Opening Comments

My last note was on my first cosmetic teeth whitening procedure and the response was quite strong. The most opened links were the dog saving the owner’s life and the 4 audit red flags for the IRS.

I want to remind people that I put this bi-weekly diatribe together by myself. I read hundreds of articles and scan hundreds of videos each week to curate the Rosen Report. Many readers send me articles, videos, and news stories to help me come up with content and it is greatly appreciated. Please keep them coming. For me to use today’s “Video of the Day,” I had to watch it 5 times to create the picture.

Video of the Day-Screen Time-SCARY

Markets

Companies Cutting Costs

AI Model-Sora-Creates AMAZING Videos from Text

Vocational Programs in School

Who Was Alexi Navalny?

Good Interview with Richard LeFrak

Systemic Risk Due to R/E Market

Some Tech Leaders Moving Back to San Fran

$55mm PH in Sunny Isles-My Has the Market Changed

Billionaire Buying Up Carmel

Video of the Day-Screen Time

This is a concerning short video showing how many months of your life are spent doing various things (school, sleeping, driving, eating…). It assumes you are 18 years old and shows a chart of the months you spend on screen time. The study suggests that 18-year-olds today will spend 93% of their remaining available time staring at a screen after you factor in their mandatory time (sleeping, working, school, eating..). Houston, we have a problem. Please watch the short video and show your kids. There is so much more to life than a screen.

Eye on the Market-Janu-wary: Online US Inflation Monitor

I have never seen an Eye on the Market with more charts relative to prose. In short, Michael questions the January inflation data and believes we will see a normalization in February if history proves true. There are 7 pages of charts.

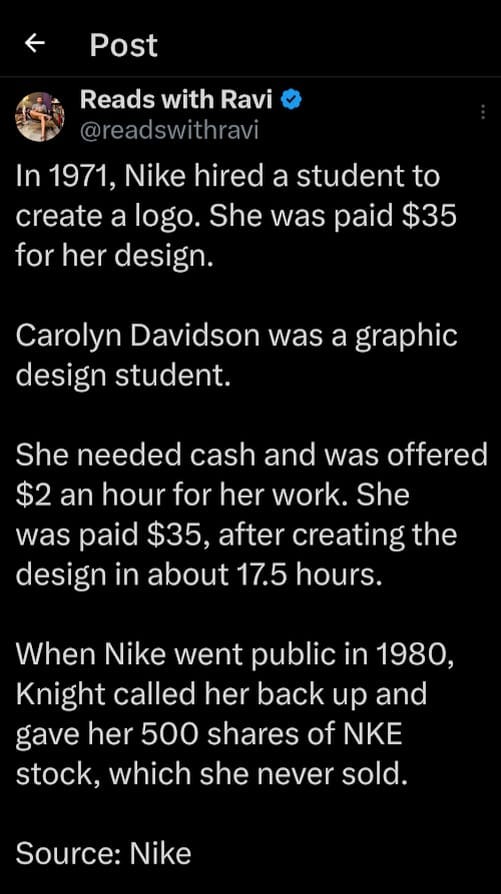

Nike-Just Do It

I found this excerpt about the creation of the Nike logo in my friend, Ted Merz’, newsletter (Surface Area). By my rough calculations, the 500 shares would be worth approximately $10mm today. This link shows the original logo drawing with Carolyn Davidson’s comments. Nike is the Greek goddess of speed and strength.

The article reminded me of my first pair of Nike shoes I bought in 1980. I brought my mom to a shoe store to show her the stunning sneakers. When she found out the price was $18.99, she laughed and let me know we would not be getting such expensive shoes. I told her, “I will get a job and buy them myself.” I was 11 years old. My mom was not one to dissuade me from achieving my goals but let me know finding a job would not be easy. I skateboarded to the Pembroke Lakes Public Golf Course as I had seen a “Help Wanted” sign.

I asked to see the manager and let him know I was looking for work. I told him I was 14 and small for my age. His dishwasher had not shown up and he begrudgingly gave me the job. “Son, I am going to show you how to use the dishwashing machine one time and if you cannot do it, you are out of a job.” I watched intently and it was harder than I thought. The machine gets the dishes about a billion degrees in a hurry. The hardest part was getting the hot items out of the machine and stacking them for the busboys to set the tables. My little, soft hands were raw. All I could think of was wearing those nice blue sneakers and that kept me going.

I worked for almost five hours, cleaned up the station, and walked over to the manager. He said, “Son, you did a great job. I owe you $10 but you did so well, here is $12 only if you come back tomorrow.” I was beaming. I skateboarded home to show my mother that I would have the money for the shoes the next day. She could not believe someone would hire me. However, she was proud that I dared to make it happen. I worked from age 11 and always had a job until my time off at 40. My valet parking and pizza delivery jobs paid my way through college.

Below was my first shoe purchase and the true beginning of my independence. The amazing logo by Carolyn Davidson made the shoe.

Quick Bites

Next week, Amazon will replace Walgreens in the Dow next week. Hats off to Bezos and what he created. Capital One’s recently announced $35.3 billion acquisition of Discover Financial is a bid to protect itself against a rising tide of fintech and regulatory threats. Wednesday, after the close, Nvidia posted record revenue (+265%) exceeding expectations and drove the stock HIGHER by 6%. Although markets were down Tuesday and flattish Wednesday, the strong Nvidia earnings should calm markets down. The 2-Year Treasury is at 4.69% (+5bps) and the 10-Year is yielding 4.32% (+5bps) after the Fed meeting minutes showed caution about lowering rates.

Good CNBC article about 2024 being the year of corporate cost-cutting. Corporate America has a message for Wall Street: It’s serious about cutting costs this year. From toy and cosmetics makers to office software sellers, executives across sectors have announced layoffs and other plans to slash expenses. Barbie maker Mattel, PayPal, Cisco, Nike, Estée Lauder and Levi Strauss are just a few of the firms that have cut jobs in recent weeks. Department store retailer Macy’s said it will close five of its namesake department stores and cut more than 2,300 jobs. JetBlue Airways and Spirit Airlines have offered staff buyouts, while United Airlines cut first-class meals on some of its shortest flights. As consumers watch their wallets, companies have felt pressure from investors to do the same. The article suggests that consumers have “cost fatigue” and passing on higher costs is growing more challenging.

A reader, Jason, sent me this Daily Beast article entitled, “OpenAI’s Video Generator Sora Is Stunning and Utterly Terrifying.” The story has incredible links that show the capabilities of the program. OpenAI teased a text-to-video AI generator that’s capable of creating incredibly detailed and realistic videos based on text prompts Thursday. The model, called Sora, can create videos up to 60 seconds long and is currently being tested with OpenAI’s risk assessment team along with “several visual artists, designers, and filmmakers” before an eventual launch to the wider public, according to the announcement. Along with being able to generate video via text, it can also create a video from an “existing still image,” and even an existing video to “extend it or fill in missing frames.” The future is now. 16 months ago, I wrote about the massive impact AI will have. I was early. Sadly, I did not buy AI-related stocks at the time. BIG MISS. This is the article from the NY Post’s perspective. The section of the All-In Podcast at the 15:30 market did a good job explaining the technology. It sounds amazing. If you are intellectually curios about AI and the impact of Sora, watch the attached All-In Podcast video. The big companies like Open AI are crushing startups who are trying to get into the space.

I have often written that a lot of students who attend traditional four-year colleges and universities should instead be in a vocational program. The economics of traditional colleges may not make sense for a growing number of kids. This WSJ Opinion piece outlines a community in Maine that re-institute shop classes into the curriculum. When residents of a coastal community sought to reintroduce shop classes and career training to their local schools a decade ago, they discovered an unexpected problem: The rules of the regional school district wouldn’t allow it. So in 2014 St. George residents voted 1,163 to 226 to break free and create their own district. One of the first things they did with that independence was develop a trade program. In my opinion, the residents will have a significant positive impact on the kids who are fortunate enough to take part in these programs starting in kindergarten. I can tell you now that people who go into vocational work can make a great deal of money. I know electricians, plumbers, contractors, and marine mechanics making a killing. I just learned of a high school kid in the Northeast who made over $250k last year with his lawn mowing and snow removal business. Why go to college?

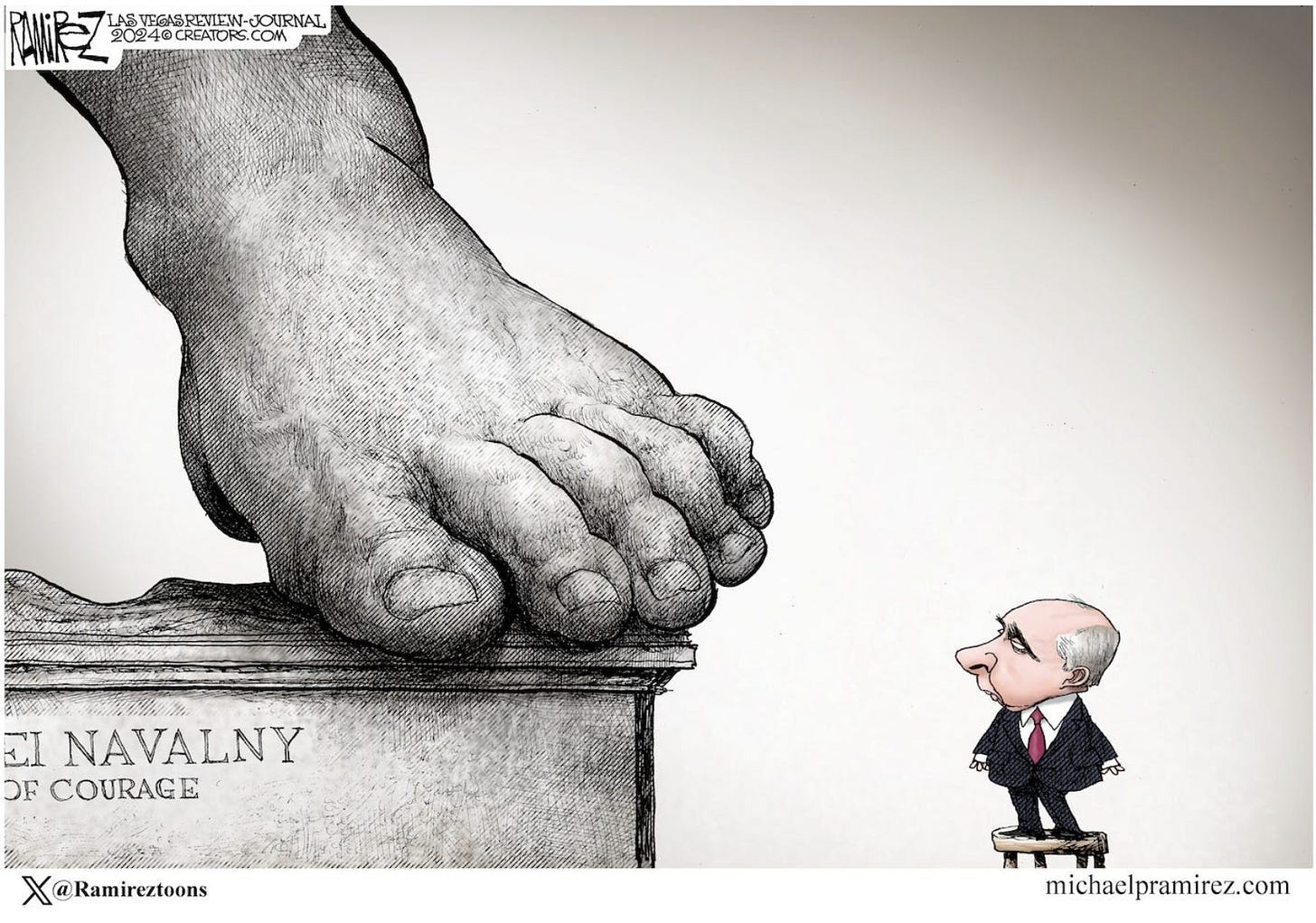

Who was Alexi Navalny? Navalny was a Russian Opposition Coordination Council member, the leader of the Russia of the Future party and founder of the Anti-Corruption Foundation (FBK). He was recognized by Amnesty International as a prisoner of conscience, and was awarded the Sakharov Prize for his work on human rights. Through his social media channels, Navalny and his team published material about corruption in Russia, organized political demonstrations and promoted his campaigns. In a 2011 radio interview, he described Russia's ruling party, United Russia, as a "party of crooks and thieves", which became a popular epithet. Navalny was a hero who tried to expose corruption and was investigated, jailed, and killed for it. He went after the biggest businesses and politicians including implying that Putin fraudulently obtained funds to build a massive estate for himself in what he called "the world's biggest bribe." Navalny was poisoned in 2020 and nearly died (Putin likes to poison people). He was arrested multiple times and despite knowing he would be detained, returned to Russia in 2021 and was arrested. Sadly, he died in jail but the clear suggestion was Putin had him murdered. I think the award-winning cartoonist, Michael Ramirez’s depiction is a good one below.

Israel

Good short video comparing Pearl Harbor/Japan to Hamas/Israel

He compares the 2,500 Pearl Harbor deaths by the Japanese and the US response killing 2.5-3mm Japanese to what Israel is doing with Hamas. He goes on to suggest Israel is being far less inhumane and attempting to target terrorists. Look at what happened with the allied forces and Germany where many civilians were killed during WWII. Israel is protecting its citizens and trying to root out terrorists. The short video is enlightening.

Jewish teens are looking at a new factor in their college search: antisemitism

The Rosen family is going on 6 school tours in March. You can bet 100% of your net worth that antisemitism is a topic being discussed. I want my children to feel safe and welcome. If the school cannot do that for them, there is no chance they attend.

Neo-Nazis seen performing Hitler salutes on march through Nashville

Imam recites Quran at Belgian parliament, calling for killing, kidnapping of Jews

Other Headlines

Magnificent 7 profits now exceed almost every country in the world. Should we be worried?

Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia and Tesla — outstrip those of all listed companies in almost every G20 country.

France Lowers Its 2024 Economic Growth Forecast to 1%

The country is cutting costs to try to be fiscally responsible (US politicians listen). France is trying to lower the deficit to 4.4% of GDP from 4.9%. The US ran a 6.3% deficit to GDP last year.

Foreign Direct investment into China has Collapsed

The chart shows Foreign Direct Investment into China is -90% since 2020. I hope it gets bad enough for the government to change course and policies.

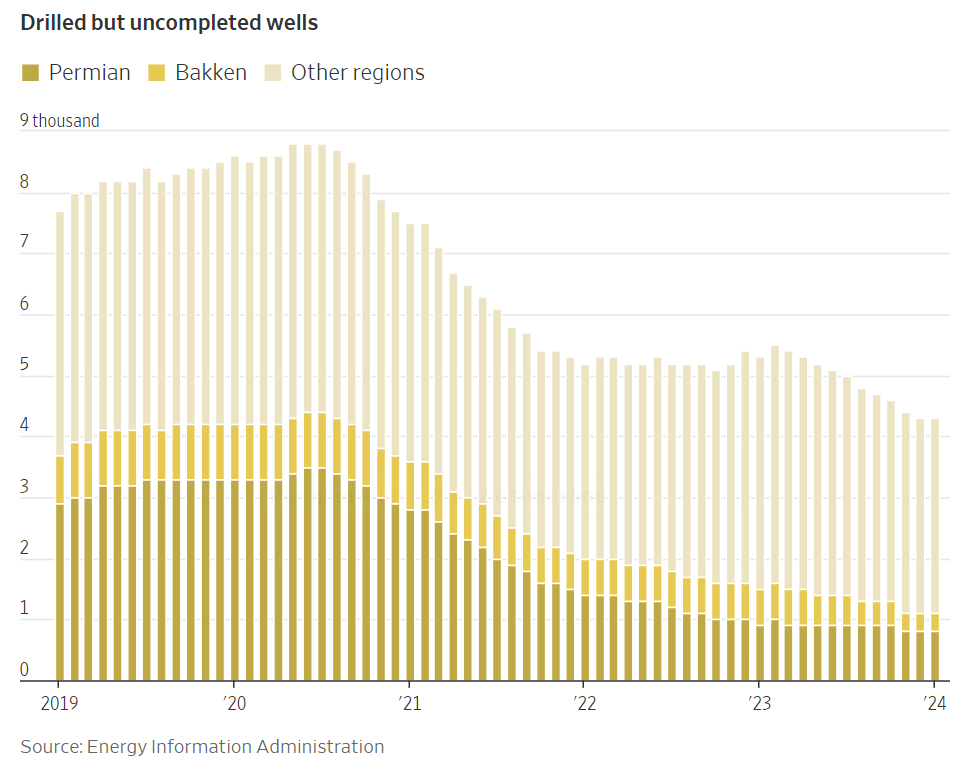

America’s Oil Power Might Be Near Its Peak

The production growth that blunted surging oil prices is dwindling. I do not believe the Biden administration has been good for the oil industry. Don’t confuse the large output with Biden’s policy achievements. The vilification of the industry under this administration will be felt in coming years.

FBI Director Says China Cyberattacks on U.S. Infrastructure Now at Unprecedented Scale

Christopher Wray on Sunday said Beijing’s efforts to covertly plant offensive malware inside U.S. critical infrastructure networks is now at “a scale greater than we’d seen before,” an issue he has deemed a defining national security threat.

Social Security to Make Major Payroll Change

The US Government has wasted $2.4 TRILLION on improper payments over the past 20 years. There will be changes made to help curtail Social Security payment errors. A small step in the right direction.

"Silver tsunami": Record number of Americans set to turn 65 this year

54mm Americans are 65 and older a 34% jump in the past decade yet we continue to give benefits at 65. Entitlements must change.

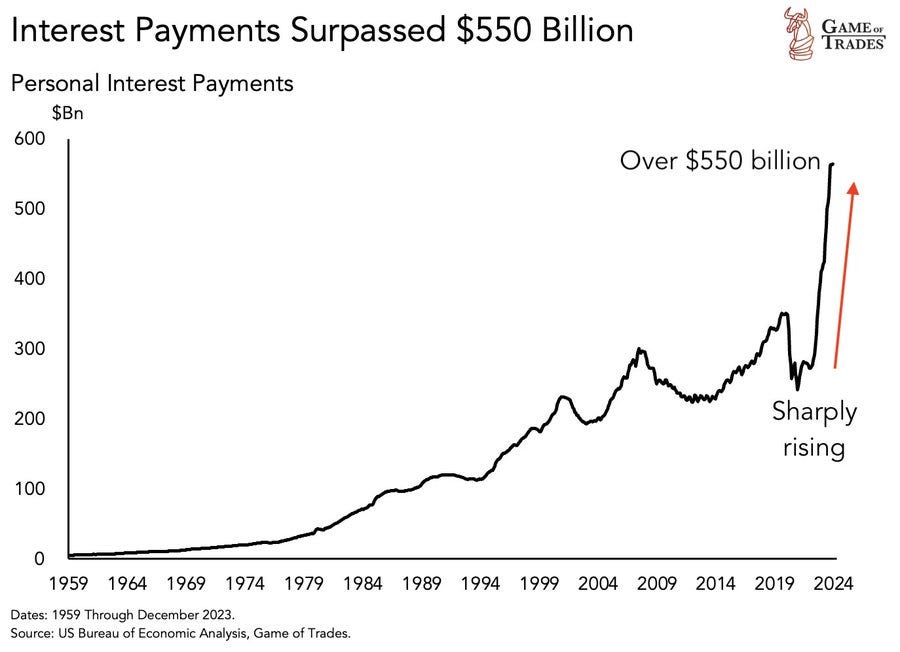

Personal interest payments have now crossed $550 billion

This tells part of the story. Home values have exploded and cash earned on investments has increased sharply. However, there are haves and have-nots. Homeowners and those with large savings are doing well, but consumers are struggling under the weight of high-cost debt. This link shows how the average American household has seen wealth increase with some good data included in it.

Sony plunged $10 billion after its PS5 sales cut. But a bigger issue is its near-decade-game margin

Palo Alto Networks shares plunge after company cuts full-year billings, revenue guidance-Stock-23%

Loeb's Third Point to delve into private credit investing as a 'complement'

I believe things are starting to get crowded in this space and fear the credit quality and terms will begin to deteriorate.

Same point in the Presidency. Obama was a brilliant orator and presented beautifully and was available to the press. Younger candidates please.

Nate Silver urges Biden: Reassure voters or ‘stand down’

“Biden needs to reassure the American public that he’s capable of handling public appearances that aren’t on easy mode. Or he needs to stand down. Or he’s probably going to lose to Trump,” Silver wrote.

Donald Trump’s Cash Crunch Just Got Much, Much Worse

All these lawsuits are crushing Trump’s finances. He now has $87k/day in interest penalties on the fraud charges. Most lenders don’t want the press of doing business, I presume. All these issues and the polls still have him in the lead. It is a statement about how bad both candidates are in my opinion.

Dominion wins access to Newsmax journalists' texts in its defamation case

Amazon driver fends off attack from drunk, naked NYC migrant — and ends up in cuffs

You cannot make up this stuff. Migrants attack people with no consequences and when a legal citizen defends himself he gets arrested?

NYC Gucci store robbed in broad daylight by brazen gun-toting crew

What the hell is going on?

One person returned 99% of the 172 purchases made. Given tighter margins, retailers are adjusting their return policies. This will be devastating to my wife. I want to be crystal clear on something. My wife is the single best returner in the history of the world. The Jordan of returns.

Good thoughts in the article.

The Vatican’s secret keeper is retiring — here’s what he wants you to know

Men and women's brains do work differently, scientists discover for first time

The Big Impact a Teeny Painting Can Have on Your Decor—and Your Brain

I do believe art makes a difference and enjoy living with the furniture and art I have collected over the past 20 years. I have fun researching the artists or designers before buying.

They consume apricot seeds & oil. They never stop moving. They drink glacier water. They rarely eat processed foods. They have strong community values.

Estimated nuclear warhead inventories, 2023

When will Iran and be on the list?

Real Estate

This is a CNBC video is of Joe Kernan interviewing Richard LeFrak. The 7-minute video has the R/E titan, Richard LeFrak, outlining his well-informed views. The LeFrak R/E empire is impressive and Richard has a unique perspective given the vast holdings of his companies. LeFrak spoke about the lack of debt financing availability having a major impact on the R/E sector. He said, “There will be severe losses by equity owners and financial institutions.”

Good Bloomberg article regarding systemic risk given R/E issues. Fears of a systemic credit event are growing among fund managers as alarms sound in property markets around the world. About one in six of those polled considers such a crunch to be the biggest tail risk facing markets, compared to about one in 11 in December, according to Bank of America Corp.’s latest Global Fund Manager survey. The deepening disquiet in US commercial real estate and Chinese property markets means it’s now the third-biggest worry for respondents, lagging higher inflation and geopolitics. More than $900 billion of debt on US commercial and multifamily real estate will require refinancing or property sales this year — a 40% jump from an earlier estimate — after banks extended loans among other factors, and as building values fall. A 10% default rate on CRE loans would result in about $80 billion of additional bank losses, according to a research paper on US bank fragility published in December. The paper warns that CRE distress could leave more than 300 mainly smaller regional banks at risk of solvency runs.

This WSJ article is entitled, “Tech Leaders Fled San Francisco During the Pandemic. Now, They’re Coming Back.” The article suggests that various tech founders do not have the infrastructure in Miami and cannot attract the same engineering talent as they can in San Fran. Others point to investors wanting companies in the San Fran area. “The reality is that the brainpower is here” in San Francisco, said Max Gazor, a general partner at the venture firm CRV and board member at Airtable. “It’s especially true for AI, given the light speed at which these companies have innovated.” Having spent time in San Fran and living in South Florida, I cannot fathom ever living in San Fran. Sorry, South Florida is so much better and the migration out of CA and into FL speaks volumes.

A South American buyer is in contract to pay a cool $55 million for an oceanfront penthouse duplex in Miami — and it isn’t even built yet. The home is in the South Tower of the St. Regis Residences in Sunny Isles Beach, Florida. At 750 feet tall, it will be South Florida’s tallest residential building on the ocean when completed. The condo, on the 61st and 62nd floors, was last asking $60 million. It’s a massive 9,843 square feet, and comes with an additional 8,822 square feet of outdoor space that includes a private pool, a Jacuzzi and a summer kitchen. When you think of the incredible wealth that has descended upon South Florida over the past five years, it is unfathomable. Home prices have tripled or quadrupled in many cases and high-end inventory is slim in Miami and Palm Beach. For perspective, the PH at the Ritz in Sunny Isles sold approximately 4 years ago for $20mm and was 7,100 feet. That was considered high at the time. Separately, Barry Diller just bought Bruce Beal Jr’s waterfront property at 5930 North Bay Road for $45mm (record price for North Bay Road).

This is an interesting article about a billionaire from Monaco who is accumulating properties in Carmel and locals are getting concerned. Patrice Pastor has bought more than a dozen properties in Carmel including the L’Auberge Carmel Hotel in the past nine years. According to the story, people are “Terrified” about the ramifications. Pastor said, “‘I’m not a nice guy.’ ‘I’m free, independent and I have money, so ... Everything in the ‘Dossiers du Rocher’ is true, and everyone knows it! The truth is that I irritate them.’

Foreclosure notice for 2021 construction hotel in Tempe, AZ. The asset was built in 2021 and has 290 rooms. $86.5mm construction loan (~$298K per key). Market hotel occupancy in Tempe is ~66%. Average daily rates are ~$150. RevPar is ~$100. Stabilized NOI for this asset is likely between $4.5-$5.5mm. Take the mid-point of $5mm, and apply a 7 cap, and you're at $71mm. 82% of construction loan. The rapid rise in rates strikes again. The cost of bad Fed policy (Transitory) and too much Biden Administration stimulus is to blame. Many properties will be lost in this cycle. Having said that, more owners should have locked in low rates.

© 2024 The Rosen Report LLC. All rights reserved. Does not constitute investment, financial, legal or tax advice. Consult with your lawyers and professional financial advisers. Rosen Report™ #658 ©Copyright 2024 Written By Eric Rosen.