Opening Comments

Video of the Day-Eric Adams Interview

Quick Bites

Evergrande/Market Sell off, Fed, High Yield,

Home-builders, Rent/Inflation/Dimon Views

New Car Wait, LA Container Ship Mess, China Policies

Chicago Guaranteed Income, Google $2.1bn Building

Social Darwinism, Ben & Jerry’s at it Again

Virus/Vaccine

Data

Covid Deaths by Age (data and chart)-Take a look at this one

New Variant

Pfizer 5-11 year old

Real Estate

My General Comments

Hoboken Townhouse Sells for $7mm

Opening Comments

I tried to send last night and was blocked by Substack for the first time. I just received approval to send. Very frustrating. My apologies.

Idid my first session of Tai Chi. A generous reader concerned about my back got me a few on-line sessions. It was not strenuous, but getting the breathing down was more challening than I imagined. Clearly, I am not a black belt after an hour.

One of the reasons I enjoy writing the Rosen Report are the connections I have made with countless new people. I learn from my interactions and thoughtful responses from readers. I write in hope of telling stories which resonate and giving information readers will find interesting. Some of my personal stories or articles evoke strong responses from readers and I often receive long emails with reader’s opinions. I do my best to respond to each one. I insert my opinions throughout the piece and enjoy when readers send thoughts. In some cases, readers are in agreement with my views and others suggest I am a moron for coming to such conclusions. I enjoy all the interactions despite some of them being more hostile than I imagined.

In my piece, I had written about the Bloomberg business school rankings and questioned how some schools were ranked higher than others. After my note, a reader sent me a podcast entitled “Revisionist History,” by a favorite of mine, Malcolm Gladwell. My reader friend sent me the podcast where Gladwell did a deep dive on the process US News and World Reports uses to rank schools. It was EYE OPENING. The podcast basically tells you the metrics used to rank are incredibly biased. I never put too much faith in rankings, but now I realize they are not worth much. For those who like Gladwell and are interested, they are in links below and about 40 minutes each. If you only listen to one podcast, listen to Part Two. Thank you Munroe for sharing. My favorite Gladwell books are Outliers and Blink. Gladwell said the word, “lugubrious,” and I did not know what it meant. It means, “looking or sounding sad and dismal.” I have a new word which will be inserted in future reports and if you are careful readers, you too will know what it means when I use it. Maybe all my readers who went to top US News rated liberal arts schools knew the meaning of lugubrious. Oh yea, ratings are meaningless.

Malcolm Gladwell

A friend of mine who I fish will regularly caught this beast of a wahoo on Monday night right by my house. Wahoo is my favorite fish to eat and I make sushi and seared wahoo. I catch a ton in Bimini. My record is 50lbs and the World Record is 184lbs. My bucket list is for a 100lb wahoo, but not sure how I would reel it in as they fight like crazy. Wahoo just started running as they show up as water temps drop. These things swim 60 mph and have teeth like razor blades. A lot of fun to catch, but dangerous. This one is 42 lbs.

Video of the Day

I have let my feelings be known about the quality of life in NYC for years. I did leave over four years ago, after all. However, I am seeing a glimmer of hope. I saw another CNBC interview with Mayoral candidate, Eric Adams. I feel Adams is saying a lot of the right things and if his actions match his words (easier said than done), I can see NYC changing for the better. I feel his answers are spot on in many cases around the migration out of NYC, business, safety, policing, bail reform… The video is six minutes long. I actually believe it would be nearly impossible to have a worse mayor than DeBlasio. However, the NY Post is running with an article about a potential illegal conversion at his Brooklyn and failed to list the residence on federal tax filings. I sure hope something like this does not become an issue for what seems like a qualified candidate. AOC is asking for the instant release of all Rikers Island detainees due to increasingly dangerous conditions at the jail. DeBlasio is not biting. Let’s hope it stays that way.

The Beast

Coming up with new ideas for the subject piece can be challenging after writing this blog for 18 months and at one point, it was daily. For some Rosen Reports, the theme just happens because I just witnessed or lived it. For others, I go into old pictures trying to think of stories which happened to me that I believe readers might enjoy. For this one, I was going through old Shutterfly albums when I came across some fond memories of my daughter, Julia, and I on the crazy sightseeing speedboat called, “The Beast” in August 2014. Julia was 7 years old and I was 44. Included on our crazy ride was Laude (Opare from Spain). I think I may have mentioned this story in an old report, but could not find it.

Julia loves adventures, wild rides, and chaos. She makes me go on crazy roller coasters and death rides at carnivals where I am convinced we may not make it. When I suggested a site seeing tour, Julia was not fired up. I surprised her that it was actually a 1,400 horse-power speed boat. I was not prepared for what happened.

We got on the boat and they asked us if we minded getting wet. Julia said, “I want to get soaked.” I am not sure Julia appreciated what was getting ready to take place. They clearly seated us where the heavy water would hit us. I brought my Go Pro I used for surfing and attached it to the seat in front of us to take pictures of the day. It started off tame and Julia was disappointed. As you can see, things got heavy in a hurry and we were soaked from head to toe. The Beast is downtown and we had to take a subway back uptown and were drenched. Julia was freezing and we went into some 99 cent store and bought her new clothes as she was too cold to get home as a wet rat. The pictures below were in the progression of the day. Started off dry and smiling and ended soaked.

Quick Bites

I wrote about Evergrande (China Developer) a couple weeks ago and as it continues to deteriorate, there has been some contagion in global markets. However, I feel it is unfair to blame all of the sell off on the China story. I do not believe this is a Lehman moment. Stocks, crypto, and commodities all sold off on Monday and despite trying to rally Tuesday, could not. I have written recently that about more strategists concerned about valuations, the need for a pullback after an incredible run, concerns about inflation, valuations and the Fed. Also, I have written about September being an historically weak month for performance. To me, Evergrande concerns may be the catalyst, but all these other things play a part. Evergrande announced they will make a bond interest payment on domestic bonds on Thursday, but did not comment on offshore bond payments. The announcement coupled with the liquidity injected by the Bank of China has calmed markets and after a brief sell off, China stocks were up.

The markets sold off sharply Monday and tried to unsuccessfully rebound Tuesday. However, Wednesday saw a healthy pop as Evergrande announcement it was making Thursday’s bond interest payment. Wedneday, stock markets were up approximately 1% in the US and ended slightly higher in China after an am sell-off. However, month to date, the S&P 500 is down 3% in September, as the market closed at 4,529 at the end of August and is at 4,395 today. The Fed announced it held benchmark interest rates near zero, but indicated rate hikes could be coming a bit sooner than expected while significantly cutting their economic outlook for this year. The committee now sees GDP rising just 5.9% this year, compared to a 7% forecast in June. However, 2023 growth is now set at 3.8%, compared to 3.3% previously, and 2.5% in 2023, up one-tenth of a percentage point.

This CNBC survery suggests investors are a bit more cautious.I have written over the past couple weeks about strategists and CIOs being more conservative on markets. Wall Street investors believe it’s time to take some risk off the table as concerns continue to pile up this month, according to the new CNBC Delivering Alpha investor survey. We polled about 400 chief investment officers, equity strategists, portfolio managers and CNBC contributors who manage money about where they stood on the markets for the rest of 2021 and next year. The survey was conducted this week. More than three quarters of the respondents said now is a time to be very conservative in the stock market when asked what kind of market risk they are willing to accept for themselves and their clients.

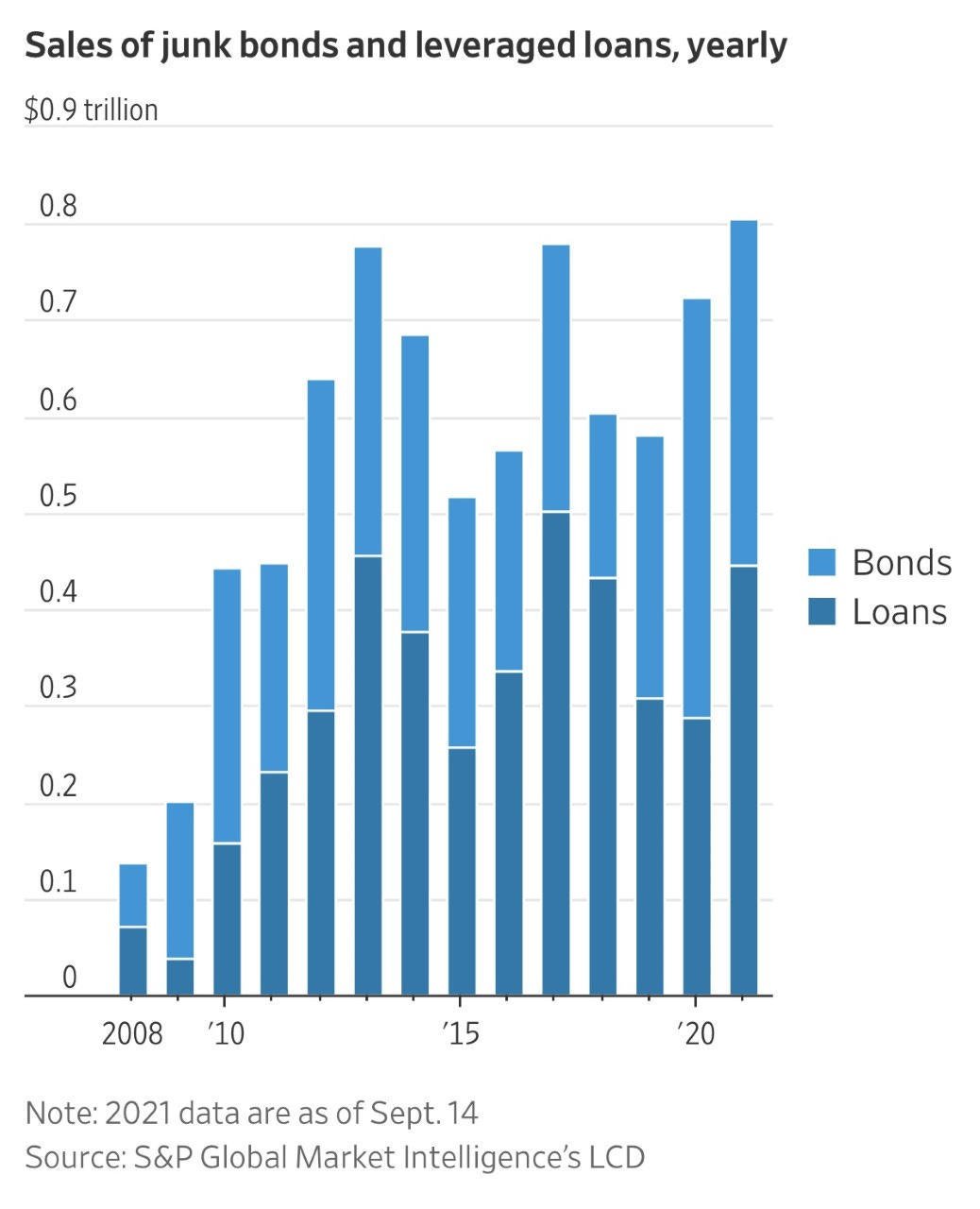

The $3 trillion market for low-rated companies’ debt is having its best year ever, powered by a rebounding economy and investors’ demand for any extra yield. U.S. companies including Crocs and SeaWorld have sold more than $786 billion of junk-rated bonds and loans so far in 2021, according to S&P Global Market Intelligence’s S&P. That tops the previous high for a full year in data going back to 2008. The record issuance marks a notable rebound from March 2020, when investors’ worries about widespread bankruptcies and defaults sent prices for low-rated debt slumping. Now, low interest rates and a stimulus-fueled economic rebound that has supported companies with weaker credit ratings have boosted the appeal of riskier debt. The HY market has been wide open with many junk bonds trading in the 3% range. I feel accomodative Fed policies and zero rates for years lead to sloppy deals getting done and complacent investors starving for yield. As the economy eventually slows (always happens), we will see many defaults and lower recoveries due to the crap deals the market absorbed during the frenzy. Most HY indices are up 5% on the year

Homebuilders in the single-family construction market are feeling better, as lumber prices are way down from sky-high levels and buyer demand is growing. Builder sentiment rose 1 point in September to 76, according to the National Association of Home Builders/Wells Fargo Housing Market Index. It was the first increase in three months. Sentiment stood at 83 in September of last year and then set a record high of 90 last November. It then dropped off dramatically when lumber prices spiked and supply chain issues hampered construction. “The September data show stability as some building material cost challenges ease, particularly for softwood lumber. However, delivery times remain extended and the chronic construction labor shortage is expected to persist as the overall labor market recovers,” said NAHB Chairman Chuck Fowke. Lumber reached more than $1,600 per thousand board feet this spring, but the more recent price has been around $400. Existing home sales fell 2% in August as prices are giving buyers pause.

Rent for single-family homes in the U.S. surged 8.5% in July, the biggest increase since 2005. The Phoenix metropolitan area led U.S. cities with an 18.9% year-over-year gain, according to a report Tuesday by CoreLogic Inc. Miami (17%) and Las Vegas (14.3%) also saw big jumps. Single-family rents have jumped amid a lack of affordable properties to buy. With little inventory available for first-time buyers, Americans looking for backyards and extra rooms have been pushed into the rental market. I really don’t understand what the Fed is seeing. I have been writing about inflation for over 6 months. It is everywhere. Yes, some is transitory, but not all. Wages, houses, rents, new/used cars, oil/gas, metals, chips, food, consumer products, rental cars, toys, shipping, logistics, trucking, appliances, clothes…Jamie Dimon came out and suggested the Fed may have to aggressively reverse course if the inflation persists at year end. I have no idea why they continue to buy $120bn/month including $40bn in mortgages.

There are car issues in many countries, including the US where some used cars are selling above sticker. A reader sent me a picture this week of a Mercedes 550 AMG wagon with a sticker of $131k and an asking price of $238k. If I had $1bn in cash on hand, I would not buy a car for $100k over sticker. Read this story about Chilean car issues. In downtown Santiago, the epicenter of what is likely the world’s hottest economy, Carol Castillo is meeting lots and lots of angry people. Castillo is a saleswoman at a Chevrolet dealership in the city, where demand for cars is so red hot from cash-flush Chileans that wait lists stretch on for months. Customers don’t take this too well, Castillo says. Shock leads to frustration and at times to outbursts, especially from those looking to buy a Silverado. The current estimated delivery date for a diesel version of the popular pickup: October of 2022. “Everybody wants their car right now,” Castillo said. It was a Wednesday morning, typically a quiet time for the dealership. And yet as Castillo looked across the showroom, every single table was filled with would-be buyers. The shortages aren’t uniquely Chilean, of course -- global supply-chain problems are spurring wait times for cars in many countries -- but they’re particularly acute here. Locals are on a buying spree of epic proportions. Cars, refrigerators and electronics are all flying off the shelves.

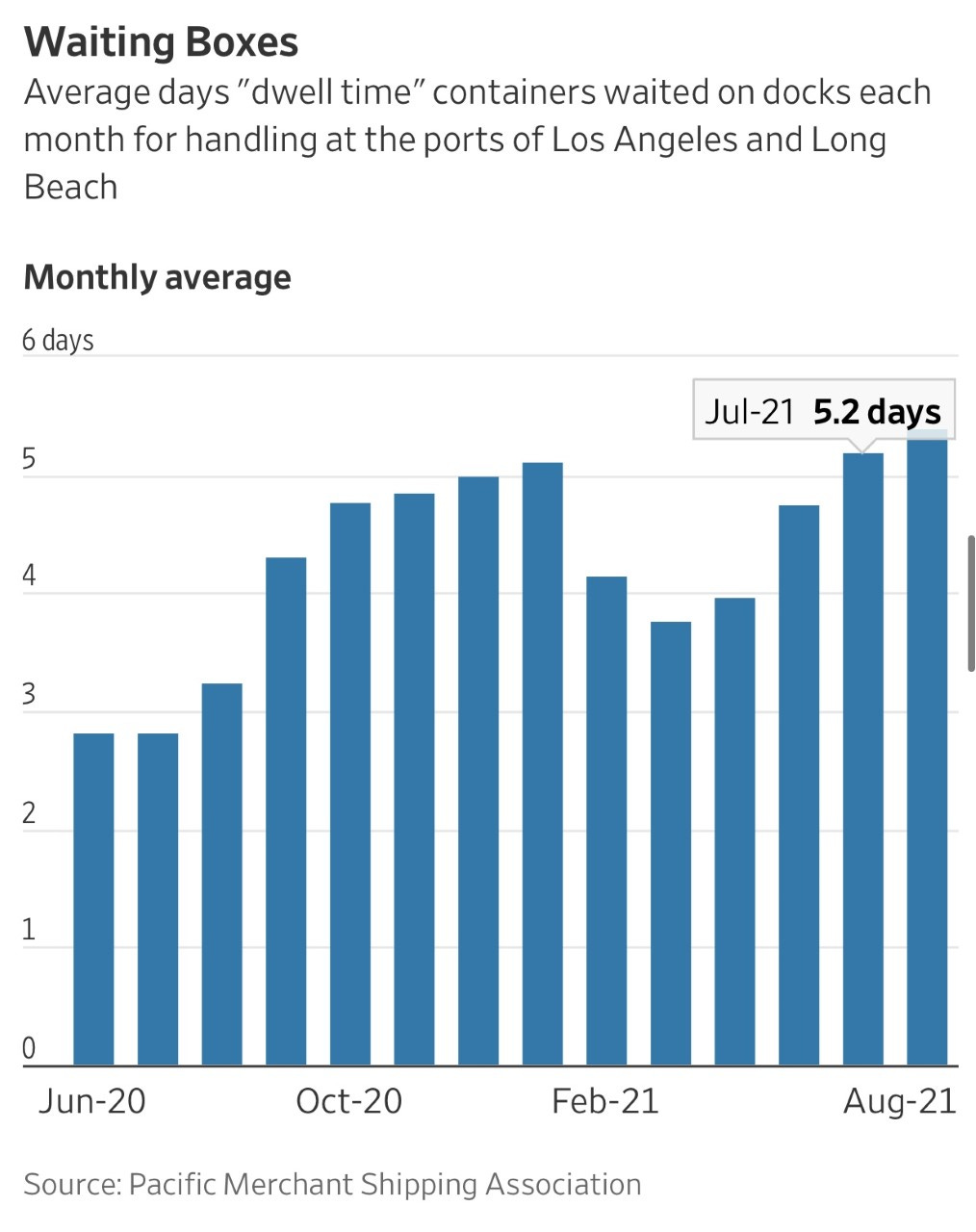

There appears to be no sailing around the breathtaking backup of container ships off the jammed ports of Los Angeles and Long Beach. Newly-arriving vessels are adding to a record-breaking flotilla waiting to unload cargo that on Sunday reached 73 ships, according to the Marine Exchange of Southern California, nearly double the number a month ago and expanding a fleet that has become a stark sign of the disruptions and delays roiling global supply chains. Before the pandemic, it was unusual for more than one ship to wait for a berth. Big vessels are continuing to join the bottleneck, experts say, because shipping lines and their cargo customers have few options for resetting countless supply chains moving goods into the U.S. that have been constructed over decades around the critical San Pedro Bay gateway now staggered by the overflowing demand for imports. When I last wrote about this a few weeks ago, there were a record 44 ships waiting to get to the port. The 2nd picture shows how many days boxes are waiting once they have been taken off the ships. Shipping prices have gone up 300-400% in many cases. This is having a big impact on the cost of goods. One company I know which makes consumer products in China has seen a large item cost go from $5 to almost $20 to ship. No inflation to see here. Remember, once it gets off the boat, you need additional logistics (train, truck…) to get it to its final destination and trucker shortages have led to additional delay and price increases.

Given China’s growth and recent aggressive regulatory actions, I think it is important to follow what is going on there economically and from a regulatory perspective. Some recent actions are called, “common prosperity.” One article I read suggested authorities will eliminate “unreasonable incomes” and illegal revenue and encourage wealthy individuals and companies to give back more to society. There is a good WSJ article which outlines President Xi’s recent actions and plans to rein in private enterprise. Approximately $1.5 trillion has been wiped from Chinese Stocks. He is trying to roll back China’s decades-long evolution toward Western-style capitalism and put the country on a different path entirely, a close examination of Mr. Xi’s writings and his discussions with party officials, and interviews with people involved in policy making, show. For most of the 40 years after Deng Xiaoping first unleashed economic reforms in China, Communist Party leaders gave market forces wider room to flourish. That opening helped lift hundreds of millions of people out of poverty and created trillions of dollars in wealth, but also led to rampant corruption and eroded the ideological basis for continued Communist rule. In Mr. Xi’s opinion, private capital now has been allowed to run amok, menacing the party’s legitimacy, officials familiar with his priorities say. The Wall Street Journal examination shows he is trying forcefully to get China back to the vision of Mao Zedong, who saw capitalism as a transitory phase on the road to socialism. Mr. Xi’s overhaul has generated more than 100 regulatory actions, government directives and policy changes since late last year, according to a Journal tally, including steps aimed at breaking the market dominance of companies such as Alibabi, conglomerate Tencent and ride-sharing leader Didi. They have gone after gaming for profit education, foreign-leaning film stars, tax dodgers and others. Not sure what is next. I do not invest in China, but a bunch of savvy hedge funds are buying up Evergrande bonds.

Chicago Mayor Lori Lightfoot pitched a pilot program Monday giving $500 monthly payments to 5,000 low-income households, part of the city’s proposed $16.7 billion spending plan that relies on an infusion of federal relief funds to close budget gaps for several years. Lightfoot, a first-term Democrat, characterized the proposed $31.5 million cash assistance program as a way to help “hard-hit, low income households in need of additional economic stability.” The payments would last a year. The idea has been discussed before in Chicago, including earlier this year by city aldermen. Similar pilot efforts, called universal basic income, have been tested elsewhere including in California and New York. I wrote about forms of Universal Income taking hold approximately 18 months ago. Some big supporters out there. I am not so sure I am a fan and fear we are opening Pandora’s Box.

Google said it is buying a Manhattan office building for $2.1 billion, one of the clearest signals yet of Big Tech’s growing appetite for office space, even as these firms embrace remote work. The deal for the new building on Manhattan’s West Side is the most expensive sale of a single U.S. office building since the start of the pandemic—and one of the priciest in U.S. history, according to data company Real Capital Analytics. Google is already leasing the 1.3 million-square-foot waterfront building, a former freight terminal dubbed St. John’s Terminal, in the Hudson Square neighborhood. The company has an option to buy, which it said it plans to exercise in the first quarter of 2022.

The stupidity of people never ceases to amaze me. This is yet another case of Social Darwinism. I hope this man has no offspring. He had petroleum jelly inserted into his arms to have big guns and could have died if he did not get it removed. Pure genius. Note the legs in the 2nd picture. If his arms are 24,” his legs are 14.” “I really worry about this. I am very afraid….I should have thought about this earlier, I know. I blame myself, I know I’m guilty,” he said.

Ben & Jerry’s has unveiled a new flavor whose proceeds will partly go to support Rep. Cori Bush’s $10 billion, anti-police bill that seeks to defund cops and replace them with social workers in certain incidents. A portion of the proceeds from sales of the flavor, called “Change is Brewing,” will be donated to “grassroots groups working to transform public safety in America,” according to Ben & Jerry’s. And when customers navigate to the Ben & Jerry’s site to buy the ice cream, they’re urged to “Join the Movement for Black Lives and support the People’s Response Act!” Recall, this is the same company which ended sales of ice cream in the “Occupied Palestinian Territory,” as “it is inconsistent with out values.” In an ironic sidebar, the founders of Ben & Jerry’s are Ben COHEN and Jerry GREENFIELD, both Jews.

Virus/Vaccine

Continued declines in cases and hospitalizations, but deaths continue to climb as seen in the charts below. Deaths are back over 2k/day again.

Chart below shows deaths by age group from covid and the total is 659k as of 9/15/21. Note that 17 and under deaths total 439 out of 659k or .00066%, while 65 and over accounts for 512k deaths or 78% of total. Depending on the study and year, more deaths for 17 and under come from each of homicide, suicide, car accidents, congenital disorders, low birth weight. Again, I am not downplaying these tragic deaths. However, many other causes of death far surpass covid in any one year and the covid death numbers are for two years. YTD through 9/11, in Chicago, 261 kids 17 and under have been shot for perspective. Murder rose almost 30% in the US in 2020 and is up another 10% in 2021 according to this article.

This article outlines a new variant I have not heard of previously. It is called R.1. and originated in Japan and was found in a nursing home in Kentucky. Over 10,000 cases have been recorded globally. This is not from a medical journal, so I will take this with a grain of salt, but mention it to keep your eyes open on it.

Pfizer said their Covid-19 vaccine was found to be safe in children ages 5 to 11 years in a late-stage study and generated a strong immune response in them, bringing the prospect of broader vaccination coverage closer. Pfizer said it would share the results with regulators in the U.S. and other countries and seek emergency use authorization in the U.S. as early as the end of the month. The companies said the two-dose shot was found to be safe and well tolerated among the children in the study. The vaccine generated levels of antibodies that were similar to those of younger adults, meeting the study’s measurements of success, according to the companies. Pfizer and BioNTech said they hadn’t yet determined vaccine efficacy—how well it protects against Covid-19—for children in the age group. Not enough young subjects in the study have become sick to compare rates between children who got a vaccine and those who got a placebo, but researchers could still learn more as the trial continues. Positive news. I just don’t know who in the heck allows their 5-year-old to be a test patient for vaccines.

Real Estate

A reader called me about a R/E project he was considering. Does he spend $3mm+ to build out a vacation home on property he owns in CA to sell it? After going through the #s, I suggested there was not nearly enough cushion to justify spending what it will take to build. Interestingly, the contractors were looking for $750/foot which seemed quite high to me for a home not on the water. I am hopeful that more people will take a step back and consider the likelihood of market conditions in 18 months before running into aggressive projects today.

I was told this house sold near asking price. I have heard from multiple brokers this is the single worst laid out house they have ever seen. It was two houses smashed together and am told the flow was horrible yet it sounds like it sold in the mid $9mm range. I am just not convinced the market can keep going at this pace.

Another reader sent me an email about a $7mm place in Hoboken. What the hell? We are nearing the market top when a townhouse in Hoboken goes for this much money.