Opening Comments

Today’s Podcast-33 minutes. A bit longer today given the large number of topics.

A quick story on the power of the Rosen Report. My friend sent me resumes for review to help him narrow the list of potential candidates for his new business venture. He wanted me to speak with a candidate based on the impressive resume. I knew a loyal reader at one of the candidate’s former employers. I called up the reader for a background check, and it turns out that the candidate’s resume was aggressively embellished to the point of dishonest. In one quick phone call, I was able to cross off a potential candidate for lying on his career profile. I have been fortunate to build a great network across so many industries in part, due to the Rosen Report. I hope I can continue to grow it with your help. 100% word of mouth.

On Saturday morning, I checked CA House election results only to find that some precincts have counted 60-75% of the votes counted and no winner has been declared. This is now 11 days since the election. To me, this does not give Americans confidence in the outcome. I took this snippet on Saturday at 7:18 am EST. Last I checked, the Republicans have 219 seats (218 is majority) with 4 seats still remaining. Looks to me like the Republicans get to 220/221 based on current standings. The Senate is 50/49 in Democrats favor and we are awaiting the GA runoff on Dec 6th.

Picture of the Day-High-End Watch Market Overview

My Failed Crypto Experiment

Quick Bites

Markets

Barry Sternlicht/Bullard on the Fed

FTX Update-MUST READ

Twitter/Musk/Trump Update

Standardized Testing for College

Other Headlines

Crime Headlines

Real Estate

NYC Commercial

Boca Raton High-End Chart Included

WSJ Article on High-End Slowing in US

Other R/E Headlines

Virus/Vaccine

NYTimes Article on Boosters

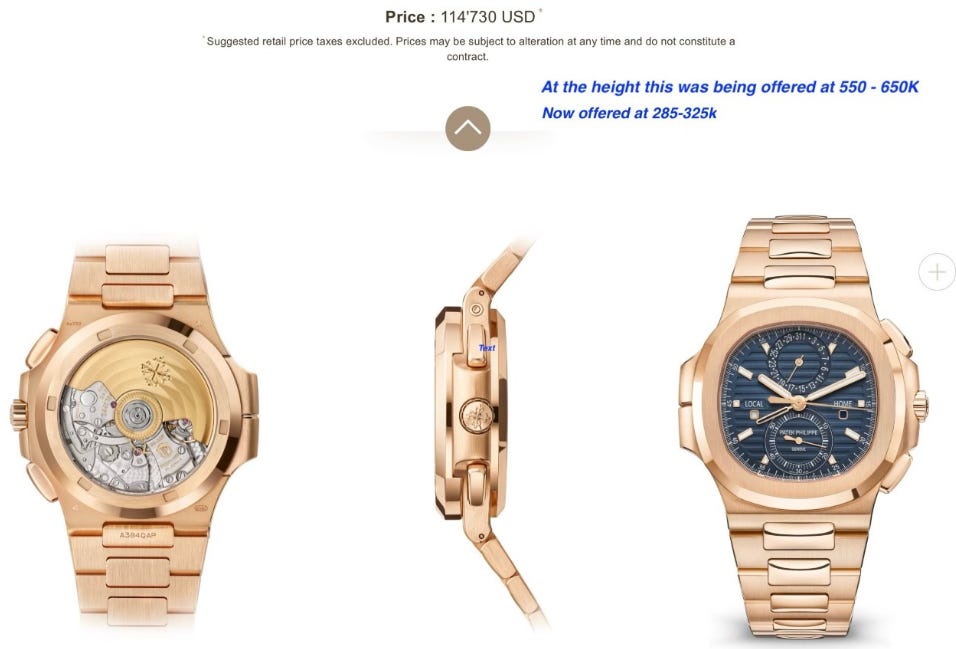

Pictures of the Day-High-End Watch Market Overview

With the help of my readers Armen and Ara who own a watch/jewelry store, Darakjian Jewelers, I had them put together some data on the watch market in italics. Text Armen at 248-765-6666 and mention you are a loyal reader and you will get the special Rosen Report treatment. I have no business relationship with them and get nothing out of any sales.

At one time, I had a substantial watch collection, and now almost never wear a watch other than an Apple watch. I saw that watches went crazy during the pandemic, but as outlined below, you can see many are well-off the highs. There is price commentary inside the pictures from Armen.

Watches were going for 2, 3, 4, even 5 and 6 times retail on the open market. The real spike happened in conjunction with the stimulus money, lack of confidence in the government and stock market and huge price increases in the crypto market.

For example, if you wanted a Rose Gold Audemars Piguet Royal Oak chronograph (retail $63,300) by the time you finally got offered the watch you truly wanted, you probably spent more than that on a far lesser watch. At one time this watch was as high as $180k.

Other brands that experienced this “premium” pricing were Patek Philippe, Rolex, Richard Mille and Vacheron Constantin.

Special mention to FP Journe. They have also skyrocketed but don’t seem to be adjusting back down. For example, I sold one of these platinum FP. Journe Resonance with gold movement in 2019 for 37k and currently these pieces go for over 290k.

With these inflated prices and product not available some of the boutique/independent brands have experienced a huge uptick in demand. All the brands other than Vacheron Constantin are Independent and in their past this desirable.

I had a Stainless-Steel Daytona years ago. I think I paid $10k for it and it was stolen. Don’t get me started. Check out the movement in prices below.

My Failed Crypto Experiment

I feel I owe my readers transparency on the heels of FTX and the frigid crypto winter. When I make a bad call, I try to be intellectually honest as to what went wrong. How can I learn and grow from my mistake? I have people in my life who only tell me about their winners and suggest they never make bad investments. This is not who I am. I have been fortunate to make many investments across asset classes from debt, equity, PE, Venture and R/E which have worked well, but made many mistakes along the way. I am not scared to admit fault in hopes others can learn from it. The chart below outlines the cumulative market cap of crypto currencies which peaked at $2.9 trillion in November 2021 and is $900bn today.

When crypto was exploding higher daily, I missed out on much of it. My position in Bitcoin was so small, the money I made was irrelevant. I never fell for the NFT angle and wrote about it extensively and the absurdity of the $69mm Beeple art sale. The NFT below is down 95% since January, despite the fact that Bieber bought it.

However, I did get involved in crytpo. I always wrote you should size these bets accordingly given the risky nature. Legendary investors became involved in crypto which added credibility including: Stan Druckenmiller, Paul Tudor Jones, Barry Sternlicht, Jack Dorsey, Bill Miller, Mark Cuban, Fidelity Investments, Blackrock…. I invested approximately 1% of my net worth into various crypto plays as outlined below:

RBN, ETH, AVAX, LOOKS, Wmemo, OHM, KP3R, Solana, Luna, DOT, AXS, BTC

Lets just say, I wish I never met the word crypto and lost 85% of my money. Thankfully, I sized my bet properly, so the damage was limited. However, I do believe the technology behind crypto and NFTs will have a lasting impact. I believe over time, the world will gravitate towards “Smart Contracts,” which should be used when buying major assets (homes, cars, boats, art…). Also, although crytpo is out of fashion today, I still believe some of the major currencies could make a comeback.

What drove a successful investor to make such an investment? In hindsight, I feel it was a few things. FOMO, or fear of missing out was part of it and hearing from legendary investors with phenomenal track records that crypto was legit all contributed. Speaking with people who had made 100x or more on their money in short order while the industry was growing into the trillions gave me the wrong belief that it was a “real” asset. The scarcity value of the currencies given the limited supply was enticing. Also, my concerns about the non-stop printing by Central Banks and having a “hedge” was the thought which proved to be a poor thesis. I also wrongly believed that crypto would de-couple from broader markets and have a sharply lower correlation to stocks.

My good friend, Mike Cembalest (JPM), did not fall for the hype. He made it clear he did not believe in the asset class as advertised and wrote as much on multiple occasions. Despite the fact that Cembalest has an IQ slightly higher than mine, I felt the size of my investment and the market momentum were worth the risk. I was wrong.

However, we are in the early stages of the crypto asset class and I am curious to see where it shakes out 10 years from now. Remember, the mortgage disaster in the Global Financial Crisis did not end the mortgage market. We did not write off banks after the late 80s collapses and did not write off every fund after Madoff. When oil went negative during the pandemic, energy companies were crushed and now they are flush with cash in many instances. I am not suggesting cypto will thrive, I just don’t think the final chapter has been written.

There is a question about regulation given many of these companies tend to be offshore. However, Gary Gensler (Head of SEC) made it clear these are securities. “Nothing about the crypto markets is incompatible with the securities laws,” Gensler said. "Investor protection is just as relevant, regardless of underlying technologies.” The SEC and politicians did not do their jobs in my mind. Not to protect me, but the “little guy.” I am an experienced investor and knew full well the risks. Dozens of people I spoke with had 80% or more of their net worth in some crytpo related investments (coins, staking, NFTs, exchanges…). Gary Gensler met with Bankman-Fried in March. What took place in that meeting? There are over 9,000 letters to Congress demanding an investigation into Gensler’s ties to FTX. Remember, Ellison CEO of Alemeda, has a father who works at MIT and formerly worked with Gensler. Also, the General Counsel of FTX was lead counsel to Gensler at the CFTC. Was there a conflict here? I don’t know enough, but people are questioning that relationship and Gensler’s lack of action.

I met with Gensler in 2012 and I can tell you, he was no wallflower. I believe he understood complex issues and he had a very strong view (Wharton, Goldman Sachs partner at 30). However, it should be noted that the investment banks were highly regulated, and that did not stop Bear, Lehman and others from imploding.

The chair of the House Financial Services Committee is Maxine Waters. She is an 84 year old sociology major in her 15th term. Call me cynical, but how many 84 year olds should be in a leadership position for the Financial Services Committee with zero Financial Services real-world work experience? There are 54 members on the Financial Services Committee. I randomly checked 15 members (average age was 57, but 9 were over 65). I found one of the 15 had any kind of finance related background (CPA-Sherman-CA). Almost all were career politicians.

This is not an indictment on any individual. The process is broken. Term limits are needed and politicians and regulators need to be held accountable for their lack of action to protect small investors. We need more people who have real world experience in business and financial markets, not career politicians. Bankman-Fried’s Alameda research promised 15%+ returns with “NO RISK”in a zero rate environment. From an Alameda pitch deck. No red flags here!

As individuals, we all need to take responsibility for our actions. Do your homework. Size your investments accordingly. Investing in short dated Treasuries/Munis or a long term view on the S&P 500 is very different than a venture investment, penny stock, or crypto and the percent of your net worth invested should reflect it. Good luck and remember, the adage from your mom, “If it sounds too good to be true, it generally is too good to be true.”

Quick Bites

The major averages ticked higher in afternoon trading Friday to end the day on an upbeat note as investors assessed tougher language from Federal Reserve speakers and pored over the latest earnings reports. All of the major averages posted losses for the week. The Dow ended 0.01% lower. The S&P 500 lost 0.69% for the week, while the Nasdaq ended 1.57% lower. All three indexes are positive for the month, however. Oil fell and was down on the week on China and fears of higher rates. Oil is back to $79 after hitting $92 in early October. Rates in general were higher on Treasuries for the week with the 2 year at 4.53%. Now the 2s/10s curve which I cite frequently is -69bps. This is a big warning sign and has historically been perfectly predictive of recessions (2nd chart). Any time we have gone negative since the late 70s, we have had a recession (vertical gray bars).

I have a lot of respect for Barry Sternlicht as an investor. He is extremely bright and successful. I agree that we have not seen the full impact of rate hikes and do fear the Fed may go too far, after all, they went too far with zero and QE. I called peak inflation in June and now am of the view inflation is more likely to collapse than spike. Maybe not back to pre-pandemic levels, but so many things are rolling over, which is why I am concerned about the Fed who has been so wrong. The Federal Reserve’s moves in 2022 to aggressively raise interest rates to cool down inflation will inflict greater harm to the economy than expected, according to Barry Sternlicht, chairman and CEO of Starwood Capital Group. “It’s not sustainable,” he said on CNBC’s “Squawk Box” Thursday. “What they want to do is clearly suicide.” Companies will pull back their budgets for 2023 as they worry about economic recession and consumer weakness. That will add pressure to companies and could continue to weigh on stocks. The destruction of wealth that’s taking place now, and the movement of capital from investment in new plants and equipment that will grow the economy, is instead going to pull it back, he said. St. Louis Fed President Bullard said, “the policy rate is not yet in a zone that may be considered sufficiently restrictive.” He suggested the Fed has a lot more work to do before it brings inflation under control. Bullard suggested we can see 5-7% Fed Funds to fight inflation. I don’t agree, but if we see 7%, stocks go a lot lower. Note the 2nd chart on used car prices. Another sign inflation is turning for the better.

If you are interested in the Sam Bankman-FRAUD/FTX disaster, you must open this link. A reporter wrote an article on SBF this summer and SBF sent him a DM on Twitter on November 13th to chat. The article shows the conversation, and it does not reflect well on the FTX founder. Below are excerpts with the reporter’s comments in blue. SBF is clearly a fraud in my mind. He had the world fooled and was the next JP Morgan according to many including Jim Cramer. All these massive firms/funds invested in him, and clearly lacked due diligence. In this CNBC story, FTX used corporate funds to purchase homes for employees. The new CEO for FTX, John Ray III, is an experienced executive who took over Enron and other disasters after the fact. He wrote about FTX and a total lack of financial and corporate controls. “Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here. From compromised systems integrity and faulty regulatory oversight abroad, to the concentration of control in the hands of a very small group of inexperienced, unsophisticated and potentially compromised individuals, this situation is unprecedented. I do not believe it appropriate for stakeholders or the Court to rely on the audited financial statements as a reliable indication of the financial circumstances of these [companies].”

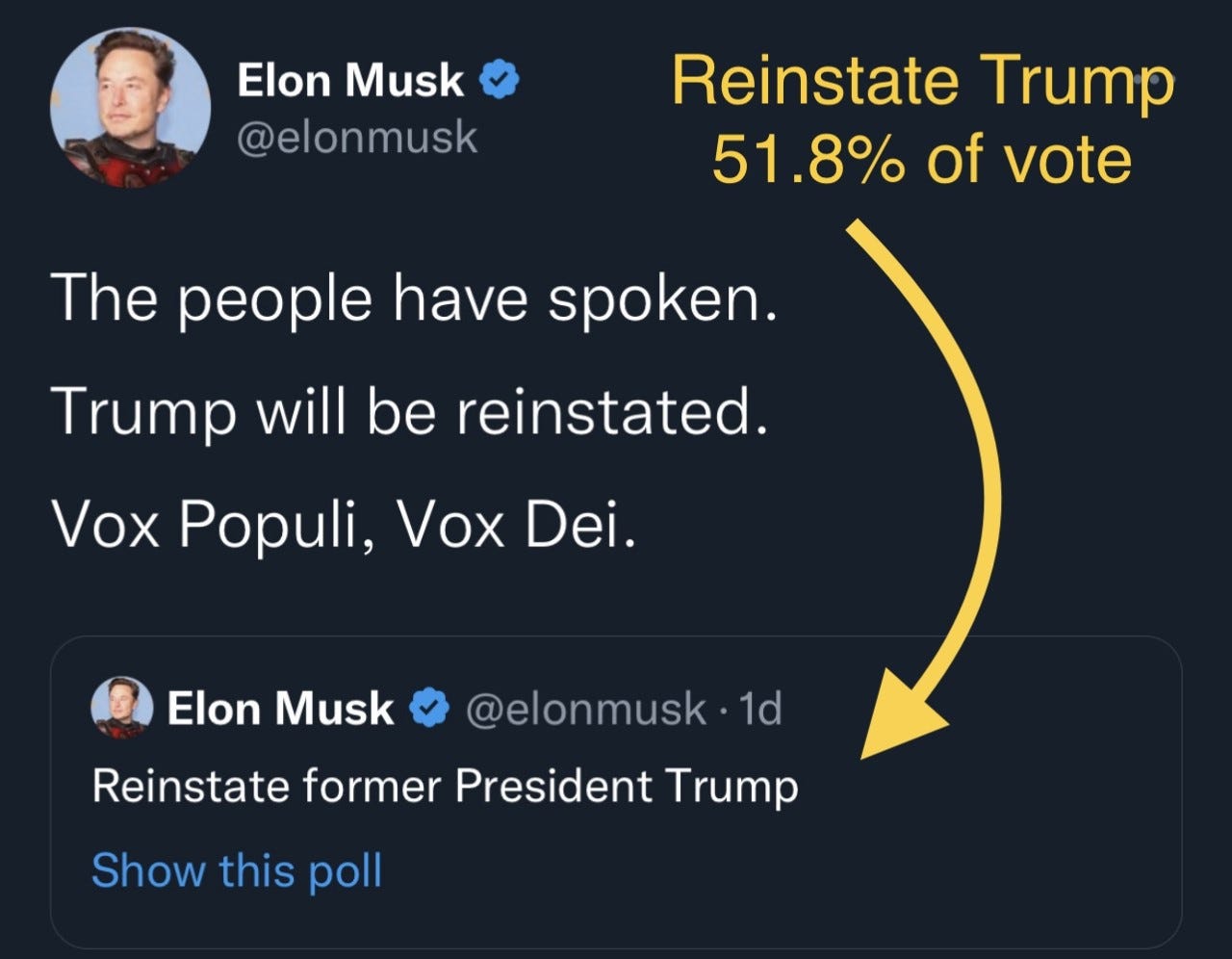

I am a BIG fan of Musk and his impact on the world, but I am worried about his handling of Twitter. One report has him at Twitter over 100 hours/week. What about the billions invested in his other endeavors where investors believed Musk would be actively involved? He fired half of the staff of Twitter and then another 1,200 resigned due to the “back to the office” ultimatum. His staff is down from 7,500 to approximately 2,500. Of note, CBS suspended all Twitter activity out of “abundance of caution,” and cited, “uncertainty” due to Musk. I disagree with the tactics of CBS. On Saturday night, Musk announced the results of his poll to re-instate Trump which had over 15mm votes and saw 51.8% in favor of Trump’s ban being lifted. Trump said he has no interest in returning to Twitter despite the fact he had 89mm followers and only 4.5mm on his Truth Social platform. Musk is brilliant and sure hope he figures out Twitter without neglecting his other endeavors, but I am concerned Twitter is turning into a dumpster fire that will take too much of his precious time. As I said countless times, it ain’t worth $44bn.

When it comes to standardized testing, there is quite a debate about fairness. It seems that many believe such tests are predictive of college reediness. Others suggest that GPA is a better indicator of college preparedness. The study suggests GPA is 5 times stronger than the ACT at predicting college graduation according to the University of Chicago. I spoke with a successful college prep business owner in NYC. One family spent $200k to prepare for the SAT for their son and got into a fantastic school, as his score improved from 1150 to over 1500. However, he then struggled in the challenging academic environment and his parents spent over $150k/semester on tutors to get him through college over and above his tuition. I have had multiple friends/readers who have spent $500/hr on tutoring to get their kids sharply higher scores on SAT/ACT ($75k per child). This NY Post article outlined 1.5k/hour tutors to get your kid into Ivy League schools. Clearly, those with less means are unable pay tutors, which is why some schools have made testing optional. This WSJ article outlines that the American Bar Association panel voted Friday to drop a requirement that law school applicants take the LSAT. I’m torn, as I do believe testing is predictive, but it can be gamed and not fair for those with less means. What do you think? This link from Collegeadvisor.com outlines top colleges which went testing optional, but some are mandating testing in coming years.

Other Headlines

Investment Giants With $2.3 Trillion Bet on More Market Turmoil

I had not considered this issue, but he brings up a good point and highlights the importance of being more independent on manufacturing.

Walmart and Target’s quarterly results lay bare the retailers’ stark differences

Carvana lays off 1,500 employees (8% of workforce) following stock free fall

Stock -97% YTD.

World Oil Demand Topped Pre-Covid Levels In September

Unfortunately, the world will be reliant on fossil fuels for decades. We are now at 101% of pre-covid oil demand globally. We are consuming approximately 100mm barrels/day globally. 20mm+ in US (more than any other country).

Masayoshi Son Now Owes SoftBank $4.7 Billion on Side Deals

CEO’s compensation plan backfiring amid plunging valuations

I have been extremely critical of the management team at Softbank.

San Francisco Sees Risk of Lost Revenue as Remote Work Prevails

Maybe the picture below and high crime rates are contributing to why people don’t want to come to the office?

NYC taxi fares expected to increase by 23% by the end of this year

Fares have skyrocketed for Uber and Taxi rides. With subways less safe, it sure adds to the cost of living in NYC.

FBI boss Wray can't 'be sure' if Facebook sending agents user info

The suggestion here is that Meta has sent the FBI user info without user consent or an FBI request (no warrant/subpoena).

Pelosi to step aside from Dem leadership, remain in Congress

She led the Democrats for almost 20 years and has been in Congress for 35 years.

Democrats poised to pick Hakeem Jeffries as Nancy Pelosi’s successor

I don’t know a great deal about him. He is 52-years-old. I am just happy there will be a senior person not geriatric.

GOP megadonors ditch Donald Trump's 2024 White House run

Good. Time for a new candidate.

Trump criminal probe: Attorney General Garland names special counsel Jack Smith. Bill Barr says DOJ has enough evidence to indict Trump.

'Kanye was rite': Jewish cemetery vandalized with swastikas (Chicago)

When you have stars with millions of followers who spew hate, it legitimizes it.

Princeton University offers classes on 'BDSM,' 'Fetishism and Decolonization'

Check out some of the class titles in the link. "Black + Queer in Leather: Black Leather/BDSM Material Culture, "FAT: The F-Word and the Public Body," and many more.

Maryland probe finds 158 abusive priests, over 600 victims

How many thousands of victims are there over the past 100 years?

Transgender female cross-country runner dominating new competition after struggling against boys

After finishing in 72nd place in a boys race last year, she won the race this year

Elizabeth Holmes Sentenced to More Than 11 Years in Prison

I want to see what happens to SBF for his fraud. Holmes blew billions and lied to all parties. She had asked for 18 months.

Sam Bankman-Fried ex Caroline Ellison made ‘foray’ into ‘Chinese harem’ polyamory

What could possibly go wrong with 10 people living together in a “poly” relationship running billions of dollar and doing drugs, while having raised money from the most influential people in the world? Lots of egg on faces.

The One Frozen Food Doctors Say You Should Stop Buying ASAP–It’s So Bad For Your Heart

Frozen PIZZA!

Crime Headlines

Watch man ‘having the time of his life’ smoking crack on subway

I am a little confused. A man DELIBERATELY runs over two dozen sheriff’s recruits and gets released so the police can complete the investigation? Why not do that with Guiterrez in jail?

Wisconsin's Most Wanted has $100K bond posted by convicted drug dealer

He is awaiting trial for shooting a man. He does not seem like the guy I would let out given his history of disappearing and violence. Are the authorities really making the community safer with these moronic policies? No red flags that a convicted drug dealer posted his bail and he actively evades authorities?

At least 5 people killed, 18 injured in a shooting at a gay nightclub in Colorado Springs

Call me crazy. If you are in taxpayer-funded housing and are involved in illegal drug activity, I feel you should be kicked out. After all, you are putting your neighbors at risk and breaking the law.

Body Cam Video Shows Paul Pelosi Opened Door for Police, Despite DOJ Saying Otherwise

Of note, the NBC reporter, Miguel Almaguer, who broke this story, which was then retracted, was suspended. No one is questioning if DePape broke in and harmed Pelosi.

Real Estate

I spoke with a commercial R/E lawyer in NYC who has large clients. There is a growing lack of commitment and confidence from tenants based on the transactions he is negotiating. He is seeing most lease renewals at reduced rent, reduced size and reduced term. This is not showing a great deal of confidence. Historically, it has benefited the tenant to lock in rents for longer periods of time.

In my community, Royal Palm, in Boca Raton, FL, there are now 32 homes for sale. The average asking price is a WHOPPING $17.4mm. There are 17 homes for sale over $15mm and 11 for sale over $20mm. When I bought in 2017, there were 71 homes for sale for an average ask of $4.9mm. In all of 2017, the average selling price of the 56 homes sold was $3.6mm and NOTHING sold for over $12.4mm (the only house which sold over $8.5mm in 2017). Twenty-Three homes sold for UNDER $3mm (most tear downs). I paid $6.3mm (new construction) not on the water and people thought I was nuts. Now, new homes like mine are asking $16-18mm. In December, inventory was down to 4 homes. Houses are definitely staying on the market longer. One which asked $35mm originally was offered $29mm and they passed. It is still sitting on the market almost 8 months later, and asking $27.9. Prices need to come down more to reflect the reality of higher rates, massive losses in equity, fixed income, crypto, lower bonuses for Wall Street and no bonuses for most hedge funds. Check out the $41.5mm listing. Just listed. Most of the inside looks good. There is an awful bathroom. Check out the chart below to see the progression of prices and average cost in Royal Palm. In 2017, the average home sold for $3.6mm and in 2022, the average is $8.4mm. The high price in 2017 was $12.4mm and in 2022, $26.5mm.

This article from the WSJ is entitled, “He Thought His Home Might Sell for $30 Million. Fifteen Months Later, It’s ‘The Steal of the Century. A half dozen or so homes are discussed in the article in LA, East Hampton, Houston, NYC, Beverly Hills, Lake Tahoe… All are high-end homes/apartments which are seeing significant mark-downs to attract attention. I like Sue Gross’ home (ex-wife of Bill Gross) and the art in Ed Minskoff’s apartment.

37% of real estate agents in the US couldn't afford to pay their rent in October

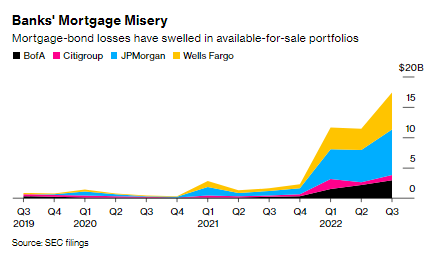

Mortgage Market Upheaval Spurs $17 Billion in Paper Losses for Banks

Existing home sales -5.9% in October and -28.4% over last year.

Tampa Bay real estate market screeches to a halt after interest rate hike

Wild allegations at Miami homeowners association show why Florida needs HOA crackdown

This story is incredible. The HOA leadership was embezzling money ($2mm) and doing all kinds of illegal things.

Virus/Vaccine

Will Covid Boosters Prevent Another Wave? Scientists Aren’t So Sure.

This is a NY Times article and shows reservations about the booster’s efficacy on new variants.

My BTC investment is down massively. I lost on all fronts.

Don’t make the same mistake in the “digital asset space twice - you lost $ because you didn’t truly understand that there is bitcoin (the true innovation) and everything else (which traps fomo’ing tradfi types. Buying btc today is like going back to 2030 except with a network far more adopted and capable of withstanding attacks. You are being given a gift to do the homework, learn about bitcoin and buy it at great entry price. Good luck!