Opening Comments

The last note had a slightly lower open rate. Riding the Perfect Wave Won't Come Cheap. Of course, you need to see my surf pictures. At 53 years-old, I am not sure how many more of those there will be, so I am going to milk it.

I was back in Miami Thursday night for a boat party as part of the F1 race. It was a great night and again took the 5pm Brightline from Boca to Miami. It was the first time the train was not empty, and I suppose part of it was rush hour and the race. I’m told there will be almost 250k people attending the race over the three days, and some tickets were $10k for the event. Carbone held another $3k person dinner on the beach with live entertainment, and Miami is hopping. When I moved down 6 years ago, I went to Miami five times a year. Then the pandemic hit and did not go down much. Given so many friends moved to Miami from NYC, great new restaurants, non-stop events, the Brightline… I will probably go to Miami 35 times in 2023. I would say that is a statistically significant increase.

Reminder, as my readership grows, you need to know this is an interactive newsletter. I get 500-1,000 emails each week with story ideas, questions, comments, and topics people want to learn more about. If I feel I have a view or knowledge of it, I will add it. Keep the ideas coming. Also, I reach out to readers who I believe are “experts” on topics to help me round out some of my pieces. Today’s theme piece received input from Peter Boockvar, the author of the Boock Report and a savvy investor and CNBC contributor. Thanks, Peter.

Markets

Regional Banks Updated

My Hero-Druckenmiller Interview

NYC Building 90% Off

Peter Theil on Miami-He is Wrong & Chachi is Right

Dallas is Attracting Finance Jobs

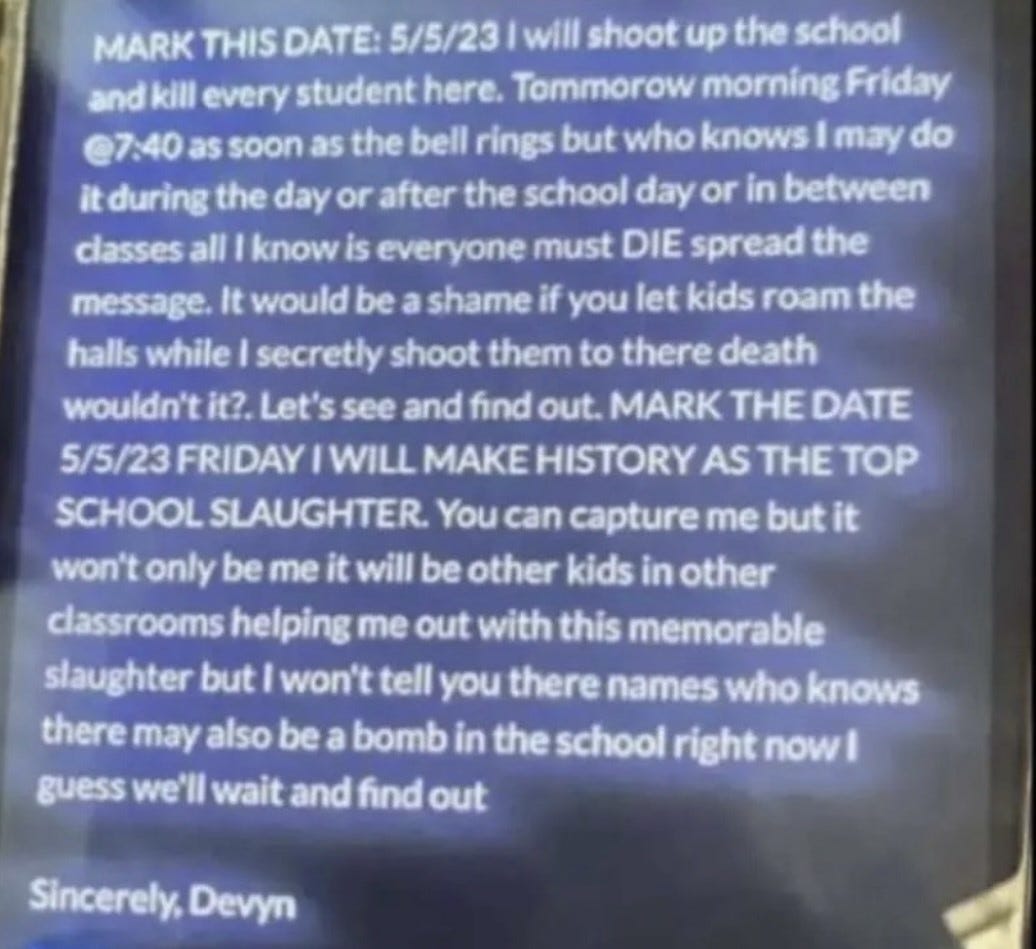

Picture of the Day-Death Threats at Schools

The world has become a scary place. Mass shootings seem to be happening with increasing frequency, and in many cases, children are targeted. As a parent, your number one priority is protecting your kids. What can you do if you send a kid to school, and you are not there to step in front of the bullet? My 15-year-old daughter sent me this Thursday night and was scared to go to school Friday. What the hell is wrong with people? Rumors were flying about which school was being targeted, and the chatter suggested it was a school in my town of Boca Raton. It is disgusting. My daughter’s school sent out this response (2nd picture) Friday am, as I presume this awful note made its way to the administrators. Our children need to feel safe and focus on learning and socializing. They should not be worried about being killed while at school. Turns out an 18-year-old student from a nearby high school was arrested and will face multiple felonies for the incident. Catrina Petit, used another student’s name and computer when sending out the threat. Look at this scary headline from Saturday “At least 8 people killed by gunman at Texas mall; shooter killed by police.” Truly a frightening time.

Police Academy Produced Bad Sequels & The Fed Does Too

The title of today’s note was meant to be a funny eye-catcher. No, the Fed is not solely responsible for the mess, but they are a massive contributor. Yes, bank management and greed all play a part too.

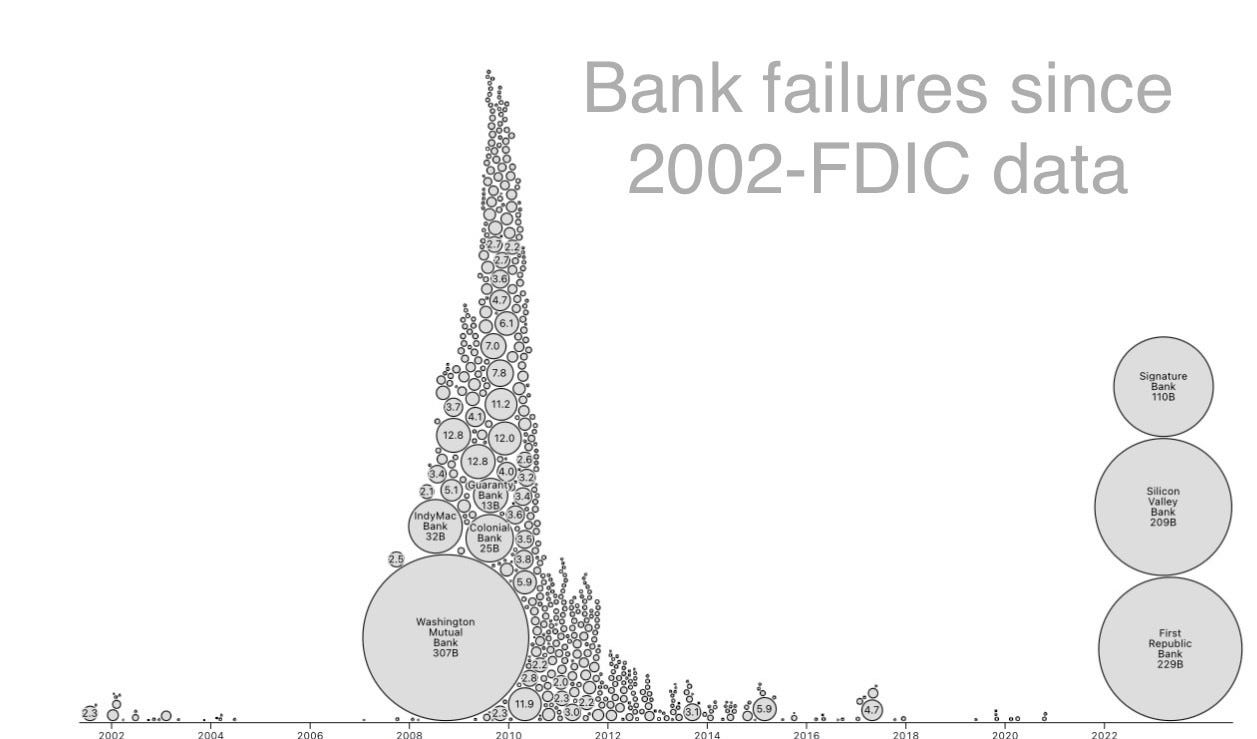

A couple of weeks ago, I was interviewed on a myriad of topics and one was to compare today’s banking issues with the Global Financial Crisis (GFC). This is the 8-minute clip of my answer which outlines a lot of issues. The short answer is NO, we are not close to the GFC. The time during 2008/9 was the scariest time of my life and major financial institutions were bleeding. The banking system is far better capitalized today and nowhere close to the issues of 15 years ago. During the GFC, the issues were shown in the largest financial institutions that were a threat to the system. Citi stock was 97 cents/share and it is now $30. Bank of America was $2.6/share and today it is $27. Check out the stock price of mighty JPM which hit $15 and is now $137.

In the banking crisis today, the largest banks are in a much better position, but the smaller, regional banks are under siege and still have not tackled the commercial R/E loan issues.

When I see financial institutions/funds implode, I find there are generally three consistent themes that explain a majority of them. One is leverage. Firms borrow too much money and lever themselves up in an effort to increase their returns. Let’s walk through a simple example of owning a home. You buy a home with 50% down or 10% down on a $250k house. You then sell it 1 year later for $500k. In simple terms, in the 1st scenario, you make triple your money ($125 initial investment and get back $375 after you repay the debt) not factoring in fees/taxes and financing costs. In scenario 2, you make 9x your money ($25k initial investment and get back $225k after you repay the debt). In an effort to improve returns, firms may use aggressive leverage, which works…until it doesn’t. Bear and Lehman were in the 30x levered range going into the Global Financial Crisis for perspective. Bear went from 12x leverage in 2004 to 33x in 2008.

Additionally, many investment banks were invested in illiquid assets in and around mortgage-backed securities and many other real estate-related ventures. Many investment banks funded themselves in overnight repo arrangements. In an effort to simplify, the banks had Treasury securities and “sold “ them to another entity with the agreement they would be brought back the following day at a slightly higher price. Essentially, many firms were funding overnight or very short term and investing in longer-dated, illiquid assets. This asset/liability mismatch is the 2nd likely cause of issues with financial institutions.

Today, we have a regional banking crisis. They funded themselves with deposits which grew rapidly and many banks started buying longer-dated securities. The deposits are overnight, meaning the customer can take money out at any time. I won’t go through all the details for each bank, but in SVBs case, they bought 20-year securities with cash and as the Fed continued to raise rates, the value declined. Depositors wanted money back and they had to sell these securities at a large loss. This is what became the beginning of the end for SVB.

I will give you a personal example. When we launched my hedge fund, Reef Road Capital, the money raised was largely locked-up for 2-3 years. This afforded my team the luxury of buying less liquid assets, as the money was “locked up.” Over time, the investors decided to go to shorter-dated terms (quarterly) and as a result, the fund changed its investments to accommodate the shorter liabilities. We went with more liquid assets because we did not want to have the dreaded asset-liability mismatch. This is what you are supposed to do when managing risk, consider the nature of your liabilities when making your investment decisions.

Michael Milken recently said, “You shouldn’t have borrowed short and lent long... Finance 101,” Milken said on CNBC’. “How many times, how many decades are we going to learn this lesson of borrowing overnight and lending long? Whether it was the 1970s, the 1980s and 90s.”

The last way to surely blow up a firm is mandate creep. We see this constantly. A fund is an expert in bonds, and the market is uninteresting, so they play in Real Estate or something else. I recall one fund that was focused on the US bought into a chicken farm in Asia prior to the GFC. What could possibly go wrong? Signature Bank started aggressively lending in the crypto space after aggressively lending in commercial R/E. What could possibly go wrong?

The Dovish Fed, which continued to leave rates too low for too long, pushed investors to take additional risk. Greenspan left rates too low for too long which CLEARLY contributed to the GFC. Remember, in 2007 when Ben Bernanke said, “Subprime is contained and there will be no recession.” OOPS. Investors in search of yield find new securities (levered plays such as mortgage-backed securities, CDOs, CLOS and other structured credit instruments). They invest in these because they offer higher yields than traditional fixed-income investments. When the Fed takes yield away from the market, there is a search to find it and generally leads to trouble eventually.

Fast forward to post GFC where again the Fed was asleep at the wheel, and they left rates too low for too long again. The Fed bought trillions of mortgages and Treasuries in an effort to keep rates low (Quantitative Easing/QE). It lead to inflation after the pandemic which was anything but “Transitory.” Remember Yellen and Powell used the words “Transitory Inflation,” at every turn? OOPS. However, low rates also forced banks and other investors to seek out additional yield or return. In my piece from July 2021 entitled, There Ain’t No Such Thing as a Free Lunch (TANSTAAFL), I was very critical of the Fed and inflation. I gave an amazing example of what was going on in the R/E market which you can read if you have interest. QE itself is what flooded the banking system with so many excess reserves and deposits that banks were overwhelmed. It’s why the loan-to-deposit ratios got so low and banks in turn just shoved money into Treasuries and Mortgage-Backed Securities. In SVB’s case, they sought out investments in 20-year mortgage-backed securities which plummeted as rates rose. The long-dated nature of these bonds made them sharply underperform shorted dated securities in a rising rate environment.

Now the Fed has raised rates 10 times in a little over a year (chart below) after leaving rates too low for too long. Part of the carnage in the banking system should be attributed to the failed policies of the Fed. Consistently, you can see after a sharp rise in rates by the Fed, a recession takes place (1980, 1981, 1990, 2001, 2008, 2020)-second chart. Low rates for 10 years starting in 2008 led to aggressive risk-taking, a boom in tech, housing, crypto…The Fed did it again by leaving rates too low for too long after the pandemic. Yes, history has a way of looking awfully similar to the past.

No, we are not in the Global Financial Crisis and quite frankly, it is not even close. Financial Armageddon was hours away during that period of time. Banks are far better capitalized today and the Investment Banks carry far less leverage. However, it is my view that the regional banking issues are not over. Also of note, SVB lost 75% of its deposits in 36 hours and the impact of social media on bank runs is less than ideal. Couple this with my concerns about the consumer (if you read my reports you are well-versed here) and the upcoming debt ceiling debates, and you can see that volatility could stick around for a while. I do believe the pull-back in lending from the banks will have a sharp impact on inflation, earnings, consumer and the economy. Financial institutions are a confidence game, and after building a reputation for years, in a matter of hours it is over once depositors lose faith.

Human nature and greed seem to get in the way of good decision-making far too often, and this cycle is no different. Banks made bad decisions again, but the Fed contributed significantly yet again. Sound familiar (1987 crash, S&L Crisis, .com bubble, GFC/Subprime, and the issues we face today). The chart from BAC shows the correlation with sharp rate hikes and numerous issues after.

Quick Bites

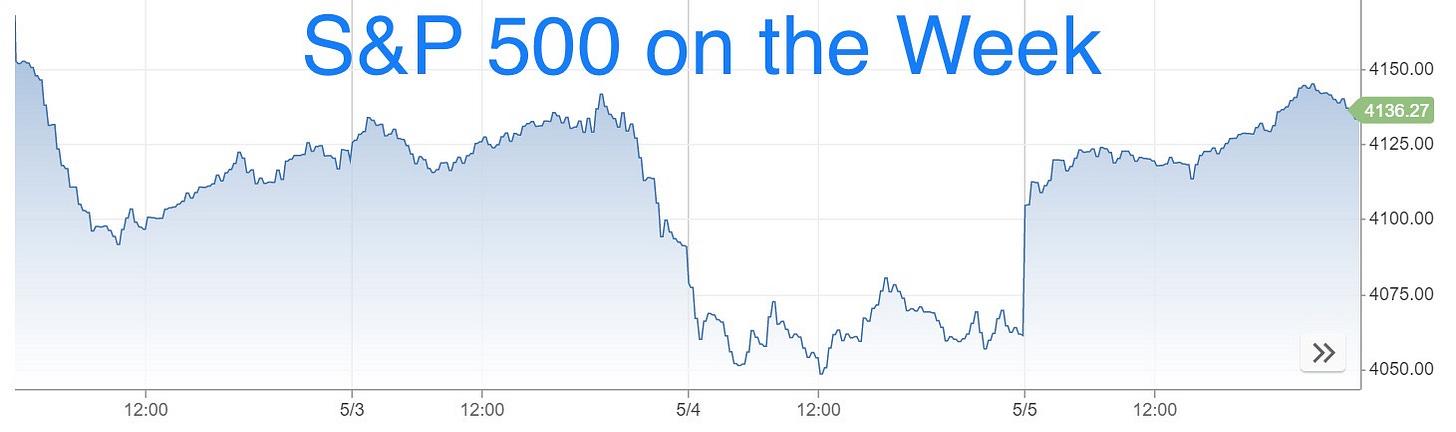

Stocks have been volatile, as the regional banking issues and loss of confidence persist, despite the sharp rally Friday. Stocks popped on Friday as regional bank shares climbed off their lows and market-darling Apple jumped after posting better-than-expected quarterly earnings. The Dow added 547points, or 1.65%. The S&P 500 climbed 1.85%, ending the day at 4,136. The Nasdaq advanced 2.25%. Despite Friday’s rally, the Dow and the S&P 500 logged their worst week since March. The 30-stock Dow lost 1.24%, while the S&P 500 dropped 0.8%. The Nasdaq eked out a small weekly gain of 0.07%. Regional bank shares rebounded sharply, but remain at depressed levels (see next bullet). On the heels of the Fed hike and likely pause, the Treasury market has seen a sharp rally. The 2-Year Treasury was 4.15% on Monday and got as low as 3.70% Thursday before closing Friday at 3.91%. Job growth was 253k in April which beat estimates of 180k. However, the prior two months were revised down by 149k. The unemployment rate was 3.4% and the estimate was 3.6%. Oil is back up to $71.3, but fell 5.,1% on the week despite the fact that China demand is returning. Bitcoin rallied 4.3% on the week and is back to $29.3, and ETH was +5.6% on the week to $1.9k.

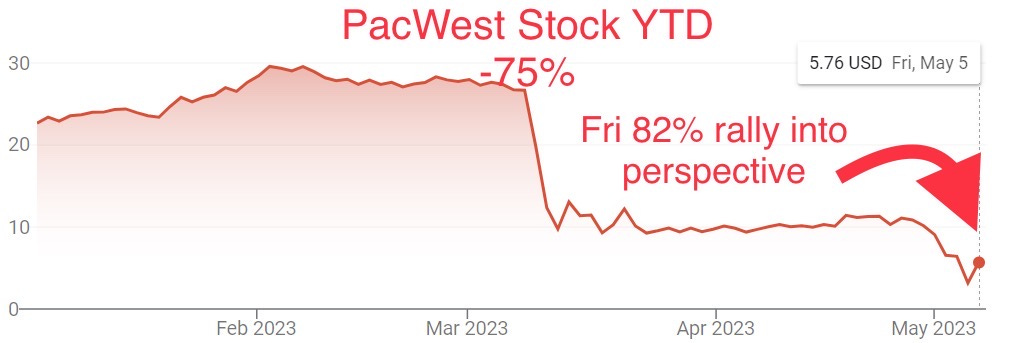

My last note went into detail as to why I did not feel the regional banking crisis was over. Since then, stock prices have deteriorated (despite Friday’s rally) and more experts have weighed in. Cantor CEO, Howard Lutnick said ”that the exodus of deposits from regional banks is the equivalent to a full percentage point in interest rate hikes from the Federal Reserve. Deposits are being pulled at such a magnitude that it’s like “putting your hand on the neck of the lenders.” He also believes the Fed is done raising rates. I do not believe The Fed should have raised last week, and will likely be cutting before year-end. I rarely agree with Bill Ackman, but he sent out an in-depth Tweet on the regional banking issues and brings up some good points. Some excerpts from Ackman’s Tweet: “The regional banking system is at risk. CRE losses loom. Meanwhile, higher-yield, more user- friendly alternatives beckon. Banking is a confidence game. At this rate, no regional bank can survive bad news or bad data as a stock price plunge inevitably follows, insured and uninsured deposits are withdrawn and 'pursuing strategic alternatives' means an FDIC shutdown over the coming weekend. And there is no incentive to bid until Sunday after the failure. Confidence in a financial institution is built over decades and destroyed in days. As each domino falls, the next weakest bank begins to wobble. Until investors are rewarded for betting on a wobbling bank, there will be no bid, and the best sale is the last price. Of note, Friday the regional banks rallied nicely, but remain down sharply on the year. The math of large drawdowns is interesting. If you have a stock at $100/share which falls 90% to $10. It needs to rally 900% to get back to $100/share. In the PacWest example, the stock rallied 82% on Friday and was still -42% on the week, -74% YTD and -82% for 1 year. As I have written multiple times, banks are about confidence. How am I supposed to have any confidence in many of these regional banks with these #s? Today, they are one bad Tweet away from a run, and JPM, Wells and BAC can’t buy all of them.

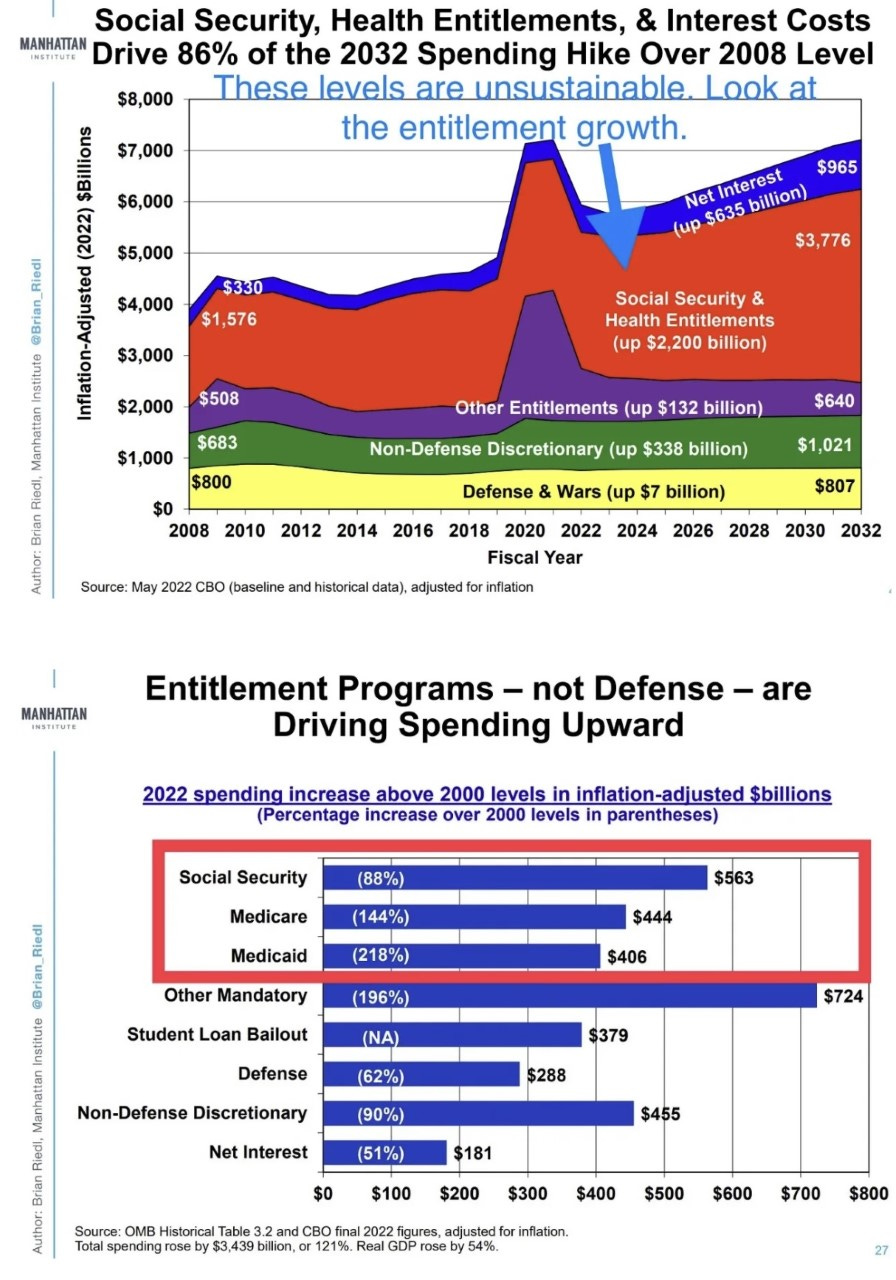

If you have been a reader of the Rosen Report for any period of time, you will know that Stan Druckenmiller is my investing hero. His 30%+ returns for over 30 years with NO DOWN YEARS are a truly remarkable testament to his investment prowess. He was interviewed at USC last week on a myriad of topics. The full-hour interview can be found here and strongly recommend those who want to learn from the best to listen. Stan is VERY concerned about the world, debt levels, entitlement spending, the aging of the population, and overall fiscal policy in the US. I have written extensively concerning debt levels/aging population/government spending and shared my concerns. I paraphrase Druckenmiller: The US spends 6x per senior on what we do per child in the US. The US spends 40% of tax receipts on seniors and things are only getting worse (will be 60% in 20 years). He also discusses the peak of the birth rate in the 1950s, which is bringing up the population of over 65 who receive entitlements while the new generation is not large enough to support them. He walks through the math of the effective government debt due to entitlements being $200 trillion rather than $32 trillion. He is critical of the Dems and Reps alike on spending. “The arithmetic of your entitlements just doesn’t work.” Spending for seniors (healthcare spend and social security) + interest on debt, it is 68% of tax revenues today and by 2040 the CBO suggests it will be 100% and 2052 it will be 117% of tax revenues. Stan makes it clear (as I have in prior notes) the idiot politicians need to make tougher choices. The Fed balance sheet is $9 trillion or 10 times the amount of the GFC. Given my theme piece today, I thought this comment was interesting, (15min mark) “The tech frenzy, crypto craze, SPACs, the search for yield by investors and by regional banks… were issue but, nothing symbolizes the problem more than Dogecoin…suggesting the Fed zero rates and QE were contributors to inflation and the latest bubbles. It almost sounds like Drukenmiller reads the Rosen Report! I don’t have the time to go through the entire interview, but if you are curious about a best-in-class investor’s view of the world, take a listen. He is short the dollar and explains his thesis which is very interesting and concerning. “I want to stay alive… financially until the chaos comes because it is coming given our behavior.” Listen to his big lay-up trade at the 30-minute mark. Amazing. He does not think this will prove to be as bad as the GFC, but also believes things can get much worse. My charts below from prior reports, as I was unable to see Stan’s charts.

Other Headlines

A few highlights: Strong earnings. $131bn cash on hand. Buffett believes the US $ will NOT be dethroned anytime soon. Munger questions the AI hype. Buffett believes Apple is better than the rest (best stock they own). Commercial R/E is cracking. Buffett commented on concerns around Regional Banks. One long-time Buffett follower suggested, “Immersing yourself in their thought processes about investing and running a business is just so brilliant.”

Barry Sternlicht: Fed rate hikes are “bordering on idiotic”

Starwood chairman blasts central bank’s “stupidity” on earnings call

Apple Finds Strength in India as Overall Sales Fall for Second Straight Quarter

Stock was up 2.7% post-earnings. This CNBC report walks through numbers.

Ferrari profit jumps 24% as demand pushes waiting list into 2025

Paramount Global shares fall 25% after weak earnings report, dividend cut

Shopify cuts 20% of its workforce; shares surge on earnings beat

J&J’s consumer-health spinoff Kenvue jumps 22% in public market debut

I cannot stand either of these two “politicians,” but I am in full agreement with banning Congress from trading stocks.

Justice Sonia Sotomayor didn’t recuse herself from cases involving publisher that paid her $3M

I wrote about Justice Thomas and his dealings, so it is only fair, I write about this too.

US Navy hires active-duty drag queen to be face of recruitment drive

Again, know your customer. I don’t think this is a good idea-just like I feel about Bud Light and their campaign. Costco is significantly reducing prices and is unable to move cases. 36 packs of Bud Light are available for $14.97!

New York is the first state in the US to pass a law that bans natural gas in most new buildings

The law would take effect in 2026 for most new buildings under seven stories and in 2029 for larger buildings. With all the issues facing residents of NYC, I think there are better areas for the idiot politicians to focus (crime, homeless, illegal immigrants, education, pro-business policies, keeping people from moving….)

Marijuana may be behind 30 PERCENT of schizophrenia cases in young men

I don’t do drugs. I have never tried a gummy. As I speak with younger Americans today (18-27 year-olds), the amount of weed they smoke is concerning. One kid told me he spends almost $500/month on weed. Sounds like a problem to me.

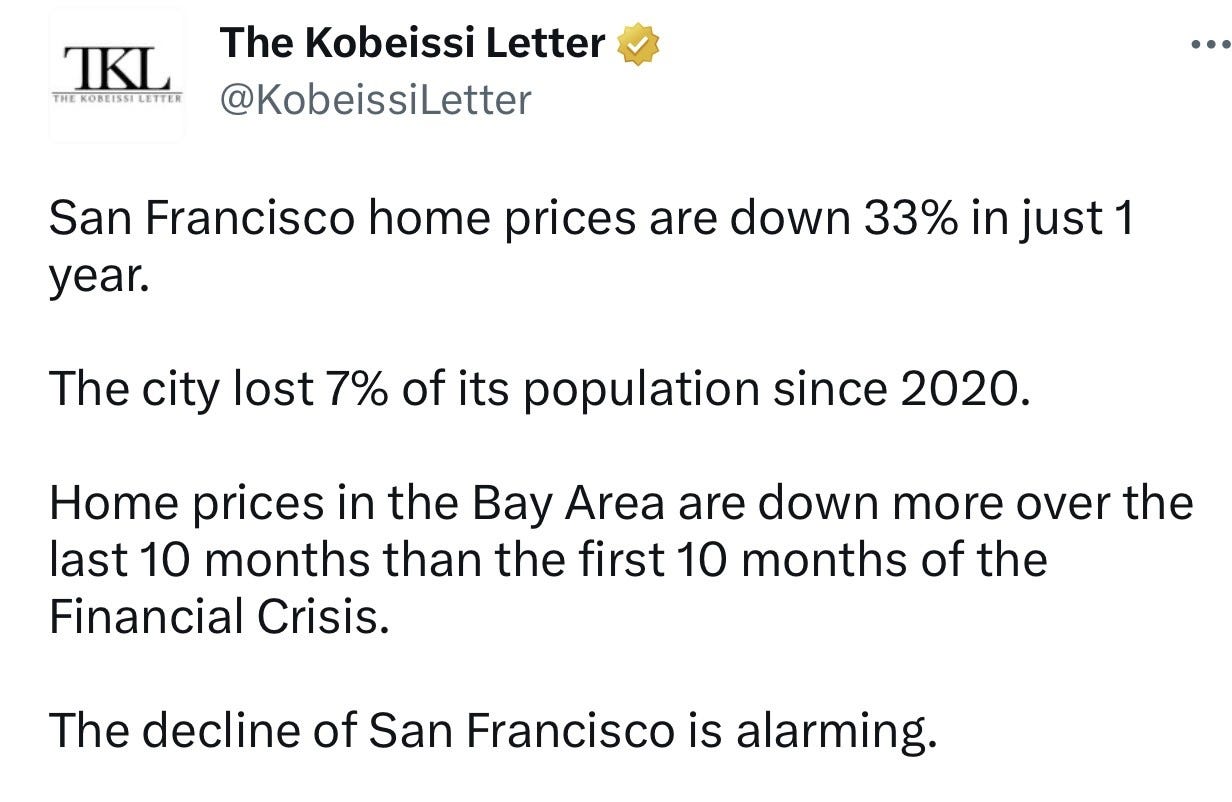

Watch the videos. What are politicians doing to make SFO better, safer and livable? Leadership matters.

The pictures are insane. 78% of homeless locals lived in the area, but have been priced out given the R/E market. Another unintended consequence of the bad Fed policies of low rates and QE forever.

NYC Mayor, AOC Spar Over Death Of Unstable Homeless Man At Hands Of Former Marine

I lived in NYC under Mayors Giuliani, Bloomberg and DeBlasio. I can tell you that the city was a much safer and better place under the first two. Any death is concerning. What about the deaths and injuries of dozens of innocent subway riders at the hands of deranged criminals? Neely (deceased) has a record that includes 42 prior arrests between 2013 and 2021, including an active warrant for assault at the time of his death related to a 2021 incident. This story suggests Neely tried to push a passenger onto the tracks the DAY BEFORE the incident in which Neely died. Maybe more money on mental health issues and repeat offenders, and fewer worries about gas stoves would improve the lives of NYC residents. No charges have yet been filed.

Chicago Police Department tells businesses to buy Riot Glass to prevent burglaries

Here is a thought. Let’s put criminals behind bars and make sure there are consequences for bad behavior and crimes. Maybe, just maybe that would prevent thieves from ransacking retail stores constantly.

I am all for the environment, but ending farming for 3,000 farms in the name of the environment seems idiotic. Read this story and it shows how far we have gone in the name of woke causes. So, we should starve rather than farm. What could possibly go wrong?

King Charles’ scaled-back coronation set to cost the UK up to $125 million

I think this should be the beginning of the end of the outdated monarchy. King Charles, get over yourself. $125mm on a “scaled back” coronation? This is largely funded by British taxpayers.

STUDENT USES CHAT GPT TO WRITE PAPER, GETS A ZERO: ‘WHAT EVER HAPPENED TO PARAPHRASING BRO’

Good. The idiot deserves it. Should be kicked out of school.

The most effective—but unpopular—way to raise happy kids, says Ivy League child psychologist

The States With the Highest Obesity Rates

Will new weight loss drugs change the game on obesity? It is such a massive issue impacting society and the healthcare industry. Can we see a huge reduction in obesity, diabetes, cancer, high blood pressure, heart attacks, strokes… with these wonder drugs over time?

Tom Brady Reportedly Could Walk Away from $375M Fox NFL Analyst Contract

Fox, if Brady is out, I know a charismatic ZERO-time Super Bowl Champ named Eric Rosen who is available to take his place. I hear he will take a “slight” discount to the $375mm Brady deal and bring his legions of followers with him.

Doctor reveals 'fascinating' surprise hack for eliminating garlic breath

I use a great deal of garlic, shallots, leeks and onions in my cooking, so I better take note.

Ukraine suggests the drone attacks were staged and they were not behind the assassination attempt.

Real Estate

A 95-unit building at 234 East 46th Street traded for $69 million in 2014 and was valued at $125 million two years later. Now it’s been sold again — for a mere $13 million. The Turtle Bay property’s rise and fall reflects that of the startup that once owned it. Crowdfund investor Prodigy, which had a majority stake in the 20-story property, lost it through foreclosure after plans to redevelop it into a long-stay hotel with Korman Communities under its AKA brand never came to fruition and a $81 million refinance loan matured. A New York City R/E investor sent this to me and was shocked at how low the price was for this building. We don’t have all the details, but if this is indicative of what is to come over the next 24 months, banks will be taking massive write-downs.

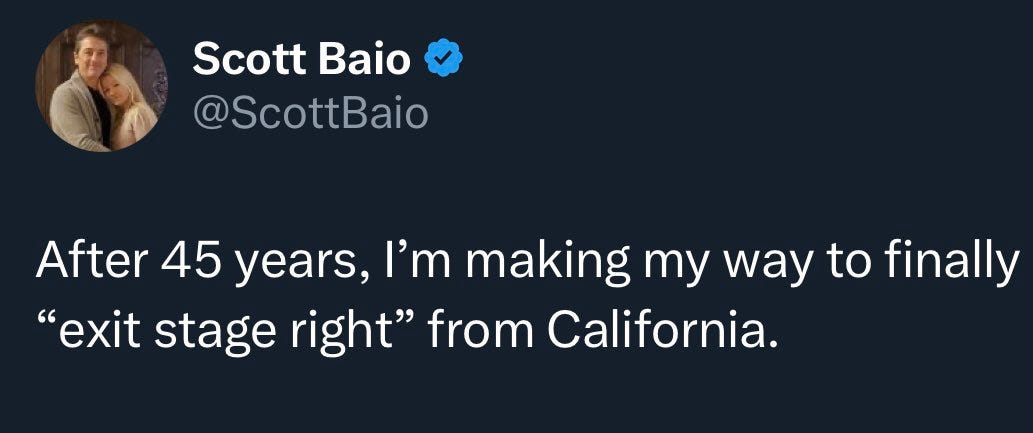

Billionaire tech investor Peter Thiel said he’s reluctant to move his operations to Florida from Silicon Valley because housing prices have soared. “If you buy a house in Miami today versus just three years ago, you’re paying four times as much for a monthly mortgage payment,” Thiel said on the podcast Honestly with Bari Weiss. “That kind of economic cost is probably not enough to

offset all the wokeness in the world or even the taxes,” he said. Peter, you are a smart guy and worth BILLIONS. Look at the data of CA vs FL. The migration of companies and wealthy individuals is astounding. Why? The quality of life, cost of living, crime, taxes, pro-business policies, and lack of idiotic woke policies mean Florida is worth the price of admission. On your billions, how much do you pay in state taxes? What does that give you? Homelessness, traffic, awful schools, the highest gas in the nation, the highest natural gas in the nation and let’s not forget about fires, earthquakes, floods, droughts, mudslides and one of the worst power grids in the country. Bloomberg has your net worth at $8bn. The taxes on your capital gains at 13.3% in CA vs ZERO should be a big number. Also, CA will raise taxes on the wealthy given the budget issues. Look what they did in LA starting one month ago on R/E taxes with the ULA “Mansion Tax” impacting any R/E transactions (residential or commercial) over $5mm. There are proposals to tax the wealthy with annual “wealth taxes” and higher income taxes. Thiel, for a smart guy, your logic makes no sense. If that were not enough, Scott Baio of Happy Days and Joanie Loves Chachi fame sent out this Tweet over the weekend (last pic). Thiel, is Chachi smarter than you?Interesting Bloomberg article on the growth in finance jobs in Dallas, TX. Wall Street titans and Texas financial shops are expanding in Dallas at the fastest pace since the 1980s oil bust that shuttered hundreds of banks in the state. Among the firms promising to add thousands of jobs to the city is Goldman Sachs. The company, which has been building up its US presence beyond the New York headquarters, plans to develop a new regional campus on three acres in the Victory Park neighborhood of Dallas. Construction will start this year on a 800,000 square feet tower to house about 5,000 employees. There have been more than a dozen significant financial services expansions in the region since the start of 2021, including Charles Schwab relocating to the Dallas suburb of Westlake from SFO. Fidelity Investments, which also has a large campus in Westlake, said it would add another 2,000 jobs based in the region. Employment in the finance and insurance industry has grown 33% over the last decade in the Dallas metro, more than double the US rate of 13.7%, according to data compiled by the Dallas Regional Chamber. The largest employers in the Dallas metroplex include Bank of America Corp. and JPMorgan. This link gives the list of the areas largest employers.