The commute we’ll never get

11-16-25

Opening Comments

My last note was about NYC restaurant reviews. The most opened links were the porch pirate video showing packages blowing up and the article on the 29-year-old trader who became an MD at Goldman Sachs.

I am back in NYC for the third time in three weeks, from Tuesday-Friday of this week, for the annual 3i Summit. There will be approximately 300 members there for what I find to be my best networking event of the year. Amazing content, speakers, connections, and some fun too. I am staying at the Alameda Hotel, as it is near the Chelsea Industrial site where the conference is taking place. Yes, I will be having multiple dinners to be sure to give my readers more reviews.

I have not been fishing much as I prepped my boat for sale and wanted to keep it in perfect shape. I went out for lobster on Thursday with friends, and we got a dozen a couple of which were decently sized. However, my friend Dean lives two hours north of me and caught some MONSTERS! The sunset Thursday night was pretty nice too.

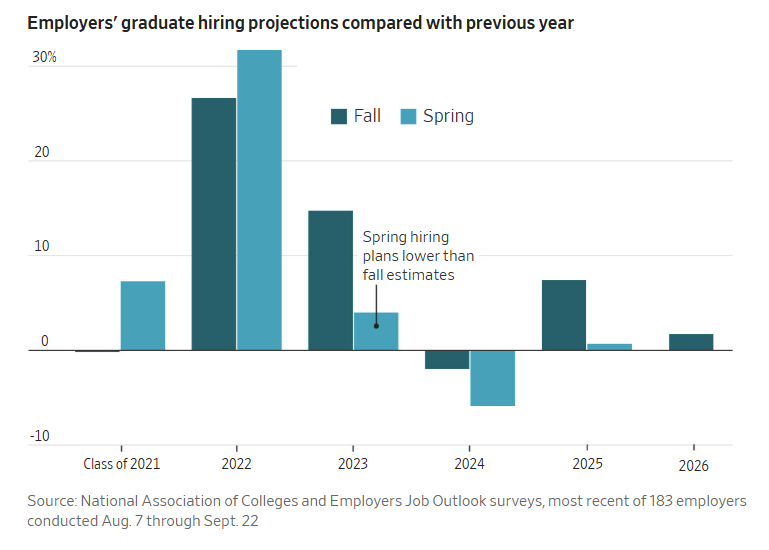

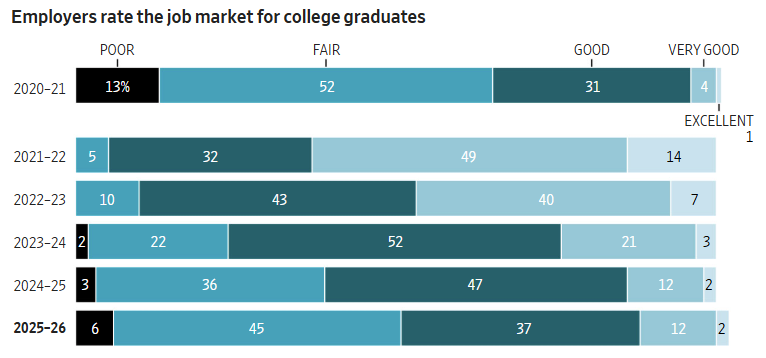

Whenever I write about the job market for college grads, I get a lot of responses, and this WSJ article suggests 2026 will be the worst job market for grads in five years (pandemic). Uncertain economic outlook and AI were mentioned in the article. This CNBC story suggests AI will impact 89% of jobs next year. Yet the Ford CEO suggests he cannot fill 5,000 mechanic jobs paying $120k/year. Given the ridiculous cost of college, more should go to trade school and be debt free while earning money faster.

Someone sent me a bottle of champagne and I presume it was a reader. If you did, please email me so I know who sent it. Thanks

Markets

Three Interesting Charts

Streaming is Out of Control

Skims $5bn Valuation

Harvard is an “Easy A”

Rising Health Insurance Premiums (Chart)

Hedge Fund Managers to South Florida…Eventually

Rising Foreclosures

Rent Control Lawsuit

NYC Apartment Buildings Doing 99 Units for a Reason

States Where Home Equity Has Doubled Since 2020

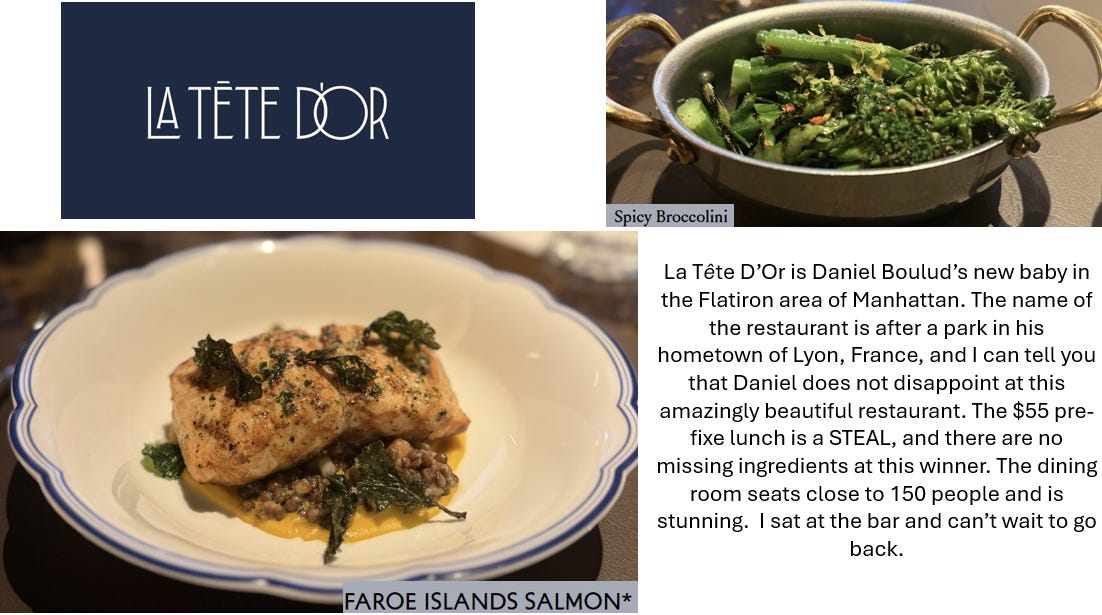

Picture of the Day-La Tête D’Or NYC

I tried Daniel Boulud’s newer restaurant La Tête D’Or in Flatiron, and trust me, it does not disappoint. Anytime you are going to a Boulud establishment, you have high expectations, yet I was blown away by everything about it. The setting is stunning, and the food was delicious. I want to know the build-out costs, as I am sure it was a fortune. I highly recommend the pre-fixe lunch for $55 (two courses) or $75 (three courses). They only started serving lunch recently, and you can get in, while dinner is a harder ticket. I started with divine lobster bisque and almost licked my bowl. It was a true work of art. My medium-rare salmon was cooked to perfection. Although it is a steakhouse, there is something for everyone, and I highly recommend it. However, given that they are known for steaks and prime rib, I need to go back for dinner to give it a proper review. I did read a couple of reviews that were not stellar, but that was not my experience.

Food-9.1

Service-9.5

Ambiance-9.4

Price-expensive for dinner, but pre-fixe lunch is a bargain

The commute we’ll never get

One of my most active contributors sent me this short video about a high-speed vacuum train in China that can travel over 1,000 km/hour (621mph). This ultra-fast vacuum tube magnetic levitation system could reduce the travel time between Shanghai and Hangzhou (distance: 200 km) to just 9 minutes. The advanced technology uses magnetic levitation to reduce friction resistance. The safety of the super high-speed rail is shockingly high and can be seen in the attached link.

The US is notoriously bad at completing large subway or rail projects promptly or on budget. Look no further than the Los Angeles “train to nowhere.” The project was scheduled to be completed by 2020 at a cost of $33bn and now it is estimated to be after 2033 at a cost that could approach $128bn.

Check out the Long Island Rail Road extension to Grand Central known as East Side Access. It was conceived in the 1960s, construction began in 2006, and was not delivered until 2023. The cost was over $11bn relative to an original budget of $2bn. High labor costs, regulations, reliance on consultants, and a lack of standardization all contribute to the high costs and delays.

In the case of New York City’s Second Avenue subway, the project cost 8 to 12 times more than the “composite baseline case” compiled from data on costs in several European countries. Per mile, the New York project cost $2.6 billion, which is high even by U.S. standards.

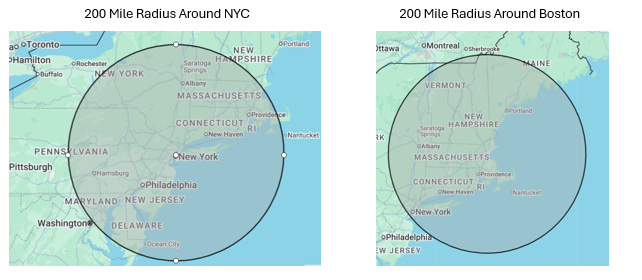

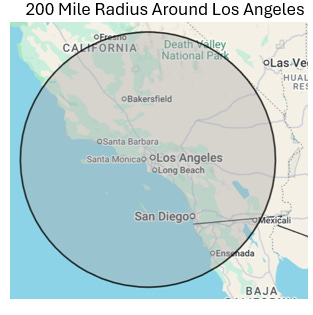

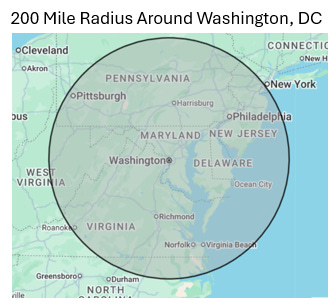

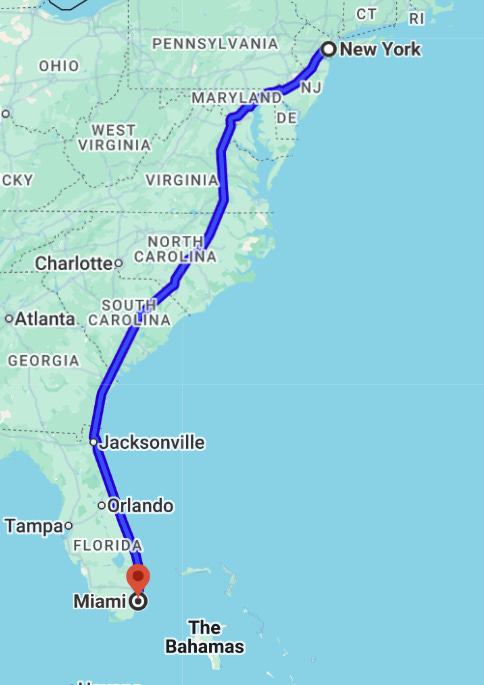

I want people to consider the ramifications of the US having select high-speed rail systems in and around major cities (NYC, Boston, DC, Chicago, LA, San Francisco, Houston, Philadelphia, Miami…). The China train that I outlined can go 124 miles in 9 minutes. Let’s put that into perspective. East Hampton to Midtown Manhattan is 100 miles and, in theory, could take 10 minutes to NYC with a couple stops. The time between Boston and Manhattan (211 miles) or DC to NYC (234 miles), would be less than 30 minutes with a couple of stops. Could you imagine how such an advancement in transportation would change the landscape of commuting? You could live 200 miles from work and get there faster than the time to commute from the Upper West Side to Battery Park. This link allows you to draw a circle around any area for any size.

No, I do not believe this will happen in my lifetime. I just thought the quality of life for so many commuters would be massively improved if such a technology existed in 10 major cities across the USA. One of my colleagues commuted from Westport to Midtown for decades. At times, it could take him 3.5 hours a day of commuting 50 miles. Instead of wasting trillions of dollars each year, the idiots in DC could get their act together to invest in high-speed rail projects that could have a major impact on the economy and the lives of millions. It could take people out of the inner cities and to more cost-effective homes with better quality schools and a significant improvement in quality of life.

If anyone decides to tackle this project, whatever you do, DON’T call the California High-Speed Rail Authority (CHRSA) or the LIRR folks for advice. Just do the opposite of everything they did. Amtrak is launching a next-gen Acela with 160mph top speeds between D.C. and Boston, but 160 mph ain’t 600 mph.

Quick Bites

Thursday saw stocks sharply weaker, with tech underperforming. The S&P was -1.7% and the Nasdaq -2.3% with AI stocks hit the hardest. The likelihood of a December rate cut dropped from 63% to 51% in 24 hours. The lack of data due to the shutdown and the announcement that those reports may never be released spooked rates markets. After a rough start on Friday, tech rebounded slightly to finish the week on a positive note. Despite the volatile week, the S&P was up slightly and the Nasdaq finished -.5%. I missed the oil move on Wednesday, which was down sharply due to OPEC’s supply outlook. With the sell-off in tech, crypto was under pressure, and BTC fell below $95k after reaching a recent all-time high of $126k. Treasury yields are up slightly on the week on fears the Fed may not cut rates in December. The 10-year was 4.15% and the 30-year 4.75%, +6bps and 4bps on the week respectively. Gold finished at $4.1k and is +48% on the year, but is 7% off the all-time highs from October.

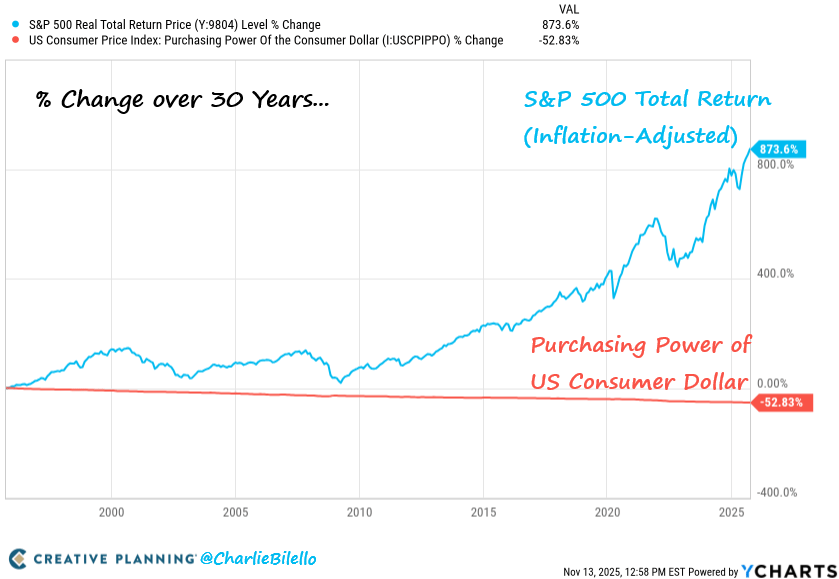

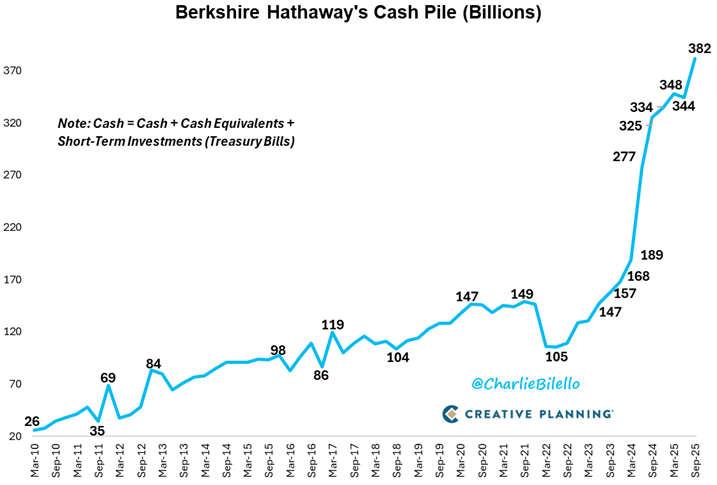

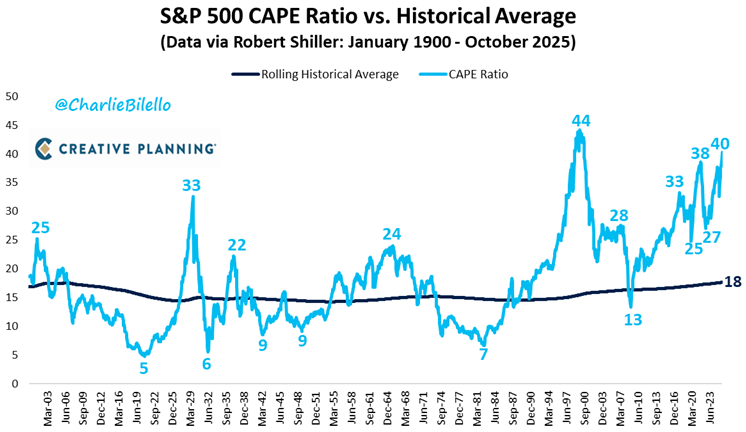

I just thought these three charts by Charlie Biello were interesting, outlining the declining purchasing power of the US dollar relative to the S&P and Berkshire Hathaway’s mounting cash position. The last chart shows the S&P 500 CAPE (Cyclically Adjusted PE) ratio vs. the historical average.

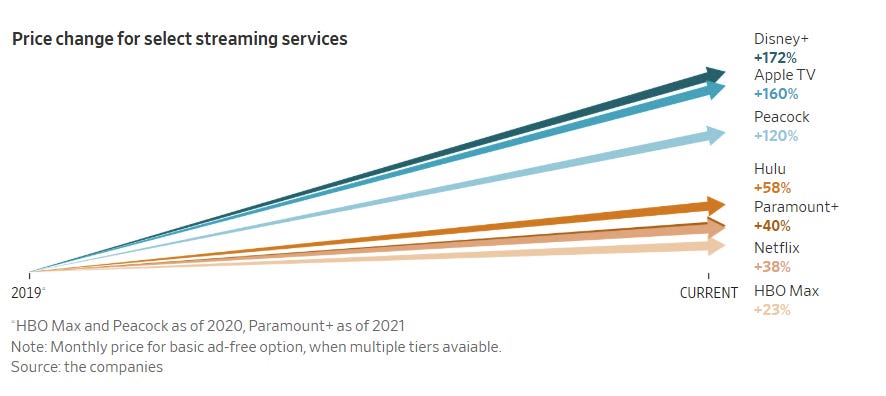

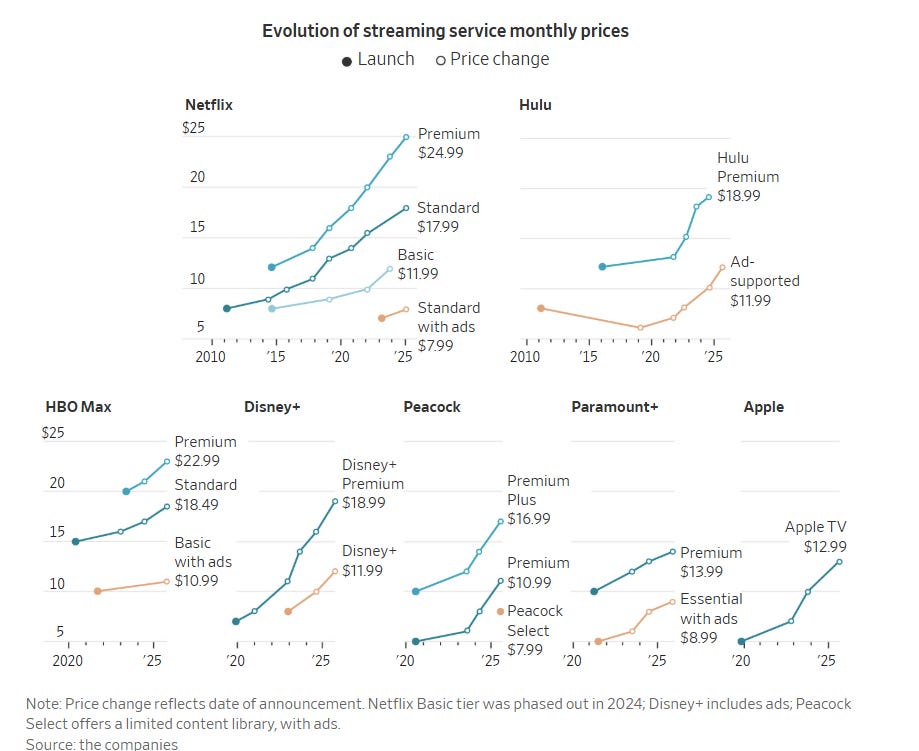

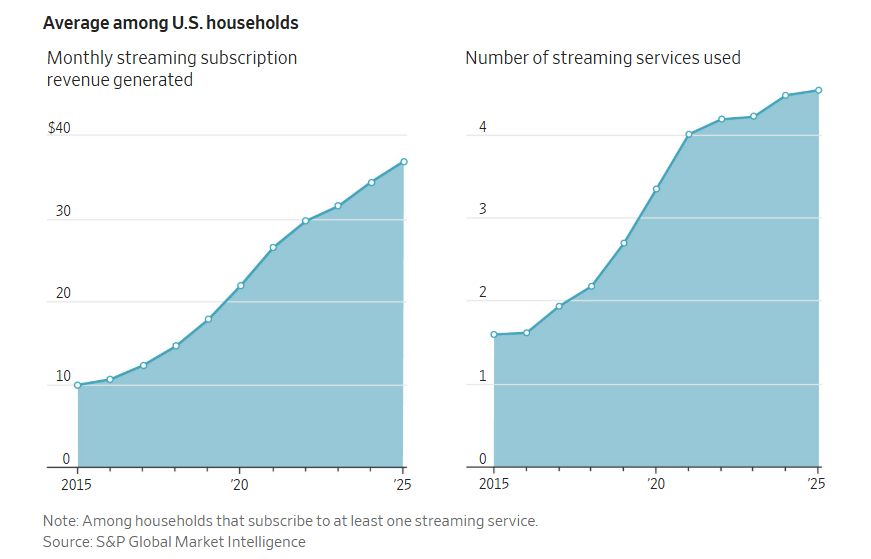

Streaming prices are up substantially, yet consumers are still paying. I spoke with many people who have “cut the cord” and pay far more each month due to all the various streaming services they use. Interesting WSJ article, “Streaming Prices Are Soaring—and Consumers Are Still Paying-Viewers stick to subscriptions as options, including bundles, flood the market.” During the last 10 years, the number of streaming services per customer went from 1.6 to 4.4. Consumer costs continue to rise in part because some media companies have bulked up their sports programming, paying big money to secure rights to the National Football League, the Ultimate Fighting Championship, Major League Baseball and other popular games and matches.

Jealousy is the best word I can think of to describe my feelings about the Kardashians. Kim’s company, SKIMS, is now valued at $5bn and is approaching $1bn in annual sales. Forbes suggests that Kim K owns about 35% of Skims after this funding round, putting her ownership stake at approximately $1.75bn assuming no debt. Skims plans to use the new capital to accelerate brick-and-mortar and international expansion, as well as product innovation and category diversification. The company has 18 stores across the U.S. in cities including New York, Los Angeles, Austin and Atlanta and one in Mexico, with plans to open additional stores overseas in 2026. The new funding follows the debut of NikeSkims, a partnership with Nike that launched earlier this year and sold out within hours. The collaboration signals Skims’ ambitions to scale beyond its core shapewear products and into activewear, apparel and performance categories, pushing the brand further into the mainstream athleticwear market dominated by Lululemon, a handful of upstarts and Nike itself.

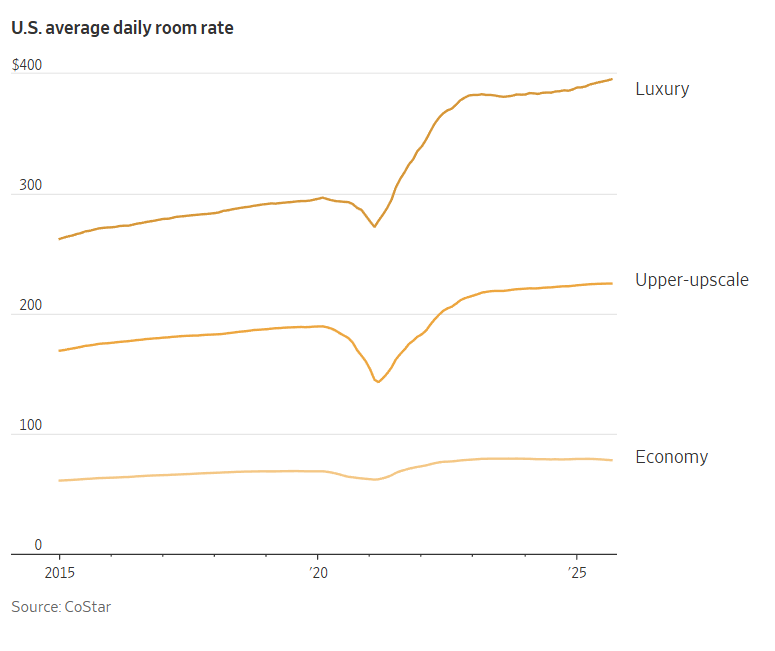

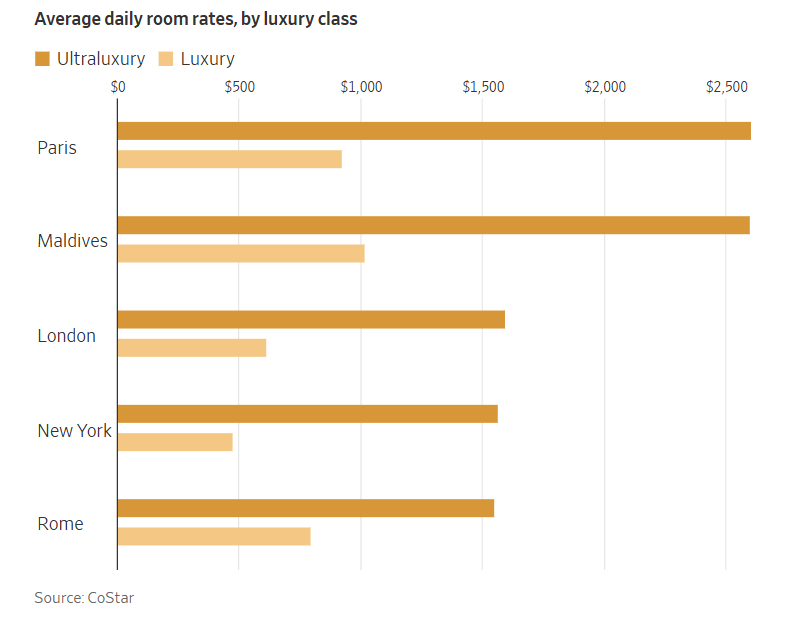

Wealthy Travelers Are Splurging on Luxury Hotels Like Never Before. Record-high luxury hotel rates did little to dull traveler demand for exclusive ocean resorts and grand hotels. The average daily room rate at a U.S. luxury hotel reached a record high of $394 this year, $168 more than the next-priciest tier. I am shocked at what hotels cost and have written about it multiple times. I am in NYC this week for a conference, and they wanted $1,500/night for the cheap rooms at the Pendry. It is seriously out of control.

Elections have consequences, and the new mayor of NYC is clearly not everyone’s cup of tea. This NY Post article outlines how some restaurateurs are cancelling plans for new eateries in the city due to the election results. Stratis Morfogen cancelled three new restaurants and superficially cited Mamdani. He is opening in other cities and named Miami. Richie Romero come to a similar conclusion and said, “The hatred of Jews, socialism, the economics – it’s too much,” he said of Mamdani. “I had to be vocal. I get attacked, but it is what it is.” The mayor-elect’s proposal to raise the city’s minimum wage to $30 by 2030 will “put fast-casual out of business,” Morfogen predicted. Public safety was also mentioned in the article. Think about all the jobs, lost tax revenue, and missed rent, stemming from companies feeling uncomfortable to open new locations or hiring post the election. Don’t say I did not warn you.

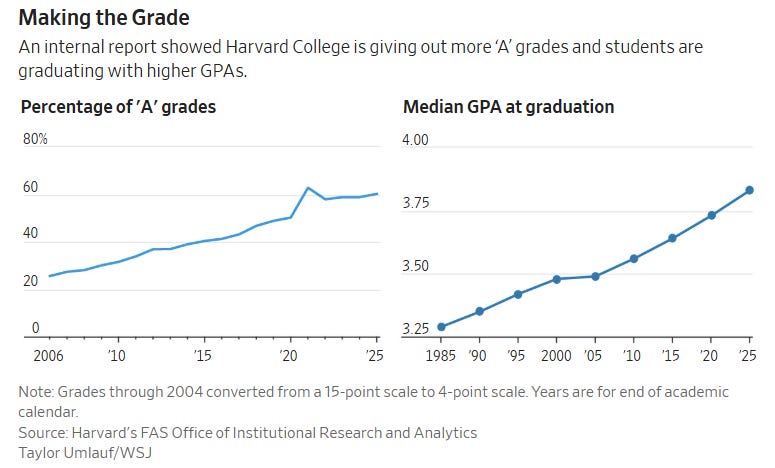

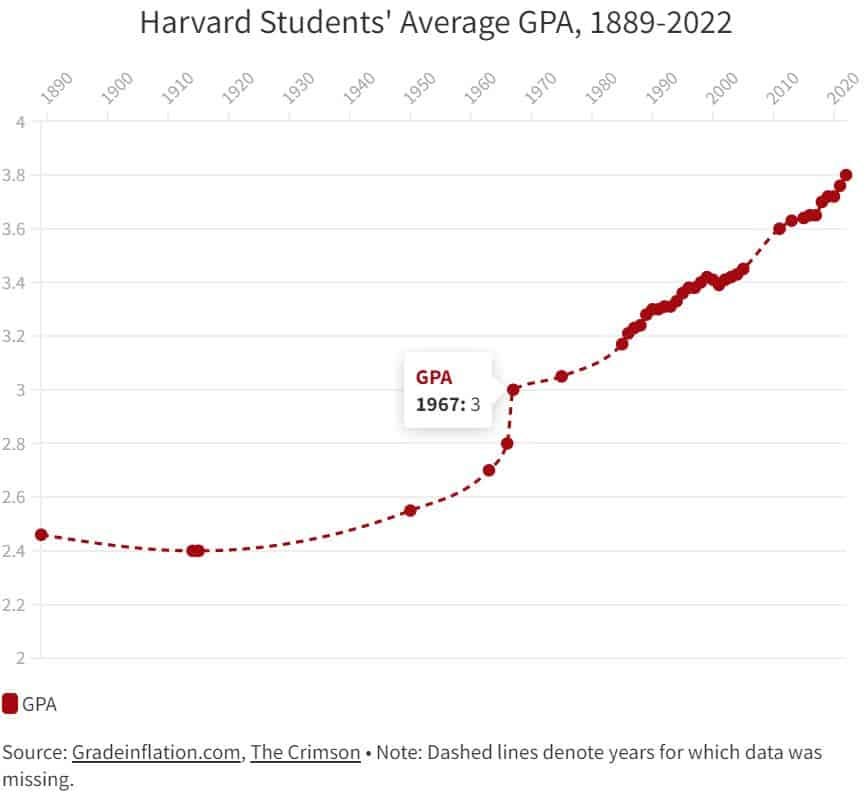

A Harvard report found 60% of grades were A’s in 2024-25, up from 25% in 2005-06, with the median GPA now 3.83. A recent internal report found that Harvard is dishing out too many A’s, and that the current undergrad system is “failing to perform the key functions of grading” and “damaging the academic culture of the College more generally.” The report prompted uproar from some Harvard students who say they already study a lot, sleep very little, and face immense stress to perform academically. “It has reached a comical level of inflation,” said Christopher Schorr, director of the higher-education reform initiative at America First Policy Institute, a conservative think tank. Princeton University capped the number of A’s starting in 2004, but discontinued that practice after finding the policy increased stress, among other issues. Other schools didn’t follow suit, creating uneven comparisons for graduates. I feel Harvard is impossible to get into, but far easier once you get there. Plenty of other schools are more academically rigorous and don’t have median GPAs at graduation of 3.8.

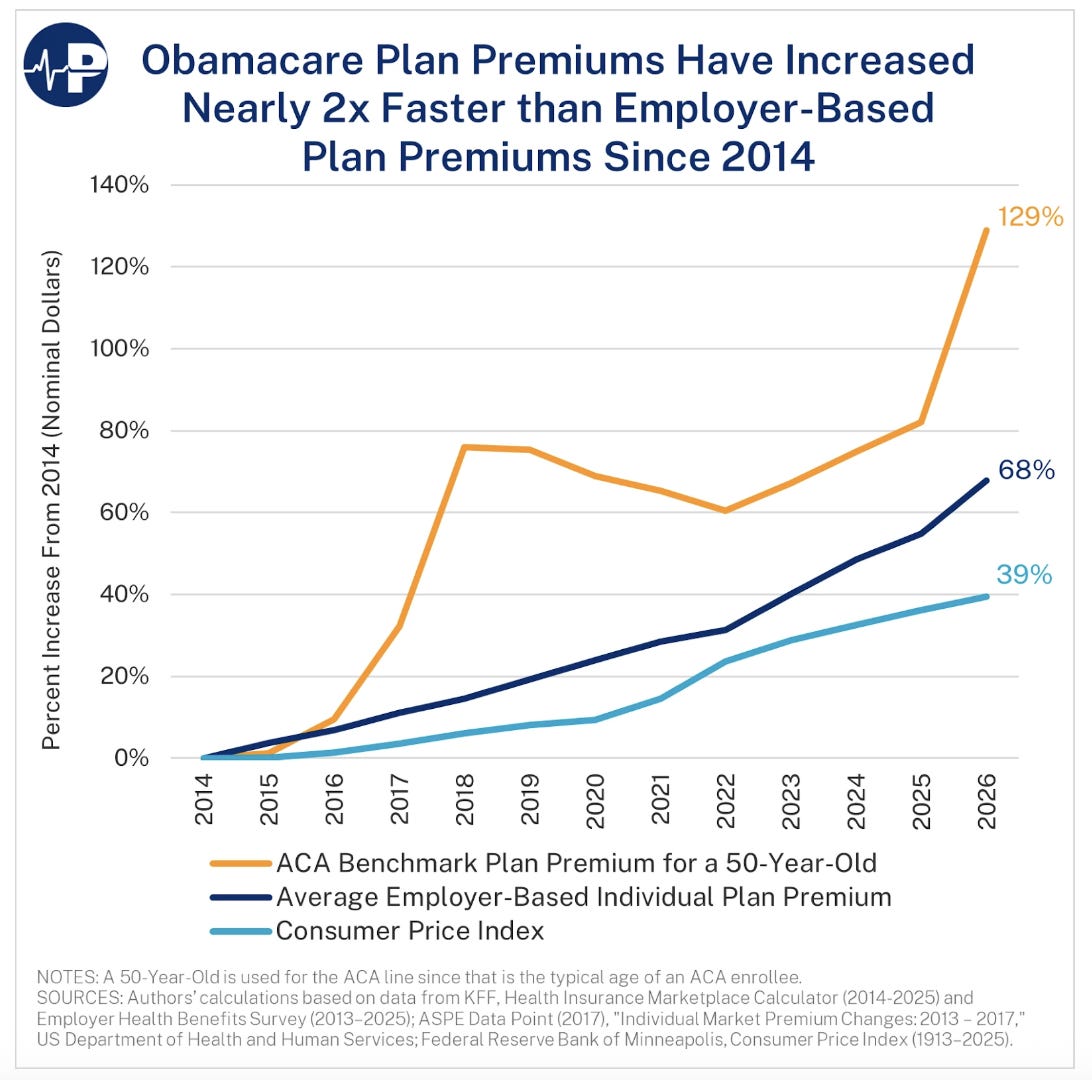

I have written countless times about the healthcare crisis and the ridiculous amount of money spent on insurance and overall healthcare. This chart shows how fast insurance premiums have risen in recent years. Note that Obamacare premiums are growing at a much faster rate than the average employer-based premium plan.

Politics

Squabbling lawmakers made $20K each during longest government shutdown in history

Trump readies tariff cuts on beef, coffee, bananas to help slash US grocery bills

Toyota opens massive North Carolina battery plant, confirms $10B US investment

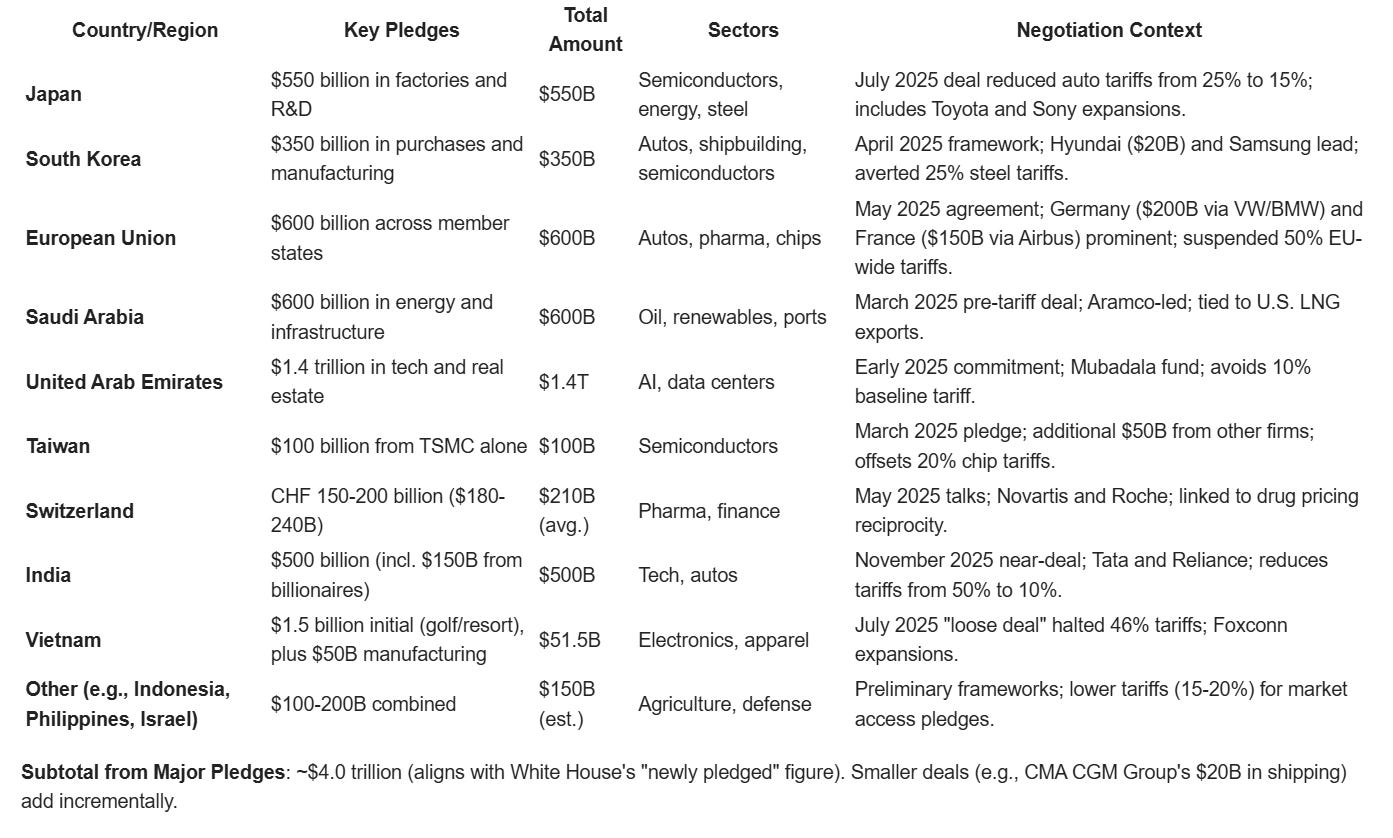

Battery plant located in North Carolina expected to create over 5,000 new jobs. I am struggling to find the total investments from corporations and countries, but Trump has definitely done a great job getting trillions of investments into the USA. I take the under on the $17 trillion Trump touts, but it is a big number nonetheless. These investments create jobs and bring manufacturing back to the USA. Some highlights below:

Seems like a big number to me.

U.S. and Switzerland reach trade deal to lower tariffs to 15%

The Democrat about to bring an Epstein reckoning for Trump

Adelita Grijalva indicates she will vote to release all documents the government holds on the late pedophile. I want all the files: Epstein, JFK, UFOs, Trump assassination attempts… There is a vote this week to release the Epstein files.

Trump to ask DOJ to probe Jeffrey Epstein involvement with Clinton, JPMorgan, Summers

Former Fed Gov. Kugler violated trading rules while at the central bank, ethics report found

Its not just members of Congress.

Mamdani election to spark New York City ‘death spiral’ as wealthy residents flee taxes

I am getting more calls from people who work for themselves or have flexible work arrangements, but the mass departures during COVID will not happen given Work From Home is no longer an option for many companies. Also, getting kids into schools in South Florida is no easy task. The people who have been calling are not working at major banks or funds.

Hochul Mulls Business Tax Hike to Fund Budget, Mamdani Plans

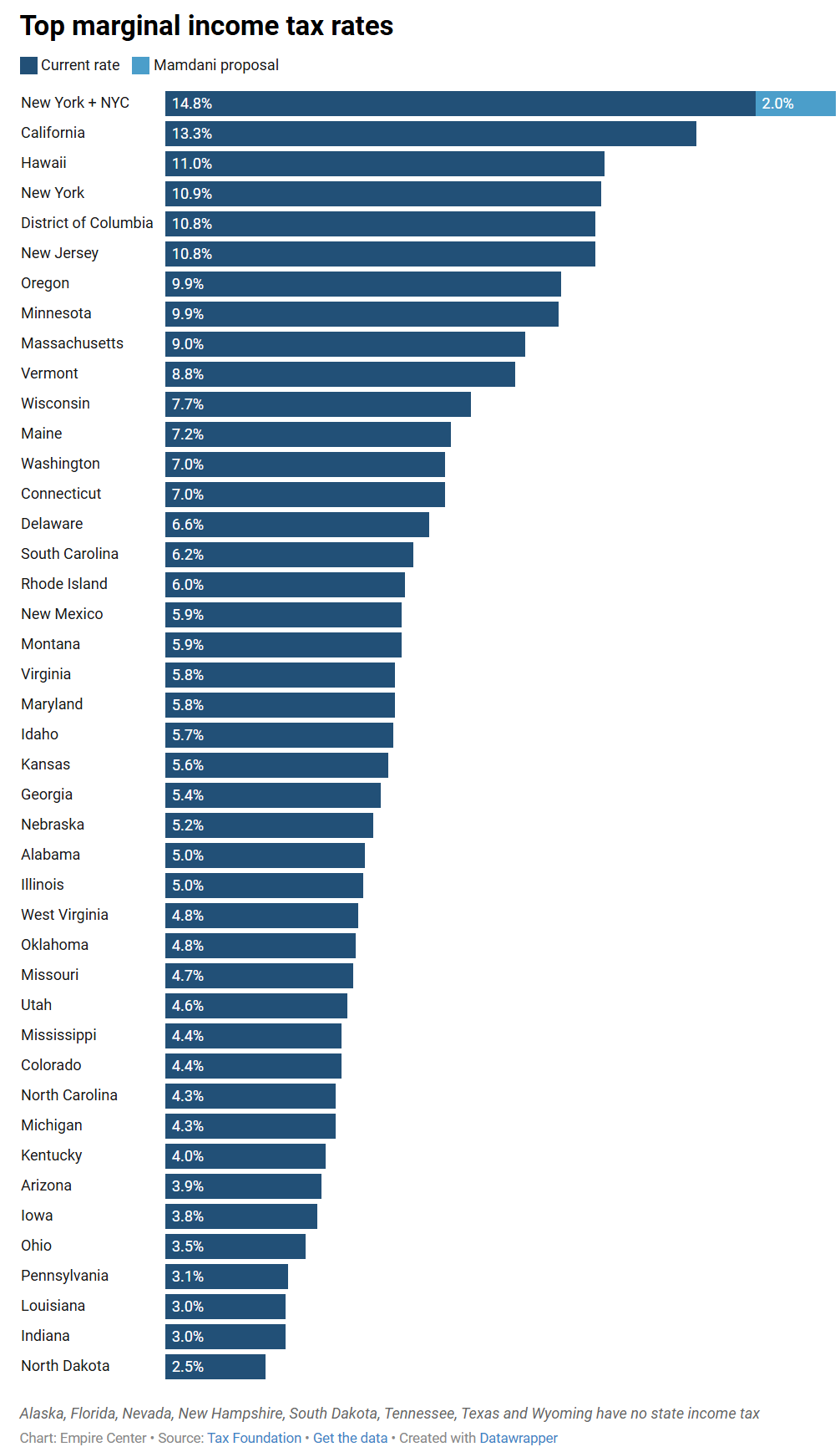

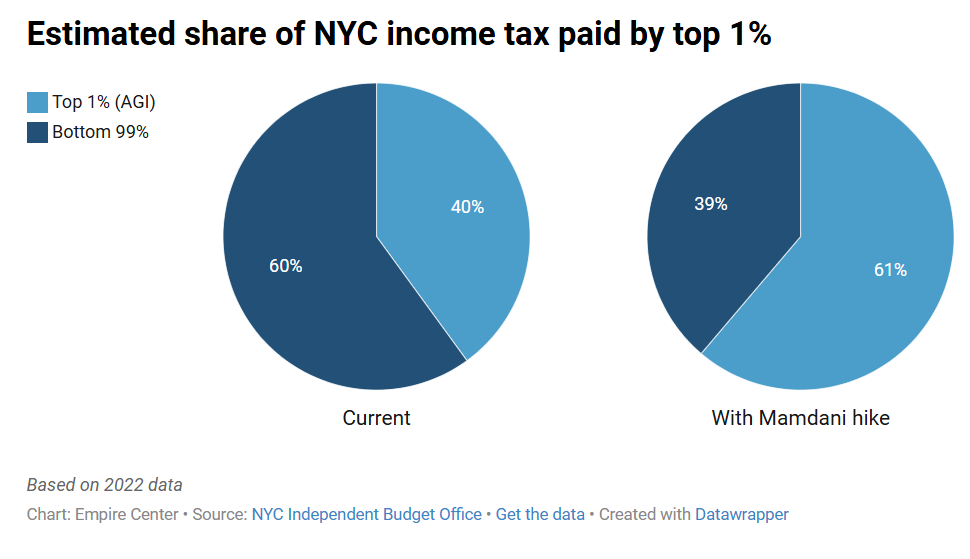

Mamdani wants to raise corporate taxes from 7.25% to 11.5%. For businesses in New York City, that would mean a combined effective tax rate of nearly 19%, the highest in the country. What could possibly go wrong? This article outlines Mamdani’s tax plans and shows the top marginal tax rates by state.

NYC Mayor-elect Zohran Mamdani calls for Starbucks boycott as union strikes

The Mamdani of Seattle: Neophyte Wilson Unseats Entrenched Democrat Mayor Harrell

Zelenskiy Vows Justice in Ukraine Corruption Probe Tied to Ex-Partner

Yes, Russia was the aggressor and is the clear bad actor in this war. However, Ukraine is incredibly corrupt, and I have no faith in the amount of graft and theft that has taken place with aid given by the US.

China tightens fentanyl precursor controls after FBI director visit, Patel says

Other Headlines

JPMorgan Chase wins fight with fintech firms over fees to access customer data

Firefly Aerospace shares jump 15% on strong revenues, boosted guidance

StubHub stock tanks 20% as CEO says it is not giving guidance for current quarter

Starbucks workers union launches strike in at least 40 cities on chain’s key holiday sales day

SoftBank shares plunge nearly 9%, extending selloff into third day

Although the stock is -28% in two weeks, it is +115% YTD.

Anthropic to spend $50 billion on U.S. AI infrastructure, starting with Texas, New York data centers

Warren Buffett’s Berkshire Hathaway reveals new position in Alphabet

Skyrocketing electricity prices fuel political backlash against tech sector’s AI data centers

Michael ‘Big Short’ Burry Rage-Quits Market, Liquidates Hedge Fund

We’ll begin with the famous quote from economist John Maynard Keynes: “The market can stay irrational longer than you can stay solvent.” Days after Burry’s bubble post on X, his Scion Asset Management 13F revealed that roughly 80% of his put positions were concentrated in the high-flyers Palantir and Nvidia. In this article, Burry suggests Meta and Oracle are using accounting to hide true profitability. His suggestion is stretching depreciation gives a better than otherwise picture on profits.

Coatue’s Philippe Laffont says the IPO market is broken beyond repair

Scientists Just Built an AI That Can Basically Read Your Mind

Unleash Prosperity released a report on Tuesday that found New York lost $517.5 billion in resident incomes from 2013 to 2022, while New Jersey lost $170.1 billion in that period, according to data from the Census Bureau and IRS. In my last note, I outlined capital outflows from the UK and Norway due to aggressive taxes on the wealthy. Rich people have options and cities, states, and countries who try to over-tax the rich find out the hard way that there is more than one place to live.

College kids’ math skills worse than ever, California finds — blame our pass-the-buck public schools

Blue state official releases man with no bail who returns one hour later to assault same woman

The system needs to do more to protect the innocent and punish the guilty.

Marty McHigh! NJ driver crashes his 1980s Delorean, is busted with 87 bags of cocaine

Chilling footage shows ‘Wild West’ moment NYPD cop fatally shoots gun-toting maniac

Google says group behind E-ZPass, USPS text scam has been ‘shut down’ after suit

I received countless scam texts about E-Z pass late fees. I hate these scammers.

The Lucas Museum of Narrative Art has announced its opening date

It looks like a spaceship!

Health

I’m an allergist — 4 things in your home you don’t realize are making you sick

This neuroscientist-approved habit tracks my progress—and boosts my happiness

People with ADHD, autism, dyslexia say AI agents are helping them succeed at work

I’m an ER doctor — these are the top 5 injuries and illnesses we see on Thanksgiving

These foods may be driving the rise of early-onset colorectal cancer in women

Middle East

Real Estate

If New York hedge fund managers don’t suddenly disperse to jobs in Miami this year, or even next, that doesn’t mean they won’t leave at all. One veteran hedge fund headhunter, says they’re simply biding their time. “A lot of people I speak to in New York are saying that ‘As son as my kids go to college, we’re moving to Miami’,” says Claude Schwab, a former talent strategist for Bridgewater and founder of hedge fund search firm The Kronor Group. I agree 100%. I have spoken with numerous people who cannot wait to get out of NYC and are waiting for kids to graduate from high school. No, it will not be the great COVID migration, but wealth will continue to find its way to South Florida from NYC.

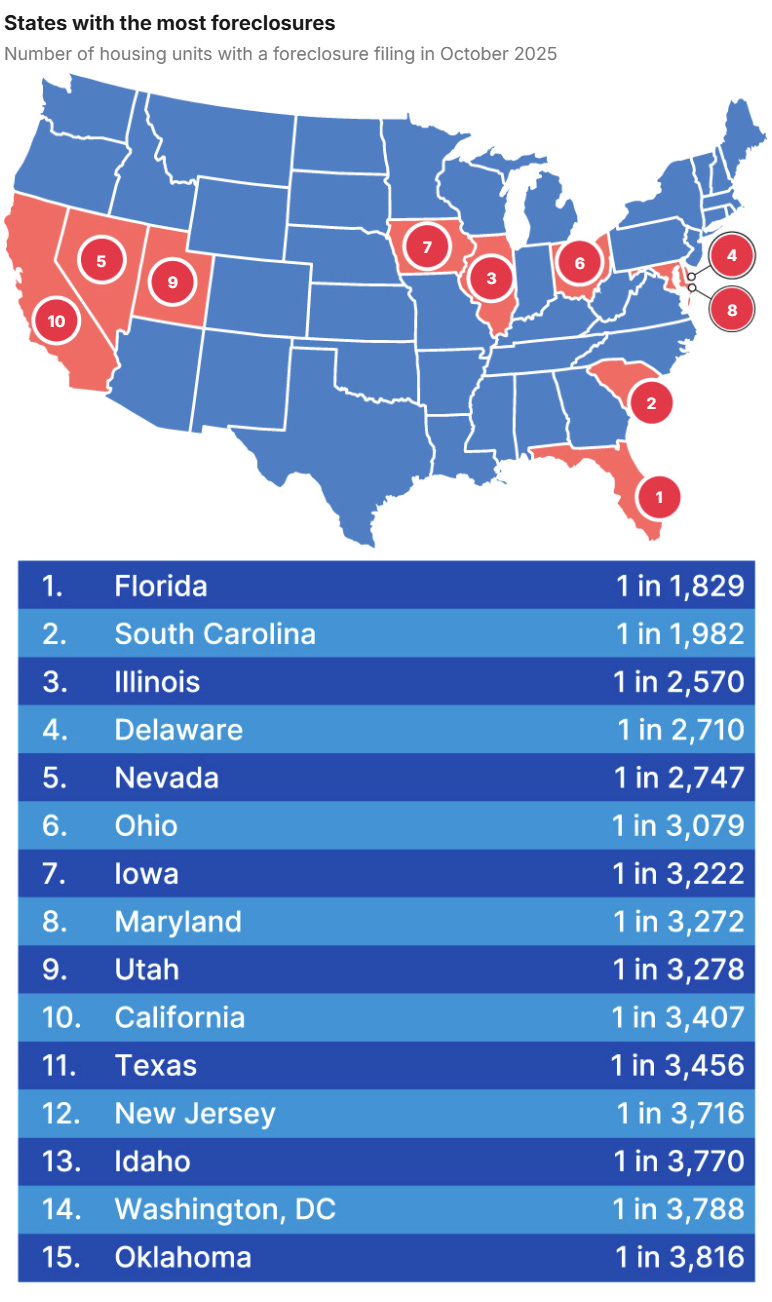

Foreclosure starts are rising recently and should be watched closely. Housing affordability has been awful given high prices and rates since the COVID boom. In October alone, there were 36,766 foreclosure filings — the first step in the process, when a lender warns a borrower they’re in default. That’s up three percent from September and 19 percent from a year ago. ‘Foreclosure activity continued its steady upward trend in October — the eighth straight month of year-over-year increases,’ said ATTOM CEO Rob Barber. The article gives good details on the hardest hit cities and states with statistics behind it, and this is CNBC’s version. Foreclosure starts, which are the initial phase of the process, rose 6% for the month and were 20% higher than the year before. Completed foreclosures, the final phase, jumped 32% year over year.

Interesting WSJ Opinion piece on rent control due to a lawsuit from landlords challenging the legality of the rent laws. That’s the subject of a lawsuit filed Wednesday by building owners challenging the city’s rent “stabilization” law. The statute limits the rent increases a landlord can demand of existing tenants or new ones. Rent increases are limited to between 3% and 4.5% when a tenant renews an existing lease or when the apartment is vacated. Many landlords look at their income statements and say, why bother? When rents are regulated so that a property can only be rented at a loss, the plaintiffs argue that it qualifies as a taking under the Fifth Amendment. Because New York’s rent restrictions mostly apply to buildings constructed before 1974, the rent stabilization is also arbitrary and violates equal protection and due process rights, says the suit.

New York City developers have a hit a fresh snag in trying to solve the city’s housing crisis: A new tax program that costs them extra dough if they want to construct buildings with 100 apartments or more. That new program, 485-x, which was meant to ensure workers got paid more per hour for large-scale multi-family developments, has had the opposite effect. Bloomberg reports that New York City developers filed 21 applications for residential buildings with exactly 99 units in the third quarter — a notable rise from the 13 filed between 2008 and 2023, citing data from the Real Estate Board of New York. Leave it to the idiot NY politicians who can find ways to take away incentives to build much-needed apartment units.

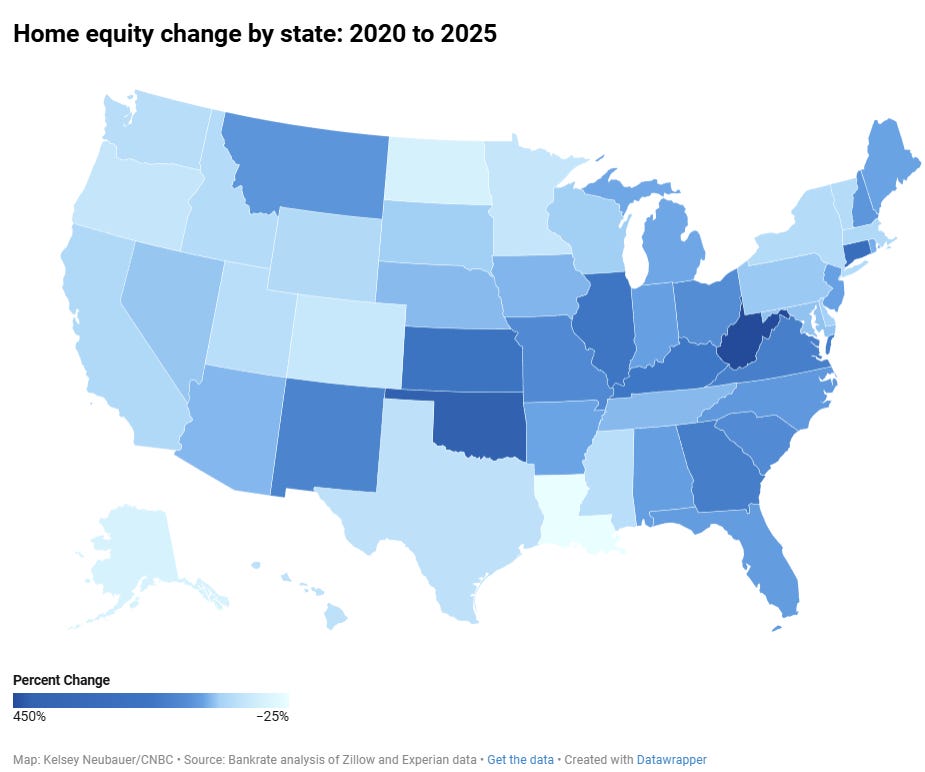

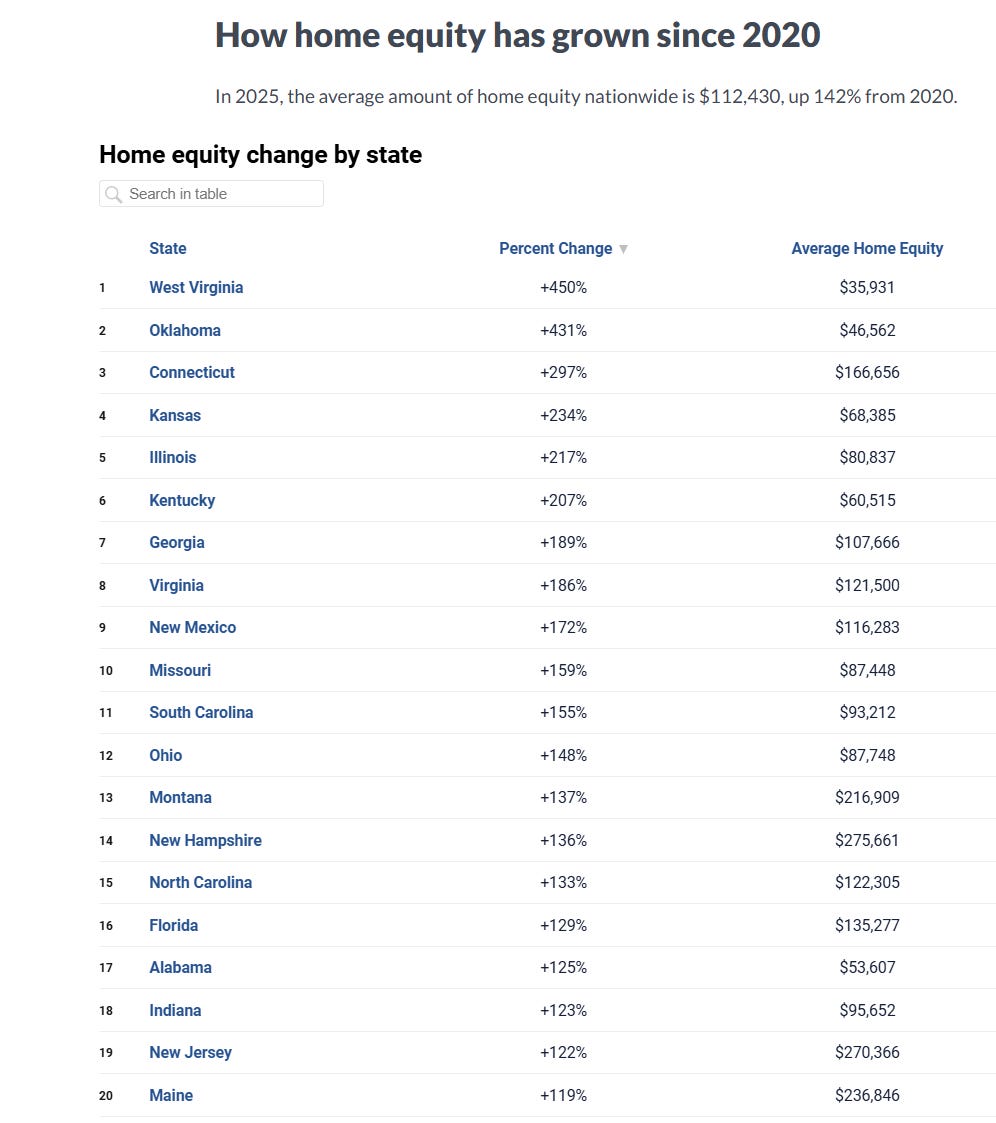

Home equity has more than doubled in these states — is yours one of them?

© 2025 The Rosen Report LLC. All rights reserved. Does not constitute investment, financial, legal, or tax advice. Consult with your lawyers and professional financial advisers. Rosen Report™ #837 ©Copyright 2025 Written By Eric Rosen.