Opening Comments

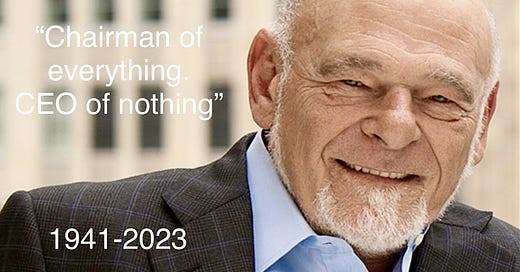

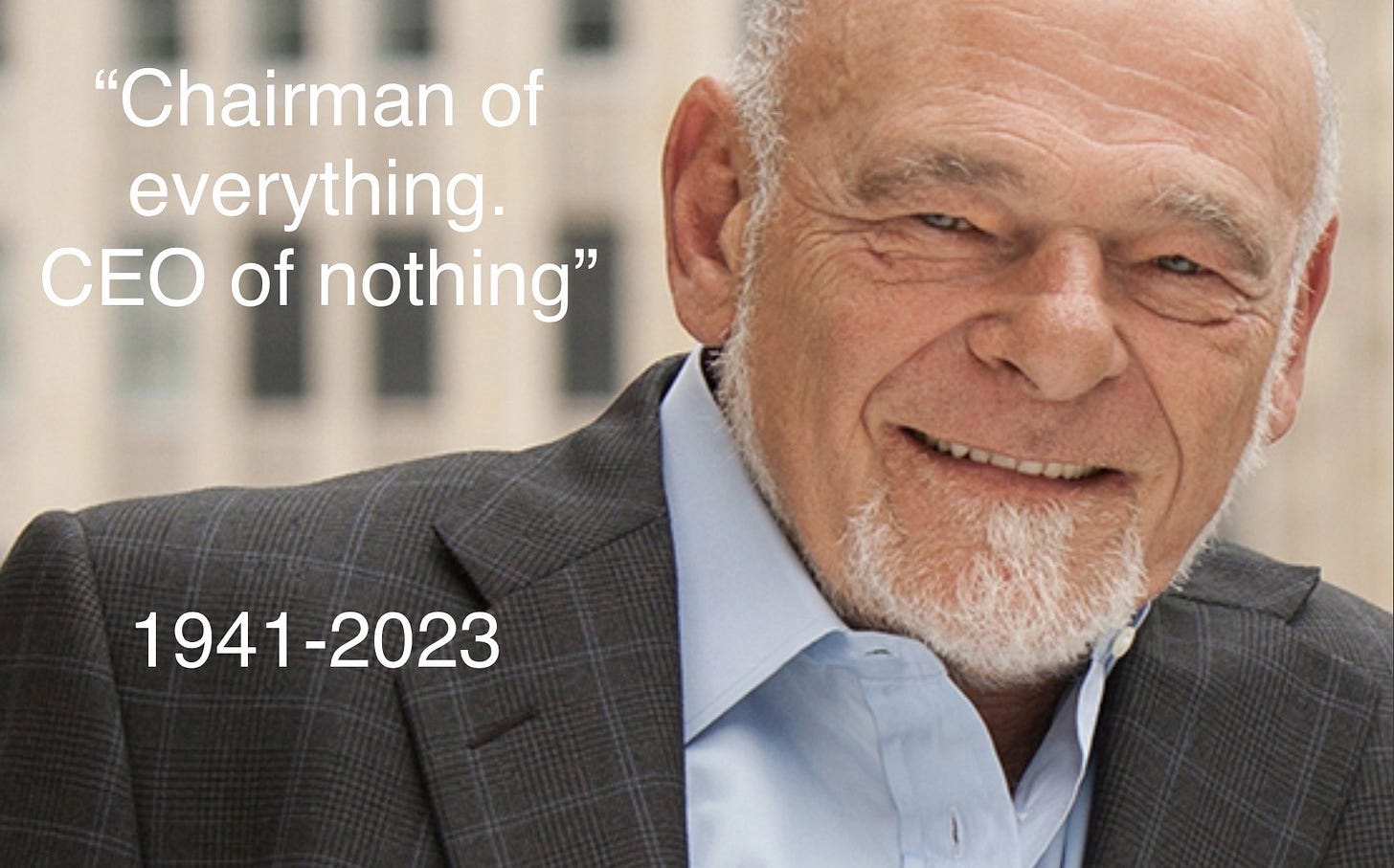

Today’s piece was supposed to be about memorable client entertainment over the years, but given the death of the great investor, Sam Zell, I decided to put together a piece on the “Grave Dancer.”

Markets

Global Debt Levels-Debt/GDP

Japan Stocks on a Tear

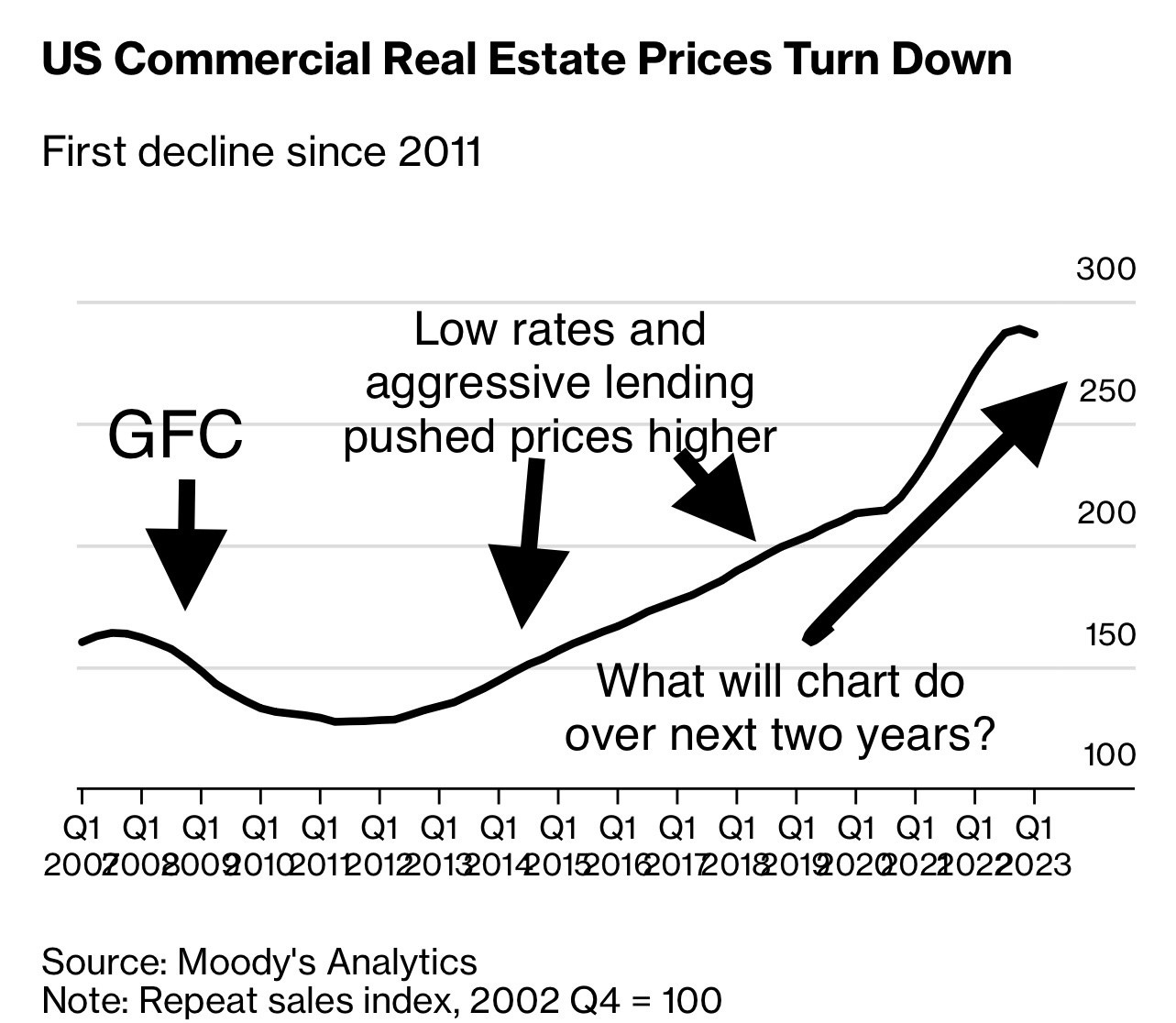

Commercial R/E Chart

NYC Office Impact on the Budget

LA Office Building Selling at Big Discount

Affordable Beach Towns

$200mm Malibu House Sold-Jay-Z/Beyonce'

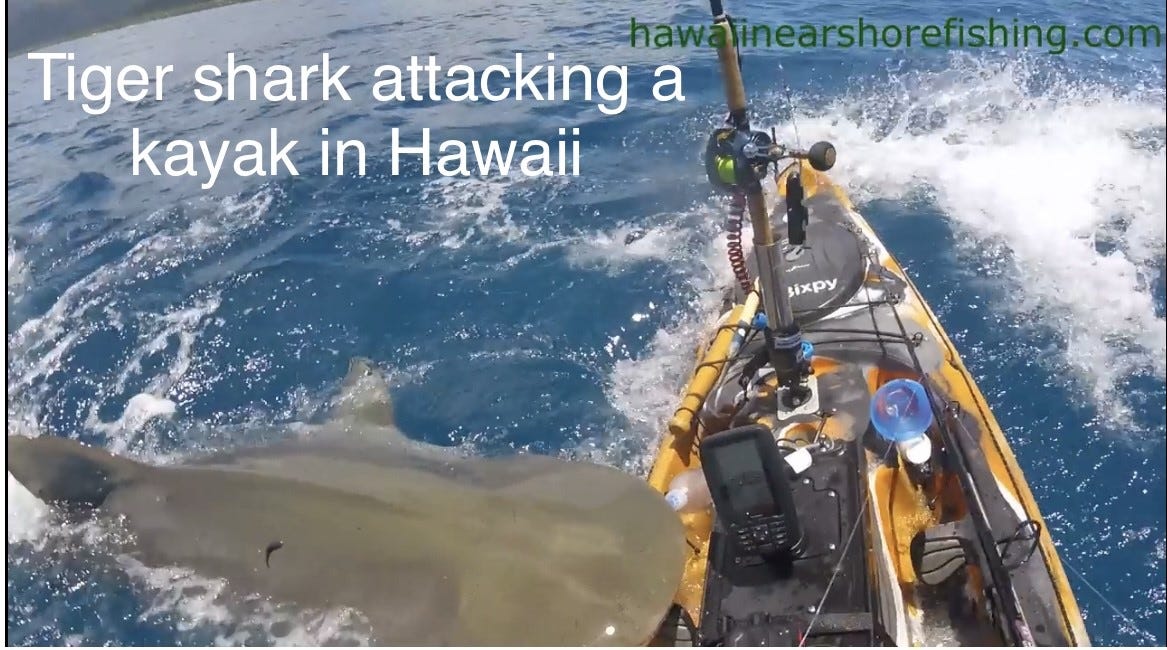

Video of the Day-Shark Attacking a Kayak

A Hawaiian angler survived a harrowing encounter with a large shark that attacked his kayak as he fished off Oahu. Scott Haraguchi captured the dramatic incident with a Go Pro video camera. The video is 40 seconds and in slow-mo it is absolutely frightening. I would have crapped my pants.

Investing Lessons From Sam Zell-The “Grave Dancer”

Sam Zell was a Chicago Real Estate genius hero of mine. Throughout the piece are some of his teachings, sayings and methods to his madness. He is considered the Godfather of the real estate investment trust (REIT), and he and his colleagues built some of the world's largest publicly-traded REITS. He passed away last week of complications from an illness at 81 years old. I am not sure if I had more respect for him for his investing prowess or his amazing directness and straightforward talking. He was known as the “Grave Dancer” because he would buy assets in deep distress as the seller was “dying,” in most cases due to over-leverage or poor market conditions. One of my favorite sayings in history is from Warren Buffet who said, “be fearful when others are greedy, and greedy when others are fearful.” This mindset is similar to Zell’s, which is why they are great investors.

His interviews were legendary. Let’s not forget the time he said, “What a crock of $hit” on CNBC around the fact that Amazon pulled its plans to open a second headquarters in NYC. Zell called it the “tyranny of the minority” and believed it would go down as one of the area’s great political mistakes. I happen to agree that the AOC-led bashing of Amazon was an idiotic decision and have written about it.

As a kid, Zell was entrepreneurial. At the age of 12, in 1953, he would buy copies of Playboy in bulk for a quarter in the city and sell them for $1.5+ in the suburbs in what he called his first lesson in supply and demand. He had a golden touch with real estate and got his start managing apartment buildings as a college student. By graduation, the enterprise was netting $150k (60 years ago). In the 1970s, when the market crashed, he and his partner, Lurie, were there to pick up the pieces and acquire quality properties at large discounts.

There are many great stories of his investing acumen, and he amassed a substantial net worth ($5-6bn) because of his ability to buy assets at distressed levels when everyone else was running in the other direction. In the 1980s and 1990s, during the market distress, Zell bought up a ton of properties at steep discounts and there was little competition looking to buy at that time.

His timing of sales of some of his properties was just as legendary as his purchases. In 2007, he sold Equity Office Properties (Office REIT) to Blackstone for $39bn for what was at the time, the largest leveraged buyout in history. It was a 25% premium to the market price and almost double the value from one year prior. Although he was not looking to sell it, he received what he called a “Godfather Offer” that he just couldn't refuse. Obviously, the assets he sold to Blackstone crashed in value within a year of the sale. I believe this is one of the best sales in the history of R/E from a timing perspective, especially when you consider the size of the assets sold. He was not looking to sell but had a price that he could not pass up. This is a great lesson for all investors. For me, everything I own is for sale at a price. Someone came to my house once and liked a piece of art on the wall. I said “Make me an offer,” and his offer was more than it was worth. I had it delivered two days later. That was totally a Zell move.

He made a big mistake in buying the Tribune company in 2007 for $8.2bn which filed for bankruptcy shortly after he bought it. He also sold the Cubs (owned by the Tribune) for $900mm including 25% of Comcast SportsNet and it would be worth $4-5bn today.

Multiple readers sent me a blog called 25iq which had a great piece written by Tren Griffin in 2015 entitled, “A Dozen Things I’ve Learned from Sam Zell about Investing and Business.” I am going to highlight my top 10 in abbreviated fashion, but you can check out the full report in the link above. I promise if you follow Zell’s investing rules, you will be a better investor. Sam said, “I spend almost my entire day listening. I ask questions, I probe, I raise possibilities.” Zell had much to teach if you want to become a better investor.

1. “The first thing you need to understand is how little you know.”

2. “When everyone is going right, look left.” “I‘ve spent my whole life listening to people explain to me that I just don‘t understand, but it didn‘t change my view. Many times, however, having a totally independent view of conventional wisdom is a very lonely game.”

3. “Listen, business is easy. If you’ve got a low downside and a big upside, you go do it. If you’ve got a big downside and a small upside, you run away.”

4. “At all times, we are keenly aware of what our exposure is. As a result, we are much more of a Benjamin Graham kind of investor. We are very focused on what the liquidation value is. Barnard Baruch, who was a very famous financier said ‘Nobody went broke taking a profit.’ In the same manner, I have never suffered from any transaction turning out to be too good. The real issue is ‘What is the downside’.” “My own formula is very simple. It starts and ends with replacement cost because that is the ultimate game. In the late 1980s and early 1990s, I was the only buyer of real estate in America. People asked me, ‘How could you buy it?’ How could I project yields? Rents? For me, it came down to these issues: Is the building well-built? Is it in a good location? How much less than the cost of replacement is its price? I bought stuff for 30 cents on the dollar and 40 cents on the dollar.”

5. “I pound on my people: taking risk is great. You’ve got to be paid to take the risk. The risk/return ratio is probably the most significant determinant of success as an investor.” “Measuring and gauging the risk reward ratio is the biggest [margin of] safety issue every investor has.”

6. “You can have all of the assets in the world you want, but if you have no liquidity it doesn’t matter.” “Liquidity equals value. At no time in my career has it ever been more clearly brought home to me than in the (2008)-09 period. If you had liquidity, you had value. …

7. “The problem with leverage is that you need to pay it back. The biggest measure of success or failure is how entrepreneurs address and deal with leverage. If you are in the real estate business without leverage, that’s like being a boxer in the ring without a glove.”

8. “Anytime you don’t sell, you buy. So if we had chosen not to sell Equity Office for $39 billion, we would be buying Equity Office for $39 billion.”

9. “I would tell you whatever business I’ve been in — real estate, barges, rail cars — it’s all about supply and demand.” “When there is no supply, real estate performs very well. Almost without regard, within reason to the economic conditions. When there is oversupply, it doesn’t matter what’s going on real estate is going to suffer.”

10. “Entrepreneurs basically not only see the opportunities but also the solutions.” “A critical element to a successful entrepreneur- he or she thinks in themes, not in single events.” “I don’t know too many insecure successful entrepreneurs.” “Fear and courage are very closely related.

Zell was one hell of a investor, business builder, character and he was philanthropic as well. He gave to education and the arts. On Samzell.com, you can find out even more information on his life. This is a short video about his life which was very well done. He said, “People sometimes ask me when I'll retire. Retire from what? I love what I do." I agree 100%. If you love what you do, you won’t work a day in your life. Here are even more quotes from Zell and there are lots of good ones. He will be missed.

Quick Bites

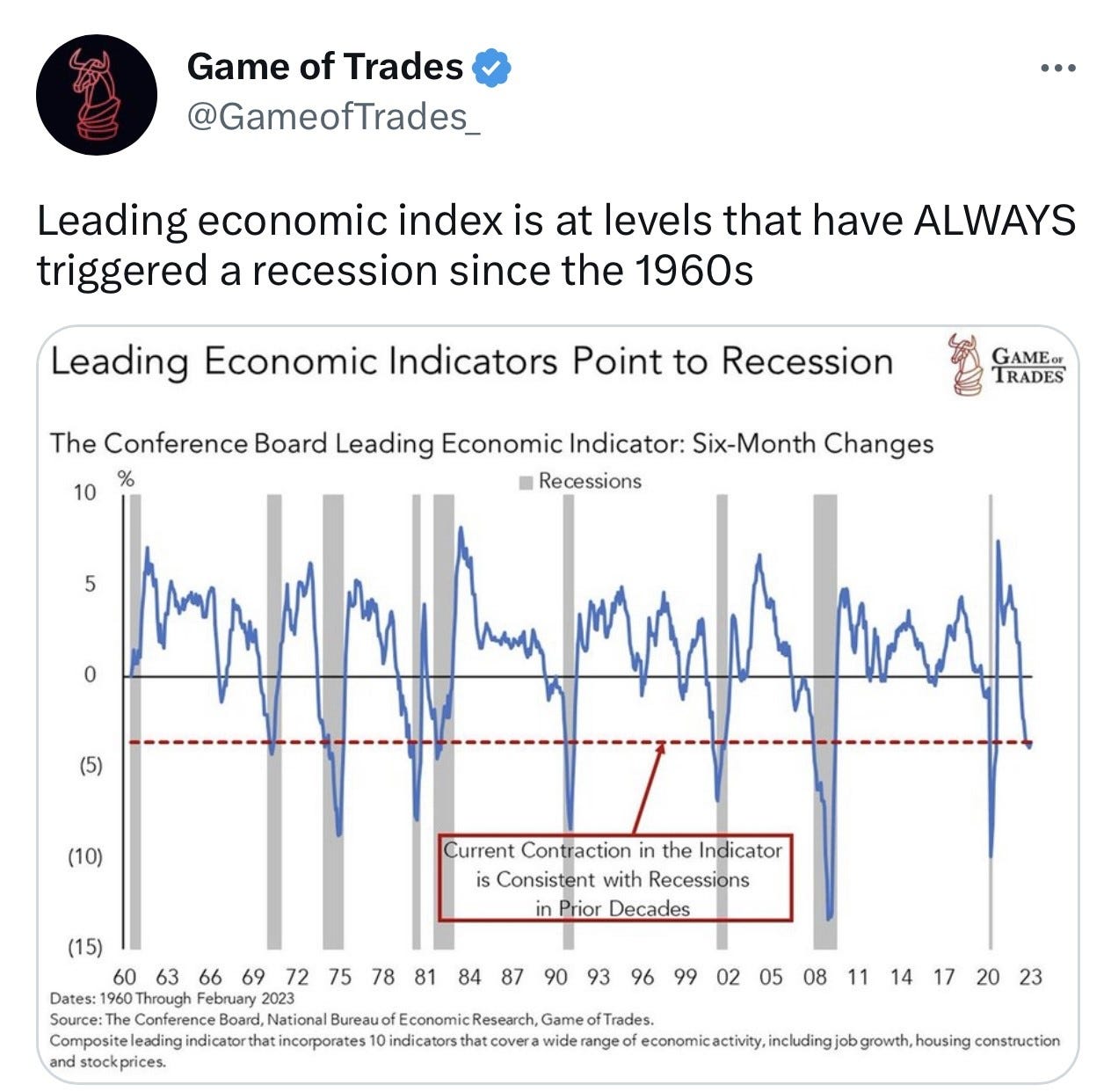

Thursday markets continued to rally on debt ceiling resolution hopes and a strong WMT forecast. However, Friday, markets sold off less than .5%, as negotiations paused. “But it is very frustrating if they want to come into the room and think we’re going to spend more money next year than we did this year. That’s not right. And that’s not going to happen,” said McCarthy. Negotiations resumed Friday evening. Saturday, McCarthy saw no progress until Biden returns. Biden said, “GOP must move off extreme positions.” “I can’t guarantee that they will not force a default by doing something outrageous,” he said. As I promised, there will be noise between now and an agreement. All three averages gained on the week with the S&P+1.7%, Nasdaq +3.0%, and Dow +.4%. There will be noise, but I believe a deal will be reached. If for some reason, the idiots don’t agree, the default would be a short-term buying opportunity. Powell said “Our policy rate may not need to rise as much as it would have otherwise to achieve our goals.” He cited issues with mid-sized banks which have prevented the worst-case inflation from happening. I have written about this extensively and suggested for two months that the sharp tightening by banks would help to bring down inflation. Bonds were volatile on Friday with the 2-year Treasury trading between 4.2% and 4.35% on the Powell comments and debt ceiling negotiations. The 2-Year settled at 4.28%. I thought this chart on Leading Economic Indicators pointing to a Recession was interesting. The vertical gray bars are recessions.

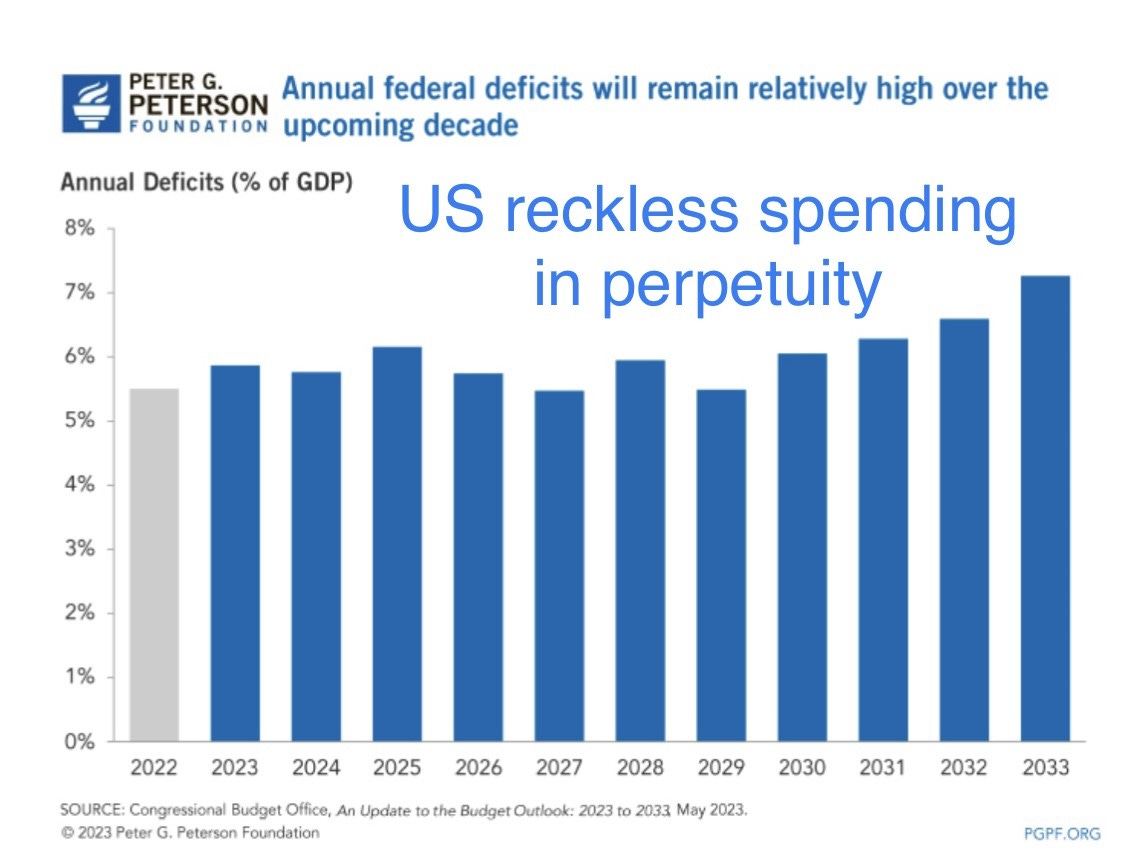

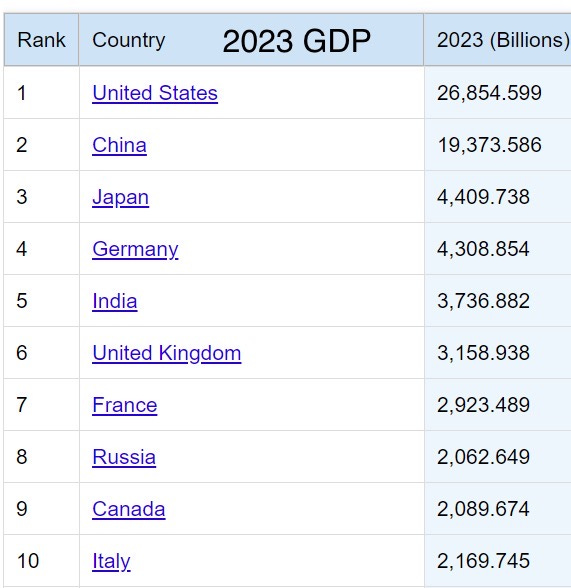

The global debt pile grew by $8.3 trillion in the first quarter to a near-record high of $305 trillion (+$45 trillion from pre-pandemic) as the global economy faced a “crisis of adaptation” to rapid monetary policy tightening by central banks, according to a closely-watched report from the Institute of International Finance. The finance industry body said the combination of such high debt levels and rising interest rates has driven up the cost of servicing that debt, triggering concerns about leverage in the financial system. Total debt in emerging markets hit a new record high of more than $100 trillion, around 250% of GDP, up from $75 trillion in 2019. I have been ringing the alarm bells on the $32 trillion US debt load, reckless spending, massive deficits, and rising rates. It seems the US is not alone in fiscal irresponsibility. The list below is not exactly a good one to be on, but reckless spending by BOTH parties, bad policies, an aging population, rising interest rates, and an explosion of borrowing since 2008 have all contributed to the US fiscal issues. I can promise you folks, this is going to end poorly unless the morons in DC start making better decisions on spending (Both Dems and Reps). Rather than being concerned about being re-elected, let’s make some tough decisions and balance a budget for a change. Term limits would help this issue. Stop giving away money and fighting every other country’s battles. My all-time investing hero, Stan Druckenmiller is sounding the alarm as well. He must be an avid Rosen Report reader. There are countless charts like the first one below and they all differ slightly based on timing and calculations, but you get the gist. The US is in some impressive company (Venezuela, Sudan, Greece, Lebanon, Cabo Verde, Libya, Bahrain…). The second chart is just not sustainable given US Federal debt has gone from $3 trillion to $32 trillion in approximately 32 years. Note the massive increase since 2008.

The hot new stock play is a country with a shrinking population, a tumbling currency and an economy that is still smaller in real terms than it was four years ago. Japan is back—at least for foreign investors. The Nikkei 225 stock average closed at a 33-year high on Friday, capping an 18% rise so far this year. The last time the benchmark was at this level, phones couldn’t send text messages, George H.W. Bush was president and the Soviet Union was still a thing. In 1990, Japan had the world’s second-largest economy after the U.S. and it seemed poised to take the top spot. Now China GDP will be 4.4x Japan in 2023. Last month, Warren Buffett said he owned more stocks in Japan than in any other country besides the U.S. Berkshire bought stakes in each of Japan’s five largest trading houses nearly three years ago. Check out the chart below. After hitting almost 40k, the Nikkei fell to well under 10k even 25 years later. It is now approaching 31k. Japanese rates remain low which has hurt the currency, but has helped stocks.

Other Headlines

"I'm making a prognostication — we're going up," he said, according to Bloomberg. "I'm actually pretty bullish."

Walmart raises full-year guidance, as earnings beat on boost from grocery and online businesses

1st Q sales rose almost 8% and WMT believes sales will be up 3.5% in the fiscal year.

Foot Locker shares drop 27% after big earnings miss, lower guidance

The company missed on top and bottom lines and had to increase markdowns to drive sales.

New car lending data should be out next month. As of Feb, auto loan rejection rates hit 9.1%, up from 5.8% a few month prior. I presume things have deteriorated further.

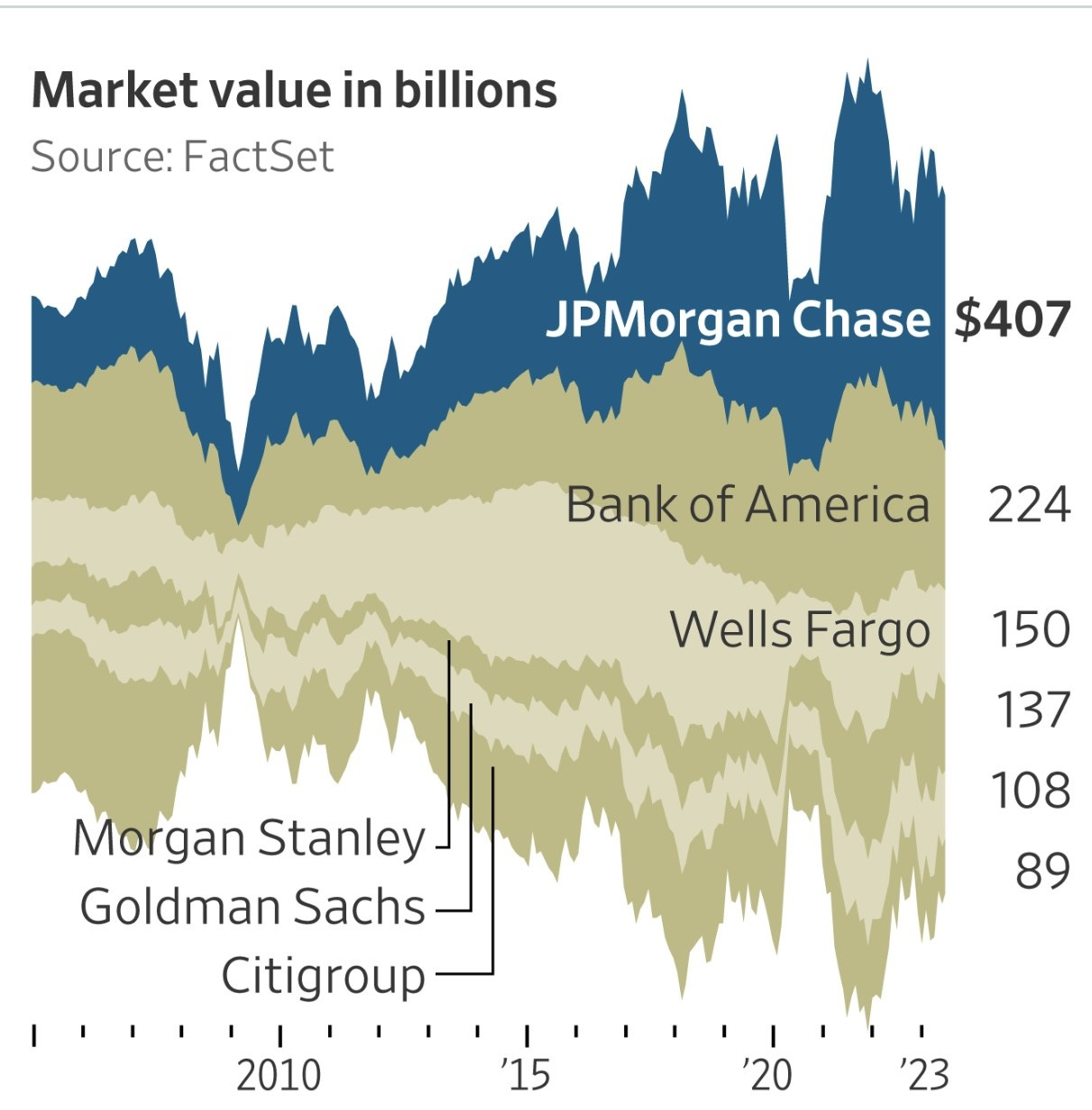

Morgan Stanley CEO plans to step down within the year, sparking Wall Street succession race

Gorman has done a very good job since taking over in 2010 after the firm was hit hard in the Global Financial Crisis.

America’s Biggest Bank Is Everywhere—and It Isn’t Done Growing

Jeffrey Epstein lawsuit: Deutsche Bank will pay $75 million to victims

Disney scraps plans for new Florida campus, mass employee relocation amid DeSantis feud

I think both sides are wrong, but feel DeSantis is playing too strong here. Disney is too important to the Florida economy. Disney is the largest employer with over 75k people in the state. 58mm people per year attend Disney World and it drives a huge amount of tourism in Florida. Some suggest Disney’s financial performance (stock-11% for 1 year) is playing a role in the decision to scrap the new campus.

Only three other major cities suffered worse population losses — San Francisco lost a baffling 7.5% of its citizens, while Revere in Massachusetts lost 5.9% and Louisiana’s Lake Charles lost 6.9%. I can tell you that the people leaving these cities are the wealthier ones. I would love to see a breakdown of net worth and incomes of the leavers from the major cities. Leaves a big budget hole, as they pay a disproportionate amount of taxes and spend multiples of the “average” citizen generating jobs and paying sales tax. The Multiplier Effect is REAL.

Job Prospects for Black Workers Have Never Been Better—In Ways That Might Last

Microsoft Says New A.I. Shows Signs of Human Reasoning

AI is moving so quickly. It is hard not to be concerned about the ramifications and implications. The question asked to AI was how to stack a book, 9 eggs, a laptop, a bottle, and a nail. The answer was remarkable.

The article suggests there are 16 records that may provide evidence of Trump’s knowledge of the declassification process.

Mayor Eric Adams: Nearly Half of NYC Hotel Rooms Now Filled with Migrants

More costs paid for by NYC taxpayers. Adams warned that the influx of new arrivals will cost the city over $4bn! What about that money going towards the education of our children? Going to homeless Americans? More police to keep citizens safe? More EV charging stations? Vocational Schools…

Maryland teen rape suspect is illegal immigrant from El Salvador

Suspected of raping a 15 year old and a woman.

55% of NYC 12th-graders chronically absent post-COVID

Maybe money would be better spent on education.

AWFUL IDEA. In stores, connect shoplifters with social services. I can see it now. A shoplifter who has been arrested 150 times sees the kiosk and says, “Please help me.” and the problem is solved.

How many got through unnoticed?

NYC hospital ‘Karen’ paid for Citi Bike at center of viral fight with black man: lawyer

The White, 6-month pregnant, physician’s assistant PAID for the bike in question. The media painted her as taking the bike from a Black man, but receipts showed she paid for it. Again, the media threw this poor woman under the bus and her employer placed her on leave. The media shoots first and asks questions later. Jussie Smollett, Nick Sandmann, Matt Araiza, this young woman and countless other cases. Read the story as to what really happened. How about some retractions?

DeSantis expected to enter 2024 presidential race next week

Recent missteps on abortion, Disney and Ukraine have DeSantis in a challenging spot. I am firmly in the anyone but Trump/Biden/Harris/Clinton camp. I think Sununu comes in, Suarez, and a handful of others, as Haley already has her name in the ring. I hope a good Dem can challenge the incredibly weak President. Should I throw my name in the ring as an Independent? I am clearly a better candidate than any of these clowns despite my “impressive” hairdo.

I have no clue what gets approved, but the proposals are concerning about less funding for police, raising taxes for wealthy individuals and corporations to the tune of $6.8bn/year, higher R/E transaction taxes on properties over $1mm and cutting spending by $5.1bn.

Jim Jordan's FBI Whistleblower Hearing Descends Into Chaos

I watched some of it and must tell you that as Americans we should be concerned about the weaponization of the FBI against Americans. The whistleblower’s security clearances were revoked and lives were ruined for coming forward. Just not right. The double standard for Hillary vs a Republican is concerning. What if this went the other direction? I call out both sides. It seems to me the DOJ is doing everything possible to suppress the investigation. I just want the truth and facts.

NYC is sinking under the weight of its buildings, geologists warn

Walk up to 7 mph wearing $1,400 'world's fastest shoes,' viral TikTok claims

U.S. Depression Rates Reach New Highs

The article suggests the pandemic isolation, loneliness, fear of infection, and substance abuse all play a part, and I believe they are big drivers. The impact of the lockdowns will prove to be far more costly than the alternative in my opinion. Also, social media is a big factor in depression. The depression rates have increased sharply since 2015.

Crazy story about Harvard researchers being bribed around nutrition issues of sugar in the 1960s. Remember, in the 1940s, doctors were hired to suggest smoking was healthy.

World’s most expensive ice cream costs $6,696 per scoop

It sounds vile. White truffle, Parmigiano Reggiano cheese and Sake Lees. It better come with a car for this price.

Russian private army head claims control of Bakhmut but Ukraine says fighting continues

Seems like a big deal if true. Zelensky said, “Bakmut only in our hearts” after Russian control.

Real Estate

US commercial real estate prices fell in the first quarter for the first time in more than a decade, according to Moody’s Analytics, heightening the risk of more financial stress in the banking industry. The less than 1% decline was led by drops in multifamily residences and office buildings, data culled by Moody’s from courthouse records of transactions showed. Banks held more than $700 billion in loans on office buildings and downtown retailers in the fourth quarter of last year, according to the Fed. More than $500 billion of that was extended by smaller lenders.

NYC Skyscrapers Sit Vacant, Exposing Risk City Never Predicted

Office vacancies hit a record 22.7% this year amid remote work. Commercial property taxes contribute approximately 20% to NYC tax revenues with office contributing half that amount. With wealth leaving NYC, corporations moving and lower R/E prices for residential and commercial, it will have a major impact on the NYC budget. How to fill the gap? It is either higher taxes, lower spending or take on more debt. Take your pick. Let’s not forget about the billions to house, feed, educate, medicate, treat… the growing number of migrants. Even the Mayor is begging for help.

Potential buyers think Shorenstein Properties’ AON Center in Downtown Los Angeles is worth a lot less than it was in 2014, The Real Deal has learned. L&R Group of Companies, an office and parking structure owner run by Adam Rubin, is expecting to bid about $160 million on the 1.1 million-square-foot tower at 707 Wilshire Boulevard — a roughly 40 percent discount compared to what the building last sold for, according to a source familiar with the matter. Shorenstein bought the tower for $268.5 million in 2014. L.A.’s new transfer taxes have also hampered sales, given the city will charge 5.5 percent on all residential and commercial sales over $10 million. If the sale goes through at $160 million, Shorenstein will have to pay $8.8 million in additional taxes. Over the next 24 months, we will see a lot more sales at substantial discounts from the prior transaction within urban office markets. Also, Uber is abandoning one of its new office buildings in Mission Bay. The entire building at 1725 Third Street is for lease for 300,000 ft. In March, Pinterest announced the closure of two offices, Reddit slashed the amount of space it occupies almost in half and Meta eliminated 435,000 square feet. Meanwhile, Google could pay upwards of $500 million as they seek to shrink their office footprint.

The sky-high rents hammering New York City tenants hit record-breaking levels for the second consecutive month, with no signs of slowing as the Big Apple heads into peak rental season. The average Manhattan apartment rental in April was a whopping $4,241 for the month — a 1.6% increase from March‘s $4,175 median price, which shattered the previous record of $4,150 established last July.

The rent marks an 8.1% jump from April 2022, according to a joint market report conducted by real estate brokerage Douglas Elliman and appraiser Miller Samuel.

This article outlines the most affordable beach towns in the US. The prices listed are shockingly reasonable. I have not been to many of these places and unfortunately, most don’t sound super appealing to me. I went to Grand Isle to fish and the tuna and redfish fishing is great, but it was devastated in a hurricane.

According to TMZ, Beyoncé and JAY-Z have purchased a 30,000-square foot home in Malibu for a record-breaking price tag of $200 million. Apparently that’s the biggest real estate transaction in California history, smashing the previous record of $177 million. It’s also the second most expensive home real estate deal in US history — behind only a $238 million transaction for a property in New York City. House looks nice, but $200mm? The flip tax paid by the seller is almost $12mm. Pictures in the link. The annual R/E tax should approach $2.5mm on the house.

While I think AOC could have handled the Amazon plan to establish a presence in Queens better she did raise important issues: 1) What is the impact on housing affordability for the existing population of the district when you add 25K employees mostly from outside the district; Cuomo's decision to offer $3 billion in tax subsidies to the company was made without much of a debate with the legislature or other constituencies. What is not generally known is that 10 months after the company's decision to cancel its Queens plan it announced that it is opening new corporate offices in Hudson Yards ( no tax subsidies ).