Opening Comments

The devastation from Ian is concerning, and now all of Florida will feel the ramifications. One estimate is $63bn in damage for insured losses from the storm, an overwhelming majority of which I presume is Florida. The suggestion is over $100bn if you include uninsured losses. Estimates are now over 100 deaths as well. I am told that numerous insurance companies were already considering leaving the state and believe people revived notices that various insurers will no longer provide coverage in coming months in Florida. My friend and reader/contributor, just told me that he was scheduled to close on a home in Palm Beach tomorrow and there is a moratorium on new home insurance, which is preventing the closing. Given the supply demand imbalance (hundreds of thousands of new homes and fewer insurers), I expect already expensive rates to go up further. If buying a home in Florida, be sure to get insurance quotes in advance. There are flood regions, which are incredibly expensive. Age of home matters. I have not received any letters, but was told by a reader my insurer is planning on leaving the state. Son of a…. This WSJ article paints a bleak picture for Southwest Florida.

Stem Cells-The Future of Medicine?

Quick Bites

Markets

Market Perspectives

ISM Manufacturing

Inverted Curves

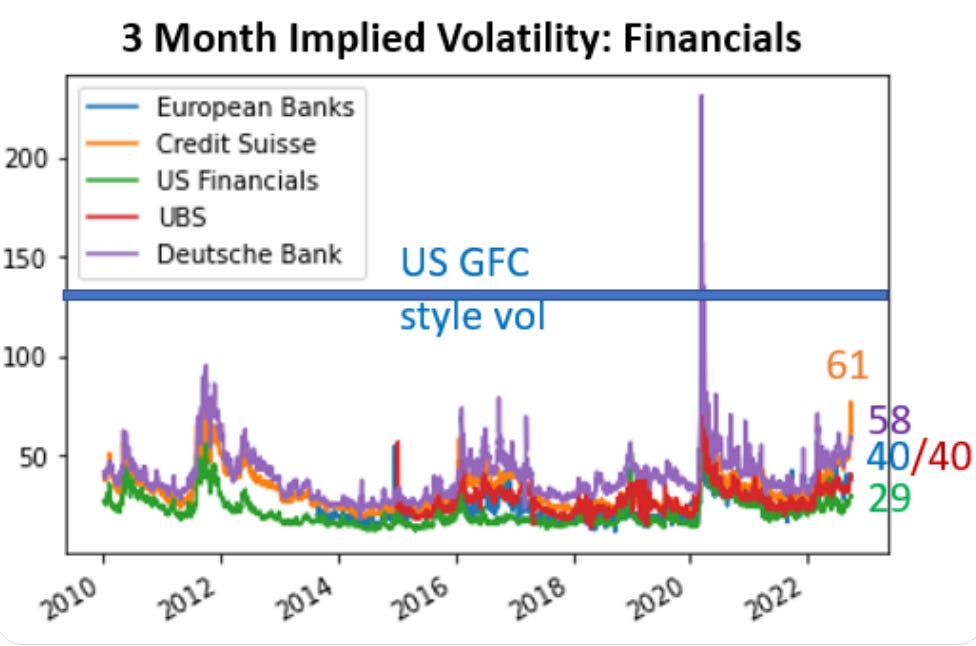

European Bank Volatility

Coal Prices on Fire

Other Headlines

Crime Headlines

Virus/Vaccine

Real Estate

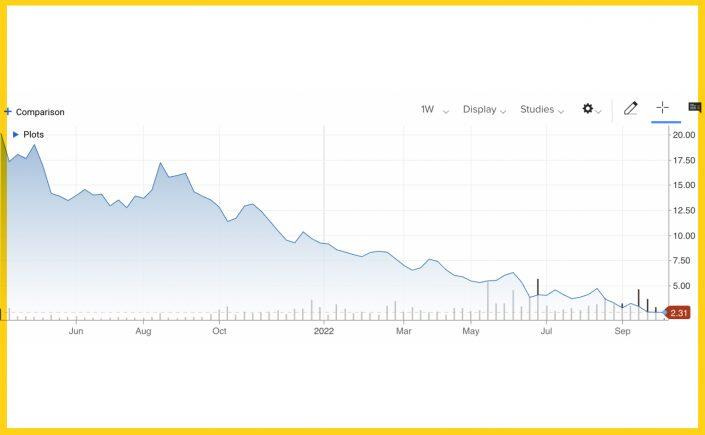

Compass Brokerage Stock Down 88%

Boca House Listed for $27mm Sells

Ken Griffin is “All-in for Miami”

Other R/E Headlines

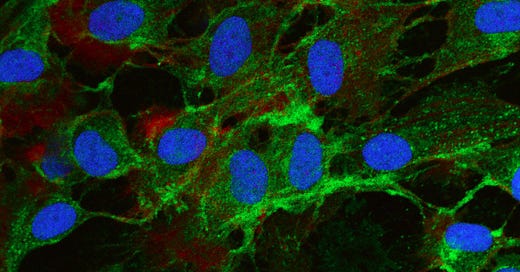

Stem Cells-The Future of Medicine?

I am not a physician and do not give medical advice. However, I believe that people should take time to understand stem cells for treating numerous issues including Autism, Arthritis, Back/Neck pain Cerebral Palsy, Multiple Sclerosis, Rheumatoid Arthritis, Stroke, Spinal Cord Injury and many others (full list here). I am not pushing anyone to run to stem cell treatment, but do suggest you do your homework and speak with world-class physicians to see if you or your loved one is a candidate. I have had multiple calls and Zoom meetings with Dr. Prodromos to educate myself and found him to be incredibly straight forward and knowledgeable. In the hours spent together, he has shared multiple testimonials with me, which brought remarkable results. Dr. Prodromos said “serious adverse events are virtually unheard of with this technique provided that they are performed by a qualified doctor with high quality stem cells.” However, the cost can be significant, $15k+.

I am not compensated from Dr. Prodromos, but did want to share new therapies in hopes it would help my readers potentially find improved outcomes and relief. To be clear, stem cell treatments are not FDA approved. As a result, the injections happen outside of the US. However, Dr. Prodromos describes that the treatments are safe, and they have published 3 separate systematic reviews in high quality medical journals showing this – these papers are available on request from the Prodromos Stem Cell Institute.

Dr. Chadwick Prodromos received his Bachelor’s degree with honors from Princeton University and his MD degree from the Johns Hopkins Medical School. He served his surgical internship at the University of Chicago; his Orthopedic Surgery residency at Rush University and his fellowship in Orthopedics and Sports-medicine at the Harvard medical school and Massachusetts General Hospital. His website is here.

I found Dr. Prodromos from a doctor friend, Peter Michalos. Dr. Michalos reached out to Prodromos after seeing a dramatic change in a fellow church member with autism. Michalos was at church where an autistic boy would often disrupt the service and then, all of a sudden, the boy had a noticeable improvement in behavior. Michalos asked his mom (physician) what happened. She said her son received stem cell treatment from Prodromos, so Michalos reached out to the stem-cell expert to learn more. The boy’s EEG improved, and his behavior improved significantly within a few weeks of treatment (testimonial in the video). Michalos went to Prodromos in Antigua to see the stem cell facility, follow patients and learn more about the procedures. (Dr Prodromos also maintains a center in the town of San Pedro Garza Garcia near Monterrey Mexico) as well as Chicago and Naples, Florida.

Dr. Michalos was amazed with what he saw, and the follow up calls were telling. He told me numerous stories of people who had significant improvements in pain, MS side-effects, sight and other ailments. No one is suggesting this is a full cure, reported results suggest there have been many positive outcomes for debilitating health issues.

Dr. Prodromos describes that they have developed a vaccine made from the patient’s own lymphocyte immune cells that has been able to arrest MS in over 90% of 200 treated patients, with follow-up over 10 years. This same technology has been effective for scleroderma, and type 1 diabetes. And he describes that a related technique has been effective for stroke, cerebral palsy, heart failure, retinopathy and in spinal cord injured patients. These techniques go beyond simple stem cell injection to use the patient’s own lymphocytes as an immunotherapy adjunct.

Dr. Prodromos came to NYC to speak, and I was invited on September 5, 2022. Unfortunately, it was during one of my back episodes, and I was unable to travel. I am considering stem cells for my back pain. Prodromos and his anesthesiologist/pain specialist, Ken Candido MD have treated 28 patients for back and neck issues, often quite severe including after failed surgeries. 24 out of 28 have seen good results, none have worsened, by injecting stem cells into the epidural space, not the disks, with no sedation necessary. Their first back pain patient was written up as a case report and accepted for publication in the journal “Current Stem Cell Research And Therapy.” You may read it here.

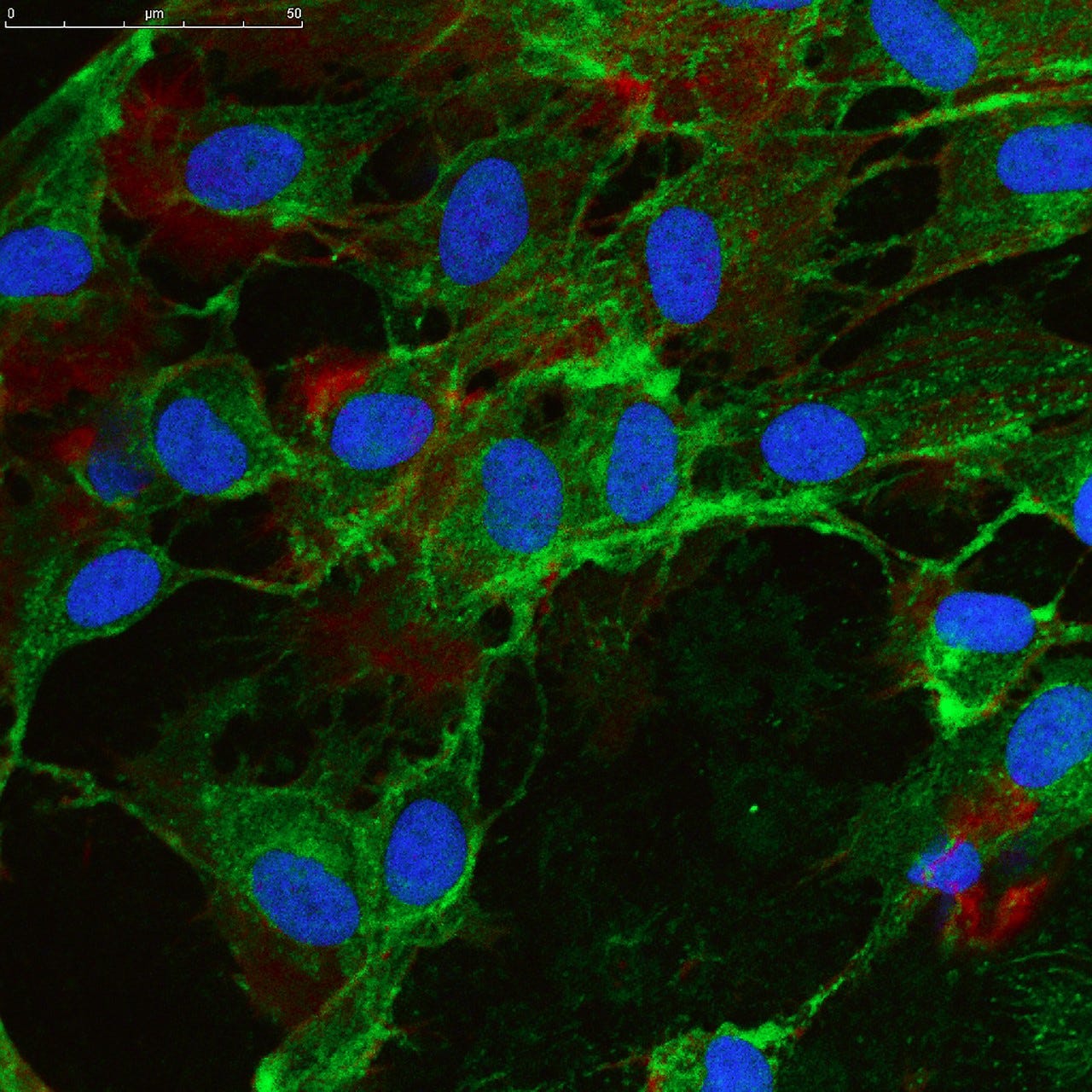

Dr. Prodromos was also featured in Tony Robins best-selling book, Life Force, and was selected by him and his company, Fountain Life, to provide stem cell injections for their patients for anti-aging and other purposes.

Dr. Prodromos describes that all patients receive IV injections of at least 100 million cells. And that these cells are genetically programmed to home to damaged areas – as this is what nature has evolved to heal us. He also treats many NFL players and other professional athletes in this fashion, e.g world ski racing champion Alex Ginnis shown here.

For autoimmune diseases, only IV injections are required. Patients only need stay for one day and the IV injection takes under an hour.

Usually, the mesenchymal stem cells Dr. Prodromos uses are derived from the wharton’s jelly of umbilical cords of American mothers who donate them. One chord can give stem cells to hundreds of patients. The cells are isolated and expanded in tissue culture at vitro biopharma in Golden Colorado, an FDA registered iso certified lab that is arguably the best such lab in the world. These cells are not embryonic or from abortions, so there are no ethical issues. They are not rejected and do not need to be tissue matched because they lack type 2 histocompatibility injections which cause rejection of other tissue. They are potent and cost less than obtaining, culturing and using a patient’s own stem cells. They are used for autism, arthritis, back pain, anti-aging and some autoimmune disorders.

However, when adjunctive immunotherapy is needed as described above, for MS, stroke, cerebral palsy, retinopathy, spinal cord injury, scleroderma, type 1 diabetes and some other disorders, Dr. Prodromos removes a small specimen of fat (which are rich in stem cells) from the patient and uses it to establish their own personal stem cell colony over about a month. These stem cells are then used in conjunction with the patient’s own lymphocytes for adjunctive immunotherapy, without which stem cell infusion alone is generally ineffective for these disorders. This combined treatment is offered nowhere else in the world.

While stem cell treatment is very effective for even very severe arthritis, there is a regenerative treatment called PRP (Platelet Rich Plasma) for arthritis, rotator cuff injury, Achilles tendon damage and other tendon injuries, which uses growth factors and anti-inflammatory cytokines derived from platelets in the bloodstream. It is obtained from a simple blood draw. It is Dr. Prodromos’ first choice for these disorders, when possible, because it is much less expensive than stem cell treatment. Stem cells are used for very severe cases or if PRP fails. The doctor does all his own “spinning” in house and maximizes the efficacy of the PRP based on years of research.

The 40-minute video of the recent NYC speech is included here for your review and includes multiple testimonials from patients. If you are interested in speaking with Dr. Prodromos, email care@thepsci.com and you can find out if stem cell treatment could help you. Do you own homework to find out of these treatments may be right for you. I can tell you that many doctors I spoke with for this article are quite positive on stem cells and believe they may be the future, but not all were not sold on it at this point.

Quick Bites

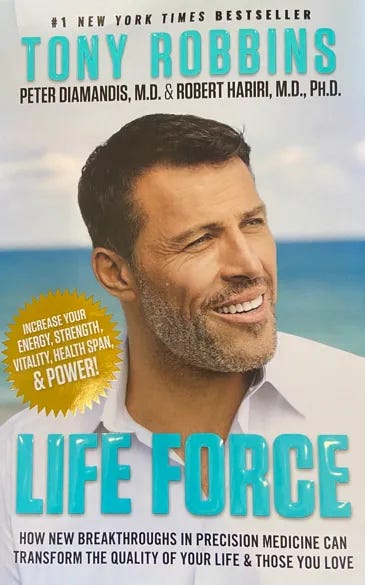

Monday and Tuesday the equity markets rebounded sharply and were up approximately 5%+ in part due to the lower Treasury yields, the UK scrapping the selling of Gilts and some suggesting stocks were oversold after a brutal September. Wednesday, after a decent morning sell off, stocks redounded to be down slightly. From Friday’s close to Tuesday highs, the S&P was +5.7%. Oil jumped 4% as OPEC weighs output cut after the sharp fall in prices and now up approximately 7% on the week. Kudlow was quite negative on Biden’s energy policy and reliance on OPEC. On Wednesday, the OPEC cut was confirmed at 2mm barrels/day, bringing oil back up to $88/barrel from recent lows sub $77. Goldman had a great research piece on reasons for the substantial OPEC cut including macro concerns and the world is too short capacity. I wonder why? Bad energy policies.

The market rally in recent days has been IMPRESSIVE. One thing I look at is breadth and it appears 97% of stocks are up over 3 days which is stunning. This was the first time in 22 years that has happened. Rates have come down with the 10-year breaking 4% last week and fell to 3.6% before bouncing back up to 3.76%. Lots of short covering, but make no mistake, the rally caught me off-guard. Cantor’s Eric Johnston changes his view on the market and feels we have no seen the lows after being incredibly negative just two weeks ago. Here is Barry Sternlicht’s take in the CNBC article, The Fed is going to cause ‘unbelievable calamities’ if they keep hiking. He cited consumers cutting back and the strong US dollar in the piece. I think part of the reason for the rally is the market may believe that the Fed will change its stance. No, not buy bonds like the UK, but soften the hawkish tone and suggest that after this rate hike, they take a pause? Morgan Stanley remain concerned that conditions remain for “something to break.” Also of note, Hedgeye’s Keith McCullogh says, “I’m about as bearish as I’ve been since 2008. I recommend prayer. Also, Art Cashing chimed in with his 2-day rally concerns.

From Peter Boockvar: US manufacturing grew at the slowest pace in 2.5 years. The September ISM manufacturing index fell to 50.9 from 52.8 and that was 1.1 pts below expectations. That’s the lowest since May 2020. New orders fell below 50 at 47.1 and is less than 50 for the 3rd month in the past 4. Backlogs slipped by 2.1 pts to 50.9. Inventories at manufacturers rose 2.4 pts after falling by 4 last month but of note, Customer Inventories rose 2.7 pts to 41.6. That is still well below 50 but the highest since June 2020. Export orders fell further below 50 at 47.8 from 49.4 in August and vs 54.4 in July. Imports were little changed. The good news is supply chains easing, but the bad news is demand is falling. Heard from builders that the supply chain is much improved in most cases and sub contractors who were impossible to hire are now available again.

I wanted to use the recent moves in bond and Credit Default Swap (CDS) spreads on Credit Suisse to go over inverted curves. Generally, credit curves are “upward sloping.” What I mean by that is if you borrow money for 1 year, it is cheaper than 3 years and 3 years is cheaper than 5 years. The term structure is “upward sloping” generally. In times of panic, curves “invert” meaning the front end of the curve (short dates) cost more in spread terms than the longer dates. Why? There is panic and fears of a default, and the longer dated bonds/CDS won’t sell off as much given the amount of duration (a measure of sensitive of the price of a bond to a change in rates). Investors scramble to buy insurance or sell/short bonds which are nearing maturity as the lack of term left reduces the duration and overall cost, despite the fact that the yield is higher. The reason, it is for a short period of time. As seen in the chart below, the entire chart shows 1-year CDS at a lower spread than 5 years until all of a sudden, the 1-year explodes on panic of a default. This would effectively bring bond prices to a similar level despite maturity. This is a sign of high default fears and something we saw in the Global Financial Crisis even for the best quality companies. 500 bps for 1-year protection in a major financial is a bad sign for that company, and it cannot last long at that level. A bank can’t withstand implied borrowing costs of that nature. For perspective, JPM, BAC, GS 1 year CDS is 50-60bps.

Other European banks are under pressure recently. This article outlines BNP (Bank Paribas) with more short sellers coming into the stock. The chart below shows the implied volatility in some European financials and according to the article, the volatility is twice that of US banks.

I have written extensively about the Euro energy crisis and bad decisions and did an 18-minute podcast entitled, “Highway to Hell” about the Progressive desire to kill the fossil fuel industry before alternatives are in place. This CNBC article is entitled, Energy giants return to fossil fuels like coal as Europe braces for winter. Check out the chart below of coal prices. The second chart is of coal companies, Arch and Peabody stock prices, and this was before the big rally in equities. Drax, a large European utility is chopping down trees in Canada at a rapid rate. The video suggests they are converting the trees into pellets to be burned to create electricity, but the company is trying to explain it away. Yes, the environmentalists plans are imploding and should be a lesson to all. Don’t close nuclear power plants before your alternatives are solidly in place, and don’t rely on maniacal leaders such as Putin, the Ayatollah or others for your energy.

Other Headlines

Stubborn inflation forces more Americans to live paycheck to paycheck

Elon Musk offers to buy Twitter at original price days before trial

He realized despite the “bot” issue, he won’t win the trial. I have suggested the case is stacked against him based on the structure of it. However, he is massively overpaying for this asset. TWTR +22% to $52/share. I believe Musk is materially overpaying for Twitter today, but has no way out.

Micron to spend up to $100 billion to build a computer chip factory in New York

Facebook to purge thousands of workers in 'quiet layoffs'

Article suggests up to 12,000 people. These highly compensated professionals.

Jeffrey Sachs yanked off air after accusing US of sabotaging Nord Stream

I am confused as Biden was at a press conference claiming that if Russia invades, we will “end” Nord 2. I don’t know who blew it up, but US officials, including the President eluded to it months ago.

Biden tells Al Sharpton he will run for president again in 2024

The chance Biden knows his own name in two years is on a asymptotic line approaching zero.

10 College Majors With the Highest Starting Salaries

Every one of them was math, engineering or some kind of computer science.

Cheating scandal at Ohio tournament rocks competitive fishing world

The would-be winners of almost $29,000 at an Ohio fishing tournament were disqualified on Friday, after it was discovered their fish were stuffed with lead weights and fish fillets. The video is crazy.

'Precipice of collapse': Putin facing 'irreversible' defeat as troops abandon ship

Crime

Welcome to @KathyHochul's NYC where you can get randomly stabbed out of nowhere.

Scary 18 second video of random stabbings. No one can ever convince me that these Progressive policies are good for anyone other than criminals.

NYC subway riders attacked by gang of neon green-clad women

There will be a Bernie Goetz moment in NYC soon at this rate. How can police not find these assailants? They are wearing glow-in-the dark, lime green body suits.

Dad killed while visiting Marist student for Family Weekend identified as Paul Kutz

Horrible story about homeless drug addicts (with criminal records) staying in the hotel. After smoking PCP, one of the homeless men shot up the lobby with a modified gun making it automatic. The innocent dad was in the wrong place at the wrong time.

Four alleged looters charged in Florida following Hurricane Ian

U.S. Border Arrests of Migrants with Criminal Histories Up 350% Since 2020

in 2022, 10,778 migrants with prior criminal convictions were arrested by Border Patrol Agents. How many more got through?

A family of 4 is missing after being 'taken against their will' in central California

Virus/Vaccine

Real Estate

Look at how much the R/E market has changed in a short time. Compass, a market leader in real estate brokerage, has seen its stock decline from $20+ in April 2021 to $2.3/share. The market cap went from over $8bn to $1bn. This Real Deal article is entitled, “A dollar deferred: Compass agents down millions on ’21 equity program.” Of note, in 2021, Compass had the highest dollar volume of any broker in the US and tends to focus on higher-end product. What does the substantial move in price of the stock suggest about the high-end residential R/E market? To compensate agents who deferred sales commissions in 2021, Compass logged a $100 million expense in connection with its agent equity program, according to public filings, suggesting that agents gave up some $90 million in compensation last year. Unlike stock-based compensation given as a bonus on top of salary or other earnings, Compass agents who participated in the agent equity program gave up the core component of their incomes (TRD’s analysis excludes the company’s 10 percent stock match).

A house in my neighborhood in Boca Raton was listed for $27mm and is under contract. I don’t know the final sale price. The house has been listed for 178 days. It is a .34 acre lot on the intracoastal with an 8,287 foot home. Uber high-end homes in my area have cooled sharply in recent months, so it is a good sign of a transaction.

I keep writing about how policy matters and in this case, Chicago’s irrational crime policies drove Ken Griffin/Citadel into Florida’s wide-open arms. He brings with him $30bn in wealth, countless uber-wealthy employees, a big philanthropic bent ($750mm to Chicago over 10 years), innovation, demand for luxury goods including homes, cars, restaurants, shopping…. The multiplier effect will be amazing. This Real Deal article is entitled, “We’re not sort of in — we’re all in:” A look at Ken Griffin’s plans to reshape Miami. Rumors are he is looking for a school to house students for Citadel employees. Think of the economic devastation to Chicago, NYC, CA… with the wealth leaving and the massive amount they spend to go along with it. The tax ramifications are huge. Citadel is up 29% this year resulting in a massive, multi-billion payout for Griffin and his teams. More lost tax revenue for Chicago. Ken, I welcome you to your new home. Ring me if I can help in any way.

Other R/E Headlines

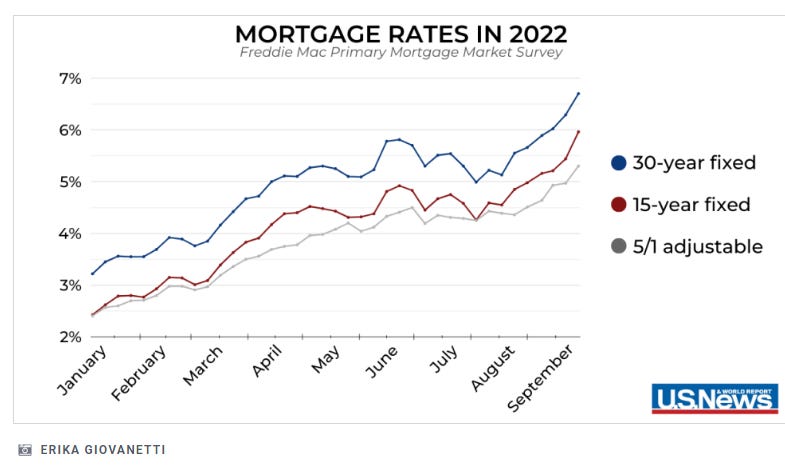

Mortgage Rates Rise to 6.7%, Continuing Upward Streak | Mortgages and Advice | U.S. News

6.7% +.9 points. (up from 6.29% a week ago, up from 3.01% a year ago)

Manhattan apartment sales fell 18% in Q3 as rates rose and markets declined

The major county in America where home prices just dropped the most is …

U.S. housing market to see the second-biggest home price decline since the Great Depression

‘The mood is dark’ — More than half of Silicon Valley residents still want to move away, poll finds

Renewing LaSalle Street (Chicago) a matter of keeping up with the neighbors

City officials are offering landlords money if they come up with new ideas for buildings that have lost their allure amid downtown’s expansion.

Denver’s most expensive home lists for $28.9 million and features a stunning charred wood treatment