Opening Comments

A reader who is experienced in newsletters suggested I change the order of the Rosen Report with opening comments prior to the table of contents. I am giving it a try, so let me know what you think. He feels the first thing you see should not be a table of contents. Makes sense.

I apologize, but something happened with Substack. I found dozens of recent subscribers who were in a different welcome account and just added them to my full email. Unfortunately, it took Substack a while to get back to me to help me figure it out. If for whatever reason, you don’t receive my report, check Substack and search the Rosen Report and all my old reports come up.

Jack played golf with Brandon Wu (PGA Tour player after qualifying from Korn Ferry last season). Both players work with the world-class instructor, Jeff Smith. I met them at the course late as I was getting my haircut (more below) and had to leave early for a Zoom call. I watched about 16 holes and it is now official; I will never make the PGA Tour. Not that there was ever a chance. These guys are good. Every putt seems to go in or just miss and Brandon’s swing is as smooth as butter. He looks like a teenager, and I have dubbed him, “The Baby-Faced Assassin.” Nice young man who graduated Stanford while playing golf at the highest level. His team won the NCAA Golf Championship and he was the stroke play medalist at the 2019 US Amateur and was on the winning Walker Cup team. I hope will do amazing things on tour, as he could not have been more humble or likable. Jack shot a 74 from the tips despite two sloppy bogeys with wedges in his hand. Nice playing against a pro who does not hit loose shots. Yes, Brandon lit up the back after a slow start and believe he shot -4 on the back. This picture is from the 17th hole which is a 180-yard par 3. Both hit 8 iron as it was downwind. The collective distance from the hole is less than 3.5 feet (Brandon is the closer one) with the divot 2” from the hole.

Jack is 16 years old tomorrow. I will talk more about this Wednesday, but Happy Birthday. You have become and incredible young man and we are proud of you.

Picture of the Day-Eric Wild Man to Kojack

It’s a Small World

Quick Bites

Markets/Crypto, Cloud Sell-Off, Black Unemployment

December Jobs Report, Mortgage Rates, Manchin Out

Media Bias/Rogan, U-Haul Moving Data

Chicago Murders 2020,

Other Headlines-Very Expanded Section. Lots of Good Headlines

Virus/Vaccine

Data-Early Omicron States May be Peaking, but Data is Deteriorating

Hospitalizations Per 100k and NY vs Florida

New Hospitalization Reporting

Prioritizing Treatment Based on Race

European Vaccine Mandates

Real Estate-Expanded Section. A Ton of Crazy Stories Which are Hard to Believe.

$52mm Palm Beach Estate Just Listed

Miami $225k/month Home for Rent-Pictures

LA Mega Mansion

Hottest Markets for 2022-Tampa

Apartment Market on Fire

Toronto Housing Shortage

Picture of the Day

I discuss the fact that historically I have not been follically challenged. My hair had gotten out of control. I took this photo the other morning prior to a haircut. This day, I received a Facetime video call from a CEO for a company I consult. I was wearing a hat, but my hair was not contained, and she lost it on me. “What the hell is going on with that hair? Get it under control and shove the hair under the hat,” she said. Due to the insult, I went and got a haircut and am now effectively Kojack. Think of the money I will save on hair products.

Before

After

The picture was taken with some kind of filter from Snapchat with my daughter’s help. You can see the hair from the back of my head if you look closely. Until I actually start losing hair, no chance I shave it. But I don’t think I look awful bald. I thought it would have been worse.

It’s a Small World

When we took our kids to Disney, we went on the obnoxious ride, It’s a Small World.” They sing this irritating song about 20 times during the ride and I wanted to shoot myself. I am reminded of the name of the ride due to a strange thing which happened to me last week. These are pictures from our Disney trip in February 2014. This is when my kids were cute and they listened to me. Julia was 6 years old and Jack, 7.

I mentioned that I joined an investment and networking club called, “3i.” In my short time, two months, I have found it a remarkable new addition in my life. I have made four investments in venture/early PE and one fund and made a dozen new friends who are all bright, successful and interesting. If anyone wants an intro, happy to do it.

I was doing due diligence on a deal brought by 3i and found another member to be knowledgeable on the industry so I reached out to him. I knew of him, but not personally, or so I thought. He was generous with his time, and I thanked him for educating me. I decided to make an investment in the company largely based on learning from his experience and suggested that we grab a lunch in coming weeks. I told him I am sure we know a lot of the same people, but little did I know just how much our lives were connected. He was living in NYC and recently relocated to Palm Beach.

On Tuesday, we had lunch at Bricktop’s on Palm Beach Island and I strongly recommend the Bistro Chicken which is not dissimilar from Le Bilbouquet’s Cajun Chicken. We sat outside on a beautiful day. Just after sitting down, he said, “Where did you get married?”

I found the question an odd one to start off a lunch with a new acquaintance, but responded, “Southampton almost 20 years ago.”

He said, “I was at your wedding.”

I said, “I think I’d know if you were at my wedding. It was not very large. Why would you be there and did you buy me a nice gift?”

Turns out he was a plus one for one of my wife’s friends. It gets better. I asked him where he is living and he said, “On Reef Road in Palm Beach.”

I said, “The name of my hedge fund was Reef Road Capital due to the fact that I surfed there as a kid. Next time there are waves, I am parking at your house given parking is impossible!” Picture below is of a Reef Road wave. It is not me pictured, but yes, it gets very good once in a while.

It turns out we had countless overlaps of friends, deals, and investments including a great deal we both invested in about 8 years ago and made a big multiple on our money. We had a good laugh. Towards the end of the lunch, he said, “Do you know anything about trading carbon credits?”

I said, “A little and am negative on it given the lack of liquidity, but I am hardly the expert. Lucky for you, after this lunch, I am walking 100 yards to meet with a developer friend of mine who is an avid Rosen Report reader. He ran Commodities at JPM and knows all you need to know on the subject.”

We walked over in two minutes and had a nice one hour meeting with my friends at the real estate development company where carbon credits were discussed at length. It is a small world and now our paths are truly interconnected. I made a new friend. Well kinda. He was at my wedding. I emailed him and let him know that given he crashed my wedding, the next meal is on him and I am ordering lobster, caviar and nice wine from the reserve cellar. Another successful 3i connection.

Quick Bites (Bold means my thoughts)

Stocks fell on Friday to end a rough first trading week of the year, as tech shares were battered by rising interest rates. The Nasdaq dropped another 0.9% on Friday to close at 14,936. The S&P 500 fell 0.4% to 4,677 for its first four-day losing streak since September. The Dow lost 5 points, or about 0.01%, to close at 36,232. The tech-heavy Nasdaq posted its worst week since February 2021, down about 4.5% in the first five trading days of 2022. The S&P 500 was off by 1.8%, while the Dow lost only 0.29% as investors rotated into some value stocks amid the rise in rates. The 10-Year Treasury crossed 1.8% at one point, but closed at 1.77%. This is something to watch. For over a decade, we have been accustomed to extremely low rates. Essentially free money. This has led to one of the best bull markets of all time in equities. It has helped propel home prices and given businesses access to cheap funding. Finally, we are seeing a move in rates. In mid-December, we were at 1.4% for the 10-Year. I hope to see rates get to some level of normalcy, but the impact could lead to some decent volatility. Crypto was hit again and BTC fell to 41.7k (-3.3%) and Ether was down to $3.2k (-6.4%). Both are up slightly from these levels now. In November, BTC was $67k and ETH was at $4.8k. Part of the recent Crypto sell off came as Kazakhastan shuttered internet service due to deadly protests and the county accounts for 18% of the network’s processing power. Given the sell-off, there are more calls for a 2022 crypto crash. I have about 1.5% of my net worth in it. I hope it crashes as I will buy more. GS is suggesting BTC could reach $100k by the end of 2022. I am not overly concerned by the moves in crypto given the historic volatility. It is also the reason it is a smaller percentage of my portfolio.

Some of the fastest-growing technology companies have plummeted in value in recent weeks with the Federal Reserve signaling rate hikes are on the way. Cloud software has been one of the best bets for investors over the past half decade. But that trade has rapidly unwound of late. The slump, which started in November and deepened this week, is part market rotation, part economy reopening from the pandemic, and part concern that the Federal Reserve’s expected interest rate hikes will have an outsized impact on this particular sector. For years, cloud computing services were some of the top gainers in technology, which itself outperformed the broader market. Since Bessemer Venture Partners created the BVP Cloud Index of publicly traded companies in August 2013, the basket is up 909%, almost triple the gains in the Nasdaq and five times better than the performance of the S&P 500. Zoom and DocuSign are each more than 50% off their 52-week highs and Shopify is down 34%. Asana was the best-performing U.S. tech stock last year until mid-November. The provider of project management software has since lost 58% of its value.

Cloud stocks as an index are down 29% from their November high. Many of the high growth stocks have been hit over rates which makes sense, but I just went big into a cloud venture fund (seed/A round) which my money will be wired next week. I think it is a very interesting space and do not mind this pull back. Good charts in the link.

The unemployment rate for Black Americans rose to 7.1% last month, even as the overall labor market improved and the ratio for White workers dropped closer to pre-pandemic levels. The increase in Black unemployment was driven by women, who saw their rate jump to 6.2% from 4.9% in November. Meanwhile the ratio for White female workers declined to 3.1%, the lowest since the Covid-19 crisis started. Overall, the jobless rate for African Americans ended 2021 at more than double that of Whites, which decreased to 3.2% from 3.7% in November, a Labor Department report showed Friday.

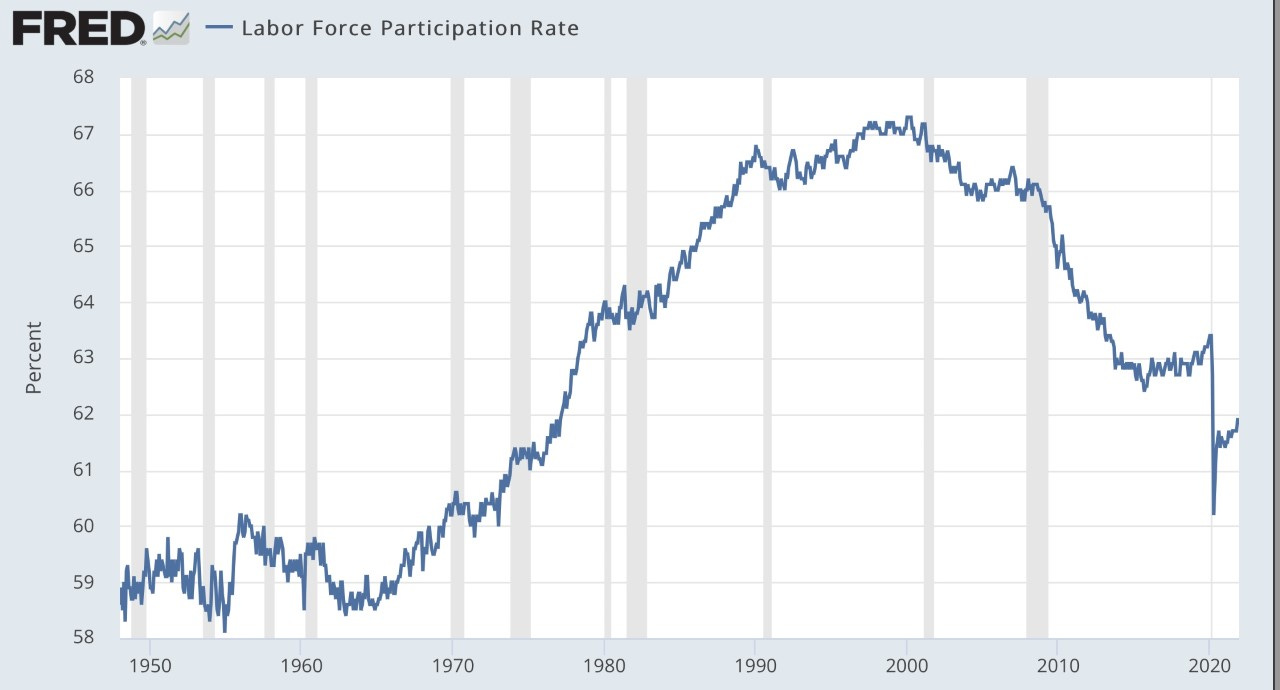

In terms of jobs for December, leisure and hospitality were the clear winners, and the data is summed up below bringing the unemployment rate to 3.9%. I did not think we would get to this level so quickly, but there is noise in it. The first chart, labor participation rate, is a bit concerning. In 2000, the participation rate was 67.2% and now it is 61.9%. The hiring in the hospitality and professional services sectors helped the broader U.S. economy add 199,000 jobs last month. Manufacturers, which added 26,000 jobs overall, hired 7,700 machinery workers, 4,200 motor vehicle workers and 1,600 furniture employees.

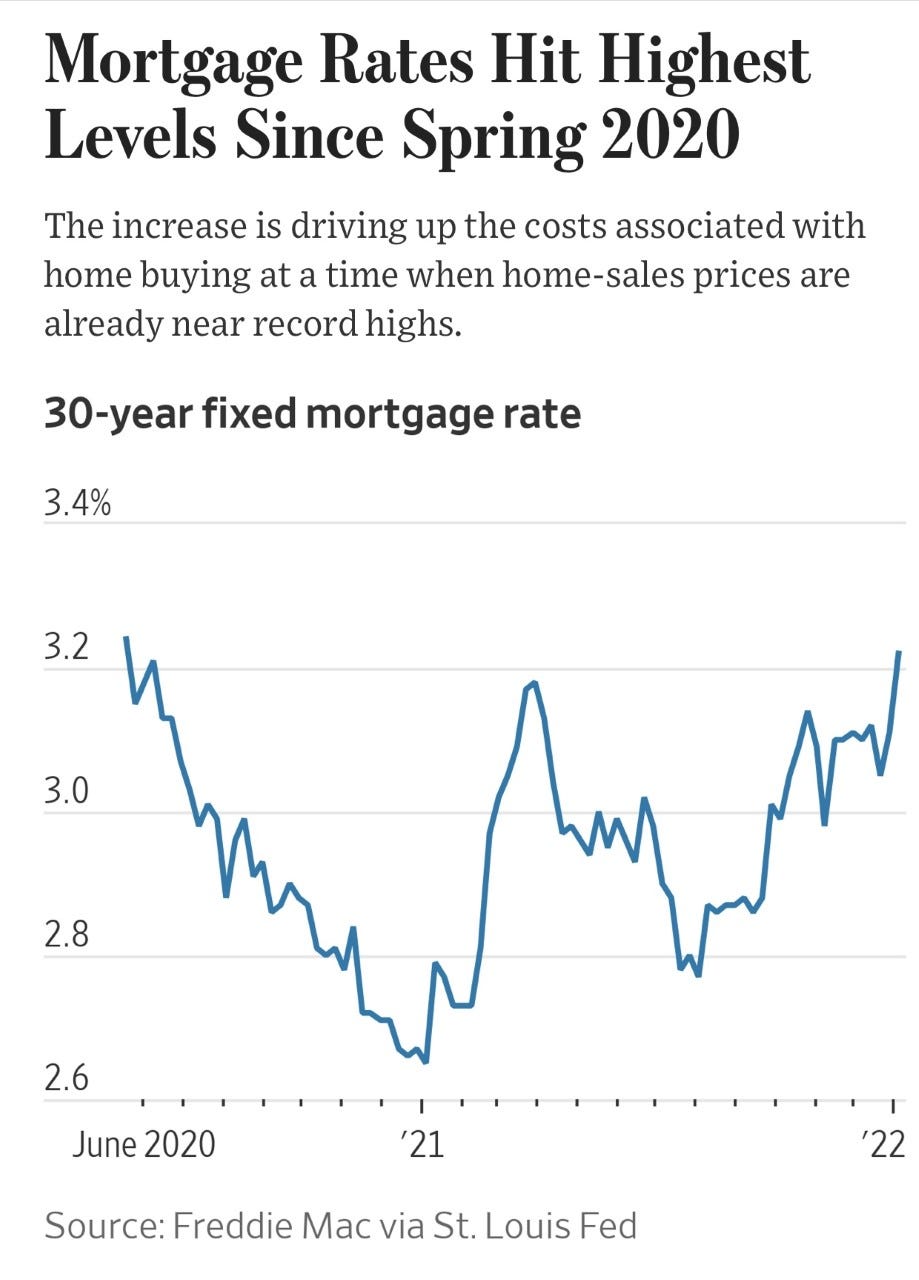

Mortgage rates this week rose to their highest levels since May 2020, driving up the costs associated with home buying at a time when home-sales prices are already near record highs. The average rate for a 30-year fixed-rate loan was 3.22%, up from 3.11% last week, according to mortgage finance giant Freddie Mac. A year ago, mortgage rates stood at 2.65%. Ultralow interest rates have been a major force in the housing boom of the last two years. Households that kept their jobs and saved money during the pandemic seized on low borrowing costs to buy bigger homes that could accommodate working or schooling from home. Second-home purchases and investor demand for rental properties also surged. I have been wrong on rates for a while. We are finally starting to see the rates market crack, which should slow down housing demand at the low to medium end of it continues. People are sensitive to monthly payments and rising rates, coupled with elevated prices, will make it harder to afford homes. The move in rates since 2021 means an incremental $150/month on a $500k mortgage.

U.S. Senator Joe Manchin’s $1.8 trillion spending offer he proposed to the White House in late 2021 appears to be no longer on the table following a breakdown between the Democratic lawmaker from West Virginia and the White House, the Washington Post reported on Saturday. Manchin told reporters this week that he is no longer involved in discussions with the White House and has signaled privately that he is not interested in approving any legislation like President Joe Biden’s Build Back Better Package, the newspaper said, citing three people with knowledge of the matter.

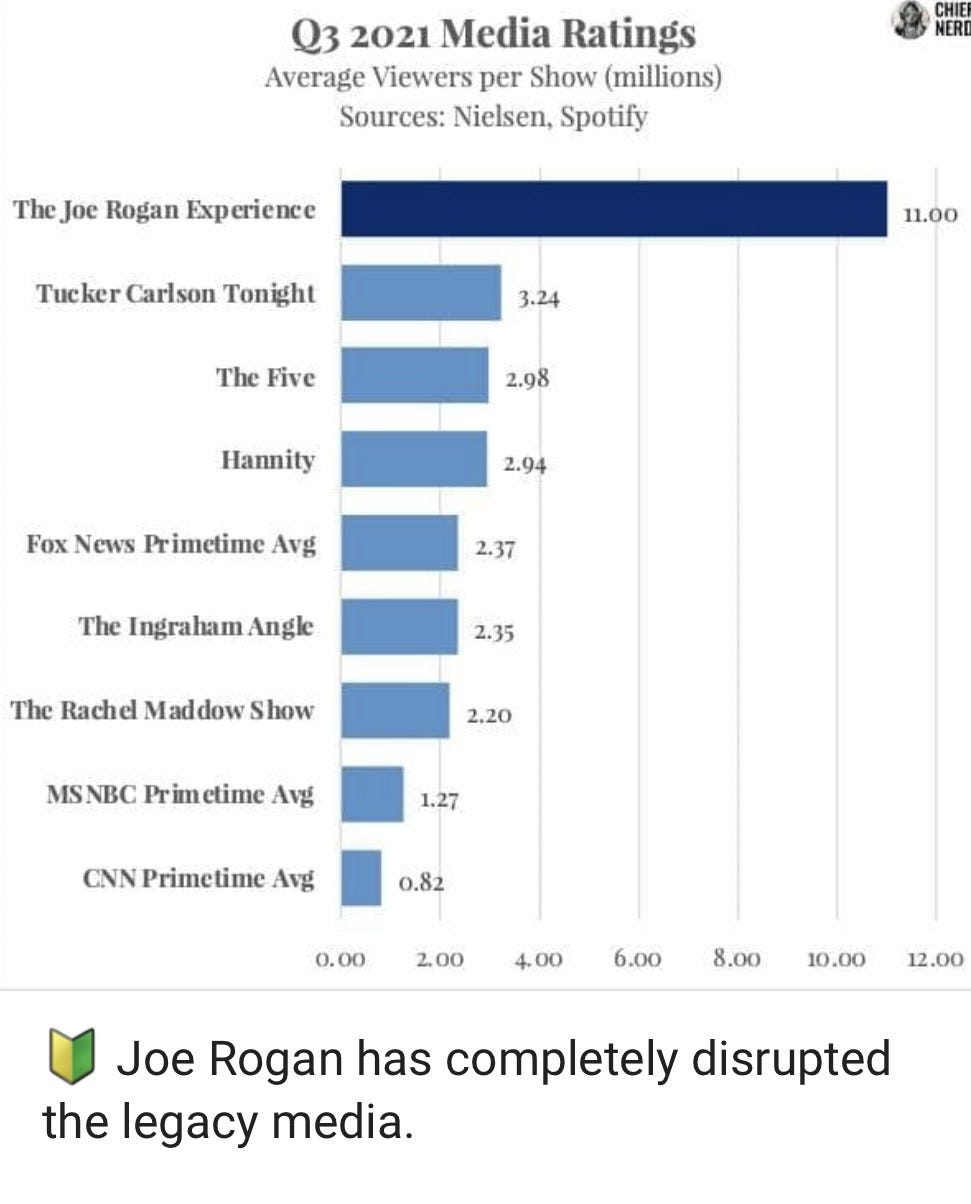

I have written extensively about media bias and the poor quality of coverage today in the news. I do not watch news on the TV anymore and I know a lot of my readers feel the same. Joe Rogan has crushed the traditional media with his numbers; No wonder he makes so much money. This article is very interesting and talks about the Power of Rogan and what he does to the profile of a guest. They liken it to being on the Carson Show in the 1980s. If you were a comedian who made it on the show and was asked to sit down on the couch, your career was made (Roseann Barr, Ellen DeGeneres, Stephen Wright, David Brenner, Jim Carrey, David Letterman, Jerry Seinfeld and so many others as outlined in this article. I loved Carson. Someone get me on Joe Rogan! If you are interested in what is going on with the media and want to understand the power of Rogan, read the full story. A picture is worth a thousand words, right? Rosen Report readers, help me disrupt and grow to 11mm. Forward the report to friends and colleagues and hit the heart/like button when you enjoy the piece.

A new report from U-Haul found that migration to southern states continued throughout the pandemic, with Texas being the top destination. Gone to Texas" was such a well-known phrase during early migrations to the state that people simply carved "GTT" on trees or fence posts when they headed west from the young United States. Now a highway version of "GTT" is underway, but it's headed from west to east: California and Illinois ranked as the states with the greatest one-way net loss of U-Haul trucks, and most of that traffic appears to have gone to Texas and Florida. So many Californians are leaving the once Golden State that the moving giant says it ran out of wheels for them to rent. California’s net loss was not as significant as it was in 2020, but here's the kicker: U-Haul says that was partially due to the fact that the company "simply ran out of inventory to meet customer demand for outbound equipment." I am consistent in my view that if you give your constituents crap and charge them full price, they will leave. The pandemic has shown that many can work from anywhere, and now more Americans have choices as they do not need to live in NY, IL, CA, NJ, CT. Here is a solution; Give your people a better quality experience and maybe they will stay. This story outlines Meta and its 589,000 square-foot lease in Austin, TX. Meta plans on continued growth in Austin. Maybe CA is just not giving its residents what they need? The data and exodus from CA suggests as much.

In 2021, Chicago went through one of its deadliest years in the last quarter-century. The medical examiner’s office handled more than 1,00 homicides last year: 836 were in Chicago alone, the most the office handled since 1994, according to the Chicago Tribune. In total, 797 people were killed in Chicago, which is the highest since 1996, when 798 were killed. Black people were the victims of 80 percent of the homicides handled by the medical examiner; males were 88 percent of the homicide deaths and the majority of the homicides were done by guns, according to the Chicago Tribune. The amount of overall gunshot victims has increased, with more than 4,300 gunshot victims in 2021 which is a serious increase from the 2,800 gunshot victims from just three years ago in 2018. A record number of more than 1,200 guns were taken by police in 2021 with 706 of those guns being assault weapons, a 61 percent increase from 2020.

Other Headlines

Sidney Poitier, Who Blazed a Path for Black Actors in Hollywood, Dies at Age 94

I was a big fan and loved the movie Guess Who is Coming to Dinner from 1967. The cast of this movie was INCREDIBLE!

GameStop surges on plan to enter NFT, crypto markets

I am reminded of 1999 when any company who put .com on the name surged to new heights. I may change the name of my newsletter to Rosen Report-crypto.nft.com to generate more buzz.

I am not the biggest O’Leary fan and I hope he is wrong.

Rivian Closes at Lowest Since IPO as EV Competition Mounts

The stock hit $179 in November and is now $86, which reduced the market cap by almost $100bn

Bring a Trailer sold $829M in cars in 2021, walloping auction houses

The Most Important Number of the Week Is $10 Trillion

Bloomberg piece about amount of bonds yielding negative globally, and I recall that number being over $18 trillion previously.

Jan. 6 anniversary: Biden blames Trump for insurrection in speech at Capitol

Florida man charged with attempted murder after allegedly strangling woman at bus stop

This seems more like a NYC, Chicago, SFO thing, but it happened in Miami

Florida resident tells ‘woke’ New Yorkers to head back north in scathing letter

Western Carolina University subjects RAs to mandatory 'woke' 'Gender Unicorn' training

Ahmaud Arbery's killers sentenced to life in prison for 25-year-old Black man's murder

Serial burglar keeps getting cut loose thanks to New York’s ‘great’ bail reform laws

“I’m grateful for [bail reform] because I’m too old to go to jail, I’m way too old, I can’t do it,” Charles Wold, 58, said in a phone interview Friday.

Masked Thieves Steal 20 Louis Vuitton Purses from Long Island Luxury Store

At this point, if I am a luxury store owner, I would have 24-hour armed guards

Conflict Quickly Emerges Between Top Prosecutor and Police Commissioner

This is a concerning development in NYC where the DA wants to decriminalize many crimes, while the Police Commissioner wants to make the city safer. Adams has said many things I agree with, but has not criticized the DA’s memo directing prosecutors to go soft on many crimes.

Mayor Eric Adams says allowing non-citizens to vote for NYC elections is ‘best choice’

I am not supportive of allowing non-citizens to vote in elections

New York Law Would Require Fashion Companies Show Social, Environmental Impact

Penn's Lia Thomas wins two races at tri-meet, loses 100-meter freestyle to transgender Yale swimmer

So a transgender swimmer loses to another transgender swimmer. I just think these rules are wrong and they should not be allowed to swim in these races.

CES 2022: Our finalists for this year’s top tech

CNN’s top finalists for top tech are incredibly cool (laptops, monitors, earbuds…)

Farmer gives cows VR headsets to reduce anxiety and increase milk production

I am incredibly impressed. How did the farmer think of this one?

Iran Revolutionary Guards commander says 'revenge' coming for Soleimani strike from 'within' US

Supreme Court appears poised to block Biden's vaccine and testing rules for businesses

Cyprus reportedly discovers a Covid variant that combines omicron and delta

A friend tested positive for both and was quite sick.

Mom allegedly stuffed son in trunk because he had COVID, needed to be quarantined

The mom in question is a school teacher in Texas and her son is 13 years old. Mother of the year. Who will want this moron as their kid’s teacher?

Virus/Vaccine

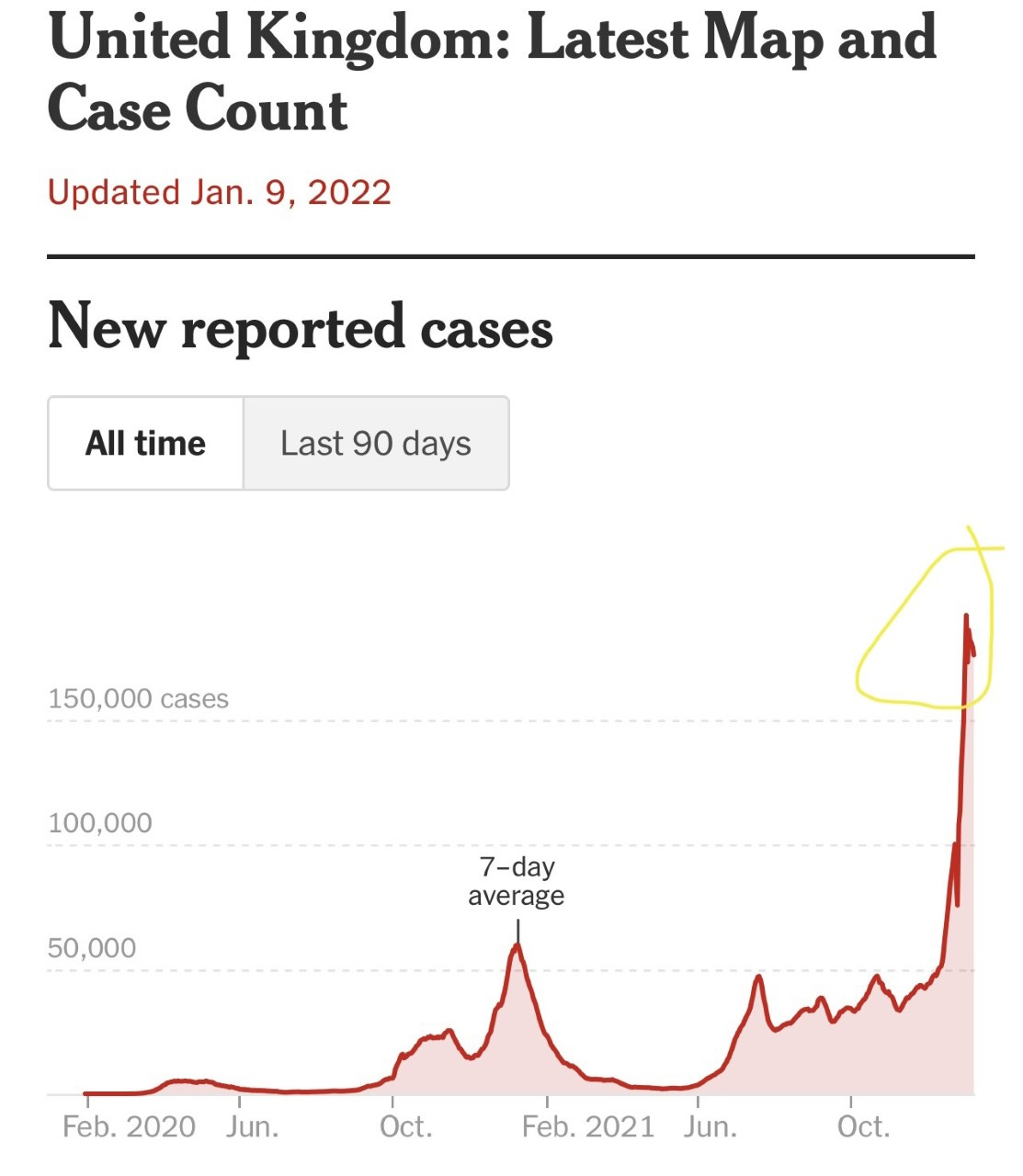

My daughter’s school had 86 positive COVID cases this week between students and faculty. Prior to this, for the month prior to break, I am not convinced there were 5 positive cases in total. However, I am beginning to see signs of case growth slowing. US cases are still growing quickly, but at a slower pace than last week even with the spike pose New Year’s due to reporting delays still in this week’s data. Some states appear to see cases leveling off such as NY, NJ, DC, Florida, Maryland, Louisiana, Ohio, Colorado, Tennessee, Nevada and others. See the second chart which I circled areas which show case growth slowing or shrinking in some places as an example. I hope that we are a couple weeks away from this breaking and based on the UK and South African curves I believe that to be the case. The UK cases peaked in the past few days (after 5-weeks) and are trending down.

US Cases grew at 226% and now average 656k/day, 120% more than the peak from last January. I would guess based on how hard it is to get a test, many more are untested or self-testing. I would not be surprised if the actual numbers are significantly higher than reported. The positivity rate is up to 26.3% for the US. Hospitalizations are increasing more sharply and were up 75% to 124k (see story below about hospitalization details) as not all are there due to COVID. Peak hospitalizations averaged 137k last January and it is clear we will surpass that in days. Deaths are climbing with an average of 1.5k/day which is up 12%. Deaths peaked at 3.3k/day in late January, a couple weeks after cases peaked. I was hoping for a better outcome, but the case data just overwhelmed. Given hospitalizations and deaths lag, I expect to see this data worsen in coming weeks. It is clear that even though you can get Omicron with the vaccine, your outcome is improved because of it. I also believe natural immunity is the best form. Shockingly, I keep testing negative despite being exposed a half dozen times in the last two weeks.

UK Cases May Have Peaked

This chart shows which states have the highest per hospitalizations per 100,000. Interestingly, 8 out of 10 states have a higher than US average vaccination rate. In the list below, only Ohio and Missouri are below the US average of 62% vaccination rates. I looked at deaths in NY state relative to Florida. NY has 60k deaths and Florida has 62.6k. NY state has 19.5 million people and Florida has 21.5mm people. There are 3.2mm over 65 years old in NY and 4.5mm over 65 in Florida. Based on the number of mandates, lockdowns and vaccinations, coupled with an older population in Florida, I would have thought NY would have had significantly improved outcomes death outcomes over Florida. In the US, 75% of the deaths have been 65 years or older and clearly Florida has a large number of citizens over 65. In NY, 16.5% of the population is over 65 and in Florida 21.5% of the population is over 65 years old.

I have written about my frustration with the CDC, WHO, NIH as well as hospital reporting during the pandemic. Many of those hospitalized are there for something else and tested positive with no symptoms, yet they are considered hospitalized for COVID. A Miami hospital has been sending out regular updates showing that approximately 50% of the cases are not COVID hospitalizations but tested positive while hospitalized for another matter. NY has decided to change reporting requirements and give more granular data. Gov. Kathy Hochul announced hospitals, will provide separate numbers on how many people are hospitalized because of COVID-19 and those who were admitted for other reasons, but subsequently tested positive for the virus and may have a mild or asymptomatic case. At NYU right now, 65% of the patients with COVID came to the hospital for another matter. according to this CNBC article. I am not trying to undermine the data, but want to be sure people understand the massive increase in COVID hospitalizations, is not as bad as it seems. This type of data should be made available nationally. How many of the 124k US hospitalizations are not actually there for COVID? Based on the states or hospitals I have seen which are breaking it out, I assume approximately 40-50% of the COVID hospitalizations are not directly caused by the pandemic. I feel that two years into the pandemic, as a country, we should have much better reporting of hospitalizations, deaths, positive case type, Ct scores…..It is shocking to me that we still have such crappy data. I do worry that given the case explosion, some hospitals will be at capacity despite the fact that Omicron is less fatal and requires a lower hospitalization rate. I am hopeful, as fast as Omicron came, it will start subsiding in weeks.

NY suggested they were prioritizing race in administering COVID drugs and now the Biden administration is doing the same. Guidance issued by the Biden administration states certain individuals may be considered "high risk" and more quickly qualify for monoclonal antibodies and oral antivirals used to treat COVID-19 based on their "race or ethnicity." In a fact sheet issued for healthcare providers by the Food and Drug Administration, the federal agency approved emergency use authorizations of sotrovimab – a monoclonal antibody proven to be effective against the Omicron variant – only to patients considered "high risk." The guidance, updated in December 2021, says "medical conditions or factors" such as "race or ethnicity" have the potential to "place individual patients at high risk for progression to severe COVID-19," adding that the "authorization of sotrovimab under the EUA is not limited to" other factors outlined by the agency. For the record, I am opposed to this type of prioritizing. The pendulum is swinging too far now.

In one European country after another, public health restrictions are steadily tightening. Italy declared a vaccination mandate for those over age 50. The biggest party in Germany’s governing coalition says it will decide by the end of March whether to try to push through a universal vaccination mandate. In France, Omicron is shattering caseload records even though more than 90% of people over age 12 have received at least two doses of the vaccine. That helped galvanize France’s lower house on Thursday to approve stricter requirements for obtaining the pass needed to go to bars, restaurants, cinemas and other indoor public spaces. If France’s upper house approves the measure, which could happen next week, a negative coronavirus test will no longer be sufficient. To participate in most forms of public life — going to concerts and sporting events, boarding flights and taking long-distance trains — people will need to prove, starting Jan. 15, that they have received the full recommended doses of the vaccine. I wonder what this does to tourism for Europe. Will it have a major impact this summer?

Real Estate

Today I have a mix of very high-end examples in South Florida and LA as well as general data on the broader housing market and what is forecast to be “hot” in 2022. I have more South Florida examples, but am keeping them in my back pocket for a day when I have nothing. The statistics in the Toronto article are startling and a sign that things must cool down soon.

A friend of mine is a Real Estate developer in Palm Beach, and a few weeks ago, I went to see a home he developed which at the time was yet to be listed. He listed the house a four days ago and they are being inundated with calls and have already received multiple offers. It is listed at $52mm and is at 1030 South Ocean Blvd with fantastic ocean views. They spared no expense, and the finishes are VERY high-end with tastefully done furnishings. The house is 14,000-feet, 8 bedrooms and 13 bathrooms. Tell them the Rosen Report sent you and you will get a massive discount. Yeah Right! It is just shocking to me how many people have the money to spend on a $50mm house.

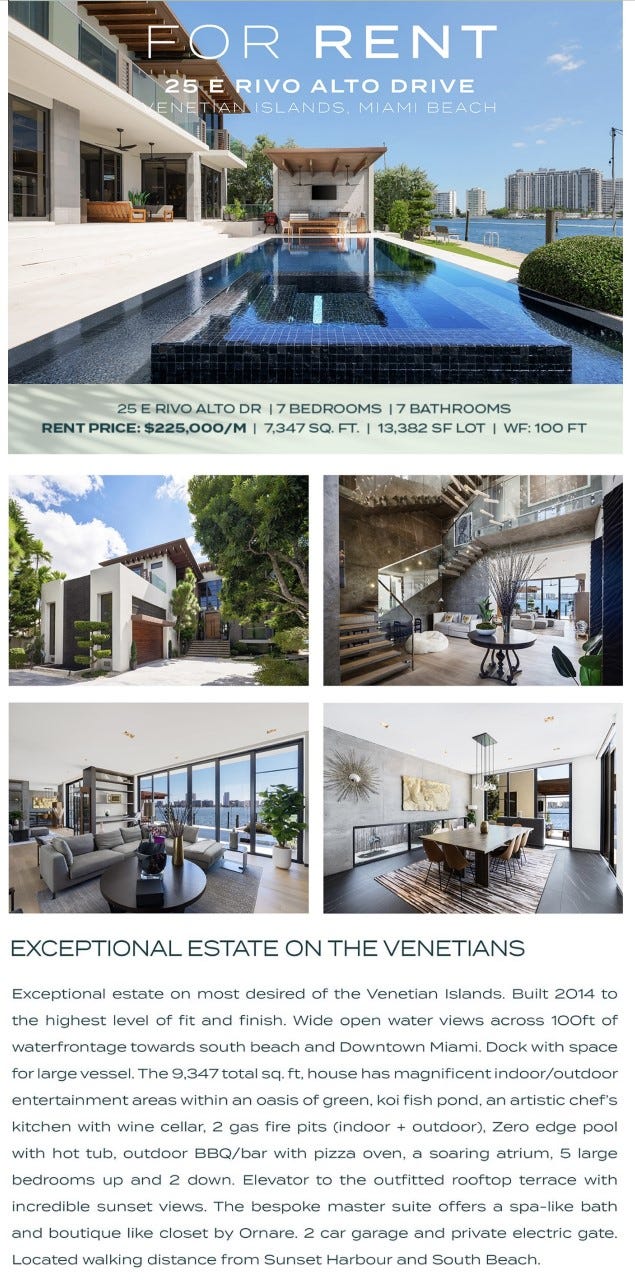

There is a house for rent in Miami on Venetian Island. The asking price is $225k/month for the 13,382-foot home with 7 bedrooms and 7 bathrooms. I will be curious to see the clearing price. I am told the house is worth in the low $20s millions. This ratio of price to rent seems off to me in the 10x range. It seems low, but the lack of high-end rent inventory in Miami is pushing up rental prices.

In a separate Venetian Islands story, a home built in 2019 (5500 sf waterfront on a standard 10,500 sf lot with 60 ft of water frontage struggled to be sold pre-pandemic for $13mm. It rented last year for 85k per mo for 6 months. The owner said for rent it’s $185,000 per month now and he’s already turned down $19M, said he wouldn’t sell for less than $23-25mm. The market for waterfront homes is just out of control. We are talking about a 10,500 foot lot.

Another mega mansion in LA is listed for $295mm. The 105,000-square-foot home is called, “The One,’ and is the most expensive in the country. I wonder of an environmentalist, Tech Executive will buy it despite the ridiculous carbon footprint. I don’t care how rich you are. Why does anyone want or need a house of this size with 21 bedrooms and 41 bathrooms. Of course, you need a 30-car garage and a bowling alley.

Interesting Zillow article on the housing market names Tampa as the winner for 2022 and lists the top 10 markets for 2022 (6 of them are zero income tax). The “coolest” markets should not surprise anyone if you have been reading the Rosen Report. Note the coolest expected markets and what they have in common. The housing market in 2022 is expected to remain hot overall, with many of the same trends that drove the market to new heights this year still firmly in place as we head into the New Year. But while all of the nation’s 50 largest markets are expected to grow healthily in 2022 and sellers nationwide should expect to remain in the driver’s seat, there can be only one Number One – and Zillow expects Tampa to top the list, with a host of relatively affordable and fast-growing Sun Belt markets following closely behind. Jacksonville, Raleigh, San Antonio and Charlotte fill out the list of the top five hottest markets for 2022, each buoyed by a combination of strong forecast home value growth, strong economic fundamentals including high job growth, fast-moving inventory and plentiful likely buyers. Additionally, these markets have historically not been particularly sensitive to rising mortgage interest rates or a slowing stock market – two risk factors for housing and the economy overall as the calendar turns. The coolest markets of the year are expected to be New York, Milwaukee, San Francisco, Chicago, and San Jose – each characterized by relatively fewer new jobs and less favorable demographic trends than other large markets, though still all expected to fare just fine on their own next year.

Apartment occupancy in the U.S. has hit an all-time high, meaning anyone looking for a new place is going to have a rough time of it. Fully 97.5% of professionally managed apartment units are spoken for as of December, the highest figure on record, according to data from the property management software company RealPage. That’s more than 2 percentage points higher than the occupancy rate in December 2020, a difference that represents hundreds of thousands of households.

Toronto, a city of more than 6.5 million people, has just 3,200 homes left for sale to start the year after a real-estate frenzy fueled by low interest rates drove the market to record levels. More than 121,000 homes were sold in Canada’s biggest city in 2021, up 28% from the previous year and smashing the previous high set in 2016, according to data released Thursday by the Toronto Regional Real Estate Board. Buyers competed for the dwindling number of properties by bidding up prices: the average selling price for the year was nearly C$1.1 million (about $862,000) in Toronto, also a record and up 18% from a year earlier, the board said. Sales got weaker in the second half as supply dried up.

A year ago, there were about 7,900 homes for sale. Rising rates and volatility in the markets should help to cool the incredibly hot housing markets.