Opening Comments

Given the Passover holiday, if you missed my last note entitled, “Handwritten Thank You Notes…Or Else!” It is one of my favorite stories about my family’s love affair with handwritten notes, given my mom’s insistence on timely notes.

I have been to countless Broadway shows and some off-Broadway performances. Last week, the Rosen family went to see the play, “To Kill a Mockingbird,” in Ft. Lauderdale. Talk about off-Broadway, it was 1,100 miles off. I thought the cast was pretty good with Atticus Finch played by “The Waltons” star, Richard Thomas." It was nowhere as good as the book, my all-time favorite, but nice to get out of the house and see a show. I wanted to name our son, Jack, Atticus, because I love the character and book so much. In the end, we decided the Rosens are just not cool enough for that name.

A reminder, many of my readers contribute to the Rosen Report. They send me story ideas, and news headlines, and are experts on various subjects. If you are an “expert,” let me know and when I cover a topic that you know, I may send you what I have to improve it. Thanks for reading.

Markets

Stocks Unattractive

Bank Lending Slowing in Charts

Aging Population/Debt Levels/Spending

Chad Ochocinco on Spending, Saving, Investing

Hamptons Home Prices Falling-Charts

Office Market-Good Charts

Video of the Day-Tail-walking Sailfish

I went fishing the other day and got a nice sailfish. Sails can tail-walk on the water, and it is a beautiful sight. I did not take a video of the event, but this short youtube video shows the longest tail-walk I have ever seen. In my case, all of a sudden a sailfish started tail-walking about 20 feet from my boat, and I had not realized it was hooked on my line just yet. It was a fun few seconds before I realized it. As I was reeling in the fish, a large hammerhead shark was circling, which only added to the excitement. Last year I caught 45 sails on my boat, this year, only 8. The season is winding down.

Miami Night Out-LPM/Dirty French-Oh My!

A reader and now good friend, Ryan, asked me to meet him in Miami for dinner. On Thursday, March 29th, we met at LPM on Brickell. Again, I took the Brightline train down, and it was another seamless experience. Let me tell you that LPM is no joke. The room is very well done and creates an ambiance that feels like it could be in NYC. The crowd is young and attractive, and the place was PACKED at 7pm despite the torrential rain. The service was fantastic, and the Mediterranean food was shockingly impressive. It is now one of my top restaurants in South Florida, and I cannot wait to go back. I have spoken with a half-dozen people who live in Miami and suggest it is their favorite place down there now. 100% chance it is a top 5 in South Florida for me now.

They started with some freshly baked bread for the table which was solid. We ordered the octopus “poulpe” carpaccio with lemon and green chili dressing and a yellowtail carpaccio with guacamole and citrus dressing. Both were great, but the octopus was on another level. The dishes were light, fresh with spectacular presentation.

For entrees, we had gnocchi with cherry tomatoes and grilled tiger prawns with green chili and coriander (NOT PICTURED). Again, I found myself pleasantly surprised by the food, presentation, and overall experience. We also had a side of fries and broccolini. Looking around the room I was taken by the attractive crowd, the vibe and the overall mood and music. The hostess was a bit aggressive, but that did not detract from the experience. EVERY table was taken. There is a 100% chance I go back there soon. The wines by the glass were FULLY priced. The bartenders do a great job on beautiful cutting-edge cocktails which look like works of art, but I did not partake.

Food-A

Ambiance-A

Service-A

Wine-Good/Fully Priced

Cost-Expensive, but Not Offensive for the Experience

After the delicious meal, we went to Dirty French, the Major Food Group (MFG) Steakhouse two blocks from LPM. I don’t know how the boys from MFG keep getting it right. It might be the coolest place I have been to in Miami. The place is dripping with hipness. Again, good people watching, and the vibe was great. We had some doughnuts for dessert, and they were good. The menu is interesting, and the steaks are about $100/each and up to $285 for two people. We hung in the cocktail lounge for a drink. I was taken by the youth in the room. Another pricey joint full of young people spending money. I have not eaten there but will give it a try soon. I hope it is as good as Carbone and Contessa.

I can say this with 100% certainty; Miami is a fun and hip place with a growing number of serious eats and cool places to hang. In the 6 years I have lived here, South Florida has changed dramatically. The wealth has left major cities in the Northeast, Midwest and West in droves and much of it has found its way to South Florida. As a result, many of the best restaurants and clubs are opening up down here. Unfortunately, the traffic, home prices and school availability is making it harder to move down today. Ryan, when are getting together again? I want to try a few other hotspots: Red Rooster, La Trova, Ariete, La Mar.

Quick Bites

S&P 500 futures and Treasury yields increased on Friday during a holiday-shortened trading session after the March jobs report showed a resilient economy and moderate inflation. The 2-year Treasury yield jumped 16 basis points to 3.99%. The 10-year Treasury yield added 12 basis points to 3.41%. The U.S. added 236,000 jobs in March, about in line with expectations, with the unemployment rate falling to 3.5% from 3.6% a month earlier. Expectations were for a 238,000 increase in non-farm payrolls, based on the consensus estimate from Dow Jones economists. The S&P 500 lost 0.1% for the week ended Thursday, breaking a 3-week win streak as a series of weak labor data points hinted to investors that a recession could be near. The Nasdaq was down 1.1% for the week, while the Dow squeaked out a small gain. Gold has been rallying this year and is +9% YTD. A couple of factors: 1) the US Dollar weakness 2) there is a move by some away from the dollar 3) Central Banks buying gold, 4) Nervousness about the banking system. With respect to oil, I have been critical of the vilification of the industry given the world will be reliant on fossil fuels for the foreseeable future. The final chart in this section should concern you regarding the lack of reinvestment by US oil producers on new drilling.

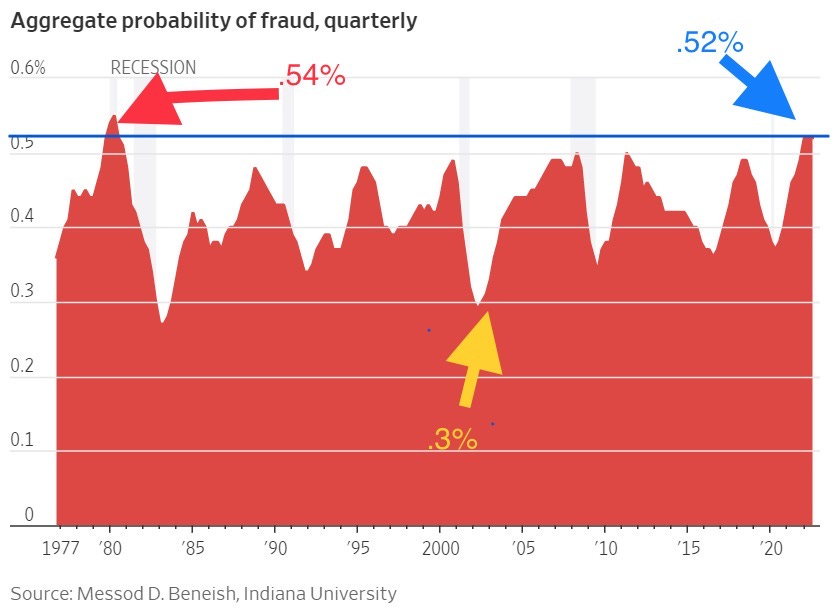

WSJ article entitled, “Stocks Haven’t Looked This Unattractive Since 2007.” The reward for owning stocks over bonds hasn’t been this slim since before the 2008 financial crisis. The equity risk premium—the gap between the S&P 500’s earnings yield and that of 10-year Treasuries—sits around 1.59 percentage points, a low not seen since October 2007. That is well below the average gap of around 3.5 points since 2008. The reduction is a challenge for stocks going forward. Equities need to promise a higher reward than bonds over the long term. Otherwise, the safety of Treasuries would outweigh the risks of stocks losing some, if not all, of investors’ money. Also, when considering the CAPE ratio, the S&P 500’s price level relative to inflation-adjusted corporate earnings over the past 10 years, the market looks expensive. Interesting perspectives and charts. I am just excited I am earning something on my money for a change. In a related note, there is another WSJ article entitled, “Accounting-Fraud Indicator Signals Coming Economic Trouble.”

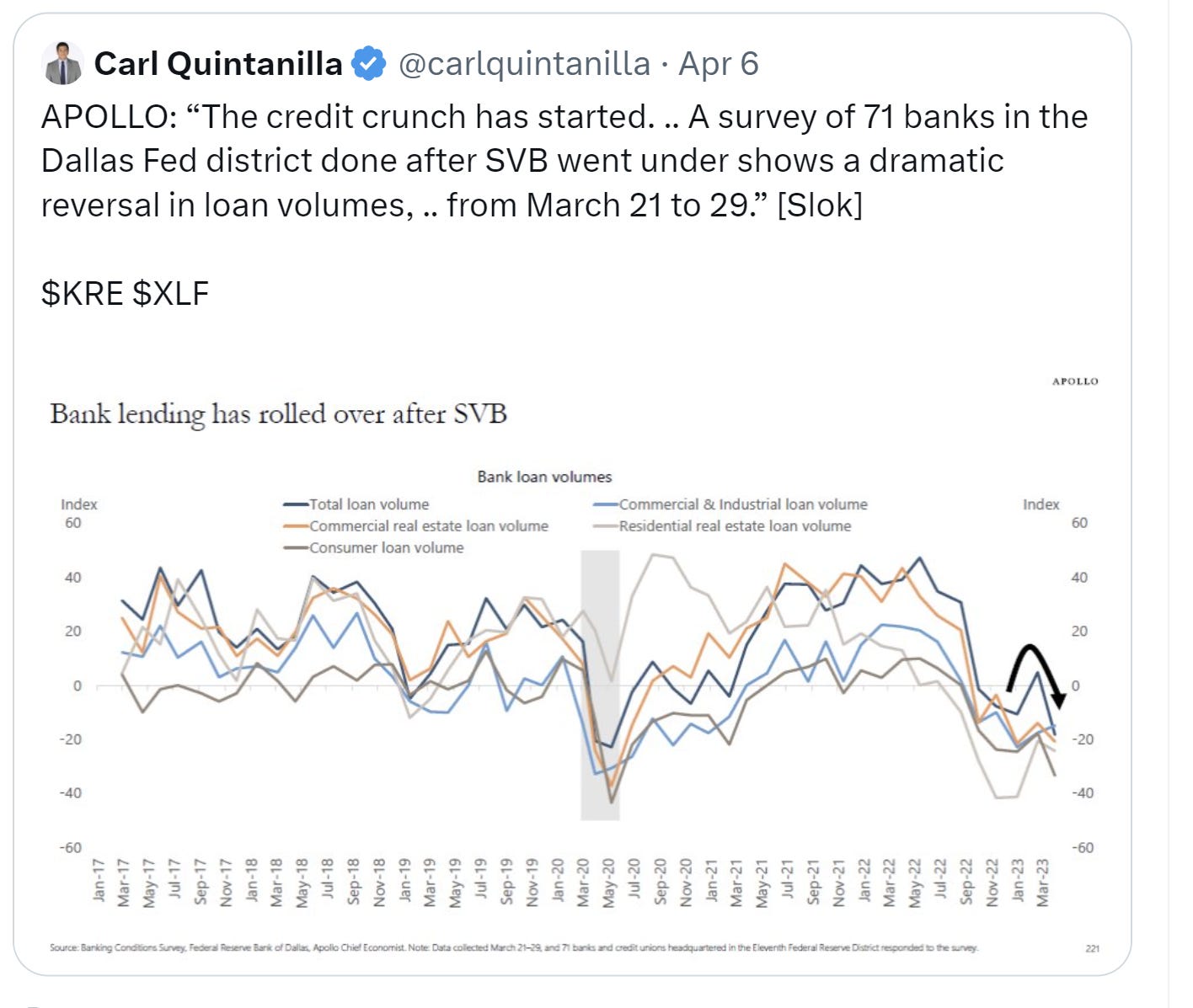

I have written extensively about my concerns about the pull-bank in bank lending, especially around the regional banks. These charts are telling. Total loans at all domestically charted banks are $12.07 trillion (blue). This amount is down $104.7 billion in the last two weeks (middle). This is the largest $ drop ever (data starts in 1974) (From Biancoresearch). This is disinflationary. Let’s see how long the reduction in lending lasts. The Fed’s report showed that by bank size, lending decreased $23.5 billion at the 25 largest domestically chartered banks in the latest two weeks, and plunged $73.6 billion at smaller commercial banks over the same period. All the banks are pulling back in lending, not just the regionals.

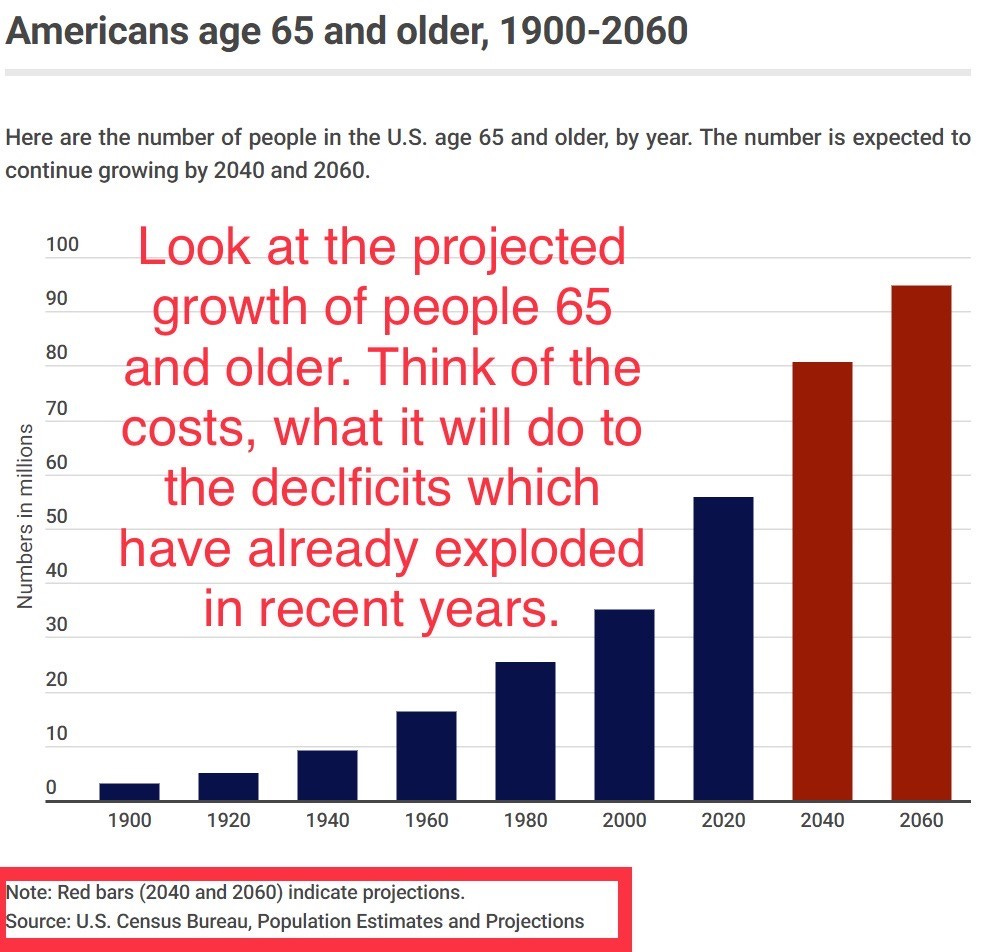

I have written extensively about the growing debt levels, rising interest burden, and crowding out of government discretionary funding. As the population ages, lives longer and health care costs skyrocket, we need a more aggressive plan. Politicians have one goal, and that is re-election. They do not consider the long-term ramifications of decision-making. Hopefully, these charts show how dire the situation is in terms of getting things under control and making tough choices. In 1950, 8% of Americans were over 65 years old and in 2020, it was 17% and growing. Means testing and raising the age when benefits kick in is a must. Doing something about the insanity around rising healthcare-related costs is needed. Why do US citizens pay so much more for drugs than other countries? This Peter Peterson Foundation study showed the US pays 2.4 times more than the average price of 9 other nations for drugs. This is largely due to brand-name drugs which cost 4.9 times more. Why must the US give money to so many countries when we are going down an awful path from a fiscal perspective? As of the time of writing this note, the debt levels are now just under $32 trillion and rising fast. Remember rising rates with mean debt service costs will explode and crowd out even more discretionary spending. There is a crazy story about anti-aging pills and the suggestion is it could hit shelves by 2028. BILLIONS are being invested in longevity and Bezos and the Chat GPT founder are pouring in money as well as Theil and others. What happens if the average lifespan increases to 90 in the US? The already dire entitlement situation turns downright disgusting.

This is not a typical story for Quick Bites but thought I could tie it in with my situation to help teach the younger readers about the importance of saving. Chad ‘Ochocinco’ stashed away 83% of his NFL salary by buying fake jewelry and sleeping in the stadium for two years to save money. He bought fake jewelry from Claire’s and flew budget airlines to be sure he could save. Given I grew up with limited means, I have always been a saver. Sure, I wish I would have invested it more aggressively. I did not want to go back to washing dishes and cleaning toilets like when I was a kid. Ochocinco was very showy, but it was a false narrative all while he was saving his dough. I love it. Put it away and do your best to avoid buying depreciating assets. I Love this interview with Chad where he talks about living in the stadium, so he would not spend money on rent. Crazy stories of how frugal he is, even when he was making millions.

Other Headlines

The US economy is unwell. April could be a cruel month

Interesting CNN article outlining headwinds and concerns about the economy.

There are storm clouds ahead for the economy, JPMorgan Chase CEO says

March’s banking chaos gave short sellers their biggest profits since the financial crisis

Banks are in turmoil but a bigger financial crisis may be brewing elsewhere

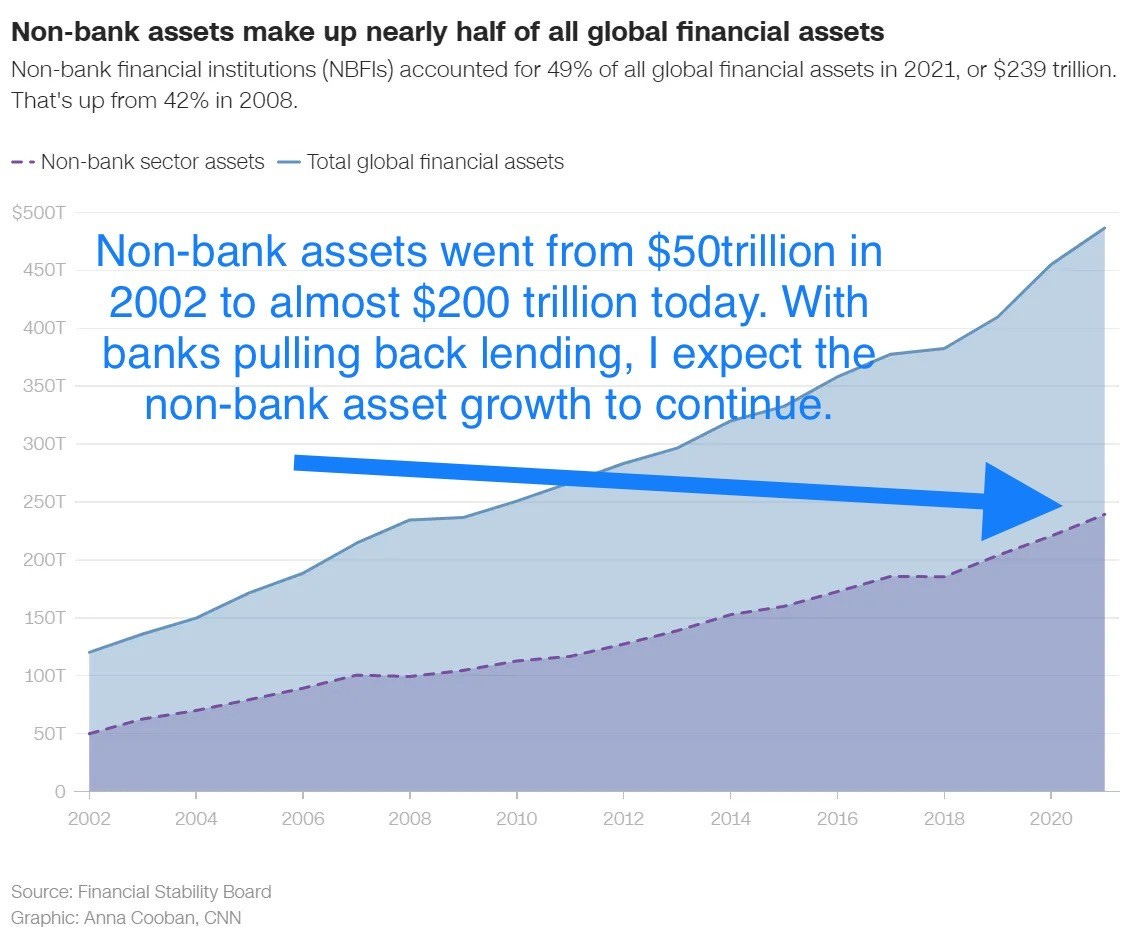

The suggestion is that non-bank lenders stability is imperative given the massive growth in assets as seen in the chart below. These “Shadow” banks don’t have access to emergency central bank funding in times of stress.

Layoffs are up nearly fivefold so far this year with tech companies leading the way

Protesters storm BlackRock's Paris office holding red flares and firing smoke bombs

This is in regards to pension reforms pushing back the retirement age.

Tesla cuts U.S. prices for fifth time since January

Tesla cut prices on both versions of its Model 3 sedan by $1,000 and on its Model Y crossover by $2,000, the website showed. It also cut prices on both versions of its more expensive Model S and Model X by $5,000.

IRS overhaul aims for tenfold increase in audits of the wealthy

The US tax code is approximately 75,000 pages long. I would like to see a 2-page tax code.

Their demographic alone amassed nearly $4 trillion in debt in the fourth quarter of 2022. This marks a 27% rise from late 2019. Interesting data in the article.

I may have found the most expensive McDonald's 'value' meals in the country

Crazy. The Big Mac Combo Meal was $16.89. Short video in link.

Report on Justice Thomas' trips renews calls for a Supreme Court code of ethics

Democrats are calling for impeachment after a ProPublica investigation suggested a billionaire took Thomas and his wife on cruises and private flights costing millions of dollars. Thomas did not report them. I am no expert but see new gift disclosure rules for the Supreme Court which seem to have gone into effect in recent months.

I had not considered the perspective Dershowitz has on the case. He feels the judge is pressured not to dismiss Trump and the jury voted Bragg into office and will convict.

What a disgusting story of abuse and coverups. One deacon admitted to abusing more than 100 children. More needs to be done to put these animals in prison. People knew and nothing was done. I don’t hear anyone trying to cancel the clergy despite decades of abuse and cover-ups.

Chicago Transit Authority's Dorval Carter Says Crime Hurting Ridership Rebound

After voting Lightfoot out of the Mayor’s office, I was surprised the city went with another “Defund the Police” candidate who is soft on crime. The Mayor Elect said looting was “an outbreak of incredible frustration and anguish” tied to “ a failed racist system.” The mayor-elect suggested more police won’t work. No additional funding for police, but more 1st responders, social workers, and counselors. Good luck, Chicago. (short video in link).

Chicago Faces Tax Hikes After Progressive’s Surprise Mayoral Win

The mayor-elect’s proposed levies on corporations, financial securities and the rich would add pressure on the business community in the nation’s third-largest city that’s already grappling with rising crime, high-profile headquarter departures, and fragile finances. Given the budget deficits in major cities and states, I believe you are going to see more new taxes levied in coming years in a handful of places. This will only drive more wealth out.

Bob Lee’s murder in San Francisco’s posh Rincon Hill neighborhood is 12th in the area this year

He moved from SFO over crime fears, yet was murdered in a fancy SFO neighborhood. I think many of these cities have the wrong policies on crime and the wealth will continue to flee. The former SFO fire commissioner was attacked the a crowbar the day after Lee was killed.

Babyfaced 12-year-old accused of Florida triple murder led cuffed to jail

The kid is just a boy. Scary pictures in the link.

Trans Teen Arrested Over School Shooting Plot

A 19-year-old in Colorado planned to carry out multiple shootings in various schools. The teenager is named William Whitworth but goes by “Lilly” and faces attempted murder charges.

Riley Gaines ‘ambushed and physically hit’ after Saving Women’s Sports speech at San Francisco State

The story is concerning a female swimmer speaking at a college about her view that Transgender swimmers should not compete with women and was physically attacked by a Transgender rights group.

Supreme Court rules West Virginia transgender athletes can compete on female sports teams

SUNY Albany protesters try to halt conservative speaker Ian Haworth

Bronx judge rips grieving mom before cutting her son's accused killer loose

Tennessee House expels 2 Democrats over gun control protest

It seems the expelled Democrats were part of protests at the Capitol which disrupted legislative proceedings. Democrats are up in arms about the expulsion and have suggested that the fact that the lawmakers were Black played a part in the decision.

Top 10 colleges to attend if you want to make a lot of money—Harvard and Yale didn’t make the list

I am a bit surprised by this list. A few are obvious, others, not so much.

Cardiologist shares 5 foods she eats to lower cholesterol—most people 'aren't eating enough' of them

Oats, Chickpeas, Arugula, Almonds, Avocados.

Steve Jobs was another level of genius around the consumer. IF this outlandish story about Jobs being the creator of Bitcoin is true, I don’t know what I am going to do. A little far-fetched, but who knows?

Elon Musk extends Substack feud with ‘Twitter Files’ ally Matt Taibbi

Chinese woman rides a Bentley to and from her job ... as a dishwasher

She is very wealthy, but bored and uncomfortable she does not get to wash dishes at home.

Japan Breaks With U.S. Allies, Buys Russian Oil at Prices Above Cap

U.S. officials believe 'leaked' classified documents about Ukraine war strength may be real

Real Estate

The median home sale price in the luxury Long Island enclave fell 7.6% in the first quarter, the first decline since 2019, while the total number of homes sold slumped 44% from the prior year to 424, according to data from Town & Country Real Estate. Fewer homes sold at all price points, but the high end of the market was it particularly hard. The number of home sales priced between $10 million and $19.99 million tumbled 61%. I mentioned weaker pricing six months ago with higher rates, lower bonuses, and layoffs…. This is not surprising. The Hamptons had been on fire and needed to come down from the insanity.

In a related note, the founder of Jimmy Choo sold her duplex PH on 95th Street (Carhart Mansion) for $19.25mm. The place looks BEAUTIFUL. She bought it in 2008 for $20mm and must have spent a fortune on decorations. The 7,140 sq foot apartment was listed for $34mm before sharply cutting the price. The pictures are remarkable. I spoke with my broker who told me my Park Avenue PH is worth 25% less than I sold it for in 2016. My home in Florida is up 250%. The market has spoken. Wait until more of the Blue states raise taxes to fill the budget deficits.

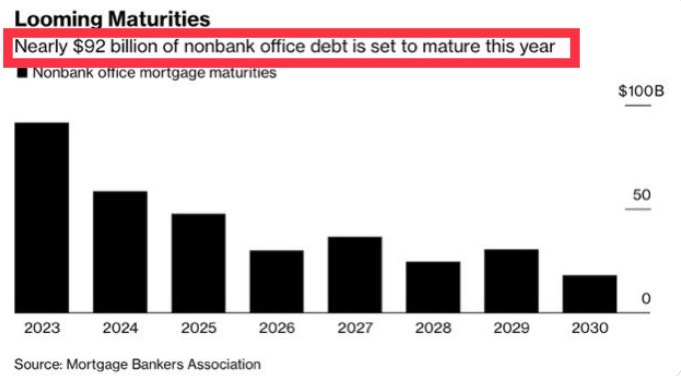

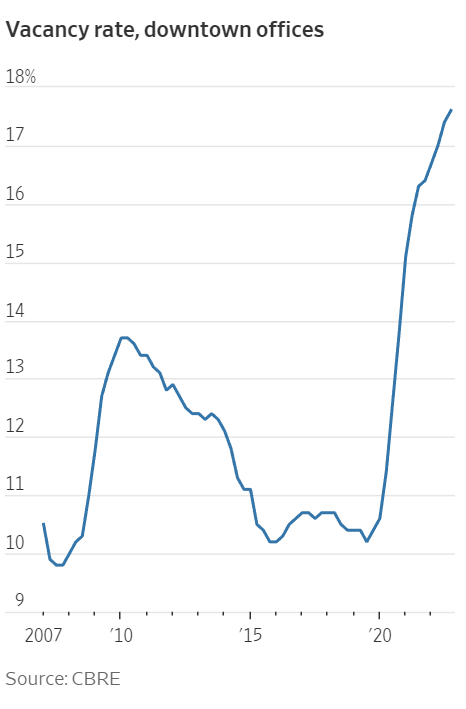

Office towers in the heart of the country’s biggest cities had always been the gold standard of commercial real estate: a market’s most expensive properties, owned by its biggest players and counted on as reliable sources of revenue for owners, lenders, and city governments alike. Now, owners of all but the newest and best buildings and the banks holding their debt are locked in a negative feedback loop of sinking value and vanishing liquidity. Without some sort of intervention or assistance from federal regulators or a bailout from elected officials, industry advocates say the office sector could collapse — and drag regional banks down with it, causing the sort of broad financial catastrophe that nearly occurred with Silicon Valley Bank. “We’re at risk of what happened in 2008 and 2009, but this time for commercial real estate rather than mortgages,” CCIM Institute Chief Economist and former commercial real estate adviser to the Federal Reserve KC Conway told Bisnow. One of the reasons why SVB was especially vulnerable to a bank run was its overexposure to one part of the economy, but hundreds of regional banks could be considered overexposed to commercial real estate, which could lead to regulatory crackdowns, Conway said. In a related story, the WSJ article is entitled, “Office Vacancies Send Real-Estate Investors to the Exits.” Good info in the WSJ article and the gap between CMBS and Corporate Bonds is exploding. SL Green stock is -69% in the past year despite a recent rally. Vornado stock is -63%. Both own some of the best office buildings in NYC.