Opening Comment

I am looking into a quick trip to Boston next week for a meeting. The cheapest round trip is well over $1,000. I have never paid so much for a flight to Boston or NYC. Inflation strikes again. This CNBC article is suggesting airfare has surged 20% over pre-pandemic levels. The TSA pre-check numbers for the past few days are averaging 8% lower than 2019 levels as seen below.

The crowds are thinning slightly in Florida as the temperatures are ticking up a notch. South Florida is ideal from early November through May or mid-June. The worst months are August through October from a heat, humidity, rain, hurricane perspective. The one bit of good news is in the summer, the restaurants and golf courses are empty. The bad news is it is so hot a humid you have a lot of bad hair days and sweat to death in minutes. Getting in your car after it has been in the sun all day and the AC blows hot is not fun either. Link to Boca weather, and I grabbed some charts. Pretty clear that from mid-June-mid October are not ideal. The big issue is school starts here in mid-August. I wish they would push it to September and end in early June rather than mid-May.

Video of the Day-UFO Sighting

Eye on the Market-Mike Cembalest

The Tide Goes Out: Growth Trade Aftermath

Old Man Clubs

Quick Bites

Markets, CPI

Bitcoin Correlation to NASDAQ

Steepening Yield Curve

Retail Returns

Brooklyn Attack

Solar Powered Boating into the Future

I’m Afraid of Open Heights

Other Headlines

Virus/Vaccine-CASES INCREASING

Data-Case Growth

Real Estate

General Comments

Miami-Dade March Condo Sales-WOW

Hamptons Dwindling Inventory

Video of the Day-Old UFO Sighting

An avid reader, Matt, sent me this video from the British Broadcasting Company of a UFO sighting in South Africa from 1994. The consistency of what was seen is pretty compelling. With the release of all this UFO data from the US Government, I am reading a lot more about the subject. I would love to interview Luis Elizondo, former director of Advanced Aerospace Threat Identification Program, which was part of the Pentagon. Does anyone have any contact with him? Disappointingly, I have never seen a UFO, but I am convinced we are not alone in the universe. I would like to have all the information from the US Government released on this matter and want to check out Area 51. Many Navy pilots have outlined sightings which should raise eyebrows and Elizondo, who has seen a lot of info seems convinced something is out there as well.

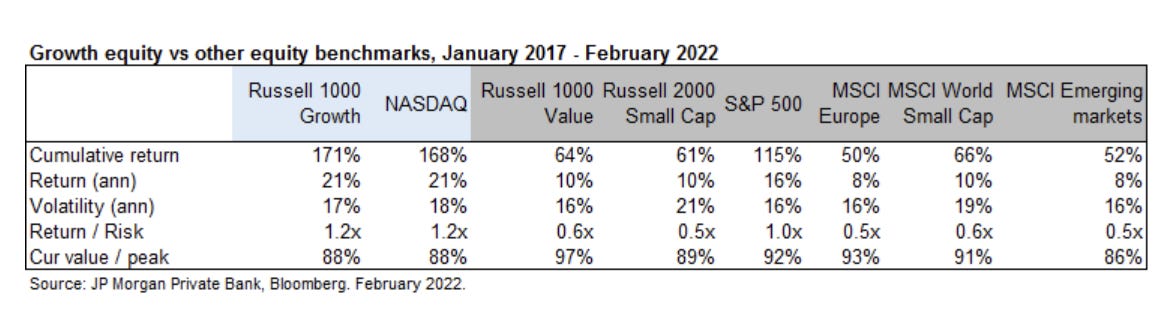

Eye on the Market-Mike Cembalest

As always, Mike keeps it interesting. His summary of the views of Sergey Karaganov, Putin’s advisor are concerning. The main piece discusses the market after the stock sell-off. I liked the commentary around the 2nd chart and the explanation on drivers. Nice discussion of hedge fund returns relative to benchmarks as well.

Old Man Clubs

At one point, I was a pretty good golfer. Despite some volatility, I could shoot solid scores even though I had an uncanny ability to make double bogeys with wedges in my hand. However, as I have aged and my ailments mounted, my game has gone in the wrong direction. I was crushing my son in golf two years ago, where it was not even close. Now it takes a miracle for me to not get embarrassed with him. Given my countless injuries, namely my back, I cannot practice for long. I had injured my back again and then tore my calf muscle and took 5 months off the game until last week.

I currently play PXG Tour irons with KBS 120 gram-S-Taper shafts which are very nice-looking clubs and meant for better golfers. Given my lack of play and age, I thought about getting new, more forgiving, irons. When Jack was in Memphis two weeks ago, I had the expert club fitter, Scott Felix (top 100 club fitter), fit me for something new. I told him I just want to have better misses. My expectations for the game are lower now and want to enjoy playing again. I told him my days of vanity on a golf course are long gone, and I would play any clubs he recommended, even if they are embarrassing clubs.

My good friend, Ned, is a very accomplished amateur golfer. Last time we played, he beat me by more than I can admit in public after I made fun of his ugly irons. They look like a 36 handicap would play them, yet he won the Met Senior Amateur and many other tournaments with them. He told me his days of vanity are behind him. I told the club maker I am willing to go with Ned irons if they will help me lessen mistakes. If they are good enough for Ned, they are good enough for me. My only hard stop was I would not go with XXIO brand clubs, as they are too embarrassing. Thankfully, he said my 105-driver swing speed was too fast for those horrific clubs, but I know it is only a matter of time.

Current Clubs

Well, Scott fit me for grandpa clubs. I will need to wear a bag over my head to hit these incredibly ugly things. I am yet to receive them but am told I should expect them in a few weeks time. Also of note, I went from 120-gram stiff shafts to 105-gram shafts. Yes, getting old sucks, and I am going the wrong way as Jack went from 105-gram shafts to 120s (my exact same old ones). Again, my irritating son is passing me by and rubbing my face in it. The new irons are more forgiving and hopefully, will improve my missed shots. One can dare to dream. Also, all of Jack’s irritatingly good golfer friends, Max, Reid, Dean, Matthew…are so good. I want to look less bad when I play with them.

Old Man Clubs

Last week, I played 9 holes twice with Jack with my old PXG irons. Both days were windy. The 1st hole is a par 5 and I hit what I thought was a decent drive. Maybe it hit a sprinkler head or something as I left myself an 8-iron into the green as it was downwind. I two putted for birdie on my 1st hole back in months. I should have quit at that point. We all know about mean reversion, and I knew I would not be only making pars and birdies all day. I three-putted the next hole for bogey and then made two pars. I was even par after 4 holes, and I far exceeded my expectations. I should have called it a day and ended on a positive note. What happened on #5 you ask? I launched my conservative 4 wood out of bounds off the tee and had to re-tee. I then hit a bomb and then chunked my wedge into the drink. I three-putted for a 9 on a par 4. I went from even par to 5-over in one hole. I doubled the next hole despite being a wedge into the green and then made bogey, par. I was dejected going into the 9th tee and tried to kill it off the tee. BAD IDEA and launched it so far right it went into the other fairway, so I quit after 8 out of humiliation. I would like to blame an aching calf, but that was not the case. I was not out of bounds, but it was too embarrassing to go to #6 to play #9.

We went out for another 9 the next day and started on #6. I started par, bogey, par, par, par, par, bogey, bogey. Three over through 8 in wind is very respectable after such a long break. I am now finishing on the hole which I made a 9 last time. What happened on #5 this time? THE SAME DAMN THING. I launched my 4-wood OB, hit a great 2nd drive and then dumped my wedge into the water. I hit my 2nd wedge to 3 ft and missed the putt to make an 8. Son of a …. I was 9 over on the 5th hole in two tries. My grandpa irons can’t come fast enough. Next up for me is white shoes, a white belt, the early bird special, dentures and BenGay arthritis cream. Maybe Boca was perfect for me after all. The small # next to the score is the number of putts on the hole.

If my new irons don’t help, I will switch back to the old ones. Ned, I am coming for you brother. We will be twins with our matching grandpa clubs. I just wish they will help me play like you. This is how I look as an old man which is apropos for my new sticks. My daughter used some filter on her phone. Don’t ask me how. She can make me bald or old with the push of a button. I would never look like this as I will shave my head at the first sight of a receding hairline.

Quick Bites

The Dow rose 344 points, or 1.01%, to 34,565, accelerating gains in the final hour of trading. The S&P 500 gained 1.12% to 4,447, and the Nasdaq rallied 2.03% to 13,644. Those moves come after the S&P 500 and Nasdaq posted their third straight losing session on Tuesday amid March’s CPI showing the highest inflation since 1981. The 10-year Treasury is at 2.7% after hitting 2.85% yesterday. Oil rallied 3.6% and is back up to $104/barrel. Note that nat gas is quite elevated at over $7 after rallying 5%+ on the day. YTD, natural gas is up 98% and over 181% for the last year. Natural gas has not been at these levels since 2008 for perspective. The chart below shows the range over 30 years.

The consumer price index, which measures a wide-ranging basket of goods and services, jumped 8.5% from a year ago on an unadjusted basis, slightly above a Dow Jones estimate for 8.4%. Investors seemed to take solace from the core CPI, excluding food and energy, which increased 6.5% year over year, in line with the expectation. Month to month, core CPI rose 0.3%, lighter than the 0.5% expectation.

Since the beginning of the coronavirus pandemic, Bitcoin has shown a tendency to move in the same direction as the large companies listed on the Nasdaq 100 index. Recently, this correlation has grown closer than ever before. Indeed, the 40-day correlation between the Nasdaq 100 index and the largest cryptocurrency by market capitalization reached an all-time high of 0.6945 on April 8, according to Bloomberg data. To me, this is concerning, I had not felt the correlation to equities should be so high. Gene, an avid reader sent me this article. Crypto has come under pressure and is BTC is -3% for the past week despite today’s 4.5% rally.

After a pronounced steepening of the yield curve, we have seen a substantial direction change in recent days. The 2s/10s closed negative on April 1st and is now +33bps. Look at the far right of the 1st chart. The 2nd chart includes Jeff Gundlach’s commentary.

I am inserting this article as I found the numbers to be staggering. I think my wife accounts for 20% of Amazon’s returns. Amazon is handling a rapidly growing number of returns that are causing a massive problem for the e-commerce giant and the planet. A National Retail Federation survey found a record $761 billion of merchandise was returned to retailers in 2021. That amount surpasses what the U.S. spent on national defense in 2021, which was $741 billion. Amazon wouldn’t share its overall returns numbers, but in 2021, the National Retail Federation estimates 16.6% of all merchandise sold during the holiday season was returned, up more than 56% from the year before. For online purchases, the average rate of return was even higher, at nearly 21%, up from 18% in 2020. With $469 billion of net sales revenue last year, Amazon’s returns numbers are likely staggering. U.S. returns generate 16 million metric tons of carbon emissions during their complicated reverse journey and up to 5.8 billion pounds of landfill waste each year, according to returns solution provider Optoro.

Frank James, the man named by the New York City Police Department as a person of interest in the Brooklyn subway shooting, talked about violence and mass shootings in multiple rambling videos posted on YouTube, including one uploaded Monday in which he said he’s thought about killing people who have presumably hurt him. Many of the videos that James uploaded included references to violence, including at a set group of people he believed had maligned him, in addition to broad societal and racial groups that he appeared to hate. In another video posted last week, James, who is Black, rants about abuse in churches and racism in the workplace, using misogynistic and racist language. The man pictured was captured on Wednesday after calling Crime Stoppers on himself. His videos are concerning and terror-related charges are expected. I keep talking about the need to fix the homeless issue and the need to be harder on crime. To be clear, this attack could have happened anywhere. A few years ago, Nicholas Cruz shot up a high school near me in Florida. However, I feel the decline in living conditions in NYC is far more pronounced. According to reports, the assailant put on a gas mask and threw two smoke bombs in to the cabin of the subway and began shooting. How scary it must have been for the people on the subway.

Maritime transport drives over 80% of global trade, but it disrupts marine ecosystems, contributes to ocean acidification and accounts for more CO2 emissions than aviation each year. This boat set sail on 12/18 and is expected to make dozens of stops on five continents. It will complete a three-year circumnavigation voyage before returning to Japan in time for the 2025 World Expo. As human ingenuity takes hold and more products are cleaner (cars, boats, trucks, planes…) we will really reduce reliance on fossil fuels. Although this is decades away, I am excited about it.

I am not sure if I have ever discussed it, but open heights scare me. I would never go on a hot air balloon, for example. I am not sure why, these pictures made me crazy. This “stairway” is at Donnerkogel Mountain in Austria. I’m a hard pass on this one.

Other Headlines

Recession Risk Is Rising, Economists Say

Forecasters raise probability of economic contraction in next 12 months to 28% as Fed tightens to beat back inflation

JPMorgan CEO Jamie Dimon Says ‘Powerful Forces’ Threaten U.S. Economy

Bank’s first-quarter profit fell 42% as it socked away funds to prepare for higher defaults in case of recession. JPM was -3.2% on the day.

JPMorgan CEO Jamie Dimon sees ‘storm clouds’ ahead for U.S. economy

The risk that the Federal Reserve accidentally tips the U.S. economy into recession as it combats inflation is rising

Biden’s approval falls to new low amid economic pessimism, inflation woes, CNBC survey finds

Fanatics wants to be a $100 billion company – here’s how it plans to get there

EV maker Lucid debuts its latest Tesla rival, a high-performance luxury sedan with a 446-mile range

Mark Zuckerberg says Meta will test Horizon Worlds virtual sales

I just don’t get it. I am not convinced I will ever spend one dollar buying things in the Metaverse. I am going to miss out for sure. Wait, there is more, Meta will take a 47.5% cut of Metaverse sales.

Surf-and-Turf Specials Cut From U.S. Menus in Sign of Price Pain

Lower-income shoppers are shifting to private-label brands

Economic data now show food spending is starting to wobble

Inflation is hammering the voters who will soon decide some key midterm races

Four-day work week proposed under new California bill

That's what's being proposed under AB-2932, which would officially shorten a work week from 40 hours to 32 hours for companies with more than 500 employees.

17 L.A. gangs have sent out crews to follow and rob city's wealthiest, LAPD says

Broward family accused of kidnapping, beating gay man so badly he was left blinded

I sure hope this horrific family spends serious time in jail.

CNN+ struggles to lure viewers in its early days, drawing fewer than 10,000 daily users

The next few bullets are around Trump and the Bidens. They do not read particularly Well for either. The Hunter emails, texts, calls open many questions for me which need to be investigated. Some emails/texts suggest Joe was being paid by Hunter who was paid by foreign countries for “services,” which are a joke.

Finland, Sweden Set to Join NATO as Soon as Summer - the Times

Clearly, this is not working out as Putin had planned.

Biden commits another $800 million in assistance during one-hour call with Zelenskyy

Biden calls Russia's invasion of Ukraine a 'genocide.' Is it a war crime?

Virus/Vaccine

A couple weeks ago, I mentioned I was seeing a slight uptick in some states in terms of cases, while hospitalization and deaths were still falling. I am now seeing a more significant increase in cases, albeit from a low base. More people I know are testing positive. Positivity rates are rising and now approximately half of the states are showing case growth. In the US, the positivity rate was .7% a few weeks ago and is now 3.3% according to Johns Hopkins data. Also of note, many are home testing which means the public data is substantially under counting positive cases. Monday, Columbia Grammar (NYC) cancelled school due to a sharp increase in positive cases. In the 1st chart, you can see that US cases have grown 8%, while hospitalizations and deaths continue to decline. The 2nd chart shows case growth in the worst hit states. I outlined the column to focus on for case growth.

Philadelphia reimposes indoor mask mandate after 50% COVID-19 spike

New omicron XE Covid variant first detected in the UK spreads to Japan as cases rise

California, New York handled COVID-19 lockdowns the worst, Florida among the best, a new study shows

Interesting article from the Committee to Unleash Prosperity (Steve Forbes)

Chinese Stockpile Food as Covid-19 Concerns Ripple Out From Shanghai

Real Estate

The migration continues. I am now constantly bumping into big hedge fund and Wall Street professionals who are living here full or part-time. I coordinated a dinner for approximately 15 people living in South Florida and the group was impressive. I could never have put this together when I moved here 5 years ago. Also of note, I have been to Miami 15 times this year, more than I ever have gone given so many of my friends have moved down there. My 1st trip to the club, ZZ’s was last night and it will be discussed in detail in the next report.

In my community in Boca Raton, I just saw a new construction home go under contract with an ask of $17.2mm. It is built by SRD who is viewed quite positively in the area as a high-end builder. I hear from owners they are generally happy with the quality and SRD stands by their product. However, they furnish them a bit cookie cutter for my liking. It does not say the final sales price, but let’s put this into perspective. The golf course lot is 14k feet for a house which is 7,819 feet and is a 5 bedroom/5.2 bathroom (2 half baths). It is on the single busiest street in the community (I would never live on it). However, I find the aesthetics of the outside of the home quite interesting. My home is the same size, but 6 bedrooms and 7.3 bathrooms (3 half baths) and my lot is almost 5,000 feet larger, on a quieter street and I only have one neighbor. I paid $6.3mm for my home less than 5 years ago. I would buy my house for $15mm+ all day rather than this one for $17mm. Below is the new SRD and I love the garage doors and design of the home. I don’t have updated professional pictures of my house, but I have high Ficus landscaping around it creating far more privacy and my pool looks to be almost twice as large. There are now 7 listings in my community with an average asking price of $11.8mm and one is a 1971 tear down, so the real average is $12.8mm once you build the new house. When we bought less than 5 years ago, there were 71 listings with an average price of $4.9mm. The market is out of control. I was told of a house which I was looking at for $9.5mm 5 years ago will fetch over $25mm when it is listed.

Miami-Dade County’s top 46 condo sales totaled $327.3 million in March, surpassing February’s total of $253.7 million. According to data from condo.com, March sale prices ranged from $2.6 million to $30 million, reflecting continued voracious demand for high-priced condos. In February, top sales ranged from $2 million to $23 million. The average sale price in March was just over $7.1 million, compared to $6.7 million the previous month. The average price per square foot in March topped $1,912, and ranged between $506 per square foot and $4,573 per square foot. The average price per square foot in February was $1,875, and ranged from $573 per square foot to $4,927 per square foot. The top sale in March was a $30 million closing at Palazzo Della Luna on Fisher Island in Miami Beach. Unit PH 6803 at 6800 Fisher Island Drive traded for $4,573 per square foot. The second most expensive sale was an $18.5 million closing at the Four Seasons Residences at the Surf Club. Unit S-309 at 9001 Collins Avenue in Surfside traded for $4,168 per square foot, the second highest price per foot recorded at the development.

Hamptons Market Data revealed the number of for-sale listings was down to 450 as of April 1, Behind the Hedges reported. Available homes dropped 8.1 percent from the previous month and almost 55 percent year-over-year, the largest inventory decline Hamptons Market Data has ever recorded. Finding affordable homes in the Hamptons remains a challenge. The number of new listings priced at $1.5 million or below has fallen by half, while contract signings dropped by 85 percent year-over-year and closings by 57 percent. The median sale price in the area in March was slightly more than $2.3 million, according to Behind the Hedges. That was unchanged from February but up 16 percent year-over-year. The Hamptons luxury market is as hot as ever, which appears to be drawing out some sellers. According to Behind the Hedges, the number of contracts for homes priced at $10 million or more increased 33 percent from March 2021, while the number of closings jumped 46 percent.