Puff Piece

1-23-22

Opening Comments

With respect to my calf injury, the MRI confirmed multiple tears of the gastrocnemius muscle with an edema and hematoma. The good news is there is no damage to the Achilles. The bad news is the pain is far greater than I thought it would be, and will be out of action for longer than I feared.

The feedback and dialogue from and with my readers continues to grow, and I am constantly learning from the broad readership and meeting amazing new people. I am getting sent hundreds of ideas each week on topics to include and being sent data to help me write. Any ideas on how to really grow my readership would be appreciated. I have never advertised and after my first 22 people invited almost 2 years ago, it has been 100% word of mouth. Given the positive feedback, high open rates, and engagement with my readers, coupled with a price-point of ZERO, I am not sure why the Rosen Report subscriber base is not in the millions! Please forward to people you think will enjoy the report.

I spoke with a handful of hedge fund managers and senior Wall Street people this weekend. There is clearly some nervousness about the markets and where they stabilize. Lots of talk about offside portfolios and complacency. Given I grew up with limited means, I am always conservatively invested. I don’t crush it in the rally, but dont get crushed in the sell-off. Today, I have over 50% cash positions and approximately 10% in public equities. However, I do have to 15% in private equities and venture, some of which is at a very low basis. Crypto is between 1-1.5% and R/E and art are the remainder. I was holding up shockingly well on my crypto positions until the last couple trading sessions and now they are down decently. The volatility is remarkable and some people have 80%+ of their net worth in it.

I went to the doctor’s office on Friday and wore a mask for 1.5 hours. I must tell you it was incredibly uncomfortable and I went outside a couple times to take some breaths as I was not feeling well. Being in school for 8 hours a day and trying to focus must be incredibly challenging in a mask for kids.

In a stupid situation, I watched what I thought was the 49ers/Packers playoff game on Saturday. I was surprised it was in SFO. Green Bay was up 10-0. I left and went to dinner. When I came back and watched it on another TV it was snowing and I was confused. Earlier, I had been watching a game from September which I thought was the playoff game. I am an idiot. I should have known Green Bay had home field advantage. I can’t believe Green Bay lost after a year Rodgers had 37 TDs and 4 INTs with a 68.9% completion rate. If Tom Brady pulls this off tonight, I don’t even know what to say.

Video of the Day-259mph on Autobahn

Puff Piece

Quick Bites

Markets/Bitcoin/Rates/Oil

Netflix Pounded-Other Names Discussed-Good Chart

Wall Street Comp

Biden Press Conference Summary-Yes, I listened for 2 Hrs

Time Magazine on Biden’s 1st Year-Not Complimentary

Will Buckhead Secede?

NY-Pick Your Prison

South LA School Vaccinating Kids and Failing as Educators

Other Headlines-Lots of Good Ones Today

Virus/Vaccine

Data-Data

Florida Cases Falling

More Children Hospitalized, but Less in ICU

Real Estate

Panther National-New Development in South Florida

Wall Street A-Listers Fled to Florida-Many Now Eye a Return

Future Home Bathrooms

CA High End Insurers Leaving

Video of the Day-Speeding on the Autobahn

Czech real estate tycoon Radim Passer has been officially scolded by the German Transport Ministry for a video he posted to his popular YouTube channel of him driving a Bugatti Chiron at an indicated 259 mph (417 km/h) on the Autobahn. The point-of-view video that's racked up over 4 million views was shot last July, but posted on January 9th and has an overlay displaying the speed of the vehicle as it speeds along the A2 Autobahn connecting Berlin and Hannover, passing cars on his way. I watched the video attached, and it is crazy how fast he is going while he is passing cars. The other cars on the highway look as though they are stopped. I would have crapped my pants and ruined his expensive seats had I been in that car.

Puff Piece

I moved to NYC in early 1997 from Chicago. While in Chicago, I exercised at East Bank Club (EBC) which is the single most impressive facility in the country with gyms, tennis, golf, pools, restaurants, spas… When I moved to NYC, I immediately joined the Reebok Club on 67th and Columbus which is a much smaller version of the EBC. It was the highest end health club in NYC, and it was a great way for me to work out and meet new people. I played in basketball leagues and Reebok really became my favorite place and second home away from work.

In early March 1997, I was waiting to play basketball at Reebok. I was watching a game and did not see anyone on the court who looked to be incredibly impressive other than one former 7’4” college player, Eric Gingold. After the game, a young man, maybe 30 years old, runs up to another player and says, “I am your biggest fan. Can I get an autograph?” This all unfolded right in front of me, and I did not recognize the player who was being asked to sign an autograph who was roughly my size. I was intently watched the entire interaction transpire and thought is this an actor, athlete, or singer. No one asks a great banker, trader, investor, lawyer or doctor for an autograph.

The player agreed to sign a piece of paper and I am dumbfounded. I asked a couple of the other people who he was, but no one knew. We were kind of laughing that someone asked for an autograph after a pick-up game in the gym. I then walked over to the kid who asked for the autograph and said, “Excuse me, who just signed an autograph for you?”

The kid looked at me like I was a complete idiot. “You don’t know who that is? He is a lyrical genius and an incredible producer.”

I responded, “Nope, I have no clue who that is and a producer of what?

The kid said, “That was Puff Daddy.” I looked at the kid like he was on drugs.

I said, “What the hell is a Puff Daddy?” He went on to explain that this man will be the next big thing in music and he is very talented as a producer, writer and rapper. I thought to myself, I am a pretty hip guy and should know who this is if he is going to be big. In the next couple months, a few new songs came out after Puffy’s best friend, the Notorius B.I.G. was murdered on March 9th 1997.

First a song, I’ll Be Missing You with Puffy and Faith Evans was released in May 1997. It was a take on the Police song, Every Breath You Take and was a tribute to the Nortorious B.I.G. It reached #1 on the charts in the US, UK, Australia, Austria, Demark and a host of other countries.

Then a little song called, Mo Money Mo Problems came out July 15th. This to me, is the single best hip hop song of all time and was a genius play on the Diana Ross song, I’m Coming Out. Although The Notorious B.I.G. (Biggie Smalls) is credited for the song, Puffy co-wrote it, produced it and sings half the song long with Mace. It was one of my favorite songs for years. The song was #1 on US Billboard and countless others.

In August 1997, the song It's All About the Benjamins came out and was another Billboard #1 hit.

Also in August 1997, Puff Daddy was on the cover of Rolling Stone Magazine in an article entitled, The New King of Hip Hop. I guess the young man who asked for the autograph could see the future, as within months, Puffy had #1 hits and made important magazine covers. I should have asked the kid for stock tips, as he could clearly see the future.

Since the time at Reebok in early 1997, Puffy has changed his name nine times (list below), dated J Lo, Cameron Diaz, Naomi Campbell, and created countless companies (Bad Boy Records, Sean John, restaurants, Ciroc Vodka, Enyce clothing line, Aquahydrate, and others). It is estimated his net worth to be close to $1bn. Anyone with this many name changes has to be important. The timing of my first sighting and his rise to great fame within weeks was never lost on me. I would have bet my net worth that this guy would not be worth $1bn, and I would have been crushed. Who would have thunk it? I have become a big fan of his music and collaborations. Maybe I need to start changing my name to get more attention and grow my readership. Name Changes in order and yes, some were used twice:

Puffy

Puff Daddy

P. Diddy

Diddy

P. Diddy

Sean John

Swag

Puff Daddy

Love

Quick Bites

The Nasdaq dropped on Friday, notching its worst week since 2020, as sharp losses in streaming giant Netflix dragged the technology-focused index deeper into correction territory. The Nasdaq declined 2.7% to 13,769. The technology-focused index fell 7.6% since Monday, for its worst week since October 2020. The Dow fell 450 points to 34,265. The S&P 500 slid 1.9% to 4,398.

Both the Dow and S&P 500 closed out their third straight week of losses and their worst weeks since 2020. The S&P 500 now sits more than 8% from its record close. Apple earnings are coming 1/27, and I believe they can help stabilize the market or send it down further if they disappoint or offer weak guidance. The VIX is up to 28.9 or +34% on the last 5 days. The 10-year Treasury is at 1.77% after hitting 1.90% earlier in the week. Oil was down almost 1% to just under $85 and Nat gas rallied 4% to just under $4. The Crypto market has been obliterated and I cannot explain why it is under performing so much in this market. BTC was -14% and ETH -18% on Friday alone. BTC is now -47% and ETH is -46% from the all-time highs. Clearly market sentiment is not helping and the leveraged long positions are being stopped out from what I read. The correlation is too high to the broader equity markets in my mind. Again, I talk about how small it should be as a percentage of your portfolio. I am talking 2% or less. Some of my readers have 80%, which is just too much for an asset class that volatile. After peaking at almost $3 trillion in November, the market cap of crypto is now $1.7 trillion or -40% from the highs. Stock futures were relatively unchanged when I checked just after 6pm on Sunday night.

Some interesting index moves and single names to show recent carnage. Despite trying for 20 minutes, I could not get more space between the columns. The chart below is for the 5 prior trading days, and there was a holiday last Monday. Even Amazon was -11% for 5 days and is -24% from all-time highs.

A reader sent me this great chart from a WSJ article from 1/17 to show the dominance of the big Companies such as Apple, Microsoft, Amazon, Tesla, Alphabet and Meta vs the rest and how they have performed relative to the 52 week high. Look at how many stocks are down 20% or more from the 52 week high within the S&P 500. This chart is not updated for the most recent leg down. However, it shows that many of the largest companies have outperformed which is a market breadth comment. The biggest companies are on the right side of the chart.

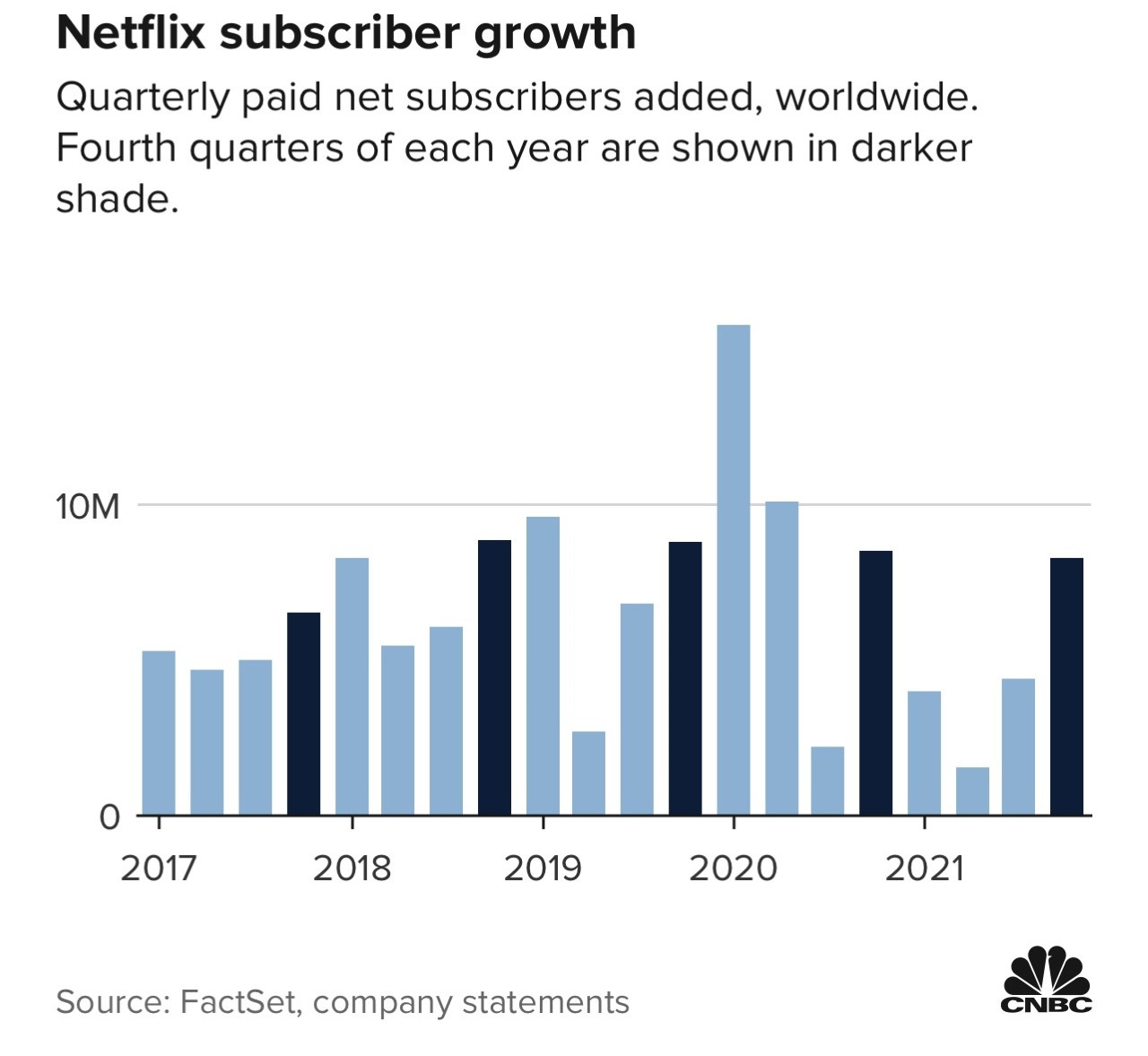

Netflix got crushed (-22%) after earnings on slower growth concerns despite beating on earnings. The company noted for the first quarter of 2022, it expects to add 2.5 million subscribers, compared to the 3.98 million it added in Q1 2021. The stock is no longer the growth darling it once was. On November 17th, the stock was $691/share and it fell to $382/share on earnings. This is a drop of 45% in a couple months for a long-time market darling. It will be interesting to see if NFLX can become an acquisition target for an Apple or another company. The market cap is down to $174bn and can make it ripe for an acquisition target. I purchased some NFLX Friday am at $387/share before closing at $398. They have 222 million subs and I feel the content and price is cheap for what you get each month. We watch NFLX constantly for $19/month. They did site competitive pressures for the slower Q1 forecast for sub growth which is quite concerning. I spoke with a hedge fund manager who actually shorted it Friday and after explaining his position I’ll probably sell my shares on Monday and re-enter at a lower price. He feels strongly that the growth will be muted and content costs are going through the roof. He believes the value is $300/share, and I’ve got to tell you his fund returns are very impressive. Peloton is -82% from its highs (despite being +12% Friday) and Zoom is -74% from highs. Many of these pandemic darlings are under siege. Also, former ETF high flyer, Ark Innovation, is down over 52% from the highs. A new “Anti-Ark” ETF launched and raised $234mm to bet against Ark Innovation. Moderna stock is -64% from its high in September 2021 given they are primarily focused on vaccines with limited other product lines. Even Square is down almost 60% from the highs. Lots of carnage. Hearing about some levered hedge funds which were hit hard this week. I will not mention names until I see them in the press, as I cannot confirm. Many stocks have really taken big legs lower. The NASDAQ 100 ETF closed below its 200-day moving average for the first time since April 2020 (450 trading days).

Higher bonuses handed out this week across Wall Street came with a warning: Don’t get used to it. After a blockbuster year, the five biggest investment banks paid out $142 billion in compensation for 2021, $18 billion more than in 2020. Pay, which on Wall Street is usually tightly tethered to how much money firms bring in, rose twice as fast as revenue. At JPMorgan, compensation for investment bankers and traders rose 13%, about three times as much as the extra revenue they produced. Citigroup revenue declined slightly from 2020, yet the firm paid out $3 billion more to its employees than it did a year earlier. Goldman Sachs gave about half a billion dollars in special stock bonuses to its roughly 400 partners, people familiar with the matter said. But in meetings across Wall Street with their bosses, bankers said they were warned this week not to expect the same in 2022. U.S. stocks are off to a rocky start. The Federal Reserve is expected to raise interest rates several times this year, which will likely damp investor enthusiasm for high-yield bonds, shares of Silicon Valley startups and other big moneymakers for banks. A looming antitrust crackdown in Washington could slow a merger boom that last year generated a record $13.5 billion in fees for the top three U.S. banks. Bank of America’s CEO said, “We don’t have enough people now” and those who quit are not coming back. Comments like this one are making compensation increase to keep precious people assets in place.

Biden held a rare, two-hour press conference last week, and I went back and listened to all of it and was not impressed, but also don’t feel like it was horrible. I felt the answers were coherent, and two-hours showed he has some stamina which many questioned, but did not like some of his answers. Sure, he had uncomfortable pauses and rambled at times, but I was not irate at his performance. At the 15 minute mark, Biden said, “I probably outperformed what people thought would happen,” while referring to his first year in office. He went on to talk about the fact that he made enormous progress. I do not think the polls agree with his statement. Biden’s approval rating is is at an all-time low one year into his presidency with 56% disapproving. At 47 minutes, he feels “the report card looks pretty good,” when asked about upcoming mid-terms. At 53 minutes, when the question about changing the definition of vaccinated to include the booster, the President stopped short and only said, “Get the booster shot.” At 1:10 a question about competence in government with respect to 5G, Afghanistan withdrawal, COVID testing.. I thought it was a fair question and Biden answered a lot about Afghanistan and the expenditures there. Biden went into 5G and it is worth a listen. Biden is “satisfied” with everything he has done with covid. I do not think that was a very good answer based on lack of tests, drugs, deaths…At 1:17, Biden talked about being more present in his 2nd year and doing more talks. Also, he will be seeking advice of outside experts and will be “deeply involved in mid-term elections.” I thought this was a decent segment. At 1:19 the question was “Why are you trying so hard to pull the country to the left.” Biden suggested that is not the case and cited his successes as a “Mainstream Democrat.” At 1:20, he said, something along the lines of: The elections could easily be illegitimate in 2020 and sure it could be a problem in 2022 given we cannot get reforms passed. At 1:26 a question about a poll suggesting 49% of polled question Biden’s mental fitness…Why do you suppose such large groups of people are concerned about your mental fitness? The response, “I have no idea.” I felt he could have handled that one a bit better.

At 1:33 when asked “How do you plan to win back moderates and independents who cast a ballot for you in 2020 but, polls indicate, aren't happy with the way you're doing your job now?" The President responded this way: "I don't believe the polls." Every poll is not wrong and the approval ratings are going the wrong direction. Even CNN took issue with this answer, and I am finding more liberal media outlets criticizing the President recently. Another mistake was his response to a Russian incursion of Ukraine. Biden suggested that a “minor incursion” by the Kremlin’s forces might not receive much aggressive push back from the United States. Although I feel two hours was too long, I believe he should do these more frequently than twice per year, especially given all the challenges we are facing as a country between the pandemic, inflation, border issues, geopolitical tensions, failed policy measures, and a widening divide between people and political parties. Overall, I did not think his performance was as bad as many thought, but felt he could have been tighter on some layup questions.

Time Magazine (left of center) has a new cover which has a solemn Biden on his one year President anniversary, while it is raining in the oval office with books on his desk: Inflation, Putin, Build Back Better, Voting Rights, Trump 2024. The story is titled “How the Biden Administration Lost Its Way.” "One year in, there’s a growing sense that the Biden presidency has lost its way. An Administration that pledged to restore competence and normalcy seems overmatched and reactive. Biden has been caught flat-footed by not one but two COVID-19 variants. He has repeatedly failed to close the deal with the Senate he boasted of mastering. The former chair of the foreign relations committee has presided over escalating tensions with Russia and China as well as a chaotic pullout from Afghanistan," the article listed Biden's woes. TIME called the president a "shrinking figure," noting his few numbers of press conferences than his predecessors, voters questioning his capabilities and how Democrats privately acknowledge the public is "losing faith in his leadership." The left media has lost love for Biden. I do not believe he will be running in 2024.

An increase in violent crime has spurred a movement in Atlanta’s wealthiest and whitest neighborhood, Buckhead, to push harder to secede and create a new city with its own police force. The idea, which has been gaining momentum over the past year, is raising alarm among Atlanta officials worried about a loss of population and tax revenue. The Republican-majority state legislature, which just opened its 2022 session, is taking up proposed legislation this month for a referendum on Buckhead cityhood. Politicians in largely Democratic Atlanta oppose the idea. Bill White, chief executive of the committee pushing Buckhead cityhood, said Atlanta hasn’t done enough to stem violence, car-thefts, drag-racing and other crimes that surged beginning in 2020, during the early stages of the pandemic and after civil unrest followed Black Lives Matter protests. “They really don’t care about Buckhead,” Mr. White, said about city officials. “They just want the money.” The ramifications of the Buckhead decision to secede are serious in my mind. Not only for the city of Atlanta, but others which could follow Buckhead’s lead. Given the income disparities and taxes between Buckhead and broader Atlanta, these moves would create a huge hole for those outside of Buckhead. Here is an idea; Be tougher on crime and put criminals behind bars to make the city safer for all, including the ones who are paying the most for it.

What could possibly go wrong with this brilliant idea? We saw what happened in CA when inmates were able to “pick which prison” they attend. New York’s transgender inmates will get to choose where they’re housed based on their gender identity under a policy directive included in Gov. Kathy Hochul’s $216 billion budget plan. The sweeping new policy says inmates who have a gender identity that differs from their assigned sex at birth will have the right to request placement in prison housing “with persons of the gender that is consistent with such person’s gender identity.” Prison wardens will have the final say on the request, making decisions on a “case-by-case basis” that takes into account “safety, security or health concerns.” I am not sure when, but at some point, the woke are going to wake up to the stupidity and say, “How the hell did we get here?” Read about the homeless LA man who murdered the UCLA student working in a store. He was arrested approximately a dozen times previously including biting a police officer in SFO. Now another innocent person is murdered. Sorry folks, the system is not working.

A mother claims her 13-year-old son, a student at Barack Obama Global Prep Academy in South LA brought home a vaccine card after having accepted the COVID-19 vaccine at school. She says he said yes when someone offered it in exchange for pizza. "The lady that gave him the shot and signed the paper told my son, 'Please don't say anything. I don't want to get in trouble.'" Jennifer Kennedy, an attorney who is following cases against the school district said, "The LAUSD does not have the power to add a vaccine to the California school schedule," she said. You don't have that legal authority." According to US News, out of 2,319 schools, Barack Obama Global Prep is #2295 for Reading Proficiency and #2265 for Math Proficiency. Both are “Well Below Expectations,” with 12% reading proficiency and 5% math proficiency. My point: The school is massively failing the kids from an academic perspective and is instead focusing efforts on illegally vaccinating them without parental consent.

Other Headlines

Meat Loaf, ‘Bat Out Of Hell’ Singer, Dies At 74

It appears he died of COVID and was an anti-vaxer

Inflation surge could push the Fed into more than four rate hikes this year, Goldman Sachs says

U.S. Food Supply Is Under Pressure, From Plants to Store Shelves

(Approaching the End of) The First U.S. Bubble Extravaganza: Housing, Equities, Bonds, and Commodities. This link is to a Jeremy Grantham article, which I found funny. He is notorious for calling market bubbles and is always negative. Maybe he is finally right? If you click, realize, this guy is a perma-bear. Talks about super bubbles.

‘Farms Are Failing’ as Fertilizer Prices Drive Up Cost of Food

International airlines suspend some US flights over 5G uncertainty

Families of US Embassy personnel in Ukraine ordered to begin evacuating as soon as Monday: officials

56% of Americans can't cover a $1,000 emergency expense with savings

No, Wharton students, the average U.S. worker does not make $800,000

Shocking how out of touch with reality some educated kids are on this topic.

Mortgage rates jump for third straight week

The 30-year fixed-rate mortgage averaged 3.56% in the week ending January 20, up from an average 3.45% the week before, according to Freddie Mac. It's the highest since March 2020, when it was 3.65%.

Push to ban members of Congress from trading stocks gains momentum

I have written on this EXTENSIVELY. I am adamantly opposed to politicians and Fed members being allowed to trade individual stocks and would like to see the rules changed.

LA County sheriff says Brianna Kupfer slaying a result of soft-on-crime policies

2 New York City cops shot in deadly exchange with suspect

Appears one cop was killed in Harlem and another clinging to life. The suspect was killed by a 3rd officer after he ambushed the cops. Lashawn McNeil had a lengthy rap-sheet and was out on probation. He assaulted a police officer some years ago as well. The system failed again. How many more senseless deaths and crimes will happen before we get tougher on violent repeat offenders in this country? The 2nd picture is the illegal gun he used with a high capacity magazine which is a weapon of war and holds up to 40 rounds while the NY limit is 10. This story suggests the cop killer kept shooting after the police were down.

Sinema Censured by Arizona Democrats for Standing by Filibuster

Pennsylvania parents outraged after school employee tapes mask to child's face

Mind you, Andrew was a grown man who had served in the Falklands, but needed his teddy bear collection managed in a certain way. Yikes.

Mars Inc. announces M&Ms characters will be redesigned for more 'progressive' world

Theodore Roosevelt statue removed from outside New York’s Museum of Natural History

I wold lose it if I were on the flight and it turned around over a mask issue. Arrest the person when they land.

Fraudsters cash in as Dems shovel out billions and billions in COVID relief

Connecticut mom left two kids home alone while she vacationed in Florida with boyfriend: cops

This Mother of the Year candidate is a school teacher and told her kids to eat candy while she left them for three days to party with her boyfriend. I hope she is fired.

Grayson Allen’s ‘bulls–t’ foul leaves Alex Caruso with fractured wrist

I don’t generally write about sports, but this kid from Duke, Allen, has been a long time dirty player. He had countless tripping infractions at Duke and this horrific foul (video in the link) in the NBA is the end of the line for me. I would never have this guy on my team if I were a coach or GM. EVER. Here is a link to some of his dirty plays at Duke. It is minutes long. Nuff said. His salary is $9.3mm/year the next two years!

Pfizer CEO says an annual Covid vaccine is preferable to periodic boosters

Virus/Vaccine

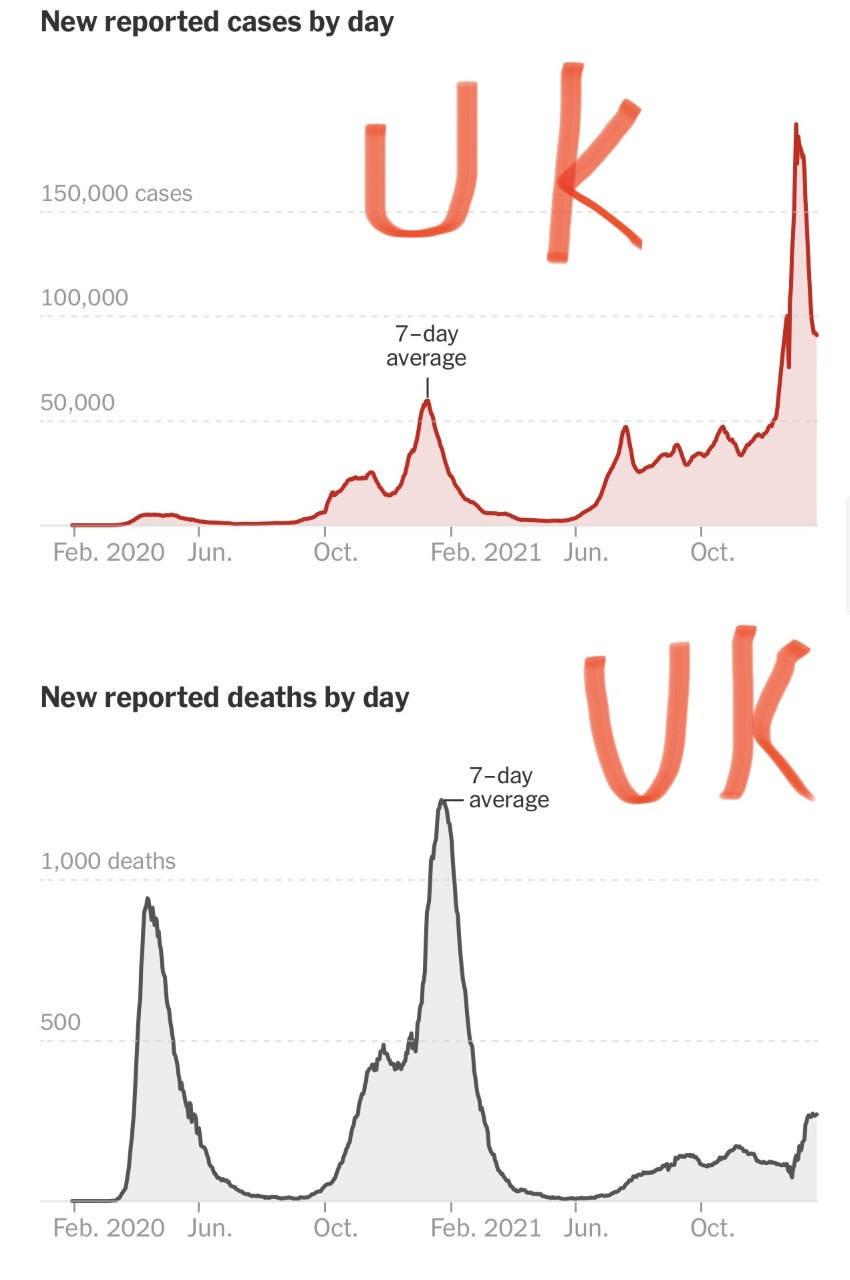

In the US, on 1/14/21, we saw the peak of cases average 246k/day. Hospitalizations peaked at 137k on 1/14/21. Deaths had a strange double peak and I am going with the peak on 1/27/21 of 3,342/day. If I look at the amount of average deaths per day of peak over the peak average cases, I get 1.4%. For the Omicron wave, cases peaked at 807k/day on 1/14/22, while hospitalizations have flattened at 159k. Deaths continue to climb, but are at 2,162/day on average. If I take deaths today over peak cases from last week, I get .27% or about 20% of the prior big wave on a relative basis. I also believe that Omicron is massively under counted on cases, as so many are showing no symptoms. Also, how many who are positive are not bothering to get tested? I am not trying to lessen the impact of Omicron, but it is far less lethal than Delta. The issue is Omicron is so prevalent, on cases, the numbers are out of control. Good news is we look to be peaking like we saw in Puerto Rico and the UK and hopefully the case decline is swift and deaths will peak in the next week or so. US Cases are falling from the peak approximately one week ago as seen on the first chart. However, deaths are growing at hit 2,152/day on average. In the UK, cases are down 50% in the two weeks since peak, but deaths are only flattening (4th chart). With respect to deaths, it seems as though they may have peaked as there has been a clear flattening for a few days. I do feel the Omicron wave will die down quickly from here. I have no clue what is coming next, but there is talk of a new Omicron variant, “BA.2” It has been detected in 40 countries. When will this end?

COVID-19 cases were nearly cut in half across South Florida’s three major counties this week in yet another sign the omicron surge has peaked in the region. The report released last week, covering Jan. 7-13, showed cases dropped week-to-week in Miami-Dade, Broward and Palm Beach counties for the first time since November. But the reduction was slight. Broward and Palm Beach saw a 4% reduction in cases while Miami-Dade’s caseload dropped by 15%. The latest numbers, released Friday by the Department of Health, show a far more significant drop during the week of Jan. 14-20. Cases dropped by 44% week-to-week in Palm Beach County, 49% in Miami-Dade and 52% in Broward.

The number of children hospitalized with Covid hit a pandemic high during the omicron variant’s surge. The CDC has said there’s no indication that omicron causes more severe illness in children. Pediatric infectious disease specialists are concerned about the long-term consequences of Covid in children. While more children are hospitalized with Covid, due to omicron’s high level of transmissibility, they don’t appear to be getting sicker than they did with previous strains, physicians say. More than 80 children are currently hospitalized with Covid in the Children’s Healthcare of Atlanta system, which has three hospitals, compared with 15 children on any given day during most of October and November, when delta was the dominant variant. Bartlett (Comer Children’s Hospital in Chicago) said many of the children hospitalized with Covid in Chicago are also obese. “The good news is in terms of the number of children who are in our intensive care unit on ventilators, that number is about the same as it was at our last peak,” Bartlett said. “Proportionally we don’t have as many super-sick kids as we did before.” Dr. Camille Sabella, an infectious disease specialist at Cleveland Clinic Children’s, said severe asthma is another major risk factor. Sabella said the children’s hospital has between 15 and 20 pediatric patients infected with Covid on any given day, compared with less than five in September and October. He estimated that about 70% of them are hospitalized because of Covid.

Real Estate

It turns out a friend has now moved to Florida to be in charge of sales at the new development, Panther National. It is far west in Palm Beach Gardens, but sounds interesting if you don’t care about being close to the beach. Dominick Seen is behind it. He is a sports agent for hockey/golf from Europe and our kids played in tournaments together. There is a lot to like about this project, but the location is a bit west. Living in a gated community with all these amenities and what sounds like an amazing golf experience is great. Also of note, houses are sustainable with solar power. These will likely go quickly unless the broader market implodes. I am told the course is done next summer and the 1st 60 homes will be done before the end of next year with people moving in next fall.

218 homes

1/3-1 Acre lots

Homes are sustainable, energy efficient

Tesla Solar Power, Tesla Walls, LEED Certified

Clubhouses, gyms, locker rooms, restaurants, bars, pool, tennis, pickle ball

18-hole full course and par 3 designed by Jack Nicklaus

Huge Practice Facility and teaching center

$200k membership (50% equity). A bunch of PGA players will be members.

392 acres and abuts a 2400-acre reserve

Back entrance to a private air strip

It is 12 miles west of the ocean.

Pricing

1/3 acre lot-4,400 feet house @ $3.5mm+

1/2 acre lot-5,000-6,000 ft house @ $4.5-5mm+

1 acre custom lot-7,500 ft+ dirt is $3.5-5mm-I assume you you are $7mm+ range for these homes

Timing

Breaking ground soon

Course opens next summer

Start moving in late 2023

Deposits

$10k Refundable-Goes hard in May

Gives you priority selection on lots

First phase of 60 homes already has 20 deposits in a few days

A reader sent me this Bloomberg article entitled, “Wall Street A-Listers Fled to Florida. Many Now Eye a Return.” Even though I disagree with most of the article, it is important to share it. Yes, NYC has better schools and restaurants and there is definitely more energy there. However, for me and the over 100 families I know who have relocated, the cost of living, quality of life, weather, taxes, crime, woke teachings and government over reaching win down in Florida. I am sure there is some job I could be offered to move back, but I am not sure what my price would be after living in paradise for almost 5 years. When I lived in NYC, I went to all the restaurants, all the museums, countless Broadway shows, sporting events, concerts, art galleries… Sure, I miss it, but when I go back for three days, I get more than my fill and am anxious to get back home to South Florida in my big home with a pool, 4 car garage and kitchen which is larger than most apartments in NYC. I can jog to the beach, ride my bike to my boat and my kids play golf and tennis year round. I do recommend leaving in the summer if you can. It sure gets hot and humid from July-October.

This is a WSJ article on the future of bathrooms in the home. It gives a bunch of examples. Steam showers which only uses 2 gallons of water in 20-minutes, for example. Futuristic toilets with limited water usage, electrolyzed water, auto flush….are also in the piece. The suggestion is you can control the bathtub from your phone in another invention.

Worried about wildfire exposure and frustrated by state regulations, insurers in California have been cutting back on their homeowner businesses. Now, affluent homeowners are feeling more of the pain, as two of the biggest firms offering protection for multimillion-dollar properties end coverage for some customers. As early as this month, American International Group will begin notifying about 9,000 customers in its Private Client Group that their home policies won’t be renewed this year. The change is part of a plan by AIG to cease selling home policies in California through a unit regulated by the state’s insurance department. “AIG is the first high-net-worth carrier to say ‘we’ve had it, we’re divorcing ourselves from California’s regulated market,’ ” said Jim Tolliver, an insurance broker in San Francisco with Woodruff Sawyer & Co., who fears others will follow suit. When I consider the natural disaster issues in CA between fires, earthquakes, mudslides, droughts… it is easy to see why insurers can’t win, and they are in the business of winning. Given taxes and proposals for higher rates, woke policies, crime, natural disasters and now limited ability to insure your high-end belongings, what more do the wealthy need to leave CA? I spoke with a very wealthy reader who had been fighting my suggestion to leave CA. He decided he has had enough and sold his place in LA and is moving to Nevada. He tells me many of his wealthy friends are doing the same thing and moving to TX, NV, FL, WY… Also of note, one of the big benefits for CA was the IPO, tech boom and huge stock gains resulting in billions of profits. You don’t think the high flying stocks which are down 50% or more are going to impact tax receipts? Additionally, there are new fires near Big Sur forcing evacuations now. I sure hope the people are insured.