Opening Comments

I am trying again to do an Audio Podcast today. I hope it works. I am working on hiring people to help me as this is far more challenging that I imagined. When you open the link, you need to hit play on the bottom. Audio only and 18 minutes long.

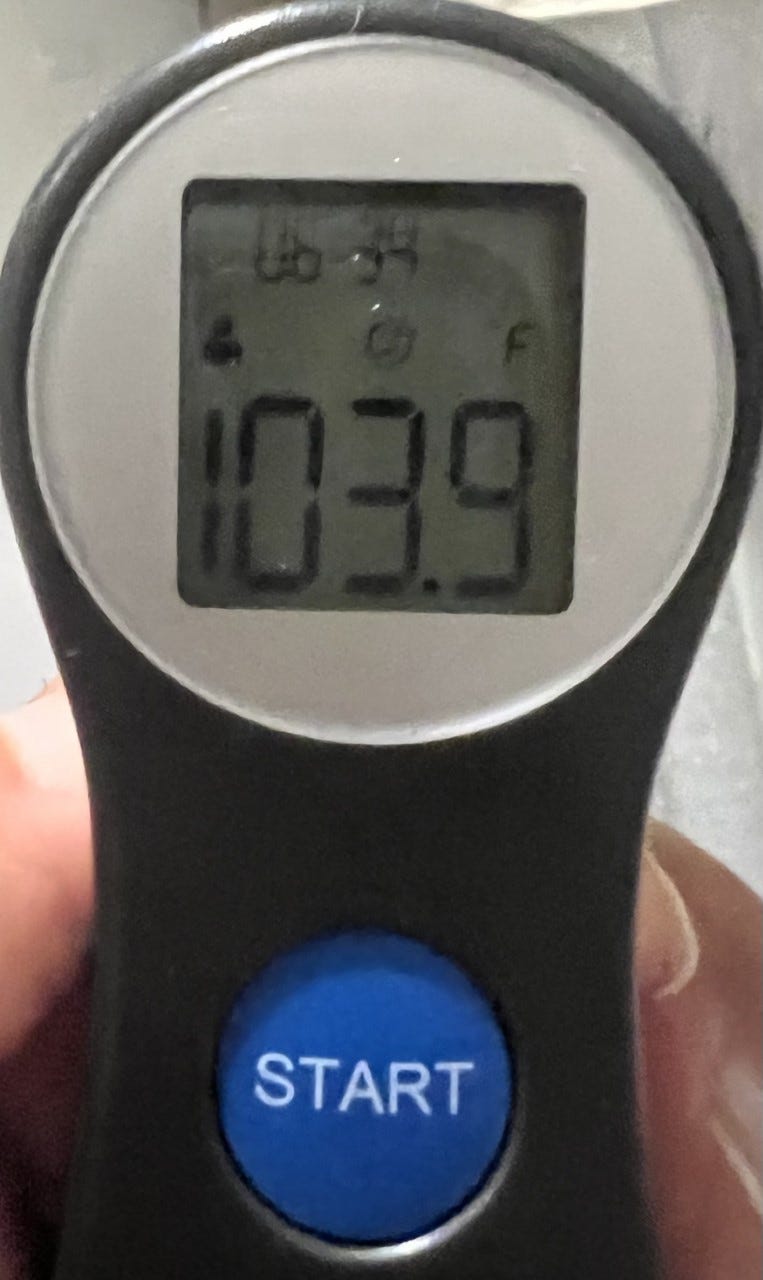

I had never knowingly had COVID until Tuesday, and I got it pretty bad. I went to the Urgent Care on Tuesday and waited a total of 2.5 hours. I do not have a primary care physician here, as it is nearly impossible, but it may be a future Rosen Report topic. The physician’s assistant at Urgent Care confirmed that I had COVID and suggested I did not have pneumonia after my chest X-Ray. She said my ears, nose and throat were quite irritated. She prescribed me Paxlovid. She did note that I was the first positive COVID test in weeks. My resting heart rate was 114 and it is generally sub 55. Tuesday night, my fever got as high as 105, but I was so delirious that my photo of the thermometer did not come out at 3am. I have lost almost 7 pounds since Monday evening, as I have only had one piece of toast. I am shockingly not hungry. I also lost my taste and smell, which is concerning given my love of food and wine. I am double vaccinated with Pfizer, but unboosted. You know it is bad when for the 1st time in over two years, I spent zero time on this edition of the Rosen Report on Tuesday. I was delirious and could barely read.

Picture of the Day

King Tides

Quick Bites

Markets

IPO Market Data

Work From Home

Dimon on US Energy Policy. I Agree 100%

Migrants Over Taking Public Schools

Other Headlines

Crime Headlines

Real Estate

$500,000 Parking Space in Chelsea, NYC

Weird Things in the Housing Market

The Repairs That Will Help Sell Your House in a Cooling Market

Buyer Bargains: Here Are the 10 U.S. Cities Where Home Prices Are Dropping the Most Right Now

Other R/E Headlines

Virus/Vaccine

Picture of the Day-Nature Pictures Taken By Drones

Red Train on a Mountain

Hippos in Tanzania

Fall Leaves

King Tides

When I went fishing the other day, I got to my boat and was shocked that I did not see the dock. It was under a couple feet of water which happens during the King Tide. The King Tide is a non-scientific term used to describe exceptionally high tides which tend to occur on full moons. I store my boat in a warehouse. and they use a forklift to take it out and drop it in the water the night before I need it. I generally go to the boat that night to set it up and needed to take off my shoes and socks to get on as the dock was under close to 2’ of water as seen below.

We just saw what high tides can do with over $100bn in damage due to Hurricane Ian.

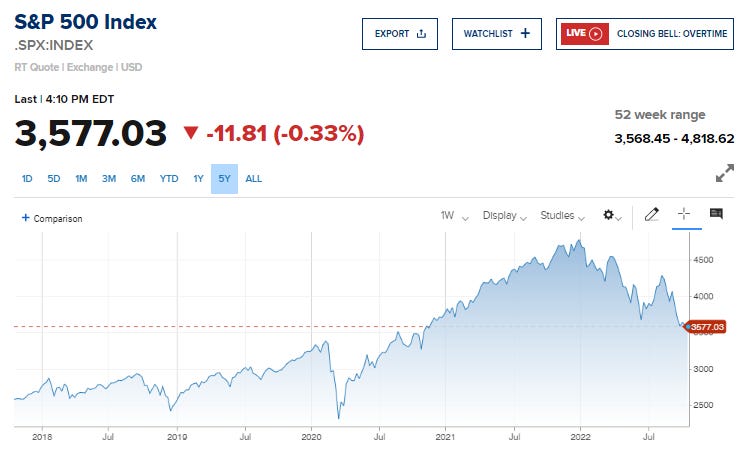

I have been clear that I did not buy into last week’s stock market rally, and I remain quite concerned about the economy, earnings revisions, rates/Fed, the strength of the US Dollar, Europe and geo-political risks. Inflation is concerning, but not as high on my list as I feel it is turning over. Of note, I do feel the carnage in SW Florida will be inflationary on wages and lumber roofing and other building supplies as there will be massive demand for cleanup and the rebuild.

Jamie Dimon came out Monday warning that a “very, very serious” mix of headwinds was likely to tip both the U.S. and global economy into recession by the middle of next year. He would not comment on the length of the recession but did guarantee volatile markets. He also warned that this could coincide with disorderly financial conditions. Remember, Jamie has more information than anyone. JPM has $4 trillion in assets and has millions of retail customers, card customers, mortgages, auto loans, commercial loans…. He has access to data up to the minute. It was at JPM that I connected the dots in 2007 about what was coming prior to the crisis.

NO, I am not that negative today, but am concerned. Banks are much better capitalized now and the banking system will not break in this cycle, but despite the recent sell-off, I see the potential for more pain ahead. Also of note, here is an interesting Bloomberg headline from this week: El-Erian Blames Fed for ‘Very High’ Risk of a Damaging Recession.

Getting into my boat with all my rods and equipment was quite challenging given the high tide and it made a mess. I just cant help but fear the tide is rising in a bad way with respect to the economy, earnings, and markets and not sure everyone is prepared for it.

I have written a great deal about the R/E markets and my concerns. A reader who is a R/E investor for a living had told me about how aggressive the brokers were late in 2021. Not returning calls, being obnoxious on feedback and just an over all attitude given how hot things had become. The brokers did not want to put in an offers below ask and were very cocky about listings. I put it in a couple Rosen Reports. My friend called me Monday to tell me how things had changed in recent weeks, and once obnoxious brokers are hounding him to make offers on properties that months ago moved quickly. My friend made an offer on an apartment building (15% below ask) a month ago and the broker told him, “The owner will NEVER accept that offer.” On Monday, the broker called back and asked, “Is your offer from last month still good? The owner will accept it now.” I believe we are starting to see more cracks and more will show in coming months. Also of note, he is putting in ‘insurance contingencies” on all offers as getting insurance in Florida is quite challenging. I had heard of financing contingencies, but not insurance. I strongly suggest it in Florida based on what I am seeing.

Personally, in the past few weeks, I have received a dozen calls from companies and individuals looking for quick money as their financing fell through or equity raise did not go as planned. I fear the King Tide is coming for the markets and we need to be prepared for it. Don’t get stuck at high tide like the guy below.

Quick Bites

Since the incredible rally October 3rd and 4th, the S&P is -5.6%, which puts it on below levels prior to that rally and levels not seen since November 2020. The S&P 500 closed lower Wednesday, notching a sixth consecutive daily loss and hitting a new 52-week low close as investors looked ahead to a key consumer report that will inform the pace of the Federal Reserve’s rate hikes going forward. Traders took a comment in the central bank’s September meeting minutes as a sign that the Fed may back off rate hikes in the event of more market turbulence, lifting stocks briefly. Participants judged that the Committee needed to move to, and then maintain, a more restrictive policy stance in order to meet the Committee’s legislative mandate to promote maximum employment and price stability, Year to date, the S&P is -24.9 % and the Nasdaq is -33.4%. The producer price index, a measure of prices that U.S. businesses get for the goods and services they produce, increased 0.4% for the month, compared with the Dow Jones estimate for a 0.2% gain. On a 12-month basis, PPI rose 8.5%, which was a slight deceleration from the 8.7% in August. If you look at the 10-Year Gilt (UK Treasury), the yields have exploded since August going from 1.8% to 4.4% despite interventions from the Bank of England. After hitting $93/barrel on Monday, oil has since dropped to $87 on the US dollar strength and demand concerns as recession fears are growing.

The IPO market has been decimated and is -94.1% for proceeds raised in 2022 relative to 2021. The number of IPOs with over a $50mm market capitalization has fallen to 64 YTD or -80.1%. Check out the 2nd chart showing IPO stocks sharply under-performing by approximately double of how much the broader S&P is down. Think about what the lack of IPO proceeds does to bank/investment bank revenues. What about the impact on states like CA in terms of income tax generation? Remember, CA tax receipts were huge in 2021 with the help of a hot IPO and M&A market. The last chart is global M&A which is better than I thought, but down sharply. NYC estimated income tax payments were 31% lower than last year.

I wrote no fewer than 30 times that I felt Work From Home would have a lasting impact on the way we live and work. The droves of wealthy to Florida who are sick of high crime, high taxes, homelessness, overly-woke rules, mandates and frigid weather are telling. This article outlines the numbers. What the Progressives fail to understand is the multiplier effect of one wealthy person leaving the city. They pay more in income tax, sales tax, consume more at retail and are responsible for many jobs due to their income and tax levels. I remain in shock at the number of young professionals from Miami to Jupiter. I was at a party Saturday night for a friend’s 50th and there were plenty of successful 40 somethings with families who have relocated down here. New York, California and Illinois lost thousands of “rich young professionals” who fled the Democrat-run state for low-tax havens like Texas and Florida, according to a study. New York had the largest net outflow of young professionals — 15,788, the study found. A whopping 28,741 moved out, while 12,953 moved to the state. Illinois has also been hemorrhaging under-35 workers, the study found. The Prairie State lost 9,386 young professionals while gaining just 6,527 — a net outflow of 2,859. Major companies are leaving CA, IL, NY, NJ, CT… and going to FL, TX, NV, TN…The impact on state budgets will be felt far more this year. Tyson foods announced they are leaving Chicago, just like Boeing, Caterpillar and Citadel.

Cutting back the development of oil and resources in the name of addressing climate change concerns is getting energy backward, according to J.P. Morgan bank CEO Jamie Dimon. “Well, I think we’re getting energy completely wrong, which is, you know, ever since the war started, we’ve known that Europe is going to have a problem and that it was pretty predictable that Putin was going to cut off some gas and certain oil, and oil prices go up,” he said in an interview released Tuesday. “And by the way, for the climate folks here, it’s made the climate worse, because people had this bad assumption that high oil prices and gas prices reduce consumption, reduce CO2. No. Poor nations, India, China, Indonesia, Philippines, Vietnam, are turning back on coal plants, as are rich nations called Germany, Netherlands, France,” he said. “In my view, America should have been pumping more oil and gas, and it should have been supported. You know, we’re trying to have our cake and eat it too.” He also stated, “This should be treated almost as a matter of war at this point, nothing short of that.” I could not agree more with his thoughts and have written about this extensively. It is almost as though Jamie is reading the Rosen Report. The US has the in-ground reserves to be truly energy independent, but we lack the proper energy policy to do it. The oil industry is vilified and does not want to make investments for obvious reasons. However, this article suggests the Biden Administration begged Saudi officials to delay the 2mm/barrel/day production cut until after the election. We don’t need them, but due to bad policy, we are now reliant on them. Come on, man! The chart below was in my last piece, but it is very important and a scary view of future US oil production. This chart is a precursor to sharply lower US production thanks to horrible domestic energy policy.

A Manhattan public school with just one certified bilingual teacher is reeling under the weight of a sudden influx of migrant students who don’t speak any English. “We’re overwhelmed,” one frustrated teacher at PS 33 Chelsea Prep said Tuesday. “We’ve all got migrant students in our classrooms. The teachers don’t speak Spanish. There’s no resources helping us out right now — it’s a very challenging situation.” One outraged mom said migrant kids — easily identified by lime green ID tags that hang from their necks — have swelled the size of her daughter’s class from 15 to 20 kids. There are many costs associated with a bad border policy. This is a perfect example. Swelling class sizes with kids who speak no English must be incredibly disruptive. Instead of 2.5mm illegals/year, allow, 25k/month to give cities the opportunity to digest the flow of people. The systems are breaking due to bad policies. One school claims to have 90 migrant children. How is this fair?

Other Headlines

Paul Tudor Jones believes we are in or near a recession and history shows stocks have more to fall

Fed’s Evans says fighting inflation is the top priority even if that means job losses

Banks and Tech started layoffs. They are highly compensated jobs. Meta had been on a hiring spree and now letting go upwards of 12k.

Uber, Doordash plunge as Labor Dept proposes gig worker change

The share of unemployed Americans who quit or voluntarily left their jobs rose to 15.9% in September.

Federal Officials Trade Stock in Companies Their Agencies Oversee

From fringe to front row: Congresswoman Greene rises in GOP

This woman scares the hell out of me. She has said countless crazy things, but my favorite was: Ms. Greene suggested in a 2018 Facebook post, that a devastating wildfire that ravaged California was started by “a laser” beamed from space and controlled by a prominent Jewish banking family with connections to powerful Democrats. How can an idiot like this get elected into office?

The Kanye West Tucker Carlson didn’t want his audience to see

Why would anyone want to protect this nutcase?

Tufts slammed for suggesting diversity series should be separated by race

Wharton Welcomes Two New Majors and Concentrations: DEI and ESGB

A Harvard nutritionist shares 6 brain foods that will help your kids stay 'sharp and focused'

Levi’s 1880s Jeans, Sold for $76,000, Reveal a Complicated History

Crime Headlines

2 teens shot outside New York Rep. Lee Zeldin's Long Island home while daughters inside

Homeless woman sought in ghoulish NYC pickpocket of dead pedestrian had 40 prior arrests

Who do these idiotic, soft-on-crime policies help?

NYC man released without bail for McDonald's ax attack arrested again and released without bail

Good Samaritans trying to stop robber tossed into Central Park lake by NYC thief

Killings in NYC subway system skyrocket to highest level in 25 years — even as ridership plummeted

Seattle Police policy would let DUI suspects flee even if in stolen car

Read this report and you might throw up in your mouth. Nothing could get me to live in Seattle. DUI with a stolen car and no charges? What is the world coming to today?

Illinois Democrats acknowledge 'tweaks' to SAFE-T Act language could be made following public outcry

Wait, did the idiot politicians in Chicago try to get to a better answer than NO CASH BAIL? Let’s dare to dream. Listen to the video in the link. SCARY.

Florida man shot at homeless family of 5 in car, struck pregnant mom

Real Estate

Peter, a loyal reader, sent me this story which covers the cost of a parking spot at the Maverick in Chelsea (NYC). What is the cost you ask? Try $500,000. The city says off-street parking spaces must measure at least 153 square feet but be no larger than 300. If Maverick’s spaces are on the small end, they would cost almost $3,300 per square foot, or double the median cost of $1,618 per square foot for actual living space in Manhattan, research firm Miller Samuel found. But if the parking spots are big, then the cost would be closer to the asking prices for Maverick apartments, which are around $2,200 per square foot. I have a four-car garage in Florida. My days of paying $1,000+ month to Park are gone. In most places, $500k gets you a decent home. For perspective, the average price of a house in the US was $525k as of June 2022 according to the Fed for homes sold.

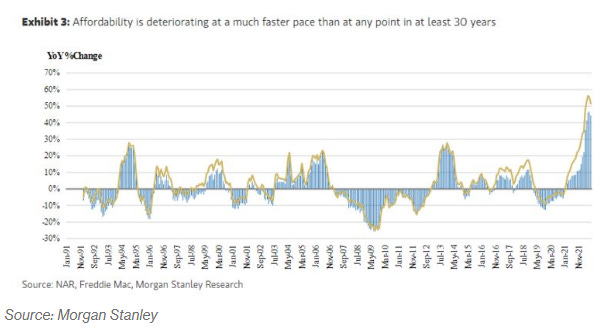

There are amazing charts in this Bloomberg article entitled, “Here’s How Weird Things Are Getting in the Housing Market-We’re hitting milestone after milestone in the US.” There are another half dozen charts to see in the link. The article is balanced and talks about some pros and cons with the pro being low housing inventories.

The Repairs That Will Help Sell Your House in a Cooling Market

Between mid-July and mid-August, about 95% of home sellers made updates or repairs before listing their properties, up from 71% of sellers six to 12 months ago, according to Realtor.com. They spent an average of $14,163. The top three interior remodeling projects with the highest return on investment are a hardwood-flooring refinish, new wood flooring and an insulation upgrade, according to a recent National Association of Realtors report. Some sellers might find that smaller fixes such as a fresh paint job can make a bigger impression on buyers than pricier changes such as a renovated third bathroom, real-estate agents said.

Buyer Bargains: Here Are the 10 U.S. Cities Where Home Prices Are Dropping the Most Right Now

Other R/E Headlines

It’s bad enough mortgage rates are over 7% – now it’s harder to qualify for a home loan

For perspective, when mortgage rates were 3% in January, a $1mm mortgage payment would have been $4,200/month and today, at 7.125%, it is $6,697/month.

Billionaire Schmidt-Backed Building Seeks Top Miami Beach Rents

The article outlines top rents in the Eric Schmidt backed South Beach office tower of as much as $170/ft and the average in Hudson Yards of $133/ft.

Virus/Vaccine

Escalating job losses coupled with elevated mortgage rates paint a rather cautious picture for both residential and commercial real estate. Paying SOFR+6.25% while purchasing 3.5 CAP property will lead to serious disappointment to both active and passive RE investors.

Thank you for the concise summary, Eric

Thank you for mentioning the king tide. It measured 3.2 ft when Ian swamped us here in Naples. That tide exacerbated the flooding monumentally!!