Opening Comments

Weather is solid down here, and the crowds are getting thicker. I was shocked to see the major resort near me still has availability at lower rates than last year for the winter break dates. I am in NYC for some meetings and holiday parties 12/14-12/17.

Please check out the Virus section today. The data is deteriorating and worth a 30 second check. Remember, some email systems truncate this message and you may need to hit a link on the bottom to see the entire newsletter.

Today’s Podcast-(24 minutes). I am going to go deeper into fewer things just to mix it up a bit. Focus of podcast will be on Miami, the Jimmy Lee Story, The Consumer, Musk/Twitter and Real Estate. The recording was done in a Publix parking lot in my car, but think it is worth a listen given the importance of today’s theme section.

Pictures of the Day-Art Basel/Miami Traffic

Iconic Rainmaker-Jimmy Lee-Teaches Me a Lesson

Quick Bites

Markets

MS, JPM, Cantor Turn Bearish

Consumer Cracking-Dipping Into 401k-Great Charts

Musk Unveils Twitter Management Deceit on Hunter Laptop

Other Headlines

Crime Headlines

Real Estate

Miami High-End Defies Gravity

Other R/E Headlines with Great Charts

Virus/Vaccine

Picture of the Day-Art Basel/Miami Traffic

I attended Art Basel on Thursday and need to reiterate my thoughts on Miami. There are many things to like about the lifestyle in the Miami area, and it sure has brought in amazing crowds of wealthy people who have chosen to relocate full or part-time. The restaurant scene is vibrant (11 Michelin Stars from zero), and the cultural events are growing. Great weather, no taxes, more jobs in tech, funds, finance, private banking…and a far better life-style than the alternative with a lower cost of living. The average age is plummeting, and there is an impressive group of young, well-educated and successful people descending on the area. It is an international city with lots of Europeans, Hispanics, Russians, Asians and most other ethnic groups. Despite prices of homes skyrocketing, it is still cheaper NYC on a per foot basis and you can swim in the ocean all-year round. The overall cost of living is much lower in South Florida, and higher quality in my opinion.

However, Miami lacks the infrastructure to handle the mad rush of new residents and visitors. The lack of school availability, roads, mass transit are issues you need to consider. My Basel experience was disappointing for a host of reasons. I felt the art was largely weak with crappy works by no-name contemporary artists. Approximately 98% of the art was just plain painful. With a couple dozen exceptions, if you gave me the art in this show, I would think you hated me.

The traffic was brutal. It took me over 2 hours to get to Art Basel from Boca, which is over double the normal travel time. I wanted to then go to Art Miami (3.4 miles), but the traffic was so heavy, I could not get there and quit after an hour. My friend, took 53 minutes to go 2.6 miles on Wednesday at 6pm in Miami. The die-hard Miami fans will say, “It just Art Basel week, and not so bad otherwise.” I will take the other side of that argument, but agree that Basel week is the worst.

I went to Dinner two weeks ago in Miami, and it took me over 1:20 minutes to go 4.6 miles to eat at Contessa. There was no event and it was pre-Thanksgiving. There is always something going on and between November to April, the traffic is a real concern: Miami Boat Show, Food and Wine Festival, Carnaval Miami, Calle Ocho, Jazz in the Gardens, Miami Open, Ultra Music Festival, Miami Sailing Week, Spring Break, Winter Break, Blues and BBQ Fest, Seafood Festival, Formula One Race and the list goes on to create havoc. The lack of a major mass transit program to shuttle people pushes my ADHD to the limits. Despite all Miami has to offer, I personally could not live there without being heavily medicated. Don’t forget the lack of golf course availability for those who are moving to play more golf. I love to go for dinner in Miami or even a weekend, but I could not live there full-time.

Iconic Rainmaker-Jimmy Lee-Teaches Me a Lesson

The year was 1998, and I worked at Chase for a great guy named Peter. I was running Par and Distressed Loan Trading team and had assembled an amazing group. We were doing quite well and building the business together. It was during this period that I had some of my fondest professional memories. I alerted the team who underwrote and sold “New Issue” loans that the secondary loan market was weakening, and loan prices were falling. It was around the time of the Long-Term Capital Management disaster. I suggested they be careful when underwriting new deals as a result. The loan trading market was in the early stages, and I don’t believe my warnings were being considered.

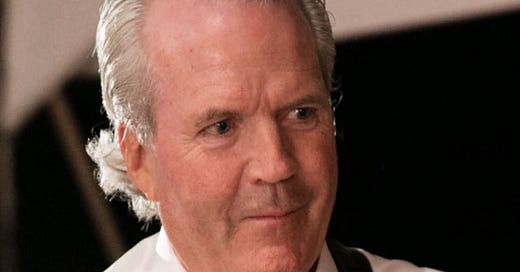

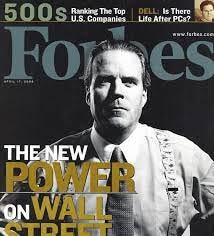

The bankers underwrote a deal (don’t recall the name) and the “New Issue” team was trying to sell it unsuccessfully. My boss, Peter, received a call from the head honcho, Jimmy Lee, to bring me up to see what I thought about the deal. For background, Jimmy was the most important person in finance at the time. He is a legend.

Jimmy and I had a very good relationship. We had bonded over the fact that both of our fathers passed away when we were very young. I was working out a lot and we would meet in the Chase gym regularly to work out together. You may remember, he brought me to lunch in 1998 with Ron Perelman, for my first seat at the BIG Boy Table at the Four Seasons Restaurant in Midtown.

Back to the meeting. I suggested to Jimmy that the price needed to be lower to increase the yield based on the weakening market conditions. Bonds and loans have an inverse relationship between price and yield. As the price falls, the yield increases. So, I recommended selling the loan 2.5-3 points cheaper to gain the attention of potential buyers and make the loan consistent with comparable deals trading in the market at the time.

Jimmy lost his temper and started yelling. “My 16-year-old daughter, Lexi, could sell these loans in a day at 100.” I felt the clearing price was around 97.5. I took offense to such a statement as Jimmy’s prized team of salespeople were unable to sell the loans at the price he wanted. I made a comment, “Well maybe you should bring your daughter in to sell the loans.” That went over like a lead balloon, and Jimmy left the meeting.

I told Peter that I was disappointed in Jimmy’s comments. I had a great relationship with Peter, and he was one of my all-time favorites. Jimmy had underwritten a deal that was at the wrong price and was upset Chase would potentially lose money, as we would be giving our fees to the investors who bought the deal to incentivize them to buy it. Unbeknownst to me, Peter called up Jimmy and suggested I was disappointed in the meeting, and he should smooth things over.

Jimmy’s assistant called me and asked me to come up at 2pm the following day to meet with Jimmy and was not sure why. Jimmy had a big glass office on the corner of the 5th floor of 270 Park Avenue. He waved me into his office, as he was on the phone. For those who don’t know Jimmy, he was the ultimate rainmaker and the most important deal man on Wall Street at the time. He was on the phone with Henry Kravis (The “K” in KKR). His assistant then says, “Jimmy, line two is David Rubenstein (Carlyle Group). Line three is Michael Armstrong (CEO of AT&T). I was literally crapping my pants. I felt so small and insignificant. I was bothering the biggest deal maker on the plant over a dumb comment, as my skin was not thick enough at the time, but that sure changed after this incident.

I wanted to leave the office in shame and his phone kept ringing with Wall Street Journal cover people. I almost felt as though I was on Candid Camera, as there is no way that this many hitters could call one man in the span of minutes. Each person who called seemed to be a huge name I recognized. I recall shaking. Jimmy told his assistant to hold calls for a few minutes, as he needed to “chat” with me.

I was humiliated. Jimmy said, “Eric, I hear you were bothered by my comments yesterday.”

I replied in a shaky voice, “I’m good.” He shook my hand, and I left in shame after a 30 second conversation, but 12 minutes of humiliation. Jimmy and I remained friends, and if anything, the incident made our bond stronger. I also believe the New Issue team started taking my market commentary much more seriously and asked me to present my market thoughts to the group weekly as a result.

Eventually the loan was sold at a healthy discount, but that is not the story. I learned a lot from Jimmy. He was a great banker, rainmaker, closer and competitor. In 2007, the NY Times had an illustration of the New Masters of the Universe, and Jimmy was basically in the center of it as one of the key figures. The picture is complicated, but the link is here.

He always asked for the order and had an infectious smile. He was a great guy and loved getting points on the board. He was uber competitive, and the incident taught me a great deal about work ethic. He worked tirelessly and would call clients at all hours to get a deal done. The last thing he needed was an incremental dollar, but he worked as though he needed to make rent and feed his kids. He loved his job and the thrill of winning a deal from Goldman or Morgan Stanley. He can teach kids today a valuable lesson about enjoying what you do. There is a saying, “If you love your job, you will never work a day in your life.” I feel Jimmy really loved his job and despite working long hours and travelling the world to win deals, he never worked a day in his life. His entire career was at the same firm, JPM and its predecessors.

When I left JPM in 2010, Jimmy called and asked me how he could help me. He opened his Rolodex and said, “Tell me who you want to meet with and let me be your top reference.” He also took me to lunch a couple times a year at the Four Seasons Restaurant in his power table for the next five years. Just two weeks before he passed in 2015, he called me for lunch the following day. “Can you meet me tomorrow for lunch? You know the place.” It was the last time I saw him alive. He looked great and bragged about his waist and his workouts and even flexed his muscles a couple times for me. He died of a heart attack in his home weeks later.

With me, he apologized without saying he was sorry and correctly put me in my place, possibly without even trying. I am still not convinced it was humanly possible to have that many of the world’s most important CEOs call within a 12-minute span. Jimmy loved his job and was very good at it. I think about him quite a bit. I vividly recall the eulogies at his funeral and remember crying uncomfortably. My friend, and mentor died. He accomplished so much in the office and was a dedicated family man who adored his family and bragged about his kids often. He had amazing interests in golf, motorcycles, and guitar and was a well-rounded person. I wish he and I had played guitar together, but we never got the chance.

Jimmy, thank you for all your help and guidance. You were one hell of a great man. Including me in some of those big meetings gave me the confidence to prove to myself that I belonged. Introducing me with such accolades helped to give me the courage to achieve more than I otherwise could. I am forever in your debt. As an aside, my good friend, Bryan, reconnected me with Jimmy’s son, Jimmy Lee Jr, and we are having dinner in NYC next week. I filled him in on some great stories about his amazing dad and in return, he gave me a few pictures we all would never have seen otherwise.

Quick Bites

The Dow closed up just 35 points, or 0.1%, to 34,430 points after hitting a session low of more than 350 points down. The S&P 500 dipped 0.1% to 4,072, rebounding from an earlier loss of 1.2%. The Nasdaq also made up ground to end nearly 0.2% lower at 11,462 points. The tech-heavy index dropped as much as 1.6% earlier in the day. All three indexes set weekly gains, with the Nasdaq posting the largest increase at nearly 2.1%. The S&P 500 added 1.1%, and the Dow ticked up by 0.2%. Friday’s close marked the first time the three major indexes notched back-to-back weekly gains since October. Stocks dipped after labor data released Friday morning showed payrolls rose by 263,000 in November, a bigger gain than the 200,000 increase expected by economists polled by Dow Jones. Average hourly earnings also came in above expectations, jumping 0.6% compared with the prior month and 5.1% against the same month a year ago. The unemployment rate held steady at 3.7%. I was a little surprised by the move in both stocks and bonds after the payroll data. The 2-year treasury is now 4.28 and 10-year is 3.49. They were recently 4.75% and 4.22% respectively. I have stated multiple times that I believe the Fed will be forced to cut rates in 2023. I don’t understand how Powell has a job. Currently, Fed funds futures imply terminal rate of 4.9%, while Eurodollar futures imply 20bps of cuts in 2H 2023. The 2-year/10-year Treasury spread is -77bps and is very suggestive of a recession based on history back to the mid 70s. Gray bars are recessions and thickness of them is the duration. Of note, Larry Summers believes the Fed will be boosting rates higher than the market expects to tame inflation. Based on what I am seeing, I don’t agree. Summers was interviewed in this link. Watch at the 35-minute mark for 10 minutes.

We have seen calls from Morgan Stanley, JPM and now Cantor Fitzgerald all swing to sharply negative. All have highlighted different issues and have moved from bullish to bearish recently, most notably, JPM and Cantor. MS Wilson said, “You should expect an S&P between 3,000 and 3,300 some time in probably the first four months of the year,” he said. “That’s when we think the de-acceleration on the revisions on the earnings side will kind of reach its crescendo.” “We believe that further market and economic weakness may occur as a result of central bank over tightening,” said Marko Kolanovic, JPM. “However, the critical parameters of this market path are the depth of the correction that prompts the Fed pivot, and the point in time next year that this pivot happens.” “Until late summer this year we thought that corporate and consumer resilience will be able to withstand the significant increase of interest rates, wealth destruction, and global geopolitical uncertainty,” he wrote. Cantor believes rates will be cut due to deteriorating market conditions and feels lower bond yields are indicative of poor economic growth. Cantor believes today’s18x earnings and the risk/reward shows very limited upside with a decent amount of downside as earnings estimates will fall starting in January. Johnston, from Cantor, suggests a “big drop” in estimates. Think about the comments in this bullet with my point below. Another article which outlines bank views of an upcoming crash.

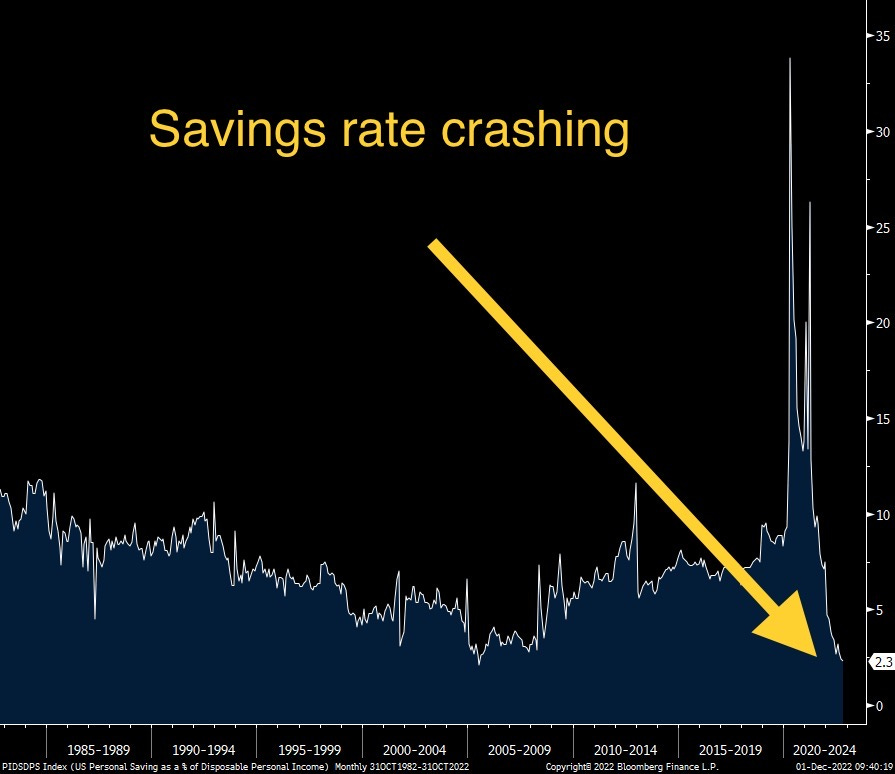

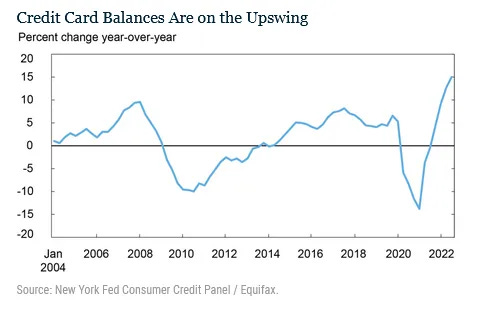

I have written quite a bit about the consumer and my concerns about growing debt levels, crashing savings and now record rates of dipping into 401k plans. The consumer has been incredibly stretched due to inflation (crashing as I called it), sharp increases in interest rates and wages have not kept pace. Vanguard says hardship withdrawals from 401k plans are at all-time highs and are “concerning,” (last chart). Fidelity is also seeing an uptick in such withdrawals. Some of these charts are new and some are from recent reports. I am concerned about what this means for 2023 and the consumer as they have been squeezed by inflation and are borrowing aggressively and dipping into savings, while rates are rising. Consumer spending rose .8% in October as inflation eased, but I am not sure how long that can last with the charts below. (Good Charts in the link)

I have written extensively about media bias. I wanted Musk to buy Twitter due to the clear fact that social media leans too far in one direction. I would have said the same thing if Facebook, Twitter and Google all were on the Right. I ask you to read this section as an American concerned about free speech and election interference, not as a Republican or Democrat. Musk released a trove of information to a journalist, Matt Taibbi, who then shed light on the depths of Twitter’s deceit. I ask the left, what would you say if the majority of the media was so biased in the other direction and worked with Republicans to block stories? It is important to note that the major media and social media make a shocking percentage of political donations to Democrats. In 2022, TWTR employees donated 99.73% of political donations to Democrats. It is clear which way the employees lean.

Taibbi said that Twitter even resorted to a rarely used tactic to stop the dissemination of the story (Hunter Laptop) – blocking the sharing of links to the story via direct message, a tool usually only used in “extreme cases,” such as to stop the distribution of child pornography. Then WH Press Secretary McEnany was locked out of her account and was told she had violated the company’s “Hacked Materials” policy due to the Hunter Laptop story. There were emails from the Biden Team during the run up to the 2020 election asking for specific Tweets to be reviewed, and the Twitter employee responded, “Handled these.” It is clear from the internal emails the senior employees (not Dorsey) knew they were grasping at straws using the “hacked materials” policy. Major social media companies knowing they were deceiving the public to block stories to help their political allies should not be tolerated in America in my opinion. I will write the same story if social media turned too far to the Right. To me, this is about right and wrong, not Right and Left. Twitter's ex-safety chief admits censoring Post's Hunter Biden scoop was a mistake. Many Liberal media outlets are now panning Taibbi as a journalist for running with this Twitter story. Also of note, Musk suggested there were “more smoking guns” to be revealed. On a side note, I checked a handful of Liberal Media outlet websites and found no mentions of this latest Twitter story.

Other Headline

Hong Kong’s Hang Seng had its best month since 1998, but remains in bear market territory

Hong Kong’s benchmark index was +26.6% in November. From February 2021 to October 2022, the HSI plunged 53%.

Blackstone's $69 bln REIT curbs redemptions in blow to property empire

Blackstone stock (parent) is -21% in 3 weeks.

G-7 Sets Russian Oil Price Cap of $60 a Barrel (Russia won’t accept it)

I thought this chart was amazing, so I threw it in this section. I have frequently written that the desired transition to EVs is not realistic due to the lack of rare earth materials, sufficient power grid and charging stations. Remember, I have owned a TSLA for almost 6 years.

Switzerland Considers Electric Vehicle Ban To Avoid Blackouts

Energy policy has consequences. Let’s learn from it.

Goldman Sachs warns traders of shrinking bonus pool as Wall Street hunkers down

Rampant retail theft making inflation worse, threatens bleeding businesses, economists say

Fintech Firms Oversaw Billions in Fraudulent Covid Aid Loans, Report Says

Clearly, the roll-out could have been cleaner, with more safeguards in place. Countless billions in fraud. Maybe some serious jail time would help to deter it in the future.

Trump calls for the termination of the Constitution in Truth Social post

I do feel the Twitter bombshell is concerning, but also have written extensively that it is time for the Republican Party to move on from Trump.

The Pentagon fails its fifth audit in a row

Internal systems tracking weapons and finances were insufficient.

NYS legislators have a bill to fund $55M in legal services for immigrants

California panel estimates $569 billion in reparations is owed to Black residents

Black Californians are due $223k each due to housing discrimination from 1933-1977.

Nuclear submarine 'buzzed by underwater object travelling faster than speed of sound'

This seems near impossible. I love this stuff. We are definitely not alone. Remember, many of the pilot sightings had the objects going into the water.

Crime Headlines

NYC subway stabbing victim offered attacker a cigarette before brutal assault

Straphanger slashed in face with razor in unprovoked NYC subway attack

Brazen Burlington Thief About To Get Busted For Boosting Bags

Man who punched Asian woman more than 100 times sentenced to 17.5 years in prison

Finally, we know what it takes to get jail time.

A hard look at New York’s controversial new approach to the homeless

I support this new tact by Mayor Adams. It should help some people who have mental issues and makes the streets safer.

Real Estate

Miami high-end continues to perform well by every measure and inventory remains light. New condo developments are selling well in pre-construction phases. For those who know NYC R/E, I almost bought in 15CPW in 2007. BIG MISTAKE, as instead, I bought in a co-op (NEVER AGAIN) on 74th and Park. To me, 15CPW was an amazing building with remarkable amenities. I then went into the newer version, 220CPS, and could not believe how amazing it turned out. Although the couple layouts I saw did not dazzle me for the price-point of $11k/foot, the amenities were another level. Now, in Miami, Witcoff is building a 49 unit Shore Club Private Collection next to the Setai. They have already received reservations on a handful of units and prices are $4k-5k+ a foot, despite the fact that it has not broken ground and is a few years away. I am told Shore Club will be even better than 220CPS, which is hard to fathom. My point is simple. There is incredible demand for ultra-high-end product in Miami and homes are almost impossible to find. The Shore Club condos continue to defy gravity with massive prices and insatiable demand. Even though I have issues with school availability, traffic, congestion and golf, the buyers remain aggressive. Look at high-end developments such as Sternlicht’s Perigon, where a unit sold for $44mm ($7,700ft). Devin Kay has sold a few units in the building.

Real Estate Charts/Other R/E Headlines

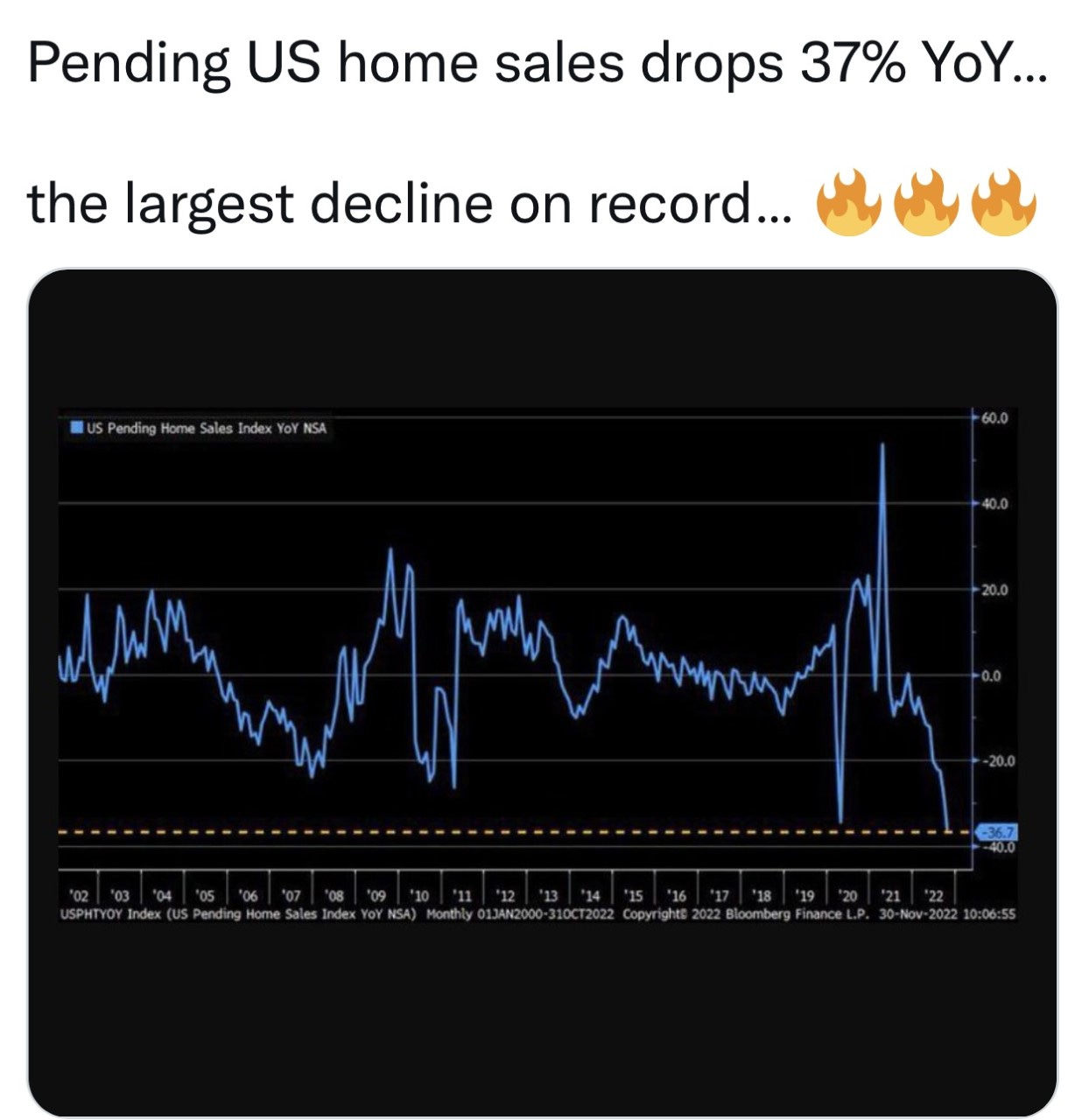

I felt the chart below was quite jarring as the red line going almost straight down is 2022.

These are the world's most expensive cities to live in 2022

Note that Miami or Palm Beach are no where to be found. Come on down!

Virus/Vaccine

The deterioration in data continues and is escalating. Cases, positivity, hospitalization and ICUs are all growing over 20% now. Approximately a month ago, I started writing about changing trends and they are now escalating.

Scientist who worked at Wuhan lab says COVID man-made virus

I said this from basically the beginning and I have been ostracized for it. I am not sure what evidence could come out to convince me this is from the wet market. The Chinese government has lied and covered this up so blatantly.

L.A. County COVID surge raises prospect of return to indoor masking order

Great content. How much Florida success and progress hinges on DeSantis being a governor given his prospects at the national stage at this point?