Opening Comments

In the never ending saga of Eric Rosen falling apart, I threw my back out yet again. Not sure how, but I am limping around like an 87-year-old. The one downside about my move to Boca is I have “gone native,” meaning I have transformed my 52-year-old body to an elderly one to fit it with my geriatric neighbors.

I watched the correspondents dinner on Saturday night. Shockingly, I thought President Biden was coherent and did a decent job poking fun of himself and his approval ratings. His best line was a joke about Brandon-”He’s having a really good year, and I’m happy for him.” I thought Trevor Noah (video link) did a nice job and his roasting of Jeffrey Toobin was hysterical. He really crushed on CNN quite a bit but dished it out for both sides.

An avid reader, Michael, connected me with an informed social media professional who gave me some great ideas on improving the experience for my readers. In coming weeks, I will be trying new things, so please give feedback. I am limited by some of the editing functions on Substack, but am trying to hire someone to help me format and make the report better and more user friendly.

Picture of the Day-S&P and Treasury Performance

Foot in Mouth

Quick Bites

Markets

Tech Market Slide in Pictures

High Yield Market-Yield Getting Interesting

GDP

Consumer Spending

Twitter/Musk-Ministry of Truth

Student Debt Reduction

NPR/PBS/Marist Poll-Approval Ratings

Other Headlines

Virus/Vaccine-Case Growth Accelerating

Data

Real Estate

General Comments

Examples of Softening

Miami Flippers Again

South Florida Infrastructure

US Home Foreclosures

Picture of the Day-S&P and Treasuries

I received this chart from Jim Reid (DB) Friday am prior to the sharp sell-off. It’s the last business day of the month and we could see something in April we’ve only see three other times since our data starts in 1973. That is a month where S&P 500 returns fall more than -5% AND US Treasuries fall more than -2%. With a few hours left of trading the former is down -5.3% and the latter -2.6% in total return terms. (The sell-off continued for both assets on Friday).

There have been plenty of bigger down months for equities, but it's very rare for Treasuries to fall as much as this on those down months as well. Of the 52 months where the S&P 500 has been down more than -5% over this period, 37 have seen Treasuries have a positive total return in a flight to quality trade.

Foot in Mouth

I find that I am a pretty friendly person and can start a conversation with anything. I said, “Anything,” because I am pretty sure I can talk to a wall and get something going. In a crazy story, my friend Rich and I went to dinner before the WHO concert last week. He drove and valet parked the car. While he was dealing with the valet, I started walking towards the restaurant.

As I walked in, a couple was staring at me in an uncomfortable manner, so I walked up to their table and said, “How are you today? Do I know you?” I felt something was up and did not recognize either of them. He said, “You look very familiar, just like one of my wife’s closest friends.”

I responded, "Is her friend Brad Pitt?”

He said, “Not exactly.”

I then said, “Is her friend a male supermodel?”

Again, the disappointing answer was, “No.”

Being a smart ass, I said, “I it sounds like I could not possibly look like your wife’s friend if he does not look like Pitt or a supermodel.” They both laughed loudly enough for other diners to turn their heads and look at us.

He asked if I would pose for a picture with his wife to send to said friend, who apparently is every woman’s dream. Yes, the picture request was a little odd, but given my massive celebrity status due to the worldwide success of the Rosen Report, I must keep my fans and potential readers happy. I complied and posed for a picture hugging a woman I don’t know. I asked where they are from, and they mentioned Philly.

So in my infinite wisdom, I said, “I have a Philly story for you.” My son and I were waiting for a delayed flight to pick up his golf coach in Philly and decided to try a famous cheese steak sandwich.” The guy’s eyes lit up in a strange fashion and did not understand why. Last summer, I wrote a report on the “experience” Jack and I had while eating a Philly Cheesesteak and the ramifications of the grease fest which tries to pass as edible food.

I told him we ended up at Geno’s and had the greasiest food imaginable and it resulted in the worst sleep of my life with an upset stomach. I slept with one eye open as the grease was sloshing around in my belly. The ramifications of the disgusting meal lasted for three days. I said, “I presume you know of these places Geno’s and Pat’s which both serve some sort of meals covered in grease and Cheese Whiz?”

He looked at me in disbelief and said, “I am Pat from Pat’s.” As an aside, Pat’s was the inventor of the Philly Cheesesteak Sandwich in 1930.

I presumed this was a joke. It was not. I was complaining about the greasiest food of my life which nearly gave me a coronary to the guy who makes the food and presume has been in his family for some time. I felt like a complete idiot. There is no one who comes up with ways to stick their foot in their mouth more than I do in an effort to be friendly. What are the odds of me going off on a restaurant to the owner who would be 1,153 miles from home? Note to self, I should have just kept walking and not engaged with the people staring at me or should have walked away when they had the audacity to suggest Pitt and I are not identical twins.

This story came out the other day about a Rockies baseball strength coaching downing 25 Philly cheesesteaks in four days. How he is alive to tell the story is beyond me.

In a funny side note, I was at a dinner Wednesday and the unanimous view was from 5 out of 8 guests was that I look like Matthew McConaughey, which I have heard about 30 times. I just don’t see it, I am a young Brad Pitt for goodness sakes!

I’m the one on the right. I am not sure who the guy I am standing with is though. He looks familiar. Can someone check if he wants to be a Rosen Report reader?

Quick Bites

U.S. stocks sunk Friday with the Nasdaq Composite notching its worst month since 2008, as Amazon became the latest victim in April’s technology-led sell-off. The Nasdaq Composite fell nearly 4.2% to 12,335, weighed down by Amazon’s post-earnings plunge. The S&P 500 retreated by 3.6% to 4,132. The Dow shed 939 points, or close to 2.8%, to 32,977. The Nasdaq finished at a new low for 2022 and the S&P 500 did as well. Cathie Wood's Ark Innovation, is about to cap off its worst month ever, with a 29% decline in April (70% below record high). For the S&P, the first four month performance was the third worst in history. Only 1932 (-28.2%) and 1939 (-17.3%) were worse than YTD -13.3%. The 10-Year Treasury Bond is now yielding 2.93% and sold off over 7bps on the day. The 2s/10s is now back to +19bps and has traded between -1bp to +39bps since the start of April. Oil rallied almost 7% on the week (4.5% for the month) and ended at $104.3/barrel. Clearly, this is not what the Biden Administration expected with the Strategic Petroleum Reserve release announcement a month ago. Natural Gas closed at $7.2 and was up 28% on the month. Crypto was under pressure with the broader market sell-off. However, BTC was only down 1.4% on the week to $38.k, while ETH dropped 1.8% on the week to close at $2.8k. I thought the 2nd chart (bottom Nasdaq YTD performers was interesting, as many were darlings for some time. This was the worst month for the Nasdaq since October 2008. The VIX is at 33.4 or up 62% on the month. The Fed meets this week and the expectation is for 50 hike.

These charts were through Thursday and obviously the Nasdaq fell another 4.2% from these levels on Friday.

This portion is from my former JPM colleges in HY research. The HY market has taken some hits as outlined in this good summary. A reader sent me a picture of some HY bonds, which are higher yielding (2nd pic). I have not been invested in the HY market for some time, but am starting to take a look again now that there is yield. It likely has more to drop, but it is at least getting interesting with more bonds at real discounts to par and yields approaching or at double digits. I believe the average HY bond price is now below $92. The average price was $101.1 on 12/31/21, for perspective. An easy/liquid way to play the HY market is HYG or JNK, but there are many others as well. The first chart is through Thursday and the HY market fell another 3/4 point on Friday.

JPM HY Research-High-yield bond spreads have widened to a high since mid-March as investors debate whether the economy and earnings can withstand aggressive Fed tightening to combat inflation. While the early stages of earnings season has been better than feared (HY Earnings Tracker), sentiment is contending with a continuous re-pricing of Fed expectations. High-yield bond yields and spreads increased 24bp and 32bp over the past week to 7.13% (hit 4.22% in July 2021) and 438bp, which are 83bp and 53bp above April’s low. And the US HY Index is providing a -2.91% loss in April with an increasing amount of dispersion evident in under performance of CCCs (-3.58%) and sectors such as Housing (4.47%), Retail (-4.04%) and Autos (-3.90%). The US HY Index is now providing a 6.94% loss year to date, already the largest annual decline on record not accompanied by a recession. Earnings and the Fed meeting will likely dominate investor focus next week amid the lightest stretch of capital market activity in more than 3yrs. Despite the second largest annual outflows on record, 2022’s supply deficit already exceeds FY21’s amid a 72% yoy collapse in new-issue and an accelerating pace of upgrades to investment-grade.

Gross domestic product in the U.S. declined at a 1.4% pace in the first quarter, below analyst expectations of a 1% gain. Declines in fixed investment, defense spending and the record trade imbalance weighed on growth. Consumer expenditures rose 2.7%, but that came amid a 7.8% increase in prices. The U.S. economy shrank in the first quarter as supply disruptions weighed on output and masked underlying strength in consumer and business spending that suggested growth will soon resume. I included a link from CNBC (1st one) and the WSJ (2nd) to give you a couple viewpoints. This chart is from the WSJ.

Consumer spending picked up sharply in March, positioning American households to help propel the economy heading into the second quarter of the year. Personal consumption expenditures increased a seasonally adjusted 1.1% in March from the prior month, the Commerce Department said Friday. Consumers stepped up spending on services like travel and dining, as well as on goods like gasoline and food. Spending on durable goods declined for the second month in a row, led by lower spending on vehicles. I feel this will be a big summer for travel/services given many cancelled vacations over the past two years.

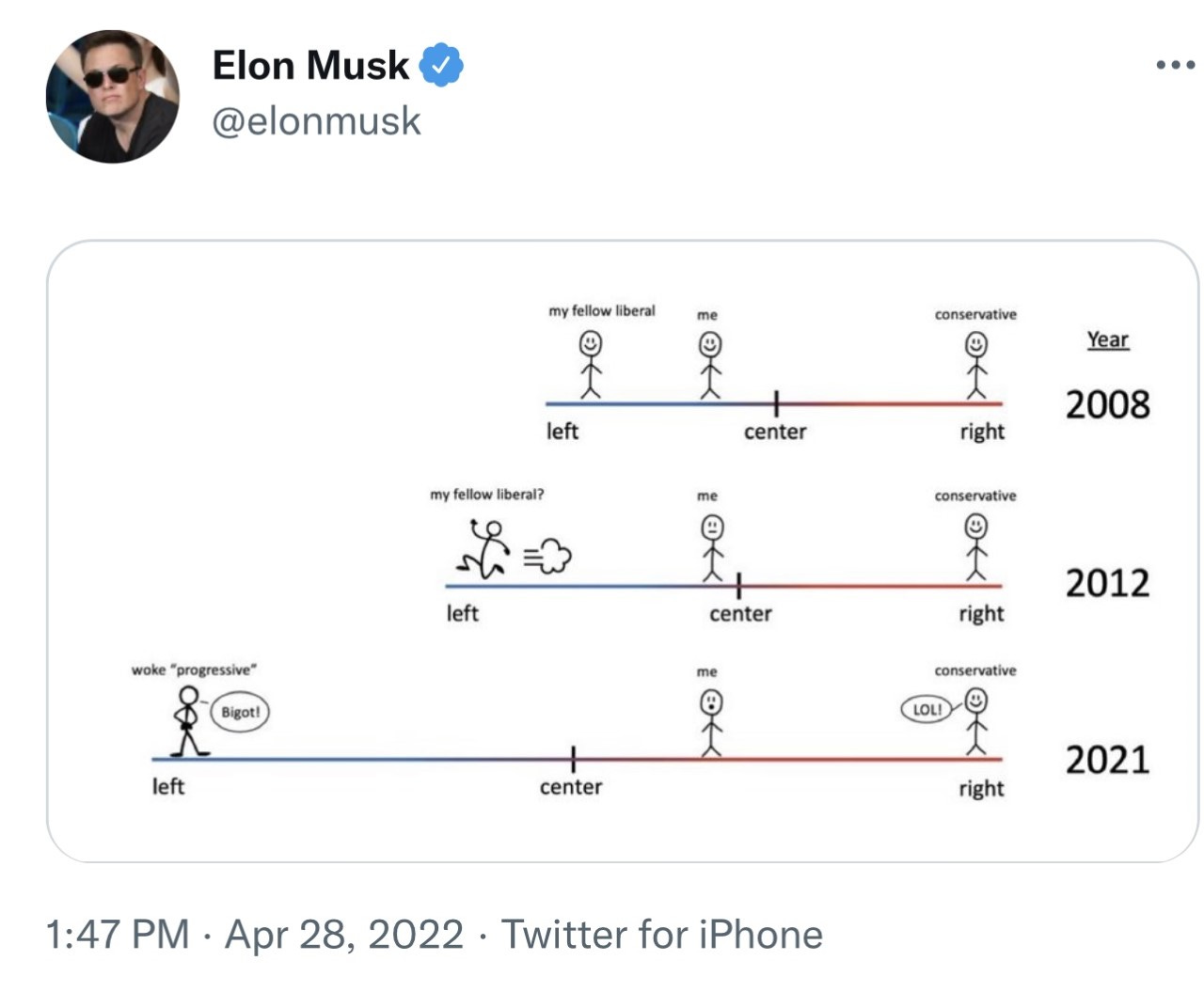

I have praised Musk’s Twitter acquisition as good for America and something which hopefully results in free speech or at least a level playing field. He has sold over $8bn of TSLA stock in recent days to help pay for the Twitter deal. Media bias is not joke and social media/big tech are the worst offenders who have banned anything of substance which goes against the Democratic party. The Biden administration announced a “Ministry of truth’ to police the internet days after Musk/Twitter was revealed. I hope all my readers are American’s 1st and Democrat or Republican 2nd. We should all be concerned about the bias and timing of such announcement and the media behavior having massive influence on outcomes. Musk appeared to react negatively on Twitter in response to the Biden administration’s establishment of a 'Disinformation Governance Board' to combat online disinformation just days after Musk’s deal to buy Twitter. "Discomforting," the South African billionaire posted on Twitter. The Executive Director of Biden’s Misinformation Governance Board, Nina Jankowicz, an avowed free speech opponent and herself a peddler of disinformation as, for example, the absurd claim that Hunter Biden’s business records were a Russian plant. She is also a clear supporter of the Democratic party, and I feel an Independent should run this moronic Board, which to me, should be disbanded.

Another headline is laughable. “Twitter Employees Melt Down, Quit Over Musk Takeover, New Internal Messages Reveal,” and show employees wanting to quit over Musk and the fear that the Trump ban will end. Employees are sick of hearing about free speech according to the piece. Read what a Time Magazine writer had to say about free speech, calling it a white male “obsession.” Here is another example of bias from Google. A study from researchers at N.C. State University finds that Gmail marked 59% more Republican fundraising emails as spam than Democratic ones during the 2020 election. Republicans filed an FEC (Federal Elections Commission) complaint on the matter. Media bias has some big consequences. Your email service and search should not have such influence, and Gmail has 1.5bn users and accounts for 91.5% of worldwide search share and 87% in the US. I just want a level playing field. I would say the same thing if the media were favoring Republicans or Libertarians. I love this picture below from Musk.

"I am considering dealing with some debt reduction," he told reporters at the White House. "I am not considering $50,000 debt reduction [per borrower]," he noted, "but I'm in the process of taking a hard look at whether or not there are there will be additional debt forgiveness," Biden said. Elizabeth Warren and Chuck Schumer wants $50,000 of debt forgiveness, but it appears Biden is leaning towards $10,000. Canceling $10,000 per borrower would wipe out $321 billion of federal student loans, and eliminate the entire balance for nearly 12 million people. Around 70% of student loan borrowers would still be left with the debt. Just what the government needs, go into more debt and throw more money in the system. Also, paying off debt sets the wrong precedent in my mind. Remember, I paid for school myself and the money I borrowed was paid back in full without the help of the government. Don’t tell me it is not possible, despite coming from limited means. Again, I feel a large percentage of kids attending four-year universities should be in much shorter and cost effective vocational programs. Also, majors matter. Spending $200k to major in some idiotic subject with no jobs should not result in a government bailout. Many colleges/universities should not exist in my mind. Very expensive educations which do not lead to real jobs are an over-priced bridge to nowhere.

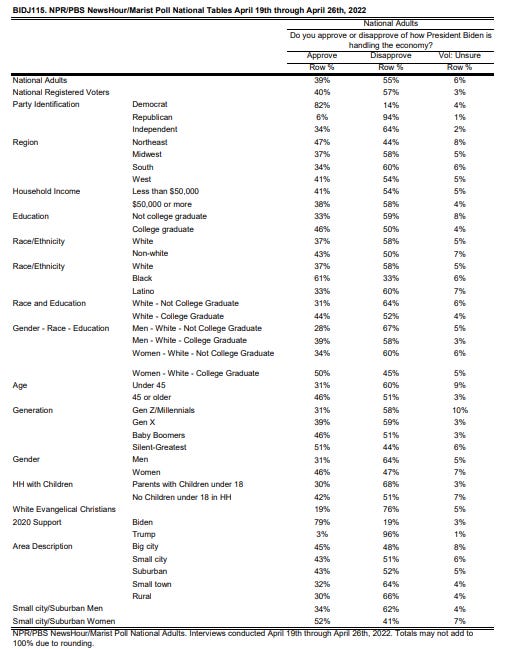

Here is a poll from last week from NPR/PBS/Marist. I feel the approval data is incredibly concerning for Democrats. Biden had 54% of Independents in 2020 and now 64% of them disapprove with only 34% approving of Biden’s handling of the economy. This link has far more details on different questions posed.

Other Headlines

Amazon shares fall on weak forecast and slowest growth since dot-com bust

It feel 14% on Friday dropping over $200bn in market cap. For perspective, McD has a market cap of $192bn.

Apple posts big beat and 9% revenue pop, authorizes $90 billion buyback

Chevron’s profit quadruples in the first quarter as higher oil and gas prices boost operations

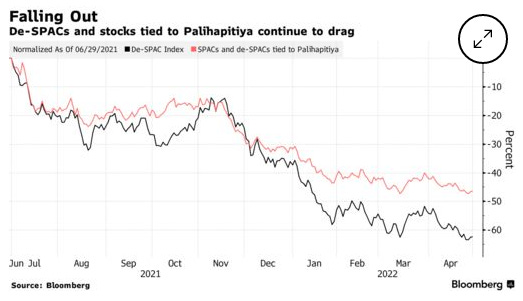

Chamath Palihapitiya’s Ex-SPACs Tumble in April, Leading Industry Plunge

Key index off more than 70% since February 2021 to record low

Blank-check market over-saturated with over 600 seeking deals

Price Rises Top 8% at Consumer Giant Unilever, Hitting Demand

64% of workers would consider quitting if asked to return to office full-time

I have been talking about the WFH topic for two years, but this stat was a bit surprising.

Cell phone radiation may be causing sharp spikes in Alzheimer's cases - Study Finds

Metaverse KISSING now possible with tech that ‘sends sensations to mouth, lips and TONGUE’

The Anti-Israel Past of NYT Jerusalem Bureau’s Latest Hire

How is this not concerning? How much more biased can you be?

Marjorie Taylor Greene Spews Head-Spinning Double Talk To Laura Ingraham

Wisconsin DA says 14-year-old boy is the suspect in the death of 10-year-old Lily Peters

This is one scary story and something I could not imagine.

Madison Ave retailers lock doors in daytime amid crime frenzy

Hello politicians and DA’s! You better do something about this crap.

Man released after elderly, cop assault, tried to shove NYC commuter

Shocking NYC carjacking caught on video as group pummels driver, stomps on car

When will lawmakers, the DA, Mayor… wake up and make some examples out of criminals to actually deter horrific outcomes? Good news Gotham law-abiding citizens, the man filmed punching the helpless driver with “knuckle dusters” was set free to do it again. He will face misdemeanor charges for breaking a man’s eye socket. How come I am not hearing more outrage from my readers on the absurdity of consequences in NYC and other incredible stupid cities who have policies which favor criminals over law-abiding citizens? How did we get here, and how do we get home? Elections have consequences and electing Mayors, Governors and DA’s who are soft on crime come at a high cost for the people who abide by the law, pay taxes and work hard to support their families.

In Chicago, Wealthy Neighborhoods Hire Their Own Private Police as Crime Rises

Lake Mead plummets to unprecedented low, exposing original 1971 water intake valve

Pelosi leads first official US delegation to Ukraine since war began

Joe Biden’s ‘kleptocracy’ gaffe breaks Twitter

The video is 30 seconds.

New text messages reveal Fox's Hannity advising Trump White House and seeking direction

Clear bias here. 82 texts with Meadows in the election aftermath.

Saudis would develop bomb 'the next day' if Iran nuclear deal led to weapons capability: Expert

I was critical of the Iran Nuclear deal under Obama. How we are not being more aggressive here is beyond me. They hate America and Israel. When you have nuclear capabilities it is a much harder decision to use force as we can see it playing out with Putin today.

Shocking aerial images show mass devastation to residential homes in Irpin, Ukraine

Many pictures are in the link.

Putin’s face is full. I called it over two months ago; he is not well. Is it cancer or Parkinson’s? I don’t know. Some articles are suggesting he will be having cancer surgery and will hand over power. I called his illness in a late February piece.

White House proposes plan to sell Russian yachts for Ukraine aid

I have shared my concerns over the seizures of oligarch assets as a slippery slope. It just does not feel legal to me.

Virus/Vaccine

Cases have grown to over 56k/day after dropping to 27k less than one month ago. However, we remain 93% from the January highs of 807k/day. Hospitalizations have gained momentum at +15% and are over 17k. However, deaths continue to drop (lagging indicator) and are almost at 300 (-28%), a level not seen since last July.

Real Estate

I am hearing from readers who are R/E investors, brokers, portfolio managers that they are starting to see pockets of slowdowns in various areas of the market. One reader owns two homes which are for rent in West Palm Beach. The showings have screeched to a halt, and interest is tepid. This is partially explained by a summer slowdown, but I am not convinced fully explained given the massive flood of people who want to relocate. Here are some quotes (One is from a Bloomberg article from Mark Kiesel from Pimco):

Reader-“Miami multifamily rents slowing dramatically - getting price cuts for the first time since the pandemic - granted this is on the low to mid end not high.”

Reader-“Anecdotally it seems like things are slowing - starting to see price cuts in Manhattan and Hamptons - I think to your point it may be aspirational pricing coming back to earth but it is definitely happening - on the rental side I think landlords are getting more reasonable as an example of my friend’s rent only bumping 3% in NYC after a 30%+ increase last year.”

Kiesel-“I can look at my long-term 25-year charts and they tell me

when to buy and sell and they’re flashing orange right now,”

Kiesel, 52, said during an interview at Pimco’s Newport Beach,

California, headquarters. “I think we’re in the final innings.”Mark Pruner-”Where we see our market slowing in Greenwich is under $1 million. We now have 8 houses under $1 million rather than the only 6 houses that we've had in previous weeks. (Supply is up 33% in only a couple of weeks, i.e. 2 more houses. Both inventory numbers are ridiculously low. Last year, we had 23 houses under $1M and going back to our last pre-Covid April, we had 54 listings under $1M in 2019. Where this slowing is most noticeable, is that earlier this year we might have had 25 or even 50 groups show up at a public open house for this price range, we now have 15 groups and even fewer at a second open house, if the house makes it that far. The rise in interest rates had clearly slowed the market from frenzied to hot. “

“Overall, we are up to 173 listings from an all time intra-week low of 136 listings two weeks ago. That's a nice jump up, but those 173 listings compare to 328 single-family home listings at the end of April 2021 and 693 listings at the end of April 2019. So, our inventory is down 47% from last year and 75% from pre-Covid times. Sales are still being limited by lack of inventory, but out 194 sales so far this year only 44 sales were for over list with another 33 going for full list price, i.e. 40% of our listings went for full list price or over list. That is the same percentage as last year. Bottom line there are still plenty of buyers out there to suck up new listings, it's just that we are seeing some lessening of competition.

My brother and I listed 113 Woodside Drive in the gated community of Milbrook for $4.89M. It sold for $638,000 over list, the most dollars over list so far this year. It epitomized what people are looking for: newer construction, beautifully maintained, a gated high-end community and water views. It was bought by a crypto guy from the Hamptons who beat out 6 other offers, all over list.”

In South Florida, not all is slowing. Devin Kay just told me this story from last week: 1 bedroom/2 bath at SLS Brickell. Two years ago, it rented for $2,800/month. Recently, it was listed for $5,000/month and in one day, there were 7 offers. It went for $5,400 in a bidding war. It is a little over 1,000 square feet. In another one, I spoke with Jonas Mikals about Panther National. The 218 home golf course community under development in WEST Palm Beach now has over 250 reservations in two months and the phone continues to ring. Pricing is from about $3.5-10mm+. I have a reservation and depending on the lot I can get, I am seriously considering it. Dan Loeb, paid $12mm for a tear down in Miami in late 2020 and he apparently has it under contract for double the price. In another flip story, a house bought for $9.3mm was flipped one month later for a 50% profit (1400 W 23rd Street on Sunset Islands). My point is despite pockets of slowdowns, choice properties in South Florida remain in demand.

I have written about infrastructure issues in South Florida given the wave of new residents. I mentioned we are short on housing and schools. Doctors are in high demand. My wife needs blood work taken and given insurance, we need to use Labcorp. She called 3 different locations around us and to draw blood. It was weeks to over a month to get a scheduled appointment. She is off to NYC to see her mother’s art show at Leila Heller’s Gallery 5/3 from 6-8pm. It is at 17E 76th Street. Jill called and got an appointment at a lab for Monday am no problem in NYC. I have a Florida doctor and wanted a check-up. I called and he said, “We are booked solid for weeks.” Mind you, this is the slower season where many have left for the Northeast or Midwest for the summer.

I found this MarketWatch article on rising foreclosures interesting. Given the moratorium on foreclosures for a long time, the data is not as straightforward as it seems. The number of active foreclosures (this is when the foreclosure process has begun on a seriously delinquent loan, but it has yet to be completed and liquidated) edged up by more than 7,000 in March — the first year-over-year increase in almost 10 years, according to mortgage technology, data and analytics provider Black Knight. Secondly, more than 78,000 U.S. properties had a foreclosure filing during the first quarter of 2022, which is up 39% from the previous quarter and up 132% from a year ago, according to real estate analytics company ATTOM. And third, serious mortgage delinquencies — those 90 or more days past due — are 70% higher than they were pre-pandemic, according to Black Knight. While those numbers seem grim, pros say the reality isn’t as bad as it looks: Though active foreclosures are up year-over-year, the number of loans in active foreclosure is still way below historic norms. On average, prior to the pandemic, the country saw about 30,000 to 40,000 foreclosure starts per month.

Definitely Matthew McConaughey! But don't try Brad Pitt