Opening Comments

My last piece, Makoto Time, was about a friendship with an amazing NYC chef. The most opened links were 11 habits of highly successful people and Harvard’s back door for ultra-wealthy kids with lousy grades. Multiple readers went to Buttermilk and thought it was amazing.

I went to the new Rao’s Miami (at Loews Hotel) on Wednesday night, as I was invited by my good friend. I will do a more robust review, but the food was better than I expected. However, I was shocked that there were so many empty tables on a Wednesday night in November.

On Thursday, November 16th (7-10pm) I will be hosting a discussion on Art As An Investment at a gallery in Wynwood in Miami. I will be speaking with Rebecca Fine, an art expert. It is a 3i Members event. I have a few seats open for Rosen Report readers. If you are interested, email me at rosenreport@gmail.com and I will try to squeeze you in.

I was shocked to see this Warren Buffett story on CNBC which suggests he traded for his personal account in names owned by Berkshire. This seems like such a major conflict against anything that “Uncle Warren,” would ever do.

A far-Left reader sent me this amazing post by Bill Ackman (Democrat) regarding the current leadership in the US and his suggestion for Biden to step out of the 2024 election. It is very well written and suggest you take less than 2 minutes to read it. Hard to argue his points. I believe Newsom will be the Democratic candidate.

Markets

BRIC Growth

Is College Worth It?

Manchin & Romney on Deficits

Property Insurance Woes

Discounts Coming for Commercial R/E

Office Traffic Will Be -20-25% from Pre-Pandemic

Picture of the Day-Richest Billionaire by Each State

One of my biggest contributors, Robert, sent me this chart which I found interesting and believe you will as well. Visual Capitalist is putting out interesting content. Given Bezos’ move to Florida, Griffin will no longer be the richest in the state.

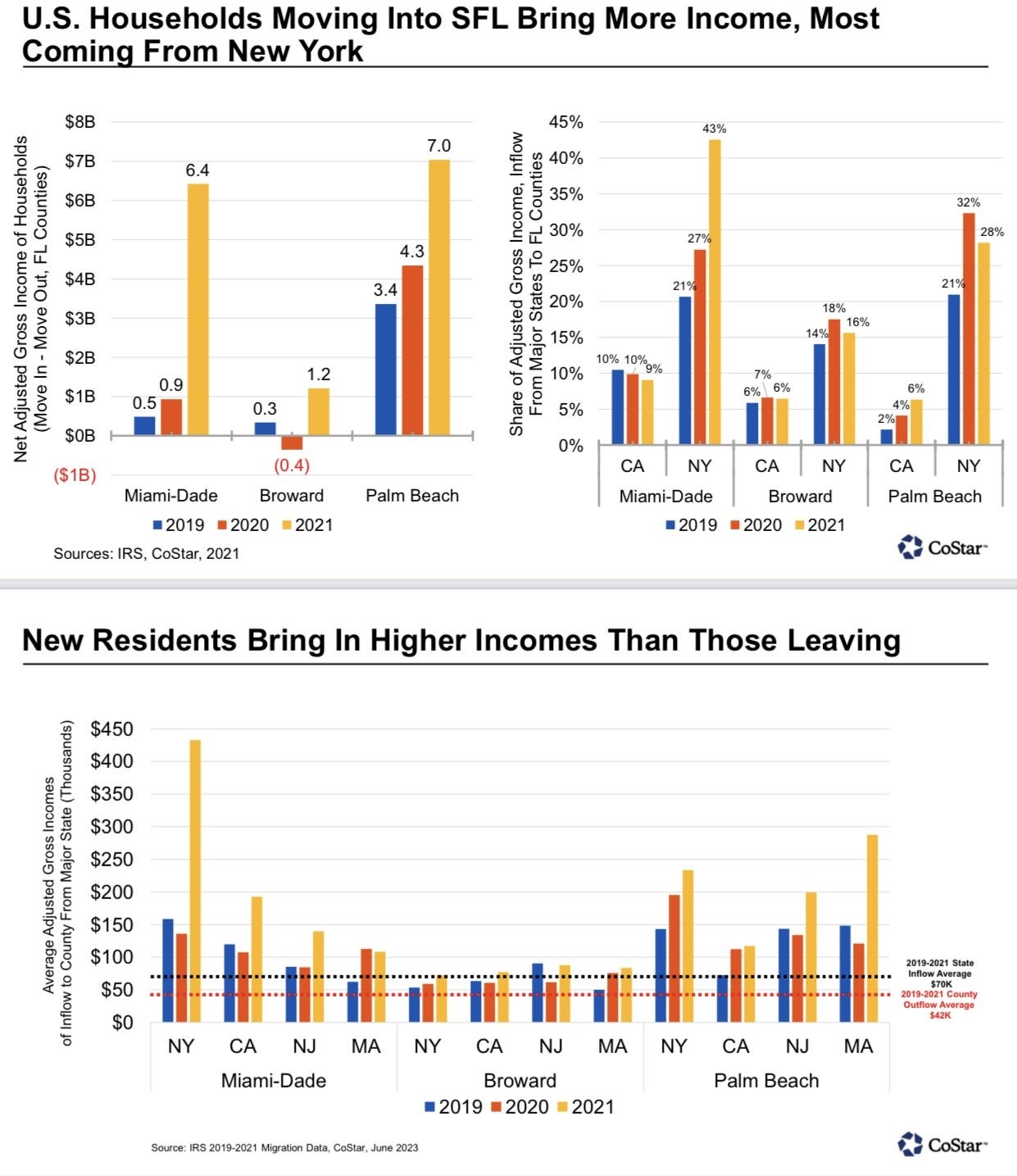

Follow the Money....To South Florida

I bought in Florida in 2017 and there were not many former Wall Street folks in these parts. I bought a house twice the size of my NYC apartment for approximately 1/4 of the price of the apartment I sold. Houses were incredibly cheap, and there were few edible restaurants in South Florida. Then the pandemic changed the world and wealth began migrating South. The other major factor was bad policies in many cities (NYC, Chicago, LA, San Fran…) which drove people to uproot families and go elsewhere. Florida was named the #1 place young and rich are moving to today.

With the new countless billions of wealth from Miami to Palm Beach, we have seen an amazing surge in high-end offerings including condos and homes, restaurants, doctors, shopping, car dealers, golf courses, beauty salons, and many others. In Miami, multiple new condo developments are getting $5,000/ft+. Just five years ago, $2,000/ft was expensive. At the Shore Club condos in Miami Beach, the average sale is $21mm at almost $6k/foot. Five years ago, a waterfront home in Miami would cost $15mm+ and today, the same home is $35-50mm. Shell Bay golf course in Hallandale is now $1.35mm and FULL. When I moved down, $150k was expensive for golf course initiation. A course near me, Boca Rio, was dying for members 7 years ago with zero to $10k initiation. Today, it is $350k with a waitlist. Follow the money.

Think of the major companies and wealthy individuals who have moved or opened offices in South Florida: Citadel, Elliot, Subway, Ryder, Bacardi, Goldman, JPM, NVIDIA, Uber, Amazon, and many others. In terms of people: Carl Icahn, Ken Griffin, Keith Rabois, Jon Oringer, Jack Abraham, Dan Och, William Lauder, Aerin Lauder, Charles Schwab, David Blumberg, Chris Burch, Jeff Bezos, Josh Harris, Barry Sternlicht, Tom Golisano, Tom Brady, Giselle, Kushner/Trump, Peter Thiel, Scotty Shleifer, Josh Kushner, and so many more. This link highlights 10 billionaires that left NY for Florida. This link shows as of one year ago, 140 companies have invested over $1bn into palm beach resulting in over 13k new jobs.

This piece can be 20 pages long, so I will focus primarily on restaurants. I have been very critical of South Florida and often called it a “Culinary Wasteland,” a saying I stole from a former colleague of mine who was referring to the Upper East Side. Since I have come to South Florida, the restaurant game has improved dramatically. NO, it is not NYC, LA, Chicago or Paris, but relative to where it was, the improvement is remarkable. Follow the money.

Florida now has 19 Michelin Star restaurants (up from zero) and 12 are in Miami. Further, Miami has 18 Bib Gourmand designations from Michelin. Other amazing Miami restaurants include Zucca, PortoSole, Contessa, ZZs, Carbone, Milos, LPM, Dirty French, Rao’s (just opened from NYC), Novikov, Zuma, and so many others. There are great new restaurants popping up all over South Florida given the wealth that has wisely relocated.

Boca Raton has been AWFUL when it comes to restaurant choices. When I moved down 6.5 years ago, there were basically a few edible alternatives and none of them were remarkable. Over a few months, multiple new high-end steak restaurants have opened in Boca (Gallaghers, Meat Market, Eddie Vs…) in addition to Abe & Louies, Chops, NY Prime, Chops and a bunch of others that were here. Rosebud (from Chicago) is opening up. Il Mulino has arrived. Red Pine (Chinese), 388 Italian, Sushi by Bou, Corvina (fish), Alley Cat & Sunset Sushi, and a bunch of others including a handful from Major Food Group at the Boca Resort. Don’t forget that Michael Dell bought the Boca Resort just prior to the pandemic and invested $300mm fixing it up. There is a new Mandarin Oriental Hotel and Condo going up in Boca as well which is scheduled to have a number of high-end eateries. Major Food Group has 14 restaurants in NYC and 12 in South Florida despite the fact that the population of NYC is massive relative to South Florida.

On the R/E front in Boca, when I moved in 2017, one home sold for over $10mm in my community. Today, 31 homes are asking $10mm or more and 10 are asking over $20mm in Royal Palm. Follow the money.

Check out the charts below showing wealth migration to South Florida. Also, what are the ramifications for NY and CA on budgets with the wealth leaving?

In Palm Beach, Marea is opening soon and is the home of my favorite pasta dish in NYC (octopus fusilli with bone marrow and breadcrumbs-Pictured). Imoto, Saint Ambrose, Bilbouquet, Lola 41, Trevini and others are also higher-end dining.

From North Palm Beach to Hobe Sound, there are at least 8 new high-end golf courses up to $500k initiation. Panther National, Apogee (3), The Ranch/Kenny Bakst (2), Atlantic Fields (Discovery), McArthur (new Core/Crenshaw), and a couple of others.

South Florida is attracting wealth and the result is higher-end everything. The point is simple. Follow the money!

Quick Bites

On Thursday, stocks hit session lows after Federal Reserve Chair Jerome Powell indicated more work may need to be done to bring down inflation, although the recent slowdown in pace has been an encouraging sign for policymakers. Stocks rallied Friday, recovering the ground lost in the previous session, as Treasury yields stabilized. The S&P 500 climbed 1.56% to finish the session at 4,415 and the Nasdaq added 2.05%, notching its best day since May. All 11 sectors of the S&P 500 were positive Friday, but tech outperformed, rising 2.6%. Microsoft leapt to all-time highs during the session and ended the day higher by 2.5%. Apple, Meta, Tesla and Netflix jumped more than 2% each, while Alphabet gained 1.8%.

Friday’s surge was also enough to lift the three major averages for a second consecutive week of gains. The S&P 500 advanced 1.3%, while the Dow added about 0.7%. The Nasdaq was the outperformer, rising roughly 2.4% on the week. However, Moody’s cut the US outlook to negative citing deficits and political polarization. The 2-Year Treasury yield was +24bps on the week and closed at 5.07%, while the 10-year was +9bps on the week to 4.64%. Interestingly, the 30-year Treasury auction was horrific this week and cleared about 5 bps above the when-issued pricing. The dealers were stuck with 25% of the bonds. Oil declined for the 3rd straight week and ended at $76.4 (-5% on week), as supply disruption concerns out of the Middle East have tempered, while demand fears continue.

Interesting Bloomberg article about BRIC countries growth. As an investor, you need to consider growing economies and this article gives perspective. In 2001, Brazil, Russia, India, China and South Africa—the emerging-markets group known as the BRICS—accounted for 19% of global gross domestic product in purchasing power parity terms. Today, including countries set to join the bloc, the share is 36%. We see this rising to 45% by 2040, more than double the weight of the Group of Seven major advanced economies. The rapid rise of the BRICS is transforming the global economy. Members are, in general, less democratic and free-market than advanced economies, and growing economic heft could bring a profound shift in influence. In August this year, the BRICS invited six more countries to join: Argentina, Egypt, Ethiopia, Iran, Saudi Arabia and the UAE. There’s no new acronym to be found—the group will likely be renamed BRICS+. First, the expanded BRICS are already larger than the Group of Seven, which comprises Canada, France, Germany, Italy, Japan, the UK and the US. In 2022 the bloc accounted for 36% of the global economy, versus 30% for the advanced economy group. Our forecasts suggest an expanding workforce and ample room for technological catch-up will boost the BRICS+ share to 45% by 2040, compared with 21% for G-7 economies.

Student loan debt in the United States totals more than $1.77 trillion. No institution in the country values free speech less than that of higher education. College universities have become some of the most profound cheerleaders of Hamas since its savage invasion of Israel. So, is college still worth it?

A joint venture between RedBalloon.work and PublicSquare surveyed more than 70,000 small businesses about the future of economics for its annual Freedom Economy Index. Among the most consequential trends was a change in how businesses view college-educated students. Specifically, 89% of respondents say college campuses no longer foster the debate and critical thinking needed to solve problems. More than 83% of the businesses indicated they are either less likely to or see no difference in hiring job candidates with four-year degrees from major universities. When you factor in the cost of education, what is taught, the incredible bias in institutions….it is harder to justify a traditional college education. I recently wrote about the kid with a perfect GPA, 1590 on SAT who was rejected from 16 schools only to get a job at Google. Clearly, Google did not care about a 4-year degree.

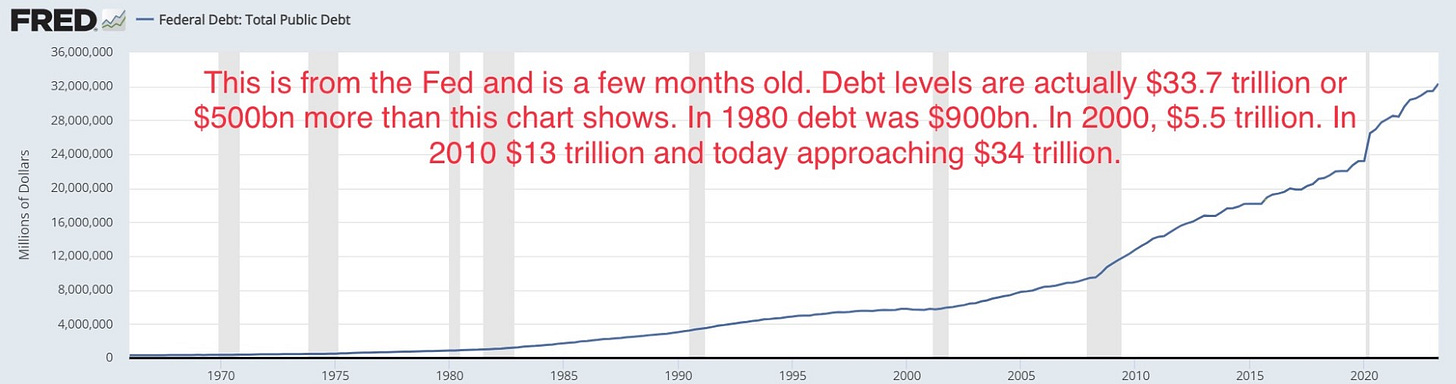

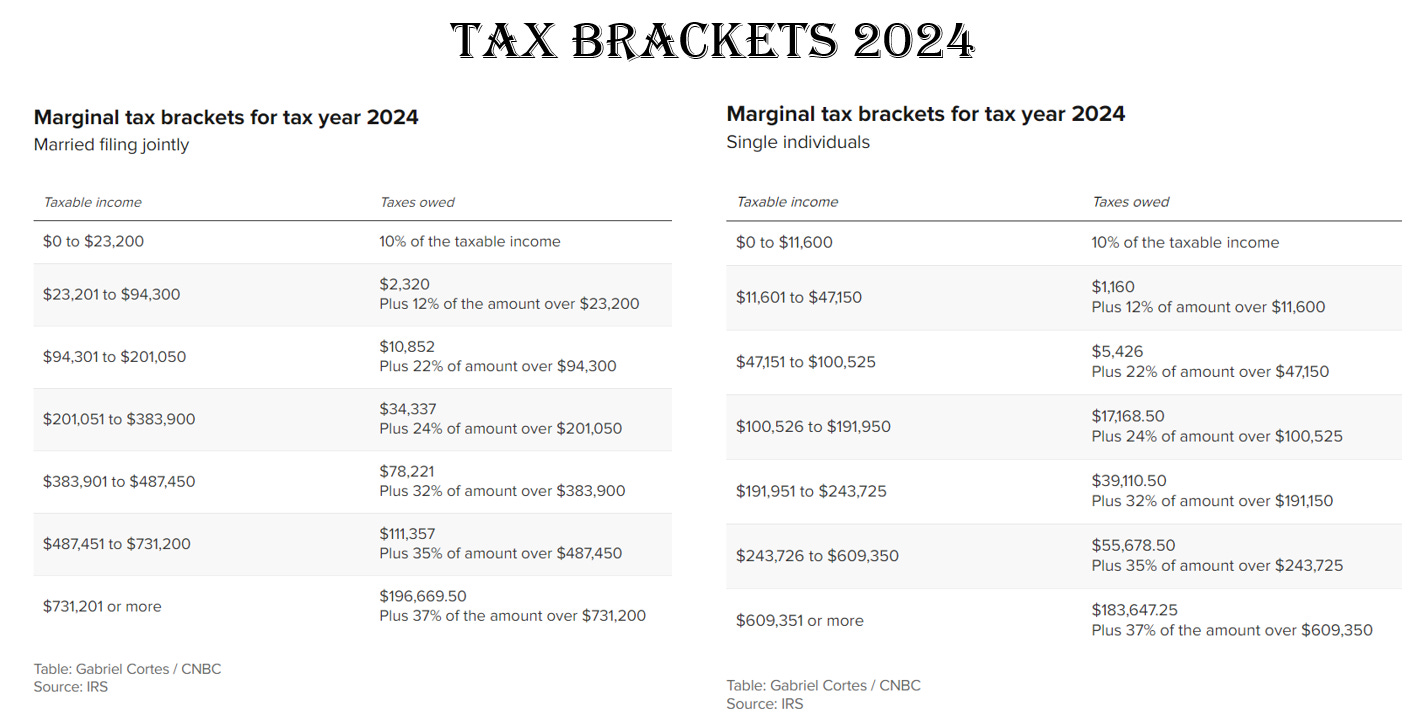

CNBC interviewed Manchin (D-W.VA) and Romney (R-UT) on the US fiscal issues and deficits. I have been harping on this issue for some time given the nearly $34 trillion in debt, growing interest burden, and careless spending. Manchin believes Social Security can last for 10 years before it needs to be slashed, while Medicare will run out of funds far sooner. I don’t know the exact answers, but can tell you they need to include the following: Fiscal responsibility/spending cuts, means testing for entitlements, and raising the age you can get benefits. Life expectancy is up 30% since Social Security began and we remain at age 65 for benefits. Estimates suggest that entitlements are underfunded by $100 trillion. What could possibly go wrong? Remember, with the aging of the population and young people not having as many children, things will only deteriorate faster.

On a related note, this article discusses NYC being on the verge of a fiscal cliff due to spending and massive deficits. NY State faces a minimum $10bn deficit and likely much larger. The article outlines cost increases far surpassing inflation and the BILLIONS related to the migrant crisis. I expect calls for taxes on the wealthy to start soon.

This WSJ article entitled, “Loneliness Isn’t Just Bad for Your Health—It’s Deadly,” was eye-opening. Loneliness and social isolation were linked to an increased risk of death from any cause, according to new research. That includes missing out on seeing loved ones, not having weekly group activities like a book club, or just often feeling lonely. “Just like we need to make time in our busy lives to be physically active, we need to make time in our busy lives to be socially active,” said Julianne Holt-Lunstad, director of the Social Connection & Health Lab at Brigham Young University, who wasn’t involved in the report.

A combination of several loneliness factors could be even more harmful, the data suggested. For example, having few family and friend visits was riskier when the person also lived alone. Americans are now spending more time alone and less time socializing in person, compared with two decades ago, a trend that started taking hold even before the Covid-19 pandemic. Please get help if you feel lonely, as the article suggests the consequences can be dire.

Israel Headlines

Is America at war in the Middle East? US Citizens have been killed and taken hostage. At least 46 US troops have been injured. The US has fired into Syria and Lebanon. US troops have been attacked at least 38 times from drones in Syria and Iraq as of a few days ago. Some of these attacks resulted in Traumatic Brain Injuries to US troops. Militias linked to Iran have targeted American bases. This link shows the US Naval presence in the Middle East.

Israel eliminates 130 Hamas tunnels in Gaza as airstrike kills weapons maker

Hamas antitank strikes show depth of ‘powerful’ arsenal facing Israel

The article is quite concerning. Where do you suppose the funding for all these high-tech weapons came from?

Israel Fears War on the Horizon Against Hezbollah in the North

The mastermind of Hamas' October 7 terrorist attacks is cornered in a bunker, says Israel

Photographers Without Borders: AP & Reuters Pictures of Hamas Atrocities Raise Ethical Questions

Netanyahu slams Hamas-linked journos used by CNN, NYT, Reuters and AP who were at Oct. 7 massacre

There are pictures of CNN/AP photographers with Hamas leaders embracing. There is a photo online of a rumored CNN photographer holding a grenade while with Hamas. CNN fired the photographer.

‘Beat that f**kin’ Jew!’ UCLA students batter Netanyahu piñata

Do you know how many Jews donate to UCLA? Huge. Stop giving to UCLA.

MIT student screaming “Free Palestine” in the middle of math class.

Heinous antisemitic slogans beamed on UPenn buildings — as civil rights complaint filed

Rowan, never give another dollar.

Jewish billionaire Henry Swieca quits Columbia board over ‘abhorrent’ threats to Jews on campus

Why won’t Hamas free all the hostages?

Baby-faced vandals spray-paint swastikas, ‘Hamas’ graffiti on Upper East Side rooftops

Pink Floyd's Roger Waters ponders whether Hamas attacks were a 'false flag operation'

Other Headlines

Sony profit slumps 29% on chip weakness but maintains 25 million unit PlayStation 5 target

Japan’s SoftBank hit with $6.2B quarterly loss as WeWork, other tech investments go sour

Citadel’s Ken Griffin sees high inflation lasting for decades

The Fed call by Powell was already the worst in history.

“We are underweight the consumer discretionary sector; the lower prices customers are looking for will weigh on company margins and earnings,” analyst Michael Wilson said in a Thursday note.

Black Swan Fund Manager Says Start Worrying When Fed Cuts Rates

‘That’s when things are going to get really awful’

The Las Vegas Sphere Is Already Losing Boatloads of Money, and Just Lost a Top Leader

Shocker. Dolan is involved.

Ransomware attack on China's ICBC disrupts Treasury market trades

Nation at risk of winter blackouts as power grid remains under strain

Beef prices hit record high as southwestern US recovers from worst dry spell in 1,200 years

CNN analyst says poll numbers spell bad news for Joe Biden: ‘Nation has soured on him’

Check out the #s. 25% of Americans believe Biden has the stamina and sharpness to be an effective leader. 61% disapproval rating. 39% of Democrats approved of Biden’s job performance. 34% of independents approved of Biden.

Takeaways from the third Republican presidential debate

If you listen to social media, Vivek performed well.

The big winner of Republican debate in Miami

I included a CNN and Fox link about the debate. I did not have time to watch the entire thing. The Drudge Poll suggests Haley won. I think the field needs to be narrowed down to Haley, Ramaswamy and DeSantis now. Sadly, I do not see anyone usurping Trump. Viewership fell 50% from 1st debate and totaled 7.5mm.

House Speaker Johnson Is Running Out of Time to Avoid Shutdown

The last thing we need right now is a shutdown. However, the spending is out of control. Deficits 22 straight years with the last one being $1.7 trillion with full employment. It is unfathomable. Moody’s cut the US Outlook to negative.

Democratic Sen. Joe Manchin says he is not running for reelection

GOP Subpoenas Hunter and James Biden in Impeachment Probe

The subpoenas issued Wednesday mark a significant escalation in the unwinding impeachment investigation

“My jaw almost dropped”: Expert stunned Ivanka offered “proof” Trump was “robbing Peter to pay Paul”

FBI seizes phones of New York Mayor Eric Adams as part of fundraising investigation

Michigan GOP faces 'imminent default' on credit line, ex-budget committee member says

'They're clearing out the homeless people': San Francisco gets ready for arrival of world leaders

Smoke & Mirrors. Let’s not help the residents live in peace, but let’s make sure Xi Jinping does not see homelessness and drugs.

Twice-Arrested Illegal Immigrant Accused of Rape, Abduction Apprehended a Third Time

I believe America is a melting pot and am supportive of a reasonable immigration policy. What we have today is no border and chaos. How in the hell can an illegal immigrant still be in the US after multiple arrests?

NYC man with 15 prior arrests busted for groping 3 young women

7 arrests this year. He also assaulted a cop, yet is roaming free. That NYC justice system sure works to protect law-abiding citizens. Come on, man!

Rampant Shoplifting at New York City Is Driving National Numbers Higher, Report Finds

Despite New York’s large population, the trends are ‘disproportionate to its size.’

Only 2% of the 140K migrants who have come to NYC have applied for work permits

Open border with no plan. Given free money from the US government, why work? The country is falling apart and our leaders don’t care.

Local residents explode at Biden officials over plan to release grizzly bears near their communities

The plan is to release up to 7 grizzly bears annually into the North Cascades ecosystem over the next 5-10 years. What could possibly go wrong? They weigh almost 1,000 lbs and run 35 mph.

AI Will Cut Cost of Animated Films by 90%, Jeff Katzenberg Says

The $2 Million Coal Mine That Might Hold a $37 Billion Treasure

Guy bought an old coal mine 12 years ago in Wyoming and turns out there are rare earths in it that could be worth up to $37bn. Why does something like this not happen to me?

Tech mogul Bryan Johnson undergoes shock therapy to get ‘erections of an 18-year-old’

I will do a lot of things for my health (eating right, exercising, regular checkups, supplements…), but using shock therapy on my genitals is a bit much.

Real Estate

This is a crazy Real Deal article entitled, “As property insurance surges, some landlords are “losing their minds”-Surging claims, decaying buildings and a carrier exodus driving costs.” Jerry Waxenberg keeps a running list of his most egregious personal injury lawsuits. The cocaine slip-and-fall barely cracked the top five. As the Bronx landlord tells it, a drug dealer was running from police in a building Waxenberg managed. The dealer bolted down the stairs, dropped a bag of coke in front of him, slipped on the powder — and sued. “One hundred seventy-five thousand dollars,” the owner said of the settlement. “Landlord’s fault.” Waxenberg said he has fielded dozens of liability suits in the past several years. Some have been settled for as much as $1 million. In the same period, his insurance premiums doubled. A policy that cost $859,000 in 2018 renewed for $1.73 million this year. These stories drive me crazy. The article suggests lawsuits are +300% this year and personal injury lawyers are calling tenants suggesting they file suits.

Billionaire real estate investor John Goff anticipates a wave of attractive properties will soon be up for grabs at discounts due to high interest rates forcing some investors to sell. Goff, founder of Fort Worth-based Crescent Real Estate, believes these properties will be offered at “compelling” prices, but the discounts won’t be nearly as steep as what he saw in the 1990s, Bloomberg reported.

“When I started Crescent, we were buying assets by the pound,” he said. “We were able to buy extraordinary properties that were newly built at fractions of what they were built for. Today, there’s definitely discounts available, but it’s not to the extreme that it was in the ’90s.” There will be many office opportunities and I believe there will be multifamily as well given higher rates, less aggressive lending and rents which are no longer climbing in many places. I hope to uncover a couple opportunities in 2024 to invest in myself on the R/E front. The $670mm CMBS loan backed by the Helmsley Building was sent to special servicing due to “imminent maturity default.” Also, Trump’s 40 Wall St. Tower loan of $122mm was transferred to a special servicer. Rising costs and vacancies were cited.

Good Bloomberg article on time in office. Workers will likely spend 20% to 25% less time in the office than before the pandemic, according to the head of real estate brokerage CBRE Group Inc. Chief Executive Officer Bob Sulentic said companies such as CBRE are seeking to balance in-person work with the recognition that people don’t want to spend hours in traffic. Landlords have also been pressured by the rise in borrowing costs, which has contributed to a nearly 21% decline in office prices in the 12 months through October, according to real estate analytics firm Green Street. Sulentic said higher borrowing costs have dented commercial real estate valuations more than his firm originally forecast.

“We thought values may come down 15%, 20%. We now think that may be another 10%,” Sulentic said. What is the impact of 20-25% declines in office time not only for office space, but Urban retail, hotels, and restaurants? We have more carnage to come as debt matures.

Rosen Report™ #630 ©Copyright 2023 Written By Eric Rosen