Opening Comments

The Rosen family had a full house hold with my mother-in-law, sister-in-law and two nieces staying at our house. On Sunday, we also had my brother-in-law, sister-in-law and their two kids in the house for lunch. The 6 cousins were running around having fun, something which has just not happened since the pandemic. So much has been taken away as we have been isolated to some degree.

I had a great dinner at Farmer’s Table with the owner on Monday night. The food is solid with many healthy choices and a big outdoor seating area. My friend told he enjoys the Rosen Report, but it can be overwhelming given how long it has become. Today, I am trying a shorter version partially due to the feedback and the fact that as you will see in “Technical Difficulties,” I had no internet for a couple days. Let me know what you think.

Picture of the Day-Car Colors of Choice

Technical Difficulties

Quick Bites

Ukraine/Markets, 2s/10s Curve, Einhorn on Markets/Inflation

States Considering Inflation relief, Nord Stream 2

Trump Social Media Venture

Goldman Sachs Getting Aggressive on Talent

McD Shooting….by a 4 Year Old

Other Headlines

Virus/Vaccine

Data-BIG Improvements Across the Board

Excess Deaths/Life Insurance

Lockdown Blues

Real Estate-Interesting Color On Found in the Rosen Report

NYC Rental Market Insanity-Jared Halpern Douglas Elliman

US Home Prices/30 Year Mortgage Rates (Chart)

Florida Running out of Develop-able Land

Blockchain.com to Miami

Picture of the Day

I read an article on the most and least popular car colors which are outlines globally and for North America below. White and black win by a good margin, with blue next. Given the new Tesla Model Y is coming white on white, I guess we are going with the flow.

Technical Difficulties

I recently wrote about my new computer which I ordered a few weeks ago with the help of a reader. There are assembly companies which don’t make computers, but assemble them to your specifications. Well, given the backlog, it is other few weeks from being delivered. At the same time, I ordered two 32” 4K screens from another vendor. The screens came in a few days and I decided, in my infinite wisdom, I would try one on my old computer until my new one arrived. I struggled to plug it into the old tower and it turns out my 10 year old computer is so outdated, there were issues. I finally bought an adapter and got one to work, but when I left my station and came back, the screen would not go back on. Given my ADHD, I was going ballistic. I called up support multiple times and spent a total of 5 hours on the problem. Hey, why not just use the old screens? I am an idiot and I gave them away. Clearly, you should make sure your new equipment works prior to getting rid of the old stuff.

I now have one massive screen and a small one. My old computer is so outdated, it cannot put out the right high definition signal to the fancy new monitor and it looks like crap. I am told when my new tower arrives, my screen will look like a million bucks. In the mean time, I wasted hours and headache trying to get a new screen to work with an old machine. If instructions say, “Some Assembly Required,” or the project is of a technical nature, I should just run for the hills. I am absolutely worthless. I am too embarrassed to tell my readers how long it took me to put together the stand with 3 screws for the new screen. I put it on backwards, as I was too proud to look at the directions. When I worked at JPM, the tech team in its entirety knew me on a first name basis as crap would only happen to me. I am convinced Jamie Dimon sent a team of elves to unplug things just to piss me off. The same was true at the hedge fund. Yes, I have lots of technical difficulties.

To add insult to injury, my computer (hard wired) lost connection Monday morning and I did not get back to Tuesday night. Writing the report just using a laptop is so cumbersome, that I did start today’s report until Tuesday afternoon, so another reason I am keeping it short today.

What are the chances that when my fancy new computer arrives I will get it hooked up to my fancy new monitors without assistance? Remember, my old tower uses Windows 7 which was released in 2009. I know they are on Windows 11 now, but let’s not forget each release has multiple sub releases. I am like 10 releases behind! Yes, it was time for a new machine. The support guy said, “Windows 7 is End of Life.” I had not heard that one, but does not sound good. If there is a period of time in March when the Rosen Report goes dark, it is because I am having “Technical Difficulties.” Just don’t say I did not warn you. It is because my technical game is not so good.

In a funny related story, I was asked to give a speech about my background and the Rosen Report via Zoom and just as I was supposed to start speaking, my camera would not turn on for my brand new laptop. In a panic, I dialed in with my phone, but I had just done a Zoom the day before on that computer. I have learned that if something can go wrong on the technology front, it is likely to happen to me. I looked up the manual and it turns out there is a “privacy slide” on the camera which was closed. How humiliating that I had three people working to fix my laptop and install new drivers and it was a privacy shutter.

Quick Bites

Markets were driven by Ukraine headlines as according to NATO, Russia has now moved from "covert attempts" to "overt military action" in Ukraine after Russian President Vladimir Putin ordered Russian troops into two separatist pro-Moscow regions in eastern Ukraine after recognizing their independence on Monday. Biden spoke and will sanction Russian banks, sovereign debt, Nord Stream 2 and individuals due to the invasion. Also, Ukraine urged citizens to leave Russia. The Russian Navy positioned to counter US, French and Italian carriers as well. Other reports suggesting full out war in the next 48 hours with airstrikes, missile launches and ground troops. Several Ukrainian government websites and banks were hit with cyberattacks as well. Although stocks are down, I am surprised they are not down more. The S&P is down 5.2% in the past 5 days and the NASDAQ is down 7.3% during that time. The S&P 500 fell for a fourth straight session Wednesday, sliding deeper into correction territory, as Russia-Ukraine tensions escalate. Today, the S&P 500 fell 1.6%, after closing more than 10% from its Jan. 3 record close on Tuesday. The Dow dropped about 430 points or 1.3%. The technology-focused Nasdaq was off by about 2%. YTD, S&P is -11.9% and NASDAQ is -17.7%. Oil was up slightly to $92 and natural gas is at $4.6 or up almost 2%. California averaged $4.742 a gallon on Tuesday, about $1.20 more than the national average. Some counties, including San Francisco, are averaging over $4.90, according to AAA. BTC was down a touch to $37.7 and ETH was up a touch to $2.6k.

I have written extensively on the 2s/10s curve during the past month to share the importance of the spread in the Treasury market and what it tells us. I am inserting the chart again today as the spread as of the close of the market on 2/22 was 40bps. Note the gray bars are recessions and anytime the spread has gone to zero or less there was a recession shortly thereafter. The thickness of the gray bar determines the length of the recession. Today, 2s/10s closed at 38bps. Watch this 2s/10s relationship. Kasman from JPM is now suggesting the Fed to hike in each of the next 9 meetings.

Billionaire investor David Einhorn asserted that the speculative bubble in markets peaked last February, and warned the Federal Reserve might struggle to rein in inflation, speaking in a recent two-part RealVision interview.

The Greenlight Capital boss also predicted a US economic slowdown, explained why he's bullish on copper, and sounded the alarm on passive investing. Einhorn blamed loose monetary and fiscal policies for an "enormous bubble" in recent years, but said the market mania peaked last year. The speculative stuff that I thought was truly insane a year ago — it's derated very, very substantially," he said. Einhorn predicted that some goods and services would continue to rise in price, and said some inflation isn't being reflected in official estimates. As a result, the Fed trimming its balance sheet and gradually hiking interest rates might not be a sufficient response to inflation. "It's not clear to me that that will be enough to get it under control," he said. I don’t have access to Einhorn’s returns, but believe he was hot early in his career (1996-2011) and has recently significantly under-performed (link is to a WSJ article from 2018). I believe his assets under management have fallen sharply as well. I have had a handful of interactions with him over the years. He is very bright, but set in his ways. His Lehman Brothers call was remarkable in 2007.

Soaring inflation in the U.S. is accelerating calls from governors and other state leaders to provide immediate tax relief for cash-strapped residents paying more for everyday items like gasoline, milk and electricity. The governors of Maine and Kentucky last week joined leaders in several states -- including Illinois, California, Massachusetts, Florida, Alabama, Washington and Missouri -- in considering offering quick, temporary inflation relief to taxpayers. State lawmakers' tax relief wish lists run the gamut from food store purchases to property taxes to vehicle sales. While the adjustments are not uniform, all of the proposals are moving in the same direction, tax policy experts say. In Maine on Tuesday, Democratic Gov. Janet Mills proposed sending half of the state's $411 million surplus back to residents as one-time $500 checks. I can only say that basically everything I buy is up in price sharply. Most notably gas, grocery items, cars, consumer products, restaurant bills….

Germany on Tuesday halted the certification of the Nord Stream 2 gas pipeline designed to bring natural gas from Russia directly to Europe, after Russian President Vladimir Putin recognized breakaway parts of eastern Ukraine and ordered troops into the region. Germany’s chancellor, Olaf Scholz, said that his country would not accept the recognition of the two self-proclaimed, pro-Russian separatist regions in the Donbas area of eastern Ukraine, and that Germany had to reassess the situation regarding Nord Stream 2. The EU imports approximately 80% of the natural gas it uses according to the US Energy Information Administration and Russia accounts for 41% of it.

Donald Trump's new social media venture, Truth Social, launched late on Sunday in Apple's App Store, potentially marking the former president's return to social media after he was banned from several platforms last year. Led by former Republican U.S. Representative Devin Nunes, Trump Media & Technology Group (TMTG), the venture behind Truth Social, joins a growing portfolio of technology companies that are positioning themselves as champions of free speech and hope to draw users who feel their views are suppressed on more established platforms. TMTG is planning to list in New York through a merger with blank-check firm Digital World Acquisition Corp (DWAC) and stands to receive $293 million in cash that DWAC holds in a trust, assuming no DWAC shareholder redeems their shares, TMTG said in an Oct. 21 press release. This article is critical of the valuation, stating it will be approximately $16bn. It cites dilution and heavy revenue multiple valuations. This note from Reuters suggested that Abraham Cinta and the Shanghai investment bank he leads, ARC Group is the financial advisor to DWAC. Cinta was one reprimanded by US regulators and barred from taking his company public. Also, this article suggests the network has been almost entirely inaccessible in the grand debut because of technical glitches, a 13-hour outage and a 300,000 person wait list.

This Bloomberg article is interesting. It suggests that Goldman Sachs is exploring confiscating vested stock for some of those who leave the firm. I cannot believe this type of thing would happen, but the article outlines it in some detail. The story is well done and quite interesting as the ramifications are serious for those who leave high paying Wall Street jobs and have big vested/unvested stock allocations. As Wall Street firms struggle to hold on to top talent, Goldman Sachs isn’t just paying bigger bonuses to dissuade executives from leaving — it’s turning the screws on those who do. Goldman is now exploring the nuclear option of confiscating their vested stock — usually reserved for cases of misconduct, and not wielded against executives taking new jobs. It’s just one of the ways the bank is playing hardball with those who leave. Other surprise measures include pulling unvested compensation from long-time loyalists like former division chiefs Gregg Lemkau and Eric Lane — who left for firms that would be considered clients. It’s part of a pattern of expanding the list of what counts as a competitor to enforce more restrictive exit agreements.

This story is tough to take. A dad pulled a gun at a McD in Salt Lake City due to a botched food order and when the cops came, he instructed his 4 year old to shoot the cops. The police pushed the gun up in the air and it shot through a canopy. Are you serious right now? Asking your 4 year old to kill a cop?

Other Headlines

The chip shortage is so bad GM dropped heated seats in winter

LG Electronics Shutters Alabama Solar Factory Amid "Rising Commodity Costs"

China Crackdown Risk Roars Back in Probe of Jack Ma’s Empire

Alibaba Group Holding Ltd., Tencent Holdings Ltd. and Meituan -- have shed more than $100 billion in the span of three turbulent days.

I don’t invest in China and do not think I ever will.

Pentagon approves National Guard deployment ahead of DC trucker convoy

Two prosecutors working on Manhattan DA's Trump Organization probe resign

According to the CNN article, Bragg has “doubts” about moving forward with the case.

Dysfunctional policies have broken America’s housing supply chain

Consumers lost $5.8 billion to fraud last year — up 70% over 2020

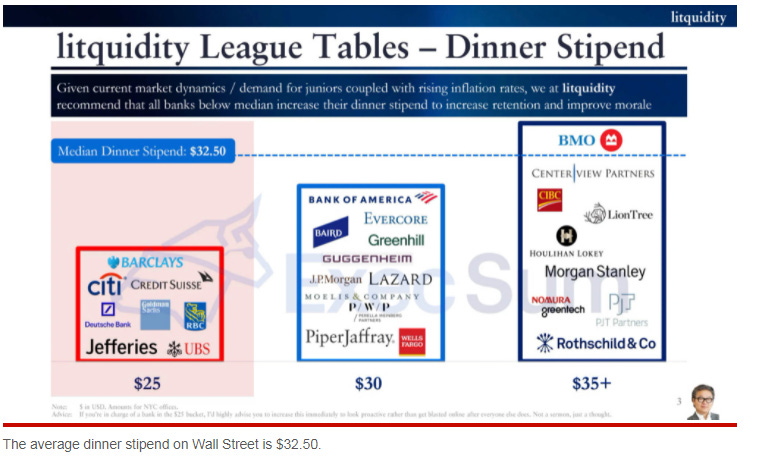

Goldman Sachs bankers gripe their dinner stipends won’t even cover Chipotle

This brings back memories of working late and getting reimbursed for food.

At least 6 NYC subway stabbings reported since the mayor unveiled new safety plan Friday

Were the assailants caught? Arrested? Will they be prosecuted?

Los Angeles prosecutor admits 2-year sentence for child molester may be too lenient

Ahmaud Arbery's killers found guilty on all counts in federal hate crime trial

I am glad this was the verdict. I want harsher punishments for hate crimes.

Eric Adams supports rolling back NYC’s COVID-19 passport requirements

Michigan coach Juwan Howard suspended 5 games for striking Wisconsin assistant

To me, this was the least punishment they could have given the coach for striking another person.

Michael Jordan Blatantly Ignores Charles Barkley at the NBA All-Star Game to Accentuate Their Rift

This is a shame as I do not feel Barkley did anything wrong, yet Jordan has made it clear the friendship is over.

16-year-old Indian chess sensation Rameshbabu Praggnanandhaa stuns world No. 1 Magnus Carlsen

This is incredibly impressive as Carlsen does not lose often. My son, Jack, played Carlsen one on one in person in May of 2014 and it took Carlsen what seemed like seconds to have Jack pinned. Jack is now 1.5” taller than Magnus Carlsen despite being 2 feet shorter in this picture.

His mother promised him $1,800 when he turned 18 -- if he stayed off social media for 6 years

I love this and I should do it with my kids. Social media is awful.

Liquid gems may rain from the sky on this sizzling hot exoplanet

WASP-121b is 855 light-years from earth, but has metal clouds which rain liquid gems. I want to go there and get rained on given my anniversary is coming up and it will save me a trip to the jeweler. Too bad it is ultra hot and has 11,000 mph winds. By the time I get there an back I think I will miss my anniversary. I had to do the calculation and it turns out the round trip is 10,089,000,000,000,000 miles. A light year is 5.9 trillion miles.

Museum of the Future, the most beautiful building on earth, opens in Dubai

The video is pretty remarkable and only lasts 10 seconds.

Virus/Vaccine

Cases continue to fall and they are down to 82k/day or -66% from the prior two weeks. If you recall, peak cases were 1/14 at 807k/day which means we are -90% from peak. Hospitalizations dropped 44% to 62k and ICUs are -41% to 12k. Deaths were -24% and are just under 2k/day after peaking at 2.7k three weeks ago. I am shortening the Virus/Vaccine section until there is meaningful news.

A long time reader, Peter, sent me this story that I had missed from the WSJ. I have written on this topic previously and that is excess death not explained by COVID. Both article today reiterate the costs of the lockdowns. Just another example of the impact of the China lies and deceit. They have yet to pay a price for the 6mm lives lost directly due to COVID, trillions in damages, disruption in lives, educational issues…. U.S. life insurers, as expected, made a large number of Covid-19 death-benefit payouts last year. More surprisingly, many saw a jump in other death claims, too. Industry executives and actuaries believe many of these other fatalities are tied to delays in medical care as a result of lockdowns in 2020, and then, later, people’s fears of seeking out treatment and trouble lining up appointments. “The losses we are seeing continue to be elevated over 2019 levels due at least in part, we believe, to the pandemic and the existence of either delayed or unavailable healthcare,” Globe Life finance chief Frank Svoboda told analysts and investors earlier this month. “We anticipate that they’ll start to be less impactful over the course of 2022 but we do anticipate that we’ll still at least see some elevated levels throughout the year,” he said. Trade group American Council of Life Insurance said the pandemic in 2020 drove the biggest annual increase in death benefits paid by U.S. carriers since the 1918 influenza epidemic, totaling billions of dollars.

Lockdowns did way more harm than good is the key point of a new book by a professor who advised the UK government on Covid Mark Woolhouse is professor of infectious disease epidemiology at the University of Edinburgh in Scotland, SAGE adviser, and now author of ‘The Year the World Went Mad’, a personal, insider’s view of how the Covid pandemic played out. The story is one of constant lurches from complacency to panic, optimism to pessimism, and back again. As he eloquently puts it, “I did not expect that elementary principles of epidemiology would be misunderstood and ignored, that tried-and-trusted approaches to public health would be pushed aside, that so many scientists would abandon their objectivity, or that plain common sense will be a casualty of the crisis. Yet – as I’ve explained – these things did happen, and we have all seen the result. I didn’t expect the world to go mad. But it did.” Lockdown, he argues, was a declaration of failure. It was a failure that was perhaps understandable in the circumstances of March 2020, but one that should never have been repeated.

Real Estate

I received great emails from Jared Halpern from Douglas Elliman in NYC. Jared is telling us just how hot the NYC rental market has become. I have the luxury of having a diverse reader group who helps me with differentiated content you won’t find elsewhere. BLDG is one of the largest landlords in the city and outer boroughs. I just received their broker blast with their availabilities portfolio wide and it was 5 pages…pre covid it was 50+ pages. The rental market is absolutely insane and if you want an entry level studio or 1 bed in the up to $3,500 range GOOD LUCK. And for the most part good luck in any sector of the rental market in NYC right now. I sent an inquiry for a friend to view an apartment and this is the response (and similar on other listings) I got. Typical response would be no problem when would you like to show etc. I am also working with a client’s employee they are relocating from Boca to NYC and we have struggled for a couple weeks now to find a solid two bed two bath on UES or UWS up to $8,000.

Response From Potential Landlord:

Hello,

Thank you for your interest. Due to heavy interest, we are holding off on showings until you have read the listing description, watched the video, and you can confirm that you have already collected your paperwork. (the full list is here)

If you wish to set up an appointment, we will need to see a letter of employment from your employer at the least as well as the below questions answered in FULL. (feel free to cut & paste the response below when you respond)

-your full name(s) (all names if there are more than a single occupant, guarantor & or a decision-maker)

-move-in deadline

-maximum budget (based on the 40X rent rule)

-pets situation

-employment background information

-Are you on a lease? If so, when does it expire? If not, what is your current living situation?

Please ensure that all questions are answered in full. Also, please reply-all if other correspondents are on this email.

Due to the very heavy volume of interest on these listings, a response to this email without answering the entire above questions, as well as an employment letter issued by your HR or management verifying your salary (& guarantors if necessary) will respectfully not get a response. We thank you in advance for your time, understanding, & cooperation regarding this matter. My team & I sincerely look forward to scheduling a viewing with you! Stay safe & have a wonderful day!

Here is another email from Jared:

We have a big client that owns a 5 story 12 unit building on the UES. Asked us to list a one bed for $2,100 for him. I had over 200 inquiries in 36 hours and over 40 showings during the one hour open house. The apartment was tenant occupied and she gave me 1 hour. The people lined up outside the building waiting to get in. I received 5 applications probably would have received a dozen more had people not gotten discouraged by how many people were there. Went for well above ask.

This NY Post story is entitled, ‘It should be illegal’: NYC landlords slap tenants with huge rent hikes’ and reiterates Jared’s comments on the rental market. The examples in the article are crazy. $4k for a studio in the West Village.

Home prices rose 18.8% in 2021, according to the S&P CoreLogic Case-Shiller US National Home Price Index, the biggest increase in 34 years of data and substantially ahead of 2020's 10.4% gain. All regions saw price gains last year, but increases were strongest in the South and the Southeast, each of which were up over 25%. Phoenix, Tampa and Miami reported the highest annual gains among the 20 cities in the index in December. Phoenix led the way for the 31st consecutive month with prices 32.5% higher than the year before. It was followed by Tampa with a 29.4% increase, and Miami, with a 27.3% increase.

All 20 cities saw price increases in 2021, and prices in all 20 are at their all-time highs. I do not believe we will see the elevated continued growth rates in prices nationally as homes are becoming unaffordable and rates are going up. We have largely seen declines in mortgage rates since the early 1980s when rates peaked at 18.4%! Lows were 2.67% in December of 2020. Of note, mortgage applications dropped to the lowest level in 2 years and refinancings were 56% lower than one year ago. The average rate for a 30-year conforming mortgage is up to 4.06% with .48 points. We are now in a rising rate environment for the next year or more which will bite into housing demand, especially at the lower price points where people are more focused on monthly payments. On a positive note, we are paying a lot less today than any other time in history other than the last year or so. The chart below only goes through February 10th and the data in the paragraph above is updated through 2/22 so there is a slight disconnect. Also of note is they are from different sources, but the chart shows the trend recent upward trend after 40 years of a downtrend.

This chart was taken from the Case-Shiller report. There are dozens of charts in the link.

A reader and real estate developer sent me this interesting article. A South Florida Sun Sentinel study found that less than 1% of vacant land can be developed in Broward and Palm Beach counties – mainly scattered individual lots. Very little vacant land is left for building homes in South Florida, but just how scarce are the options? As the region struggles with a housing shortage, the amount of vacant land zoned for residences is down to less than 1% in parts of the region. The South Florida Sun Sentinel requested the amount of all vacant land parcels that are currently zoned “vacant residential” or “vacant commercial” from the Palm Beach County and Broward County property appraiser’s office. According to an analysis of the data, there are only about 20 square miles, or less than 1%, of land that remains vacant and zoned for residential use. For perspective, Palm Beach County is 2,383 square miles. On top of that, those 20 square miles are fractured into hundreds of lots all over the place. It’s even worse in Broward County. Of the county’s 1,323 square miles, only 5 square miles, or less than 1%, remain vacant and zoned for residential use. Miami-Dade County did not return the request for information. Due to such limited land supply, I see prices especially in Palm Beach County staying strong. However, I also believe the limited inventory is pushing development to Hobe Sound, Stuart and beyond. A ton of new developments and courses going on right now up north.

Blockchain.com is leasing a 22,000-square-foot (2,044-square-meter) office in Miami’s Wynwood arts district, close to Peter Thiel’s Founders Fund, in the latest sign of crypto industry expansion in the Florida city. The company will eventually employ about 300 people in the building formerly known as Cube Wynwd, which will become the Blockchain.com Building. Blockchain.com moved its Americas headquarters to Miami from New York last year, and had been in a temporary space in nearby Brickell. The move has coincided with a large increase in head count at the company, which was valued at $5.2 billion in a 2021 fundraising.