Opening Comments

My last note was about robo chefs, which I feel will be more prevalent in coming years in the restaurant industry. The most opened links were the story about Trump’s swollen ankles (pictures) and the video of the day of the silent discos with headphones. Trump was diagnosed with a vein condition that causes the ankle swelling.

We are in Southampton for a few days. We will be in CT Tuesday and Wednesday for golf at two amazing courses (Stanwich and Blind Brook) with one of my closest friends.

My readers know I have been pushing people to learn padel, the fastest growing sport in the world. I invested in a fantastic facility in Boynton Beach, Florida called Replay and our memberships are booming. Andre Agassi joined a $20mm investment group in Ballers, a multisport members’ club that includes padel. Trust me, padel is the future.

Markets

Russell 2000 Short Bets Increasing

Healthcare Jobs Taking Over America

Top 10 States for Best for Workers

$86.5mm Palm Beach House Sale

Homebuilders Cutting Prices

Ultra Wealthy Preferred Cities to Own

Pictures of the Day-Hav & Mar Review

Chef Marcus Samuelsson brings his Ethiopian and Swedish roots to this new seafood restaurant, Hav & Mar. Samuelsson has numerous well-known restaurants under his belt including Red Rooster, Metropolis, Marcus Bar and Grille and others, and Hav & Mar is an interesting new addition that is packed with flavor. “The restaurant takes its name from the countries that have shaped his identity, with “hav” translating to ocean in Swedish and “mar” meaning honey in Amharic, the official language of Ethiopia.”

The restaurant is located in West Chelsea and the dining room is aesthetically pleasing offering a globally inspired, seafood focused menu. I picked the restaurant after reading positive reviews and wanting to try something new that was not Italian or sushi. Hav & Mar did not disappoint and offers reasonably priced foods with spices and flavoring you rarely get elsewhere.

We started with Swediopian which is a berbere-cured salmon with cucumber and avocado. The dish looked like a work of art and was surprisingly good. We also had the tuna tartare which also was presented nicely and had a slightly different take than many other establishments.

For my entree, I had the highly recommended Addis York, which was a fried chicken and a soft-boiled egg. Although I was not blown away, it was different and flavorful. Both Jack and Peter had the pan seared black bass and that was a hit on every level. Both dishes were creatively presented.

For dessert, we split the chocolate cake and blood orange sorbet. The cake was very good, and I highly recommend it. The texture was fantastic and presentation appealing, even if the portion control police were involved.

There is a lot to like about Hav & Mar, especially if you want something different. We went on a Tuesday night, so it was not packed but could see how Samuelsson could get a fun crowd. The bar is very nice as well. The location can be a bit challenging, but I recommend you give it a try. Congrats to Samuelsson who seems to have the magic touch.

Food 8.0

Service 8.2

Ambiance 7.9

Price-Fairly priced (dinner was $80/person with no alcohol

As an aside, it poured when we were eating and stopped raining just as we were leaving. Given I had another full day of food, Jack and I decided to walk for a little bit and caught a great sunset on 32nd Street.

I Feel Like Andy Rooney

I have been writing the Rosen Report since February of 2020, and it is truly a labor of love. It is hardly financially rewarding relative to my Wall Street career, but I enjoy my bi-weekly diatribes on such a wide array of topics. When I wrote my daily notes at JPM, Jamie Dimon called them, “The Rosen Daily Missives.”

My Rosen Reports remind me of Andy Rooney who did “A Few Minutes with Andy Rooney” from 1978 until 2011 on 60 Minutes. In his three-minute satire, he talked about a wide range of topics and was always entertaining. I looked forward to his silly rants and his out of control eyebrows. His tagline, "That's my last word on that,” was his ending statement. Here are some of his moments which will bring back some fun memories.

I feel a bit like Rooney in the sense that I have the opportunity to write about whatever I want in my title section and have covered so many topics including fishing, surfing, restaurant reviews, health scares, inflation, expensive vacations, movie reviews, music, travel, horrible hotels, bosses, life lessons, mentors, self-deprecating experiences, my cooking skills, and more.

Everyone consumes the Rosen Report differently. Some brave souls read it end to end. Many read a few sections. One of my friends always tells me, “I read your opening comments and title piece and then straight to real estate.” However, in a survey, overwhelmingly, people preferred the title section of the newsletter to any other section. Many readers who never met me felt as though they know me from my personal stories, many of which are a bit embarrassing. I must admit, coming up with new stories and ideas is the most challenging and time-consuming part of my notes.

The report is now read in 50 states and 105 countries, and I am randomly stopped by people I have never met who recognize me from my newsletter. I have been stopped on the streets of NYC, subways, planes, restaurants, golf courses, ferries from the Hamptons to Connecticut, and random stores. In a funny story, I was at Le Bilboquet in Palm Beach sitting at the bar having lunch and the bartender said, “I was recently turned on to this great newsletter and you look just like the author.” To which I replied, “Small world. I have heard of the report and understand it is fantastic.” I later told him it was me and he laughed.

Thank you for putting up with me and giving me the opportunity to share my stories and thoughts on the world. I appreciate my readers and the many new friends I have made. I do feel as though it keeps me in front of so many people, I would otherwise lose touch with and am thankful for all my wonderful relationships.

Now, I just need a tagline like Rooney, some bushy eyebrows and to last another 28 years writing this blog.

Quick Bites

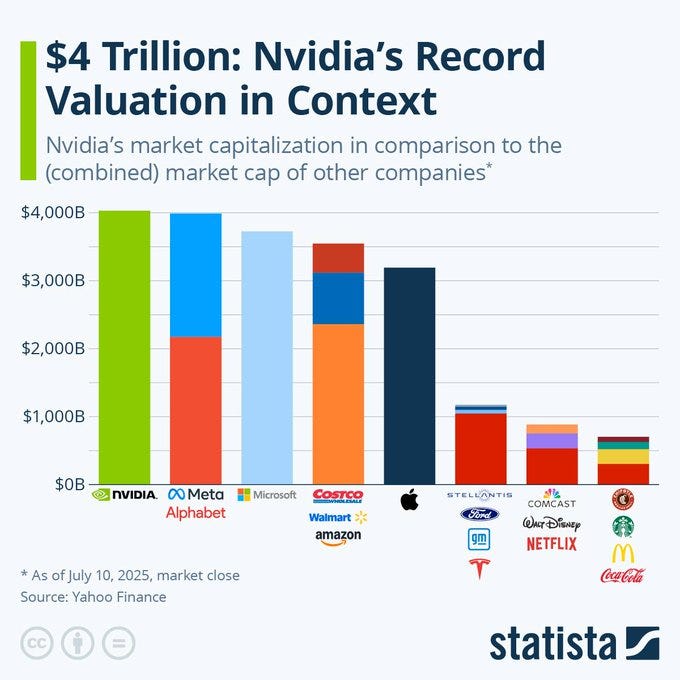

Markets rallied nicely Thursday on strong earnings reports hitting new highs for the S&P. As of Friday morning,12% of companies reported and 83% beat expectations, above the 5-year average of 78%. The Labor Department reported Thursday that jobless claims for the week ending July 12 came out at 221,000, marking a decrease of 7,000 from the previous week. Friday, it was announced that Trump is pushing up to 20% minimum tariffs on the EU according to the FT. Stocks sold off slightly on the news. The strong economic data coupled with concerns around the Trump/Powell saga sent had Treasuries volatile and the 10-year close at 4.43% and the 30-year at 5.00%. I have written about concentrations in the stock market and feel the chart below is a good one that shows Nvidia’s size as well as the size of other major companies. Chart is 10 days old.

The Russell 2000 has underperformed the S&P, and this Bloomberg article outlines recent bets against the Russell with short bets up to $16bn on the index. The S&P is +7.2% YTD and 95.2% over 5 years, while the Russell 2000 is +2% YTD and 63.5% over 5 years. Hedge funds are increasing bets against the shares of smaller companies after a rally, as doubts linger about the resilience of the US economy in the face of a global trade war. Many smaller firms lack robust balance sheets and can borrow far less than companies in the S&P 500, making them more sensitive to economic fluctuations than their larger peers.

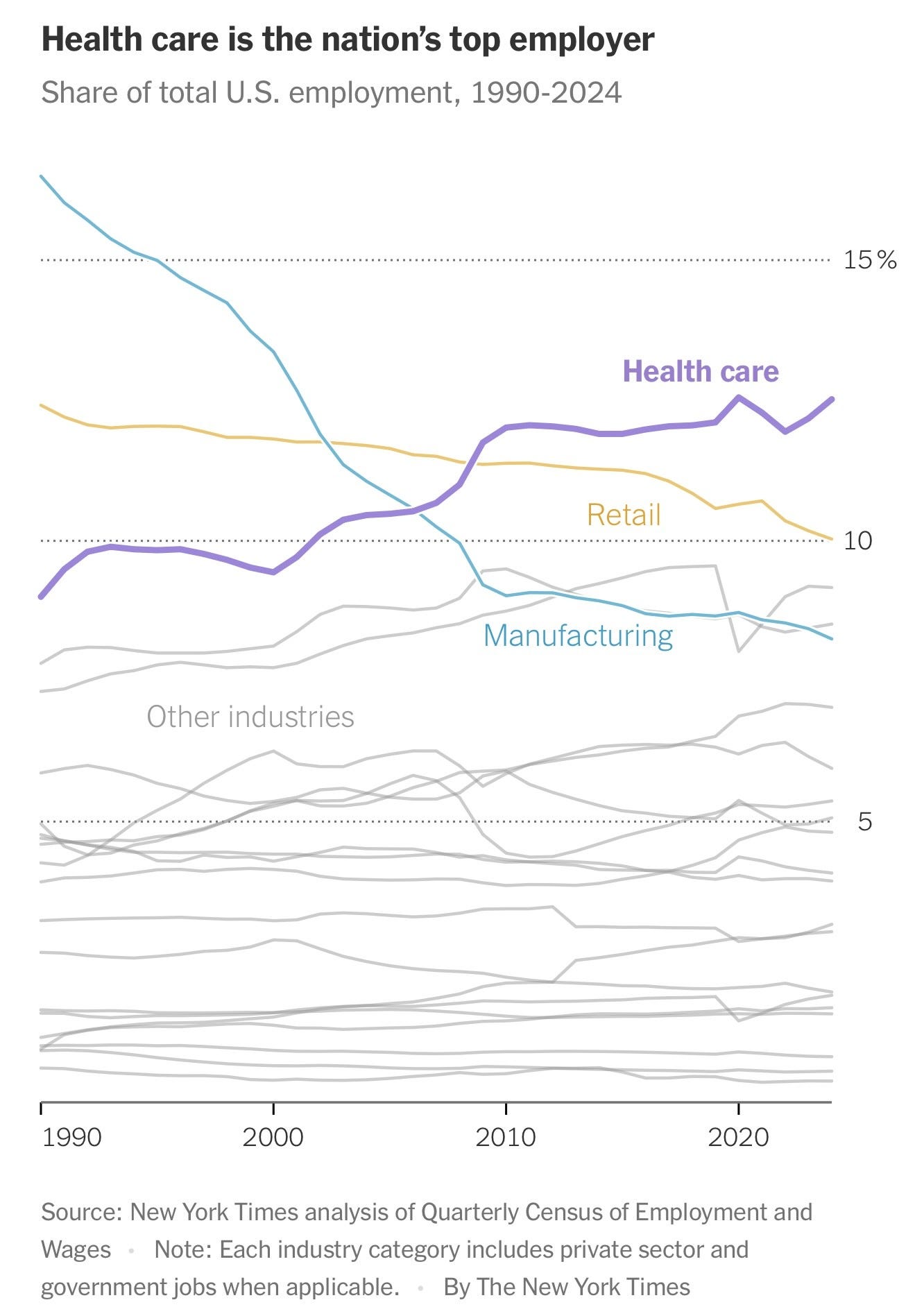

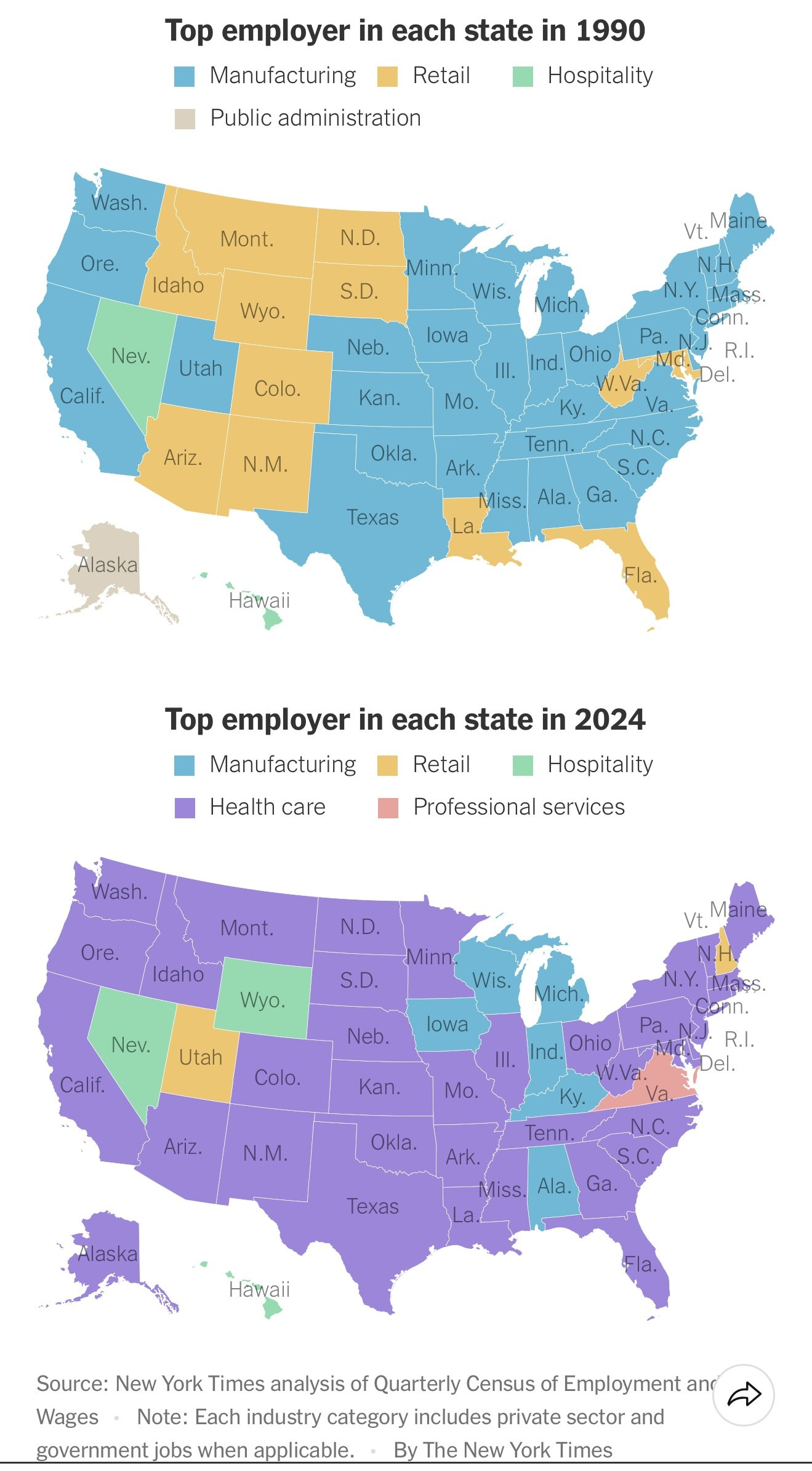

The NYTimes article on how the healthcare industry has changed employment in the United States. In 1990, most states had manufacturing as the top employer. In 2024, 38 out of 50 states had healthcare as the largest employer; but in 1990, no state had healthcare as the top job provider. I have written extensively about the aging population, chronic conditions, obesity, and the massive rise in healthcare costs which are driving the employment changes. Over 11k Baby Boomers turn 65 each day and people are living longer which puts a massive strain on the healthcare system. The 74% of obese or overweight Americans also pressure the system. Not surprisingly, retail was the top employer in a dozen states in 1990 and only two in 2024. Let’s blame Bezos for that drastic change. Clearly, the rise of AI should reduce the need for healthcare workers in some spots, so I am not convinced the map will look the same in 10 years. Check out the last chart showing health care administrator job growth since 1970 is over 3,000% higher, while physician growth is closer to 100% over the same period. Thank you to the PhD student reader from Vanderbilt for highlighting this story for me.

This CNBC article outlines the 10 states which are best for workers in 2025. Since around 2017, other than the brief spike in unemployment during the pandemic, there were far too few workers to fill the available jobs in the U.S. But in April, according to the U.S. Chamber of Commerce, the nationwide labor shortage pretty much ended. Thanks to the combination of a cooling job market, people finally returning to work following the pandemic, and AI taking over an increasing number of human tasks, the skills gap “has largely closed,” the Chamber says. As of May, there were 7.2 million workers available to fill 7.4 million jobs. While that still represents a modest shortage, it is a far cry from 2021 and 2022, during the so-called “Great Resignation,” when the shortages routinely totaled in the millions. We consider the educational attainment of each state’s workforce, and the concentration of science, technology, engineering and math (STEM) workers in each state. We also look at the career education pipeline, state workforce training programs, and workers with industry-recognized certificates. We look at each state’s right-to-work laws. We consider which states are most successful in attracting skilled workers, and we measure the productivity of each state’s labor force. The article goes into details on each state.

Tariffs

Trump Eyes Tariff Rate of 10% or 15% for More Than 150 Countries

EU to Prepare Retaliation Plan as US Trade Stance Seen to Harden

Retailers caught red-handed using Trump's tariffs as cover for price gouging

Here’s where Walmart prices are changing — and staying the same — as Trump’s tariffs hit

Politics

What happens if Trump fires Fed Chair Powell: ‘This would be a mess,’ analysts warn

I have been adamant regarding the separation between the Fed and President and am against Trump firing Powell even though I think he screwed up by leaving rates too low for too long and is overspending on the Fed renovations. This post outlines the $700mm cost over runs on the project taking the total to $2.5bn or nearly $2,000/foot. That price seems quite high to me on a per foot basis. However, this Bloomberg article suggests that much of the construction is underground complicating construction. This is Powell’s response to the renovation questions. This WSJ article outlines Bessent’s push to talk Trump out of firing Powell. Thank goodness for Bessent.

House passes rescissions package slashing $9B in federal funding for foreign aid, NPR and PBS

House Republicans float grilling Joe, Jill Biden as former aides stonewall cover-up probe

'There was a treasonous conspiracy in 2016 committed by officials at the highest level of our government," Gabbard said. The American people have been lied to and the media continued the lies for years on so many topics. What are the consequences?

Most Americans disapprove of Trump admin’s handling of Jeffrey Epstein files

Trump Orders Release of Epstein Documents, Threatens to Sue WSJ Over Report

The letter bearing Trump’s name, which was reviewed by the Journal, is bawdy—like others in the album. It contains several lines of typewritten text framed by the outline of a naked woman, which appears to be hand-drawn with a heavy marker. A pair of small arcs denotes the woman’s breasts, and the future president’s signature is a squiggly “Donald” below her waist, mimicking pubic hair. Trump denies having written the letter. Trump sued the WSJ and Rupert Murdoch for libel due to the article regarding the Epstein birthday note. Trump claimed he does not draw pictures as a defense regarding the card and this NYTimes article refutes Trump’s claim of sketch history. I hope this Epstein thing does not die and we get answers.

Zohran Mamdani is giving NYC businesses fair notice: He’s coming after them

I am still not convinced this socialist who hates capitalism and billionaires will be able to get much of his platform approved. However, if he wins, I believe many of the wealthy NYC residents and business owners will be relocating, and South Florida will continue to be a top destination.

Socialist Zohran Mamdani called for ‘abolition of private property,’ resurfaced video shows

“If there was any system that could guarantee each person housing — whether you call it the abolition of private property or you call it a statewide housing guarantee — it is preferable to what is going on right now,” Mamdani said. Mamdani, in another resurfaced clip, talks up “seizing the means of production” — a policy long advanced by Marxists. Your vote matters. In the 2021 Mayoral election, 23% of eligible voters participated. If this clown show wins and eviscerates NYC, I do not want to hear complaints if you did not vote.

New Butler shooting details expose the Secret Service’s shocking culture of incompetence

Trump admin pulls plug on $4B for California's 'train to nowhere' project

The budget started at $33bn (2008) and was last quoted at $135bn. Billions have been spent, and the project is not close to completion.

Middle East

New U.S. assessment finds American strikes destroyed only one of three Iranian nuclear sites

Hard to know what to believe. I would be shocked if these all did not have major damage.

Israel Is Preparing to Bomb Iran...Again - National Security Journal

Israel levelling thousands of Gaza civilian buildings in controlled demolitions

Other Headlines

The U.S. consumer is pushing back against recession fears once again

The June retail sales data came in hotter than expected, rising 0.6% month over month, the Census Bureau said Thursday. That easily topped the 0.2% monthly gain expected by economists.

Inflation outlook tumbles to pre-tariff levels in latest University of Michigan survey

Insurers just marked the costliest first half of the year since 2011

Global insured losses for the first half of this year have reached $84 billion— the highest first half total since 2011.

“We saw record card member spending in the quarter, demand for our premium products was strong and our credit performance remained best in class,” Chief Executive Officer Steve Squeri said in a statement Friday.

TSMC profit surges 61% to record high fueled by AI chip demand

Netflix posts earnings beat as revenue grows 16% in second quarter

Drones, AI and Robot Pickers: Meet the Fully Autonomous Farm

How many times can the government fail citizens? Yet another criminal repeatedly arrested that murdered innocent people. Bad policy.

A vehicle drives into a crowd in Los Angeles, injuring 30 people, including at least 3 critically

Straphanger, 51, on life support after man punches him to ground in Times Square subway

Why do I feel as though CA and NYC seem to have repeat offenders that end up hurting people? The CVS worker was clearly acting in self-defense yet faces up to 25 years in prison if convicted.

Nvidia CEO: If I were a 20-year-old again today, this is the field I would focus on in college

Physical sciences.

Flight cancellations are surging this summer. These airports have been hit the hardest.

Musk launches AI girlfriend available to 12-year-olds

What could possibly go wrong?

ACA insurers propose biggest premium hikes since 2018 as Trump policies take hold

Insurers are asking for a typical rate increase of 15% with more than a quarter proposing hikes of 20% or more. KFF, a nonpartisan health policy research group, looked at 105 Obamacare insurers in 19 states and the District of Columbia that have filed rates so far.

Of course. All those hidden UFOs and alien bodies will be destroyed. Save the UFOs!

‘Harry Potter’ star Emma Watson banned from driving for six months

Seems harsh for doing 38mph in a 30mph zone.

This is so funny. Chris Martin said, “Either they are having an affair or just very shy.” It was the CEO of Astronomer and his Chief HR officer. Byron’s wife deleted her Facebook account on the heels of the concert video. Byron resigned from the company.

Health

Musical Training May Hold The Key To Fighting Age-Related Brain Decline

I better start playing guitar again.

Doctor warns against washing your clothes in this water temperature: ‘It’s a big deal’

Basically use hot or cold and not warm.

Eating these common foods could reduce Alzheimer's risk, experts say

Choline-rich foods, like eggs and broccoli, may reduce cognitive decline in adults, studies show.

I have not had a soda of any kind in 38 years.

Interesting chart on heat deaths by city

Real Estate

Hellman Jordan founder Jerry Jordan and his wife, Darlene Jordan, sold their lakefront estate in Palm Beach for $86.5 million, marking the most expensive home sale on the island so far this year. The couple paid $14 million for the Palm Beach mansion in 2000, property records show. The 1.7-acre estate, developed in 1938, includes a 13,400-square-foot main house with five bedrooms, eight bathrooms and one half-bathroom, a pool and a dock. Records show the Jordans sold the mansion at 203 South Lake Trail to a trust. The off-market sale marks the second priciest residential sale in Palm Beach so far this year. In February, William Lauder sold 2.3 acres of oceanfront land for more than $160 million, but the assemblage is vacant. It’s part of a $350 million assemblage that sources say billionaire Microsoft Excel creator Charles Simonyi is piecing together. Although we have seen things slow in South Florida and in much of the country, the highest end remains relatively strong in Palm Beach and Miami.

I have written a bit about the slowing housing market and lower homebuilder confidence, which has been negative for 15 months. The nation’s homebuilders continue to see weakening demand from potential buyers concerned about the broader economy. As a result, they are cutting prices at the highest rate in three years, according to the monthly builder confidence survey from the National Association of Home Builders. That’s why 38% of builders said they cut prices in July, the highest share since the NAHB began tracking the metric in 2022. Just 29% were cutting back in April. The average price reduction was 5% in July, where it has been every month since November.

This NYPost article outlines where the “Ultra-wealthy” buyers are clamoring to live. The lucky number of individuals worth $30 million or more is expected to grow by 33% over the next five years. A new report narrowed down where the moneyed are living, where they’re buying second homes and where they’re rubbing elbows. The data, compiled by the information services firm Altrata and reported by Mansion Global, geographically tracked the real estate moves of individuals with net worths exceeding $30 million. New York City, in particular, continues to reign supreme among the global well-to-do. Big Apple homes are owned — but perhaps not occupied — by more than 33,000 ultra-high-net-worth individuals, according to the data. I wonder the impact of Mamdani win for mayor of NYC would be on the wealthiest people’s desire to own there. Ranking runner-ups Los Angeles and Hong Kong lagged behind New York with populations of upper-crust owners numbering close to 20,000 each. Miami, a recent rankings climber, overtook New York as the most popular metro for luxury second homes. Miami beat out other hot spots like London, Beijing and Hong Kong with with 13,200 über-wealthy second-homeowners. Prosperity in the Sunshine State didn’t stop there — the relatively small metro of Naples notched an extreme ratio of 19 ultra-rich second-home owners for every one primary resident.

© 2025 The Rosen Report LLC. All rights reserved. Does not constitute investment, financial, legal, or tax advice. Consult with your lawyers and professional financial advisers. Rosen Report™ #803 ©Copyright 2025 Written By Eric Rosen.