Term Limits Please

9-26-21

Opening Comments

Picture of the Day-Used Car Prices

Quick Bites

Markets, Crypto/China Article, Oil Prices, Supply Chain Issues

Billionaire Tax on Unrealized Cap Gains

Women Controlled IB, College Trends/Jobs-No College

Drugs In NYC, Taliban Brutal Rule, Chris Cuomo

Border Issues

Virus/Vaccine

Head of CDC on Boosters

Moderna CEO on End of Pandemic

Natural Immunity Legal Challenge

NY Hospital Personnel & Vaccine Mandates

Real Estate

My General Comments/Mortgage Rates

Household Net Worth and R/E

432 Park Lawsuits

Midtown Apartment Sale for $35mm

Opening Comments

Apologies about the last report. Substack blocked my delivery until they “approved” me for not being spam. I was a bit upset as I have never been blocked before, but they assured me it was a one time thing.

After two full weeks, my back is starting to get better. Thank you to all who gave me ideas and thoughts. One crazy one is “Cupping” where they put some kind of suction cup on your back and it looks like you have massive hickeys all over the place. I am yet to try it, but a handful of readers swear by it. At this point, I will try anything. Below is a picture from the internet on cupping.

A few years ago I had spoken with an exotic car dealer owner who told me Rolls Royce cars depreciate at a crazy rate and he does not recommend ever buying them. It was not like I was considering buying one in the first place. On Friday, I was speaking with a wealthy man about his cars and he said, “I am selling my cars, the market is insane.” He bought a Rolls Royce over two years ago for $360k and sold it with over 5,000 miles for $392k. He also sold his AMG G-Wagon which he bought for $181k and sold for $241k again it was over 2 years old. Rolls Royce generally deprecate by 32% after two years, in this case, it appreciated 9%. Another guy chimed in on the conversation and said that when he recently returned his car on lease, the dealer cut him a substantial check to prevent him from buying the car. The dealer so desperately needed the inventory, they paid him to return the car early. These are depreciating assets actually increasing in value.

I just don’t understand how the incredible accommodation at the Fed level coupled with supply chain issues is a good thing Boats are notoriously bad investments. Not today, used boats are going up in price. The backwards price action makes me feel uncomfortable. I am hoping for a return to normal soon which does not see assets rise dramatically in price when they should be falling.

My sister, Debbie, proof reads many of my reports. She is on vacation for a couple weeks, so if you find an extra typo, blame her, not me. Given she is so highly paid for her services (ZERO dollars), I do not feel she deserves any vacation time. She is heading to the wedding of her daughter, my niece, so at least it is for a good cause.

Picture of the Day

To continue the theme from my opening comments, I inserted the Manheim Used Vehicle Index chart below. Americans bought fewer used cars in August, but that didn’t drive prices down. The average listing price for a used car rose to $25,829 – another record in a year of nonstop records. Used car advertised prices have risen 24 percent in one year and 34 percent since August of 2019, before the COVID-19 pandemic rocked markets.

Term Limits

I have been critical of countless politicians because generally they are rotten in my opinion and in many cases overstay their welcome. This is not a right or left issue, but a general political comment. Yesterday, I read that Senator Chuck Grassley (R-Iowa) is 88 years old and is seeking yet another term. He would turn 95 years old during his next term if re-elected. Grassley was in the House beginning in 1975 and then ran for Senate in 1980 taking office 1/3/81. He has served approximately 45 years between Congress and the Senate and wants another 6 year term. The article reminds me what is wrong with our political system. We are in desperate need of term limits. I have attached a chart of the longest tenured Senators and members of the House in history. The top 25 range from 44 years to over 59 years of service. The 100th ranked person is at 36 years for perspective. Seems like things are getting a bit stale to me.

My problem with politicians is once they are elected, they are focused on re-election, not making the right decisions for the LONG TERM best interests of the constituents.

Many politicians don’t understand the real world of small business. Here is a great example from an article. Term limits also would provide inescapable, bracing reminders of what life in the real world is like. After former Senator George McGovern tried (and failed) to succeed in small business after spending eighteen years in Congress, he observed: "I wish I had known a little more about the problems of the private sector.... I have to pay taxes, meet a payroll -- I wish I had a better sense of what it took to do that when I was in Washington." (Fund, op. cit., p. 10.) Ensuring that Members eventually are exposed to life outside of Congress should inculcate a more sophisticated understanding of the logic and the limits of federal regulation. To me, having real world business experience would be incredibly helpful to politicians.

Incumbents have a huge advantage in elections and term limits help to level the playing field. One article attached below suggests the tun over rate for House incumbents who attempt re-election is below 10%. This is in stark contrast to the first century of America's government, when long-term congressional incumbency was rare and Members often voluntarily chose to leave Washington and return home.

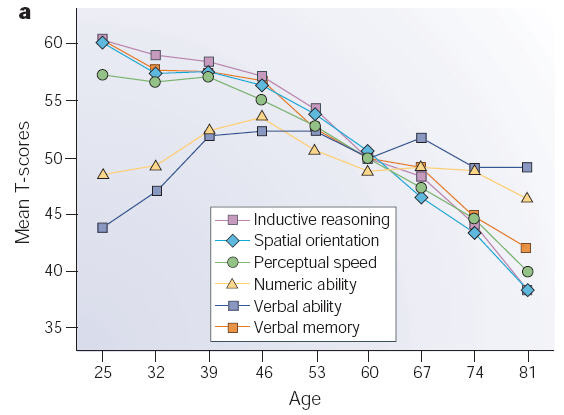

People in their 80s and 90s tend to have reduced cogitative functions. I am 51 and I feel I am less sharp than I was 15 years ago. I cannot imagine what it will be if I make 80, let alone 90+. I read a handful of articles on aging and cognitive decline. Below is a good chart from the article, “The Biology of Aging.” Note the steep declines in the 60s compared with the age of US politicians. In general, the symptoms of cognitive decline that are associated with aging include:

Slower inductive reasoning / slower problem solving

Diminished spatial orientation

Declines in perceptual speed

Decreased numeric ability

Losses in verbal memory

Few changes in verbal ability

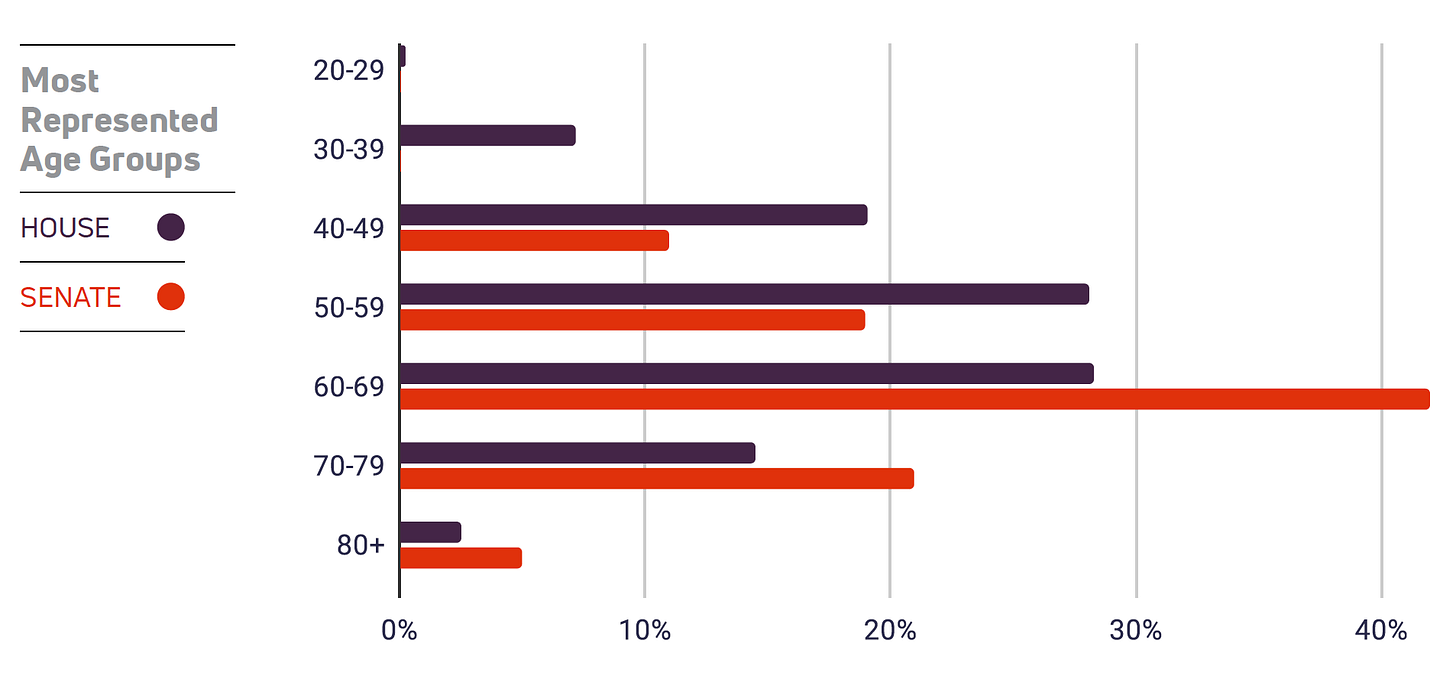

This chart is from an article from 2/21 which outlines ages of the House and Senate. Not a lot of spring chickens here. Approximately 70% of the Senate is over 60 years old. This CNN article came out this weekend and entitled, “They’re 80+. The’re in charge. They’re not going away.”

Here is an article outlining the most corrupt members of Congress and there are some real solid citizens outlined here. Both Democrats and Republicans are named in the article which cites: money laundering, tax evasion, using campaign money for personal purposes, prostitution, bribery, directing public money to the spouse….

To be balanced, I am including an article for term limits and against term limits. According to one article, term limits were contained in the Articles of Confederation, but not in the Constitution because its drafters saw it as “entering into too much detail.”

The article against term limits suggests it would 1) take away power from voters, 2) severely decrease congressional capacity, 3) limit incentives for gaining policy expertise, 4) kick out effective lawmakers, 5) do little to minimize corrupt behavior.

Despite these arguments, I would like to see term limits of 3 terms and then have politicians go and try to be productive members of society, not as lobbyists. I checked on Congressional approval ratings since 2010. The range is between 9% and 28%, so hardly a lot of support from the constituents. Maybe term limits would help improve how these politicians are perceived, as it would be hard to be much worse.

Quick Bites

The S&P 500 and the Dow Jones Industrial Average eked out gains on Friday, wrapping up a volatile week on Wall Street. A move by China to ban cryptocurrencies weighed on the technology sector and Nike shares fell as supply chain issues stemming from the pandemic hit the sneaker giant. The Dow Jones Industrial Average gained 33.18 points, or 0.10%, to 34,798. The S&P 500 edged 0.15% higher to 4,455 and the Nasdaq Composite ticked down 0.03% to 15,047. “As bad as things started off on Monday for stocks, a mid-week bounce and calm on Friday isn’t so bad,” said Ryan Detrick, chief market strategist for LPL Financial. “Still, many of the worries over Evergrande, a slowing economy, and continued supply chain issues are still out there.” 5 Day Chart of S&P 500 below. Big drop early in the week and then largely rallied from there. There is also more talk of US debt limit issues being breached by mid-October if the ceiling is not raised. This NBC article explains a bit what is going on with the subject, but expect more news on it this week.

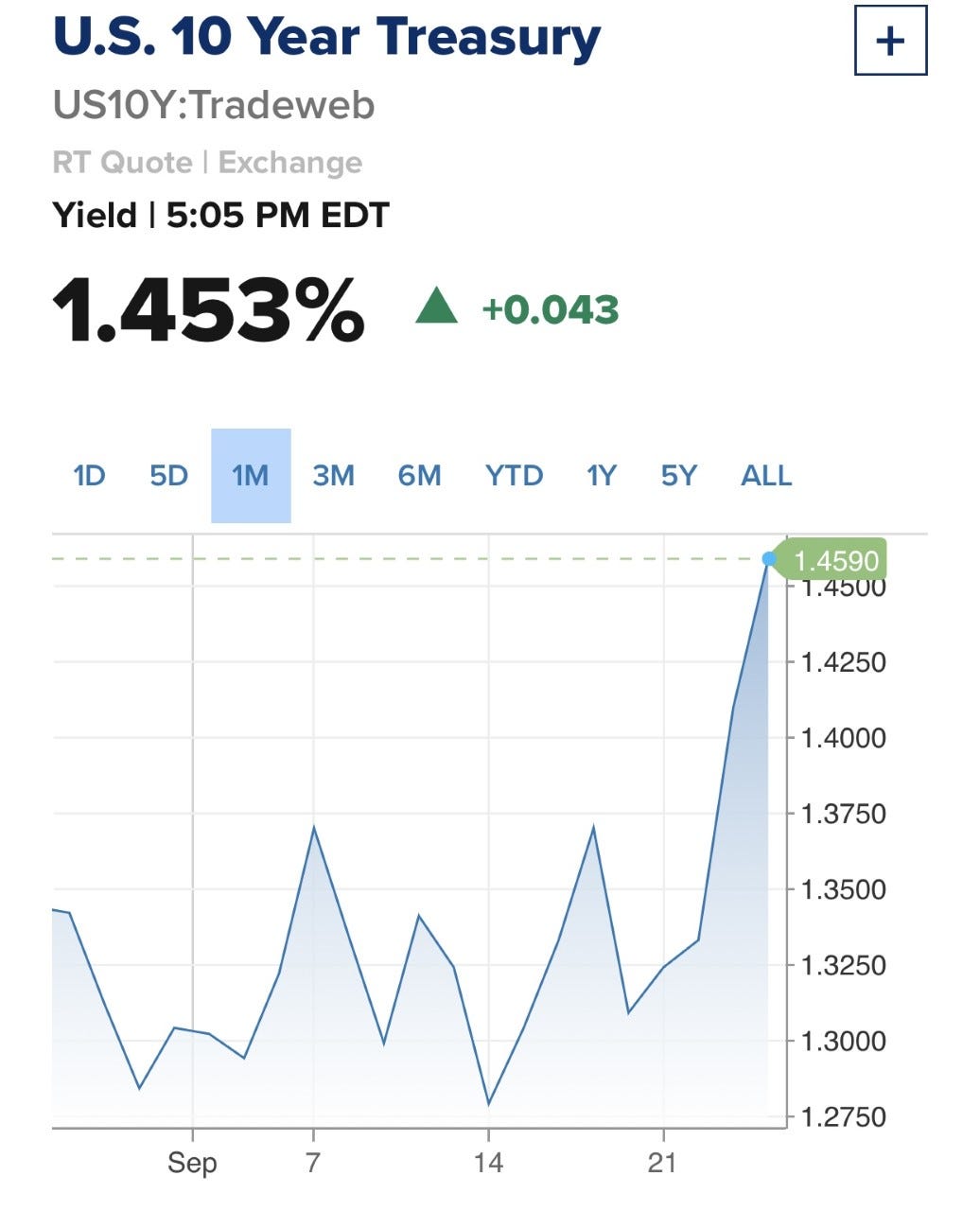

The 10 Year Treasury has moved decently in the pas week or so and wanted to mention it. The 10 Year is now at 1.45% after being as low as 1.15% in August. On 9/14 intraday the rate hit 1.26%, so almost 20 basis points in about 10 days.

Bitcoin and Ethereum tumbled into the red on Friday, with traders rattled by tough talk out of China. The price of Bitcoin fell sharply after the People’s Bank of China said in a Q&A that all crypto-related activities are illegal. Services offering trading, order matching or derivatives for virtual currencies are strictly prohibited, the PBOC said, while overseas exchanges are also illegal. Bitcoin fell from almost $45k to $42k, but has since rebounded back to $43k+ for perspective. A reader sent me a GS article entitled “Is China Investable,” which gives perspectives of a few experts.

Oil is almost at 5 year highs at $73.98/barrel and I am feeling it at the pump. During my well documented 8,000 miles of driving this summer, I became an expert on gas prices. This week, I spent $3.89/gallon to fill up my car in Florida. For perspective, during the peak of the lock downs, I filled up for $1.43/gallon. On a 20 gallon purchase, that is a $49.2 difference and I fill-up 7 times month. For a 12,000 mile/yr driver at 20 MPG, that equates to an incremental $1,476/year in gas relative to last year’s lows. Remember, the median household income is approximately $68k/year, so the increase in gas prices is meaningful. Add it to all the other price increases discussed at length in prior reports, and it really impacts many families. “As oil prices are on track to close another week of gains, the market is pricing in a prolonged impact of supply disruptions, and the likely storage draws that will be needed to fulfill refinery demand,” said Louise Dickson, senior oil markets analyst at Rystad Energy. 5 year oil chart below.

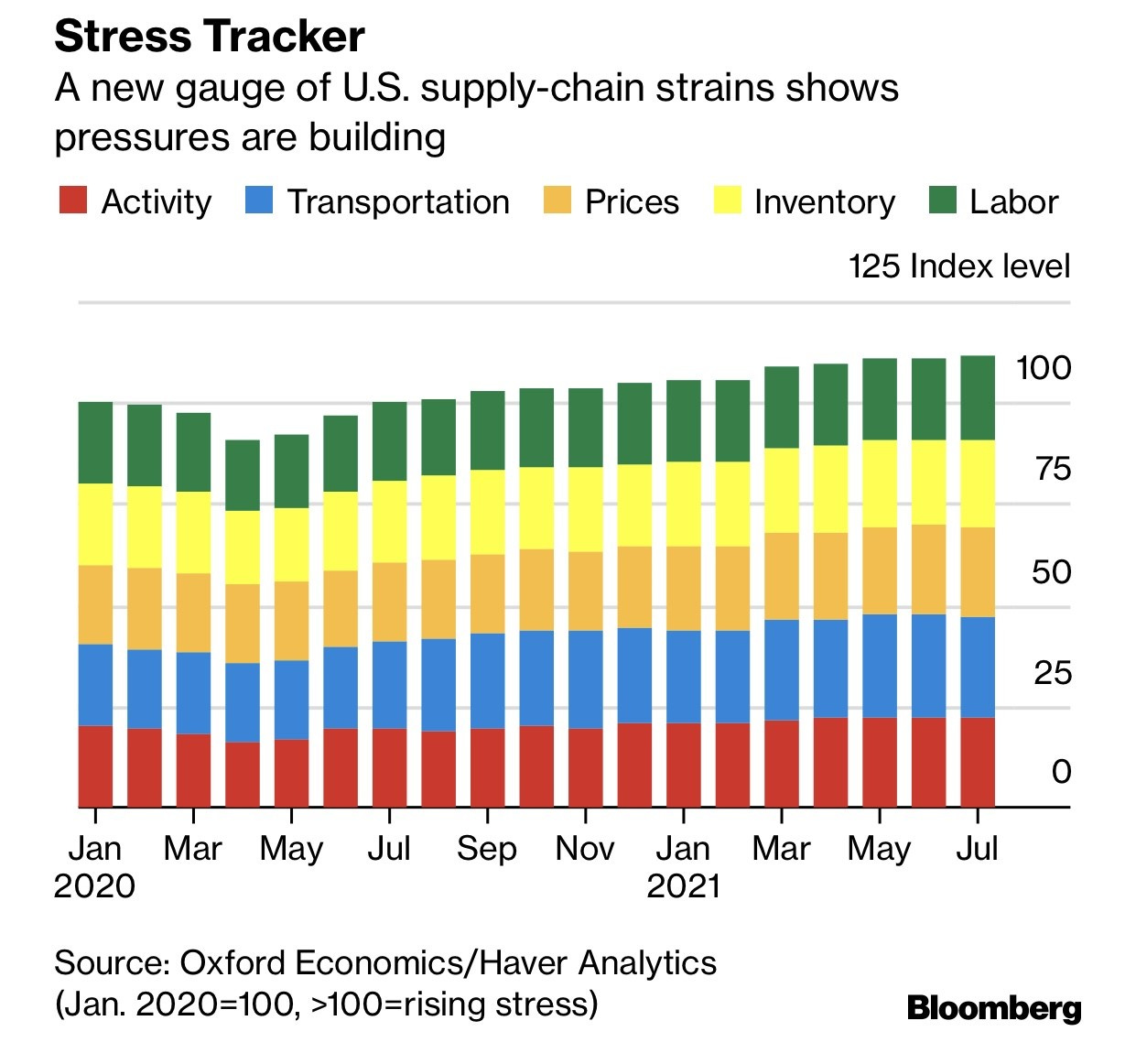

A few stories about supply chain disruptions or labor issues. Both are becoming more prevalent. Costco back to some limits on purchases due to supply chain issues. FedEx is rerouting more than 600,000 business packages a day, its president said Tuesday. It can't find enough workers to process them at some sites, Raj Subramaniam said. FedEx estimated that the labor shortage cost it around $450 million in the quarter. Nike said that global supply chain congestion is hurting the business more than it previously anticipated. The sneaker giant lowered its fiscal 2022 outlook to account for longer transit times, labor shortages and prolonged production shutdowns in Vietnam. Costco confirmed it will start limiting purchases on essential household products for what has become a perfect storm of supply chain delays for many retailers. "We are putting some limitations on key items like bath tissues, roll towels, Kirkland Signature water, high demand cleaning-related skews related to the uptick in the delta-related demand," Costco chief financial officer Richard Galanti said during the company’s fourth quarter earnings call. A Texas taco restaurant shut because it couldn't find enough staff in the labor shortage, its owner said. Staff were poached by bigger companies and job applicants didn't show up for interviews, he said. Restaurant staff have been leaving the industry in search of better wages and benefits. I have a water chiller in my sink which gives me ice cold and filtered water. The water was not cold and I needed a new chiller. I ordered one and they are not in stock with an expected 6 week lead time. You guessed it, supply chain issues. Pre-pandemic, the company told me they had hundreds in stock. This CNBC article is entitled, “Costco, Nike, & Fedex are warning there’s more inflation set to hit consumers as the holiday approaches.” The article suggests a 40’ shipping container from China to the US (LA) went from $2k to $16k. I spoke with someone who imports from China and they have seen the price move from $3.2k to $28k! It is so prohibitively expensive, he is no longer able to manufacture in China. To me, this is a good thing for the US and hopefully leads to more US manufacturing. The issue is, right now, factories cannot find people willing to work and are unable to make as much product as they should. This is a great Bloomberg article about global supply chains which included a US chart below. I have spent a great deal of time talking about inflation and supply chains for the past six months as I am concerned.

President Joe Biden said he supports a proposal to tax billionaires for the appreciation in their investments on an annual basis, a change that would prohibit some of the richest Americans from deferring their tax bills. The idea of a levy on unrealized appreciation is being promoted by Senate Finance Committee Chairman Ron Wyden, the Democrat in charge of compiling his chamber’s tax proposals to offset Biden’s social-spending agenda of up to $3.5 trillion. Wyden, who has been working on versions of this proposal for years, will release updated details soon, according to Ashley Schapitl, a spokeswoman for the senator. Requiring investors to pay taxes annually on their unrealized gains would end a longstanding rule that says levies aren’t due to the IRS unless an asset is sold. The change would require ultra-wealthy taxpayers to report on the gains and losses on their stock, bond and other asset holdings annually, rather than being able to defer any taxes until they sell. It’s not immediately clear the rate that would be applied to a new billionaires’ tax. To me, this is a horrible idea. I have not seen everything spelled out, but the ramifications would be dire for people who own a illiquid assets (R/E, privately held stock, art, family businesses…). I may start a valuation company if this happens as people will need to value a bunch of illiquid assets. How do you value a minority share in a privately held company? Bad idea.

I love the concept of this new Wall Street investment bank and hope these women crush it. Wall Street is about to get a new investment bank, one that very deliberately shatters the glass ceiling. The firm, Independence Point Advisors, will be a rarity that’s both owned and managed by women and minorities in an industry long dominated by White men. A wry joke early on that it should be called Salomon Sisters -- a twist on the testosterone-fueled Salomon Brothers of old -- has served as something of a code name for the venture among New York’s tight-knit crowd of bankers and financial headhunters. Independence Point is the brainchild of Anne Clarke Wolff, who most recently was chairman of Bank of America Corp.’s massive corporate and investment bank division. An alum herself and mainstay on American Banker’s “Most Powerful Women to Watch” list, Wolff, 56, previously held leadership posts at JPMorgan Chase & Co. and Citigroup Inc., working for Jamie Dimon and Michael Corbat.

Here are two related stories about education and careers. I have been critical of four year degrees for many given the rising costs coupled with starting salaries for many careers. To me, the economics are making less sense. Fewer men than women are attending college which is leading towards a "mating crisis," New York University professor Scott Galloway told CNN on Saturday. Women made up 59.5% of college students at the end of the 2020-2021 school year, an all-time high, the Wall Street Journal reported earlier this month. That's in comparison to 40.5% of men enrolled in college. Data from the National Center for Education Statistics found that in 1970, men made up close to 59% of those enrolled in college, compared to around 41% of women who were enrolled. Additionally, the Journal reported that in the next few years the education gap will widen so that for every one man that earns a college degree, two women would have earned one. Galloway told CNN that the problem is much bigger than just the current numbers because men drop out at greater rates than women. "College is becoming the domain of women and not men," he said. The next article lists high paying jobs which do not require a college degree. A report by The Interview Guys finds recreation and fitness studies teachers and plumbers are among the best-paying careers where you don’t need anything on your resume to get the job. Pipefitters, steamfitters, and insurance sales agents also need little to no experience, yet pay very well.

The Garment District is Gotham’s newest shooting gallery, a disturbing heroin hotspot of addicts booting up in broad daylight. The outgoing de Blasio administration appears unwilling or unable to address the crisis, as the quality-of-life disaster unfolds just steps from high-profile Midtown landmarks such as Macy’s, Madison Square Garden and the sparkling new Moynihan Train Hall. The block bordered by 35th and 36th streets, and Seventh and Eighth Avenues, is “littered with used needles, broken glass crack pipes, trash, urine, and feces” as junkies shoot up and dealers brazenly sell drugs, lamented one neighbor on social media. “I’ve personally seen dozens of deals go down. I’ve seen a person OD and nearly die.” In my last piece I included a short video of Eric Adams and was impressed. He said something I agree with 100%. It was about charging residents a premium and not giving premium service. His comments were suggesting the city needed to be cleaned up to expect people to want to live in NYC, spend excess on taxes and cost of living. I am in agreement and sure hope my long time home can be cleaned up again.

The Taliban will once again resort to executions and amputations to enforce a strict interpretation of Islamic law — though possibly not in public, one of the group’s founders said in a new interview. Mullah Nooruddin Turabi, the one-eyed, one-legged enforcer who was in charge of justice during the Taliban’s brutal rule two decades ago, warned the international community not to interfere with the new regime in Kabul. “Everyone criticized us for the punishments in the stadium, but we have never said anything about their laws and their punishments,” Turabi told the Associated Press from the capital. “No one will tell us what our laws should be. We will follow Islam and we will make our laws on the Quran,” he added. Sure does not sound like the kind of neighbor I would like to hang out with and watch college football with on Saturday afternoon.

I include this bullet, not because I believe Cuomo should be fired over this inappropriate act from 16 years ago, but because he claims he is Mr. Woke and is on the most woke network on TV. I like to call out hypocrisy. Cuomo’s email apology to his former boss about the incident is cringe worthy. This link has the actual email in it. Seems like brothers Chris and Andrew have something in common when it comes to being aggressive with women. A veteran TV news executive says CNN anchor Chris Cuomo sexually harassed her by squeezing her buttocks at a party in 2005. Shelley Ross said in an opinion piece in The New York Times on Friday that Chris Cuomo, who had formerly reported to her at ABC News, greeted her with a bear hug "while lowering one hand to firmly grab and squeeze the cheek of my buttock" while she was at a party with her husband. Ross said Cuomo told her, "I can do this now that you're no longer my boss," and she responded, "No you can't," pushing him off while stepping back to reveal her husband, who had witnessed the episode. Cuomo sent an email shortly afterward saying he was "ashamed." He mentioned a celebrity who had been arrested for similar behavior recently, and apologized to Ross and her husband.

Secretary of Homeland Security Alejandro Mayorkas admitted Sunday that the vast majority of Haitian migrants who crossed the southern U.S. border in recent weeks have already been released into the United States, and it is possible that more will follow them. So far, approximately 12,400 of the people are having their cases heard by immigration judges, while another 5,000 are being processed by the Department of Homeland Security. Currently,, only 3,000 are in detention. I am not a big fan of the current situation with respect to the flood of immigrants coming into the US and the policies around it. I am 100% supportive of allowing in some immigrants if they follow the proper process and are documented. What about vaccination status/requirements. Americans are being required by the Federal Government to work, colleges to attend school, employers to keep your job, but hundreds of thousands coming into the US illegally are not required? I read beginning October 1, there will be requirements for immigrants to be fully vaccinated, but believe there were no requirements previously.

Virus/Vaccine

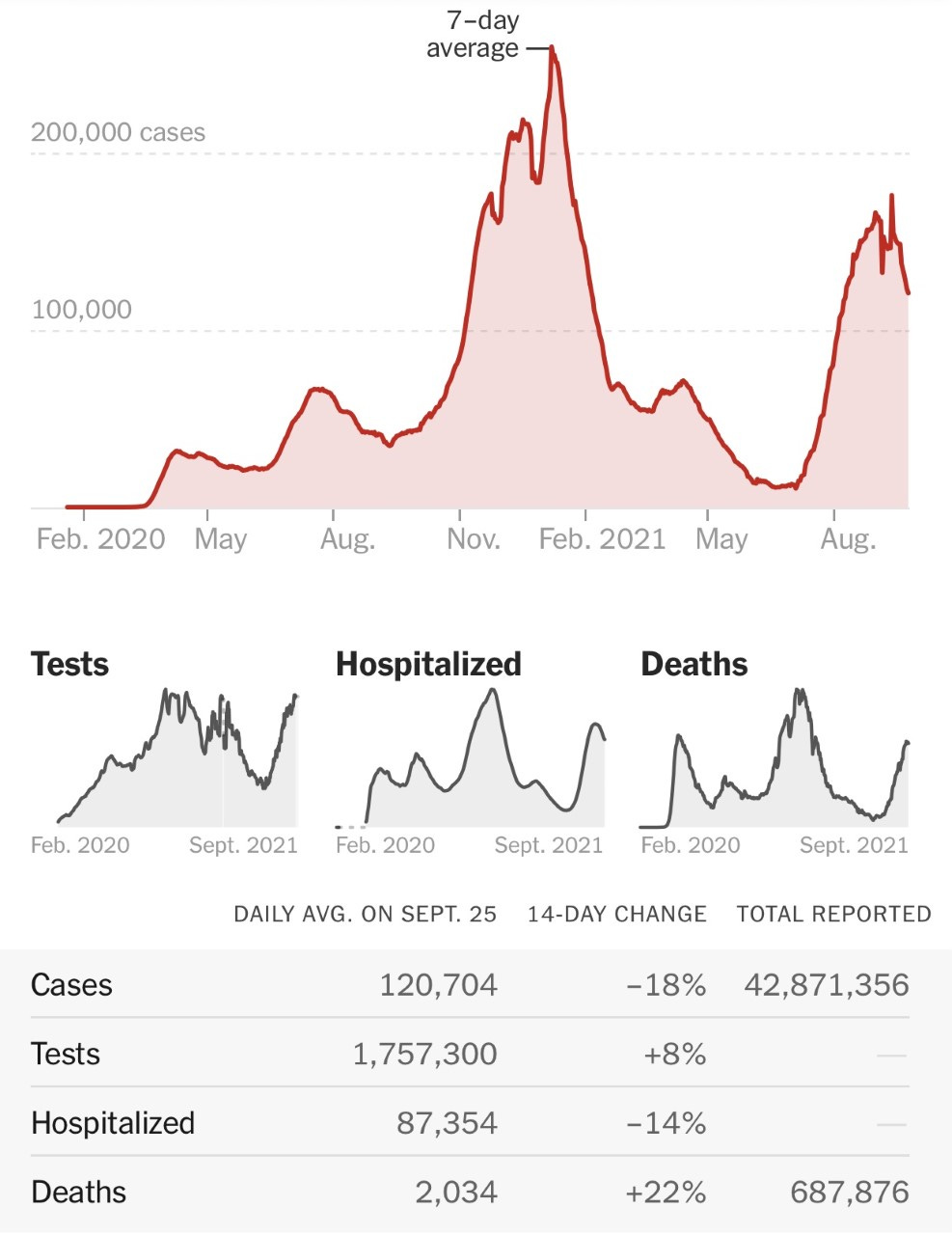

Cases and hospitalizations continue to decline and deaths are growing, but the rate of growth is declining. Cases are 120k/day, less than half of peak levels. Hospitalizations are down to 87k relative to 137k peak levels. Unfortunately, we remain over 2k/deaths a day, but peak was 3.4k/day. On vaccinations, over 6.1 billion doses have been administered across 184 countries. In the USA, 389 million doses have been administered at a rate of 693k/day. 55.2% of Americans are fully vaccinated and 64.2% of people have been given at least one dose according to Bloomberg.

The head of the Centers for Disease Control and Prevention overruled an advisory panel Friday by approving the distribution of Pfizer and BioNTech’s Covid-19 booster shots to a wide array of workers across the U.S. CDC Director Dr. Rochelle Walensky signed off on a series of recommendations from the panel, including distributing the shots to older Americans and adults with underlying medical conditions at least six months after their first series of shots. But she broke from the panel by also clearing boosters for those in high-risk occupational and institutional settings in an unusual decision that’s likely to stoke protests from anti-vaccine advocates. These mixed messages within the CDC sure don’t help matters.

Moderna Inc Chief Executive Stéphane Bancel thinks the coronavirus pandemic could be over in a year as increased vaccine production ensures global supplies, he told the Swiss newspaper Neue Zuercher Zeitung. "If you look at the industry-wide expansion of production capacities over the past six months, enough doses should be available by the middle of next year so that everyone on this earth can be vaccinated. Boosters should also be possible to the extent required," he told the newspaper in an interview. Vaccinations would soon be available even for infants, he said. I am not convinced this is the outcome and fear we will be living with COVID-19 and mutations for years to come. Singapore and Israel have far higher vaccination rates than the US with Singapore in the 80% range, yet they have seen numerous cases.

The argument that natural immunity against COVID-19 is an alternative to vaccination is emerging as a potential legal challenge to federally mandated vaccination policies. Vaccination is already required for certain workers and some college students. The federal government, despite steeper legal hurdles to imposing vaccination, has also invoked the U.S. Department of Labor to mandate inoculation for health care workers and is expected to roll out a larger policy effectively mandating vaccination for a majority of U.S. workers. The stated goal behind mandatory vaccination policies is to protect against the spread of disease, meaning that the crux of any policy is immunity. The notion that a previous COVID-19 infection provides natural immunity that can be at least as good as vaccination in some people is something a judge would likely need to consider in a challenge to a mandatory policy, especially against a government actor. “I think that a judge might reject a rule that's been issued by a body, like the U.S. Department of Labor or by a state, that has not been sufficiently thought through as it relates to the science,” Erik Eisenmann, a labor and employment attorney with Husch Blackwell, told Yahoo Finance.

In Buffalo, the Erie County Medical Center plans to suspend elective in-patient surgeries and not take intensive-care patients from other hospitals because it may soon fire about 400 employees who have chosen not to get vaccinated against the coronavirus. Officials at Northwell Health, New York’s largest provider of health care, estimate that they might have to fire thousands of people who have refused to get vaccinated. And while the vast majority of staff members at New York City’s largest private hospital network, NewYork-Presbyterian, had been vaccinated as of this week, more than 200 employees faced termination because they had not. These are just a fraction of the workers at risk of losing their jobs or being put on unpaid leave after Monday, when a state directive requiring hospital and nursing home employees in the state to have received at least one shot of a virus vaccine takes effect. As of Sept. 22, state data shows, around 84 percent of New York’s 450,000 hospital workers and 83 percent of its 145,400 nursing home employees had been fully vaccinated. But tens of thousands of people are estimated not to have gotten a shot despite being threatened with losing their jobs. The holdouts say they fear potential side effects from the vaccines, have natural immunity or believe that the mandate violates their personal freedom. I am vaccinated, but understand people’s desire to make their own decisions, especially if they were infected and have natural immunity. Employers are in desperate need of bodies and it seems from these articles, thousands of hospital workers may not be eligible given vaccine requirements just as flu season is coming and we are still dealing with elevated cases, hospitalizations and deaths.

Real Estate

I spoke with a large real estate landlord in NYC who owns Class A office space. His buildings were down to below 10% for occupancy (not leases) and it got all the way up to 30%. Today, it is back down to 23% in terms of people in the building on any given day. This is crushing the retail component of the buildings in Midtown. I also connected with another landlord who owns properties around the city. His office space is struggling, especially near the Garden, but his apartments are full with rents rising again.

I remain convinced that R/E down here will slow down on the gains. I spoke with someone who told me about a house on Palm Island in Miami which sold for $19mm 13 months ago just received an unsolicited offer of $35mm. Real estate in South Florida is becoming too expensive and remember, I am long South Florida R/E. Even lower end homes have gone up by multiples and finding an affordable home is extremely challenging. The Surf Club in Surfside has multiple recent sales for between $3,500-4,000 foot for ocean facing units. South Florida is not accustomed to such high prices on a square foot basis. I am told of builders spending upwards of $800/foot to build high end single family homes down here. I feel 4 years ago, the number for a high end home was closer to $400/foot to build.

The average 30 year mortgage is now at 3.13% after a recent low of 2.9%. The rate increased 9bps on Friday alone given the 10 year Treasury is back up to 1.45% after being as low as 1.15% in August.

U.S. household net worth surged to an all-time high in the second quarter, powered by a buoyant stock market and a record $1.2 trillion jump in real estate valuations. A Federal Reserve report on Thursday showed that household net worth rose by $5.8 trillion, or 4.3 percent to $141.7 trillion in the period, according to Bloomberg. In June alone, home prices rose 18.6 percent, the biggest increase in three decades

The next two stories are about high end condo buildings in midtown Manhattan. To me, I would NEVER live in midtown. It is a commercial area filled with office buildings. Despite my view, people rushed to buy these over priced condos and in the story of 432 Park Avenue, there are a lot of lawsuits about the quality of the building. A friend of mine knew how much I disliked living in a co-op and suggested I sell to buy in 432 Park. I am sure glad I did not do that, but instead migrated 1,300 miles south. A condo board representing the residents of one of the tallest and ritziest buildings on Manhattan’s Billionaires’ Row have sued the developers of the ultra-luxe building, alleging that over 1,500 design flaws have led to flooding, electrical explosions and “horrible and obtrusive noise and vibration.” The board accused the developers of the 1,396-foot skyscraper at 432 Park Ave. for failing to properly design the building and refusing to take responsibility for issues that have “endangered and inconvenienced residents, guests, and workers,” according to the suit, filed Thursday evening in New York Supreme Court. “This case presents one of the worst examples of sponsor malfeasance in the development of a luxury condominium in the history of New York City,” the suit claims, referring to the building’s developers, CIM Group and Macklowe Properties.

A penthouse on the 74th floor of 53 West 53 is in contract. The two-bedroom, 2½-bathroom home was asking $35.46 million. The deal was first reported by Marketproof. At 4,928 square feet, the full-floor residence floating above the Museum of Modern Art features views of the skyline, Central Park and the Hudson and East rivers. Details include direct elevator access, 11-foot ceilings, floor-to-ceiling windows, and an eat-in kitchen. The main bedroom boasts three walls of glass, a walk-in closet and an ensuite bathroom with radiant heated floors. There is not a price for me to live in this location in NYC, let alone at $7,000/ft. This area and around the UN are my least favorite places to live in Manhattan. 53rd Street is in the middle of Midtown and is very corporate and has zero residential feel. However, clearly there are some amazing views. No, I would never live above the 20th floor in one of these buildings.