Opening Comments

I have a love hate relationship with Substack. My last report was flawed in that I had made a bunch of updates and for whatever reason they did not get saved. This happens far too often despite the “auto save” feature in the editor which seems to be possessed. It was frustrating because my changes were substantive. Substack announced it is laying off 14% of its work force due to “Uncertain macroeconomic outlook.” The customer service is only available via email and sometimes it takes days to get a response and that was prior to the announcement.

I enjoyed my time in Florida and saw a bunch of good friends and family. The nature of the residents in South Florida has changed so much in my five years. There are a ton of people from the Northeast, Midwest and California who are well-educated, successful and interesting. It is very different from 5 short years ago when South Florida was filled with snowbirds, blue haired people and very few well-educated young professionals.

I have been very vocal about inflation and wrote numerous articles well over one year ago about my concerns. I wrote a month ago that I believed inflation was peaking and I have more tangential evidence of it. Readers shared stories. One has a relative in a high-end custom closet company and the closing rate for new business has fallen precipitously in the past couple months. In another example, painters who were ‘booked solid” had multiple cancellations to open up availability. I spoke with a contractor who told me after being “full-out” for over a year, jobs are postponing and those staying are cutting back budgets. Also of note, the Atlanta Fed GDP tracker shows the U.S. economy is likely in a recession.

On the front of energy policy matters. Check out this electricity chart for Germany. What are the impacts of such prices on manufacturers and consumers? Also of note, wood stoves and firewood are in short supply. The “market is empty,’ according to Gerd Muller, head of the office of the German Firewood Association.

I am trying to continue to grow my readership. Please forward this to one friend who you think would appreciate the Rosen Report. Thank you.

Picture of the Day-Betting Odds For President

I Need A Lawyer

Quick Bites

Markets

Bad 6 Months for Markets

Nat Gas Correction

Wells Fargo CEO on Rate Hikes

Concerning Data in Charts

Polls-Americans Unhappy Across Party Lines

Other Headlines

Virus/Vaccine

Data

Real Estate

My General Comments/Boca Example

Devin Kay on Miami Market

Never Buy a Land Lease Building

Picture of the Day

I thought these pictures were interesting and I started looking into betting odds when a well-known investor, Jeff Gundlach, sent out this Tweet below. The three pictures following the Tweet outline the odds of each candidate for Democratic nomination, Republican Nomination and overall 2024 Presidential election winner from Predictit.org. Very early, but telling. I believe it is in the best interest of the country to not have Biden or Trump in the White House. Interestingly, DeSantis is in the lead for 2024 President and both Musk and Joe Rogan have spoken about him in a positive manner in recent weeks.

I Need A Lawyer

I have two older sisters, Debbie and Shelley. Given I was basically 9 and 10 years younger than my siblings, I was the baby of the family. They were in high school, and I was five years old, which is a huge gap. I spent a lot of time with Debbie, who took care of me after school, because our mom was working. When I was about 5, Debbie would play a game she invented called the “Backie-Bender.” I was about 10 years old in the picture when my sister was in college.

The game was quite simple. My sister would lay on the bed or floor on her back with her arms and feet up in the air and I would lay across them on my back. She would push her feet up to flip me into a back flip and catch me in her hands. What could possibly go wrong with such a safe game with a four year old? Brilliant.

Once our grandfather saw us playing this game on the floor and yelled, “You’re gonna break his damn neck!”

Well, on one particular day which I vividly recall despite my concussed state, Debbie tried to flip me but couldn’t, and as her feet went back, she forced my head straight into the wall, knocking me silly. She was a mess and feared she hurt me badly. More readers are coming to the proper conclusion that I am not right and the Traumatic Brain Injury I received on that fateful day in June of 1973 in Northbrook, Illinois at 2436 Chesapeake Lane was the culprit.

I am not sure of the statute of limitations here, but need to uncover a good personal injury lawyer to go after my sister for what amounts to at least $500mm in damages. I could have been a contender if it were not for the famous Backie-Bender disaster. Any typos or mistakes in any Rosen Report or any errors I have made since that fateful day are 100% due to the injuries suffered from the Backie-Bender game 48 years ago. I will testify as such and have a great excuse every time my wife blames me for something….Backie-Bender from 1973. Debbie, it is ALL your fault.

Quick Bites

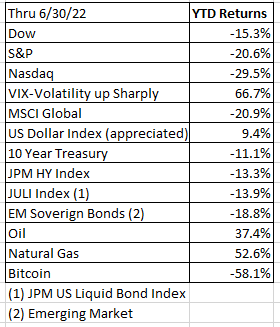

On Friday, the Dow rose 321 points, or 1.1%, to 31,097. The S&P 500 rose 1.1% to 3,825. The Nasdaq was also up by 0.9% to 11,128. Homebuilder stocks contributed to the market going higher, with PulteGroup umping 6.5%, while Lennar and D.R. Horton rose more than 5% each. Etsy shares popped 9% to lead the S&P 500 higher. McDonald’s led the Dow higher with a 2.5% gain. Coca-Cola and Boeing also rose more than 2%. Despite the gains, all of the major averages posted their fourth down week in five. The Dow fell 1.3% for the week. The S&P 500 lost 2.2%, and the Nasdaq finished lower by 4.1%. The Institute for Supply Management said manufacturing activity in June was weaker than expected. Its index of national factory activity dropped to 53 for the month, the lowest reading since June 2020. ISM’s new orders index also fell to 49.2 from 55.1 — showing contraction for the first time since May 2020. Of note, the 10-year Treasury yield fell 9bps to 2.89%, the lowest level in many weeks over disappointing economic data and recession fears. The yield was 3.37% a few weeks ago. Also, the 2s/10s Treasury yield curve fell back to 4bps. If you recall it went slightly negative 4/1, then to +44bps in May and now back to almost flat. Historically, negative 2s/10s leads to a recession. The grey vertical bars are recessions and note the 2s/10s goes negative prior.

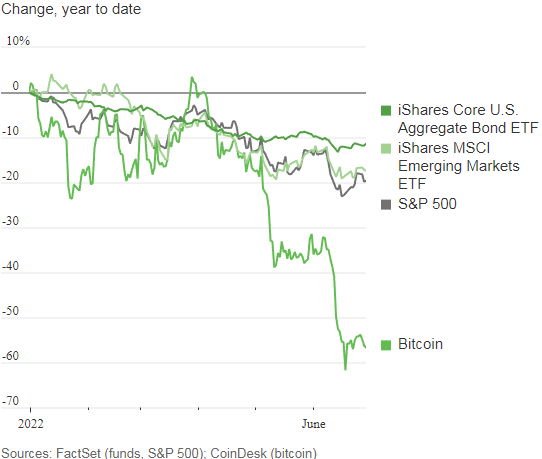

Thursday marked the final day of the second quarter. The Dow and S&P 500 posted their worst quarter since the first quarter of 2020 when Covid lockdowns sent stocks tumbling. The tech-heavy Nasdaq Composite is down 22.4% for the second quarter, its worst stretch since 2008. The S&P 500 posted its worst first half of the year since 1970, hurt by worries about surging inflation and Federal Reserve rate hikes, as well as Russia’s ongoing war on Ukraine and Covid-19 lockdowns in China. The biggest driver of the pull-back was induced by the Fed and free money from the politicians causing inflation. We did not need to end up here and my Rosen Reports made it clear with my inflation concerns well-over one year ago. Another massive screw up by all those fancy PhD Fed Presidents who said, “Transitory” 300 times. This article from CNBC goes over Bitcoin’s brutal quarter.

Natural gas came under severe pressure on June and dropped sharply Thursday after an inventory report showed a larger-than-expected storage build, sparking fears of an oversupplied market. Henry Hub futures declined 16.53% to settle at $5.42 per million British thermal units. The contract ended June 33% lower, which was the worst month since December 2018. However, natural gas is still up 50% YTD and almost 85% over the past year. Remember, Nat gas was $9.3 three short weeks ago and is trading at $5.6 today. However, Russia seized control of 4% of the world’s liquefied natural gas production over the weekend, which is something to follow. Gazprom already owned 50%+1 share, but Shell and Japanese companies owned the rest. The chart below is as of Thursday close. Of note, JPM sees “Stratospheric $380 oil on Worst-Case Russian cut. However, on a slightly positive note, gasoline prices are down slightly from all time highs at $4.81 vs the highs of $5.01.

Wells Fargo CEO Charles Scharf said he is betting on “more significant rate hikes” as the Federal Reserve tries to rein in high inflation, and that the economy is not as prepared as it should be. “I wouldn’t bet on a number, but I would bet on more significant rate hikes,” Scharf told CNBC’s Sara Eisen at the Aspen Ideas Festival on Wednesday, adding that he considers 50 and 75 basis point hikes to be “significant themselves.” “Is it going to be more than that? Maybe, but it would require some change in the data to see something like that,” he said. Fed Chair Jerome Powell said Wednesday at a European Central Bank forum that he would not allow inflation to take hold of the U.S. economy. I believe inflation is peaking and the impact of the current rate hikes and future hikes coupled with economic sentiment and the re-opening of supply chains will cool inflation levels in coming months.

Good Yahoo Finance article with solid charts showing concerning trends. An influx of data showing softer consumer spending, sagging sentiment and subdued manufacturing suggest a US economy with a more fragile foundation, prompting several forecasters to lower their estimates for growth. Check out the charts on trends heading the wrong way. I believe these are additional signs inflation will moderate. We are seeing demand destruction, shattered confidence and will see more layoffs in coming months. Make no mistake, oil/gas can get uglier given the Russia situation.

This is a CNN link which is pretty harsh given how left that news organization has become. To me, it is clear that Biden is un-electable and the media and Dems are starting to get more aggressive against Biden as a result. The vast majority of Americans across party lines are unhappy with the state of the US, a new set of polling finds. In an AP-NORC survey released Wednesday, 85% of US adults say that things in the country are headed in the wrong direction, with just 14% believing things are going in the right direction. That’s a more pessimistic reading than in May, when 78% said things were headed the wrong way and 21% that things were generally moving in the right direction. Currently, both 92% of Republicans and 78% of Democrats are dissatisfied with the direction of the country – the highest number among Democrats since President Joe Biden took office last year. Only 20% of Americans describe the nation’s economy as good, with 79% calling it poor, according to the AP-NORC poll. This sentiment, too, is relatively bipartisan, with both 90% of Republicans and 67% of Democrats describing the economy as poor. In another poll, The Harvard CAPS-Harris Survey found 71% of Americans did not want to see Biden run in 2024, while 61% suggested Trump should not run. Get the message guys, please do not run. I don’t believe these idiotic Tweets by the President are helping him. Bezos is growing increasingly critical of Biden for good reason and has called on the new idiotic “Disinformation Board to review some of Biden’s posts. The China Daily is having some fun with Biden’s post and said, “Now US President finally realized that capitalism is all about exploitation. He didn’t believe this before.” Remember Biden aggressively went after oil companies a couple weeks ago as well and suggested “well above normal refinery profit margins were not acceptable.”

Other Headlines

Apple CEO Sucks Up to China in Interview With State-Owned Media

The US is beholden to China and this interview is comical given the human rights violations by China. Given Apple needs China, I guess Tim Cook can look past all the issues.

Chinese purchase of North Dakota farmland raises national security concerns in Washington

Lots of rules in China on foreign ownership of businesses. Why does the US allow this? What could possibly go wrong here?

Fed’s preferred inflation measure rose 4.7% in May, around multi-decade highs

Slightly less than expected and was for May. What does June and July look like?

Tesla delivered 254,695 electric vehicles in the second quarter of 2022

+53k from same period last year, but slightly below expectations. Supply chain and COVID issues were a factor.

Klarna Discussing Valuation Cut to $6 Billion From $45.6 Billion

Last summer, money was raised at a valuation of $45.6bn and now the buy-now, pay-later giant is considering a $6bn valuation for a new round of funding. That would be and 87% decline.

Meta slashes hiring plans, girds for 'fierce' headwinds

Many companies who were aggressively hiring have changed directions in a hurry including: Netflix, Tesla, Coinbase, Uber, Meta, Klarna, Carvana Redfin, BlockFi, Stitch Fix and more.

2023 Chevrolet Corvette Z06 NFT Received Zero Bids, Went Unsold

Zero bids for the NFT which included a REAL Corvette to the winner. I am not a new vette fan, but give me one from the 50s and I am in. I appreciate the technology behind NFTs, but don’t plan on buying any. This is an ugly car in my view.

EU agrees on landmark regulation to clean up crypto ‘Wild West’

Major crypto broker Voyager Digital suspends all trading, deposits and withdrawals

Horrible run for crypto in recent months and the bad news continues.

FTX signs a deal giving it the option to buy crypto lender BlockFi

Beer Made From Recycled Toilet Water Wins Admirers in Singapore

Chicago shootout: Wild video shows suspect allegedly opening fire point-blank at police

Elections matter. Chicago is an uninhabitable disgusting mess with most of the wealthy people who can leave running for the exits including Citadel. Soft on crime and vilifying cops is not the way forward. Chicago is the case study.

Young mom shot dead on Upper East Side victim of domestic violence

This happened at 8:30pm in a very good neighborhood in NYC. Scary. Mother shot while pushing her 3 month old in the stroller. Disgusting. It appears to be a case of domestic violence, as her ex-boyfriend was charged with what prosecutors are calling a “premeditated execution.”

Drug traffickers arrested in California with 150,000 fentanyl pills released after just days in jail

They should be in jail for 25 years in my opinion. More cities and states are uninhabitable due to moronic crime policies.

“It ripped my heart out:’ Police chief comforts crying child after family member arrested

We see all the negative police stories, but this is a nice one where it shows that not all cops are bad. Actually, an overwhelming majority are good.

She’s 2½. She took an IQ test and became Mensa’s youngest member

Crazy story of how this young girl started to read and spell.

Google's Gmail censorship cost GOP candidates $2B since 2019, Republicans say, citing new study

I have been critical of the media and social media around the incredible bias. If they were right biased, I would say the same thing. We need a level playing field.

The "Tire Extinguishers" Arrived in the U.S., They're After Gas Guzzler SUV

The US is seeing an increase in tire deflation for SUVs by environmentalists. They leave a note.

This North Carolina City Was Just Named the No. 1 Food Destination in the U.S. — Here's Why

I did not see this one coming. Ashville, NC is a food mecca? Who would have thunk it.

Virus/Vaccine

Case growth escalated as did the positivity rate which hit almost 16%, the highest since February. Of note, deaths are now averaging 387/day or +24% over the prior two-week period.

COVID-19 Testing: NYC Rates at 5-Month Highs Amid 6th Wave Fears

Real Estate

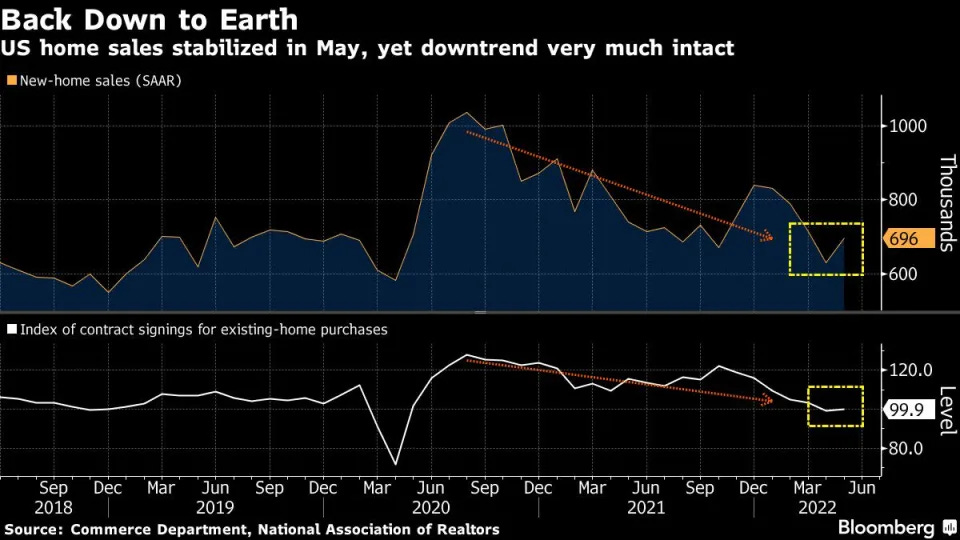

Things are slowing down by every measure on the R/E front down here in Florida. I spoke with an owner from Boca Bridges, the new GL Homes community in West Boca. They bought the house for a base price of $1.5mm (early-pre-construction pricing) with $600k of upgrades for a total of $2.15mm for a 5,000 foot home. Peak (6 months ago), they felt the house could have seen offers in the $3.9-4mm range and today, $3.5mm. A broker told me some “flippers” are getting nervous and a few people who bought 18 months ago have lost so much in the markets and crypto, they are unable to close and are looking to sell. Although inventory remains low, I am seeing it build from obscenely low levels. On a more positive note, Devin Kay (Elliman) a broker wrote this to me about Miami.

I think a lot of people are going to believe the market down here is slowing more than it really is simply because it is summer time and most people are not here. Virtually every single one of my clients is gone for the next 3 to 4 months and there are not many buyers out there looking right now because they are all out of Florida for the summer. I have seen more price reductions in the last month than the previous two years but again, that has a lot to do with the fact that there is just nobody here to buy right now and a lot of these properties were grossly overpriced and the days of people wildly over paying for things are gone. Inventory is still at record lows so I think overall prices should not be affected that much because there is still virtually nothing for people to buy. I am working with about 10 buyers in the $8-30m range who would buy tomorrow but there is nothing for me to sell them.

There is no circumstance where I would buy an apartment or a building which had a land lease. Unknowingly, I looked a couple in NYC years ago, as the prices were low. Then I looked at the monthly charges which were insane. There is the Carnegie House on Billionaires Row in NYC with many older residents who could lose their homes due to the land lease issues. Co-op apartments in a luxury doorman building are selling for as low as $100,000 for a studio and $659,000 for a three-bedroom penthouse with a terrace. But the glitch in the only-in-New York scenario is that owners in the 324-unit building must pay a combined $280 million to buy the land under the structure, or face an additional $26 million a year in ground rent on top of the current $4.4 million a year. If they don’t cough up, they face losing their homes.

Other R/E Headlines

Manhattan Beach manse aims for record price on The Strand

$36 million ask on beachfront home created by KAA Design Group, inspired by luxe resort

Real estate in China is still a big concern despite signs of overall economic recovery