Opening Comments

My last note, “The Brilliance of Eric’s Stupidity,” hit a chord with many readers who shared their stories with me. To best follow today’s story, I suggest you read the title section from the last note first.

I am going to start to put in the most read links from the prior piece and one link had far more than any other opens: Harvard-trained psychologist: If you use any of these 9 phrases every day, ‘you’re more emotionally secure than most.’

The migration to Florida is well documented. I have discussed the issues around infrastructure with respect to schools, traffic, hospitals, and doctors and the challenges of getting into them. Forget about joining a nice golf club, it is nearly impossible today. I own a Kia Telluride and need an oil change and my reverse camera adjusted. I could not make an appointment in a reasonable period of time and was told to drop off the car without an appointment. I tried to do it and the service tech told me it would need to stay 3-4 days with no loaner. I asked if I could bring it back when there is an opening and he said, “No. You will go to the back of the line.” We are “weeks” behind schedule.

I want to thank my loyal readers for all the story ideas and emails. I am now receiving up to 1,000 emails a week from readers with ideas, comments, suggestions and new stories. Given I do this alone, the help is appreciated. Remember, some servers truncate the report and you need to click, “View Entire Message,” to see the whole thing.

Markets

Where is Economy Headed?

Hedge Fund Talent Wars

US Birthrate Stagnating and Implications

Musk on R/E Markets

Investors are Cooling on Housing

Boca Raton High End Since 2017

New Home Purchases by Investors is Down Sharply

High-End Summer Hamptons Rentals-Short Term

Video of the Day-Orangutan Kissing a Baby

Orangutans are amazing animals. They share 97% of chromosomes with humans, while chimps share 99% with humans. This video shows an Orangutan at a zoo, tapping on glass to see a 3-month-old baby up close. It then kisses the baby. In this video, a chimp reunites with his caretakers after 6 years and the interaction is moving. Wow, the chimp is an awful lot like a person. Both videos are short.

Mentoring NBA Players

You need to read the last note, “The Brilliance of Eric’s Stupidity” to understand this story about my time mentoring NBA players.

I had completed my disaster shoulder surgery in December of 2008 and was doing physical therapy in Midtown Manhattan with Tim Stump. Due to my infection and complications from it, my PT lasted almost a year. One evening, Tim was doing his best to make me cry by pushing me to improve my range of motion on the shoulder which had lost most of its strength. He then worked with me on a table, and I looked to my left and saw a man I recognized.

I said, “Excuse me, I am a big fan of yours.”

He looked at me and said, “How do you know who I am?“

One of the things which helped to make me successful was my ability to recall facts, figures, data on topics I had read. I could memorize numbers for a great many companies at a remarkable clip and speak about them effortlessly. My trading books had thousands of positions and I needed to understand the important ones.

What the man did not know is I had read a long article about him two weeks before which told me all the details of his life. What did I do? I started reciting his life story back to him in perfect detail to the point I might have sounded like a stalker. He looked at me perplexed and I then told him of my recall skills and the article. We laughed and both ended PT that day at the same time.

Billy Hunter, the Executive Director of the NBA Players Union (1996-2013) was the man in question and was rehabbing from a massive knee surgery. He was on crutches and in bad shape. We hobbled out together and when we got downstairs, he realized he left his phone on the table. I ran up to get it for him and when I returned it, I gave him my business card (that was a thing in the Dark Ages). I said, “Billy, I can no longer watch your NBA players file for bankruptcy after making tens of millions of dollars (they now make hundreds of millions). I don’t want to get paid, but I want to speak with them about being smarter with their money and helping them build wealth. I will never charge one dollar.” Kenny Anderson, Antoine Walker, Shawn Kemp and countless others came on challenging financial times despite tens of millions of career earnings in the years prior to my encounter with Billy Hunter.

Billy thanked me for getting his phone and took my card. He said, “Eric, don’t be surprised if your phone starts ringing.” Sure enough, he called me the next week and brought a bunch of players to lunch to introduce me. I gave them my pitch and why I wanted to help and that they could call me day or night and use me as a resource.

My phone started ringing with regularity, and I must admit, I was a bit startled by some of the bad investment ideas they were considering.

To be fair, these elite athletes did not generally have a finance or investing background. They would ask about sizing and want to put way too much into any one risky investment in many cases. Their friends and family would come to them to invest in some awful business ideas, and it was hard for the players to say, “NO.” Also, there were too many people looking for handouts in their entourage and I would explain the math of earnings AFTER taxes, managers, lawyers, agents… and the importance of saving and investing wisely.

In one situation, I received a call from the player’s manager asking if I would make a loan against an upcoming contractually obligated payment coming in 6 months’ time. I then had a conversation with the player, and then his legal counsel. They wanted $1.5mm against a $6mm payment coming from an NBA team. No brainer, right? Not so fast. The player had already pledged over 100% of the coming earnings, and there is a little something called taxes which would take 50% of his earnings, not to mention his professional fees to agents. I was a hard pass, and the player was upset.

The only player I advised that I will name is Derek Fisher. We became quite friendly and met numerous times through the years and spoke regularly on the phone. He always asked good questions and was the point guard who won 5 NBA titles with the Lakers and Kobe Bryant including a few with Shaq. Derek took my suggestions and advice to heart, even when they were not what he wanted to hear. Derek went on to coach the Knicks against my advice to stay away from the owner, Dolan given he is that bad. During that time, he hosted me and Jack a few times and allowed us in the locker room. When I would go to LA, I would hang with Derek once in a while as well. He was always very nice, polite, and appreciative. I was given a ticket to the Celtics/Lakers final in Boston and it was a lot of fun.

I enjoyed the period of time when I was hanging out with NBA players and trying to help protect their money and investments. I no longer am involved with the informal program Billy and I created but would be happy to help any pro athletes who need my assistance.

Quick Bites

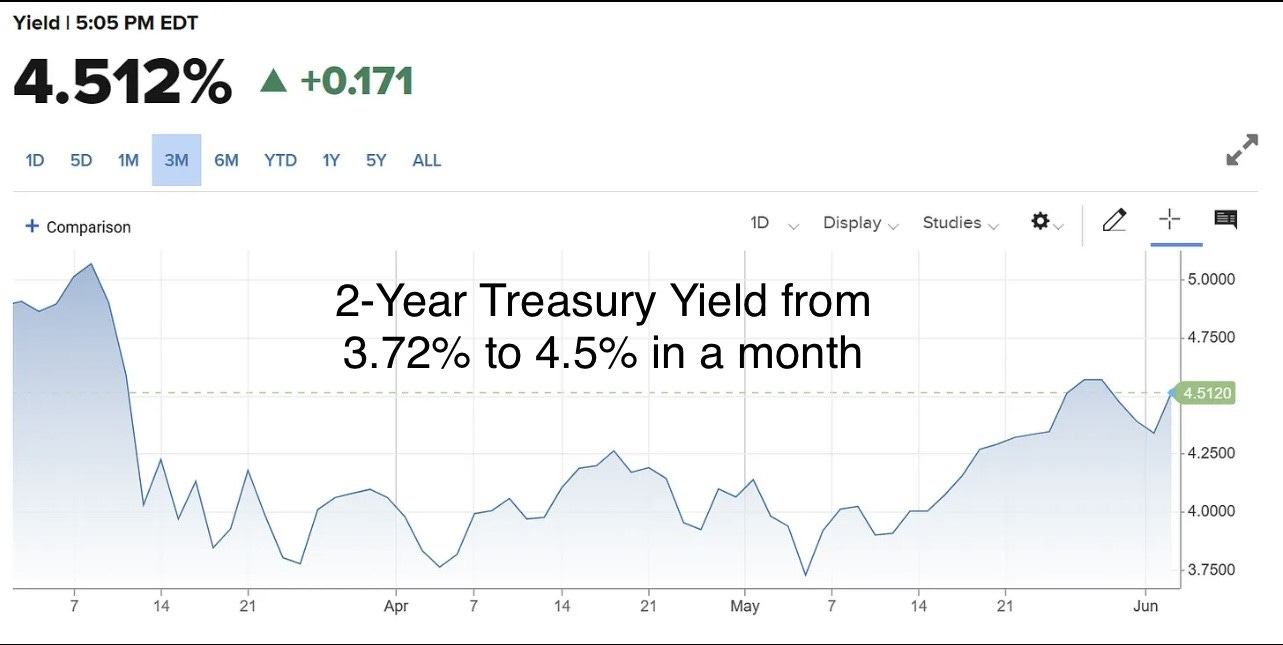

Good news is good news again. The strong jobs report coupled with the Debt Ceiling issue being solved caused markets to rally sharply Friday. The Dow jumped 701 points, or 2.12%, to end at 33,763. The S&P 500 climbed 1.45% to close at 4,282. The Nasdaq advanced 1.07% to 13,241, reaching its highest level since April 2022 during the session. With Friday’s gains, the S&P 500 and Nasdaq finished the holiday-shortened trading week about 1.8% and 2% higher, respectively. The Dow’s Friday advance pushed it into positive territory for the week, finishing up 2%. The Nasdaq notched its sixth straight week higher, a streak length not seen for the technology-heavy index since 2020. Nonfarm payrolls grew much more than expected in May, rising 339,000. Economists polled by Dow Jones expected a relatively modest 190,000 increase. It marked the 29th straight month of positive job growth. Treasury yields rose on the strong jobs report with the 2-year yield rising 17bps to 4.52% and the 10-year +9bps to 3.70%. Remember, one month ago, the 2-year was at 3.79%. The futures market is now showing a 25% chance of a hike at the June 14th meeting. With the debt ceiling done, a massive amount of Treasury issuance is coming and that will drain bank deposits further.

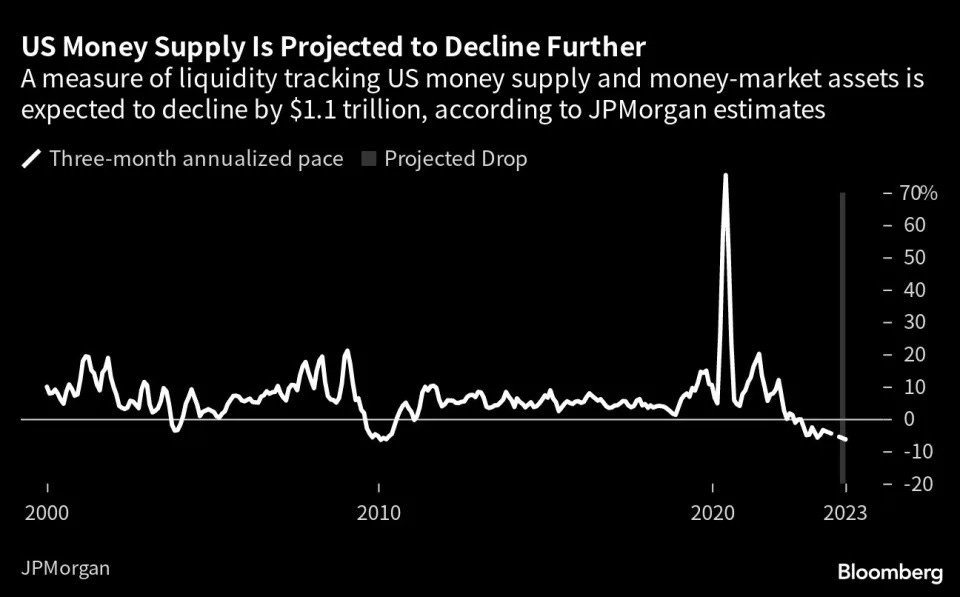

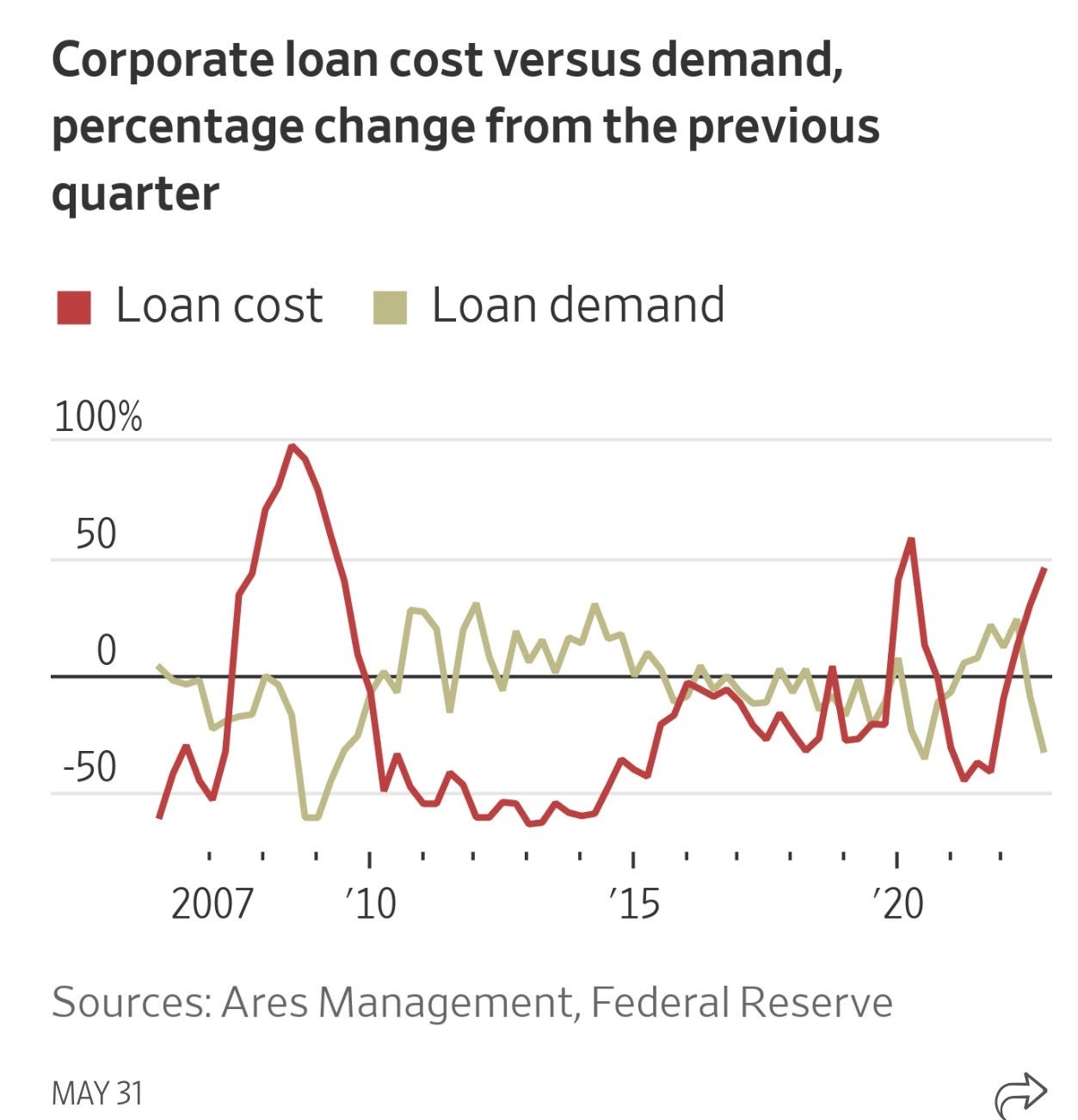

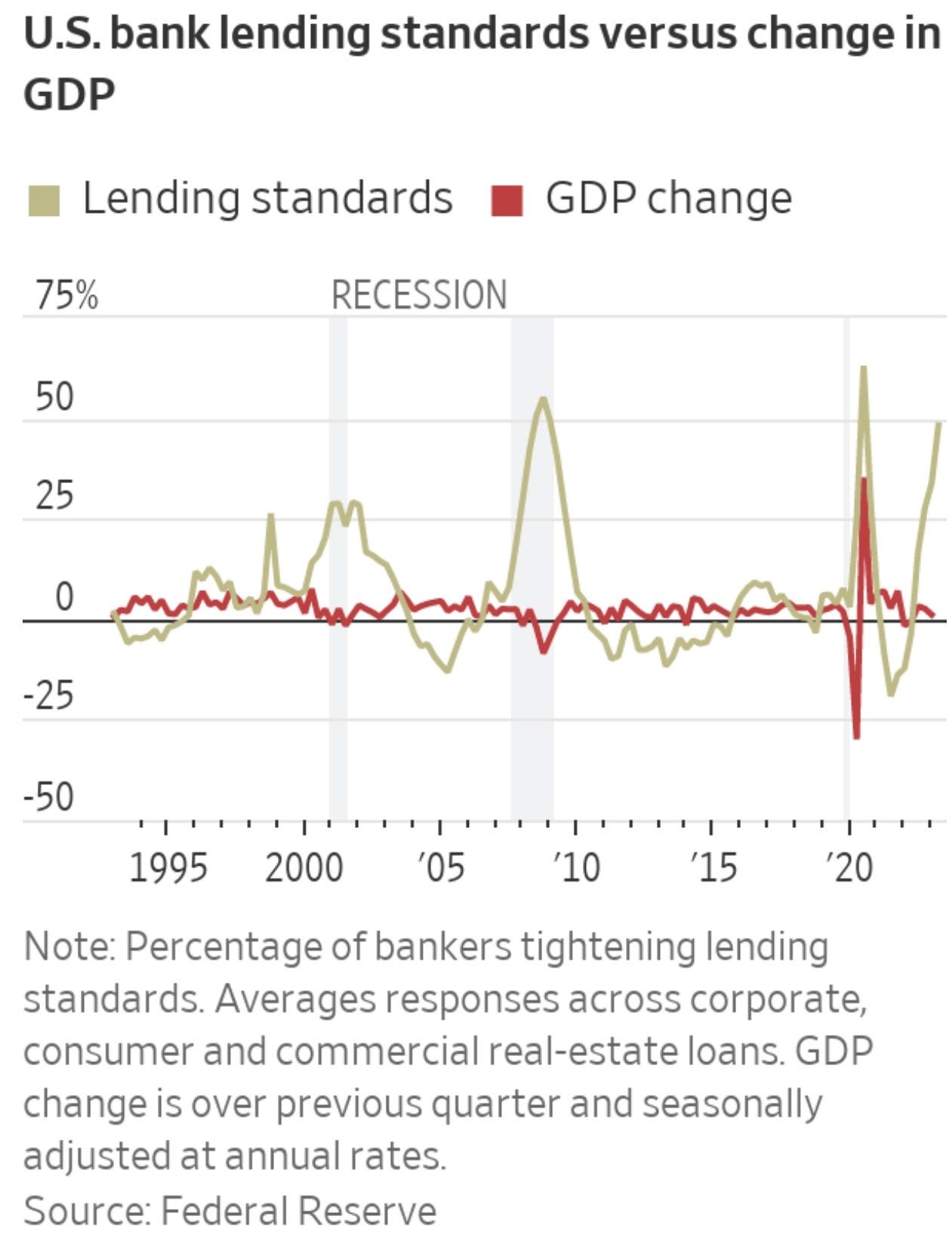

I thought this was a good WSJ article entitled, “Where is the US Economy Headed? Follow the Money.” I have been clear that the consumer is under pressure and bank lending is getting tighter. Dollar General announced earnings on Thursday and cut its sales and profit outlook as the customer base is getting hit by inflation. The stock was -17% on the news. Dollar General CEO Jeff Owen said “The macroeconomic environment has been more challenging than expected, particularly for our core customer.” Macy’s: “We planned the year assuming that the economic health of the consumer would be challenged, but starting in late March, demand trends weakened further in our discretionary categories.” Lending conditions for companies, consumers and real-estate developers tightened this spring to levels not seen since the height of the Covid pandemic, an analysis of public and private lending data by The Wall Street Journal shows. The flow of cash on Wall Street was already slowing this winter, but recent turmoil in regional banks made it worse. The slowdown is a consequence of the Federal Reserve’s interest-rate-hiking campaign against inflation, and it means there is now less money available for U.S. businesses and households to hire new workers, build plants and pay the bills. Americans’ credit card debt is just under $1 trillion (up $250bn in 2 years) and the average interest rate is 24%. The combination of record consumer credit balances and a pull-back by lenders is concerning and should be closely watched. I do not see how the consumer can keep up massive debt growth, crashing savings while fighting inflation.

Great Bloomberg article entitled, “Hedge Funds at War for Top Traders Dangle $120mm Payouts.” When portfolio manager David Lipner said he was quitting billionaire Izzy Englander’s Millennium Management to join a rival, the hedge fund countered with an unusual proposal: A one-year paid sabbatical and an incentive upon return if Lipner stayed. And stay he did. For Millennium, the $58 billion industry giant known for ruthlessly cutting underperformers, the generous offer was seen as totally worth it. After all, Lipner had made money for the firm for more than a decade, longer than most hedge funds remain in business. Such enticements are now becoming part of a growing array of expensive tools the world’s biggest hedge funds are deploying to hire and retain traders. They show how a limited pool of talent and surging demand for steady returns in a volatile market are prompting firms to pull out all the stops to attract the best — with clients footing the bill. The hunt is no different from the bidding war for Premier League or NBA players, one executive said. Last year, a senior portfolio manager was lured by a major New York fund with more than $120 million in guaranteed payouts, according to a headhunter who said he’d done several deals paying north of $50 million. Contracts worth $10 million to $15 million are increasingly becoming common for traders, said another. Millions of dollars in signing bonuses and a higher cut of trading profits during initial periods — aimed at replacing any pay lost from leaving a past employer and having to sit out non-compete periods — are now becoming the norm at multi-manager investment firms ranging from Millennium, Citadel, Point72 Asset Management to BlueCrest Capital Management and Balyasny Asset Management. I just question some of the retention tactics as being too aggressive.

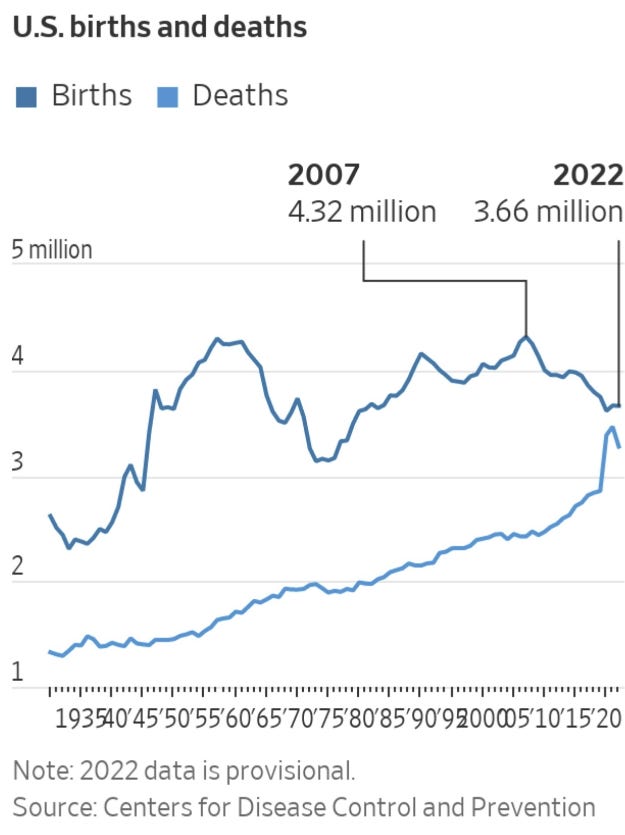

I felt this WSJ article entitled, “A Visual Breakdown of America’s Stagnating Number of Births,” is important due to the ramifications of the data. About 3.66 million babies were born in the U.S. in 2022, essentially unchanged from 2021 and 15% below the peak hit in 2007, according to new federal figures released Thursday. Experts have pointed to a confluence of factors behind the nation’s recent relative dearth of births, including economic and social obstacles ranging from childcare to housing affordability. “You’re going to have a real shortage of workers unless we have technology somehow to fill the gap,” economist, Kathy Bostjancic said. I also feel the perception of the future looks less attractive and that factors into the decision to have children as well. The total fertility rate—closely watched because a level of 2.1 children per woman is the “replacement rate” needed for a population to maintain current levels—was 1.665 in 2022. I have sounded the alarm bells on US debt levels and entitlement issues. As the population ages and birth rates plummet, available workers fall. How in the hell are we going to pay for the astronomical social security and healthcare costs for the massive population over 65 years old? We will have a population aging and costing a huge amount of money from a healthcare perspective, and we won’t have enough workers to support them. Think of Japan with debt/GDP approaching 300%. In 1960, 6% of Japan’s population was over 65 and in 1980 it was 12%. In 2000, Japan had 22% of its population over 65 years old and today it is approximately 30%. The working-age population of 14-64 years old fell 16% between 1995 and 2021 in Japan. The US birthrate is declining, and people are living far longer. Without a workforce to support the heavy load of an aging population, trouble lies ahead. $32 trillion in debt and rising fast, higher rates, and ballooning entitlement costs… need to be addressed.

Other Headlines

Euro zone inflation falls more than expected to 6.1% as core pressures ease

India's Russia oil imports jumped tenfold in 2022, bank says

So much for sanctions. In 2021 Russian oil accounted for just 2% of India's annual crude imports. That figure now stands at almost 20%, Bank of Baroda said. I better not hear of aid going to India under any circumstances.

Lululemon shares surge after reporting 24% sales growth, raising full-year guidance

Fantastic earnings.

Meta orders employees back to office 3 days per week after slashing 21K jobs

Telecom stocks fall on report Amazon considers launching mobile service for Prime members

Amazon has single-handedly crushed retailers and malls and now they are going after telecom! All I know is I order on Amazon now and it comes to my house in hours. Why go to a store? Free shipping, free returns… It is just so easy.

Ultralong-Range Electric Cars Are Arriving. Say Goodbye to Charging Stops.

This is huge. My biggest complaint about our long-range Tesla is the lack of range. 500-mile range is a game changer for me.

I have written about this countless times. Tax receipts have fallen below pre-pandemic 2019 levels. The article outlines details on wealth migration and poor policies and spending. I continue to suggest it will result in increased taxes, fewer services, and a reduced quality of life. The math just does not work. Also, the migrant issue is taking billions of dollars from the coiffeurs as well.

There is supposedly a recording where Trump acknowledged that he had taken classified documents that detailed a potential attack on Iran. The recording suggests he was unsure if he was able to classify the documents according to the NYTimes and CBS. I need to see the document myself as we know the media rarely gets it right the 1st time. However, this one does not read well for Trump. This type of behavior, election interference in GA, and involvement with Jan 6th are things to go after. The NYC porn star hush money case is not high on my list of real crimes.

Joe Biden takes hard fall at Air Force Academy commencement ceremony

I have no problem with the fall. I find he seems to stumble a lot. My issue was it took 3 people to help him up. It just does not show strengths or give confidence. I want cognitive testing and age limits. Sorry, we need to demand more of our elected officials. Biden, Fetterman and Feinstein are three examples who should not be in office. There are plenty of Republicans who should not be in office for other reasons. Santos comes to mind, but let’s not forget about the massive number of lies Biden has told and some are in this CNN link.

Biden’s 2024 Hail Mary: Name Barack Obama as His Running Mate?

I thought this opinion piece was interesting suggesting Barak Obama could be Biden’s running mate according to the constitution. I have no view on the legality of it, but do feel Biden and Harris together is a problem ticket and that would change dramatically if Obama were legally allowed as the article suggests.

Lauren Boebert missed voting against the debt ceiling bill she hated and can't explain why

Nearly 10,000 Photos from Hunter Biden’s Laptop Published

I spent 30 min on it and there are a lot of compromising photos. Hunter sure likes to take nude pictures of himself and his lady friends. I feel the whole thing is sad. Hunter clearly has demons and has been a disaster. Anyone willing to pay this crack addict millions of dollars to sit on boards must have their head examined.

Federal judge rules Tennessee restrictions on drag shows unconstitutional

A federal judge ruled on Friday that a Tennessee law banning drag shows in public or in places where children could view them is unconstitutional, finding that it violates freedom of speech protections.

Customers choose items they would like to buy from a digital kiosk. Shoppers then pick up their products at a checkout counter after an employee retrieves the shopping haul.

San Francisco’s New Porsche Dealership Vandalized Days Before Opening

California Spent $17 Billion on Homelessness. It’s Not Working.

The number of homeless people in California grew about 50% between 2014 and 2022. The state, which accounts for 12% of the U.S. population, has about half of the nation’s unsheltered homeless.

Minnesota to provide illegal immigrants with free college tuition

Why not use the money to help Americans? Why do we spend so much money on everyone else? We have Americans and veterans who risked their lives for our country in need of housing, food, and education…yet we continue to find ways to give the money to everyone else.

OK School Sued By Mother Of Female Student Assaulted By Transgender Male In Women’s Washroom

Violent crime arrests skyrocket for NYC kids in 2023, NYPD data shows

The Big Apple has seen a staggering 80% increase in the number of kids arrested for robbery and a 23% hike in youngsters arrested for felony assaults so far this year.

Positive attitude and a high degree of emotional awareness.

Former Chicago Mayor Lori Lightfoot lands teaching gig at Harvard after leaving office

Her course is called, “Health Policy and Leadership.” It should be called, “How to be the worst mayor in history.” “How to ruin a once great city?” “How to let criminals run the show…” I can go on for a long-time folks.

Harvard MBA Grads Enter a Tepid Job Market Hoping for the Best

The article suggests that at this point in the year, less than 10% of Harvard MBAs are looking for a job and today it is more like 30%.

China defends buzzing American warship in Taiwan Strait, accuses US of provoking Beijing

Chinese jet flew past nose of U.S. plane, Pentagon says

A senior U.S. official said, “We have seen an alarming increase in the number of risky aerial intercepts and confrontations at sea" by Chinese aircraft.

Top Chinese scientist concedes that coronavirus may have leaked from Wuhan lab

I said this basically on day 1 and was canceled by countless readers and told I was a conspiracy theorist. No chance this was the wet market.

This is a great chart on NY and Florida COVID Deaths. Remember, NY lockdown, mandated masks, closed schools, and forced toddlers to get triple vaccinated. Look at the difference and then factor in age (Florida is older). Maybe some cities and states overreacted? Note, the worst urban office and retail markets in the country were the strictest on pandemic protocols (NYC, Chicago, LA, SFO, Seattle, Portland, DC…). Do you think it is a coincidence?

Real Estate

"Commercial real estate is melting down fast. Home values next," the Tesla and SpaceX chief tweeted on Monday. The tech billionaire made the comment in response to a tweet by the Craft Ventures founder David Sacks, who said that a big chunk of commercial real-estate debt was due to mature soon. Musk has previously warned that cracks could appear in property markets following turmoil in the banking sector. JPMorgan estimated that about $450 billion in commercial real-estate debt set to expire this year could default. Meanwhile, Morgan Stanley Wealth Management said commercial-property prices could tumble 40% from their peak in light of the sector's troubles. I don’t think Musk was specific enough about commercial and residential R/E issues. Urban office, business hotels and urban retail are definitely in trouble in Blue cities (NY, Chicago, LA, SFO, Portland, Seattle, St Louis, DC…), but not everywhere. Also, new product is doing quite well in NYC for example, but the older office is in serious trouble.

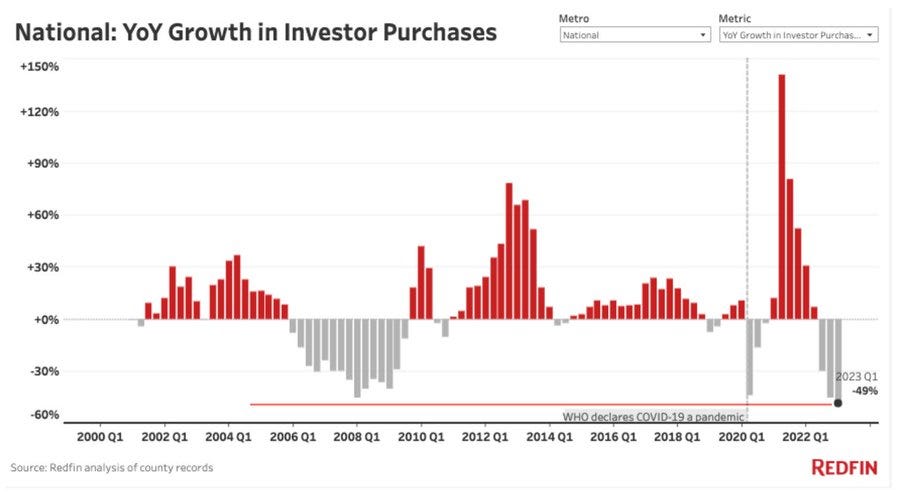

In a related note from the Real Deal, “Investors purchased 48.6 percent fewer homes in the first quarter than they did a year earlier, according to a Redfin report. The annual decline is the largest recorded by Redfin, which has data going back to the start of the century.” Investors purchased roughly 41,000 homes in the first quarter, down from approximately 80,000 from a year ago. Investor purchases also dropped 15.9 percent from the previous quarter, more in line with the quarter-to-quarter drop in overall home purchases than the year-to-year decline.

In my community in Boca called, Royal Palm, I have been tracking the sales of homes. I created the chart below. When I bought in 2017, there were 71 homes for sale at an average asking price of $4.9mm. In December 2021, we got down to 4 homes for sale with an asking price of almost $18mm. Today, there are 33 homes for sale for an average price of $16.4mm or 3.3 times higher than when I bought in 2017. Today, 15 of 33 homes are listed for $15mm or more. Homes are definitely staying on the market longer than a year ago. Note the volume decline from the peak 2021 of 103 homes to 14 in 2023. Part of this is due to less inventory, but also due to market concerns, lack of available schools, and financing costs…. Homes here under $5mm are generally knockdowns, and there have been $12mm knockdowns on the water. The best example of a slowdown is a high-end home at 298 Key Palm which looks amazing. Originally listed for $35mm. I am told they were offered $29mm almost one year ago and passed. It is now listed for $24.995mm (pictured below). The house has been listed for approximately 1 year. If it were completed in 2021, it would have sold at closer to $30mm or more in my opinion.

Interesting chart showing a sharp decline in new home purchases by investors.

The most expensive Hamptons home rentals for 2023 ($1M for July!)

The article suggests that people want to spend less time in the Hamptons and travel to Europe. This is driving more high-end, short term rentals. Some amazing pictures of beautiful properties are in the link.