bps hike at the next meeting. Also, the Fed minutes show they expected the banking crisis to lead to a mild recession in 2023. the 2-Year Treasury remains quite volatile and was- 9bps on Wednesday (was -21bps on the CPI data) and now yields 3.97% after the lower-than-expected inflation data. The futures market is calling for a 65% chance of a 25bps hike at the next meeting and then over 50bps of cuts prior to year-end. My personal view is the Fed should pause, as the impact of higher rates and the banking crisis should continue to temper inflation. On the week, the S&P is down slightly, while the Nasdaq is down 1.3% despite better-than-expected inflation data. More market chatter on recession is driving some of the concern. Oil was up over 2% to $83.35 and is now up 3.5% on the year after being down 15% at one point in March. Bitcoin is hovering around $30k and is +80% on the year, but remains at less than half of the high price from November 2021.

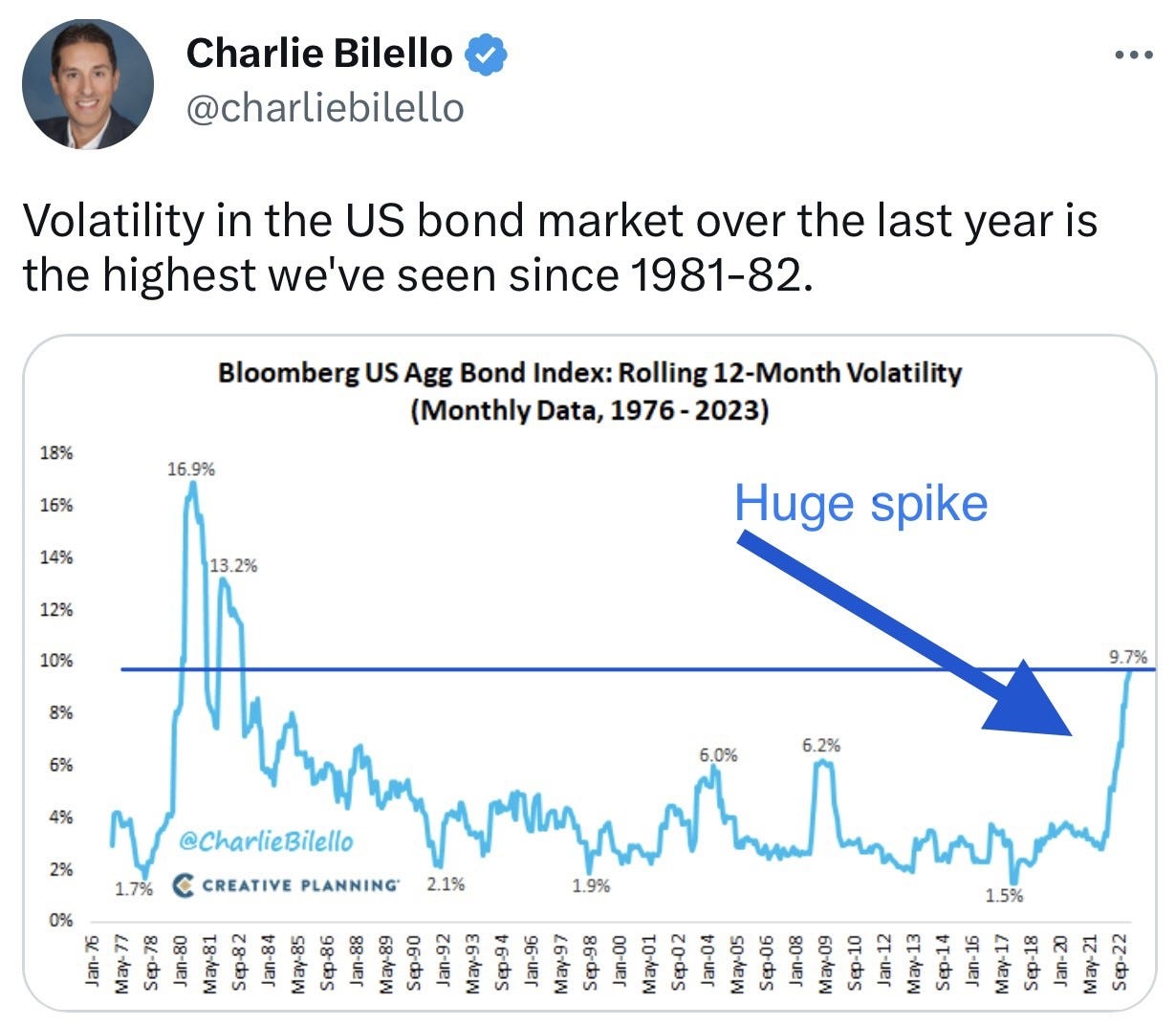

There is a good Bloomberg article, “Bond Market Is Overplaying the Risk of a Deep Recession.” When banks started going belly-up, the reaction in bonds was emphatic. Two-year Treasury yields slid a percentage point over three days in March, the most since 1982. For traders accustomed to treating such signals as sacrosanct, the message was obvious. Gone were the days when inflation was their main menace. Rates showed stress in the financial system made a recession inevitable. In normal times, so violent a repricing would be one of the strongest signals markets could send that a recession is at hand. Right now, the interpretation is less obvious. “The bond market has gone berserk,” says Dominique Dwor-Frecaut, a senior market strategist at the research firm Macro Hive Ltd., who previously worked in the New York Fed’s markets group. “For once, I’m on the side of equity markets. I don’t see a recession coming.” Mohamed El Erain feels the bond market volatility makes it hard to put too much credibility in the 2-year Treasury moves. The chart below shows bond vs stock volatility is back to 2008 levels. Which market is wrong, Treasuries or Equities?

Paul Singer is one of the most successful hedge fund investors of our generation. He manages $55bn in Elliot (his middle name). He warned about subprime mortgages before 2008, Dodd-Frank in 2010, and inflation in 2020. After Silicon Valley Bank, what does he think is next? “Valuations are still very high,” he says. “There’s a significant chance of recession. We see the possibility of a lengthy period of low returns in financial assets, low returns in real estate, corporate profits, unemployment rates higher than exist now, and lots of inflation in the next round.” His pessimism about the soundness of the dollar and other currencies isn’t new. Singer believes bank bailouts destroy market discipline and encourage reckless behavior. He worries that the current market trouble is only the beginning. “We think this crisis is a result of overleverage, overvaluations, bubble securities, bubble asset classes,” he says. “And this is just one episode. It’s not the same, but it is something like the collapses of those Bear Stearns subprime credit funds in the spring of 2007.” They were felled by bets on risky mortgages and served as a preview of the financial crisis to come. In the article, Singer goes off on monetary policy, something he and I agree on. It has been AWFUL. A Barron’s article from September 2022 suggested that Elliot has returned 13.5% on average since 1977 and has had only two down years (1998 and 2008).

I was not familiar with the Corporate Equality Index or CEI score prior to reading this article. Executives at companies like Nike, Anheuser-Busch and Kate Spade, whose brand endorsements have turned controversial trans influencer Dylan Mulvaney into today’s woke “It girl,” aren’t just virtue signaling. They’re handing out lucrative deals to what were once considered fringe celebrities because they have to — or risk failing an all-important social credit score that could make or break their businesses. At stake is their CEI score, which is overseen by the Human Rights Campaign, the largest LGBTQ+ political lobbying group in the world. The CEI is a lesser-known part of the burgeoning ESG (Environmental, Social and Corporate Governance) “ethical investing” movement increasingly pushed by the country’s top three investment firms. ESG funds invest in companies that oppose fossil fuels, push for unionization, and stress racial and gender equity over merit in hiring and board selection. I am not convinced Bud Light’s core customer is all that fired up about the new trans spokesperson. This article suggests the “boycott” of Bud Light may have some legs. I am all for inclusive behavior and do not stand for any kind of discrimination. However, I do fear the pendulum is swinging too far on highly subjective political scores which are impacting companies and not always in a positive manner. SVB received an “outstanding” rating on the DEI front and it seemed they were more interested in getting a high inclusivity rating than managing the bank’s risks. The SVB Board pledged $5bn to support sustainability efforts, yet had no chief risk officer for 8 months. This is the link for the “Best places to work for LGBTQ+ equality in 2022.” This Bloomberg article from November 2022 showed that almost 20% of EUs top EST funds had more than 10% of their investments in companies “with violations of” the UN Global Impact Principles. It found that 40% have more than 5% of such exposure. Also, if you recall, last year, Exxon was rated a top 10 best in the world company on ESG, while Tesla did not make the list.

Other Headlines

Apple’s Mac shipments fall more than 40%, worse than major rivals

All five of the largest computer makers — Apple, ASUS, Dell, HP and Lenovo — saw double-digit drops in first-quarter shipments, reflecting weaker demand and persistent inventory woes. But Apple’s decline was the biggest of the bunch.

Samsung forecasts a shocking 96 percent drop in profits for Q1 2023

Citing a weakening economy and lower chip demand.

CarMax Jumps as Profit on Used Vehicles Drives Earnings Beat

Nearly half of Americans say it’s unlikely they’ll buy an electric vehicle as their next car

Only 19% of respondents say it’s “very” or “extremely” likely they would purchase an EV. High cost, limited charging stations and range are all factors in the survey.

Musk says Twitter is roughly breaking even, has 1,500 employees

The # of employees is down 80% since Musk took over. What does that tell you about the previous management’s ability to run a company?

JPMorgan Calls Managing Directors to Office Five Days a Week

EPA to propose car pollution limits that would require major increase in EV sales

Construction Industry Has Work, Needs More Workers

A surge in nonresidential building is keeping contractors busy and searching for talent. “I’ve got more work to look at and bid on than I could possibly handle,” said Jeff Harper, president of Harper Construction Co. in San Diego. “I’ve said ‘no’ to 10 jobs in the last four months.”

70% of Americans are feeling financially stressed, new CNBC survey finds

Some 70% of Americans admit to being stressed about their personal finances these days and a majority — 52% — of U.S. adults said their financial stress has increased since before the Covid-19 pandemic began in March 2020.

ChatGPT may be coming for our jobs. Here are the 10 roles that AI is most likely to replace.

The article suggests that 47% of US jobs could be eliminated over the next 20 years. Although I believe AI is a game changer, I don’t see that many jobs lost.

Tech jobs-Coders, computer programmers, software engineers, data analysts. Media jobs-advertising, content creation, technical writing, journalism

World's most advanced robot speaks several languages in creepy video

This is scary. Looks so lifelike. Translates in multiple languages. Watch the short video, but you might have nightmares. These robots are coming for your job.

AI bot, ChaosGPT tweet plans to 'destroy humanity' after being tasked

I am not going to lie, this one is scary.

Joe Biden on presidential run in 2024: ‘I plan on running’

He would be 86-years-old in office if he were to win and serve his full term. We need age limits in Congress and to run for President. Sorry, he is not fit for office now, let alone in 6 more years. I feel you need to be no more than 70 years old when sworn into office for President, Congress/Senate. We have multiple Senators unable to serve due to health issues. It is unfair to the constituents. Sen Feinstein is 89 and needs to step down already and there are others.

Barr warns Trump faces more threat from classified docs case than over hush money

"I think he was jerking the government around," the ex-attorney general said.

Trump sues Michael Cohen for $500 million, alleging ex-attorney breached his contract

Manhattan DA Bragg sues GOP House Judiciary chairman to prevent interference in Trump case

Biden White House Directly Coordinated With FBI to Set Up Trump Raid According to New Docs

The six biggest revelations from the Pentagon’s leaked intel documents

Lots of valuable info in these leaks which show just how deeply the US infiltrated the Russians and exposed the US is spying on allies. It also likely exposed US intelligence sources. The US was able to warn Ukraine about planned strikes in real time The White House has urged journalists not to report on the leaked Pentagon documents.

Leak shows Western special forces on the ground

UK, Latvia, France, US and Netherlands have boots on the ground in Ukraine?

What a disgusting story of abuse of an elderly woman with dementia. The young women who were arrested were 18 and 20 years old. The sheriff’s comments: "I wouldn't let them care for a pet cobra because he might accidentally bite them and he would die of scumbag poisoning," Ivey said. "Not only are they bags of crap, but the people that were on there laughing and mocking this poor lady, yeah, you're bags of crap, too."

Downtown San Francisco Whole Foods Closing a Year After Opening

Why are they closing one of the largest supermarkets in Downtown SFO? The Whole Food spokesperson said, “If we feel we can ensure the safety of our team members in the store, we will evaluate a reopening of our Trinity location.” Maybe, just maybe SFO has it wrong on homeless, crime, and violence and is not doing the job to protect the INNOCENT law-abiding, tax-paying citizens. No chance I would ever live in SFO or Chicago. WMT is closing half the stores in Chicago. No specific mention of crime, but we know it is a driver.

Man in Brazen NYC Store Killing Arrested — and Cops Claim It Was His 2nd Murder in 30 Hours

Messiah Nantwi, the alleged Harlem smoke shop shooter, is accused of killing another person in a separate Manhattan incident a day before, the NYPD says -- and he once was indicted for allegedly trying to kill cops. Sorry, DA Bragg, your policies are awful. Throw these dangerous people in jail. No Bail.

Former San Diego State University student left with '1% chance of survival' after hazing incident

You read what these animals did to a kid and you want to throw up. I truly hope those involved rot in jail and their lives are ruined. Anyone who can do this to someone else has no conscious.

What is Florida Doing to Prevent School Shootings?

Armed “Guardians”

Gun Control Measures

Florida’s Red Flag Law

Mental Health Services in School

More Law Enforcement Oversight in School

FBI warns against using public phone charging stations

The FBI is warning consumers about “juice jacking,” where bad actors use public chargers to infect phones and devices with malware. I wrote a piece, “Prevent Hacking,” a couple months ago where this was discussed.

Thousands of Rutgers University Faculty, Staff Go on Unprecedented Strike

First strike in school’s 257-year history.

Fed Up With Mayhem, Miami Beach Wants to Tame Spring Break for Good

A curfew will be imposed for 2024 in an effort to stem the flow of drunk college kids from disrupting the community.

Michael Jordan’s Signed Air Jordan Sneakers Set $2.2 Million Record (Sotheby’s)

Dalai Lama apologizes after video asking boy to 'suck my tongue’

Real Estate

Almost $1.5 trillion of US commercial real estate debt comes due for repayment before the end of 2025. The big question facing those borrowers is who’s going to lend to them? “Refinancing risks are front and center” for owners of properties from office buildings to stores and warehouses, Morgan Stanley analysts including James Egan wrote in a note this past week. “The maturity wall here is front-loaded. So are the associated risks.” The investment bank estimates office and retail property valuations could fall as much as 40% from peak to trough, increasing the risk of defaults. As can be seen in the charts below, regional and local banks own a good deal of the loans in the R/E space. With deposits leaving, concerns about bank ratios and the falling valuations, expect growing defaults and losses in banks already scrambling.

In the face of rising headwinds in the office market, Blackstone has unloaded two 13-story buildings in Southern California at a big discount. A joint venture between Barker Pacific Group (BPG) and Kingsbarn Realty Capital paid $82 million, or $146 per square foot, for the Griffin Towers office park with 560,000 square feet of Class A office space in Santa Ana, Calif., in Orange County. That’s 36 percent less than the price Blackstone paid to acquire the site nine years ago. The real estate giant bought the property from Angelo Gordon and Lincoln Property Company for $129 million in 2014. The office towers in the past have also traded for $89.9 million in 2010 and $183.8 million in 2007, records show. I expect a great deal more of these “deeply discounted” sales to take place in the next 24 months as maturities loom, banks pull-back lending, valuations decline and vacancy rates remain high.

Blackstone announced the largest R/E drawdown fund ever at $30.4bn. Clearly, the R/E minds at Blackstone believe big opportunities are coming in the industry. The article suggests a 16% IRR on over $100bn of R/E invested over 30 years.

Millions of Americans are now 'rent-burdened' for the first time ever — in these 3 states, you can expect to spend over 30% of your income on rent. In MA, FL and NY, Americans spend 32.9%, 32.6% and 31.2% of their income respectively on rent, according to the Moody's report.

An apartment-building investor lost four Houston complexes to foreclosure last week, the latest sign that surging interest rates are beginning to upend the multitrillion-dollar rental-housing market. Applesway Investment Group borrowed nearly $230 million to buy the buildings with more than 3,200 units as part of a Texas buying spree during the pandemic. Arbor Realty Trust, a publicly traded mortgage company, foreclosed on the properties after Applesway defaulted on the loans, according to public documents filed in Harris County, Texas. The apartment market has held up far better than office or retail. Rents surged during the pandemic. Even though they are coming down, losing 3,200 units within a couple of years of purchase after large increases in rent is something to watch. I believe the units in question were considered low-income housing.

Top 10 places in the U.S. to buy a beach house based on vacation rental performance, home value and more. I am not going to lie, I have never heard of many of these places. 30A, Florida; what is that?