Opening Comments

My torn calf muscle is in a shocking amount of pain and am unable to put any weight on it. With limited mobility, my life has taken one hell of a boring turn. I am the world’s worst patient, due to my impatience and inability to sit still. To add insult to injury, while cooking with a newly sharpened knife, I sliced part of finger, which means no guitar for a week. Seriously, I am a disaster. I had 5 conference calls this afternoon, so I am sure I missed a couple things. The Rosen Report is leading to many new clients and opportunities. If you like what you read, forward the note and hit the “like” button which is the small heart under the “n” in my name at the top of the email.

On the medical front, getting an MRI or Catscan in South Florida is challenging. In the past 4 months, I will have had a CT Heart Angiogram, and 3 MRIs due to my myriad of injuries (stress fracture, arthritis, torn calf…). You cannot get appointments easily. All my appointments have been between 5:45am and 6:30am including today’s at 6:30am in Boynton Beach (30 minutes away). However, the imaging center called me Tuesday night to reschedule given my insurance company has not approved my MRI despite a 5-day window.

The two most opened posts were the Olivia Culpo one regarding her banned outfit and Prince Andrew regarding emails to Ghislaine about Virginia, the woman he does not know.

On the hiring front, I am on boards and do a fair amount of consulting. I can tell you that hiring quality talent today is as challenging as I can ever recall. Once you find a good candidate, getting that person to switch jobs is not easy. The existing employers are making big counter offers as they know how hard it is to replace talent. Additionally, the younger professionals tend to be incredibly loyal and not as financially focused as my generation. Younger candidates are asking a lot more questions about diversity in the firm and on the management team. Twenty years ago, this was not something which was voiced as a concern and today, it happens quite frequently.

On the weather front, Tuesday morning was the coldest day of the season with lows at 46 degrees, but highs of 66 degrees. Nice change and it was the first time I wore sweatpants in a year.

You can now order free COVID tests online from the US government with up to four kits per household. The site, www.covidtests.gov is simple to use. Everyone should take advantage to have some tests at home. Also of note, Biden is giving Americans 400mm free N95 masks. Given the population of over 329mm, it is not such an impressive number in my mind.

Picture of the Day-Feel Good Story

My Triceps Can't Keep Up With Inflation

Quick Bites

Markets/Oil, Market Breadth Chart, 30 Year Mortgage Rate

GS Comp, Insider Trading, New CA Proposed Taxes

Gallup Poll on Political Preferences

NYC Remote Jobs on the Rise

Consistently Worst Three Banks

European Car Sales Plunge

China Birthrate Problem-Also too Many Boys

Other Headlines-Expanded-Including Biden Presser Points

Virus/Vaccine

Data-Noise due to MLK Day Limited Reporting

Deaths Modeled

Fourth Shot Effectiveness

CDC Restricted Travel List

Real Estate-BIG Section. I guarantee you that you cannot find all this anywhere. The Rosen Report network is strong as ever!

General Comments

NYC Rental Examples-MARKET IS BACK

$35mm NYC Co-Op Sale

10 US Housing Records in 2021

Hoboken, NJ Cool Lofts-Did I just say “Hoboken and Cool in the same sentence?”

Montecito, CA Estate

NYC Landlord Concessions for Commercial Space-WOW

Picture of the Day

In a world where stars show off cars, homes, clothes and other material possessions, let this story be the one which resonates. Wow, this keeps things in perspective. I vaguely remember including this in a report months ago, but liked it so much it is here again.

Sadio Mane, a Senegalese soccer star, earns approximately $10.2 million annually, has given the world a rude awakening after some fans spotted him carrying a cracked iPhone.

His response is legendary:

"Why would I want ten Ferraris, 20 diamond watches and two jet planes? I starved, I worked in the fields, played barefoot, and I didn't go to school. Now I can help people. I prefer to build schools and give poor people food or clothing. I have built schools and a stadium; provide clothes, shoes, and food for people in extreme poverty. In addition, I give 70 euros per month to all people from a very poor Senegalese region in order to contribute to their family economy. I do not need to display luxury cars, luxury homes, trips, and even planes. I prefer that my people receive some of what life has given me."

My Triceps Can’t Keep up With Inflation

In November, I wrote a report entitled, My Waist is Expanding Faster than Inflation. It received a record number of likes and it was about how in my old age, my pants just don’t button like they once did. Despite inflationary pressures, my waist was outpacing price growth. Today’s note suggests my triceps cannot keep up with inflationary pressures. Given my torn calf, I am on crutches. Crutching myself around town has made my triceps expand over the past 5 days. However, they clearly cannot keep pace with price growth now. As readers know, I have been critical of the Fed and being too accommodative for too long. I was against the $1.7 trillion Build Back Better Bill on the heels of the Infrastructure Bill at this stage of the cycle. Everywhere I turn, prices are through the roof and it seems to be getting worse, not better. Hiring talent has never been harder or more expensive and I do feel the wage increases will be “sticky.”

A reader sent me “Alternate Inflation” charts showing inflation today relative to 1980 and 1990 calculations. Due to methodological shifts in government reporting, inflation levels have been depressed. Using the 1990 methods, you can see inflation has surpassed 10% and with the 1980 methodology, it is approaching 15%. Even using today’s depressed methods, inflation is running at 7% in December. It was a 39-Year high and driven by goods and services. Regardless of the method you use, inflation is real.

I cannot think of one item I am buying that is cheaper than pre-pandemic. Grocery items, consumer products, cars, homes, vacations, hotels, rental cars, restaurants, clothes, gas, boats, jewelry, rent, electricity, healthcare… the list is endless. Food prices are hitting consumers hard and every time I buy something at the grocery, I have sticker shock and it is not just the US. In Thailand, the price of pork is up so much, people are turning to crocodile meat. I hear it tastes just like chicken.

P&G earnings came out and they discuss price increases. Also of note, shipping costs are through the roof and importing costs from China remains multiple times more expensive relative to pre-pandemic.

The markets are starting to discount a more hawkish Fed, and that makes sense to me. The 10-Year Treasury is approaching 2% for a reason. Tuesday was the first time Fed Funds futures fully priced in 4 hikes for 2022. Last week, the odds for 4 hikes were 50% before it jumped to 80% last Friday. I shorted some 10 Year Treasuries in the 1.4% range, and they rallied and I felt like an idiot. Now, I feel a little less stupid.

Despite my insane arm work outs lugging my big butt around the house on crutches, there is no chance my arm growth can keep up with prices of goods and services. Even Disney is getting bashed for prices and longer lines as they are under staffed. Prices for tickets are up 6.5% for a one day pass to $164 and 9% for a two day to $319. Disney swag is up even more with a Miss Piggy backpack up from $80 to $95 or +18.75%. Mickey ear headbands jumped $10 to $39.99 for an increase of 33%.

Goldman’s earnings report on Tuesday showed substantial wage inflation with a 33% in pay expenses. I cannot find one employer who is finding it easy to hire. Local hotels, restaurants, contractors, banks, consumer product companies, Disney… Talent is in short supply and does not seem to be coming to an end soon. Jeremy Barnum from JPM mentioned expense pressures impacting margins going forward as well.

Ain’t no escaping inflation and regardless of how many miles I crutch, I just can’t keep up. Trust me, the picture below is indeed my arm. Would I ever lie to my loyal readers? I do expect to see things ease a bit by the summer, but I do not think prices in general are going back to pre-pandemic levels.

Quick Bites

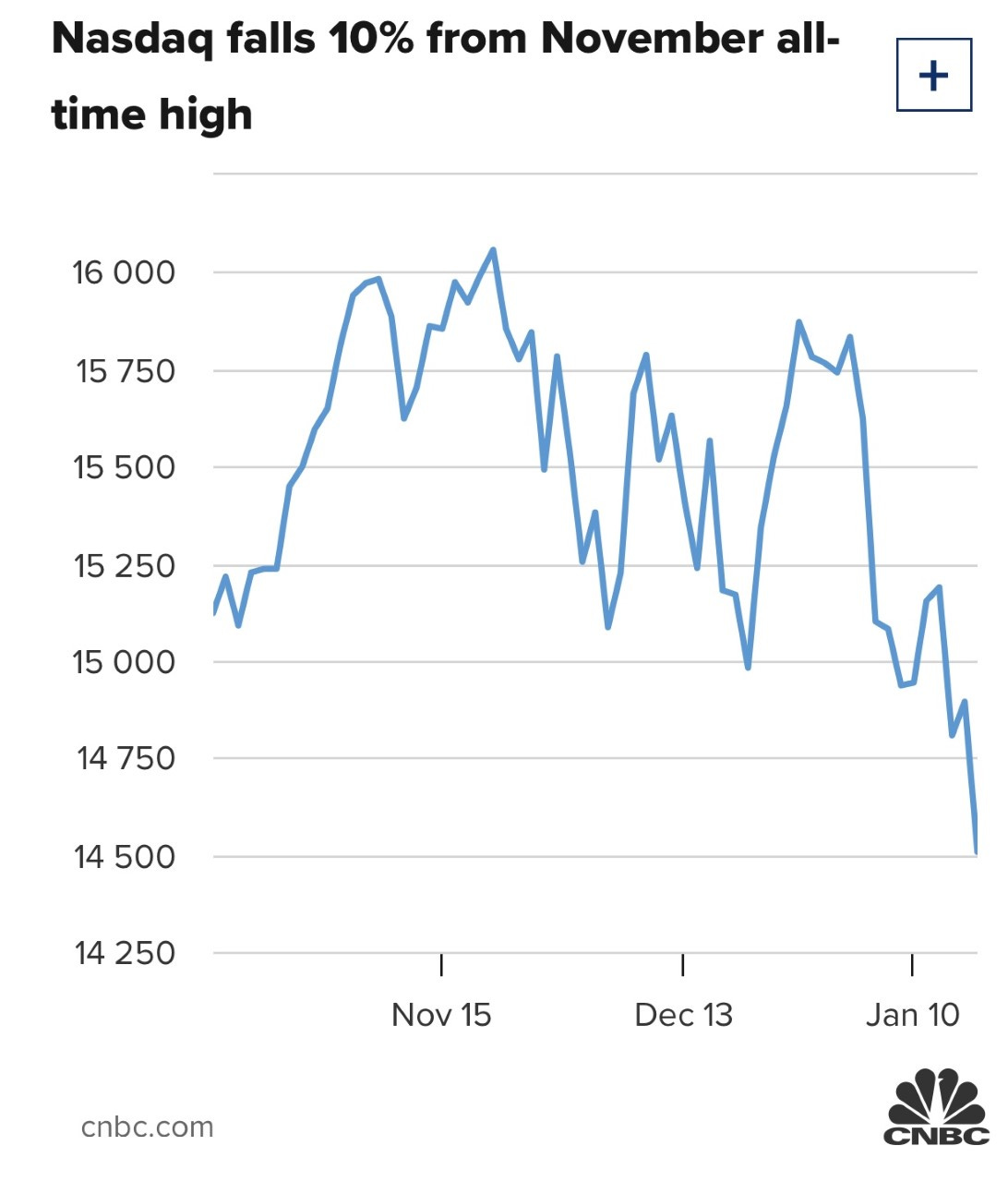

The Nasdaq fell again on Wednesday, bringing its decline from its November high to more than 10% as investors continue to dump tech shares as interest rates spike to start the new year. The technology-focused Nasdaq dipped 1.15% to 14,340. Wednesday’s losses brought the index 10.7% off its most recent record close in November 2021. The Dow fell 340 points to 35,029, dragged down by a 3.1% decline in Caterpillar’s stock. The S&P 500 slid nearly 1% to 4,533. The small-cap benchmark Russell 2000 lost 1.6% on Wednesday, closing at a 52-week low. Stocks fluctuated between losses and gains but ultimately closed at session lows on Wednesday. The 10-Year Treasury fell 10bps on Tuesday and now yields 1.85 % after hitting 1.9% on Wednesday. Remember, the 10-year was yielding 1.34% in early December. The 2-Year Treasury broke 1% on Tuesday and settled at 1.05% for the 1st time in almost two years. It is clear that the bond market is starting to price in more aggressive Fed tightening. YTD, S&P is -4.9% and NASDAQ -8.3%. Bitcoin and ETH were up slightly and ended at $42k and $3.1k respectively.

Oil prices continue to escalate and the most recent cause is rising geopolitical tensions. Among the factors driving the rally are concerns that tensions in the Middle East and Europe will spill into energy markets by denting supplies from major crude producers, particularly Russia and the United Arab Emirates. Any outages are likely to goose prices in a market where demand is rising and stockpiles have fallen below recent norms, traders and analysts say. US Gas Prices are up to $3.31/gallon relative to $2.38/gallon one year ago or a 40% increase. In December 2019, gas averaged $2.69/gallon in the US. CA averages $4.65/gallon according to AAA.

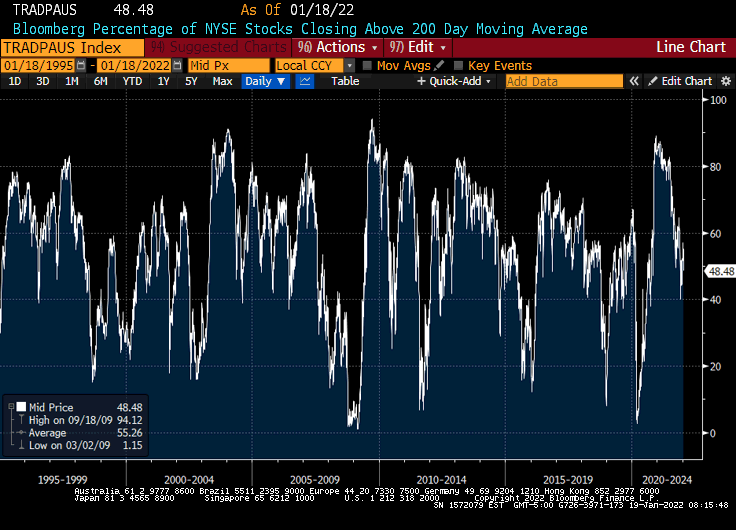

I have written about market breadth and a reader sent me this chart to show the percentage of NYSE stocks closing above the 200-day moving average. The chart shows the drop of stocks closing above the 200-day moving average from nearly 90% down to 48% despite the fact that the S&P is 5% from an all-time high.

The average rate on the popular 30-year fixed mortgage hit 3.7% Tuesday morning, according to Mortgage News Daily. That is the highest since early April 2020 and now 83 basis points higher than the same time one year ago. This coupled with high housing prices will cool demand and most buyers care about monthly payments and an 83 basis point move is a big deal.

Wall Street firms are playing catch up with employee compensation, boosting pay in the second year of a deal-making and trading boom. That’s what Goldman Sachs CEO David Solomon conceded on Tuesday during a conference call with analysts to discuss the bank’s fourth-quarter results. At one point during trading, shares of the bank had fallen more than 8% after a jump in quarterly expenses took investors by surprise. Analysts peppered Solomon and new CFO Denis Coleman with questions about the elevated expenses and their expectations for the future. “There is real wage inflation everywhere in the economy, everywhere,” Solomon declared, when asked by Deutsche Bank analyst Matt O’Connor if the recent pay gains were “catch-up” raises. Compensation costs at Goldman jumped 33% to $17.7 billion for 2021, a whopping $4.4 billion increase, executives said. That made the average per-employee compensation reach about $404,000 in 2021, up from $329,000 in 2020.

In a recent piece I wrote about politicians and insider trading, and I received quite a bit of commentary with people in shock. There is a new Post article on the subject which outlines politicians and Fed members and their trading habits which are rife with conflict. I continue to contend this should not be allowed. It talks about the Pelosis beating the S&P for almost 15%, but it is a far more wide ranging problem than just one person. The article discusses 61 federal judges traded a company’s stocks while the company was a litigant in their courtroom. I cannot believe this is allowed.

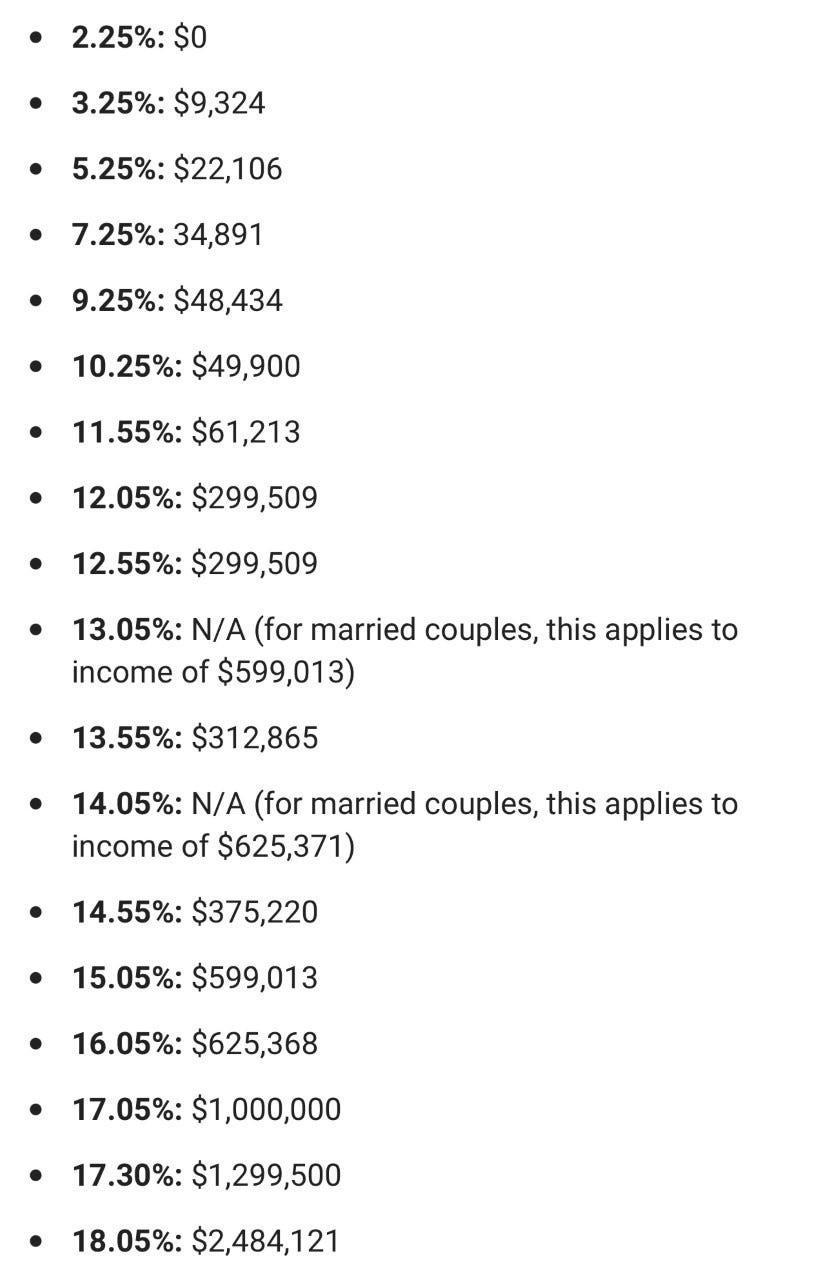

California lawmakers unveiled a new bill at the beginning of the year that would establish a single-payer health care system – an ambitious plan that would be funded by nearly doubling the state's already-high taxes. A new analysis from the Tax Foundation, a non-partisan group that generally advocates for lower taxes, found that the proposed constitutional amendment would increase taxes by roughly $12,250 per household in order to fund the first-of-its-kind health care system. In all, the tax increases are designed to raise an additional $163 billion per year, which is more than California raised in total tax revenue any year before the pandemic. The proposal includes three main revenue raisers, according to Jared Walczak, a fellow at the Tax Foundation: Higher income taxes on wealthy Americans, a payroll tax on certain employees' wages for large companies, and a new gross receipts tax. Under the bill, the top marginal rate on wage income would soar to 18.05% – well above the median top marginal rate of 5.3% and the state's existing rate of 12.3%. There would be an 18-bracket system, with higher taxes kicking in for individuals earning more than $149,509. The highest rate would apply to those who earn more than $2,484,121. If you make $1mm, you will pay an effective rate of 14.6%. Let’s say you make $5mm in a year in CA vs NV, TX, FL or another tax-free state. You would pay an additional $865k in taxes for an effective -state rate of 17.3%. If you make $10mm, you pay an additional $1.77mm for a 17.7% state rate and if you make $100mm, you pay an additional $18.1mm for an effective rate of 18.1%. What wealthy person would pick to live in CA and spend that money? Donate it to your favorite charity or start a scholarship fund for kids in need. I hope this passes, as it will make R/E in Florida go up by another 20%. What about all those tech billionaires and venture fund managers who have billions in gains? Why would you stay in CA? Relocate to NV, TX, WY, FL…Save hundreds of millions or billions and fund cancer research or feed the homeless. Think of how much Musk saved by leaving CA. Also, CA would also adopt a new 2.3% gross receipts tax (GRT) on qualified businesses minus the first $2 million in annual gross receipts, at a rate more than three times that of the country's current highest GRT. I have no idea if these draconian taxes pass, but again, the fact that they are being proposed would be enough for me to sprint out of the state of CA. Also, could they make the tax rates more complicated? Why not simplify it with 5 break points rather than 18! This article discusses another large semiconductor plant for Texas. Tell me again why they are leaving CA? I almost moved to CA from NYC and I’m very glad to be in South Florida instead.

I found this interesting Gallup poll on changing political preferences. On average, Americans' political party preferences in 2021 looked similar to prior years, with slightly more U.S. adults identifying as Democrats or leaning Democratic (46%) than identified as Republicans or leaned Republican (43%). However, the general stability for the full-year average obscures a dramatic shift over the course of 2021, from a nine-percentage-point Democratic advantage in the first quarter to a rare five-point Republican edge in the fourth quarter. These results are based on aggregated data from all U.S. Gallup telephone surveys in 2021, which included interviews with more than 12,000 randomly sampled U.S. adults. The article discusses how the popularity of the President is key in determining political preferences and outlines Trump and Biden’s impact on the chart below. From my research, I believe Gallup is more of a centrist polling house and that is confirmed by All Sides Media. I find the pendulum swings sharply and it is hard to get it to stay in the center. Trump was a vote against Hillary and Biden a vote against Trump. Hopefully, a new candidate will emerge who is strong with sound policies to pilot this plane which is taking some sharp drops in turbulence.

New York City firms offered nearly quadruple the number of remote jobs to new applicants in the past year. “And this is just the beginning,” said NYC Partnership CEO Kathryn Wylde, whose business group analyzed figures compiled by the numbers firm Emsi Burning Glass. The key industries with the highest jump in virtual-work offers amid the coronavirus pandemic included administrative, information and financial services. In early 2020, there were 6,700 out of 163,000 postings for city jobs that could be filled by remote workers, or 4 percent of the total. By this past December, there were 25,800 out of 243,000 jobs postings for the same work, or 10.6 percent. I have written about this extensively and every company I am consulting or on the board is allowing some remote work. This was unheard of pre-pandemic. This CNBC article is on topic with the BlackRock CEO suggesting work will “never be the same” because of the pandemic. The AirBnB CEO, Brian Chesky, says he will work remotely and stay in a new rental every two weeks.

In my Wall Street career, I have found three firms that seem to find ways to get involved in scandals more than any others (Credit Suisse-CSFB, Union Bank of Switzerland-UBS and Deutsche Bank-DB. They step into every pothole imaginable. I had the misfortune of working for UBS for one year (5/11-8/12), and I can tell you it was the worst year of my professional career. A trading scandal in another division happened just after I joined UBS. I would have rather cleaned toilets at Goldman Sachs than run Fixed Income at UBS. The CEO of CSFB stepped down for violating COVID protocols as he attended a professional tennis match during quarantine. You cannot make it up. All these firms (CSFB, UBS, DB) blew up in the Global Financial crisis, there have been secrecy issues, bad loans, trading scandals, kickbacks, LIBOR scandals, misleading investors, tax evasion assistance issues, Archegos, Greensill, money laundering, spying... The list is endless. These are the worst run large banks in my mind and have been for ages. There has been substantial senior management turnover and too many embarrassing mistakes. A cohesive senior management team is imperative. Just look at GS and JPM. At one point DB flew me to London to interview me to run Fixed Income and thankfully, it never materialized. I might have made a bunch of money, but given the firm’s uncanny ability to make mistakes, I am glad I missed that one as it was not worth it. The three links with the specific names outline scandals for each firm and collectively, they could be made into a great Saturday Night Live skit. It should be noted that pre-GFC, these firms paid incredible amounts of money to traders incentivizing them to take crazy risks which clearly contributed to the downfall in 2008/9. They paid some people $30-70mm/year! I calculated the total returns in the chart below using the calculator on www.buyupside.com website.

Total Return (1)

UBS 46%

DB -75%

CS -57%

JPM 520%

GS 570%

(1) 6/2000-1/2021

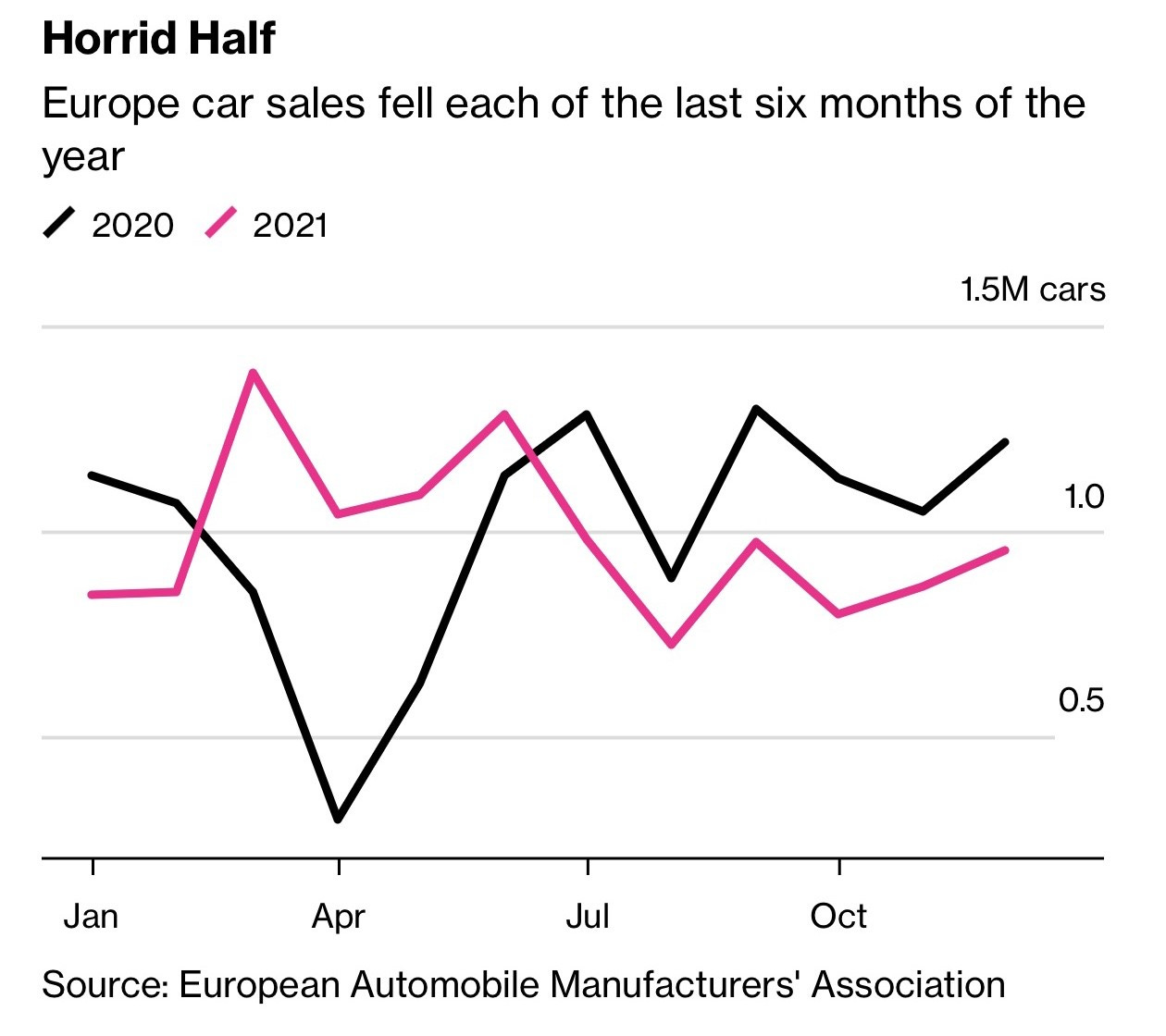

Europe’s car sales slid during December for a sixth month of declines in a row, showing the extent of the uphill battle automakers are facing in the chip supply crisis. Passenger car registrations dropped 22% last month to 950,218 vehicles, the European Automobile Manufacturers’ Association said Tuesday. New-car sales fell 1.5% last year, when automakers had their worst-ever showing since the association started tracking the market in the early 1990s.

I have been incredibly critical of China with respect to the pandemic, lies, treatment of its people, hacking, patent infringement and the list continues. This WSJ story outlines China’s birthrate problem. The number of newborns in China fell for a fifth straight year to the lowest in modern Chinese history, despite Beijing’s increasing emphasis on encouraging births. Last year’s 10.62 million births, down from 12.02 million in 2020, barely outnumbered the 10.14 million deaths, the National Bureau of Statistics said Monday, suggesting the day may be near when China’s population starts to shrink. Some analysts believe the population may have already peaked. At the end of 2021, China’s population was 1.413 billion, up only 0.034% from the year-earlier 1.412 billion at end 2020. The birthrate—the number of births per thousand people—slipped to a fresh low of 7.52 in 2021 compared with 8.52 in 2020, underscoring Beijing’s challenge in brightening a dire demographic picture. Nearly one in five Chinese is 60 or older. Monday’s data showed a further rise in that percentage, to 18.9% in 2021 from 18.7% in 2020. The article goes into detail about a preference for boys resulting in 17.5mm more boys than girls aged 20-40. In the USA, for ages 20-39, there are 1.3mm more boys than girls. Even with the fact that the population of China is 4.2x greater than the US, the differential of boys aged 20-40 is substantial.

Other Headlines

Peloton insiders sold nearly $500 million in stock before its big drop, SEC filings show

What could possibly go wrong here? Historically, truckers who cross state lines needed to be 21 years old.

Biden Concedes Covid-19 Frustrations, Sees Path for Stalled Legislation

Biden believes Congress can pass parts of a broken-up Build Back Better plan

He also talked about getting inflation under control with the help of the Fed

He also said, his “report card” looks “pretty good.” He confirmed Harris as his 2024 running mate as well.

I am not sure about what polls he is looking at, but the approval ratings do not look “pretty good.”

When I think of a Rhodes Scholar, I find them to be incredibly impressive and accomplished. In this instance, we have uncovered a moron who lied about growing up poor while going to private schools.

New York AG says Trump’s company misled banks, tax officials

Article suggests the company valued property for one price for taxes and another for bank loans.

Eric Adams insists subways still safe and there is only ‘perception of fear’

I hope Adams is incredibly successful as Mayor, but I do not agree with his statement on the subway and am concerned about the direction of crime and the new DA’s bad policies. Another article is entitled, “Fear is real, justified; New Yorkers blast Adams on subway crime “perception.”

Hi-tech ‘SEX vest’ could let lovers ‘fondle remotely’ during steamy VR sessions

Based on the open rates, I know this one will get Rosen Report readers attention.

Sixth mass extinction event in progress - and it's humanity's fault

The previous mass extinction events were caused by natural events, according to this article, #6 is different.

Tickets for Weekends with Adele at Caesars Palace’s Colosseum range from £700 to £9,000-plus.

Trans women athletes hold competitive edge, even after testosterone suppression, scientists say

I am adamantly opposed to trans women competing against women in any sport.

Browns lineman Malik McDowell arrested naked after ‘violent attack’ on deputy

The video in the link is quite disturbing as Malik is running around naked. One report suggested someone slipped him drugs.

Black Women in Georgia to Receive $850 a Month in Guaranteed Income to Fight Racial Wealth Gap

The fund will provide 650 Black women across Georgia payments of $850 per month, over the next two years, making it one of the biggest guaranteed income initiatives in the country.

LAPD identifies suspect in stabbing of UCLA grad student Brianna Kupfer

Teen killer sentenced to 14 years in stabbing death of Barnard student Tessa Majors

NYC subway riders take no chances after murder, transit violence spike

Soft-on-crime Los Angeles DA ripped after child molester faces little or no time

Lara Logan dropped by agency after comparing Fauci to Nazi doctor

I am not a Fauci supporter, but this comparison is ridiculous. Remember, many of my grandmother’s family were killed in the Holocaust.

JetBlue pilot stunned as 'shape-shifting UFO' appears beside plane 37,000ft over Texas

I watched the video. I am not blown away.

I want this to happen to me just one time in my baseball cards or coin collection. I am going to go through the coins next.

Virus/Vaccine

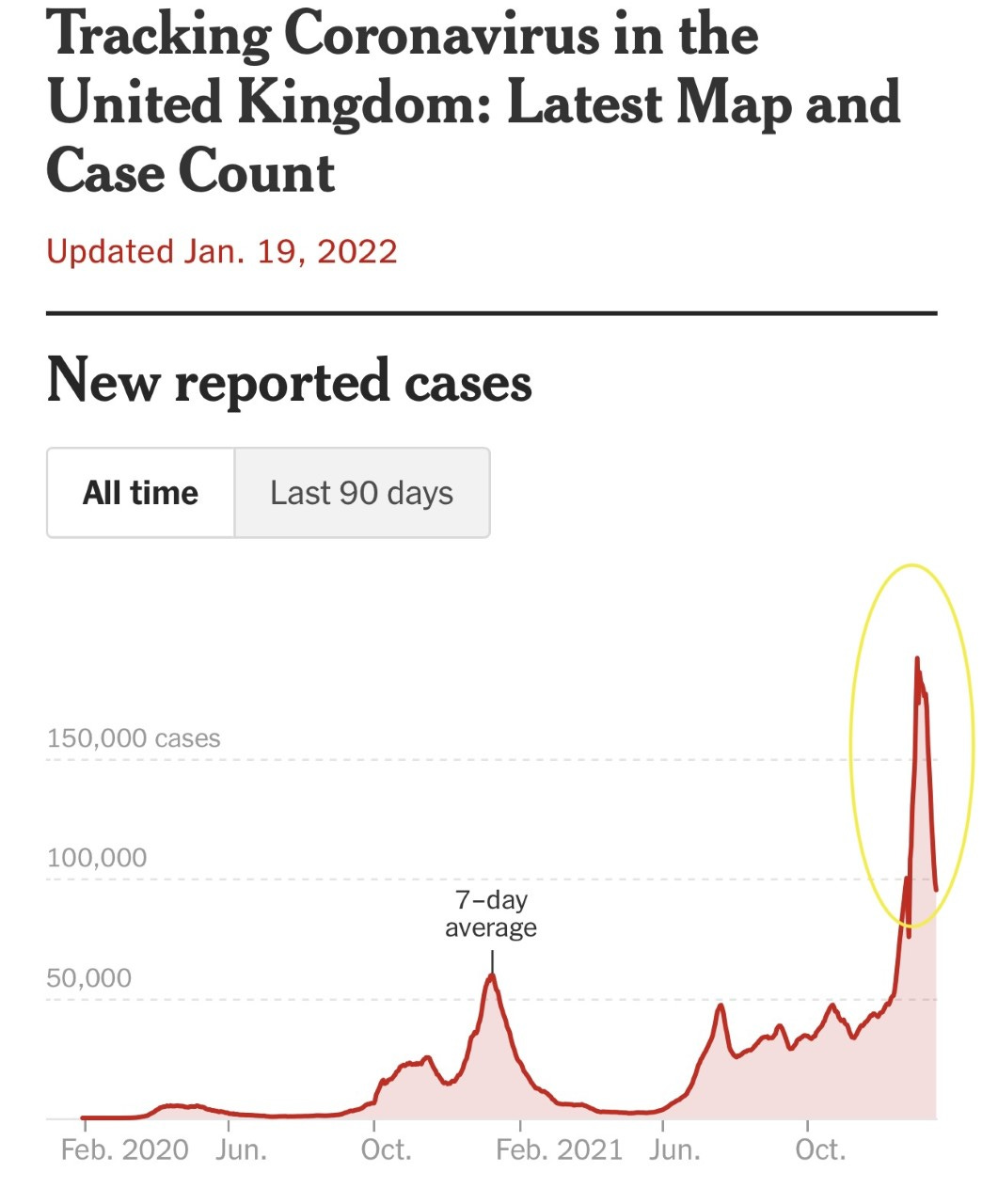

It appears the US may be peaking on Omicron. The UK, Puerto Rico, and South Africa peaked approximately 30 days from the spike. Look at the UK chart which has seen cases fall precipitously in the past week. For the US chart, remember due to MLK Day, some states did not report distorting the data. However, even on Sunday, the case chart started to turn down, so hopefully, we are seeing a peak. Unfortunately, hospitalizations and deaths won’t peak for a couple weeks, but the deaths should remain decently below the prior peak as Omicron is far less lethal. Given the MLK holiday has made the data less reliable, I wont go into details on hospitalizations and deaths today. Jackson Health Systems in Miami confirmed that 55% of the COVID patients were admitted for non-COVID reasons as of this morning. Again, I am not trying to diminish Omicron, but also make sure readers realize not every hospitalization is due to COVID. Jackson posts the info daily. First chart is US data and 2nd is UK.

The seven-day rolling average for daily new COVID-19 deaths in the U.S. has been trending upward since mid-November, reaching nearly 1,700 on Jan. 17 — still below the peak of 3,300 in January 2021. COVID-19 deaths among nursing home residents started rising slightly two weeks ago, although still at a rate 10 times less than last year before most residents were vaccinated. Despite signs omicron causes milder disease on average, the unprecedented level of infection spreading through the country, with cases still soaring in many states, means many vulnerable people will become severely sick. If the higher end of projections comes to pass, that would push total U.S. deaths from COVID-19 over 1 million by early spring. I am of the opinion that the deaths over two months will be at the lower end of the range given in the article.

Nearly a month after Sheba Medical Center launched a landmark study to test the efficacy of a fourth COVID shot, the hospital said Monday that this fourth booster was only partially effective in protecting against the Omicron strain. “The vaccine, which was very effective against the previous strains, is less effective against the Omicron strain,” Prof. Gili Regev-Yochay, a lead researcher in the experiment said. “We see an increase in antibodies, higher than after the third dose,” Regev-Yochay said. “However, we see many infected with Omicron who received the fourth dose. Granted, a bit less than in the control group, but still a lot of infections,” she added. “The bottom line is that the vaccine is excellent against the Alpha and Delta [variants], for Omicron it’s not good enough,” she said.

The CDC elevated its travel recommendation to “Level Four: Very High,” telling Americans they should avoid travel to those destinations, among others.

Real Estate

In my community, Royal Palm, we are down to 3 active listings. Remember, when I bought in May of 2017, there were 70 listings. The inventory picture remains bleak and every level, but especially the high end. I am receiving at least three calls or letters per week from brokers wanting to list my house. I believe the price is now well more than double what I paid 4.5 years ago. I took a developer out west to see the new communities in Boca between Lyons and 441. The developments are remarkable with fantastic amenities and the homes look nice. I am just in shock at the prices which start now around $1.5mm and go to $7.5mm+ at Boca Bridges, Lotus, 7 Bridges…10 miles west of the beach.

For NYC, I just learned some crazy data points from a reader. He owns a newer apartment building with high-end finishes in the Lower East Side. Just prior to the pandemic, he was told by his R/E broker what to expect: For the 3-bedroom on the 2nd floor which is 1,550 feet, they expected approximately $8.5-9k after concessions. During the pandemic, they were getting approximately $8.3k/month. He just signed a lease today with zero down time for $12k/month with ZERO concessions. For the 3 bedroom on the fourth floor, they expected $9-9.5k. During the pandemic, they rented it for $8.7k and just rented it with ZERO down time for $13k/month. NYC is back faster and stronger than I could have possibly imagined in many cases. These are crazy rents for 1,550 apartment with no doorman. The landlord was pleasantly surprised by the new and improved rent roll.

A large duplex at 1107 Fifth Avenue sold for $35mm. Interestingly, I know the seller and recall an amazing story. I believe he bought the unit in the early 1970s for approximately $350-400k. Things got so bad and dangerous in NYC by the mid 1970s that he told me he could not sell it for $150k. Well, almost 50 years later, how does $35mm sound?

This WAPO article outlines 10 housing records broken in 2021

Median sales price-$386k or +24.4%

Supply of homes-1.3mm homes down 23%

Speed of Sales-15 days in June/July vs 39 days in 2020

Most homes sold in two weeks or less-61.4%

Most home sold more than ask-56.5% in June

Mortgage rates hit all time low-30-year fixed hit 2.65%

Record share of homes bought by investors-18.2% in 3rd Q 2021

Second home demand doubled-+91%

More people looked to move to a different metro area-31.5%

Luxury home prices jumped-+25.8% to $1.025mm

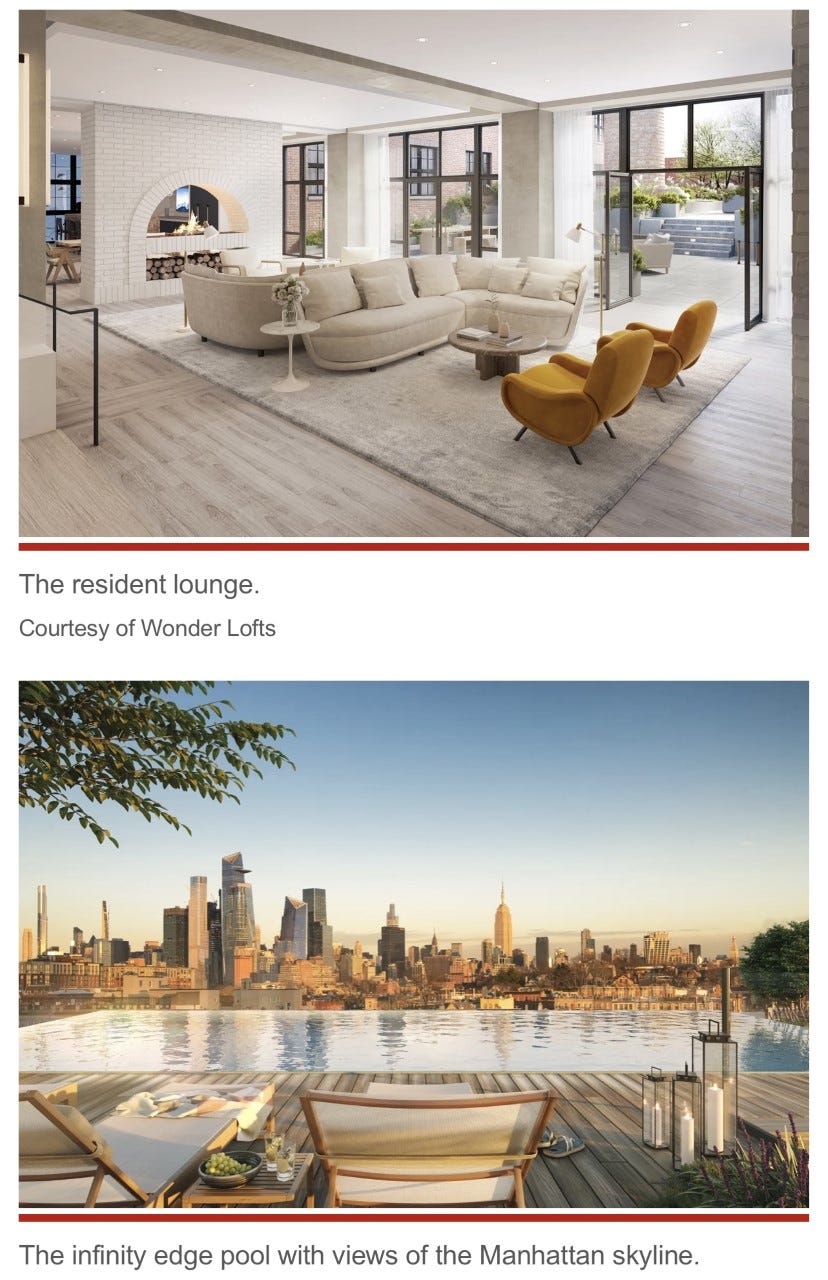

People are leaving the Big Apple to live in a former Wonder Bread factory.

Located in Hoboken, the historical factory sits directly across the Hudson River from Manhattan, and has been been transformed into a luxury residential building. Known as Wonder Lofts, a nod to the famous bread brand, it prides itself on the expansive, “suburban-sized” layouts within its 83 condos — 60% of which reportedly sold within a few months of its opening. “A large part of the draw is that we are one of the few buildings in Hoboken that offer amenities and homes above 2,000 square feet,” Robert Fourniadis, Senior Vice President of Residential of Prism Capital Partners, which developed Wonder Lofts, told The Post. Floor plans of the newly built residential units range from 1,200 to 2,700 square feet of living space. Prospective buyers have the option of a two bedroom unit that sells for $1.25 million, and up to five bedrooms at a cost of around $2.4 million. Although I can’t imagine I would live in Hoboken, NJ, I do like the amenities and space in a loft relative to a co-op in NYC. The views are amazing too.

In the foothills above Montecito, Calif., a roughly 330-acre property with the remains of an amphitheater and stone aqueducts is hitting the market for $78 million. With views of the coast, it is one of the largest undeveloped properties in the wealthy enclave, said listing agent Chris Harrington of Coldwell Banker Realty. Known as Mar Y Cel, the property is a series of 18 parcels, he said. The sellers are Keith Schofield, 83, a research chemist and retired professor at the University of California at Santa Barbara, and his wife, Kay Robinson Schofield, 74. The couple bought the property for $14 million in 2000 with the intent of building a family compound, Mr. Harrington said. For perspective, the S&P is up 406% since 2000, so after carrying costs, broker fees… the $78mm sale would be slightly better than the S&P. I love this area of the country to visit. I find it stunning.

The U.S. office market has shown some promising signs of recovery in the wake of the pandemic, but landlords are taking larger hits than ever before to complete the big-ticket deals. Cash incentives and months of free rent are helping to prop up the national office market, The Wall Street Journal reported. These incentives range from cash payments to tenant improvements and money for construction projects. CBRE reported cash payments made to tenants in the Manhattan office market have more than doubled from 2016 to 2021, from $76 per square foot to $154 per square foot, for the market’s most expensive leases. According to CBRE data reported by the Journal, landlords were collecting 7.7 percent less on these leases in the same five-year period, despite official rents increasing 1.6 percent. In 2021, CBRE reported the average rent in Manhattan for offices charging at least $100 on the face was $128 per square foot; after incentives, that dropped down to $84 per square foot. A recent lease signed in Times Square serves as a microcosm for the larger market. Digital media manufacturer Roku recently agreed to a long-term lease for 240,000 square feet at RXR Realty’s 5 Times Square. The company expects to move into the space by the fourth quarter. However, the deal contains a catch for RXR. According to the Journal, the company is receiving more than $30 million for construction work, in addition to a rent-free period lasting anywhere from 18 to 24 months. Those incentives severely diminish the asking rent, which was north of $90 per square foot. With all the landlords I speak with in the NYC commercial space, they talk about concessions and build outs destroying the stated rent prices. They are fearful of vacancies as debt is coming due.