Opening Comments

In my last piece, in the crime section, I wrote about the horrible Pelosi attack and said, “I am a bit suspicious of the Pelosi attack story and the more research I do, the more questions I have. Still doing homework, but want people to know I am not 100% convinced the story is as it seems.” I did not say the attack did not happen, I merely questioned the main narrative at the time. Given the media has been so wrong on so many topics, you will hopefully excuse my reluctance to accept the initial news as fact: Jussie Smollett Attack, Nick Sandmann confrontation with American Indian, Hunter Biden Laptop, Steele Dossier, Old Dominion Voting has ties to Venezuela, Inflation is Transitory, The migrant surge was seasonal …. There are many others. My point is, just because it is written, in the WaPo, NYTimes, Fox News, CNN or MSNBC…does not make it fact. I feel there is too quick of a rush to get out a narrative to fit the media outlet agenda today. Unlike the popular media, I admit quickly when I am wrong. Although I have a great deal more questions, it seems to me DePape was indeed a mentally ill (illegal alien) who was out to harm Nancy Pelosi, and that was his intent. DePape did bring tape, rope, hammer, gloves and zip ties to the house according to police. I would like to see both security cam video of the house and police cam video, but it is clear that some of the far right initial stories do not have legs. I remain shocked that a family worth hundreds of millions and Nancy being behind the VP to take over the Presidency with no security, despite living in a high-crime district. There were many misrepresented claims early on which confused the situation from both sides. The FBI has not exactly been incredibly trustworthy in recent history and has showed incredible bias. I feel we all should question when we are told something which does not add up, and I will continue to do so. However, as new facts come to light, we need to correct or clarify the record. I just wish the popular media would do the same. Note, my correction was at the TOP of my piece, and my crime story on Pelosi was on the bottom. Maybe, just maybe, the popular media should take note. The fact that 7% of the US population have a “great deal” of trust in the media should not be surprising. I wish Paul Pelosi a speedy recovery and hope DePape serves a full sentence.

My daughter went trick or treating and her goal was 15 lbs of candy. She surpassed her goal, getting 19.5lbs. However, she failed my one request miserably. I wanted candy corn. She brought back ZERO.

Remember, some email services truncate this message. At the bottom, you may need to hit the section “View Entire Message” to get to the Real Estate section.

Pictures of the Day-War Relics Found in Memphis

Latest Eye on the Market-Mike Cemablest

Gator Bait Part II

Quick Bites

Markets

Maersk on Economy

US Household Cash Positions

Fortune On Venture Valuations

Biden Accuses Oil Companies of “War Profiteering”

Other Headlines

Crime Headlines

Real Estate

High-End Boca Year over Year results-Only Found in the Rosen Report

Moody’s Home Price Projections from Fortune

Homebuilders on Edge-CNBC Article

Other R/E Headlines

Virus/Vaccine

Picture of the Day-Civil War Relics in Memphis

I enjoy stories of found relics of historical importance. The low water levels on the Mississippi River allowed Civil War relics to be discovered by Riley Bryant, a collector. The location under the bridge used to be home to Fort Pickering, a base that was used for shipping first by the Confederates and later the Union after they took over the facility in 1862, according to historians. Next time I go to Memphis, I am heading over to the bridge to find my loot.

Latest Eye on the Market-Mike Cemablest

We begin with a discussion of when equity markets might bottom by looking at leading indicators with an excellent track record of signaling the end of a selloff, and at the history of inflation spikes in the developed world. Then, a Thanksgiving list of things I am thankful for. My list this year: CH4, HR4346 and mRNA-1273. As they say, “your mileage may vary.” Always insightful perspective and charts.

Gator Bait II

A couple years ago, I wrote a Rosen Report entitled, “Gator Bait” regarding a scary situation which happened to me as a kid. I am summarizing it below as I was unable to find it on the platform I used back then. I was reminded of the story because another gator situation happened in the last couple weeks at my golf course in Florida. An 80-year-old member, Ron, hit his ball into the water, just on the edge. Normally, he would have just picked it up by hand, but this time, he grabbed a club out of his bag to lift the ball out of the water. He did realize that a large (10 foot) gator was right there which lurched at him hitting his golf club. He told me the story a couple days later and was still shaken by it for obvious reasons. It reminded me of this one which happened to me. The club since had the gator removed by authorities, as once they get aggressive with people, you need to get rid of them in a hurry.

When I moved to Florida in 1977, we lived in an area called Pembroke Pines about 17 miles west of the beach. In the 70s, the town I lived in was once considered to be part of the Everglades. We were in a townhouse community, and there was a public golf course nearby called “Pembroke Lakes.” Coincidentally, Pembroke Lakes was my first job washing dishes and cleaning toilets at 11 years old, but that is a story for another time.

I loved fishing for bass and would sneak on the course to catch fish all the time. While fishing, I would find golf balls, which gave me a brilliant idea. I thought if I were to dive in the lake for balls, I could get a ton and sell them back to the golfers.

All was going well, and I was making some money when I was caught by the golf ranger. Rather than getting me in trouble, Tommy wanted to go into business with me. He was in his 60s and a retired teacher who worked at the course for free golf. The agreement allowed me to dive for balls while Tommy would be on the lookout and we would split the find at the end of the day.

This “partnership” was working well for months. Every month, I would get on my swimsuit and grab as many golf balls as possible. I was under water and started hearing a strange splashing. The sound was golf balls being thrown at me by my “partner.” I got my head out of the water to yell at him, and he was screaming at the top of his lungs for me to get out of the water. A large alligator was eyeing me for diner, and making its way quite quickly. I am not sure if people recall Scooby Doo, but he would run on the water when being chased by a ghost. Well, that is effectively what I did to get out of harm’s way. When I got to the bank, Tommy grabbed my arm and pulled me up, and the gator was about 10 ft. behind me and closing in fast. I was about 12 years old and a skinny kid. I would not have stood a chance had the gator taken a bite.

My sister just took this picture with her 600mm zoom lens.

That was the end of the golf ball diving partnership and my last time in the water. I stuck to fishing and finding balls on the water’s edge, never to dive again. My business deal taught me a bit about working with a partner - in particular how unfair it was that I did all of the work, while old Tommy boy sat in the cart and basically did nothing until he saved my life. I guess in the end he saved me from becoming Gator Bait, so we are even. Here is a picture of me around the time of the incident. My only protection would have been my large head of hair.

Quick Bites

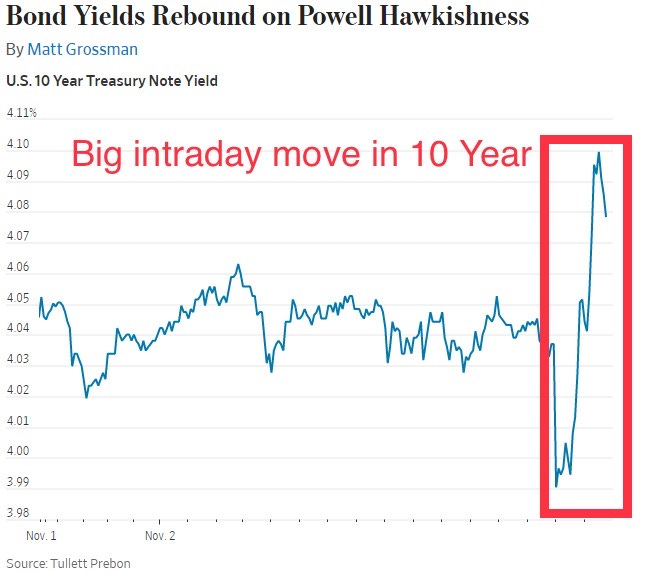

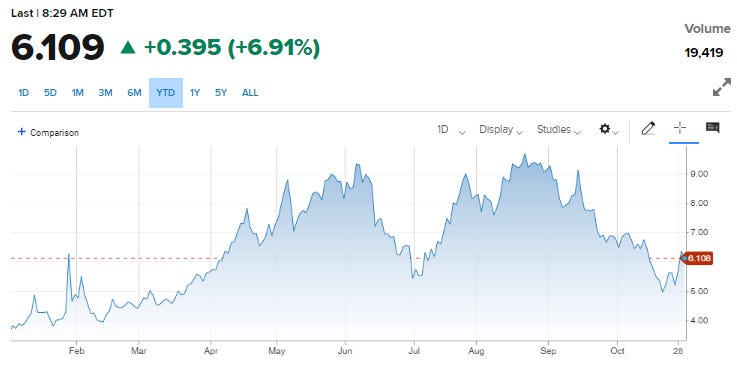

Stocks notched a significant comeback in October, though they fell on Monday. The Dow jumped 14% in its best month since 1976, while the S&P 500 and Nasdaq Composite rose roughly 8% and 4%, respectively, this month. Private payrolls rose 239k, better than expected and wages increases 7.7% according to ADP. The Fed raised 75bps to 3.75-4% for the Fed Funds rate and hinted at a change in policy ahead. “In determining the pace of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.” Yields on Treasuries were down 2-9bps across the curve and stocks went green on the announcement, but changed course after Powell’s commentary when he suggested the risk is doing too little, not too much and the terminal rate will be higher than previously expected. ”It is very premature to think about pausing and we have a ways to go.” “Policy needs to be more restrictive, and that narrows the path to a soft landing,” Powell said. The 2-Year ended up +6bps after being -10bps initially and closed at 4.6%. The 10-Year Treasury broke below 4% before settling back up at 4.08% and was 4.21% a little over a week ago. I continue to believe 50bps is coming in December. The US Dollar was weaker initially and then rallied. Stocks rallied initially and ended up lower. The Dow slid 505.44 points, or 1.55%, to settle at 32,148. The S&P 500 dropped 2.5% to close at 3,760, while the Nasdaq Composite tumbled 3.36% to finish at 10,525. Big intraday moves below in the 10-Year and Stocks. Consumer discretionary and information technology were hardest hit. AMZN, NFLX, Meta shed nearly 5% and TSLA and Saleforce shed either side of 6%.

Maersk, the world’s largest container shipping firm, on Wednesday posted record profits for the third quarter on the back of high ocean freight rates, but noted a slowdown in demand. Despite $10.8bn in quarterly EBITDA, the CEO said, “With the war in Ukraine, an energy crisis in Europe, high inflation, and a looming global recession there are plenty of dark clouds on the horizon.” “This weighs on consumer purchasing power which in turn impacts global transportation and logistics demand. While we expect a slow-down of the global economy to lead to a softer market in Ocean.” He also stated, in a separate Bloomberg article, “It’s really hard to be very optimistic with a war on our doorstep and a bigger energy crisis this winter so that is impacting consumer confidence and therefore also demand.” The company said Wednesday that global container demand is expected to contract between 2% and 4% in 2022, down from a previous projection of +1% to -1%, noting that freight and charter rates declined in the third quarter as demand moderated and Chinese Covid-19 restrictions diminished.

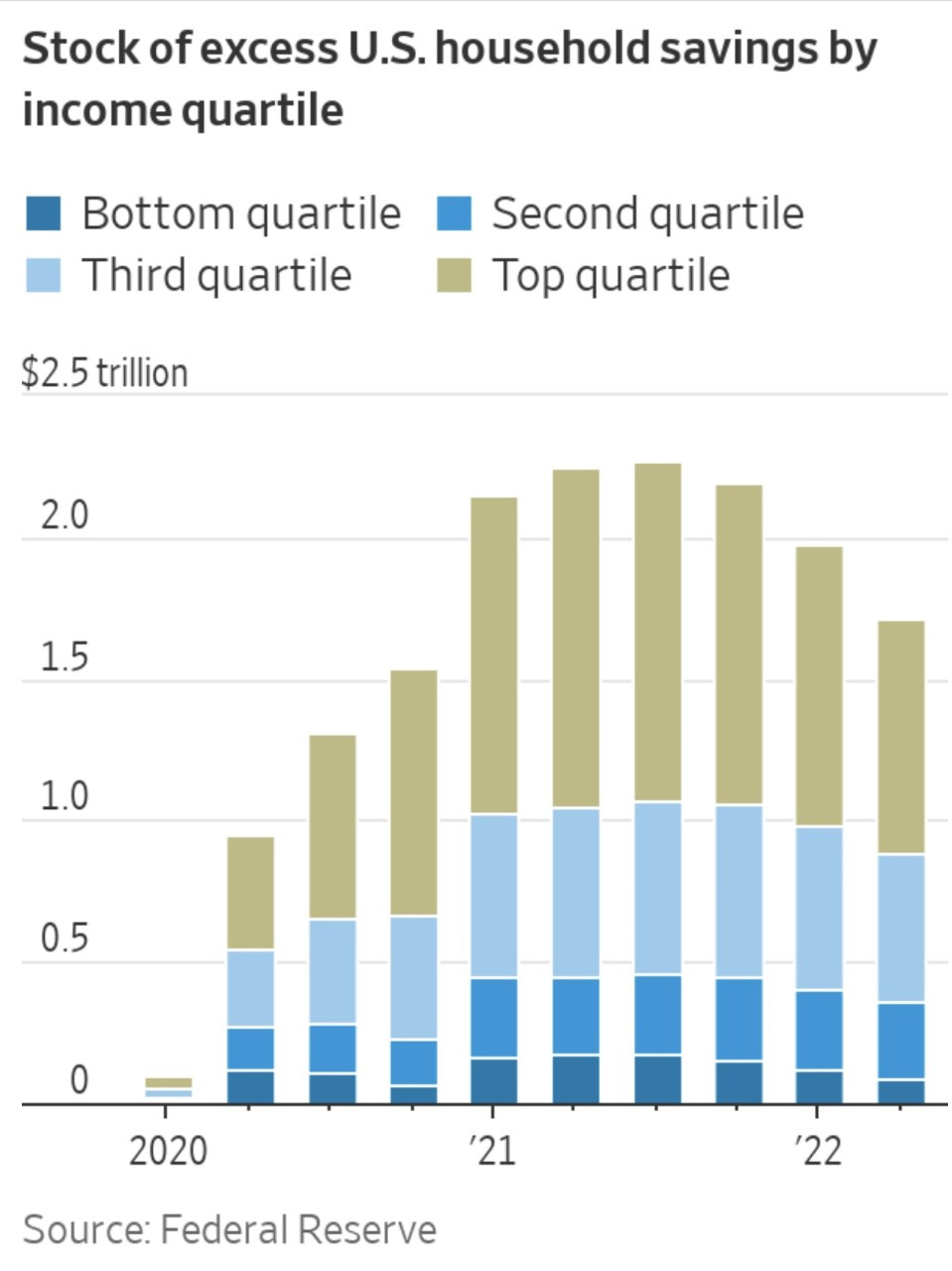

Interesting WSJ article on US household cash positions entitled, “Cash-Rich Consumers Could Mean Higher Interest Rates for Longer.” Washington’s response to the pandemic left household and business finances in unusually strong shape, with higher savings buffers and lower interest expenses. It could also make the Federal Reserve’s job of taming high inflation more difficult. Some officials have argued for slowing the pace of rate rises after this week’s meeting. But the debate over the speed of increases could obscure a more important one around how high rates ultimately rise. In economic projections released at the Fed’s last meeting in mid-September, most officials anticipated their policy rate would reach at least 4.6% by early next year. I do believe inflation is cracking, and the Fed has a more dovish stance or pauses after the December 50bp hike, despite the commentary in this well-written article. I think the Fed will be forced to cut rates in 2023.

Biden is again going after the oil companies of “war profiteering” and warns of excess profit penalties and other restrictions. I can only say this is yet another bad energy policy idea, and President Carter tried this unsuccessfully, raising only 20% of the projected revenues, while driving down production. We are going the wrong way on energy independence in the past 20 months, and it will take years to recover. President Biden, let’s learn from one of the worst policy Presidents in US history and not follow in his awful footsteps. Just a thought.

Other Headlines

Euro zone inflation hits 10.7% in October

Energy costs+41.9%, Food, alcohol, tobacco+13.1%. The energy debacle was largely avoidable. Too much reliance on Russia and too much focus on alternatives before they had the capacity in place.

Natural-Gas Prices Have Plunged Into Autumn

Despite being up 52% YTD, natural gas prices have fallen sharply since August.

Facebook’s Monopoly Is Imploding Before Our Eyes

Interesting article. I also felt the All-In Podcast take on Meta was compelling. It starts at 31:20 into the podcast. Meta -73% YTD.

Elon Musk bringing Twitter to Texas? What’s next as billionaire dissolves board

Tesla, SpaceX, the Boring Company and Neuralink have operations in Texas. Musk sure is spending a lot of time on Twitter and bringing employees on from his other entities. Not a good sign for TSLA.

Mortgage Giant Rocket Plunges Back to Earth, Hit by Rising Rates

Perfect example as to why the US needs to be more self-sufficient and not reliant on other countries.

Hold your nose and sell’ to brace for a possible market downturn, Jim Cramer says

Goldman Sachs expects European gas prices to tumble 30%

This would be very good for Europe and take off a great deal of pressure.

Suggests that by 2026, there will be 87.5mm millionaires globally.

This is a large research piece by the Coatue Venture Team. Some is over my head. I did not look at 100% of it, but anyone interested in AI may want to spend time here.

The Case For A Republican Sweep On Election Night

Telling headlines from Five Thirty Eight Pollster, Nate Silver. He leans way left.

Trump Org. CFO will spill tax fraud to New York jury, prosecutors say

Florida has made a right turn since 2020. These four factors explain the change

One of the things mentioned was Hispanic voters turning to the GOP. (CNN)

Netanyahu predicted to win Israel election, but Balad's rise could steal Right's victory

U.S. concerned about Iranian threats to Saudi Arabia

Iran hates the West and hates Jews. We have given them far too much with bad foreign policy over the years. Time to take a harder stance and prevent them from developing nuclear capabilities.

Taylor Swift makes the top 10 spots of the Billboard Hot 100 all her own

Her song writing/story-telling is remarkable. She has accomplished so much at 32.

Kanye West fans launch GoFundMe to ‘make him a billionaire again’

What imbecile would fund this page for an anti-Semitic lunatic?

Iran sent more than 3,500 drones to Russia for its war against Ukraine: intel dossier

I sure hope the US or Israel takes care of Iran’s nuclear capabilities before it is too late.

North Korea Launches 23 Missiles, Triggering Air-Raid Alarm in South

Putin battling pancreatic cancer, Parkinsons disease

I called this in February.

Crime Headlines

NY man sprung on no bail in Facebook-posted beating executes wife in front of kids just hours later

Elections have consequences. Think about your vote and what makes you comfortable around the important issues of crime, economy, and whatever else you value. Allowing repeat offenders to continue to hurt or kill innocent bystanders does not seem like a good option to me.

Paroled criminals avoid jail despite new arrests thanks to dangerous NY law reform

How to Survive on New York’s Subways

WSJ Opinion Piece with tips for the subway. Eliminate Opportunities to make you a target. Trust your instincts. Sit in the center of the car. Keep your head on a swivel….

SEVEN BRIDGES: Teen Girls Fight, Adult Found Face Down In Parking Lot, Police Respond

This is a gated community in West Boca Raton, Florida. You just don’t expect to see this. A girl Julia went to school with was beaten up pretty good. A 60-year-old woman was injured as well in two incidents.

Tennis world horrified over 'disgusting' assault of teen by coach

This is a DISGUSTING video. Should be charges. Who does this to a kid? The article suggests the father is the one kicking and beating the child.

Crime is the dark horse issue of this election (CNN)

In new Gallup polling, the economy still ranks as the top issue, with 85% of registered voters saying it will be “extremely” or “very important” to their vote. But guess what came in second? Yes, crime – with 71% of registered voters saying it was either extremely or very important to their vote.

Real Estate

I ran numbers in my community in Boca (Royal Palm) around sales to show how things have slowed. In 2021 (through October), there was a total of 89 sales for $516mm, for an average price of $5.8mm. Some of these are just lots or teardowns and others are new construction. At the end of October, 2021, there were also 7 pending sales and 12 homes on the market for sale. Through October, 2022, there were 27 sales for $210mm for an average of $7.7mm. If you take out the one $26.5mm sale in 2022, the average falls to $7mm. There are two more pending sales today. We went from 4 homes for sale in December of 2021 to 28 homes for sale today and were 33 homes just a few weeks ago. Homes are staying on the market for months. There are no bidding wars, and foot traffic has slowed dramatically. This is due to unrealistic offering prices, sharply higher mortgage rates, equity and bond market losses, and lower consumer confidence. The picture compares the prior four years for quarters 1-3 in Royal Palm. The chart was created by Royal Palm Properties. In 2020, sales were impacted by COVID rules and the lack of travel, yet outpaced sales in 2022.

I found this Fortune article which outlines Moody’s housing market call interesting and enjoyed some of the charts. I have written extensively about housing and am seeing many cracks in markets with inventory growth, turnover slowing down, price reductions and affordability issues with higher rates. Last week, we learned that slumped home construction subtracted 1.37 percentage points from U.S. GDP in the third quarter. That’s the biggest housing contraction since 2007. Meanwhile, mortgage purchase applications are down 41.8% on a year-over-year basis. Total mortgage purchase applications are now lower than any point hit during the Great Recession.

CNBC article entitled, “Homebuilders say they’re on the edge of a steeper downturn as buyers pull back.” The once-hot housing market is cooling off at an alarming rate, and some homebuilders say it will only get worse come the new year as new orders dry up. Fast-rising mortgage rates have caused once-frenzied homebuyers to turn on their heels and become worried about their potential investment and the health of the overall economy. “There’s this cliff that’s happening in January,” said Gene Myers, CEO of Thrive Homebuilders in the Denver area, which was one of the hottest markets in the years leading up to and through the coronavirus pandemic. Barely six months ago, single-family housing starts were still up 10% year over year. That was just before mortgage rates really started to jump quickly. To go from a 10% annual gain in construction to a 19% drop in that time frame is an historically sharp turn. The video in the article suggests the refinance market is -86% since last year. Demand for mortgages from home buyers was -42% from one year ago. People have such low mortgages locked in, they don’t want to sell and re-purchase at such significantly higher rates.

Other R/E Headlines

Home prices are falling faster now than in 2006—Redfin’s CEO just revealed why

With new mortgages down 55%, US lenders are starting to go bankrupt

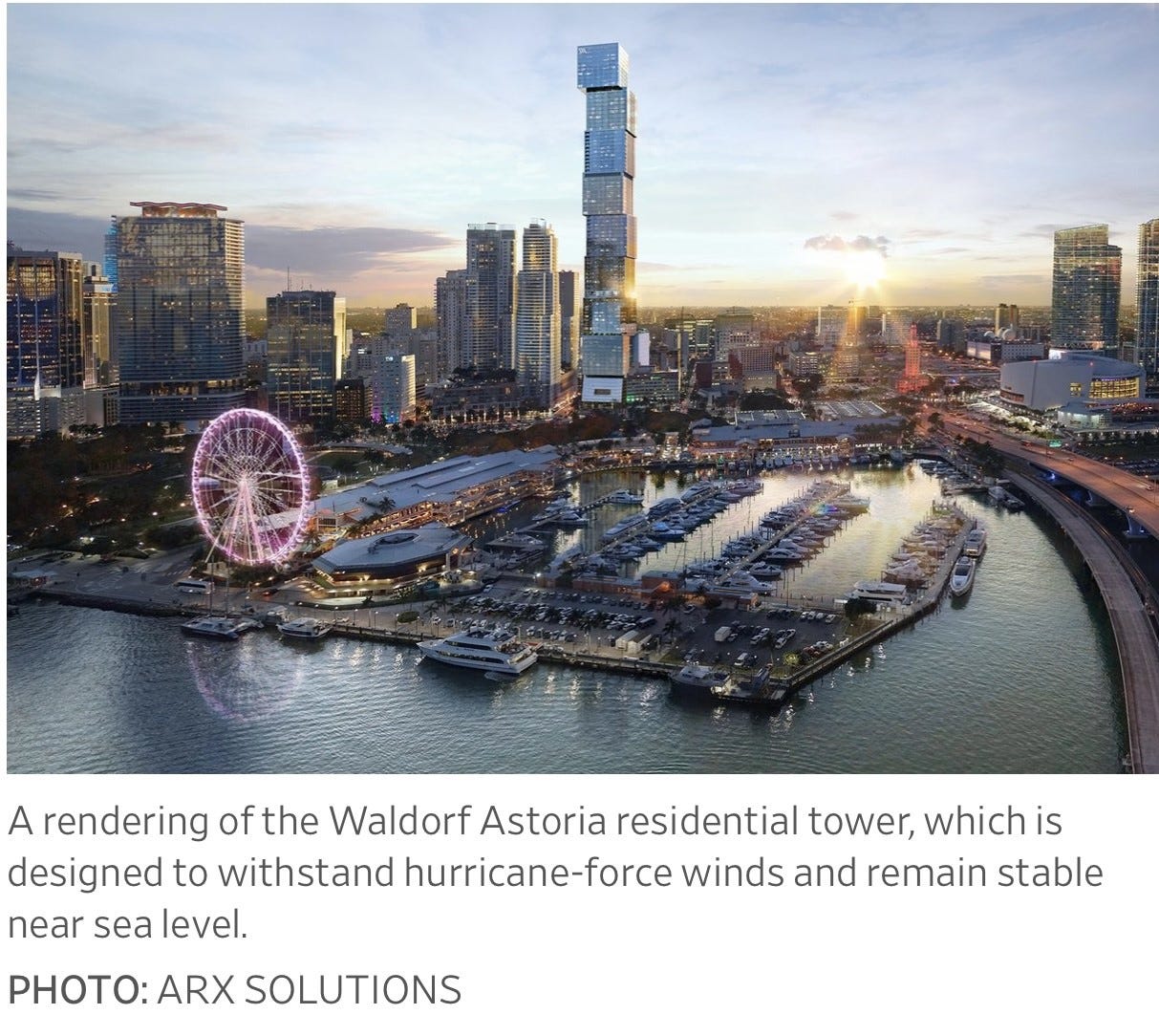

Miami’s First Supertall Tower Breaks Ground

The 100-story building requires special foundations and a pendulum-like device to prevent swaying. It is a Waldorf Astoria residential tower with 205 guest rooms and 360 condos.

Virus/Vaccine

I suggested things are turning recently and we have growth in cases and hospitalizations for the first time in a while. NYC is seeing a sharp increase in hospitalizations, and I am concerned as temperatures drop, the trends will continue.

Hospitalizations on the rise in New York City as new COVID strains spread rapidly

In 5 weeks, hospitalizations up 46% to 1,100 in NYC.

Team Candy Corn! 🌽