My First Bite out of the Big Apple...A Lesson in R/E and Expectations Management

6-21-23

Opening Comments

From my Bad Roman review, the most opened link was Stan Druckenmiller’s AI investments. Also, the notes in the R/E section with the expert received a lot of positive feedback. Some amazing data in there.

Lots of driving. My drive from Marion, Mass to NYC on Monday took over 5.5 hours and should take 3 hours and 45 minutes. Jack and I were in Philly for another tournament Tuesday, and my good friend, Ryan, was the caddy. He is a local and knows the course well. Ryan is my headhunter extraordinaire who I use to find talent when I advise companies and sit on boards.

Does anyone know a member of North Fork Country Club near the Hamptons? Jack has a tournament and would like to play a practice round if possible. Thanks.

In the past two weeks, I believe readers bought a total of 6 more Kia Tellurides. I lost count of how many readers have bought one, but it is over 60 cars by now. I may trade mine in for a new one if I can get the dealer’s offer down.

My First Bite out of the Big Apple...A Lesson in R/E and Expectations Management

Markets/Powell Comments

Private Equity Unhedged on Rates for Portfolio Companies-OUCH

Auto Delinquency Data

Survey-One Word to Describe Biden & Trump

CA Reparations Details for Proposal

Miami Update on a Couple Transactions

The Value of $250k in Cities-NYC is Worst

Another Large NYC Apt Sold at a Loss Despite 2006 Purchase

Self Storage Market-Great Chart

Video of the Day-Woman Falls on Treadmill-Lost Pants

A woman was running on a treadmill in the gym in Chicago and her shoelace came untied. She fell and tried to hold onto the bars. Her leggings got caught in the treadmill and were taken off. She let go and hit her face on the treadmill. It is a short video and pretty funny. No serious injuries and she is laughing about it. Tie those shoes kids.

My First Bite out of the Big Apple...A Lesson in R/E and Expectations Management

I had been working in Chicago at Bank of America (formerly Continental Bank), while attending the University of Chicago for business school. I had been contacted by a handful of large banks/investment banks in NYC to consider running a trading desk.

In an embarrassing story, after I received offers to move from Chicago to NYC to run trading desks, I called my grandmother, Nell Rosen, who was 91 years old at the time. She was a fireball despite standing 4’10” tall. I told her I did not know many people in NYC and I was a little nervous about leaving my life in Chicago. She said, “Are you kidding me right now? You are 27-years-old and the world is your oyster. Don’t be such a wuss.” Well, being called out by my Lilliputian 91-year-old grandmother was the kick in the ass I needed to take the job. Thank goodness for Nell. I am 17 years old in the picture below.

I took a job at Chase (became JPM) and moved to NYC without an apartment. Chase put me up at the Waldorf Astoria, as the apartment market was tight with little availability. Remember, I was coming from Chicago, not Alabama, so I thought I had a grasp on prices.

Chase hired a real estate agent, and we went looking for a place. I have written extensively on the topic of expectations management (including the last piece on Bad Roman). The savvy broker took me to the “Nevada Towers” as our first stop. It is a building on 70th between Broadway and Columbus on the Upper West Side. It was a tired looking building from 1977.

She showed me a 400 square foot studio apartment which was DISGUSTING and told me it cost $2,700/month (as is). I swear I almost cried. It was on a low floor, and it was so loud, I could not live there if you gave it to me. The wood floor was missing some of the tiles and the walls looked like they had not been painted in ages. The broker did a masterful job of showing me the worst place first to manage my expectations. My gut is she exaggerated the cost just to make it seem even more outlandish so the future showings would seem cheap. I officially questioned my decision to move to NYC. She saw the look on my face and knew she had me right where she wanted me. I was livid and thinking I am going to be living in a disgusting place and should never left MJ and the Bulls. Remember, in 1997, there was not a developed internet with full information on apartments as there is today. Clearly, the Dark Ages. I found this article about a 77 sq ft apartment in Greenwich Village with NO BATHROOM which rented for $2,350/month recently. What idiot would pay that much money for a less than 11x7 ft room? It actually makes Nevada Towers look good.

We looked at a few more places. They were all gross from my perspective, and the broker was only setting the hook deeper. Chase continued to put me up at the Waldorf which was fantastic, as it was across the street from my office, and I was working 12 hours or more a day. I was at the Waldorf for a couple months and working so much, I had little time for apartment hunting. I remained scarred by the first studio and desperate to find a place to live.

The broker called and told me she had a great apartment for me. It was at 61 W 62nd Street (62nd and Columbus) across from Lincoln Center. It was an 800 sq ft 1 bedroom with 1.5 baths and a dining room and large living room. It also had a terrace (waste in NYC-see below). Although it turned out to be a location I did not love, it was my first NYC apartment, and it was $2,700/month, slightly below by $3,000 limit. My life in NYC began in the spring of 1997. Relative to the hell hole of the Nevada Towers studio, I looked like I was living in the Taj-Mahal. The brilliant ploy of the real estate broker worked and I felt like a negotiated a deal from my Russian landlord.

Don’t get me wrong, my 8th floor apartment was loud, as it faced Broadway and that is a busy street with honking, ambulances and traffic. However, I was settling into NYC and loving my life. Work was going exceptionally well, and my business was thriving. I had a team of amazing people and was learning and growing into a solid manager. There is ZERO chance I would have had my success if I did not move to NYC. Thank goodness for Nell.

NYC terrace space are NOT worth it. Filthy, dirty, disgusting and you just don’t use it. I had 3,000 square feet of terrace on 74th and Park Avenue (sold in 2016) and might have used it 2 times a year. It was so gross out there it needed to be power washed prior to every use. It is amazing that in 1997 I was looking at crappy apartments and then lived in a Park Avenue PH 14 years later. That is what is great about America. Anything is possible, and I am proof of that concept.

Quick Bites

Stocks fell Wednesday as investors took a breather from last week’s market rally, and weighed Federal Reserve Chair Jerome Powell’s latest comments on inflation.

The Dow was lower by 0.30%. The S&P 500 dropped 0.52%, while the Nasdaq slid 1.21%. It was the third consecutive day of losses for the three indexes. Powell said Wednesday that more rate hikes are likely ahead as the central bank tries to combat inflation. “Inflation pressures continue to run high, and the process of getting inflation back down to 2% has a long way to go,” he said. Intel stock dropped 6% on Wednesday after the company gave investors an update on the company’s turnaround plan to become a foundry competing with Taiwan Semiconductor Manufacturing Company. Treasury yields were largely unchanged with the 2-year at 4.72% and the 10 year at 3.72%.

Good Bloomberg article entitled, “Hedging Failure Exposes Private Equity to Interest-Rate Surge.” The high level of unhedged debt is “something that for us just points to a latent risk that is percolating,” said Sriram Reddy, managing director of credit at Man GLG, a unit of Man Group, the biggest publicly traded hedge fund. “Any downshift in earnings could be very painful.” William Cox, senior managing director at KBRA, a credit-ratings firm that specializes in mid-sized companies and private debt, foresees a rash of defaults among corporate borrowers that are unhedged because they simply can’t generate the cash flow to keep up with rising interest costs. With Powell suggesting higher for longer, this rate move will leave many companies unable to handle to debt load. Again, thank the ineptitude of the Fed for leaving rates too low for too long, while continuing Quantitative Easing, which pushed inflation to high levels. However, PE managers and CEO/CFO levels should have done far more to take advantage of the “free money” by locking in lower rates.

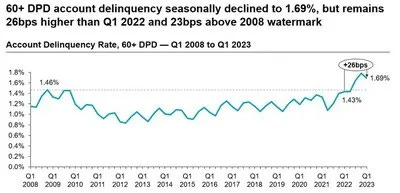

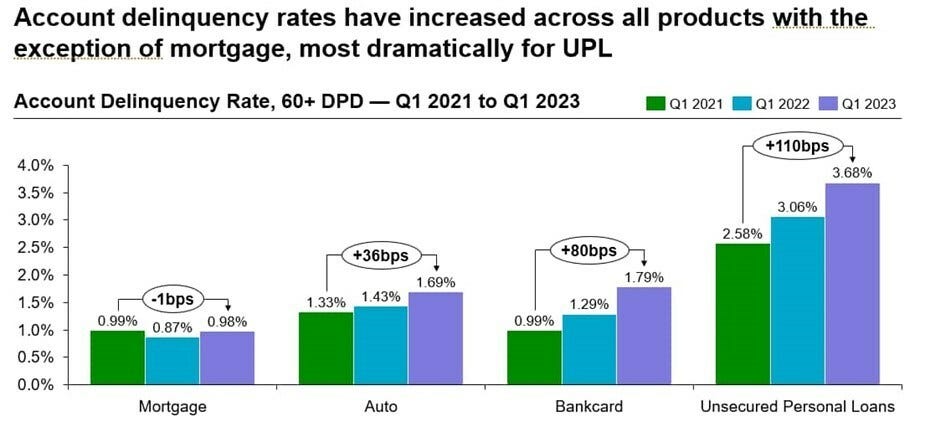

Auto loans more than 60 days past due reached 1.69% in the first three months of 2023. That tops recession-era highs of about 1.46% in 2009 and 2010, and is 26 basis points higher than the 1.43 percent recorded in the first quarter of 2021. The spike is mostly contained within the subprime tier, with independent lenders focused on subprime loans for used-vehicle purchases most feeling the squeeze, according to S&P Global Mobility. Tighter lending standards combined with high interest rates and lower used-car inventories, this has led to a decrease in loan originations. There were 15.3% fewer originations in the fourth quarter of 2022 than in the same quarter of 2019, according to S&P Global Mobility. Auto loan delinquency rates are seasonal and I fear that in coming months we could see some heavier deliquesces/defaults. In a two-year span since Q1 2021, the delinquency rate for the massive bankcard industry has risen 80 basis points from 0.99% to 1.79%.

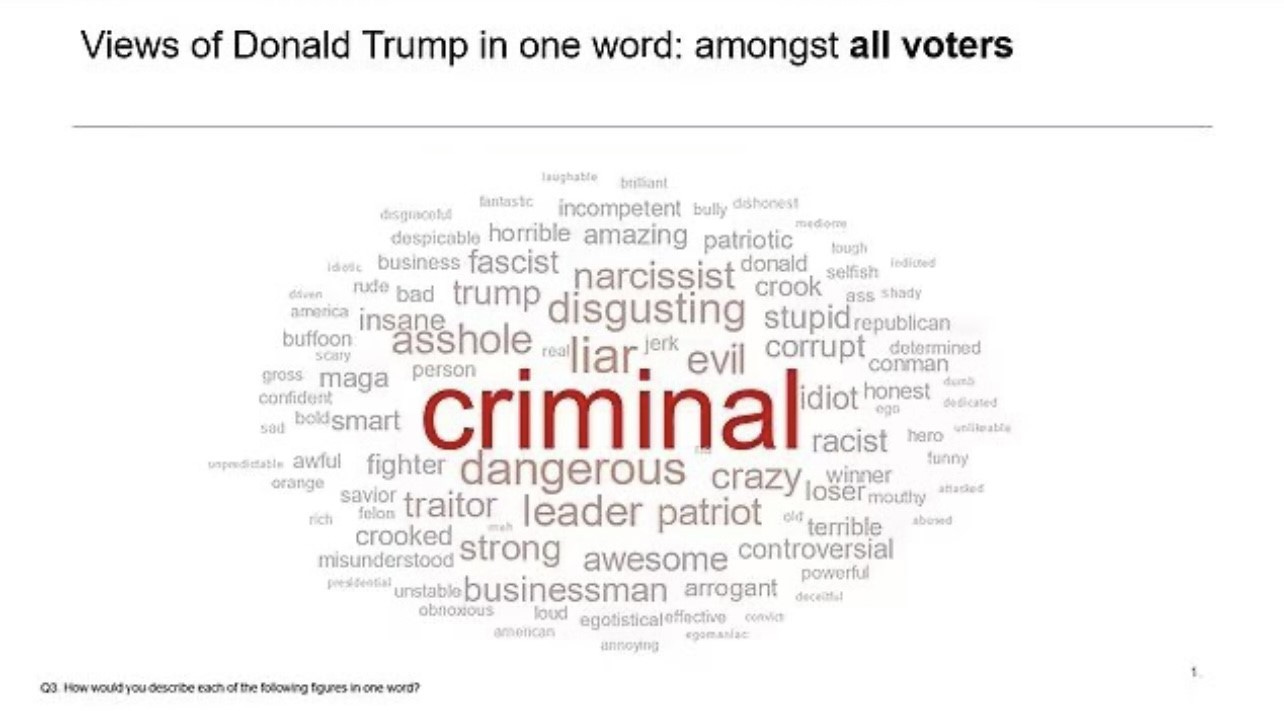

I continue to be critical of the leading Presidential candidates on both sides. A recent poll asked 1,000 likely voters to give their view of Trump and Biden in a word. To me, these look like descriptions of candidates in Brazil, Venezuela, Somalia, Libya… and not the United States of America. Rosen Report readers, we can do better than these two morons. Please consider the harm these people will cause America before voting. How did we get to these people being leading candidates?

Interesting Bloomberg article on the calculations for slave reparations in California. The numbers are striking in their precision. The statistical value of each year of human life, accounting for racial differences in life expectancy: $13,619. Wealth missing due to lower rates of Black home ownership: $148,099. Average devaluation of Black-owned businesses: $77,000. Each year of disproportionate incarceration factored by race, combining lost wages and freedom: $159,792. But none of the recommendations by the task force are more charged than offering direct compensation to eligible Black residents who are descended from a person enslaved in the US. Depending on the harms claimed and how many years a potential recipient has lived in California, the loss calculations go as high as $1.2 million per person. Estimates for the total cost of reparations, according to task force calculations, run as high as $800 billion — nearly three times the state budget. As California slides from an era of hefty surpluses into what is projected to be a $32 billion deficit in the coming fiscal year, Newsom has called on lawmakers to be “prudent” and brace for recession. One question. Where will the hundreds of billions of dollars come from? Good charts in piece.

Other Headlines

TipRanks reveals the top 10 Wall Street industrial sector analysts

Shows which analysts’ recommendations perform the best by sector.

A.I. could ‘remove all human touchpoints’ in supply chains. Here’s what that means

Simon Cowell replaced by a robot? Scientists use AI to pick hit songs

Shell boosts dividend by 15%, maintains oil output through to 2030

Blinken and Xi pledge to stabilize U.S.-China relations in rare Beijing talks

Given the Chinese government has never lied, I feel good about these talks. Covid originated in the wet market, it cannot transit from person to person, no deaths in China from it, China never steals IP or knocks off US products, China treats their people well with no child labor, it was a weather satellite, not a spy balloon, no problem with the Uyghur population…The list is endless. We should trust them 100%. China is planning a military training facility in Cuba and Blinken announced the US does not support Taiwan independence. Sure sounds like the US is getting their ass kicked by China.

Half of all Democrats say Joe Biden is too old to be president

Bill Barr: The Truth About the Trump Indictment

This time the president is not a victim of a witch hunt. The situation is entirely of his own making. Barr writes an excellent piece on the Trump Document case. Bill once defended/protected Trump. Those days are GONE. Very well written, but not without bias.

This video has excerpts of the Brett Baier interviewing Trump and Trump digging his grave. Trump’s utter stupidity is now getting to the levels of absurd. He continues to incriminate himself. Dude, shut-up. Baier, good on you for asking tough questions. Why can’t the left ask more tough questions to Biden? Would we ever see an interview where CNN, MSNBC, WaPo, NYTimes asked Biden the line of questions that Trump was asked by Baier?

Hunter Biden to plead guilty to federal tax crimes, take deal on gun charge

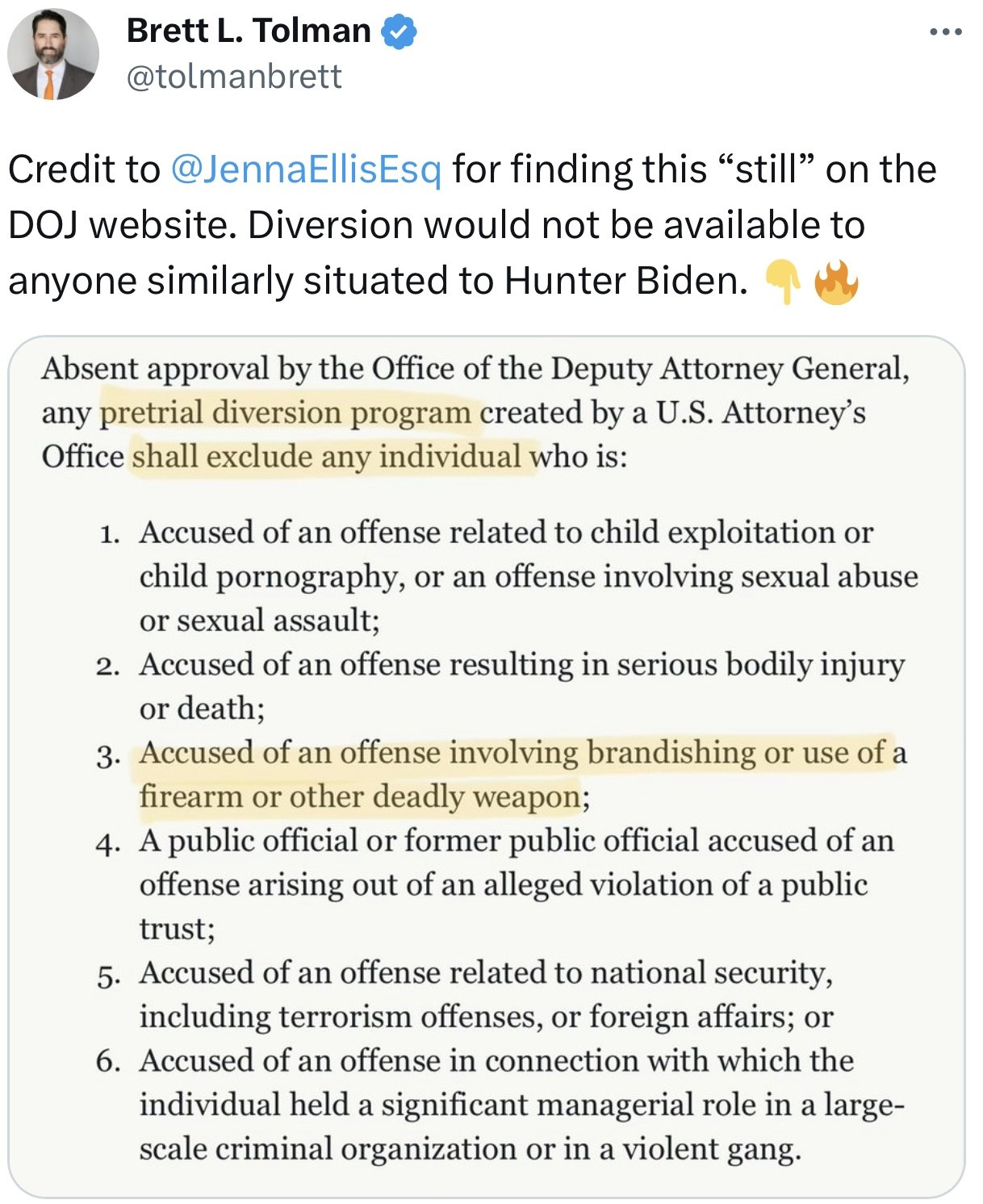

A defense attorney reader sent me this note about the deal: Rosen Report readers should know that the Feds don’t give diversion for gun charges. This is a special deal. I represented a client years ago on an identical gun charge and the case was dismissed only after 12 months of litigation and a constitutional violation resulted in exclusion of the firearm. Diversion allows Hunter to do probation and get the case dropped if successful. It will be interesting to see how long they put him on probation and if he screws up what the prosecutorial response will be. Just seems like more uneven justice. Hunter is an unmitigated disaster who was kicked out of the Navy Reserves (drug test), had an affair with his dead brother’s wife, long time crack addict, hooker problem, nude selfie taker, who carries guns while high on crack and does not pay child support. Check out this link explaining how former FBI Director Louis Freeh gave $100,000 to a trust for two of President Biden’s grandchildren as he sought to pursue “some very good and profitable matters.” Nothing to see here folks. Kodak Black’s lawyer discussed two tier justice system after his client got 46 months for the same charge as Hunter.

Former attorney general says a key FBI document should be released as long as steps are taken to protect the confidential human source

Democrat Donor Arrested for Starting Massive Fire Democrats Blamed on Climate Change

127 homes and 66 buildings were destroyed and firefighters were injured in the blaze from 2022 in Yosemite National Park. The fire burned 30 square miles. How much damage did the arsonists do to the environment?

Norway proposes 40% gender quota for large and mid-size unlisted firms

Chicago Reels After 75 Shot, 13 Killed Over Bloody Long Weekend

Tell me why the wealthy people and corporations are leaving Chicago, San Fran, NYC, DC, LA in droves? I can’t figure it out.

Neo-Nazi accused of stockpiling weapons, plotting attack at Michigan synagogue

I want hate crimes to have mandatory minimum sentences. We need better deterrents.

NYC straphangers slashed in three subway attacks Sunday

Sorry Bragg, you are not doing enough to stop crime. If the voters are dumb enough to reelect you, they deserve what they get. Idiots like you make me look like a genius for leaving NYC 6 years ago. Your doing wonders for the value of my South Florida R/E portfolio. Go Blue. The slasher was caught within 24 hours.

NYC stab victim Tavon Silver previous hate crime victim

The guy was attacked twice on different occasions and died in the 2nd attack.

Central Park dog stabber caught on video moments after attack

Big city police chiefs join their officers in rush to exit

This is the first time I recall inserting another writer’s Substack piece. The Washington Post reports that there are openings for the top police job in Washington, D.C., New York, Chicago, New Orleans, Louisville, and Charleston, S.C. In Baltimore, the chief, who was hired in 2019, resigned earlier this month but was immediately replaced via an internal promotion.

Knife-wielding thief chugs beer after storeowner traps him in shutters

Love this video from England.

New Orleans archdiocese concealed serial child molester for years

Why have we not cancelled the Church and Clergy for the countless abuses and cover ups over decades? How many children have been harmed?

Harvard-trained neuroscientist: Avoid these types of toxic co-workers

McDonald’s employee throws drink in customer’s face in wild fight caught on video

How many reasons do you need to not eat disgusting fast food? Obesity, diabetes, cancer, heart disease and apparently drinks thrown in your face.

People paid to go on this trip. What an unmitigated disaster. New report suggests banging is heard showing signs of hope. You must listen to the founder of the submarine company around his hiring practices. He brags that he won’t hire 50 year old White guys. He did not want to hire experienced military experts and instead went with kids to be “inspirational.” How is that working out for him and those trapped down there now? The sub is approximately 12,000 feet under water and the more articles I read, the more clear to me that this was an avoidable disaster.

Real Estate

Another 4200 SF apartment at the Surf Club just went pending for $19M. It is on the the 2nd floor with little to no views. The Shore club only has 10 units left in the entire building now out of 49, have sold over half a dozen units for over $5,000 per foot and won’t be delivered until 2026. The Surf Club amenities are another level and prices per foot tend to be at the highest end of what Miami has to offer. To me, there are nicer buildings, but the Surf Club vibe and amenities are amazing. Pre pandemic, the Surf Club was low to mid $2k/ft. For a high floor with views, it is a minimum of $5.5k/ft today. Many units are up almost 200% since 2018. There are rumors that Jeff Bezos is looking at the $140M 3 acre parcel on La Gorce island as well as at Julio Iglesias’ remaining 2 lots on Indian creek for $100M+. As usual, I have broker friends to show you places anywhere in South Florida, NYC or Hamptons.

Good CNBC article on how far $250,000 gets you in various cities. Hint, NYC is the worst place listed. Only 7% of American households earn $250,000 or more. For those high-income earners, however, certain cities will offer them the most bang for their buck — and others will offer far less. The real purchasing power of a $250,000 salary depends on a city’s overall economy, taxes and cost of living. Across the United States, $250,000 is worth as much as $203,664 in Memphis, Tennessee, but as little as $83,000 in New York City. When I speak with young people living in NYC making $100-150k/year, it is clear the parents are contributing. Obviously the taxes are high, but the cost for rent, transportation, food, entertainment, clothes is through the roof.

More than a decade after first listing her Central Park West penthouse for $50 million, Susan Weber, the 69-year-old ex-wife of billionaire George Soros, 92, is finally in contract to sell it for less than what she bought it for. The sprawling 6,000-square-foot duplex was last asking $24.5 million — less than half its original asking price in 2012. Weber bought the apartment for $25 million in 2006; StreetEasy shows the listing bounced on and off the market with steadily decreasing asking prices. Let me get this right. She bought the place for $25mm in 2006 and sold it for a loss despite being on Central Park and a penthouse? It is clear she also put millions into the apartment in the last 17 years. If you invested $25mm in Miami or Palm Beach, it is a minimum of $100mm and could be $150mm+. In South Florida, you would have had to buy multiple homes or lots to spend so much money in most cases in 2006. What are the prices of high end R/E (some exceptions) telling us about the great migration? Could part of this be explained by horrible policies which are driving wealthy to South Florida?

Interesting article on self-storage market strength. I wrote a piece some time ago about becoming a hoarder. Despite a large home with a 4 car garage, I embarrassingly needed to rent a storage space two years ago and have not been there 3 times. No wonder why the industry is doing so well. I liked the chart below.