Opening Comments

The last note was on Bitcoin ATMs and the most opened links were the TSLA Gen2 Robot and the IBM CEOs illegal hiring practices.

I turned 54 on November 25th and I think I am losing my marbles. I love the Erdoes annual holiday party in NYC and I recall it being on Friday each year. I flew to NYC on the 6am Thursday and booked my flights to fly back on the 7am Saturday. Coincidentally, Phillip Erdoes called me Wednesday night on a separate matter and I told him I was looking forward to seeing him on Friday. He said, “You won’t be seeing me on Friday. Our daughter has a gymnastics event and we will be flying back on Saturday.” I thought he was kidding given he is a jokester. He told me the party was on Saturday this year. There is a 100% chance that I would have gone to the party on Friday had he not told me. Philip and Mary got a kick out of the whole thing. I called Mike Cembalest to double check, given I though I was being pranked. I flew back on the 6 am Sunday.

I was in NYC for a few days, overate as usual and it is your fault. On Thursday, I ate two FULL meals. I ate at the Roman restaurant, Riscoli and at Charlie Bird. More robust reviews to follow, but Riscoli ambiance is great and the meatballs were amazing. Not all food was as impressive. Charlie Bird was disappointing from a service and food perspective, but the Hamachi appetizer was solid. Yes, I ate two full pasta dishes in one night to write reviews for my readers. On Friday, I ate at the new Junnon restaurant, Jazba (Indian) and then the Thai place Soothr. Both were very good and casual. Junoon is my favorite Indian in the city and the flavors do not disappoint at Jazba It was way too much eating two full meals two nights in a row and back-to-back Indian and Thai food turned out to be a bad idea for my digestive system. Yes, again, two full meals. On Saturday, I ate at Hudson Yards at Kamasu (sushi) and Zou Zou (Mediterranean). Zou Zou is a knockout. My expanding waistline is 100% your fault, as readers continue to request restaurant reviews. I will write all about it after I have gastric bypass surgery.

The Changing Landscape Of the Forbes Billionaires List Since 1982

Markets

Santos Congressional Seat Up For Grabs

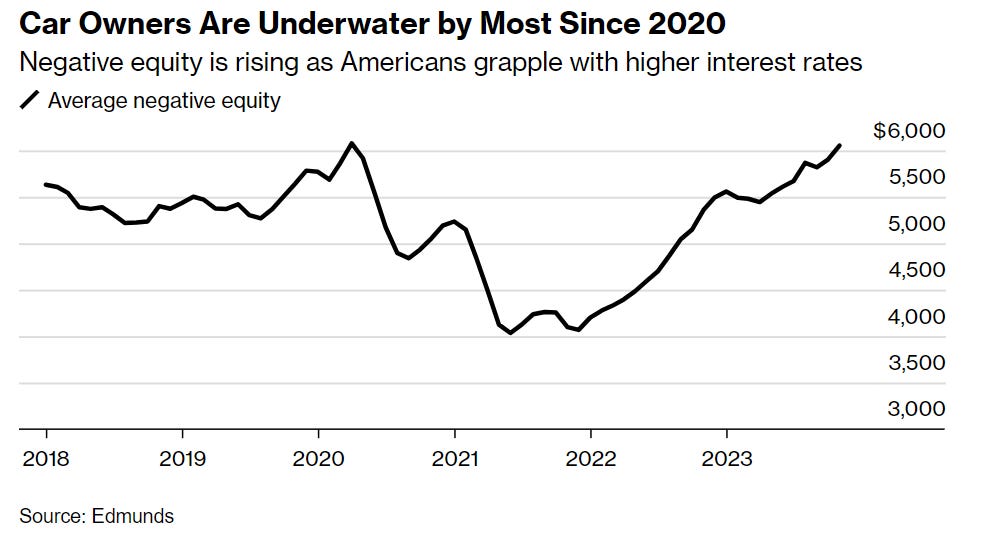

Car Owners Underwater

Wal-Mart and Amazon Returns at Steep Discounts

“Prison Cell” NYC Apt for $2,300/month

Color from Devin Kay on Recent Activity

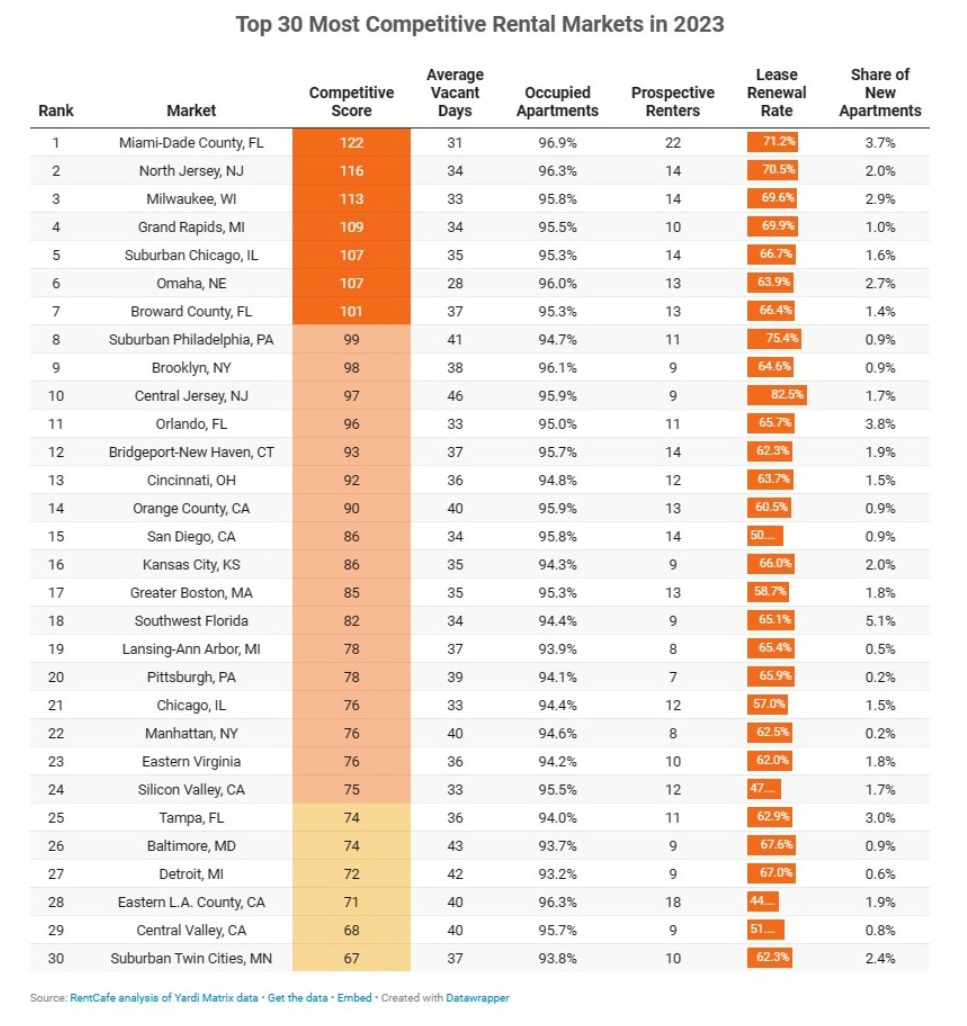

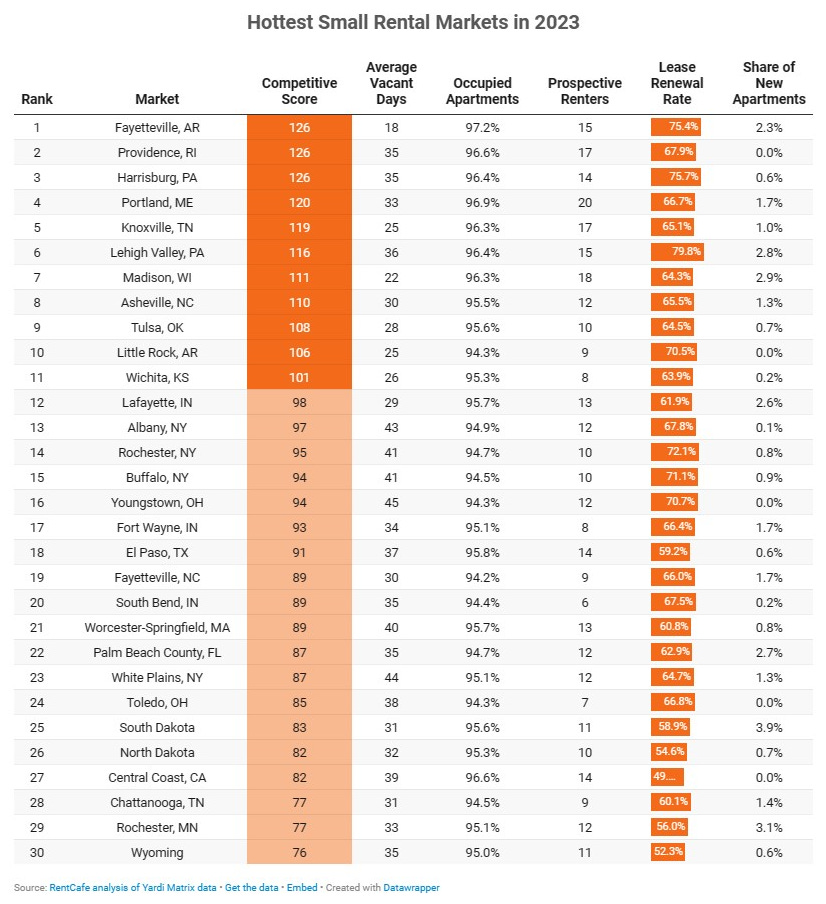

Miami is Hottest Rental Market in Country

Mortgage Calculator with Rates Down

Video of the Day-Podcast with Teddy Gold-3i CEO

I’m excited to announce the new podcast brought to you by 3i Members and the Rosen Report, the Founder Spotlight! In this podcast, I interview notable technology, finance, and real estate founders within the 3i community. In these thirty-minute episodes, members share their success stories, lessons learned, and invaluable business wisdom. Some of these guests include:

Fabrice Grinda, Founder of FJ Labs

Mitch Julis, Founder of Canyon Partners

Jessica Beck, Co-Founder & COO., Alfred

Greg Waldorf, Lecturer Stanford Graduate School of Business, frmr. CEO of eHarmony

Ted Seides, Founder of Capital Allocators and Co-Founder/CIO of Protege Partners

The first episode of “Founder Spotlight” is with 3i Members CEO/Co-Founder Teddy Gold. I think you will be impressed with Teddy, who became a CEO at the age of 27 and is now on his way to his AARP card at 29. Since we are very close, we have some fun banter, and I believe you will enjoy the show. There is a lot more to come over the next few months with dynamic and interesting business and thought leaders. I hired a team to help me with content, and you will see more clips on my various venues, including YouTube, LinkedIn, and Instagram (yes, I will be posting for the 1st time). If you want to learn more about 3i Members, check it out with the link.

The Changing Landscape Of Billionaires Since 1982

When I was a kid, there was a show called, “Lifestyles of the Rich and Famous,” and Robin Leech hosted it. I was mesmerized. The tagline was “Champagne wishes and caviar dreams.” I could not fathom such wealth and was drawn to the lavish lifestyles.

In 1982, the Forbes list (1st year) looked very different than it does today on many fronts, most notably what it takes to make the list. In 1982, there were only 13 billionaires on the list and a net worth of $75mm secured a spot. The richest person in the US, was Daniel Keith Ludwig (shipping and R/E) and had a net worth of $2bn in 1982 or $6.2bn adjusted for inflation. Others on the 1982 list were Getty, Caroline Hunt, David Packard, David Rockefeller, Forrest Mars, Lamar Hunt. The second youngest person on the first ever Forbes 400 was Apple’s legendary cofounder Steve Jobs , then just 27, described in his bio as a “computer freak” worth upwards of $100 million. Sam Walton, the iconic founder of Wal-Mart, appeared with a net worth of $690 million. The list from 1982 had 22.8% from oil, 15.2% from manufacturing, 9% finance and only 3% from technology. The link to the original 1982 list compares the wealth then and now and it is startling.

If we look at the Forbes “Real Time Billionaire” list, the numbers are “slightly” larger than in 1982, even if you adjust for inflation. At the top of the list is Musk with a net worth of almost $254bn, while the 100th person, Donald Bren (real estate) has a measly $18bn. At 200 on the list is Li Shuirong (petrochemicals) who is clearly needing government assistance at $10.1bn. The 300th person is Pavel Tyac (coal mines) at $8bn from India. The bottom 10 or so people on the list are worth $6.8bn to round out the top 400 on Forbes. The link is great an updates wealth pulling from public stock data and uses comps for private holdings.

To compare 2023 with 1982, at the top, the wealthiest person is 121 times richer and at the bottom, 89 times wealthier than 41 years prior (without adjusting for inflation). On the top 400 list today, 15% earned their fortunes in technology relative to 3% in 1982. Given the median net worth in America today is $192k, Musk’s wealth is almost 1.3 million times more than the median.

Founding a company is the best way to get to the top of the list. My big takeaway is the US is primarily where the wealthiest individuals created their fortunes. I counted 160 out of 400 people living in the US or 40%, by far the most dominant country on the list. America has too many problems to count, but it is the land of opportunity like no other place in the world.

A recent Bloomberg article showed the Richest Families in the world and thought that was interesting. The world’s richest families are more geographically diverse than the wealthiest individuals. Also, family wealth is concentrated on industrial, luxury goods, and retail with zero technology.

I want to plead my case right now to any individuals or families listed. I am available for adoption. I am a hard worker and, a good cook and some people think I am quite humorous. If you give me a healthy allowance, you will find me lovely and I will only write positive things about you. Yes, everyone has a price, including the author of the Rosen Report and John Rahm. Of note, I can be bought for less than $450mm.

Quick Bites

Stocks have been on fire with major indices scoring 7 straight weeks of gains driven by a sharp move down in rates. For perspective, in mid-October, the 10-year Treasury yield was at 5% and today it is 3.91%. As of Friday, the Dow is higher on the month by 3.8%. The S&P 500 is up by 3.3%, while the Nasdaq Composite has climbed 4.1% so far in December. The S&P 500 marked its longest weekly winning streak since 2017, and could still soon join the Dow with its own all-time high. The broad market index is less than 2% away from that mark, which was set in January 2022.

I have written extensively about car loan delinquencies and issues with falling prices. This Bloomberg article is entitled, “‘Underwater’ Car Loans Signal US Consumers Slammed by High Rates.” “We're in this situation where combined with the cost of the vehicles being so high and the interest rates being so historically high, you have a lot of people who are in bad car loans,” said Joseph Yoon, consumer insights analyst for Edmunds. Several factors combined to create the current situation. The average rate for a loan on a new car is 7.4% and 11.6% for a used vehicle. Plus, in recent years, dealerships and lenders have started offering six- and seven-year loan terms, as well as lower down payments, which make it harder for owners to build equity in their vehicles. During the pandemic, the value of used vehicles soared, thanks to supply chain issues and increased demand as Americans spent stimulus checks. But since a peak in early 2022, used-car values have fallen more than 20%, according to the Manheim Used Vehicle Value Index. That has left many Americans with a rapidly depreciating asset on their hands. In a related matter, the 2nd chart outlines the growth in credit card debt in the US which now tops $1 trillion. The chart is from Visual Capitalist.

Interesting WaPo story entitled, “Inside the mad dash to buy your Walmart and Amazon returns.” In strip mall parking lots around the United States, people start lining up at 7 a.m. to dig through other people’s rejects. “I call it dumpster diving,” said Adriane Szackamer, a psychologist and mom of two living in the Chicago suburb of Highland Park. In 2022, Americans returned $816 billion in merchandise, according to the National Retail Federation. But at the dozens of bin stores that have popped up around the country, that merchandise is now getting a second life as store owners buy truckloads of pallets of returned goods either directly from retailers or liquidation companies. Some of the bargains in the article are unbelievable.

Now that the habitual liar, Santos, is out of Congress, there will be an election on February 13th to replace him. Democrats have chosen a recognizable figure in the form of former Rep. Tom Suozzi, who had represented the district for three terms before stepping away to pursue a failed bid for governor in 2022. Meanwhile, New York Republicans on Friday announced Mazi Melesa Pilip, a former Israeli army soldier and current county legislator, as their candidate. This selection sets the stage for an intense showdown, with the Cook Political Report now categorizing the race as a "toss-up."

Israel

After my two dinners on Friday night, I was invited to a Shabbat dinner at my friend Mark and Erica’s home. I was seated next to a hero from October 7th (Shalom Avitan) who saved countless lives as he was being shot at by Hamas terrorists. He is a volunteer for United Hatzalah and risks his life to help others. I can only tell you his story was very powerful and he has been so moved by his experience that at 23 years old, he is joining the military. He was the young man who was shown holding the two 10-month-old babies who had their young parents killed. The orphans were reunited with the grandparents who will raise them. The children were dehydrated and drank bottle after bottle. Despite the horrific stories, many refuse to call Hamas terrorists. Shalom is interviewed here on CNN.

Israeli military says it mistakenly killed 3 Israeli hostages in battle-torn part of Gaza

US and Britain say their navies shot down 15 attack drones over the Red Sea

Are you telling me with WIDE OPEN borders no terrorists are living in the US?

GOP calls to strip Harvard of billions in federal cash, tax breaks over ‘antisemitism shame’

I would love to see this happen. It would crush the school. Great charts in the link to outline the benefits Harvard receives.

Jewish Alumni Group: Harvard Aims to Reduce Jews to 1-2% of Student Population

We have seen data that suggest that the Jewish population at the College has declined from 20-25% in the 1990s-2000s to 5-7% today, but that almost all that decline occurred in recent years. We have heard from multiple sources at the University that it is the official, undisclosed policy of the school to drive down Jewish admissions to 1-2% of the student body, proportionately matching Jews’ percentage of the U.S. population.

Harvard forces Jewish student group to ‘hide’ menorah at night for fear of vandalism

‘It’s like asking me how often I drink water. Antisemitism was everywhere.’ Apostates, former Islamists, and an almost-terrorist on how they changed their minds. Amazing story.

Other Headlines

Recent data shows AI job losses are rising, but the numbers don’t tell the full story

According to a recent report of 750 business leaders using AI from ResumeBuilder, 37% say the technology replaced workers in 2023. Meanwhile, 44% report that there will be layoffs in 2024 resulting from AI efficiency.

Apollo Plans Credit Product With $2,500 Minimum Investment

Firm is setting up asset-backed credit company for individuals

Citigroup employees, on edge over layoffs, told they can work remotely until the new year

Citi has been a disaster. Over 5 years Citi-1%, MS +143%, GS +137%, JPM +75%, Bank America +44%, Wells +11%.

Why Argentina’s shock measures may be the best hope for its ailing economy

161% inflation is a slight problem.

In Congress, a Democrat and Republican Push Back Against the ‘Debt Deniers’

More politicians should be worried about deficits, debt, interest burden and the future. $34 trillion in debt and $100 trillion of underfunded entitlements is too much, yet we are running massive deficits with 3.5% unemployment. What could go wrong?

Boston mayor posts photo of controversial 'electeds of color' party despite criticism

What would have happened if she had a “whites only, men only, or Jews only?”

I fear our border policy will cause the US pain for years to come. What is a country without a border?

LI squatters fail to pay mortgage for 14 years, ‘abuse’ the system to stave off eviction

How is this possible? Read the story and you will be disgusted. They should be in jail.

‘Lion King’ musicians being targeted after NYC Broadway shows: ‘Out of control’

18-year-old stabbed to death on Manhattan street

Two blocks from my old apartment. I was walking on the UWS at the time of the attack.

Bronx building collapse is a warning of disasters likely to get ever more common

Record US Holiday Air Travel to See 7.5 Million Fly, AAA Says

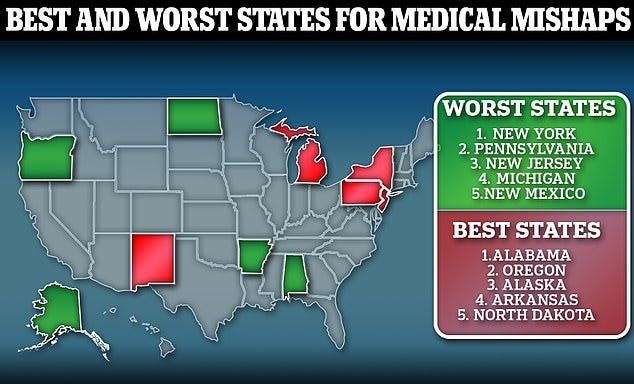

States where doctors are most likely to give you the WRONG diagnosis

Shocked FL is not on the bad list.

Man spots a 'UFO' from his balcony in Chicago resembling an alien FACE - and experts are baffled

Amazing pictures in the link.

Real Estate

As written previously, I am in the process on the website, Rosen Report Jobs, and working with companies trying to hire full-time and internship positions. I am partnering with Executive Recruiters in finance and technology to help me find the best candidates and opportunities. I am shocked by the number of resumes I am getting from young people who want to leave NYC for South Florida. One young man told me “The quality of life just no longer works for us. I am willing to take a significant pay cut to leave NYC. It is not just one thing pushing us out, but the totality of many well-documented issues have my wife and I looking to head South.” Some version of this statement has been told to me two dozen times in the past two weeks by 25-35-year-old finance professionals. I saw this link to a tiny apartment in the Village dubbed a “prison cell,” for $2,300. There is no closet and I have never seen a smaller shower. I don’t know the square footage, but it can’t be more than 150 square feet based on the pictures. Yes, the migration to South Florida has slowed. My concern is for NYC is that the next wave seems to be getting younger and the leadership needs to be held accountable. Crime, homelessness, illegal immigrants, COVID mandates, cost of living, traffic, housing issues, taxes… Even though Miami rents have exploded, it sure is cheaper than NYC. Check it out online. I know someone paying $7,700 for a one-bedroom in the Village in NYC. Add in the cost of Ubers, taxes and food and it is not close on the cost of living to South Florida. I took a cab 1.1 miles at 10am in NYC and it was $20. My Uber from LGA to the Upper East Side was $80 for 9 miles and my 24-mile ride in Boca to the airport was $50.

From Devin Kay (Colleague at Douglas Elliman). The market is still very active, and only see that increasing now that they have announced interest rates will start to come down. My team put over $75 Million in properties under contract last week alone from Miami up to Jupiter. We represented the buyer and seller on two deals over $15 Million. Sales at Shell Bay are still going strong, I sold another combo unit (my 5th combo) last week for $8M. This is now the 8 transaction I’ve done in the building over $7.5M, including three over $10M. We have a bunch of great properties hitting the market in the next 60 days including condos, houses and land in Miami Beach, waterfront houses and condos in Boca & Highland Beach and a few things up in Palm Beach & Jupiter. There was an off-market deal on Palm Beach that just went for $75M, a house on Intracoastal. It seems activity is picking up. Remember, I have you covered from Miami to Jupiter as we have a team of people with expertise in each market. I have a new buyer in Ocean Ridge and brought in a broker on our team, Nick, who lives in Ocean Ridge to partner to be sure the client gets the information they need.

On a similar vein to my prior comments, this CRE Daily piece is entitled, “Miami Tops US Hottest Markets.” Living in Miami would be tough for me. I love going down for the day or to dinner, but the traffic and congestion makes it challenging. The restaurants and scene in Miami have improved 200% in the past 5 years and is impressive. There are dozens of good restaurants now. In 2023, the Midwest emerged as the most competitive rental market in the U.S., with three cities in the top five, driven by its affordability, ample space for remote work, and easy access to nature. But Miami still leads the nation. Factors at play: The Rental Competitivity Index (RCI), developed by RentCafe, is used to gauge the competitiveness of rental markets, incorporating five key metrics: the duration of apartment vacancies, occupancy percentages, the number of renters vying for apartments, lease renewal rates, and the annual completion rate of new apartments. In 2023, the national average RCI was 59.5, but significantly higher in the most competitive markets.

Good CNBC article with an interactive mortgage calculator. Homeownership became more affordable this week, as 30-year fixed mortgage rates dropped below 7% for the first time since August. After a peak of nearly 8% in late October, the average 30-year mortgage rate has been sliding every week since. As of Thursday, the rate is 6.95%, according to Freddie Mac data. Based on the new average rate of 6.95%, the monthly costs for a 30-year fixed-rate mortgage worth $300,000 would be $1,986. Compared with October’s peak rate of 7.79%, that works out to $172 in monthly savings. For a mortgage worth $400,000, the savings would be $229 per month.

© 2023 The Rosen Report LLC. All rights reserved. Does not constitute investment, financial, legal or tax advice. Consult with your lawyers and professional financial advisers.

Rosen Report™ #639 ©Copyright 2023 Written By Eric Rosen

THanks! You just missed the list.

Hi Eric

I am glad you didn’t put me on your billionaire list. Was it because I was a few zeros short? I really enjoy your reports. Keep up the good work.

Curtis