Opening Comments

Since the start of my son’s golf tournaments on May 30th, I have now driven over 1,800 miles. By June 21st, expect that number to be an incremental 1,200 as we need to drive from Ashland, Kentucky to NYC and then Pennsylvania and Baltimore. The Toyota Camry I rented gets over 43 mpg. I have not had a car with that type of fuel efficiency. I don’t like the car, but do like that a tank lasts a long time given the crazy gas prices.

Thursday and Friday, we stayed in Memphis at our golf course, Spring Creek Ranch. Saturday, we drove to Lexington, KY and stayed in a Courtyard by Marriott. Relative to the Comfort Inn we stayed at in Zachary, LA, it was like the George V Four Seasons in Paris. I have never been so happy to be in a Marriot. The thread count of the sheets was in the triple digits, the reception desk employees had teeth and the room did not smell like a dead body. All was good until at 4am a fight broke out in the room next door with some heavy F-Bombs with Southern drawls until 6am. I called the front desk multiple times to no avail. My pleasant night sleep ruined. The manager gave me a full refund. It gets better. When we went to leave the next day, someone had slashed the tire of the rental car. Although my tire changing skills are legendary (5 min 12 seconds), I could not go far on that tire. I had to exchange the car and drive 30 minutes out of the way. Given I have never been to the town, I found it odd. Was it an unhappy Rosen Report reader stalking me?

One consistent theme from Louisiana, to Tennessee to Kentucky to Pennsylvania is the lack of labor. Everyone was complaining about the inability to hire talent and the unwillingness of people to work. Some restaurants are limiting patrons as they lack the staff. With inflation rampant and folks hurting, I find it odd that more people do not want to work. At one place, $20/hr is not getting any attention. National minimum wage is $7.25.

Hitting send from my phone hotspot during Jack’s practice round. Hope it goes through.

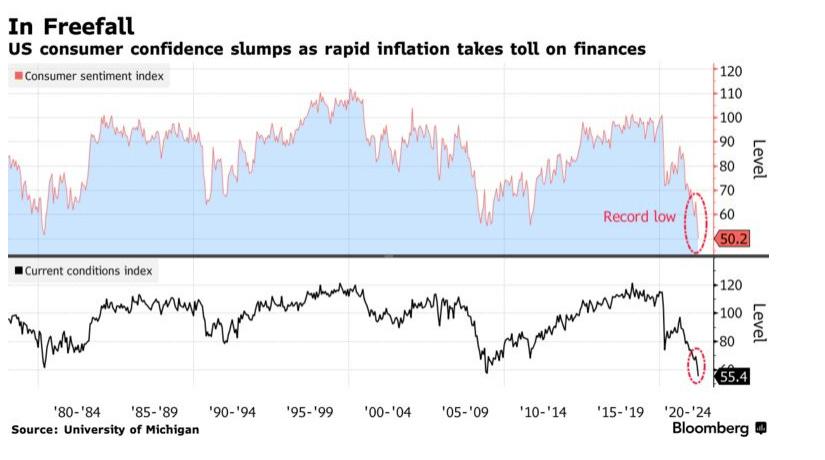

Picture of the Day-Consumer Sentiment in Freefall

Frenemies

Quick Bites

Markets

Stock vs. Bond Yields

Rates/High Yield

Inflation

Druckenmiller Market Call

Presidential Polling Troubles

Trust in Government Gone

Other Headlines

Virus/Vaccine

Data

Real Estate

My General Comments-FL Schools and Restaurants

Housing Prices Falling (chart)

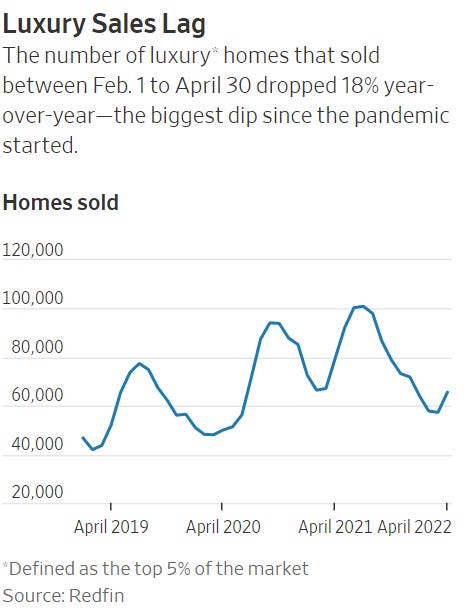

High-End Real Estate Cooling

CA Exodus

Picture of the Day

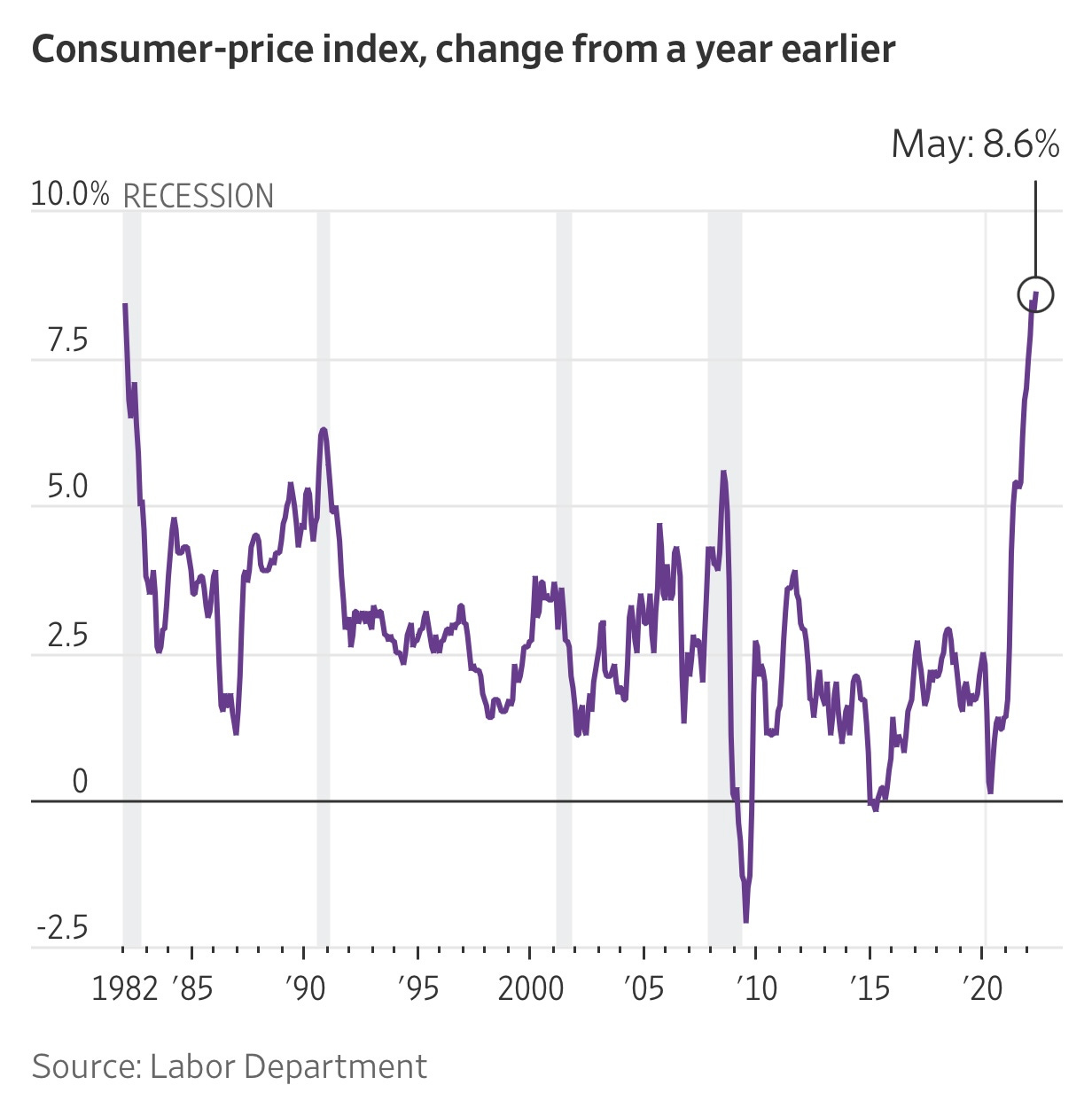

The University of Michigan Consumer Sentiment index fell to 50.2 from 58.4. “Throughout the survey, consumers signaled strong concerns that inflation will continue to erode their incomes, and the factors they cited are unlikely to abate soon,” Joanne Hsu, director of the survey, said in a statement. “While consumer spending has remained robust so far, the broad deterioration of sentiment may lead them to cut back on spending and thereby slow down economic growth,” Hsu said. This chart goes with the bullet on Biden’s approval ratings which are at new lows and spells massive trouble for the left. Consumer confidence (1st chart) fell to an all-time low. US average gas prices crossed $5 for the first time last week and CA averages $6.43. Alpine County, CA averages $7.8/gallon, the most expensive in the nation. Gas is now +63% on the year and +112% since Biden took office last January.

Frenemies

In 2015, when I as at my fund in NYC, Reef Road Capital, we had made a loan to a company which ended up having challenges. The company violated covenants which brought us to the table to negotiate new terms, given the company numbers were under-pressure. The phone call between the CEO (whom I will refer to Bob for this story) and I became quite heated with some heavy threats from both sides. I felt as though I needed to protect our interest as lenders, and he felt he was protecting his interest as a major shareholder. I swear, it would have ended in fisticuffs if we were in person. He asked me for my home and work address and suggested he was going to come to pay me a visit. Yes, it got ugly. I uttered some pretty harsh words. Eventually, cooler heads prevailed and we worked out a deal which allowed the company leeway with the lenders getting some benefits as well.

Fast forward about 18 months, and Jack and I were planning a golf, food, music, fishing trip to New Orleans, as my wife and daughter wanted to ski for spring break instead. I asked my team if anyone had New Orleans connections for ideas for us. The analyst on the deal mentioned said, “You should call Bob as he is a big fisherman in the area.” Based on my last interaction which included multiple vulgarities and threats, I was reticent to reach out to Bob.

Time cures all wounds, and I decided to give him call. We had a very cordial conversation, and he gave me ideas about the trip and invited Jack and I to stay with him in Grand Isle, Louisiana to fish for Redfish. I was shocked at Bob’s generosity in light of the heated exchanges we had 18 months prior, but was appreciative of his offer.

Jack and I went to New Orleans and ate at a bunch of good restaurants including Commander’s Palace and Brennan’s. The best burger was at Port-of-Call, a dive burger joint. We listened to jazz and had a great time despite the fact that Jack was not a fan of the French Quarter and the pungent aromas walking down the streets. I concur that the French Quarter is indeed disgusting.

Bob had someone pick us up in New Orleans and took us to his fishing cabin in the small town of Grand Isle. Jack and I fished for two days with “Herc,” the fishing captain and Redfish expert. His name is Herc because he is a mammoth of a man. Jack and I caught over 100 redfish and had so much fun. Bob set up a big cookout and crawfish boil after fishing. I had never been to a crawfish boil. There is a big process of marinating and cooking and cooling the crawfish. I vividly recall being given a huge plate of crawfish and trying to peel the shells and I was struggling mightily. The locals around me were peeling their crawfish at a rate of about 20 to my one and I was quite frankly ashamed. It was downright embarrassing. It got so bad, some of the locals started helping Jack and I peel our crawfish. They were calling us, “New York,” suggesting we were inept at crawfish peeling. I did not stop them from helping as the food was so good, I did not want to miss out. Fresh sauteed redfish is amazing as well.

We had a great couple days fishing, eating, and building a friendship after a “rocky” period which included threats of violence. Enemies became good friends, and we still are to this day years later. I was reminded of this story given I was just in Louisiana, but unfortunately did not have nearly as much fun on this trip in Zachary as I did fishing and eating crawfish in 2017. My point is, despite things starting off on the wrong foot, it does not mean enemies will remain as such. I would have never thought the friendship was possible after the initial altercation. Thankfully, I was wrong. Herc could have put me on his other shoulder. He was that strong.

My point is, even when you think there is clearly no resolution to problem and no possible way to come to an agreement, any two reasonable people can eventually work things out. Despite things starting off on the wrong foot, it does not mean enemies will remain as such. I would have never thought my friendship with Bob was possible after the initial altercation. Thankfully, I was wrong.

Quick Bites

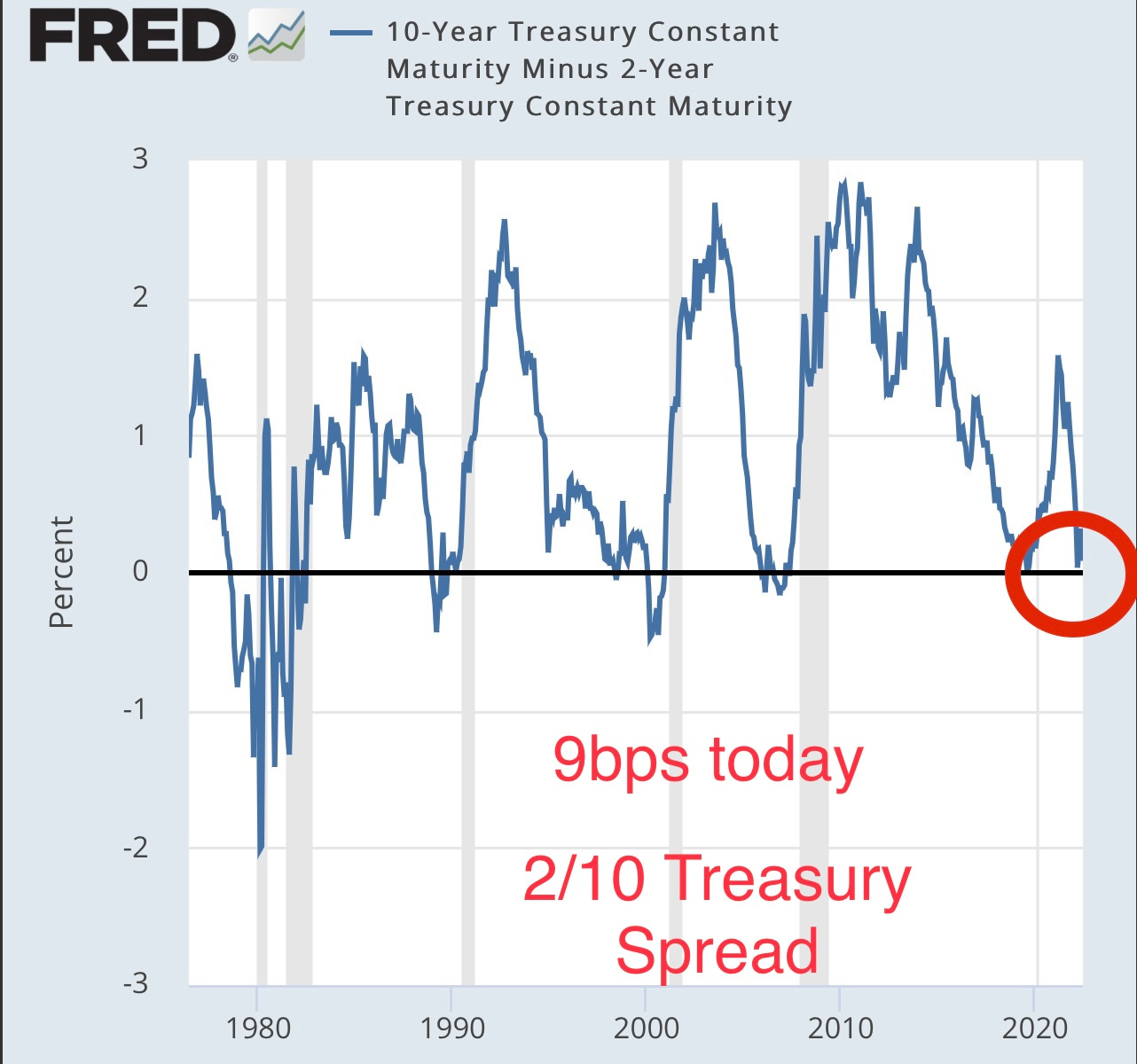

Markets were under pressure with Nasdaq underperforming given the hot CPI data which pushed up front end rates. Dow has been down 10 out of last 11 weeks which is the first time since the Great Depression. The Dow shed 880 points, or 2.73%, to close at 31,393. The S&P 500 fell 2.91% to settle at 3,901. The Nasdaq Composite sank 3.52% to 11,340. The sell-off was broad, with nearly every member of the 30-stock Dow in the red. Declining stocks on the New York Stock Exchange outpaced advancing ones by more than 5 to 1. Apple dropped nearly 3.9%, while Microsoft and Dow, Inc. slid about 4.5% and 6.1%, respectively. Salesforce sank 4.6%, and Amazon fell more than 5%. Friday’s declines means Wall Street suffered its worst week in months. The Dow fell 4.58% for its 10th down week in the past 11. The S&P 500 and Nasdaq Composite lost 5.05% and 5.60%, respectively, for their ninth losing week in 10 and the worst week since January. Year to Date, the Dow is-13.6%, S&P-18.2%, and Nasdaq-27.5%. Shockingly, the VIX (volatility index) is at 27.8. In 2020, it closed above 66 and traded much higher intraday. Oil sold off slightly as did natural gas. Oil was -1% to $120.5 and natural gas fell 2.3% to $8.75. New China lockdowns helped push oil lower. I am hoping to see a real capitulation day where VIX pops. More “experts” are calling for S&P to get to 3400-3500 which is roughly 10% lower than the Friday close. The 2s/10s Treasury spread is down to 9bps with the massive move in the 2 year Treasury. It was +40bps one month ago. Grey vertical lines are recessions after the spread goes negative.

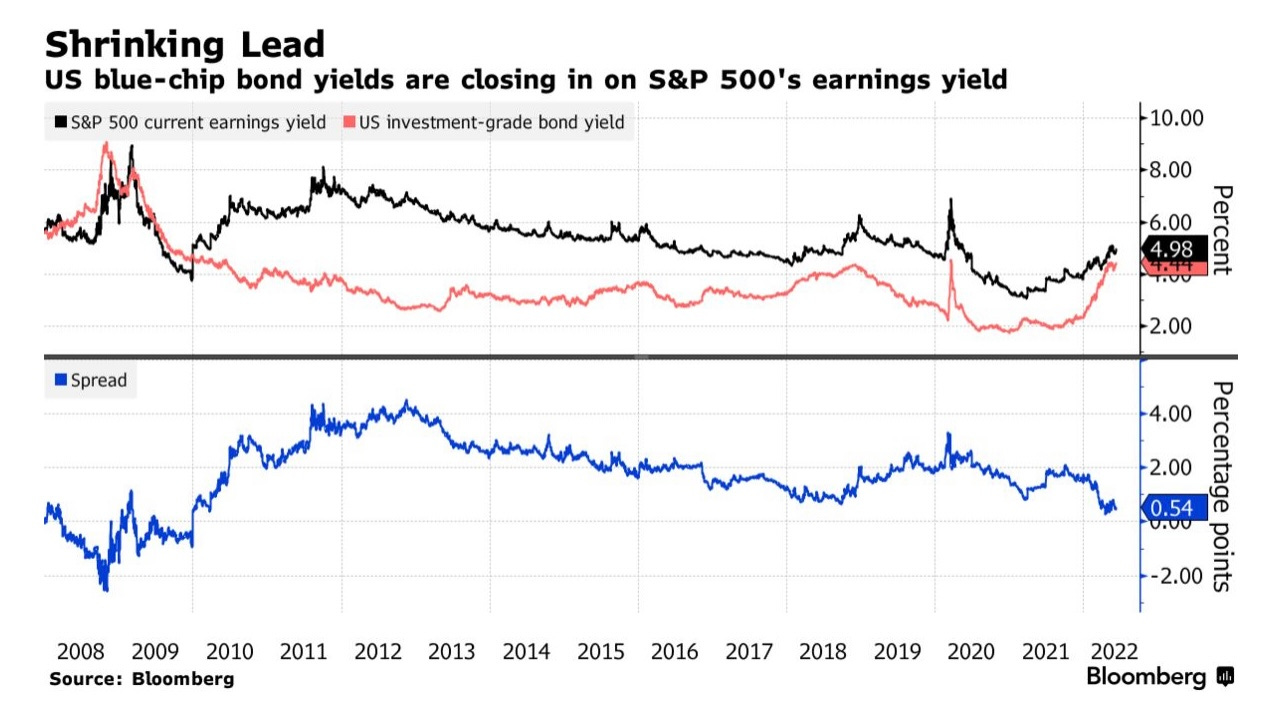

This Bloomberg article is entitled “Valuation Trauma Is Refusing to End for S&P in Free Fall.” The suggestion is that rising bond yields are now giving investors choices they have not seen in many years. The old acronym, TINA (There is No Alternative) to stocks is losing steam as bonds are becoming more attractive. I recently bought a portfolio of shorted dated muni bonds with a tax equivalent yield of about 4%. If I had waited a week, I could have done better.

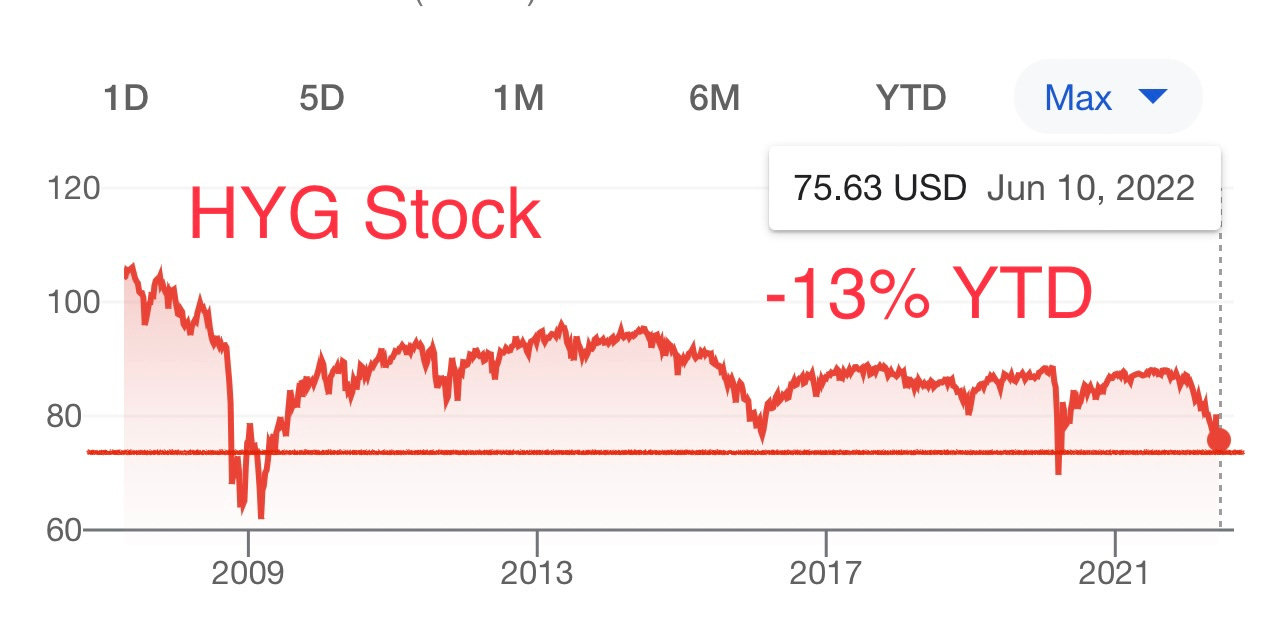

The rates markets backed up substantially Friday given the CPI data. The two-year Treasury sold off 24 bps to 3.065% (highest level since 2008) and the 10-year Treasury yield rose 12bps to 3.165%. The odds of a 75bps increase for the June meeting went from 9% on Thursday to 27% on Friday post the CPI data. Although the consensus is a 50bps increase, more economists are suggesting 75 bps for the June meeting. The High Yield Bond ETF, HYG, fell 1.7% Friday, was -4% on the week and is now down over 13% on the year. The 2nd chart shows the JPM HY Index Yield and Spread over Treasuries. The suggestion is with Friday’s sell-off, the yield is back to the May highs with the yield exceeding 8%. The data is through Thursday for the 2nd chart.

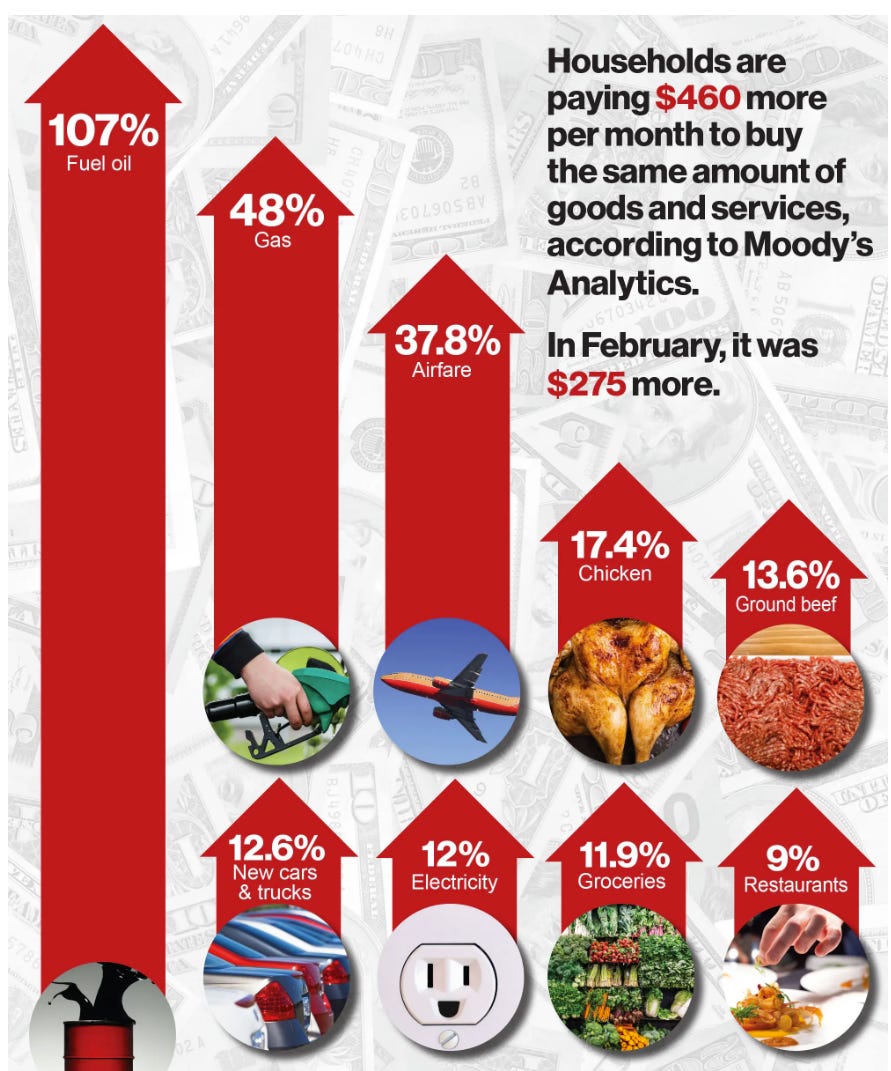

The consumer price index rose 8.6% in May from a year ago, the highest increase since December 1981. Core inflation excluding food and energy rose 6%. Both were higher than expected. The estimate was 8.3% and excluding food and energy was 5.9%. Surging food, gas and energy prices all contributed to the gain, with fuel oil up 106.7% over the past year. Shelter costs, which comprise about one-third of the CPI, rose at the fastest 12-month pace in 31 years. The rise in inflation meant workers lost more ground in May, with real wages declining 0.6% from April and 3% on a 12-month basis. May’s increase was driven in part by sharp rises in the prices for energy, which rose 34.6% from a year earlier, and groceries, which jumped 11.9% on the year, the biggest increase since 1979. But inflation pressures were distinctly broad-based in May, said Sarah House, senior economist at Wells Fargo Securities. I have spoken about my inflation concerns for a year and you can find them in my prior reports. I wanted QE to end a year ago. In July of 2021, I wrote a piece entitled, “There ain’t no such thing as a free lunch,” and it outlined the lunacy of the Fed and inflation at the time. The last sentence of the piece was: “Make no mistake, there will be a price to pay eventually for these loose policies from Central Banks, as There Ain’t No Such Thing As A Free Lunch.” I was adamantly opposed to the $1.9 trillion BBB program the liberals were pushing. Could you imagine where we would be if that was passed? Manchin deserves a medal for blocking it. I continue to contend that inflation is most likely peaking in the near term. We have started to see some assets start to crack on prices (fertilizer, lumber, housing, semiconductors, housing, appliances…). Oil/gas will be challenging and smells as though it is going higher, but demand destruction will take hold. According to estimates by Bloomberg Economics, US households will spend $5,200 more this year than they did last year on the same consumption basket. I am less confident that inflation falls quickly. Check out this headline, “Americans owe $22 billion in late utility bills as energy prices spike 34%.”

Billionaire investor Stanley Druckenmiller struck an pessimistic tone about the markets Thursday, seeing a turbulent road ahead as the Federal Reserve struggles to engineer a soft landing. “For those tactically trading, it’s possible the first leg of that has ended. But I think it’s highly, highly probable that the bear market has a ways to run,” the founder of Duquesne Family Office said at the 2022 Sohn Investment Conference. “The probabilities of being a soft landing are pretty remote. Historically, I think we’ve only pulled off two or three in history....there’s so much wood to chop. And there’s been such a broad asset bubble going into it,” Druckenmiller said. “Once inflation has got above 5%... it’s never been tamed without a recession. So if you’re predicting a soft landing, you’re going against decades of history.” I believe Druckenmiller is the best investor in the past 50 years based on his returns.

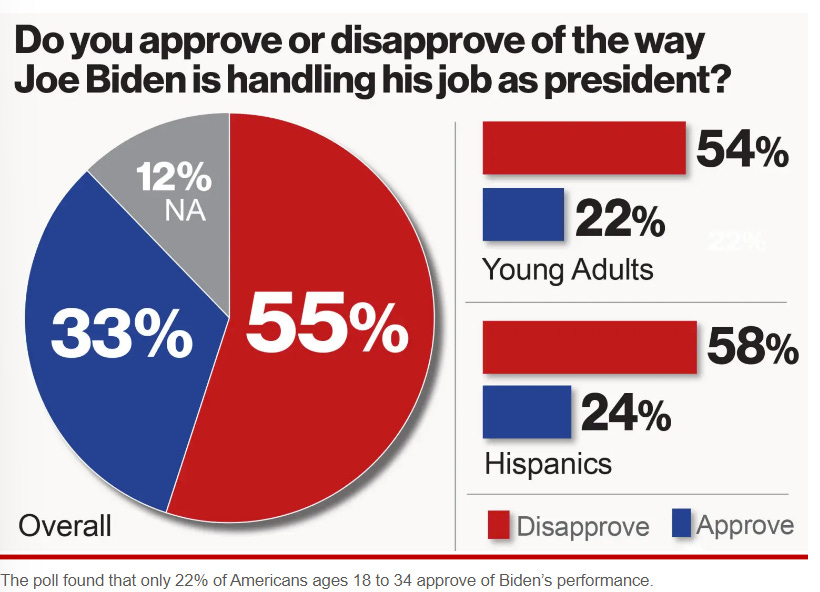

A new poll came out from Morning Consult/Politico. You know it is bad if Trump was more popular at the same point in the Presidency. Trump was 6 points better than Biden at the same point for both approval and disapproval. Maybe, if Biden admitted to some wrongs and took responsibility rather than blaming Putin, things would not look so dire. I do not feel Biden has been particularly good at much during his time as president, and the polls agree. The new Quinnipiac University poll suggested Biden’s job performance slipped to 33%. The survey, conducted June 3-6, found that 22% of Americans ages 18-34 approve of Biden’s performance — the lowest rating of any age group. Just 24% of Hispanic voters and 49% of black voters said they approve Biden’s work. This headline from the NY Times should be concerning: 'Many Democratic lawmakers’ are concerned by Biden’s leadership, feel U.S. is ‘falling apart.’ The suggestion is a growing number of Democratic leaders do not want Biden to run in 2024. I wonder why? My ask is simple. I want someone to run that I believe in. I don’t want another election where it is a vote against someone. I want it to be an election where I want to vote FOR someone. Elon Musk said he voted for Biden. Now, he calls him a 'damp sock puppet' and plans to vote Republican. Additionally, David Axelrod called Biden’s age a major problem.

A new Pew Research Poll came out and shows the public trust in the US Government has fallen to 20%, near historic lows. Unfortunately, that low approval rating reflects “decades of distrust,” the report said, and “a sentiment that has changed very little since former President George W. Bush’s second term in office.” For perspective, in 1964, Americans gave the government a positive rating of 77%. Overwhelming majorities of Black, Asian and Hispanic respondents said that “government should do more to solve problems.” But just over half of White people said that “the government is doing too many things better left to businesses and individuals.” Mandates, lockdowns, high inflation, high crime, porous borders, broken promises, deficits, general ineptitude and lies lead to a lack of trust. This is meant for both parties.

Headlines

Stitch Fix shares sink after company announces layoffs, offers weak guidance

DocuSign shares crater after first-quarter earnings miss

Stock fell 25% on the news.

American Airlines Grounds Almost 100 Airplanes Because It Doesn't Have Enough Pilots To Fly Them

Why $4.47 gas in Mississippi hurts more than $6.37 gas in California

Controversial soft-on-crime policies keep alleged NYC serial stabber out of jail

NYPD cops on pace to quit, retire in record numbers

The #s in the article are scary. Ramifications are serious for police hate.

Michigan Sheriff's Department Reduces 911 Call Responses Due To "Exhausted" Funds For Gas

This is crazy.

Los Angeles DA Gascon blames increasing crime on 'bad policies' that 'over-criminalize communities

Washington state saw 10,024 percent jump in catalytic converter thefts since 2019

Washington is not alone in this problem as the rest of the country saw an estimated 26,000 thefts in the first four months of 2022, a 33.5 percent increase.

Florida toddler in a diaper found walking pit bull by himself. It wasn’t the first time

Parents need jail time. A toddler in a soiled diaper, walking a pit bull in the rain. What could possibly go wrong?

Over $200K being spent on drag queen shows at NYC schools

Are you kidding me? Some of this is to kids who are three? What idiots think this is a good idea?

Scientists have crafted living skin for robots, further blurring the line between human and machine

SCARY

Researchers develop injectable gel that can repair cracks and tears in spinal discs relieving pain

Given I have back pain, which at times, is debilitating, I am hopeful this treatment has legs.

Ukraine is running out of ammunition as prospects dim on the battlefield

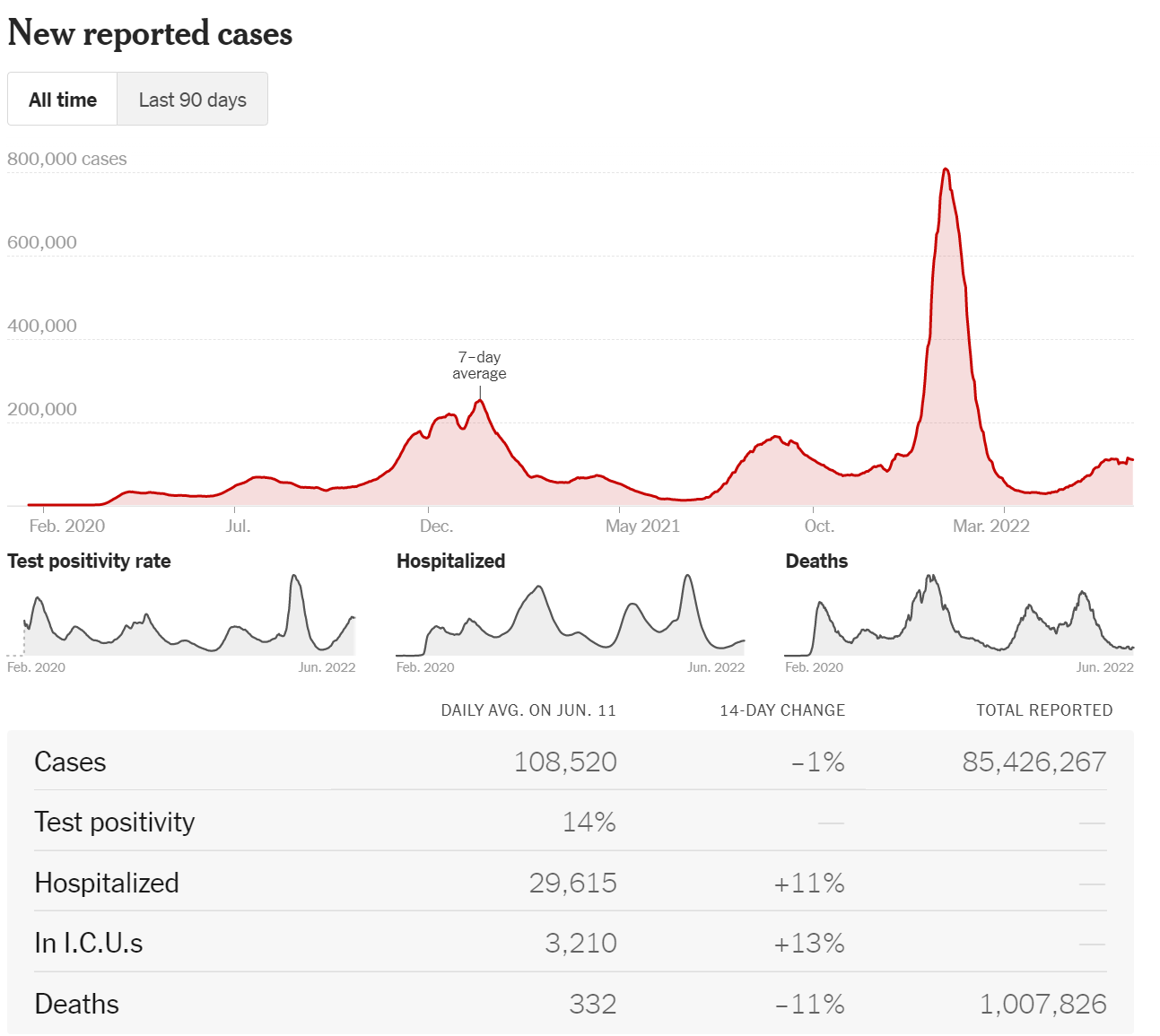

Virus/Vaccine

Charts are self explanatory, but in the data we have the Memorial Day data which skews it more positive than actual as it compares to the prior two-week period.

Real Estate

My comments today are around South Florida private schools and restaurants. Enrollment at 15 private schools on South Florida’s eastern coast is up 14% on average over the past two years, compared with a 1.7% increase across the country, according to the National Association of Independent Schools. There’s a glaring problem, though: There simply aren’t enough schools with a certain level of prestige to absorb the demand from high-earning finance workers migrating south. Getting into private schools is near impossible down here now. What was once a walk in the park is now akin to getting into Stanford. You must have a school acceptance prior to buying a home down here. Trust me.

On the restaurant front, many haters out there on South Florida. I get it. However, there are now 11 restaurants with Michelin Stars and more which are deserving of them. Up until this rating season, I do not believe Miami has had Michelin Star restaurants. The wealth flows to South Florida have driven higher end eateries to open. The link goes over the 11 starred restaurants. L’Atielier de Joel Roubuchon received two stars and was the only Miami restaurant to do so. One star included” Ariete, Boia De, Cote Miami, The Den at Sushi Azabu Maimi, Elcielo Maimi, Hiden, Le Jardinier, Los Felix, Stubborn Seed, The Surf Club Restaurant. There are others which warrant consideration and some are in this link. No one can deny that the Miami scene had changed dramatically for the better, and I expect that trend to continue. The quality of life, taxes, weather and cost of living are just too attractive relative to the basket. Just get out from July-October if you can.

While low housing inventory continues to pose a problem for homebuyers, rising mortgage interest rates appear to be dampening demand and leveling out home prices in select regional markets, according to a new report from Realtor.com. Peak is in on housing. Housing opportunities are coming. Second homes, challenging locations and those which need work will be coming down.

Interesting WSJ article on high end real estate cooling and I agree. Even Deep-Pocketed Buyers Are Starting to Back Away From the U.S. Housing Market/Economic uncertainty fueled by rising interest rates, volatile stocks and frothy prices is leading to a luxury slowdown, with a housing bubble in Austin near bursting. Less frenzy at the high end too. More listings are not being met with a high number of showings or multiple bidders as was the case. A lot of good examples in the article. There are now 21 listings in my community and an average ask of almost $16mm. Just a few months ago, there were four listings. When I bought 5 years ago, there were 71 listing with an average ask of $4.9mm. Homes staying on the market far longer, and the bidding wars are gone. The peak is in.

Your true-life adventure stories are always a very enjoyable read. "Reasonable people can work things out", well said. All good things