Opening Comments

My recent piece, Intellectual (Dis) Honesty is summarized in a 13-minute video. I am trying out something new. Let me know what you think. The most opened links from the late note, “A Perfect Day of Fishing,” newsletter was the video of the wrestler with Cerebral Palsy and tips on raising successful kids.

I went to the iConnections Hedge Fund Conference in Miami on Monday and Thursday to see some friends and attend parties. I met my good friend, Alex, at the Fontainebleau Hotel and we got two small bottles of water in the lobby.

If you guessed $18.62 prior to “tip,” you would be correct.

Pasta e Basta-Carbo Loading Restaurant Review

I went with my longtime friend, John, to the new restaurant, Pasta e Basta, in Miami’s Midtown area for lunch. If you like authentic handmade pasta with impressive sauces, check it out. The homemade food is quite good and the presentation is remarkable. We sat outside and it was a great atmosphere. The inside is nicely appointed, but quiet at lunch during the week. If you don’t like pasta, don’t waste your time. The name Pasta e Basta means, “Pasta and that’s it,” in Italian. There is nothing else on the menu apart from a salad. No hot vegetable sides. Everything was shared and very good, but the ravioli was the only thing that did not dazzle me. The pork cheek in the Cacio e Pepe was remarkable and the combination of high-quality tomato sauce and Pecorino cheese made for a memorable appetizer. The Bolognese resulted in being the President of the “clean plate club” as it was one of the better ones I have had recently. It is made with grass-fed beef and pork and goes very well with the homemade tagliatelle. The potato gnocchi was served in a creamy sauce with Gorgonzola Cheese and walnuts and the texture and taste were amazing. Some of the best gnocchi I have had in Florida. They also offer some gluten-free options. Between the delicious warm bread and olive oil served to start and all the pasta, you need to do some heavy cardio before and after the meal. I ate at Milo’s for dinner that night and I will write it up as well. I am not lying, I gained 3 lbs on Thursday between Pasta e Basta and Milos.

Off to Vegas tomorrow to speak at the SF Net Conference. The weather looks awful with temps in the 40s and rain. Back on redeye landing Thursday am. Hope to get a report out Wednesday. If any readers are attending, reach out via email and we can connect. Rosenreport@gmail.com

Video of the Day-Interview of Ted Seides of Capital Allocators

Markets

Gundlach on Markets

Challenger Job Cuts

Recent 2024 Presidential Election Poll

Uptick in South Florida Deals

Rise of the $100mm House

NYC Office Rebound

Bank Woes on Commercial R/E Exposure

Video of the Day-Ted Seides Interview

Due to my partnership with 3i Members, I am fortunate enough to interview some amazing thought leaders. Some of my recent interviews with Greg Waldorf, Fabrice Grinda and Jessica Beck were well-received. In today’s video, the interviewer (Ted Seides of Capital Allocators) gets interviewed by yours truly. I was nervous interviewing a world-class interviewer of major finance leaders, but feel the result was amazing due to Ted’s remarkable skills and comfort in front of the camera. Here is a link to the Ted Seides interview. I have found more people listen on Spotify or Apple than YouTube. My YouTube page has new videos every week. Check it out.

Rosenreportjobs.com

The main goal of Rosenreportjobs.com is to help people with their careers. My primary focus is getting college kids summer internships at no charge. I believe an internship for college students can help change their career trajectories. It might teach them what they want to do or even more important, not want to do for a living. The website is early stages and I am looking for feedback. There are a handful of resumes on the site from some of the beta test users.

There are three sections:

Companies post full-time job openings or internship opportunities with details about the role, company, and ideal candidate.

Candidates post their resumes, bios or scan for job openings.

Internships are meant to connect college students to companies for summer jobs.

How can you help? I would appreciate companies posting internships and I will be reaching out to some of you asking for a favor to do it if you have the bandwidth. A college student learning and getting real business experience can significantly contribute to their development.

Students putting resumes up is important too. Be sure to take the time to write about yourself and what kind of internship you are seeking. I will be helping companies narrow the list, and the more information you give, the easier it is for me. If we can help become a space to match up candidates with roles, would be a success. Over the coming weeks I will have more internships now that it is live, so please check the site frequently. The first post is an alternative asset manager with $5bn + under management looking for an intern for NYC for the summer. I know the founders and it would be a great opportunity. Another hedge fund will be posting a summer job this week as well.

Numerous college students have reached out looking for summer internships and hope as I get the word out, more companies will post. It is late in the season as many firms in finance have already picked their summer interns, but I am cautiously optimistic with a little push, I can get some additional summer opportunities posted. For example, I am speaking at a large conference in Vegas next week and I will mention the Rosenreportjobs.com site and what I am trying to accomplish for interns.

On the paid jobs front, if companies post full-time roles and they are filled without my involvement, there is a 15% charge. If you would rather go through me and my team and personally, we charge a 22.5% fee for first-year compensation. These fees are less than most executive recruiters charge. My handful of current searches are all with me doing the heavy lifting and believe a majority of full-time searches will go that way. I have dozens of candidates primarily in credit (private credit, loans, CLOs, distressed, special situations) and quants right now.

If you have questions, suggestions or ideas, you can email me at rosenreport@gmail.com. This is a work in process and am open to suggestions on how to improve it after the beta test led to real improvements from my readers. Please contact me to post internships. I will do anything possible to get kids great summer experiences.

Quick Bites

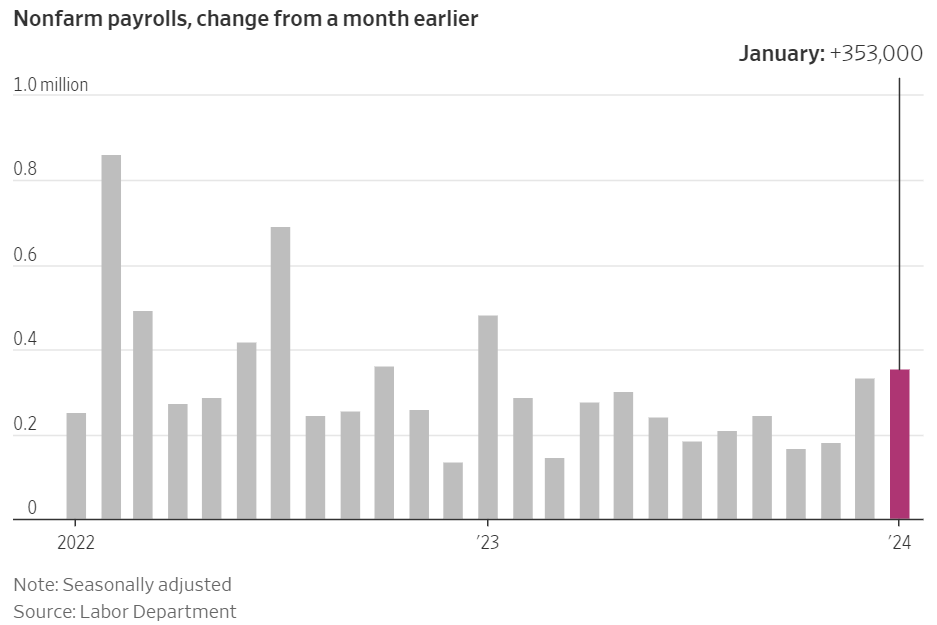

Meta shares popped 20% after earnings, improving guidance and declaring its first dividend. The move in Meta is the largest one-day gain in history at over $200bn, pushing Zuckerberg’s net worth +$28bn in a day to $165bn. For perspective, Zuckerberg’s one-day gain would be the equivalent to the net worth of the 60th wealthiest person in the world. Amazon also beat on earnings and the stock was up 7%. However, Apple was -almost 4% despite beating estimates, as China showed a 13% sales decline. For the week, the S&P 500 added 1.4%, the Nasdaq Composite gained 1.1% and the Dow rose 1.4%. It was the fourth week in a row of gains for the major benchmarks after a stumble to start 2024. After a soft ADP, nonfarm payrolls expanded by 353k relative to 185k expectations. As a result of the jobs data, treasuries sold off sharply with the 2-year +17 bps and the 10-year was +12bps. The market was anticipating 5-6 cuts in 2024 and post this data, it fell to 4-5 cuts. Larry Summers (Former Treasury Secretary) suggested that we can see rates above 3Z% through 2030. Oil prices fell by about 2% on Friday and posted weekly losses after U.S. jobs data shrank the odds of imminent interest rate cuts in the world’s largest economy, which could dampen crude demand.

I watched the interview on CNBC with Jeff Gundlach on Wednesday evening. The “Bond King,” is a savvy investor and always someone I enjoy following. He believes the Federal Reserve poured cold water on hopes for a “Goldilocks” economic scenario benefiting risk assets, and the bond king stuck to his call for a likely recession this year. “When I hear the word ‘goldilocks,’ I get nervous,” Gundlach said. Today, Jay Powell took Goldilocks away,” he said, referring to Federal Reserve Chair Jerome Powell. “For now, we think there will be a stall in the inflation rate coming down,” Gundlach said. “That will probably mean that the market is not going to get the Goldilocks picture that it was euphoric about a couple of weeks ago.” Gundlach said he still expects to see a recession hitting in 2024. He suggested that investors may want to raise cash to fund buying opportunities when an economic downturn arrives.

U.S.-based employers announced 82,307 cuts in January, a 136% increase from the 34,817 cuts announced one month prior. It is down 20% from the 102,943 cuts announced in the same month in 2023, according to a report released Thursday from global outplacement and business and executive coaching firm Challenger, Gray & Christmas, Inc. Except last January’s total, this is the highest number of job cuts announced in January since January 2009, when 241,749 cuts were announced in the first month of that year. The link goes into detail by sector and is quite informative.

I was surprised by the results of this poll. As signs point to the 2024 presidential election being a repeat of the 2020 race between President Joe Biden and former President Donald Trump, Biden holds a lead over Trump 50 - 44 percent among registered voters in a hypothetical general election matchup, according to a Quinnipiac (KWIN-uh-pea-ack) University national poll of registered voters released today. In Quinnipiac University's December 20, 2023 poll, the same hypothetical 2024 general election matchup was 'too close to call' as President Biden received 47 percent support and former President Trump received 46 percent support. However, Biden’s approval rating is around 38%. This is an interesting NBC News headline, “20-point deficit on handling economy highlights Biden’s struggles against Trump. Another related headline: Donald Trump Will Be Rejected by Most Swing State Voters if He’s Convicted of a Crime, New Poll Suggests.

Israel

I would be a lot more aggressive with the Houthis if it were my call. Biden admitted the US plans are not working against the Houthis.

So much for the element of surprise. Why announce it?

U.S. strikes more than 85 targets in Iraq and Syria in initial barrage of retaliatory attacks

UPenn faculty block building entrance, stage ‘die-in’ protest in support of Palestinians

Protesters laid on the steps of a campus building and pretended to be dead as a representation of Palestinian plight.

NYC students condemn Dept. of Education for failing to address rising antisemitism

86th and Broadway at 10:30 am. What are the consequences? How about being charged with a hate crime and jail time?

Democratic Reps. Rashida Tlaib and Cori Bush vote no on bill banning Hamas terrorists from US

Other Headlines

China’s economy is about to implode. We will all feel the aftershocks

Chinese hackers are determined to ‘wreak havoc’ on U.S. critical infrastructure, FBI director warns

China never suffers consequences for bad acts. They created the pandemic, lied, bought up all the PPE, did not disclose the transmission, were disingenuous about the death count, steal IP, treat their people poorly and now they are determined to “wreak havoc” on US infrastructure? At what point do we call them the enemy? This story suggests the Chinese Government is murdering thousands of people each year using mobile injection vans and firing squads.

Elon Musk says Tesla will hold a shareholder vote to incorporate in Texas after Delaware pay snub

This is on the heels of the Delaware judge’s ruling that voided Musk’s $56bn pay package.

Accusations, tears and rants: 5 takeaways from today’s tech CEO hearing

Volvo shares jump 26% on higher sales, plans to stop Polestar funding

Julius Baer shares up 10% as top wealth manager weathers write-off storm, CEO steps down

The Messenger is shutting down

The Messenger, a digital news startup that launched with $50 million in funding last May, plans to shut down operations.

23andMe’s Fall From $6 Billion to Nearly $0

I tried to take the test a couple of years ago and apparently, I don’t know how to spit. They sent me a note that my spit was bad and I needed to do it again. I never did.

Deutsche Bank to cut 3,500 jobs as quarterly profit plunges 30% on hit to US real estate

Peloton shares plummet 20% as fitness company gives dismal outlook

The stock was $167 at peak COVID and is now approaching $4/share.

Mastercard jumps into generative AI race with model it says can boost fraud detection by up to 300%

I have been harping on this topic for some time. Gundlach, Dimon, Taleb, Sternlicht and others are all sounding alarm bells.

JPMorgan’s Trades Threaten to Take Privacy Out of Private Credit

Interesting article suggests that trading of private credit will force the investors to mark the positions to market indicating volatility to the return streams.

“Begging for money”: Trump under “enormous financial strain” as report reveals massive legal costs

South Carolina Presidential Primary Election Results 2024: Joe Biden wins

The corruption and conflicts in politics is out of control everywhere. If you look into the history of Fulton County DAs, it is quite eye-opening. Paul Howard, Jr (Prior to Willis) had all kinds of investigations and violations. Look at what Willis’ boyfriend, Nathan Wade, is billing the county relative to the other DA’s. Wade has billed $653k and the other lawyers are $90k or less.

I suggested deporting them in my last note.

NYC launches $53M program to hand out pre-paid credit cards to migrant families

Great 1 minute video.

California man arrested after Nike products worth $5 million are found in warehouse

That is a lot of shoes!

Denver nears its breaking point as migrants and the cold pile in

Major cities are buckling under the weight of migrants. NYC, Chicago, Denver and others are begging for help. We need a real border, a formal process and plan. This is an unmitigated disaster.

Joe Rogan Gets New Spotify Deal Worth Up to $250 Million

Hit show to be distributed broadly, including on YouTube, rather than exclusively on audio-streaming service.

LVMH takes aim at $30 billion watch market with high-end, reinvented pieces

I went 14-15.

Ozempic Makes You Lose More Than Fat

The suggestion is you lose muscle.

“Watching Vince Vaughn…this huge tough guy, funniest guy, quickest guy…I was just in awe of this human, this man just failing, just willing to try anything.” Good lessons here. You have to be willing to fail to succeed.

Dad got ‘massive’ tattoo of Taylor Swift and Travis Kelce on butt to win daughters Eras Tour tickets

Don’t get me wrong; I love my kids. However, I am not getting a massive tattoo on my butt of Travis and Taylor to get them concert tickets.

Article suggests $1.4-2.5mm for a suite.

Here's which US cities are the best for singles to mingle ahead of Valentine’s Day

Cities that made the list include Tampa, Florida, and Reno, Nevada — among others.

Michael Jordan game-worn sneakers fetch $8 million at auction: Sotheby’s

Six shoes from 1991, 92, 93, 96, 97, & 98 dubbed the “Dynasty Collection.”

Florida fisherman singlehandedly reels in 1,200-lb, 12-foot ‘monster’ great white shark

Caught from the shore in Pensacola. Not having a boat to help you fight the fish and landing a 1,200 pound shark is impressive.

Real Estate

I continue to feel that many areas in South Florida are overvalued and will see a pullback. However, we have seen an uptick of deals recently at the high end. This is the “busy season” as more potential buyers are in town from the Northeast, Midwest and West looking for homes. On my block, a new home just sold for $16.85mm. I toured the home. Nice house on a golf course lot with solid views and high-end finishes. The coloring was a bit too brown for my taste, but it was a very well-built home with amazing finishes. A few newer homes on the water sold in the past week in the $15-20mm range a little north of where I live. I continue to believe that newer, move-in condition homes are in demand. Vacant lots, houses that need a lot of work, and those that have aspirational pricing sit on the market. A recent home I toured was asking way too much. They lowered the price to something more realistic and had two offers within 24 hours. If I can give you any advice if you are a seller, be realistic and you will get traffic. Another friend listed his house 6 months ago at a price 20% higher than I suggested. It has had very few showings and is getting stale. Aspirational asking prices hurt your ability to sell.

Interesting WSJ article entitled “The Rapid Rise of the $100mm Trophy Home.” It has been nearly 20 years since the country’s first $100 million home sale, but in some ways the market is just taking off: Since 2020, at least 24 homes nationwide have traded for $100 million and up, more than the total number of nine-figure sales during the entire prior decade combined. The 24 homes, and their uber-wealthy owners, also tell the compelling story of massive wealth creation and migration in the U.S. since the onset of the pandemic, with a dramatic surge in nine-figure deals in Florida in recent years. Since 2020, three homes over $100 million have changed hands in New York City compared with six in and around Palm Beach, including a $170 million deal in 2023 that set a Florida sales record.

Finally, a positive NY Post article on the NYC office market entitled, “Manhattan office market rebounds faster than rival cities as NYC demand surges 40%.” Manhattan’s pandemic-pummeled office market is headed for a spectacular rebound — and not only landlords, but business advocates and eatery owners are thrilled. Although the Manhattan office market hit bottom in 2023 with more than 20% vacancy rate, the short-term future looks rosier, according to a new report from national real estate technology platform VTS. Its latest quarterly Office Demand Index (VODI) found that demand for space in the Big Apple rose nearly 40% in 2023 over the previous year — lifting demand to 75% of pre-pandemic times.

The US commercial real estate market has been in turmoil since the onset of the Covid-19 pandemic. But New York Community Bancorp and Japan’s Aozora Bank Ltd. delivered a reminder that some lenders are only just beginning to feel the pain. New York Community Bancorp’s decisions to slash its dividend and stockpile reserves sent its stock down a record 38%. The selling bled overnight into Europe and Asia, where Tokyo-based Aozora plunged more than 20% after warning of US commercial-property losses and Frankfurt’s Deutsche Bank AG more than quadrupled its US real estate loss provisions. The concern reflects the ongoing slide in commercial property values coupled with the difficulty predicting which loans might unravel.

© 2024 The Rosen Report LLC. All rights reserved. Does not constitute investment, financial, legal or tax advice. Consult with your lawyers and professional financial advisers.

Rosen Report™ #653 ©Copyright 2024 Written By Eric Rosen