Opening Comments

Last week, I was in Miami and checked out a restaurant, “Red Rooster.” It is a cool, hip comfort food place that received the “Bib Gourmand” designation from Michelin. My friend, Billy, and I ate some tasty appetizers and had drinks at about 5pm, and the food was impressive. We had mac and cheese, fried chicken, lamb chops, deviled eggs and a kale salad. Everything was very good, and the “Happy Hour” menu and drinks are quite reasonable. They served a Stags Leap Artemis Chardonnay for $6/glass at the bar or patio. Chef Marcus Samuelsson does it right.

A reminder that some email servers truncate my notes so you need to hit, “View Entire Message.” Make the email safe so it does not go into spam. If you download the Substack App, you will always have the Rosen Report, and I am told the layout is better. No Picture of the Day given the theme piece is longer today.

Kidney Donation and Perfect Scores May Not Be Enough To Get Into College

Markets

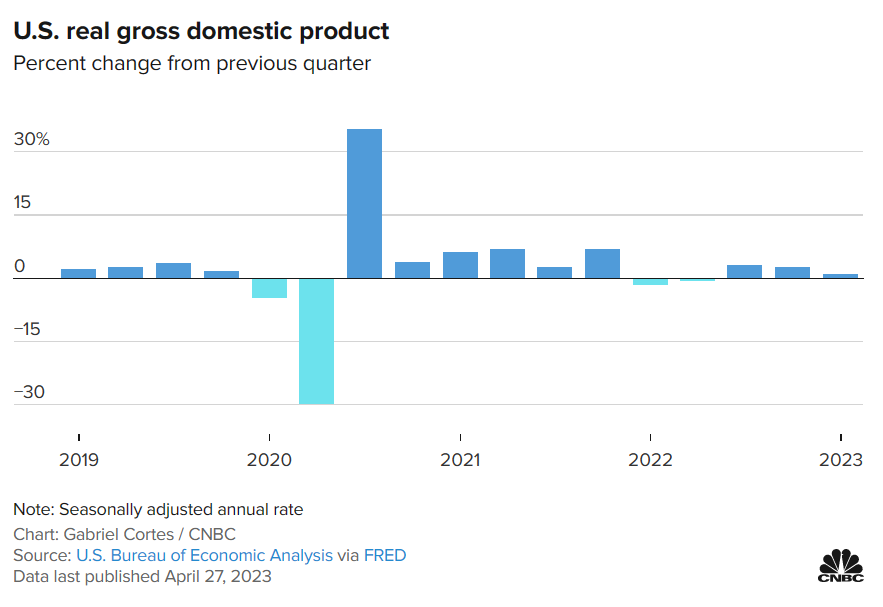

GDP/PCE

SPAC Crash In Pictures

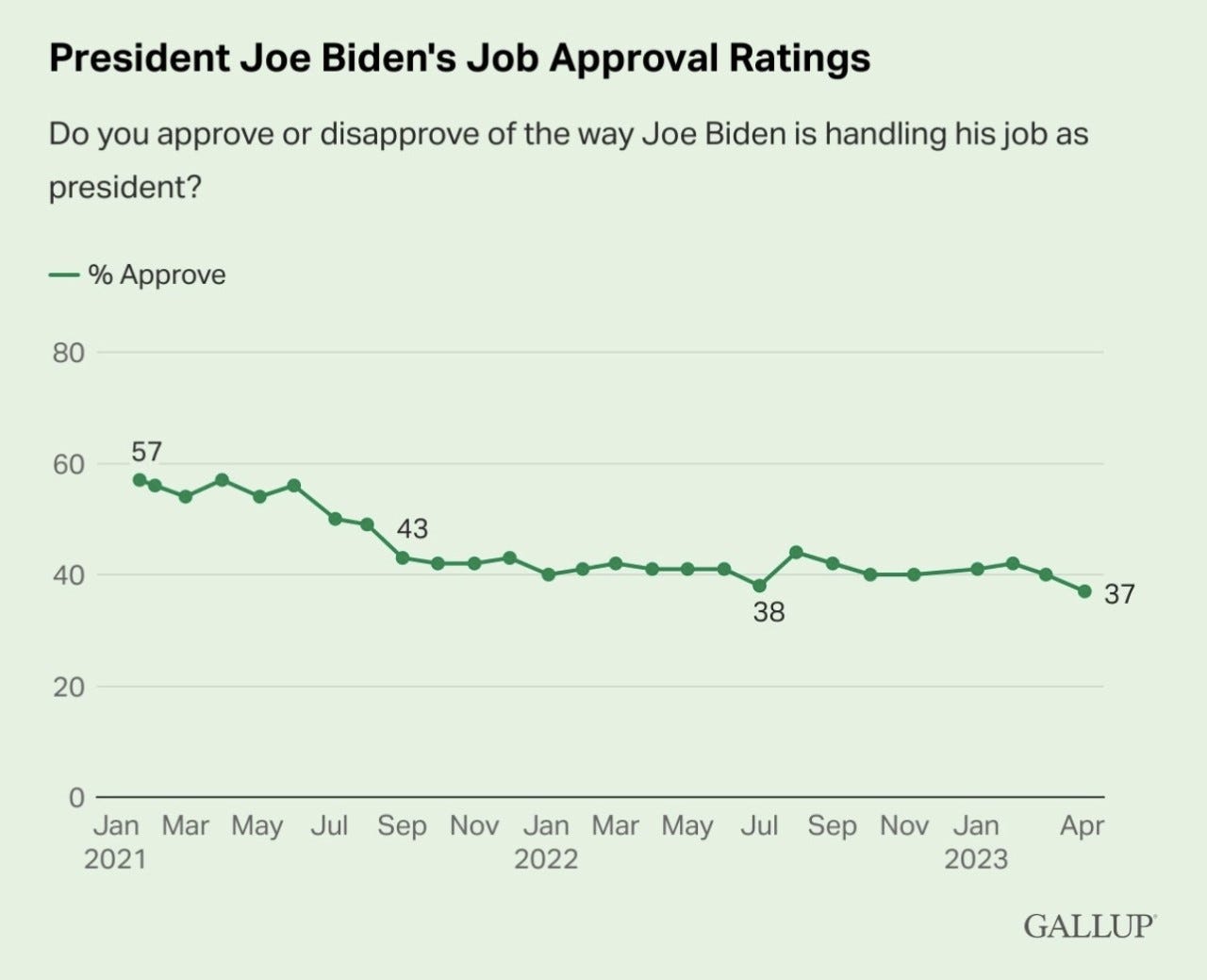

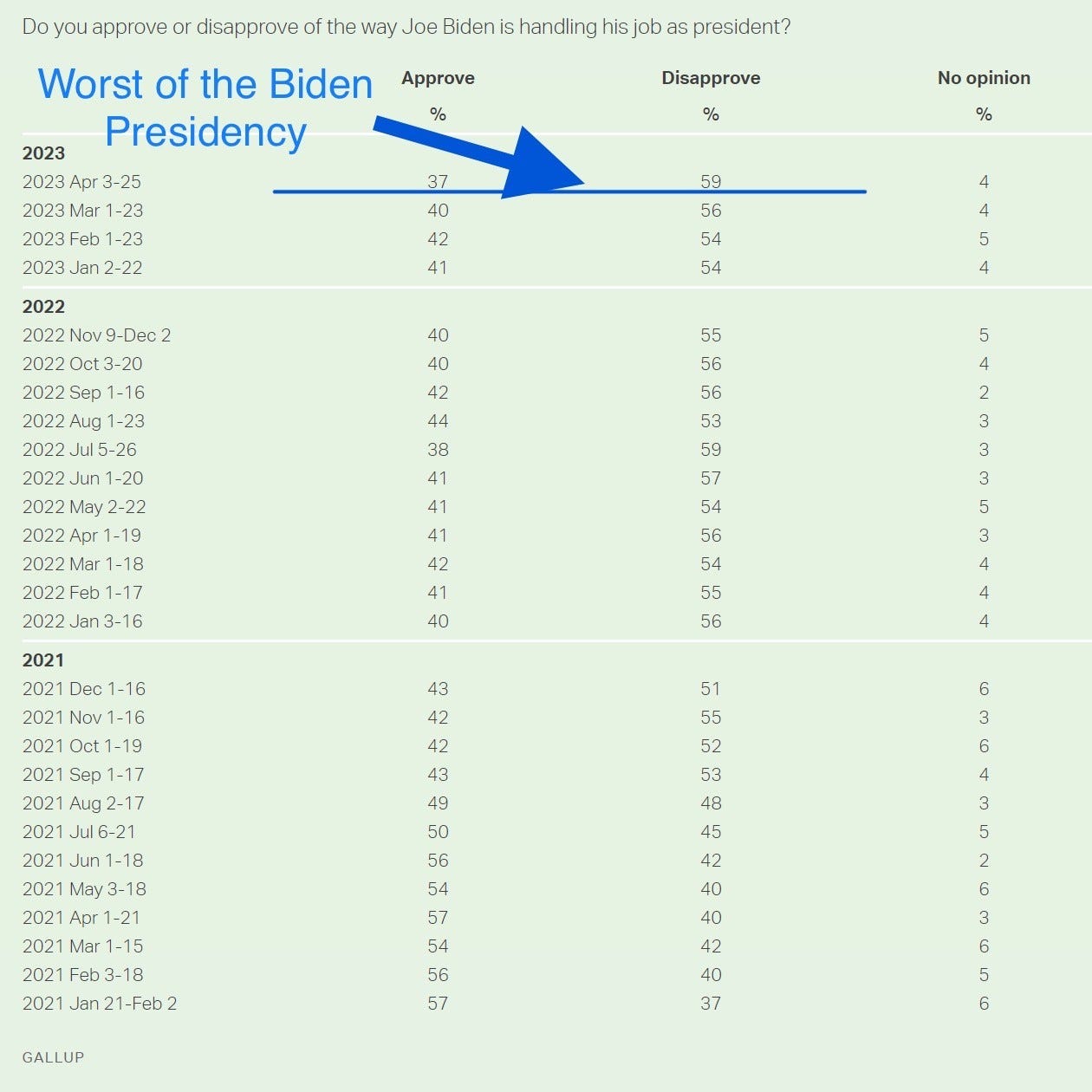

Biden Polls at the Lows of His Presidency

$80mm/acre in Miami

Vornado Shuts Off Dividend

SFO Office Building Down 80%?

Kidney Donation and Perfect Scores May Not Be Enough To Get Into College

My kids are high school freshmen and sophomores, and our college process has not started. Quite frankly, I dread it given how challenging it has become to get accepted into schools today.

I reached out to an old friend from NYC, Dr. Kat Cohen, founder and CEO of IvyWise, to help me with additional information on this insanely frustrating topic. IvyWise is an educational consultancy and hired dozens of former Deans and Directors of admissions from top schools. They seem to help improve outcomes, and their students are accepted at far higher rates than the average applicant.

One important note before reading these crazy stories. I am telling only half of the picture given I have not met all these kids, not seen recommendation letters, applications or the interview which are all critical parts of the admissions process. It is not just grades, board scores and extra-curricular activities today. Even one less-than-stellar recommendation letter can derail the application. Kat told me that soft skills and EQ are critical in the admissions process. Things like grit, resilience, responsibility, kindness, gratitude, classroom and community impact, and leadership play an important role and this all needs to show up in the profile. She also told me that today approximately 60% of applicants are women, making it harder for them to gain acceptance.

An article came out last week entitled, “Student with 2 published books, 4.2 GPA and 1560 SAT score rejected by Harvard, MIT, Yale and Princeton.” If you read this article and total this young man’s accomplishments, you would find it implausible that any school could reject him. What is even more shocking, many kids with fantastic applications are getting turned down by what I formerly considered “safety” schools.

One student received a near-perfect ACT score, straight As from a top boarding school with tons of extracurricular activities. The student studied hours a day to have a perfect application yet was rejected by 12 of 15 schools and virtually all of them did not even waitlist the student. In my day, the applicant would have gone 13 for 15, not 3 for 15.

Another student had numerous AP classes with straight As, and near-perfect board scores, was captain of an accomplished sports team, and learned sign language to teach deaf kids martial arts. I believe he went 3 for 12, and again only got waitlisted at a couple of the schools. Although he is happy at his ultimate landing spot, I feel given his credentials, he should have had far more college options.

I met a man last summer who told me a crazy story. He went to undergrad and grad school at a solid university. He donated a fair amount of money and was on the Board of the school for many years. His son applied to the school with a solid ACT score and basically straight As. The kid is a shoo-in, right? Not so fast. He did not get accepted. The man called up the dean of admissions who told him, “We are focusing on first-generation collegians and diversity.”

As impressive and “hooked” as these students are, the process is very different than it was 10, 20, and even 30 years ago. Kids are much more connected. With the world at their fingertips, they’re able to research and apply to more schools than ever before. However, what this sometimes creates is this sense that perfect grades and test scores, and amazing accomplishments are all it takes to get in. When in reality, all the Ivies could fill their incoming classes three or four times over with the same caliber of excellent students.

Kat explained to me, “It’s easy to look at these students and say, ‘Wow, they’re so impressive they deserve to get into all these prestigious schools.’ But we don’t see the rest of their application, which is critical. It’s not just about IQ, it’s also about EQ. If the majority of applicants have the hard factors, like the grades and test scores, how does an institution select 20%, 10%, or less than 5% of them? They ask: who are we inviting to our campus? What kind of an impact will they make here in the classrooms and in the community? Were they ‘serial joiners’ or ‘jacks-of-all-trades-masters-of-none’ who had 25 different activities on their list? Hopefully not. Also, how will they fulfill an institutional need? This could be anything from needing more male classics majors to more students from South Dakota. This is why a holistic approach to admissions is so important.”

We have seen the admissions rate plummet as much as 90% (Columbia) between 1990 and 2026. Check out the acceptance rates 20-30 years ago at top schools relative to the low acceptance rates today.

Applications to these schools have exploded, but class sizes have not expanded at the same rate as applications – leaving tens of thousands of new students competing for a very limited number of spots.

The Common App has over 1,000 colleges, which has grown dramatically over the past 25 years. The Common App and the elimination of board scores at many schools have propelled the number of applications dramatically in recent years. Couple this with an inflow of international students and a focus on diversity and first-time collegians and many applicants who were once shoo-ins are now scrambling. There are now over 1,800 schools that are test-optional or test-blind. This was virtually unheard of 20 years ago.

Another interesting factor is the ability to tour a school online. The cost of physically touring schools is high for many families and today, you can search the web and get a great idea of campus life. This is a good thing as schools now attract a broader group of students. Lastly, diversity is playing a large role in the process and the number of diverse candidates is up sharply in the past 20 years. Historically underrepresented groups (Blacks, Hispanics, Asians, Native Americans, First-time Collegians, LBTGQ…) are now far more regularly accepted than at any time in history.

It’s important to note here that elite colleges aren’t just looking for highly accomplished students. They’re looking to build a community with a rich and engaging student body.

“It’s not can you get the A, it’s HOW you get the A.” Kat told me. “Students need to go above and beyond and make an impact in the classroom, raise the level of learning for their peers, and make the classroom a more dynamic place. We counsel students in high school on how to work on these soft factors, build strong relationships with their recommenders, and build a strong profile that will demonstrate how they’ll fit into the fabric of the school and make an impact on the campus community because this is really important when students are being evaluated.”

Look at Duke, in 1980, they had 9,900 applicants and a 30.25% acceptance rate. In 2001, the school had 14,647 applicants and a 21.0% acceptance rate. Now look at the class of 2026 which had over 50,000 applications and a 6.2% acceptance rate. Of note, if you apply for an early decision (ED), you significantly improve your chances of being accepted. In many cases, the acceptance rate basically quadruples on ED versus regular decision. For Dartmouth, the regular acceptance rate was 4.7% and the ED rate was 21.3%. For the class of 2026, Ivy League Schools ranged from 3.2% to 8.7% overall acceptance rate, while in 1992, it ranged from 15.8% to 30.6%.

What kids post online can come back to haunt them, and there are countless stories of rejection or admissions which are rescinded due to questionable behavior. Make sure your kids know posting anything which could be viewed as offensive is a very bad idea, even in private chats.

I am not looking forward to the Rosen family starting the college application process based on my research. I suggest if you can afford it, you consider hiring a college advisor such as IvyWise or others to help you navigate the challenging process. I am not convinced donating a kidney will sharply improve the chances of acceptance today, but hey, I have another one just in case.

Quick Bites

Stocks finished Thursday higher as strong results from Meta boosted tech-related names. The Dow advanced 1.6%. The Nasdaq jumped 2.4%, while the S&P 500 climbed 2.0%. It was the best day since January for the Dow and S&P 500 and since March for the Nasdaq. Meta shares leapt 13.9% after the company reported quarterly revenue that topped expectations and issued an upbeat forecast. Shares of other tech-related names such as Amazon, Alphabet, Microsoft and Apple also popped. After the close on Thursday, AMZN announced and beat on cloud and advertising revenue causing the stock to pop 10% after hours, but reversed after executives suggest cloud revenue growth would continue to slow. The stock ended up being -4% despite the earnings beat. Snap missed and fell as much a 20% on Thursday after the close, but finished Friday -17%. Cloudflare (web performance and security) had strong earnings, but revised guidance pushing the stock down 21%. “Macroeconomic uncertainty, which intensified over the course of Q1 with every failing bank, resulted in a material lengthening of sales cycles, a significant decline in close rates, even as win rates held strong, and an extreme back end weighting to the quarter. To give you some sense, almost half the new business closed in the last two weeks of the quarter, which is very nonlinear for us.” For the week, stocks were up nicely despite volatility with the S&P +.9% and the Nasdaq+1.3%. For the month, all major indices were up with the Dow+2.5% and S&P +1.5% and Nasdaq up slightly. According to CNBC, the gains in the market are concentrated on 10 companies which explains 93% of the gain. This lack of breadth is concerning. YTD, the S&P is +8.6% and Nasdaq+16.8%, while the broader Russell 2000 is +.4%. After a decent rally, oil lost ground again on recession fears and closed at just under $80/barrel. The one-day VIX is collapsing, suggesting the market thinks the Fed raises are coming to an end soon and inflation will be tamed. Treasuries rallied on the week, with the 2-year -12bps to 4.02% on volatile economic data.

RDI-5-RDI explained.

Growth in the U.S. slowed considerably during the first three months of the year as interest rate increases and inflation took hold of an economy largely expected to decelerate even further ahead. Gross domestic product, a measure of all goods and services produced for the period, rose at a 1.1% annualized pace in the first quarter, the Commerce Department reported Thursday. Economists surveyed by Dow Jones had been expecting growth of 2%. The growth rate followed a fourth quarter in which GDP climbed 2.6%, part of a year that saw a 2.1% increase. The report also showed that the personal consumption expenditures price index, an inflation measure that the Federal Reserve follows closely, increased 4.2%, ahead of the 3.7% estimate. Stripping out food and energy, core PCE rose 4.9%, compared to the previous increase of 4.4%. With inflation still running higher than normal, this GDP slowdown is concerning. Also of note, the KC Manufacturing Index (average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes) fell (3rd chart). The personal consumption expenditures price index excluding food and energy increased 0.3% for the month, in line with the Dow Jones estimate. On an annual basis, so-called core PCE increased 4.6%, slightly higher than the expectation for 4.5%.

The SPAC market was hot and now, not so much. This WSJ article is entitled, “SPACs Delivered Easy Money, but Now Companies Are Running Out.” More than 100 companies, including Bird Global Inc., Owlet Inc. and electric-car startup, Faraday Future Intelligent are running out of cash, according to a WSJ analysis of the companies.’ Shares of many of these companies trade under $1, more than 90% below where they did when they went public, and are in danger of being delisted. Those that have raised cash typically have done it on onerous terms. There are charts showing 25 SPACs running out of cash and I inserted one of them (2nd Chart).

Gallup had a poll come out late last week which showed Biden’s approval rating at the lowest of his presidency at 37%, while his disapproval rating is at an all-time high of 59%. The latest poll finds 83% of Democrats, 31% of independents and 4% of Republicans approving of the way Biden is handling his job. The reading among independents ties as his lowest for that group and represents a nine-point decline since February. Even the most hated President of all-time, Trump, had a higher rating at this point at 41.6%. In the polling, 75% believe the economy is getting worse with only 19% suggesting it is getting better. High inflation, rising rates, major layoffs, bank failures, and recession fears are all weighing on voters’ minds. I struggle that Biden and Trump are the best the US has to offer. Please, can we get some new candidates? Clown show Trump announced he is retiring the name “Crooked Hillary” for “Crooked Biden.” Former Vice President Pence testifies to federal grand jury investigating Donald Trump and January 6. Biden cheat sheet shows he had advance knowledge of the journalist's question and there are pictures to prove it in the article. The leader of the free world cannot answer questions without getting them in advance? The LA Times denied submitting questions to the WH ahead of the press conference. Look at the picture and you tell me.

Other Headlines

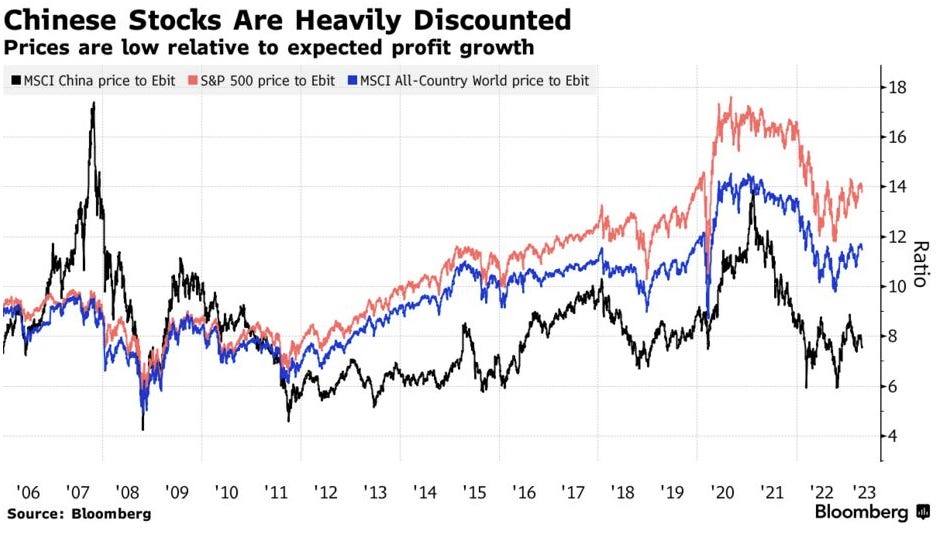

Darkening Gloom in Chinese Stocks Puzzles Wall Street Veterans

Bets Offering 2,400% Payout on US Default Lure Growing Crowd

Low likelihood of default, but lots of noise between now and agreement.

JPMorgan Creates AI Model to Analyze 25 Years of Fed Speeches

Economists use ChatGPT-based language to detect signals. Firm plans to expand tool to cover more than 30 central banks. The potential impact of AI is massive and will eliminate the need for countless jobs over the next five-ten years.

Deutsche Bank Plans More Job Cuts After Traders Trail Peers

Fixed income trading slumps 17%, trailing Wall Street peers. Since the GFC, DB has never rebounded and is a shadow of the former company in terms of the investment bank.

First Republic most likely headed for FDIC receivership, sources say; shares drop 46%

Despite $30bn in deposits from major banks, the market has no faith in First Republic. The stock -98% YTD to $2.3/share-market cap $433mm. Feb 2023 high was $148/share. The bank had $233bn in assets at the end of the 1st Q. We have seen SVB, Signature, and First Republic (3 of the 4 largest bank failures in the US all-time). Who is next? Story that JPM and PNC are bidding on First Republic in conjunction with the FDIC takeover with bids due Sunday afternoon. Given JPM’s size and deposit base, they need special approval. Of note, emergency loans from Federal Home Loan Banks hit a record of $1.04 trillion in Q1, the highest level since the GFC.

Fed report on SVB collapse faults bank's managers — and central bank regulators

Meta shares are up 170% in five months despite virtually no revenue growth

Harley-Davidson Says Repo Shortage Is Fueling Credit Losses

Harley suggested its credit losses were due to a shortage of repossession agents. The repossession industry is seeing an uptick in demand as more Americans struggle to afford their car payments.

Samsung’s profit plunged 95% to its lowest level since 2009 as chip demand slumps

Intel reports largest quarterly loss in company history

133% annual reduction in earnings per share. Revenue dropped nearly 36% year over year to $11.7 billion. However, the stock rallied 4.5% on Friday.

Dropbox to lay off 500 employees, or about 16% of its workforce

The pandemic drove Clubhouse to a $4 billion valuation that never looked sustainable

Late 2021, Tiger Global and DST invested at a $4bn valuation, up from $100mm 15 months prior. The company is laying off 50% of its staff. No new valuation is given in the article. I wonder where Tiger and DST have this position marked today?

SEC’s Gensler says ‘the law is clear’ for crypto exchanges and that they must comply with regulators

Bitcoin was +6% on the week, but fell 1.3% on Friday and closed at $29.3k.

Feinstein's absence allows Republican emissions measure to pass Senate by single vote

89-years-old and demented. She is costing her party due to her selfish ways. Mandatory cognitive testing is required now at all ages. Age/Term limits.

Eric Adams wants FEMA to ban cities from busing migrants to NYC — as 1,300 arrive this week alone

NYC pedestrians run for cover after gunman opens fire in Manhattan

Watch the short video. 5:45pm-Hell’s Kitchen. Lots of pedestrians.

Colorado teens charged in fatal rock-throwing spree took photo of victim’s car as ‘memento’

What is wrong with people? A 20-year-old young woman was killed and the animals went back to photograph the car.

5 dead in Texas shooting as armed suspect with AR-15 is on the loose

Americans are saving far less than normal in 2023. Here’s why.

The ramifications of ChatGPT and AI are massive. AI can do so many jobs currently done inefficiently by people. Everyone should spend an hour on Chat and AutoGPT to see what it can do. Remember, it only gets better and more efficient over time.

The No. 1 career mistake to avoid in your 20s, from a Google VP: ‘You risk plateauing your career’

Good thoughts in the article.

These are the 7 best large U.S. cities for starting a new business—New York and D.C. don’t fare well

Top diets for heart health, according to American Heart Association

Ukrainian drones hit oil depot in Crimea, Russian official says

Real Estate

The waterfront property that was the longtime home of the Miami Herald has been sold to a developer for a whopping $1.225 billion. The 15.5-acre site on Biscayne Bay in downtown Miami is being purchased by SmartCity Miami LLC, an investment group led by by Miami-based Terra and its CEO, David Martin, according to a news release from the seller, Genting Group. The price comes out to almost $80mm/acre. No specific plans have been announced for the property. I presume some combination of condo/apartment/office/retail on that much space in that location. Gotta go vertical at that price for the land.

I have written about Vornado and SL Green extensively. They are two large REITS that invest in NYC office and retail primarily and the stocks have been under real pressure. Vornado Realty Trust (NYSE:VNO) announced that it will postpone dividends on its common shares until the end of 2023, at which time, upon finalization of its 2023 taxable income, including the impact of asset sales, it will pay the 2023 dividend in either (i) cash, or (ii) a combination of cash and securities, as determined by its Board of Trustees. VNO also announced that, in order to enhance shareholder value, its Board of Trustees has authorized the repurchase of up to $200 million of its outstanding common shares under a newly established share repurchase program. Cash retained from dividends or from asset sales will be used to reduce debt and/or fund share repurchases. On the announcement, VNO stock fell 20%+, but recovered to -1% given the broad market rally on Thursday. Quite a turnaround after the dividend announcement. Remember, they have some of the best office and retail properties in NYC. Over the last year, VNO is -61% and SL Green-65%.

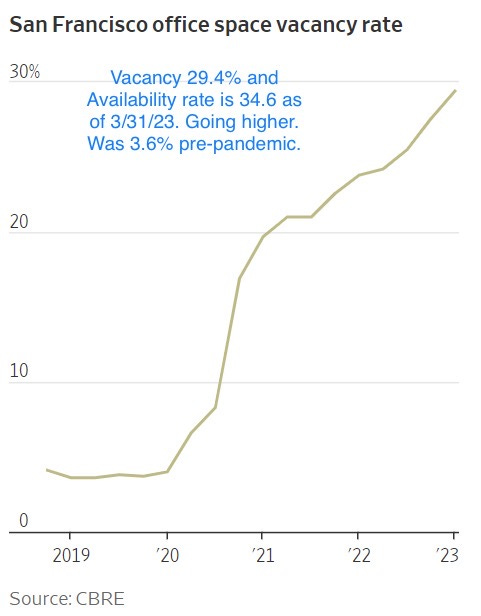

Before the pandemic, San Francisco’s California Street was home to some of the world’s most valuable commercial real estate. The corridor runs through the heart of the city’s financial district and is lined with offices for banks and other companies that help fuel the global tech economy. One building, a 22-story glass and stone tower at 350 California Street, was worth around $300 million in 2019, according to office broker estimates. That building now is for sale, with bids due soon. They are expected to come in at about $60 million, commercial real-estate brokers say. That’s an 80% decline in value in just four years. In another office building deal, less than a year after coming to market with a $160 million asking price, the office tower at 550 California Street owned by Wells Fargo is likely to sell for about one-quarter of that price, according to a source close to the deal.

The bank is currently evaluating several offers in the low $100 per square foot range, or around $40 million for the 355,000-square-foot, 13-story Financial District tower it bought for $108 million in 2005. Yes, WFH has contributed to the tech carnage on the SFO office market, but the homelessness, crime, and quality of life in SFO has been a big factor in the issues facing the city. The fact that cell phone usage remains 31% of pre-pandemic levels in SFO is telling and concerning. Major companies such as TLSA, HP, Charles Schwab, Oracle and many others have left the SFO area for greener pastures as well. Another new factor hitting SFO is First Republic which is poised to shed 750k ft in the city, as more than half of its 70,000 employees are in the Bay Area.

The spike in applicants is a combo of more foreign applicants + the colleges marketing themselves so they get more low quality applicants. This makes the acceptance rate look lower. The odds of getting in as a great student have decreased a bit but not all that much.

The test scores optional is also for legacies. Most kids of alumni are too stupid to get good SAT scores. Harder to accept them then. So just make it about something easier to fudge and then you can justify having the dim children of your alumni.

I spoke to head of admissions at a top school. The non legacy students who get in are all submitting test scores.

Eric,

Enjoyed the read. One reason for the sudden spike in applicants is also the concept of need blind financial aid. If you think about it a lot of kids from lower income families now have a good shot at getting an Ivy League education. In short, they apply to an Ivy League as an option and if they do not get in then they go to their state college.

At this point the whole thing is a crazy lottery, and unless they have some serious AI systems I fail to believe that these colleges do a good job in reviewing so many more applications. What really kills me is the unrealistic pressure being put on teenagers to have perfect (and completely unrealistic) resumes.

I think more people should read Frank Bruni's book: "Where You Go (to college) Is Not Who You'll Be." And more important than having an Ivy League degree is the idea that kids have resilience, balance, passion, integrity and a desire to make this a better world.

Lastly, I think that many of these schools should focus less on the brand and more on educating more people to solve important world problems. Malcolm Gladwell pokes fun at how the likes of Harvard love to sit on their billions of endowment money like Smaug the Dragon. I went to Penn and feel that if Ben Franklin where alive today he would take issue with this state of affairs.

David

'