Opening Comments

My last note was about my epic surf trip in California where I showed my 30-second surf video to some amazing music along with plenty of pictures as I am not convinced I have too many rodeos left in me. The most opened links were travel secrets of the super-rich and phrases used by resilient people. Given people request my restaurant reviews as much as almost any other topic, I am trying to include one in almost every Rosen Report. It will be easy this summer as I will be in NYC.

When I make a mistake and a reader corrects me, I ALWAYS post about it. In my last piece, I called out Mitch McConnel for another “freeze-up,” but I had mistakenly thought it was a new clip. It was from 2023. My apologies for the confusion. I still think he is too old and not fit for office, but the video was not from last week.

Another reader, a finance professor, wanted me to clarify the impact of the Biden Administration tax proposal. Given the lack of deductibility of city and state taxes against federal income taxes, he feels the effective state tax rate in CA would be 26% if the new proposal passed. Higher Federal rates cause the state tax to be a larger share of what is left after the federal tax is paid. IF these tax proposals pass, I contend there will be another massive migration of wealth out of high-tax states to FL, TN, TX, NV…

I am excited to be moderating a panel for 3i Members with Mitch Julis (Co-founder of Canyon Partners) and my good friend, Steve Shenfeld, (Chairman of Mid-Ocean) regarding developments in Private Credit Markets. I will include it in my report in mid-May after the event. It is live for 3i members and they can ask questions during the webinar-. If you would like to learn more about 3i Members, click here.

Sunset Sushi-Best Omakase Lunch Value in Town

Upcoming reviews-Regina’s Farm, Motek, and Sushi Yasu Tanaka.

Sunset Sushi moved next to Alley Cat on Palmetto in Boca. I went with my friend, Josh, for the Omakase lunch special and I must tell you that I was VERY impressed with the food, presentation, service and experience. We started with a red miso soup that was bursting with flavor, albeit saltier than traditional miso (the only item I did not love). The sushi was fresh, presented beautifully, and included a nice assortment of amberjack, yellowtail, tuna, sea bream, salmon, scallop, toro, eel…They also finished with a stunning toro hand roll with large pieces of fish. There is a 300% chance I return. All the sushi was delicious, but the hamachi, salmon, toro and sea bream were the best. I was invited to the VIP dinner event there by one of the owners, Eric, and cannot wait to go back on Thursday. I HIGHLY recommend this for lunch at a very reasonable price of $50/person. You also can order additional items ala cart to supplement. So delicious, and sitting at the bar in front of the chef made it all the more interesting and informative. I took all the pictures on my iPhone and used the function to isolate the sushi to see what people think.

Video of the Day-Best Piano Rendition of Flight of the Bumblebee

Markets

Innovation/Intel

Fertility Rates Hit New Low

Florida Home Insurance Issues

Steve Ross/Related-Changing the South Florida Landscape

Austin, Texas R/E Market Cooling

FL Home Inventory Builds

Mortgage Applications Crumbling

Video of the Day-Best Piano Playing Ever

Yuja Wang is an amazing pianist. Her rendition of Flight of the Bumblebee is stunning. The speed and accuracy are mind-numbing. Her hands move so quickly, that they are a blur. Must watch this short video.

Relevantly Irrelevant

At times in my life, I have gone from incredibly irrelevant to relevant back to irrelevant…. When I was working at JPMorgan and running the Credit Trading Business, after building the Loan Trading Platform to be a market leader, I felt I was incredibly relevant. I called the Global Financial Crisis in the summer of 2007 and published countless emails showcasing my concerns to tens of thousands of people. By the summer of 2008, I was on speed dial for senior leaders across the bank, hedge fund managers, senior Fed officials, and other senior staff at competition financial intuitions… and felt as though I was “da Man.” I had substantial job offers for ridiculous opportunities (don’t get me started on how and why they did not come to fruition). I feel as though when the world was melting and many institutions, funds and businesses were imploding, I was the person many came to for advice, help, and answers. One person I have a great deal of respect for said in mid 2008, “Eric, you are seeing the ball so clearly, it is just downright impressive.”

After leaving JPM in 2010, I decided to take down time. My father passed when I was 5 years old and my kids were 3 and 4 years old. I wanted to be present and involved to give my kids the experience I never had. It was an amazing time for me, but truth be told, I became irrelevant to the business world and realized that I missed being in the game and in the center of the action. UBS came around and offered me a big job and I took it for the wrong reasons. The UBS investment bank had become a shadow of its former self, and I was told I could help bring back the cache. Well just a few months after I arrived, a rogue trader in London lost $2.3bn and any hopes I had of making an impact were gone as the firm became under siege by regulators. It was a long and painful year of my life and I left to launch the hedge fund, Reef Road Capital.

I quickly became relevant again and was raising money, making investments, hiring, and building a business with my incredibly impressive colleagues. I realized how much I enjoyed being in the game and interacting with the best and brightest. The process of Reef Road started in the summer of 2012 and we launched in May of 2013. I enjoyed my time and building a business while working with people I enjoyed.

I moved down to Florida and was officially “Retired,” to spend time with my family while my kids still wanted “dad time.” Sadly, that ship has sailed now that they are almost 17 and 18 years old. My son was passionate about golf that led to hours at the golf course every day. I realized that I could be the most irrelevant person on the planet to anyone other than my family and friends. I was not adding a ton of value other than my mentoring program and started to feel down about myself. Had I made the wrong decision to leave Wall Street/Asset Management?

Well, the pandemic came around and I was asked by my former readers from my JPM for my thoughts on the world, and the Rosen Report was born in February of 2020. It has turned into a business where I feel I am relevant to some of the most prominent names in finance, real estate, asset management, corporate America, and many others. My engagement with my incredibly sophisticated reader base in intellectually stimulating and made me realize how much I love the action and being involved. I have been fortunate to have the opportunity to interview amazing people. A highlight was my panel with Brian Koppelman and David Costabile from Billions. In addition, I have done podcasts and webinars with market leaders such as Mitch Julis, Fabrice Grinda, Kyle Bass, Ted Seides, Greg Waldorf, Jess Beck, Alicia Levine, Peter Boockvar and many others.

After writing for over four years, I started various business lines (R/E brokerage, Executive Recruiting, Hard Money Lending Platform, Speaking Engagements, and formalized a mentoring program for college students and young professionals). I am so much happier being engaged with so many smart people through the Rosen Report. Thank you for reading the RR and helping me grow the newsletter. More importantly, my readers keep me intellectually stimulated and on top of what is going on in the world.

Quick Bites

The week saw volatility given earnings misses and beats as well as economic data that surprised markets. Downbeat US GDP reports, inflation concerns and some earnings misses sent stocks lower on Thursday. U.S. gross domestic product expanded 1.6% in the first quarter, the Bureau of Economic Analysis said. Economists polled by Dow Jones forecast GDP growth would come in at 2.4%. Along with the downbeat growth rate for the quarter, the report showed consumer prices increased at a 3.4% pace, well above the previous quarter’s 1.8% advance. This raised concern over persistent inflation and put into question whether the Federal Reserve will be able to cut rates anytime soon. Add to this Meta fell 15% after weak guidance despite better-than-expected revenues and it sent stocks lower and Treasury yields higher. At one point, Meta was -19% or $200bn in market value decline. However, Thursday, after the close, Alphabet reported on better than expected earnings as AI-fueled cloud growth (pushing the stock +10%. Also, Alphabet announced its first dividend and a $70bn share buyback program. MSFT was +2% post-earnings as well. The most volatile stock around earnings is Snap and it rallied 28% post the news contributing to the rally Friday. The S&P (+2.7%) and Nasdaq (+4.2%) had their best week since November despite the volatility. The 2-year and 10-year Treasury yields are now +75bps and +81 respectively YTD with the 2-year yield over 5% at one point in the week. All those hoping to refinance at lower rates will be squeezed unless we see a sharp reversal in rates.

I saw this headline from CNBC, “Intel used to dominate the U.S. chip industry. Now it’s struggling to stay relevant,” and it got me thinking about innovation. Intel stock is -50% from the all-time high of two years ago, while NVIDA is +500% during the same period. How many companies dominated an industry before being passed up by a newcomer to disrupt the industry? IBM, Commodore, Blackberry, Motorola, Blockbuster, TiVo, Yahoo, AOL, My Space, Sony Walkman, Palm, GM/Ford, Kodak, Borders, Polaroid, Xerox, Sears/Kmart/Toys R Us (retail in general), and so many others were passed up by new and innovative companies such as Apple, Microsoft, Google, Tesla, Facebook, Netflix, Amazon, Nvidia, and others. Just because you are at a great firm, does not mean you always will be a market leader. I love Jeff Bezos’ vision and management style. He told employees, ‘One day, Amazon will fail’ but our job is to delay it as long as possible.” If AMZN fails in my lifetime, I will be in shock. My point is simple. Just because you are great company, does not mean you will maintain dominance. To be a decades-long market leader, innovation, creativity, servicing clients, taking calculated risks, and investing back into the business/employees are critical for success. Do not rest on your laurels and demand excellence. Who did I miss on those who failed and those who have innovated?

This WSJ article is entitled, “U.S. Fertility Rate Falls to Record Low,” and only solidifies my concerns about government spending and entitlements. In 1940, there was approximately 40 workers per retiree and today, there are three workers per retiree. What could possibly go wrong? Amazing charts in the article. We need fiscal responsibility, entitlement reform and balanced budget amendments. Let’s hold our fiscally irresponsible elected officials accountable. This link shows the US has added $11 Trillion of debt in the last 4 years and adding $1 trillion approximately every 100 days.

This is a Bloomberg story found on Yahoo entitled, “Florida’s Home Insurance Industry May Be Worse Than Anyone Realizes.” Seven property insurers in Florida went bankrupt in 2021 and 2022. The bankruptcies left thousands of homeowners scrambling to get new coverage, which often came with a big increase in cost. Worse, many had outstanding claims for hurricane damage that had not been addressed. The seven property insurers that went bankrupt had all been rated A (“exceptional”) or higher by Demotech, Inc., an Ohio-based insurance ratings firm. (One of those insurers was also rated A- by competitor AM Best Co. Inc.) In fact, nearly 20% of the companies doing business in Florida that Demotech rated as financially stable went insolvent during the period 2009 to 2022. In their data sample, 99.7% of the ratings issued by Demotech were an A or above. The article suggests that given the high number of insolvencies of insurance companies, the Florida market is full of weak players. Choosing your insurance provider and coverage is critical, especially in states with more issues such as California and coastal cities in the Southeast. If you need a second set of eyes on your coverages, carriers, deductibles… Give my sponsor, Kevin Lang, of Lang Insurance a call (866.964.4434). They provide coverage in all 50 states. This WaPo story is entitled, “Forecast group predicts busiest hurricane season on record with 33 storms,” so you better make sure your insurance is up to date.

Israel

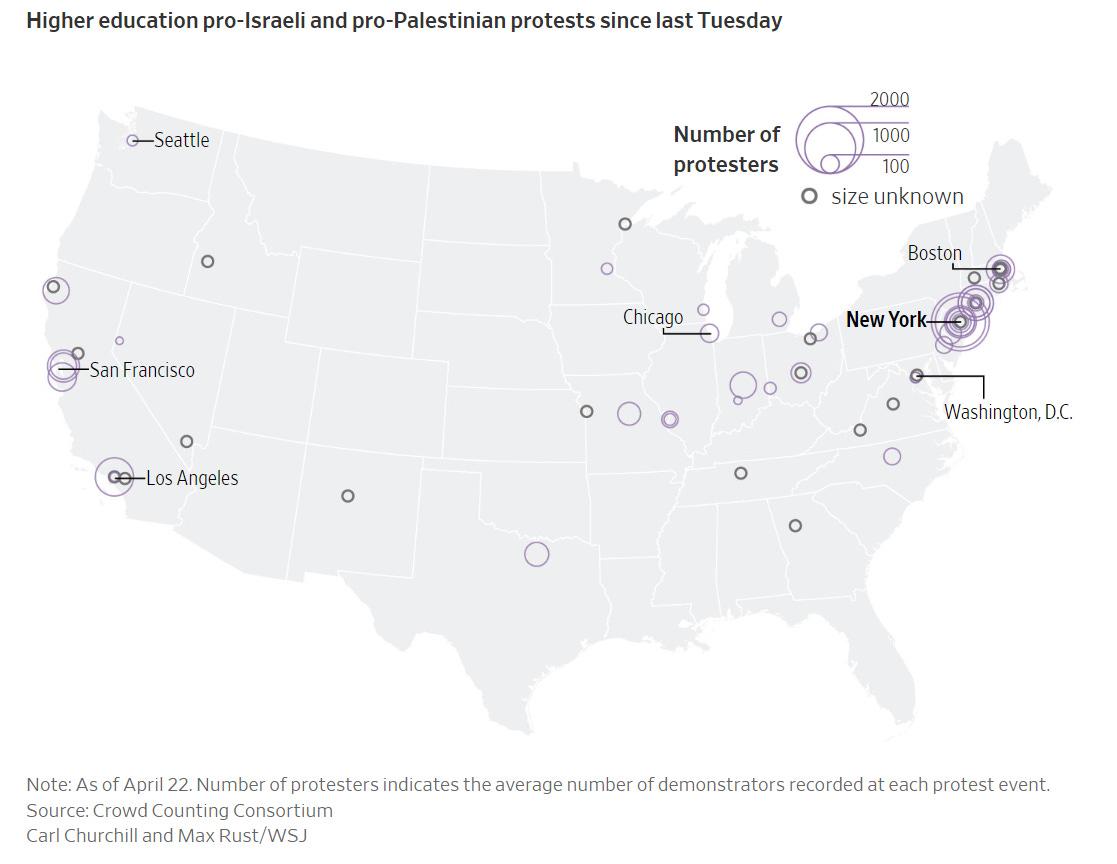

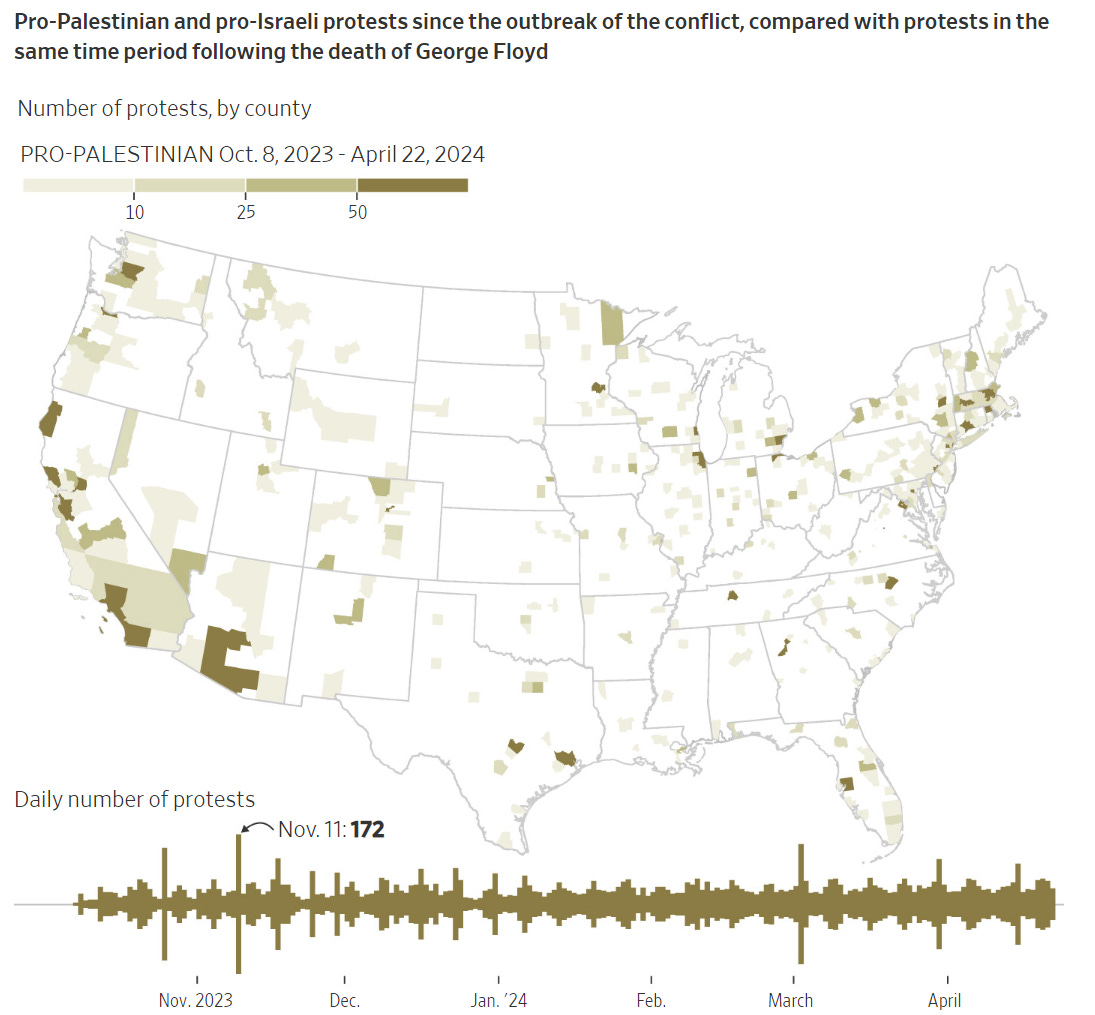

The deterioration on campuses continued this week. The number of schools that I will no longer consider for my children is growing. Leadership at these schools varies from embarrassing to impressive. There are students who are threatening Jews and want to end Israel and any Zionists. Simple solution, deport them to Gaza, Syria, Iran, Iraq, Afghanistan to be with the people they admire. Now, graduation ceremonies are being cancelled due to the anti-Israel protests. Sadly, college seniors did not get to have a high school graduation four years ago due to the pandemic.

UK Navy Reports Two Vessels Attacked In Red Sea, One Damaged

According to the article, Soros (who survived Nazi occupation of Hungary) has funded Israel hate on 18 campuses in the US. I just don’t get it. There is a chart in the link with all the schools including Emory, UT, Cornell, Yale, GW, Ohio State, Northwestern, Tufts, Harvard, MIT…

Columbia faces protest deadline; USC cancels main graduation ceremony

NYPD chief swarmed by anti-Israel protesters and berated while seeking shelter in NYU building

Horror as GWU protester carries sign with Nazi ‘final solution’ call for extermination of Jews

Governor of Texas calls for anti-Israel activists to be ‘expelled’ and put in ‘jail.’

DeSantis warns of potential expulsion for student protesters in Florida

UF Student Protesters Pack Up After School Reminds Them of Rules and Consequences

There was a great song entitled, “This is How We Do It,” by Montrell Jordan. I think that is appropriate for how UT, UF, and DeSantis want to handle the Palestinian protests. I have spoken with dozens of families who are moving away from applying to Ivy League Schools and others who have allowed aggressive acts toward Jews. Many schools in the South are picking up applicants and believe that trend will continue as long as the woke schools allow such lunacy.

Other Headlines

Rubrik prices IPO at $32 per share, above the expected range

FDIC says Republic First Bank is closed by Pennsylvania regulators

Sound familiar? paper loses on bonds that lost value as interest rates increased and too many uninsured deposits were cited as the cause of the bank seizure.

Exclusive-ByteDance prefers TikTok shutdown in US if legal options fail, sources say

I would rather it shut down than China spying on Americans.

Tractor Supply CEO says there’s still ‘significant migration’ out of urban areas

Airlines Must Now Pay Automatic Refunds for Canceled Flights

Many large U.S. cities are in deep financial trouble. Here’s why

The exodus of wealth coupled with irresponsible spending are responsible for the mess. I have written before that I don’t want to be charged $700 for Taco Bell and that is what is happening in NYC, Chicago, LA, San Fran, DC…. High taxes, high cost of living, crime, woke policies, anti-business sentiment, immigration, and onerous mandates… have pushed many out while the politicians refuse to reign-in spending. If you are going to charge me a ton, give me quality. I will pay a big price for a 3 Michelin Star meal.

Biden's 13th-Quarter Approval Average Lowest Historically

How bad is it if you are behind Carter and Trump?

Forecasting pioneer: ‘A lot would have to go wrong for Biden to lose’

Migrants swing bats, belts and even traffic cones at each other in wild brawl outside an NYC hotel

Cities cannot handle the volume of immigrants and it is unfair to the citizens in the neighborhoods as well as the businesses struggling as a result of the chaos. There are areas of NYC I will not go in due to the ridiculousness.

Nearly two-thirds of Americans believe illegal immigration is real crisis, not a media narrative

The Harris Poll also found that 51% of Americans would support mass deportations of illegal immigrants, which included 42% of Democrats, 46% of independents and 68% of Republicans.

Blinken tells CNN the US has seen evidence of China attempting to influence upcoming US elections

Wait. The Chinese government is not to be trusted? They lie, cheat, steal, kill their own people, create pandemics… Who would have thought it?

Harvey Weinstein’s felony sex crime conviction overturned by NY’s highest court

The judge allowed testimony from women who were not connected to the case. If this scumbag gets off on a technicality, I will be livid. Weinstein is a predator and ruined the lives of too many women.

Three terrifying attacks in two days rock NYC’s Central Park

Harris Teeter is combating DC theft surge with new policies, including bag restrictions

Maybe we should have a border and control who comes into the country.

Ex-athletic director arrested for framing principal with AI-generated voice

Brilliant idea, bad execution. The idiot used the school’s network to search OpenAI tools, “Large Language Models,” “Deep Learning”… to frame the principal suggesting he made disparaging comments toward Black students and the Jewish community. It does bring up a concerning trend where you can be accused of something you did not do.

Possible UFO over NYC baffles passenger flying into LaGuardia

Aliens, you know how to reach me. Take me to your leader. Show me the future so I can write about it in the Rosen Report. I need to be able to take CLEAR pictures on my iPhone so everyone believes me. I will put a Rosen Report hat on your head assuming it fits and that is the proof I need.

Real Estate

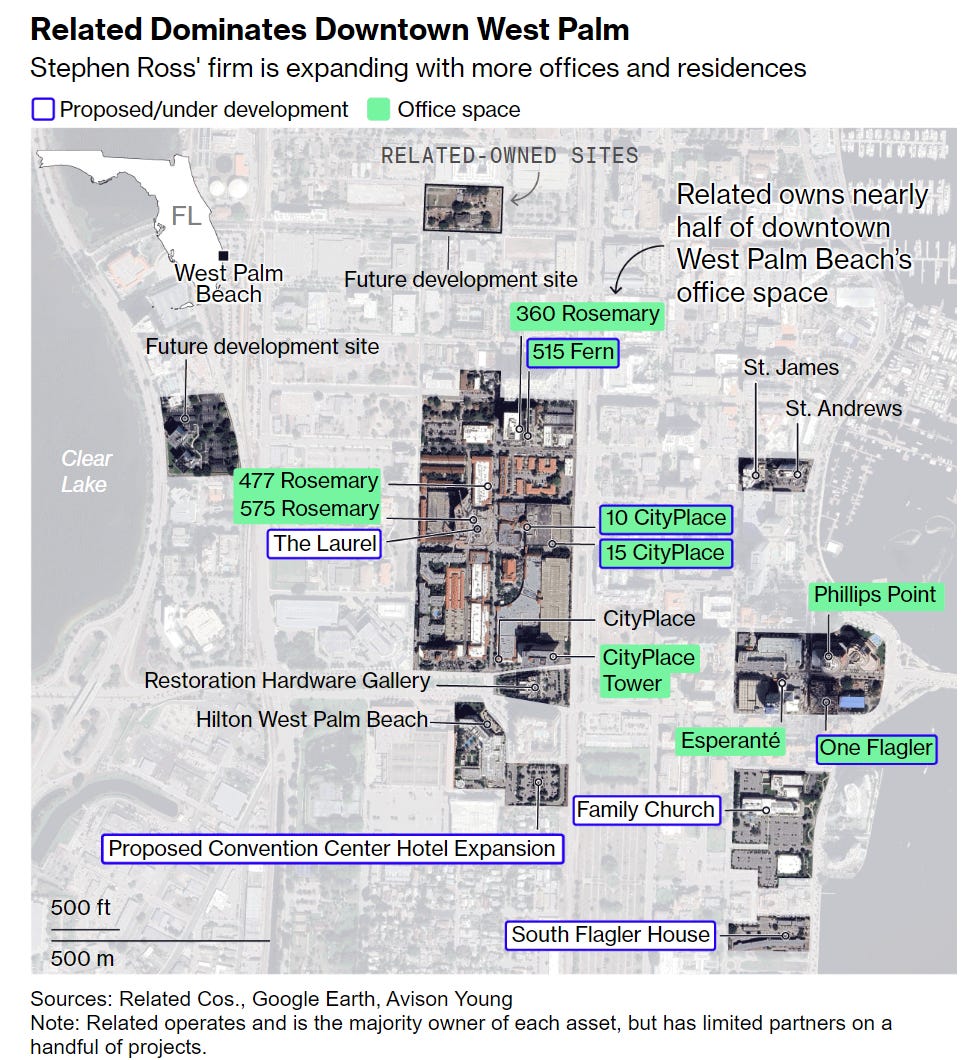

This is a great Bloomberg article entitled, “Billionaire Stephen Ross Believes in South Florida—and Is Spending Big to Transform It.” Some of Florida’s most prominent names gathered at an oceanfront Palm Beach mansion this month to raise money for a tantalizing prospect: building a local outpost of Nashville’s Vanderbilt University, an institution that would add educational prestige to an area booming with newcomers. The Related Cos. founder, best known as the mastermind behind New York’s Hudson Yards complex, had no prior affiliation with Vanderbilt. He was a relatively new resident of the Sunshine State, having spent the bulk of his career in Manhattan. Yet bringing a renowned university to nearby West Palm Beach would be a key piece to one of his most ambitious bets yet. In what’s likely to be the capstone to his career, the 83-year-old Ross is going all-in on West Palm—and South Florida—as a new power center. After joining the mass of New Yorkers who moved south during the Covid-19 pandemic to embrace the state’s sunny climate and low taxes, he’s reshaping the city with shiny new towers, while also trying to transform the entire region. Ross, who founded Related five decades ago and built it into a property giant with a $60 billion portfolio, West Palm could be one of the most attractive communities in the country. I continue to harp on the fact that so much wealth and business acumen has moved to South Florida. The transformation in my 7 years is remarkable. My friend group has evolved and includes Private Equity, Wall Street, Hedge Fund managers, CFO, musicians, entrepreneurs, real estate investors, family office founders and more. Titans such as Barry Sternlicht, Steve Ross, Steve Witkoff, the LeFrak family, Ken Griffin, and many others are changing the landscape both literally and figuratively. Now there is serious talk of a Vanderbilt campus in South Florida. It just keeps getting better every day. What Related is doing in West Palm Beach is remarkable. I have a lot of respect for big-time R/E developers that can change the skyline and dream big. Well done to Steve Ross and the team of people who made it happen. As hot as the West Palm housing market has become (2nd chart), Palm Beach Island is far hotter and has seen exponential pricing increases since the pandemic. The median price of sold homes on the island is now over $12mm.

As hot as the market is for the high end in Miami, Boca, Delray, Palm Beach... the Austin, Texas market is going in the opposite direction. I like Austin, but would prefer Nashville or South Florida. After a 12-year streak as the fastest-growing large metro area in the US, Austin lost that slot in 2023. An office glut has pushed the vacancy rate 5 percentage points higher than the US average, according to data from Colliers. Home prices have dropped 18% from the pandemic highs seen in May 2022, the most among the 50 largest US metro areas, Redfin data show. Even so, the city ranks as one of the least affordable housing markets. To be sure, even a slowing Austin economy is still hot enough to be the envy of a lot of other places. The 3.5% unemployment rate trails the national average, and the downtown skyline is full of construction cranes. Samsung Electronics Co. is opening a $17 billion plant in suburban Taylor, and plans to invest $40 billion in the area as it ramps up chip production. The city is also home to major operations for Meta, Apple and Google. Henley & Partners forecasts that over the next decade Austin will be the top US city for growth in the number of centi-millionaires, or people with a net worth of $100 million or more. Austin saw a boom in corporate relocations during the pandemic that has since slowed. In 2022, 64 companies either moved their headquarters or significant operations to Austin, according to a local development group. That number dropped to 37 in 2023. This year, Austin has seen only 11 such moves.

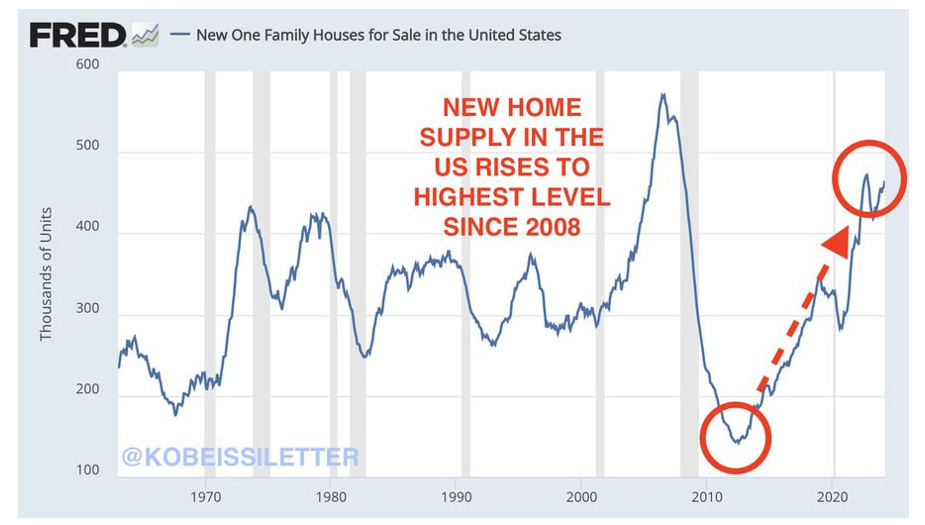

To be fair, some FL markets are seeing increased inventory as well according to this Post article entitled, “Florida real estate sellers slashing home prices as inventory surges to uncomfortable levels.” Prices have made housing unaffordable. Add to it high rates, skyrocketing insurance costs and HOA/Condo fees have gone up by 100% recently. I am not seeing pullback at the high end, but at the low end, inventory is building.

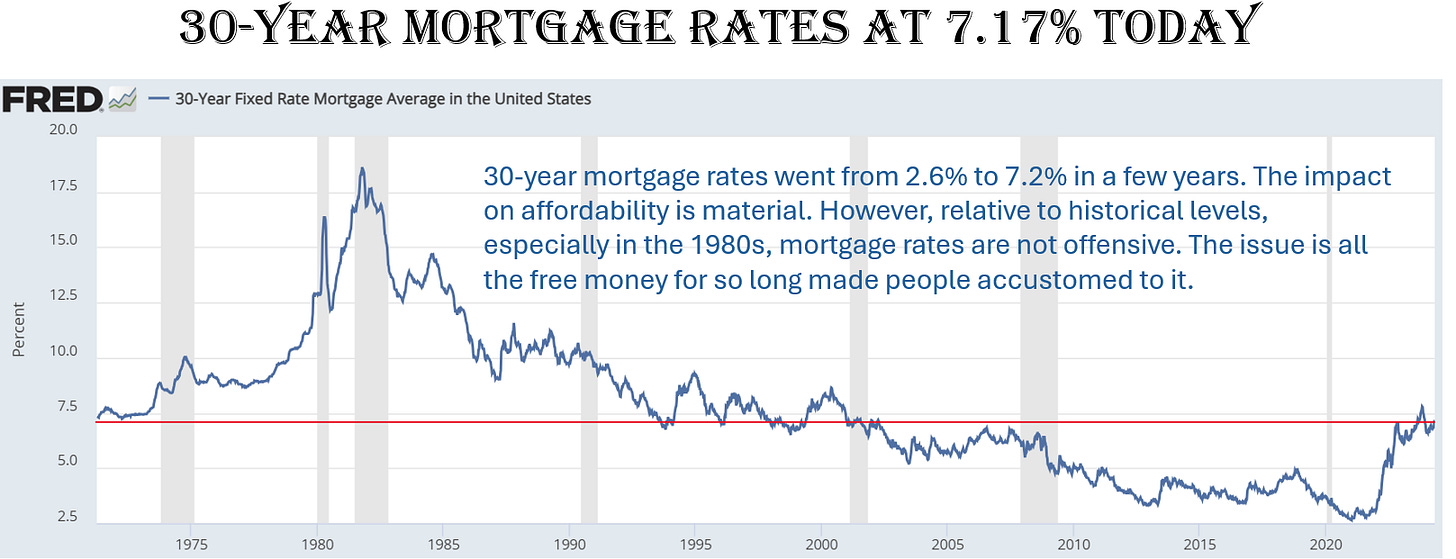

The chart below is telling. Mortgage applications at 30-year lows. A combination of lack of affordability due to rates and housing prices, coupled with the impacts of inflation on purchasing power and the lack of inventory in some markets has mortgage applications crashing. Given the median cost of a home hit an all-time high of $383k, it makes sense that mortgage applications have slowed down sharply. This happened while the 30-Year fixed rate mortgage hit 7.1% last week. Also note that the housing supply has increased from 280k to almost 500k since 2020 lows.

This Real Deal article is entitled, “Major developers are converting South Florida malls into mixed-use projects,” and outlines examples of malls being converted to apartments, hotels, medical office, movie theaters…In one example, Electra America and BH Group’s joint venture on the $1 billion makeover of Southland Mall into Southplace City Center, a mixed-use project that will ultimately have 4,395 apartments and condos, a 150-room hotel, 60,000 square feet of medical office space, 150,000 square feet of retail outparcels and a community amphitheater. The new buildings would surround the existing 808,776-square-foot retail facility, which is undergoing a major renovation. Indoor malls, which usually have large surface parking lots, present a favorable opportunity for developers to build large mixed-use projects amid a scarcity of large developable tracts in dense neighborhoods, noted Jaime Sturgis with Native Realty, a Fort Lauderdale-based brokerage. I appreciate vision and creativity. It is nice to see that people have the foresight to create something new and make it valuable.

© 2024 The Rosen Report LLC. All rights reserved. Does not constitute investment, financial, legal, or tax advice. Consult with your lawyers and professional financial advisers. Rosen Report™ #677 ©Copyright 2024 Written By Eric Rosen.

Been too long. I miss you. I fondly recall my childhood with your family. Thanks for everything.

Great pictures Eric! ❤️ Miss you! Love ya, Mom Lento