Opening Comments

My last piece was about my issues cooking a 3lb+ Cowboy Steak. The most opened links were the salacious Glenn Dubin story, the teens covering their faces during pictures and the job interview tip. The feedback from my interview with venture investing legend, Fabrice Grinda, was off the charts. I promise, if you listen to the interview, you will learn something.

I have been beta-testing my job site with the help of some amazingly talented Rosen Report readers. THANK YOU for your feedback. We are working on the site with your recommendations and hope to have something more functional in the coming weeks. I am getting more internship opportunities and would appreciate anyone in a position to reach out to me if you can hire a summer intern. There are no fees for interns and want to help college students grow and develop skills.

As a reminder, I have my R/E license and work on a team at Douglas Elliman. My team is amazing, and we have you covered from Miami to Jupiter. A reader and friend called me today for advice on a $10mm property and he was working with another broker not realizing I had my license.

Markets

Bezos/Amazon History

MS Block Trade Scandal

New Disruptive Company-Chamath

Indian Creek Island/Brady Home Update

730 Park Sale for $7.4mm-Original Ask of $17.7mm

Multifamily Property Economics in One Chart-Must See

Blackstone $271mm Loan on Manhattan Multifamily (Special Servicing)

Blackstone NYC Office Loan For Salle At Less than 50% of Face Value

Video of the Day-Baby Trying Wasabi

Sadly, my Instagram Reels addiction outlined in my recent report has not slowed. I was up until 3 am the other day watching reels. I still like fishing, cooking, surfing, music and basketball, but have uncovered some new ones. I found a toddler video that had me in tears. This mother (who should have her child taken away) offers wasabi to a baby who is not interested. Eventually, the baby tries a touch of the wasabi. I don’t know why, but I could not stop laughing at the video. The adorable kid is not happy after the wasabi.

My Best & Luckiest Trade Ever

When I ran the Credit Trading business at JPM, I felt managing talent and risk were two of my strongest areas. I helped to create a special culture in the division I managed. I had an amazing team of people who were remarkable and made me look good. The books were extremely complex with over 1mm live Credit Default Swaps (CDS) on the books under my purview. The amount of CDS notional value made managing risk challenging. As the spring of 2008 approached and markets were getting more volatile with scary headlines, my fear index was rising sharply. Although I had the desk positioned properly with massive hedges, there were individual company exposures of concern. The VIX (a measure of volatility of the S&P) went from 10 in early 2007 to 30 in early 2008. It ended up in the 80s by the fall on the heels of Lehman! I want to be clear, this was a once in a lifetime trade and trust me, not all others worked out so swimmingly.

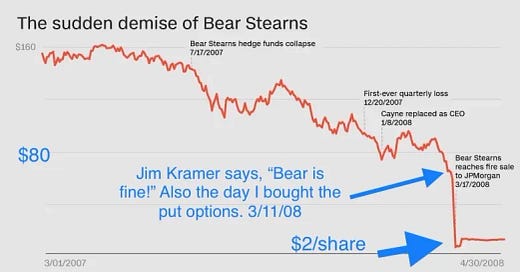

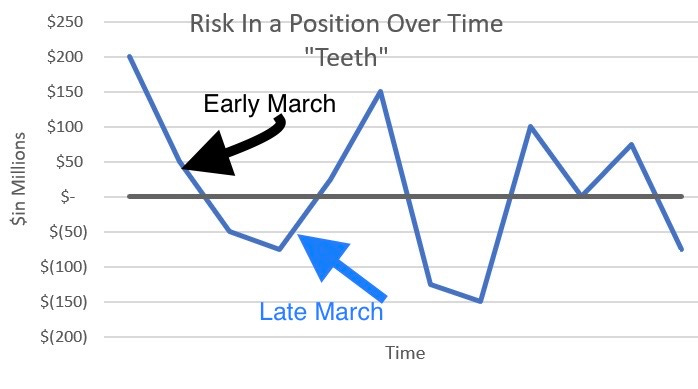

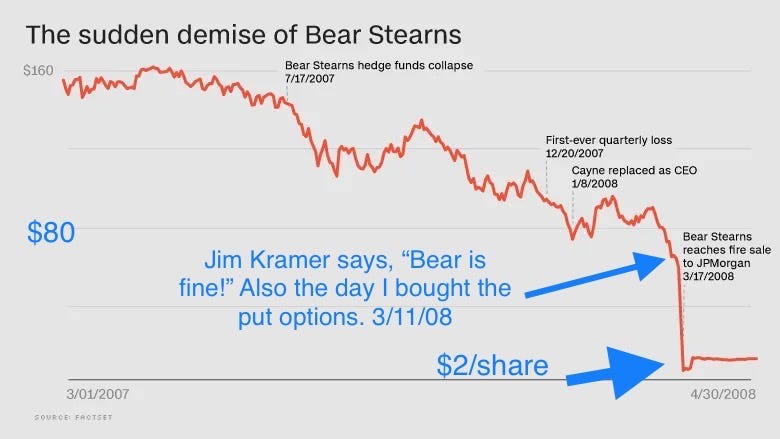

The financials traders had a long position in Bear Stearns bonds through a short CDS position. Think of it as selling insurance. If you are short CDS, you are long risk. If you are long CDS, you are short risk. The long risk position was going to expire on March 20th 2008 and we would be back to a large short-risk position (what I wanted). We called the CDS positions “teeth” because the risk moved from short to long on names, given we were market makers trading hundreds of millions of volumes. Names with large swings tended to once be investment grade and then became high yield or distressed which had less liquidity. Below is an example of what risk might have looked like in a name like Bear. Yes, big risk swings make managing risk on names that become questionable quite difficult.

I did not like the way Bear stock was behaving, as it had fallen from $131 in October 2007 to the 70s in early March of 2008. I feared that Bear could default before my risk flipped back to short on March 20th. Financials and retailers can crash in a hurry once investors/vendors smell blood. I asked an analyst to search for short-dated put options on Bear Stearns stock which I purchased on March 11th, 2008 for 25 cents, and the trade was picked up by Reuters. The contract gave me the right to sell the stock at $30/share (strike price). At the time, the stock was trading in the $70s. I was called an “idiot” for spending $500k in my management book, but I had a bad feeling. This “hedge” would protect the desk that was long risk in Bear until just after March 20th. On March 11, 2008 Jim Kramer screamed, “Bear Stearns is fine. Bear is not in trouble. Don’t take out your money.” The video is one minute long. By March 13th, Bear had a $2bn liquidity position and it was basically game over.

This Reuters article gives a timeline of the Bear debacle and how quickly things unraveled. By March 14th, just a few days after I bought the options, Bear was around $31/share and the value of my 25c options was up sharply in value despite having only days left until expiry.

That Friday night, I received a call that I needed to lead the global due diligence for the credit business concerning Bear Stearns. I went into the office on Saturday and walked over to Bear across the street. I was mortified at what I saw. The risks were massive and wrong way. I was shocked at the size of the positions they had for a relatively small firm. The marks on the books were far too high, and I went back to a conference room at JPM with about 14 people including Jamie Dimon. I wanted to speak, as I felt we should not move forward with the purchase. I recall saying, “Let Bear go. We can better platforms for pennies on the dollar.”

JPM agreed to buy Bear for $2/share over the weekend despite my objections. It was later increased to $10/share. My position worked out great, as the put option cashed out at over $26 despite the 25c purchase price. Additionally, JPM assumed the Bear debt and the CDS expired without my desk taking a $40mm hit. My desk made over $50mm within a week and did not lose on the CDS as I feared. Had I got my way and JPM walked from Bear, my desk would have lost $40mm on the CDS position and made $58mm+ on the options and I would have been fine, as the firm would have been better for it in my opinion. In the end, it was a good gut call, but lucky that it played out the way it did so quickly.

As a funny aside, I met my wife, Jill, on a blind date after being set up by a mutual friend who met Jill at Ace Greenberg’s apartment. Ace was the long-time CEO of Bear, but was not in charge at the time of the downfall, and became critical of the excessive risk-taking of the new management team. He sold a majority of his stock before the collapse.

Now why can’t I invest $500k today and make $50mm+ in a week? I guess I need to be a member of Congress or the Senate for that.

Quick Bites

Stocks have sold off a little in recent days. The S&P is -.8% on the year and the Nasdaq is -1.2% YTD. Today, stronger than-expected retail data (+.6% vs +.4% estimates) pushed Treasury yields higher. The 10-Year was +4bps to 4.1% and the 2-year was +12bps to 4.35%. JPMorgan Chase CEO Jamie Dimon said he remains cautious on the U.S. economy over the next two years because of a combination of financial and geopolitical risks. Futures suggest a 53% of a March rate cut. Oil has been volatile on the Middle East developments offset by slower than expected growth in China. However, it is trading around $73, +$4 off the levels from 1 month ago. It is well below the $94 level from October of 2023.

Bezos has had a massive impact on the world and founded one of the most disruptive companies in history. I thought this CNBC article was interesting about why he started with books. Amazon might be a $1.5 trillion “everything store” today. In the beginning, it was just books — and Jeff Bezos had a reason for that hyper-specificity. Bezos explained why he chose to only sell books on his website — at least, at first — in a “lost” video interview recorded at a Special Libraries Association conference in June 1997. Out of all the different products you might be able to sell online, books offered an “incredibly unusual benefit” that set them apart, Bezos said. “There are more items in the book category than there are items in any other category, by far,” said Bezos. “Music is No. 2 — there are about 200,000 active music CDs at any given time. But in the book space, there are over 3 million different books worldwide active in print at any given time across all languages, [and] more than 1.5 million in English alone.” This link has the history of Amazon product introductions. I like this link that compares Bezos’ physical appearance over time.

A loyal reader sent me a well-written Bloomberg story about a concerning case where a Morgan Stanley employee was tipping off hedge funds of blocks of stock coming to the market. After reading the articles and the SEC and DOJ Statements, I am dumbfounded as to why there were not more repercussions. In short, a large owner of a block of shares would contact a firm to sell the stock. Some of these block sales are in the many millions of shares. Knowing that a large block of shares is coming is MATERIAL information, yet Pawan Passi, the head of block trading at MS, and a colleague would tip off hedge funds of the upcoming share sales. The hedge funds would short the stock and buy it back when the block went for sale making substantial short-term profits. These actions were a violation by MS on many fronts and led to MS paying $249mm to the DOJ and SEC, but the bank avoided criminal charges. Passi admitted to wrongdoing and that it was a violation of policy. I would like to understand who the funds were that benefited and what consequences they suffered. Why were no charges brought for the violations? There are countless examples of wrongdoing and some are outlined below:

The equities-syndicate desk was contacted in 2018 about a block of 10 million Canada Goose shares. That same day, an investor asked a desk employee whether there was anything he should be focusing on. “How is your store of cold weather jackets,” the employee replied. The investor made a $760,000 profit from shorting the stock, according to prosecutors.

In another instance, involving a 2021 sale of millions of shares of Star Bulk Carriers Corp., Passi told the seller that he would keep the prospective sale confidential. He proceeded to share the details of the negotiations of the sale with a hedge fund “on an almost daily basis.” The fund then shorted Star Bulk Carriers on its very first trade in the company’s shares. It would later buy a chunk of the block to cover its short.

The question came after a suspect move in iHeartMedia Inc. shares the day the bank was executing a block trade on behalf of a client. Passi blamed a different bank for leaking information about the deal. The day before, he had sent information about the trade to a hedge fund that was shorting the media company.

Suspicion of such leaks spread not only on the Street — some perhaps driven by envy of Morgan Stanley’s block-trading success — but also within the bank itself. Investors were too perfectly positioned to make money on the trades, one employee said. “How are they set up for every one of these f—ing things?!” the employee asked Passi in August 2021.

Although Chamath Palihapitiya (AOL, Facebook, Social Capital, Golden State Warriors, SPACs…) is a controversial figure, I find him fascinating, and he has made a great deal of money. He launched a new company called, “8090,” which is outlined below. He wants to uncover software companies he can disrupt by building 80% of the functionality at a 90% discount. He received 1,200 responses to his Tweet with ideas.

Israel

Yemen Houthi rebels fire missile at US warship in Red Sea in first attack after American-led strikes

Two Palestinians kill woman, injure 17 in coordinated Israel car-rammings

Other Headlines

US Economy Set for Another Cash Boost If Congress Backs Tax Deal

Congressional negotiators are locked in talks over renewing expired business tax breaks and boosting the child tax credit, evenly split between both. If passed, the tax breaks offer a double-edged sword for an economy that appears on course for a soft landing. While the extra cash would boost consumer spending, it would also risk reigniting inflation pressures — complicating prospects for the Federal Reserve to lower interest rates this year, economists warned.

‘We have a huge fiscal problem’: Banking group IIF sounds the alarm on record global debt

“We have a debt problem globally. We have the highest levels of debt in a non-war period in modern history, and it’s at the corporate, household, sovereign, sub-sovereign [levels],” Adams said. “We have a huge fiscal problem everywhere, including the U.S. We’re running deficit at 7% of GDP. We need sobriety, and we need to focus on how we are going to get our fiscal house in order,” he added. I have been harping on this issue. We have an unsustainable spending and deficit problem. The growing interest burden coupled with mounting entitlements, is crowding out discretionary spending.

Artificial Intelligence Will Affect Almost 40% of Jobs, IMF Says

No timeline was given in the article. It also said that advanced economies may see 60% of jobs impacted. Goldman believes AI could impact 300mm jobs worldwide.

Judge blocks JetBlue-Spirit merger after DOJ’s antitrust challenge

JBlue+5% and Spirit -45% on news. Spirit is the worst airline of all time.

My readers know I call out everyone. I do not like the front runners for President from either party. However, Biden continues to make crazy statements and this one from a few months back is eye-opening. I think the odds are increasing that Newsom or Michelle Obama come in and Biden will back out. I believe Obama beats Trump. I am not convinced Biden or Newsom can.

Iowa caucus results: Trump wins, DeSantis edges Haley for second place, Ramaswamy ends campaign

Trump had 51% of the vote and won 98 out of 99 counties. However, the turnout was only 14.4%. NH is a different story (2nd chart).

Just does not read well.

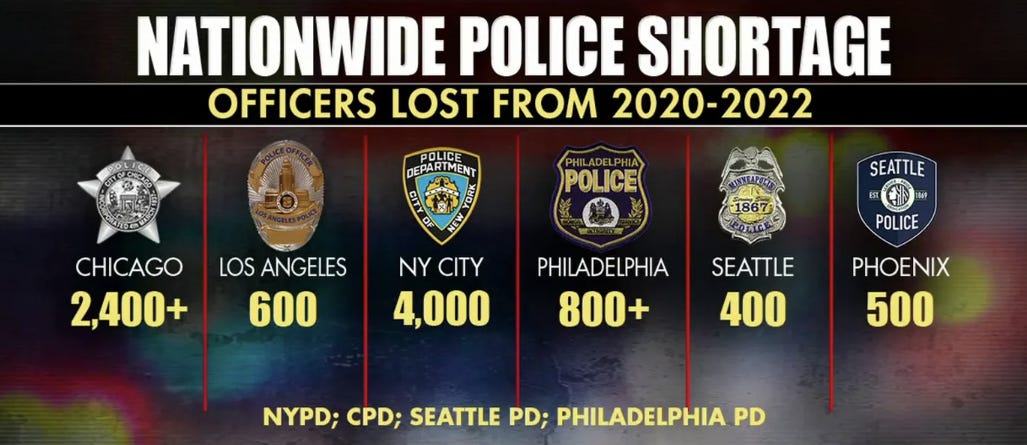

Alameda offering $75k signing bonus in addition to a $113k starting salary. NYC starting salary is $58.6k.

Violent crew terrorizing NYC newsstand vendors steals $15K in two-week spree

Principal Dan Marburger is a hero.

Here's How Much Passengers Were Paid After Alaska Airlines Plane Lost Its Door Plug Mid-Flight

I had not realized they would be paid, but passengers were given $1,500/each.

"Targeted disabilities are those disabilities that the Federal government, as a matter of policy, has identified for special emphasis in recruitment and hiring," the FAA’s website states. "They include hearing, vision, missing extremities, partial paralysis, complete paralysis, epilepsy, severe intellectual disability, psychiatric disability and dwarfism."

The wealth of the world’s five richest men more than doubled since 2020

Since 2020, these billionaires’ net worth has skyrocketed 114% to a total of $869 billion, after taking inflation into account, according to Oxfam’s annual inequality report. The list includes Musk, Arnault, Bezos, Ellison and Buffett.

His main yacht is 417 feet and the support yacht is a mere 246 feet. I know you can afford it Jeff, but do you need both yachts? Come on, man!

He went 110 miles between charges, far less than the estimated range of 320 miles. The infotainment system had issues but he said the truck was comfortable. In a separate matter, the frigid temperatures are making charging EVs an issue as well.

The twins who ate plant-based diets experienced ‘significant’ cardiometabolic benefits, but the study had limitations

You are 48% more likely to land a first date if you do this 1 thing, new data shows

The answer is not what I would have guessed.

Doctor shares exact age you should stop drinking if you want to prevent dementia

The doctor suggests 65 is the cut-off. This means I have 11 more years of drinking wine.

The No. 1 in-demand remote job companies are hiring for—it can pay over $100,000 a year

The best rewards credit cards of January 2024

My favorites are the Barclays/JetBlue and the Amazon Prime Card. For business, I use the Chase Sapphire Preferred Card.

Bar Keepers Friend is my single favorite cleaning solution in the kitchen for pots, pans and stove top. Powder is better than liquid form.

Arnold Schwarzenegger detained at Munich airport, ‘criminal tax proceedings’ initiated

Ukraine and Switzerland urge countries to support peace plan in Davos

Let me get this right, the next pandemic starts in a wet market and not in a lab, right? Why are you creating these viruses? For what reason?

Hot pink ‘UFO’ whizzes past Poland-bound airplane, flight attendant video shows

Real Estate

The luxe Miami waterfront mansion of future Hall of Fame quarterback Tom Brady is nearing completion. The recently retired and newly divorced athlete is in the final stages of completing his posh bachelor pad in the exclusive Indian Creek Island, famously known as “Billionaire Bunker.” Brady paid $17mm for the 1.84 acre lot and the article suggests he received a $35mm construction loan. He is building a 23,000 square foot home. David Guetta recently bought a home for $69mm on the island and Bezos bought TWO lots for a total of 4.6 acres for $148mm recently. Good pictures in the link. Indian Creek is a like Fort Knox. Armed guards are everywhere and they patrol the surrounding water by boat. I considered buying a lot in 2017 but decided I did not want to spend so much. I would have made a killing. Julio Iglesias bought his first lot on Indian Creek for $650k in 1978 and owns a bunch of property there. The island totals 297 acres and has about 30 homes. It was developed in the 1930s by a group of wealthy Midwesterners.

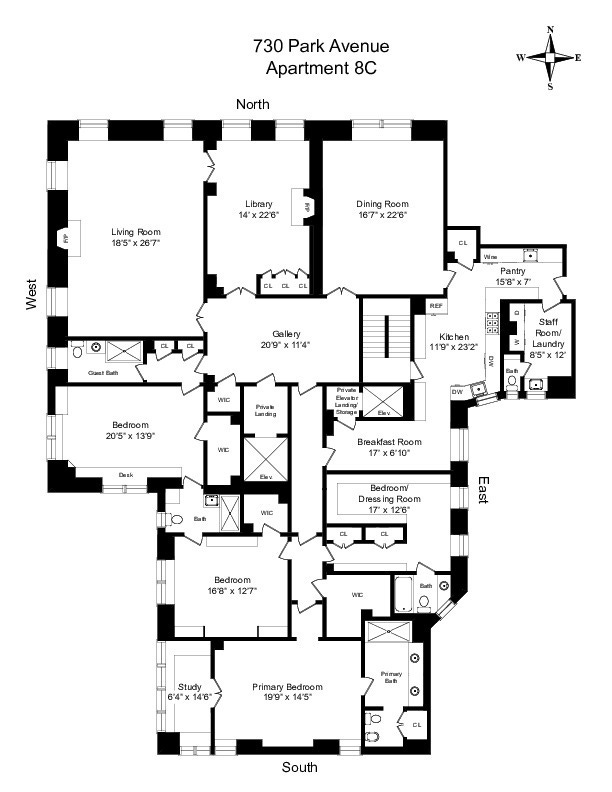

I had recently written about Ed Minskoff’s 730 Park Avenue Apartment being listed for almost 2 years. It started at $17.7mm and the sale just closed for $7.4mm This is one of the better co-op buildings on the Upper East Side and the unit showed well given an amazing art and furniture collection. It has 4 beds and 4.5 baths. The monthly maintenance was $11.9k. Prices of many co-ops are getting so beaten up that they are starting to look cheap relative to the condos. Having said that, I would never buy a co-op again and go through the ridiculousness that it takes to get into one. Also, the amenities are awful at most co-ops (small gym, no pool, no parking….). Many new condo buildings have remarkable gyms, pools, restaurants, valet parking, concierge…). The amenity package at 220 CPS is bonkers, but units go for $10k/ft or more in some case and co-ops are trading at a fraction of that. I don’t know the exact square footage of the 730 Park sale, but as a guess it was under $2k/ft for perspective.

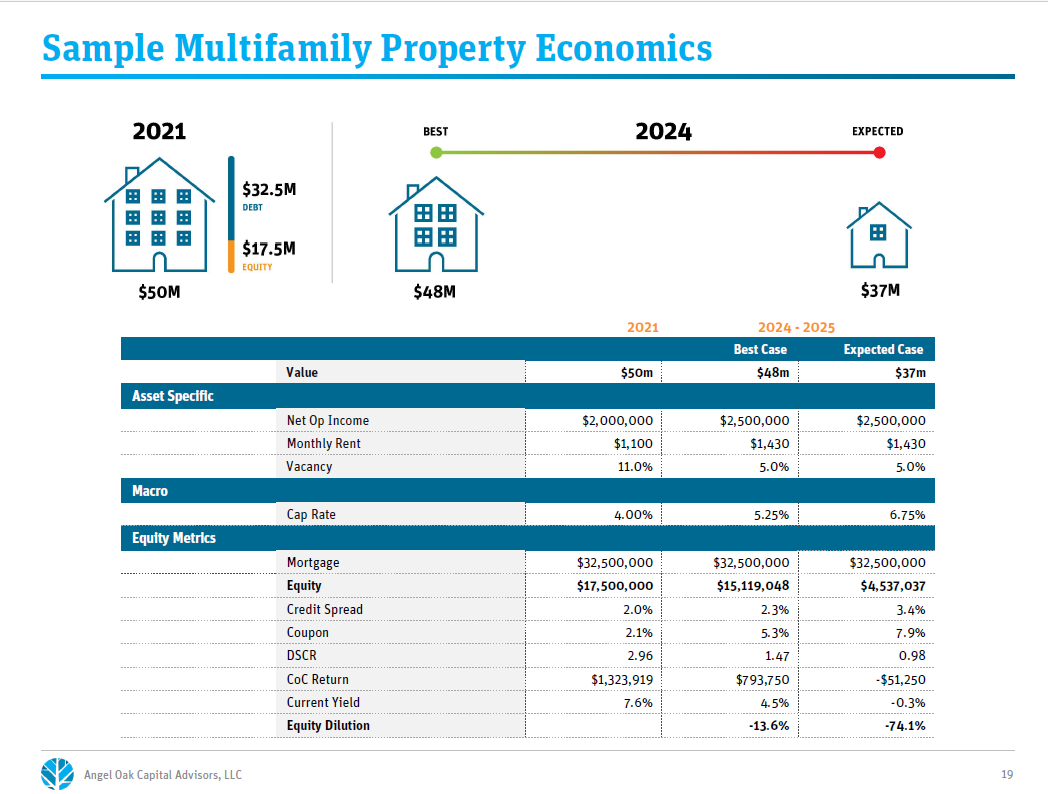

Fantastic chart outlining multifamily property economics

Check out this headline, Blackstone’s $271M Loan on Manhattan Multifamily Portfolio Hits Special Servicing.”

Blackstone’s Defaulted NYC Office Loan for Sale at 50% Discount

Debt servicer said to market $308 million loan at $150 million

© 2024 The Rosen Report LLC. All rights reserved. Does not constitute investment, financial, legal or tax advice. Consult with your lawyers and professional financial advisers.

Rosen Report™ #648 ©Copyright 2024 Written By Eric Rosen