Opening Comments

Clearly baseball cards struck a chord with the readers and yet again, they seem to get pleasure out of my pain. I appreciate all the emails and story ideas. I open 100% of them and at least read parts of the links. It would be impossible for me to read all of the links in full, but use many of them in the Rosen Report, so keep them coming. Some people send emails to some Substack account which I cannot seem to access. Use rosenreport@gmail.com to get to me. One reader sent me a picture of his good cards. They appear to be worth “slightly” more than mine. This NY Post article is about a man suing his mother for holding his baseball cards hostage. Who can I sue for having bad baseball cards?

Unfortunately, my epic fishing trip is delayed due to seas approaching 10 feet. The one downside of winter fishing is the seas are generally much higher than in the summer months and it makes crossing over to the Bahamas challenging. One time, I tried and had to turn around given the brutal waves and winds.

It is Martin Luther King Day on Monday and given all he achieved, I felt the need to mention him. The nation is divided again on a host of matters and we should could use a powerful, bonding figure to bring this country together. On October 14, 1964, King won the Nobel Peace Prize for combating racial inequality through nonviolent resistance. King was assassinated in 1968. Who can step up in 2022 to help reduce the huge, growing chasm in this country? Leadership from DC never seems to impress me. What would MLK think about the state of the USA today?

Pop Goes My Calf Muscle

Julia’s School Play

Quid Pro Quo

Quick Bites

Markets, JPM Guidance, Retail Sales Disappoint,

WH Commentary on Biden Plunging Approval Rating

Insider Trading by Politicians/Excess Returns

Fauci $10.4mm Investments, FlyFish NFT Restaurant NYC

Shoplifting on Trains?

Baltimore Arsonist Released and He Is Not Sure Why

Other Headlines

Virus/Vaccine

Data-Cases Growth Slowing, Hospitalizations and Deaths Rising

Study-Omicron Less Severe Outcomes

Experimental Nasal Spray

Real Estate-Expanded Section Today-Lots of Info.

South Florida Construction Crews

South Florida Rent Example & $45mm Sale in Highland Beach

Miami Luxury Sales. Here we go again

Sotheby’s Luxury Market Outlook: R/E and Beyond

Home Sales Slowing

Manhattan Rents-Charts on Miami & Austin Rents

$190mm NYC Apartment Sale

Pop Goes My Calf Muscle

My readers know I am an active person who does not sit still easily. I was invited to be a fourth in a double tennis game Friday morning. Well, I went for a drop shot and “POP,” went my calf muscle. My partner heard the horrific sound. I have not been in this much pain often. I have a surgeon on speed dial given my constant ailments (back, ankle, stress fracture, arthritis, pulled muscles…), and he said to come right over, confirming a tear. Thankfully, my Achilles appears in-tact. Unfortunately, it means months off from exercise, which is a kiss of death for me. The surgeon gave me a shot of Toradol and Cortisone. Son of a … Getting old sucks. I am 52, going on 82. Maybe I do belong at the early bird specials here in Boca with my white-haired friends. I have not been on crutches in over 30 years, and my underarms are raw after a few days. I needed to go buy new crutches as the doctor lent me his. There is not a store in South Florida which has medium crutches. They have been out for 6-9 months. They tried to sell me a medical knee scooter (pictured below) and I lost it. There is no chance I would use one of these things and lose my street cred. What would my readers think if I was tooling around in one of these old people contraptions? They told me I needed to go to a thrift shop to find crutches. I spent $10 on old crutches which look to be from the time Ronald Reagan was President. I have the last pair of mediums on the planet. Maybe I should make an NFT out of them and sell it for $100k and then sell the actual crutches for $100. Supply chain strikes again.

School Play

My daughter was the female lead in the school play, Honk Jr. It is essentially the ugly duckling story which grows to be a beautiful swan. Julia was cast as the mother duck and had 8-10 minutes of solos. Unfortunately, this never ending pandemic wreaked havoc on the play with sick actors and staff. They changed the requirements for the musical for the actors to wear masks and limited the audience. I wanted them to postpone, but as they say, the show must go on. Hard to believe my little girl is 14 and belted it out so beautifully. I am not what one would call a religious person, but I learned a little Yiddish in my life and there is a term called, “Nachas.” It means a pride in another person’s achievements and it is something a parent feels about a child when they accomplish great things. I never understood the word until I had kids. Julia, you practiced every day after school until 6pm for almost four months and gave up a lot to do the play. We are very proud of you and the conditions between singing with a mask on, contact tracing protocols, missed practices sure made this much harder than it needed to be. The video I took from my phone did not come out, but I will add it when I get the official one from the school. Her upcoming music video we recently shot will really showcase her singing and writing talents.

Quid pro Quo?

The year was approximately 1999/2000 and I was living at 81st and West End on the Upper West side of Manhattan while working at Chase around the time of the JPM Merger. I was single, either side of 30, making money and felt the need to own a 1997 993 convertible Porsche in NYC. Oh, to be young and stupid. The car was stunning, but not so practical as getting the golf clubs in the car required higher math. I “bought” a parking spot near my building to allow me to park my prized possession myself and not let the moronic people within the garage park my ride. It looked something like the car below as I could not find any pictures of me in it. My car was ocean blue with grey interior and top, while the one pictured has a blue top.

On a Saturday afternoon, I pull into my garage on 80th and Riverside with the top down and my clubs hanging out the back. I took my clubs out and closed the roof and a woman in her 50s approaches me. “Nice car. Do you play a lot of golf?”

I responded, “Thank you, and yes, I play when I can on the weekends.” She asked if I was married, and I let her know I was single. We had a nice 5-minute conversation and the woman said, “My name is Nancy and I have a proposition for you.” I was a bit startled as I thought she was hitting on me. However, she told me her husband was a big golfer and involved at a club called Preakness Hills in NJ. She said that he would take me golfing, and the club was looking for members under 35. She mentioned there was a big discount for “junior members.” But there was a catch. IF I took her up on her offer, I had to take her “beautiful” daughter out on a date. Wait, what? She handed me her business card and said, “Call if you are interested.” This is not a joke Rosen Report readers.

I never heard of the club she mentioned and at the time I was a member of the worst golf course on the planet. I asked some people about Preakness and I was told it was good and far better than my situation. I decided to reach out to Nancy and her husband, Arthur, took me golfing and to lunch at Preakness on a Saturday afternoon. The course was nice and in solid shape and only 30 minutes from my apartment. He let me know that there was a great program for under 35-year-old candidates which was minimal initiation and 1/2 dues. The food was pretty darn good too. Arthur was a lovely host and we became friendly.

Being a man of my word, I called and Nancy to thank her and asked for her daughter’s number. I also wrote Nancy and Arthur a thank you note, just like mom taught me. I had zero expectations on this strange set up, but made the call. Shockingly, the phone conversation was the single best one I can recall. She was funny, sarcastic, bright, interesting and lived less than 50 yards from me which is why I met her mother in my parking lot.

We set a date, and I walked over and pick her up and head downtown in a cab. She is cute, and I start thinking what if this is how I meet my wife? We had a nice dinner at a hip place which I do not recall and she said, “Let’s go for a drink.” So, we went into a bar and sat down to order a drink. It was before Bloomberg came in and saved my life by ending smoking in restaurants. I looked at her and said, “I love it in here. No one is smoking.”

She looked at me like I had three heads and said, “I am a smoker, but you cannot tell my parents.” The date went from good to bad in a hurry. I have an ZERO SMOKING POLICY. There are no exceptions under any circumstances. I took her home after an awkward cab ride and never spoke with her again. I hate smoking and would never spend time with someone who smokes.

Now the difficult part. I joined the club and would golf with Arthur and there was always an uneasy tension about why I did not call his daughter back. I wanted to keep her confidence, so I never told Arthur and Nancy the story.

18th Hole at Preakness Hills

Well, I took my kids, Jack and Julia, to the Palm Beach Par 3 last week and while waiting for the car from the valet, I saw Arthur after all these years and said, “Arthur, it is Eric Rosen,” and gave him a hug. It is 18 years since I was a member of Preakness, and it reminded me of the story. No, I did not tell him what happened with his daughter, but given how the Rosen Report seems to get around, I have a funny feeling the cat is out of the bag. I feel after over 20 years the statute of limitations on the smoking secret is over, but it feels good to get the secret off my chest. Kids, please don’t smoke or vape.

Quick Bites

Major bank stocks declined after their earnings reports on Friday, weighing on the U.S. markets as Wall Street notched a second straight negative week to start the year. The Dow slid 202 points, or 0.6%. The S&P 500 inched up less than 0.1%, while the tech-heavy Nasdaq Composite outperformed with a 0.6% gain. Bank stocks, which had outperformed in recent weeks as interest rates moved higher, were broadly lower as their reports appeared to underwhelm investors despite strong headline numbers. It has been a rocky start to 2022 for investors. Tech stocks fell sharply in the first week of the year as the Fed signaled a more aggressive approach to inflation, accompanied by a spike in interest rates. Both of those moves partially reversed course earlier this week but had snapped back by Friday afternoon. All three major averages were down for the week. The 10-Year Treasury is 1.8% or +23bps YTD. Crypto is up slightly with BTC at $43k (hit $40k) and ETH at $3.3k. Nat Gas remains elevated at $4.23, but down from $4.86 the other day. Oil is up to $84+ after being at $70 less than one month ago. Remember, oil traded negative in 2020.

JPM CFO Jeremy Barnum told reporters on a conference call that management expected “headwinds” of higher expenses and moderating Wall Street revenue to cause the company’s returns to dip from recent years. That means it’s likely the bank will miss the firm’s 17% target for returns on capital, he said.

“Over the next one to two years, we expect to earn modestly below that target as the headwinds likely exceed the tail winds,” Barnum said, adding that the goal is still valid over the “medium term.” JPMorgan will see expenses climb 8% to about $77 billion in 2022, Barnum added, driven by “inflationary pressures” and $3.5 billion in investments. JPM stock was -6.5% at one point on Friday and closed down over 6%. Inflation is here and something I have spoken about for over 9 months. The next story hits on it as well. No, we do not need a nearly $2 trillion spending bill right now. Philadelphia Fed President Patrick Harker said Thursday he sees three or four interest rate hikes this year as likely to fight inflation. I famously hired Jeremy Barnum back into JPM in 2006 or 2007 despite it being controversial and now he is the CFO. I felt strongly he would have a positive impact on my business and he did. I learned a lot from him about derivatives. I have only received positive feedback about Jeremy in his new role. I should get some kind of an assist here. In a related matter, Citigroup shares slide after fourth-quarter profit declines 26%

Retail sales fell much more than expected in December as surging prices took a big bite out of spending, the Commerce Department reported Friday. The advance monthly sales report to close out the year showed a decline of 1.9%, considerably worse than the Dow Jones estimate for just a 0.1% drop. Excluding autos, sales fell 2.3%, a number that also fell well short of expectations for a 0.3% rise. In addition to the weak December numbers, the November gain was revised down to 0.2% from the initially reported 0.3% increase. Considering that the sales numbers are not adjusted for inflation, the data point to a slow ending to what had otherwise been a strong 2021 in which sales rose 16.9% from the pandemic-scarred 2020. Everything I buy is up in price. Every item in the grocery, gas, cars, fishing lures, tennis balls (if you can get them), clothes, restaurants, hotels, rental cars…There is nothing I can recall which is going down in price. I spoke with the chef at my golf club. He said, “In terms of food, we are up 25-35% on average over two years. For King crab legs, pre-pandemic, we paid $400 for a 20 lb container and I just paid $1,000. Lump crab went from $30 to $60 per pound. Meat and fish is up the most and in many cases, you just can’t get it.”

The White House is trying to justify the 33% approval rating from the latest Quinnipiac Poll and it is actually comical how the WH has decided to respond. We all know there is noise in polling, but trends need to be watched and for Biden, they are not going in the right direction for many reasons. From the White House Jen O’Malley Dillon: "This week's Quinnipiac poll, just like Quinnipiac's poll for the last five months, is very likely an outlier." As evidence, she cites the FiveThirtyEight running poll average (of all polls conducted) that shows Biden with an average job approval score of 43%. I find it funny the WH is sending out memos to say effectively, “Biden is bad, but not quite that bad.” The link is to a CNN article, so you know it is not good if CNN is picking on Biden. Biden took hits this week on vaccine mandates and Sinema killing changes to the Senate filibuster. Compare where Biden stands today to where his predecessors have been. If you take the average of Quinnipiac and FiveThirty Eight, you get 38%, right on top of Trump. At roughly this same time in their presidencies, here's where the last seven people to hold the office were:

Donald Trump: 37%

Barack Obama: 50%

George W. Bush: 86%

Bill Clinton: 54%

George H.W. Bush: 71%

Ronald Reagan: 49%

Jimmy Carter: 57%

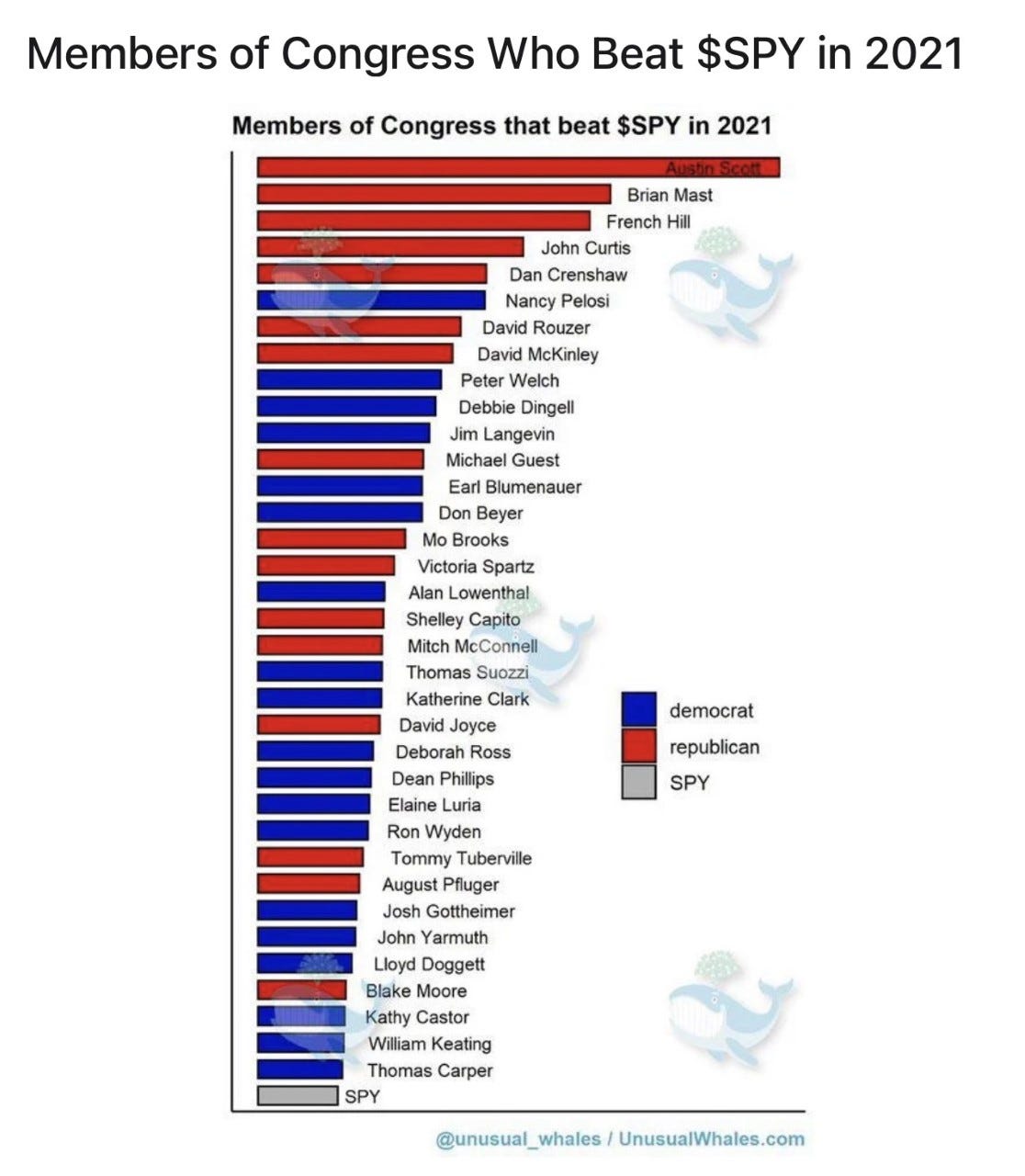

I have been incredibly critical of the laws or lack thereof around politicians and trading stocks. When I worked at JPM or my hedge fund, there were so many rules about what I could not do in terms of personal trading, it was insane. Long holding periods, no shorting, restricted lists. Politicians seem to have far less restrictions than Wall Street professionals or journalists. An article is going around about the number in Congress which outperformed the S&P in 2021. Regardless of the accuracy of the chart below, I do not believe politicians should be able to trade individual stocks or participate in IPOs. They should be able invest in mutual funds or index funds and be required to have longer holding periods. The chart outlines the Representatives who beat the S&P in 2021. Maybe they are in the wrong business and should each start hedge funds. Oh no, if that happened, all the inside info would get them into jail. Pelosi has been vocal on being against more strict laws on the topic, but to be clear, this is not a partisan statement, both sides violate ethical standards in my mind. There was a 60 Minutes by Steve Kroft about insider information trading by politicians from 2019. They talk about being on the healthcare committee and getting information, but are allowed to trade related stocks. Stories about 2008 inside information Congress received from the Treasury Secretary and then traded on the information before it was public, yet there were no consequences. How is this humanly possible? A reader reminded me about the 60 Minutes story. The video link can be found here. Both Democrats and Republicans are outlined in the story, but there is a decent amount which is critical of Nancy Pelosi, and she got very defensive on the questioning.

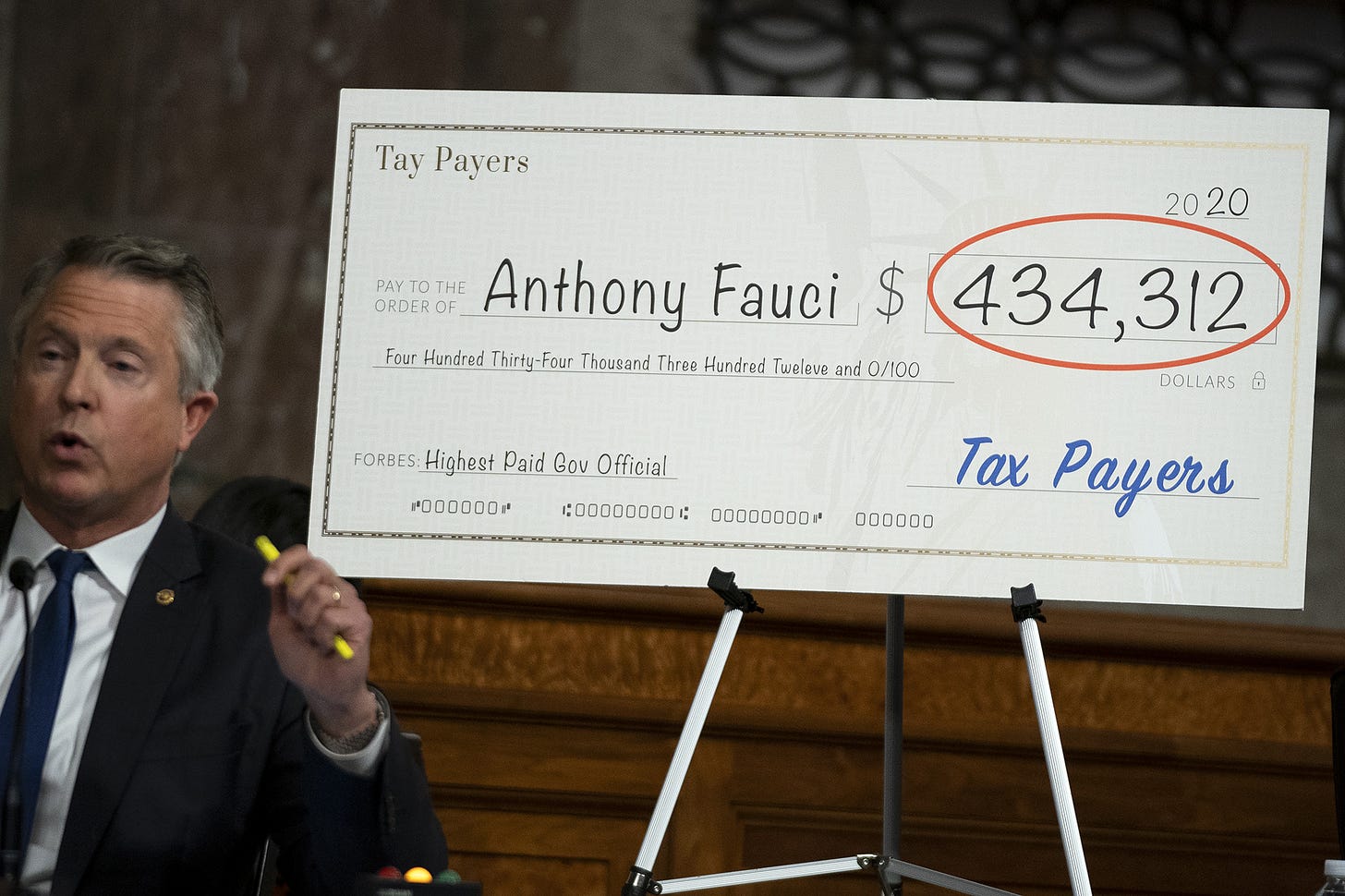

In a related story, Fauci’s financial disclosure statement shows $10.4mm of investments. He is the highest paid Federal employee at $434k/year and is on track for a $350k annual pension. On the surface, I have no problem with a highly compensated 81-year-old to have $10mm in stock. The S&P was up approximately 12.6%/year on average from 1980-2020. That compounding is powerful and if he consistently invested in the market over 50 years, he could very easily have accumulated a substantial net worth. However, I would like to know if he was only investing in index and mutual funds or was profiting off of healthcare or biotech stocks, an area which he can influence outcomes. I am comfortable with the former, but believe there are massive conflicts with the latter.

Flyfish Club, set to open in a yet-to-be-announced Manhattan location in the first half of next year, will be a luxury “seafood-inspired” dining club from the VCR Group, a hospitality and restaurant group that includes Gary Vaynerchuk, the serial entrepreneur and co-founder of online reservation system Resy. To gain access to the club, members must have a Flyfish NFT, which is a unique digital asset stored on the blockchain and purchased using cryptocurrency. The company released 1,501 tokens this month, bringing in around $15 million, according to David Rodolitz, the founder and CEO of VCR. As of Friday afternoon, you could buy a regular-membership token on the secondary market for the equivalent of around $13,600. A token giving the holder access to an even more exclusive tier, which includes access to a private room serving omakase — chef-created, multicourse sushi meals — could be had for the equivalent of around $29,500. And that’s just to get you in the door — patrons will still have to pay for their meals, albeit in U.S. dollars. The uses of NFTs seem to be endless and this is one clever idea. I have confidence that over the next 10 years, NFTs will dominate everyday lives. I have less confidence in the crap art being sold for tens of millions or virtual real estate. In a related story, check out this CNBC link regarding Wal-Mart and NFTs. Walmart appears to be venturing into the metaverse with plans to create its own cryptocurrency and collection of NFTs. The big-box retailer filed several new trademarks late last month that indicate its intent to make and sell virtual goods. WMT entering the NFT crazy only solidifies it as more legitimate.

Instead of shoplifting from stores, some thieves are zeroing in on another target: Trains and delivery trucks full of packages on the way to customers’ doorsteps. UPS Chief Executive Carol Tome said Friday that one of the company’s 18-wheeler trucks was robbed in Atlanta in the early hours of the morning. She said thieves hijacked the truck after the driver left one of the delivery company’s largest hubs. “He was stopped at gunpoint. He was zip-tied, thrown into the back of his feeder car and they took the packages,” she said on CNBC’s “Squawk Box.” The robbery took place in late December, according to an NBC news report. In downtown Los Angeles, a video from the local CBS station shows looted packages littering the train tracks. Thieves raided cargo containers and left behind cardboard boxes that had been carrying purchases from Amazon and REI, including some with UPS labels and tracking numbers, according to the report. Those abandoned boxes carried merchandise ranging from unused Covid tests and fishing lures to EpiPens, according to tweets from one of the TV station’s reporters. Until we see real consequences for bad acts, the insanity will continue.

I try to add my opinion or thoughts on virtually all of my Quick Bite selections. However, I just don’t feel this one needs any more that the facts. What the hell? A Baltimore man who pleaded guilty to torching his ex-girlfriend’s home said he was surprised by a plea deal he received, saying it sends the wrong message to criminals in the city. "I was just charged with 18 different counts, that was dropped to 10, that was dropped to one. When I shouldn’t be out right now. I disrupted somebody’s life. I traumatized somebody because of how I felt in a situation," Luther Trent said, according to WBFF. "Personally, yes, I want to be out but principally, no I shouldn’t be out because I could have done a lot more damage than I did. I was expecting to get time. People who were in that situation, they should expect to get time." Trent pleaded guilty to one count of first-degree arson after setting his ex-girlfriend’s house on fire while she and her two roommates were inside in May of last year. He was released from jail after serving fewer than six months due to a plea deal from the Baltimore City State’s Attorney’s Office. Well said, Luther Trent. Now only if the idiot politicians would listen.

Other Headlines

Elizabeth Warren favors Raskin and that should scare the banks. I am not overwhelmed with the choices here.

Fed Needs Half-Point Rate Hike to Regain Credibility: Ackman

I have been clear that the Fed was behind and too accommodative for too long

Inflation Is Now Hitting the Rich and the U.S. Mountain West

Bloomberg article highlighting the Western US seeing higher inflation. Good charts.

'Sick to my stomach': Dollar Tree fanatics protest new $1.25 prices

Netflix raises prices in U.S. and Canada, stock pops

Netflix offers such quality product, it remains under priced.

McDonald's locations have cut hours by 10% due to staffing shortages: CEO

Goldman’s Most Elite Rank to Get Millions in One-Time Payouts

Omicron leaves Germany on brink of recession as growth dips

Output in Germany fell by between 0.5% and 1% in the fourth quarter. Forecasts are also shaky for the first three months of 2022

DirecTV loss could cripple right wing One America News

The largest satellite provider in the United States said late Friday it will drop One America News, a move that could financially cripple the right wing TV network known for fueling conspiracy theories about the 2020 election.

Jeffrey Epstein brought eight women with him to the Clinton White House

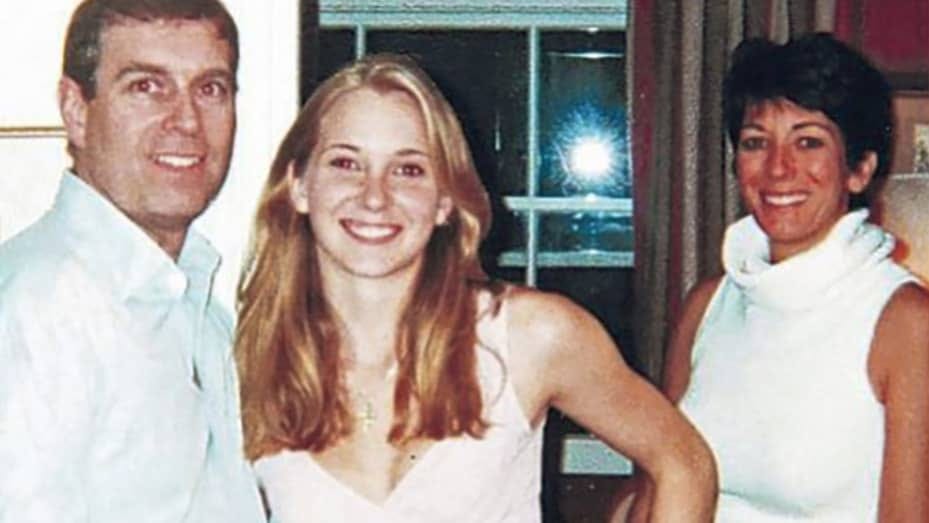

Prince Andrew stripped of royal patronages and military affiliations as sex

Does anyone believe Andrew? I sure do not. Read the emails on this subject from Andrew to Ghislaine. He claims he did not know who she was. OOOPS!

Alec Baldwin turns over cellphone in investigation of fatal 'Rust' shooting: DA

Michigan woman sentenced after trying to hire hitman for husband online

The rocket-scientist woman went on a fake website called, “RentAHitman.com” to kill her ex-husband.

Burger King murder suspect yells ‘f–k you all’ at angry crowd as he’s led out of station

The man allegedly murdered a 19-year-old employee in a robbery and yelled at the crowd about slavery reparations and shouted, “America’s gonna burn!”

Philadelphia carjackers shot by legally armed drivers 3 separate times so far in 2022

Given DA’s and the Police are unable to protect people, now citizens are taking matters into their own hands. Thank you George Soros.

Two Carjackings In Midtown Manhattan Took Place Within An Hour Of Each Other This Week

Deranged man pushes Asian woman to death at Times Square subway station

Video: Perp Sucker Punches 79-Year-Old Man on Brooklyn Sidewalk

Manhattan DA's controversial crime policy concerns restaurants

These NYC carjackings took place in the middle of the day and the subway push at 9:40am at Times Square. The sucker punch was during the day. Do we still think NYC crime is heading in the right direction? The new DA is not helping matters by decriminalizing everything.

Woman, 24, Stabbed to Death While Working at Luxury L.A. Furniture Store in Random Daytime Attack

Olivia Culpo asked by American Airlines to ‘put on a blouse’ before flight

You need to click the link to see the difference in the people. Olivia was asked to cover up, but another woman in a far more revealing outfit was not asked to cover up. Nothing to see here. The other woman was in shock she was not reprimanded based on Olivia.

‘Baby Shark’ Has 10 Billion Views. For Parents, That Is 10 Billion Too Many.

US intelligence indicates Russia preparing operation to justify invasion of Ukraine

Interesting story. I did not know what “False Flag” was until I read it. Crazy accusations in this CNN article.

Volcano erupts in Pacific, West Coast under tsunami advisory

COVID-19 patients show more signs of brain damage than people with Alzheimer’s disease

Fascinating study by NYU about brain damage from COVID showing 7 markers of brain damage which were higher than patients with Alzheimer’s.

The article suggests the answer to the question is sugar.

University of Michigan removes Schlissel as school president

Article suggests an “inappropriate relationship with a university employee. Also, I read about emails which were uncovered.

Expect more worrisome variants after omicron, scientists say

You mean the Chinese government was not honest with COVID data. I don’t believe it. They tend to be such a truthful and law-abiding group.

Australia has decided to 'let Covid rip.' Is that a good idea?

In just over a month, the country’s Covid cases have sharply risen from around 1,000 a day to more than 100,000 a day — but its deaths remain low.

Virus/Vaccine

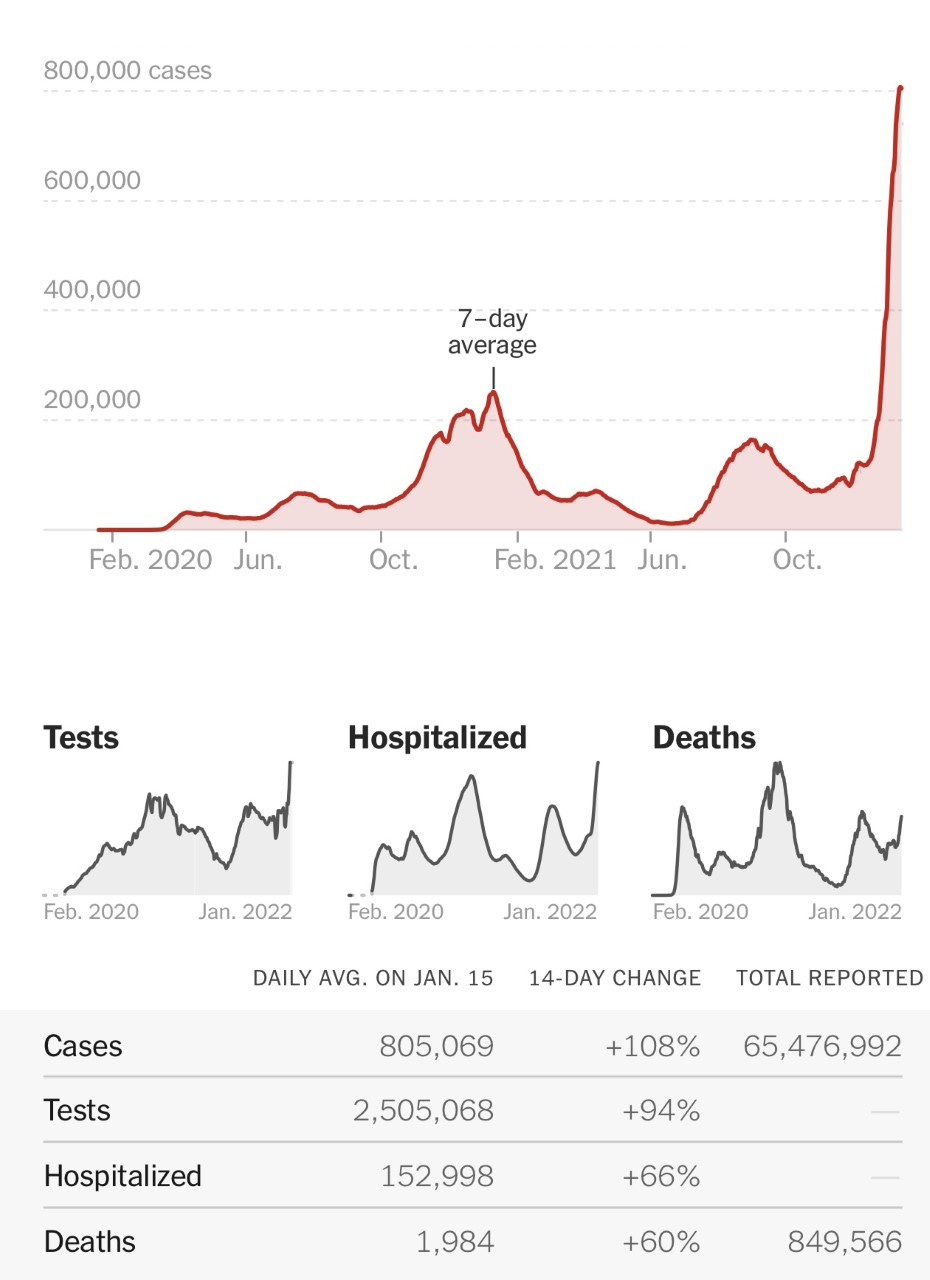

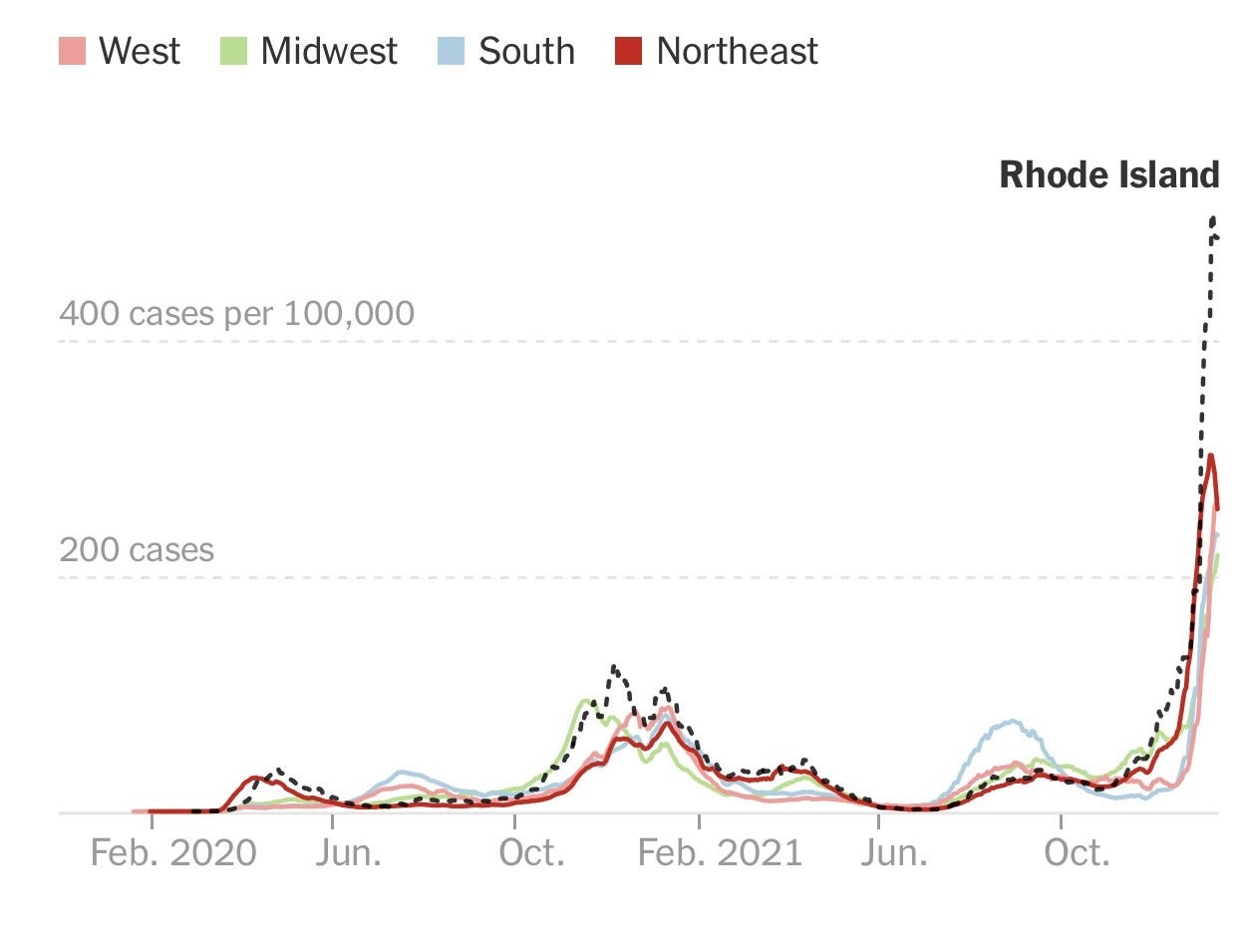

There is good news and bad news. The good news is the case growth is slowing sharply despite the fact that it continues to grow at a rapid rate. The bad news is the hospitalizations and deaths won’t peak until a couple weeks after the cases peak which I am expecting shortly. In early January, cases were growing at over 260% and now are growing at 108% over the past two weeks and are at 805k/day. It is not ideal, but clearly the growth rate is slowing and a peak is coming. Unfortunately, hospitalizations and deaths lag cases, so we have a few more challenging weeks ahead. The Johns Hopkins Positivity rate peaked a few days ago at 26.4% and is down to 20.8%, another sign that Omicron is starting to slow. Hospitalizations stood at 153k (new record) and grew at 66% for the prior two weeks, but that is down from last week’s growth rate when it was 84%. Deaths are approaching 2k/day and grew at 60% over two weeks. The prior peak was 3.3k last January. In the 2nd chart, you can see the Northeast has peaked and the South is peaking. In the third chart, you can see many states are peaking or have actually started to decline.

Patients at a large health system in Southern California who had the Covid omicron variant were much less likely to need hospitalization, intensive care or die than people infected with the delta strain, a study found this week.

Infectious disease experts found omicron patients at Kaiser Permanente Southern California were 74% less likely to end up in ICUs and 91% less likely to die than delta patients. None of the patients with omicron required mechanical ventilation, according to the study. What’s more, the risk of hospitalization was 52% lower in omicron patients than delta sufferers, according to the study, which has not been peer reviewed. Researchers are publishing studies before they are reviewed by other experts due to the urgency of the pandemic. This is good news, but was expected. The issue is the number of cases has been multiples of the previous peak, So even with Omicron being less lethal, the numbers of hospitalizations and deaths have been growing. At my daughter’s school, there has been approximately 140 cases between students from K-12 and faculty in two weeks. Not one is very sick. Zero hospitalizations. I am now aware of over 350 cases in the past month with one hospitalization of an 83-year-old who ended up dying.

The Supreme Court on Thursday blocked the Biden administration from enforcing its sweeping vaccine-or-test requirements for large private companies, but allowed a vaccine mandate to stand for medical facilities that take Medicare or Medicaid payments. The rulings came three days after the Occupational Safety and Health Administration’s emergency measure for businesses started to take effect. The mandate required that workers at businesses with 100 or more employees get vaccinated or submit a negative Covid test weekly to enter the workplace. It also required unvaccinated workers to wear masks indoors at work. “Although Congress has indisputably given OSHA the power to regulate occupational dangers, it has not given that agency the power to regulate public health more broadly,” the court wrote in an unsigned opinion. “Requiring the vaccination of 84 million Americans, selected simply because they work for employers with more than 100 employees, certainly falls in the latter category,” the court wrote. I agree with the courts here.

A new experimental nasal spray could prevent people from getting infected with COVID-19 for up to eight hours, according to a study. The promising treatment has shown it can block infection from the virus in lab studies with mice, according to researchers at the University of Helsinki in Finland. “This technology is cheap and highly manufacturable, and the inhibitor works equally well against all variants,” study author Kalle Saksela told Gizmodo. “It works also against the now-extinct SARS virus, so it might well also serve as an emergency measure against possible new coronaviruses.” The spray, developed for immunocompromised and other high-risk people, is made of an antibody-like synthetic protein that recognizes and binds to the spike protein of the coronavirus — temporarily stopping it in its tracks, according

Real Estate

The absurdity in South Florida continues. I spoke with developers who are telling me that contractors are demanding to be paid in full prior to immobilizing crews. One told me that his contractors made it clear that without millions up front, they were going to other jobs and it would be six months before he could return. With limited inventory, I would think the crew shortage would loosen up as there are so few parcels left to develop at the high end of the market. When I moved here, contractors were pounding on your door looking for work. Now, it is akin to winning Powerball to get someone to show up are your house. One, asked me for a deposit via Venmo, just to show up!

On the rent side in West Boca/Coconut Creek, I spoke with a young man who rents a 1,000-foot, two bedroom/two bathroom apartment. He is paying $2,100/month and has been there a couple years. New tenants are paying $3,000 for the same apartment. This is on 441, at least 10 miles west of the beach. I am in shock. In Highland Beach a home sold for $45mm on the ocean in an off market transaction. It was previously listed for $25mm pre-pandemic. The address is 2455 South Ocean and is approximately 14,000 feet on 1.5 acres. The demand for high end property from Miami to Jupiter is never ending.

A 16,000 foot lot on Hibiscus Island in Miami Beach sold for $16mm. You can build an 8,000 foot home there. Pre-pandemic the lot would have been $10mm or less. A house a few doors down with the same sized lot just sold for $29mm, but the views are not a strong as the $16mm lot. Pre-pandemic, the $29mm house would have sold for $14mm. Rumors are flying about Ken Griffin and even more South Florida R/E purchases. Remember, he paid $400mm in Palm Beach, approximately $160mm in Star Island (4 properties) and rumors are that he bought the PH in the new Surf Club. He is also rumored to have bought a $16mm apartment in 1000 Museum in downtown Miami. Yes, he is rich, but does he really need this much real estate in South Florida? He is approaching $1bn in South Florida R/E and he has a lot of building to do.

Interesting Sotheby’s link about the luxury market outlook across real estate, collectables, NFTs, tax havens…. Lots of info in this link.

This Bloomberg article outlines how housing purchases slid. A combination of inventory limitations, rising rates and affordability due to high prices are all contributing factors. I am not looking for a massing housing correction tomorrow, but have said that the pace of price growth must slow down. It has become out of control in too many markets. Transactions fell 11% from a year earlier, the biggest annual decline since June 2020, according to a report Friday by Redfin Corp. Demand is still fierce, but what’s holding back deals is a lack of inventory: Active listings -- homes for sale at any time during the month -- fell 19% year-over-year to an all-time low. Meanwhile, prices jumped 15% to a median of $382,900. Bidding wars for the few properties listed are driving up home prices. In turn, that’s squeezing out some first-time buyers, especially as mortgage rates start to rise from near record lows. At the same time, homeowners now sitting on a mountain of equity are using it to trade up. It’s a widespread slowdown with sales falling from a year earlier in 79 of 88 large metro areas tracked by the brokerage. The biggest declines were in Nassau County in New York and New Brunswick, New Jersey, both down 22%.

The average cost of Manhattan apartment rentals surged to the highest ever for a December, with landlords demanding double-digit rent increases amid sharply dwindling supply. The median rental price for Manhattan properties, including discounts, hit $3,392 last month — the highest for a December in more than a decade of record keeping and up 21% from the year-earlier December, according to a market report compiled by brokerage firm Douglas Elliman and appraiser Miller Samuel. Median rents for doorman buildings – a proxy for luxury apartments, was $4,298, an annual increase of nearly 23%. By comparison, non-doorman buildings saw rents increase about 8% to $2,695.

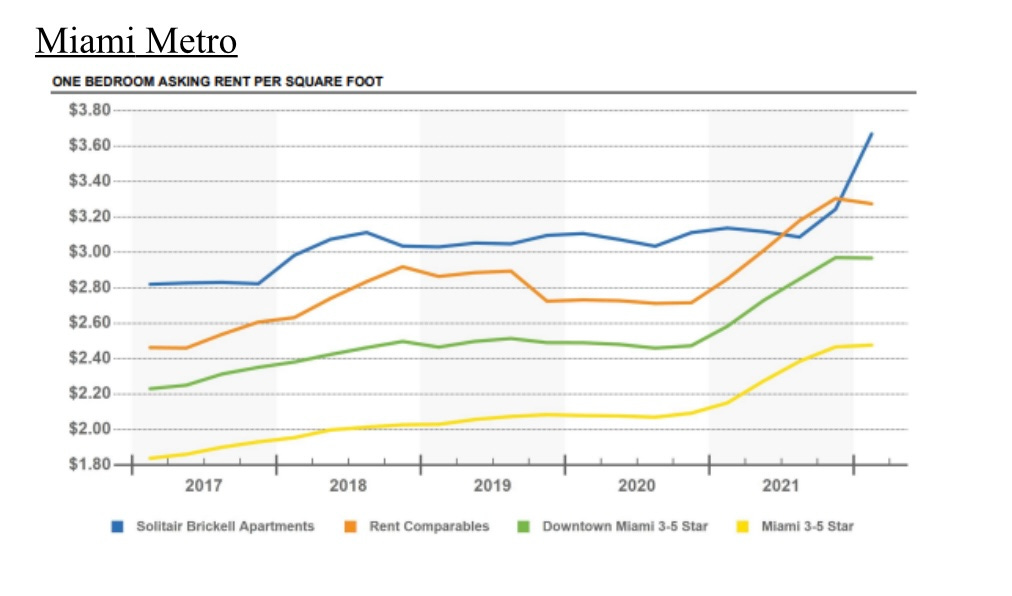

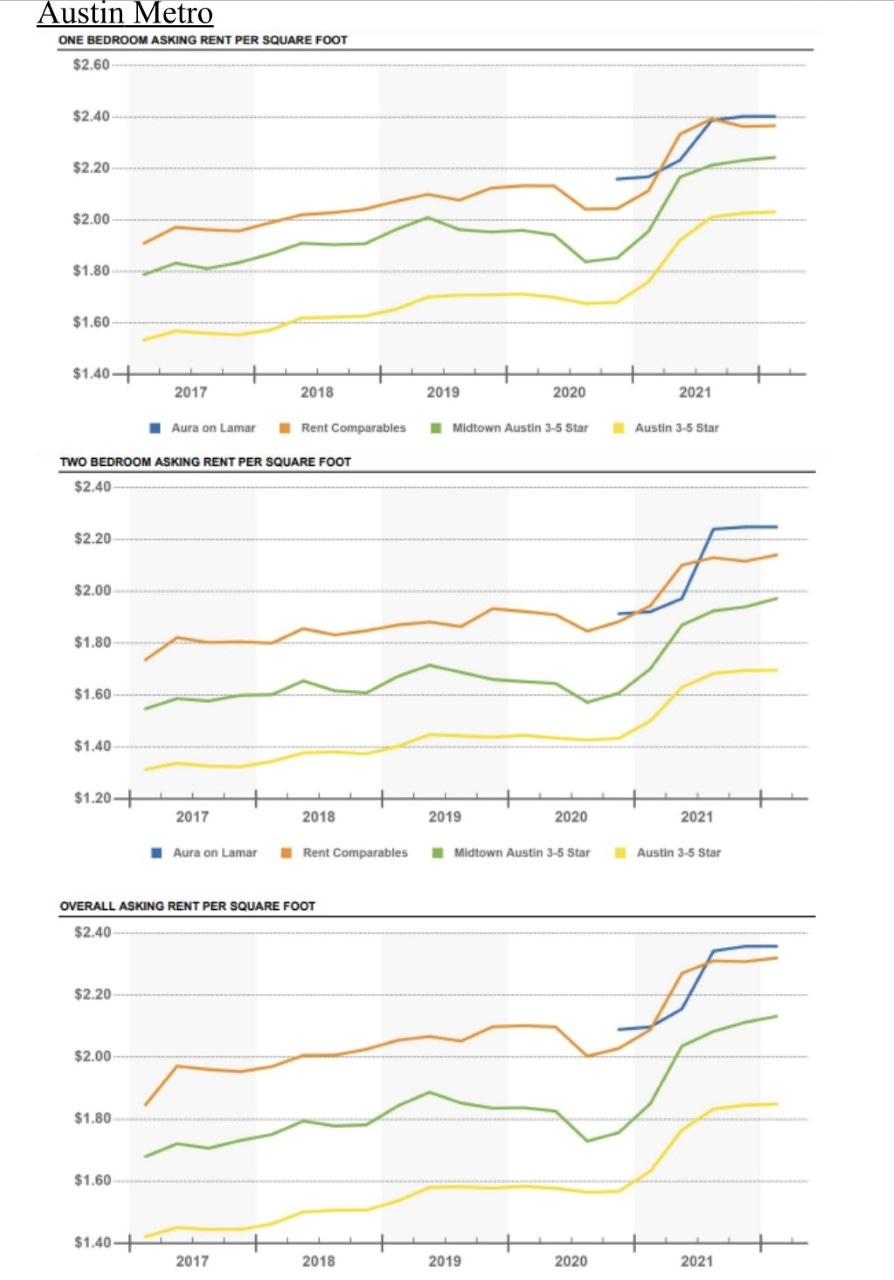

Studio apartment units saw the biggest jump, with the median rental price jumping 22% to $2,550 for December. Apartments located in downtown Manhattan were most expensive, with a median price that rose 28% to $4,095 for the month. Rents seem to be on fire in almost every market. The R/E apartment owners who are Rosen Report readers let me know that prices are up sharply. I probably know or speak with 15% of my readers. In that 15%, I would not be surprised if they control 250,000 or more apartment units. It literally could be 500,000. I get a great deal of data. One reader sent me pages of charts and I am including a couple on Miami and Austin. Virtually every market I have seen shows a decent upward trend in the past year to 18 months.

Hedge fund billionaire Dan Och just doubled his money in one of the biggest residential deals in New York history, the Wall Street Journal first reported. The Och-Ziff Capital Management founder has sold his penthouse at 220 Central Park South for close to $190 million to mystery buyers —more than double the $93 million he paid in 2019. I have been to 220 Park a couple times and it is by far the nicest building I have ever seen. I don’t happen to care for the location, but the amenities and services are amazing. I went into an apartment which was approximately 2500 feet and going for around $25mm at the time. It was nice with solid finishes, but awfully small for that price, not to mention the monthly maintenance and taxes. I would far rather spend 1/2 and live in a great house in Florida which is 3-4x the size.